Академический Документы

Профессиональный Документы

Культура Документы

Accounting - Problems

Загружено:

Azfar JavaidАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounting - Problems

Загружено:

Azfar JavaidАвторское право:

Доступные форматы

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 1|P a g e

Problem 01: THE ACCOUNTING CYCLE I (General Journal, Trial Balance & Financial Statements) Hagen Corporation opened the year 20x6, with the following trial balance information: Details Cash Accounts Receivable Land Accounts Payable Loan Payable Capital Stock Retained Earnings Dividends Revenues Salaries Expense Rent Expense Supplies Expense Interest Expense Debits Credits $ 100,000 $ 0 300,000 0 600,000 0 --- $ 240,000 --120,000 --200,000 --440,000 ------------------------$ 1000,000 $ 1000,000

Januarys transactions are listed below: Jan 02 Jan 03 Jan 05 Jan 07 Jan 11 Jan 12 Jan 15 Jan 17 Jan 20 Jan 23 Jan 24 Jan 29 Jan 31 Jan 31 : Collected $40,000 on an open account receivable. : Purchased additional tract of land for $80,000 cash. : Provided services on account to a customer for $60,000. : Borrowed $48,000 on a term of loan payable. : Paid salaries of $12,000. : Provided services to customers for cash, $44,000. : Purchased (and used) office supplies on account, $8,000. : The Company paid shareholders a $10,000 dividend. : Paid rent of $6,800. : Paid salaries of $16,000. : Paid $64,000 on the open accounts payable. : Collected $200,000 on accounts receivable. : Repaid loans of $88,000. : Paid interest on loans of $2,400.

a) Create the general ledger accounts, and enter the initial balances at the start of the month of January. This requirement is already completed on the worksheets. b) Prepare journal entries for Januarys transactions. c) Post Januarys transactions the appropriate general ledger accounts. d) Prepare a trial balance as of January 31. e) Prepare an income statement and statement of retained earnings for January, and a balance sheet as of the end of January.

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 2|P a g e

Worksheet (a) Ledger Books CASH Date

Description

Debit

Credit

Balance 100,000

ACCOUNTS RECEIVABLES Date Description Jan 01 Balance forward

Debit -

Credit

Balance 300,000

LAND Date Jan 01

Description Balance forward

Debit -

Credit -

Balance 600,000

ACCOUNTS PAYABLE Date Description Jan 01 Balance forward

Debit -

Credit -

Balance 240,000

LOAN PAYABLE Date Description Jan 01 Balance forward

Debit -

Credit -

Balance 120,000

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 3|P a g e

CAPITAL STOCK Date Description Jan 01 Balance forward

Debit -

Credit -

Balance 200,000

RETAINED EARNINGS Date Description Jan 01 Balance forward

Debit -

Credit -

Balance 440,000

DIVIDENDS Date Description Jan 01

Debit -

Credit -

Balance -

REVENUES Date Description Jan 01

Debit -

Credit -

Balance -

SALARIES EXPENSE Date Description Jan 01

Debit -

Credit -

Balance -

SUPPLIES EXPENSE Date Description Jan 01 Balance forward

Debit -

Credit -

Balance -

RENT EXPENSE Date Description Jan 01

Debit -

Credit -

Balance -

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 4|P a g e

INTEREST EXPENSE Date Description Jan 01

Debit -

Credit -

Balance -

Worksheet (b) GENERAL JOURNAL Date Jan 02

Accounts

Debit

Credit

Jan 03

Jan 05

Jan 07

Jan 11

Jan 12

Jan 15

Jan 17

Jan 20

Jan 23

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 5|P a g e

Jan 24

Jan 29

Jan 31

Jan 31

Worksheet (d) HAGEN CORPORATION Trial Balance January 31, 20x6 Accounts Debits Credits Cash $ - $ Accounts Receivable Land Accounts Payable Loan Payable Capital Stock Retained Earnings Revenues 104,000 Salaries Expense 28,000 Supplies Expense 8,000 Rent Expense 6,800 Interest Expense 2,400 Dividends 10,000 $ . $ .

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 6|P a g e

Worksheet (e) HAGEN CORPORATION Income Statement For the Month Ending January 31, 20x6 Revenues Services to customers Expenses Salaries Supplies Rent Interest Net Income HAGEN CORPORATION Statement of Retained Earnings For the Month Ending January 31, 20x6 Beginning retained earnings Plus: Net Income Less: Dividends Ending Retained Earnings . .

HAGEN CORPORATION Balance Sheet January 31, 20x6 Assets Cash Accounts receivable Land Total assets Liabilities Accounts payable Loan payable Total liabilities Stockholders equity Capital stock Retained earnings Total stockholders equity Total liabilities and equity .

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 7|P a g e

Problem 02: THE ACCOUNTING CYCLE II (Adjustments) Toto Motors is an automobile service center offering a full range of repair services for high performance cars. The following information is pertinent to adjusting entries that are needed to Toto, as of March 31, 20X5. Toto has a fiscal year ending on March 31, and only records adjusting entries at year end. Toto has a large investing in repair equipment, and maintains detailed asset records. These records show that depreciation for fiscal X5 is $61,700. As of March 31, 20X5, accrued interest on loans owed by Toto is $10,839. Auto dealerships outsource work to Toto. This work is done on account, and billed monthly. As of March 31, 20X5, $27,400 of unbilled services have been provided. Toto maintains a general business liability insurance policy. The prepaid annual premium is $12,000. The policy was purchased on October 1, 20X4. Another policy is a 6-month property and casualty policy, and it was obtained on December 1, 20X4, at a cost of $6,000. Both policies were initially recorded as prepaid insurance. The company prepared a detailed count of shop supplies at March 31, 20X4. $18,952 was on hand at that date. Management believed this level was greater than necessary and undertook a strategy to reduce these levels over the next year. During the fiscal year 20X5, Toto purchased an additional $62,500 of supplies and debited the Supplies account. By March 31, 20X5, the effort to reduce inventory was successful, as the count revealed an ending balance of only $6,800. During the fiscal year, Toto began offering a service contract to retail customers entitling them regular tire rotations, car washing and other routing maintenance items. Customers prepay for this service agreement, and Toto records the proceeds in the Unearned Revenue. The service plan is a flat fee of $189, and Toto sold the plan to 678 customers. At March 31, 20X5, it is estimated that 25% of the necessary work has been provided under these agreements. Totos primary advertising is on billboards. Big and Wide Outdoor Advertising sold Toto a plan for multiple sign locations around the city. Because Toto agreed to prepay the full price of $13,000, Big and Wide agreed to leave the signs up for 13 months. Toto paid on June 1, 20X4, and recorded the full amount as a prepaid. However, the advertising campaign was not begun until July 1, 20X4. It will conclude on July 31, 20X5. Toto leases shop space. Monthly rent is due and payable on the first day of each month. Toto paid Marchs rent on March 1, and expects to pay Aprils rent on April 1. Prepare adjusting entries (hint: when necessary) for Toto, as of March 31, 20X5.

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 8|P a g e

Worksheet (a) Problem 02 GENERAL JOURNAL Date Mar 31

Accounts

Debit

Credit

Mar 31

Mar 31

Mar 31

Mar 31

Mar 31

Mar 31

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 9|P a g e

Problem 03: THE ACCOUNTING CYCLE III (Adjustments Adjusted Trial Balance) Alberto Condor has an eye for quality. He recently formed an art gallery where allows artists to display their artwork for sale. Customers buy the artwork through the gallery, but payments are actually made payable directly to the originating artist. Artists, in turn, pay Albert a 20% commission that is appropriately reflected as revenue of the gallery. Following is Alberts trial balance after the first year of operation. This trial balance does not reflect the adjustments that are necessary, as described by the additional information. ALBERT CONDOR ART GALLERY Trial Balance As of December 31, 20x8 Accounts Debits Credits Cash $ 64,400 $ Supplies 23,765 Display equipment 52,500 Loan Payable 26,250 Capital Stock 87,500 Revenues 170,065 Rent Expense 38,500 Salaries Expense 84,000 Interest Expense 1,750 Utilities Expense 18,900 $ 283,815 $ 283,815 The display equipment was purchased near the beginning of the year. It has a 5-year life and no salvage value. Its cost should be depreciated equally over its life. Albert is entitled to receive $62,650 of commissions for art sold. This revenue has not yet been recorded, but it is fully expected that the artists will soon be making payment. Supplies on hand at year end were counted, and amount to $11,900. Decembers rent of $3,500 had not yet been paid. a) Prepare the necessary adjusting entries as of December 31, 20X8. b) Use T-accounts to determine the adjusted balances of the accounts. c) Prepare the adjusted trial balance for Amber Nestor.

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 10 | P a g e

Worksheet (a) Problem 03 GENERAL JOURNAL Date Dec 31

Accounts

Debit

Credit

Dec 31

Dec 31

Dec 31

Worksheet (b) Problem 03 CASH REVENUES

ACCOUNTS RECEIVABLE

RENT EXPENSE

SUPPLIES

SALARIES EXPENSE

DISPLAY EQUIPMENT

INTEREST EXPENSE

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

INTERMEDIATE FINANCIAL ACCOUNTING

2013

MBA/EMBA M. Azfar Javaid Attari Razavi Qadri 11 | P a g e

ACCUMULATED DEPRECIATION

UTILITIES EXPENSE

LOAN PAYABLE

RENT PAYABLE

CAPITAL STOCK

Worksheet (C) Problem 03 ALBERT CONDOR ART GALLERY Adjusted Trial Balance As of December 31, 20x8 Accounts Debits Credits Cash $ $ Accounts Receivable Supplies Display equipment Accumulated Depreciation Rent Payable Loan Payable Capital Stock Revenues Rent Expense Salaries Expense Interest Expense Utilities Expense

Emails: javaidazfar@hotmail.com / azfarjavaid@yahoo.com

Вам также может понравиться

- Accounting Test 1Документ8 страницAccounting Test 1Nanya BisnestОценок пока нет

- Use The Following Information For Questions 63 andДокумент2 страницыUse The Following Information For Questions 63 andjbsantos09100% (1)

- Bad Debts and Pfbd..Документ6 страницBad Debts and Pfbd..rizwan ul hassanОценок пока нет

- Financial Accounting 2012 Exam PaperДокумент28 страницFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- CH 21Документ11 страницCH 21Hanif MusyaffaОценок пока нет

- Week1c.introduction - Exercises WithoutAnswersДокумент8 страницWeek1c.introduction - Exercises WithoutAnswersyow jing peiОценок пока нет

- Non Current Asset Questions For ACCAДокумент11 страницNon Current Asset Questions For ACCAAiril RazaliОценок пока нет

- Chap8 QuizДокумент5 страницChap8 QuizGracey DoyuganОценок пока нет

- Accrual and ProvisionДокумент66 страницAccrual and ProvisionVeronica Bailey100% (1)

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceДокумент12 страницLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- All Practice Set SolutionsДокумент22 страницыAll Practice Set SolutionsJohn TomОценок пока нет

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Документ13 страницComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaОценок пока нет

- Self-Constructed Assets TutorialДокумент3 страницыSelf-Constructed Assets TutorialSalma Hazem100% (1)

- Ac101 ch3Документ21 страницаAc101 ch3Alex ChewОценок пока нет

- MODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodДокумент16 страницMODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodJohn Mark FernandoОценок пока нет

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsДокумент13 страницIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikОценок пока нет

- Exercises For Unit 4 Inventory ValuationДокумент3 страницыExercises For Unit 4 Inventory ValuationDr. Mohammad Noor AlamОценок пока нет

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Документ7 страницFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesОценок пока нет

- Bab 3 Chapter 12 PDFДокумент4 страницыBab 3 Chapter 12 PDFGrifyn IfyОценок пока нет

- Beechy 7e Tif Ch09Документ20 страницBeechy 7e Tif Ch09mashta04Оценок пока нет

- Accounting Indvidual AssignmentДокумент3 страницыAccounting Indvidual AssignmentEmbassy and NGO jobs100% (1)

- Final Round - 1ST - QДокумент6 страницFinal Round - 1ST - QwivadaОценок пока нет

- Answers B Exercises 001Документ7 страницAnswers B Exercises 001Nashwa SaadОценок пока нет

- Lease Problems Hw1Документ6 страницLease Problems Hw1Vi NguyenОценок пока нет

- Earn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFДокумент1 страницаEarn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFAnbu jaromiaОценок пока нет

- CH 6 Classpack With SolutionsДокумент20 страницCH 6 Classpack With SolutionsjimenaОценок пока нет

- Accounting For Incomplete Record PDFДокумент23 страницыAccounting For Incomplete Record PDFSumiya YousefОценок пока нет

- Chapter 4 Question ReviewДокумент11 страницChapter 4 Question ReviewNayan SahaОценок пока нет

- f7 2014 Dec QДокумент13 страницf7 2014 Dec QAshraf ValappilОценок пока нет

- Multiple Choice QuestionsДокумент8 страницMultiple Choice QuestionsPrashant Sagar Gautam100% (1)

- Basic Accounting Equation Exercises 2Документ2 страницыBasic Accounting Equation Exercises 2Ace Joseph TabaderoОценок пока нет

- Terrific Temps Fills Temporary Employment Positions For Local Businesses SomeДокумент2 страницыTerrific Temps Fills Temporary Employment Positions For Local Businesses SomeAmit PandeyОценок пока нет

- Advanced Accounting BU 455A Spring 2013 Test OneДокумент14 страницAdvanced Accounting BU 455A Spring 2013 Test OneMichael Tai Maimoni100% (2)

- Forum ACC WM - Sesi 3 (REV)Документ9 страницForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- Quiz Bee QuestionsДокумент19 страницQuiz Bee QuestionsBelen VergaraОценок пока нет

- Financial AccountingДокумент9 страницFinancial AccountingAnonymous VmhXGNlFyОценок пока нет

- Question Bank - Practical QuestionsДокумент10 страницQuestion Bank - Practical QuestionsNeel KapoorОценок пока нет

- Final Exam - Ae14 CfasДокумент7 страницFinal Exam - Ae14 CfasVillanueva RosemarieОценок пока нет

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinДокумент11 страницAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Financial Accounting December 2009 Exam PaperДокумент10 страницFinancial Accounting December 2009 Exam Paperkarlr9Оценок пока нет

- Reimers Finacct03 sm09 PDFДокумент48 страницReimers Finacct03 sm09 PDFChandani DesaiОценок пока нет

- Iandfct2exam201504 0Документ8 страницIandfct2exam201504 0Patrick MugoОценок пока нет

- NCR Cup JR Basic Accounting FinalДокумент6 страницNCR Cup JR Basic Accounting FinalNicolaus CopernicusОценок пока нет

- Chapter-4-Solved-Problems (Cost Accounting)Документ31 страницаChapter-4-Solved-Problems (Cost Accounting)Zainab GamalОценок пока нет

- Zakaria Ch1Документ8 страницZakaria Ch1Zakaria HasaneenОценок пока нет

- Exercise - Income ApproachДокумент1 страницаExercise - Income ApproachThùy Linh Vũ NguyễnОценок пока нет

- Depreciation, Impairments, and DepletionДокумент38 страницDepreciation, Impairments, and DepletionAlbert Adi NugrohoОценок пока нет

- Contract Accounting Journal EntriesДокумент3 страницыContract Accounting Journal Entrieskawasakidude21100% (2)

- 109Документ34 страницы109danara1991Оценок пока нет

- Investments: Learning ObjectivesДокумент52 страницыInvestments: Learning ObjectivesElaine LingxОценок пока нет

- CH4 Completing the Accounting Cycle 實習Документ2 страницыCH4 Completing the Accounting Cycle 實習ibtisam1011Оценок пока нет

- Consignment Account NotesДокумент12 страницConsignment Account NotesLinda Duvalier-Evans100% (6)

- Beams9esm ch05Документ5 страницBeams9esm ch05David IroayОценок пока нет

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisДокумент6 страницQuizzes - Chapter 6 - Business Transactions & Their AnalysisClint Abenoja100% (1)

- BU127 Quiz Q&aДокумент14 страницBU127 Quiz Q&aFarah Luay AlberОценок пока нет

- Week 6 Financial Accoutning Homework HWДокумент7 страницWeek 6 Financial Accoutning Homework HWDoyouknow MEОценок пока нет

- IF2 - Project 1 PDFДокумент6 страницIF2 - Project 1 PDFBillОценок пока нет

- Accounts TestДокумент6 страницAccounts Testwaqas malikОценок пока нет

- Accounting QuestionsДокумент4 страницыAccounting QuestionsGayaОценок пока нет

- Assignment of Fundamental of Accounting IДокумент12 страницAssignment of Fundamental of Accounting IibsaashekaОценок пока нет

- Computer Information Systems: Preston University Malir Campus KarachiДокумент4 страницыComputer Information Systems: Preston University Malir Campus KarachiAzfar JavaidОценок пока нет

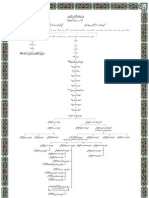

- Shijra e Nasab SiddiquiДокумент1 страницаShijra e Nasab SiddiquiAzfar Javaid33% (3)

- A Brief History of Computers - Lecture 01Документ55 страницA Brief History of Computers - Lecture 01Azfar JavaidОценок пока нет

- Naqshbandi Taweez Divine CourtДокумент4 страницыNaqshbandi Taweez Divine CourtAzfar Javaid100% (1)

- Project Management - Chapter 2Документ2 страницыProject Management - Chapter 2Azfar JavaidОценок пока нет

- Organizational Behavior I - Chapter 1Документ6 страницOrganizational Behavior I - Chapter 1Azfar JavaidОценок пока нет

- Burrhus Frederic Skinner - Operant ConditioningДокумент1 страницаBurrhus Frederic Skinner - Operant ConditioningAzfar JavaidОценок пока нет

- Flex Efficiency 50 CC Plant Information KitДокумент45 страницFlex Efficiency 50 CC Plant Information KitAzfar JavaidОценок пока нет

- The Audience MotivationДокумент12 страницThe Audience MotivationAzfar JavaidОценок пока нет

- Comparative Statement of Profit and LossДокумент6 страницComparative Statement of Profit and LossHimanshi ChopraОценок пока нет

- Assignment ..Документ5 страницAssignment ..Mohd Saddam Saqlaini100% (1)

- Solution Chapter 11 Afar by Dayag CompressДокумент16 страницSolution Chapter 11 Afar by Dayag Compressholmeshaeley1Оценок пока нет

- PPE Lecture NotesДокумент54 страницыPPE Lecture Notesmacmac29Оценок пока нет

- Fabm1 q3 Mod7 Journalizing FinalДокумент32 страницыFabm1 q3 Mod7 Journalizing FinalAdonis Zoleta Aranillo88% (8)

- AFARДокумент41 страницаAFARAlican, JerhamelОценок пока нет

- Cochin ShipyardДокумент18 страницCochin ShipyardvishalОценок пока нет

- Corporate Finance Chapter 4Документ15 страницCorporate Finance Chapter 4Razan EidОценок пока нет

- FAR - Module 6 - Act. 6 AnswerДокумент15 страницFAR - Module 6 - Act. 6 AnswerAngel Justine Bernardo100% (6)

- ACC 201 Accounting Cycle WorkbookДокумент78 страницACC 201 Accounting Cycle Workbookarnuako15% (13)

- Topic 3-DeprДокумент28 страницTopic 3-DeprMichael.land65Оценок пока нет

- 1 PBДокумент10 страниц1 PBxyzОценок пока нет

- Financial Management 532635578Документ30 страницFinancial Management 532635578viaan1990Оценок пока нет

- Incomplete RecordДокумент30 страницIncomplete RecordMuhammad TahaОценок пока нет

- In y Ter CompanyДокумент6 страницIn y Ter CompanyEllenОценок пока нет

- Frozen Foods Worksheet - ClassДокумент3 страницыFrozen Foods Worksheet - ClassVishal MishraОценок пока нет

- RadheДокумент8 страницRadheMohitОценок пока нет

- Jawaban Soal Siklus Dagang (Perpetual)Документ10 страницJawaban Soal Siklus Dagang (Perpetual)indira puspasariОценок пока нет

- COM670 Chapter 4Документ28 страницCOM670 Chapter 4aakapsОценок пока нет

- PTPPДокумент155 страницPTPPnaufalmuhammadОценок пока нет

- Saras Dairy AjmerДокумент51 страницаSaras Dairy AjmersumeetОценок пока нет

- Problems On Leverage AnalysisДокумент4 страницыProblems On Leverage AnalysisMandar SangleОценок пока нет

- Chapter 3 Business CombinationДокумент9 страницChapter 3 Business CombinationAnonymous XOv12G100% (1)

- JLRM Financal StatmentsДокумент33 страницыJLRM Financal StatmentsEsha ChaudharyОценок пока нет

- Adjusting Accounts and Preparing Financial StatementsДокумент58 страницAdjusting Accounts and Preparing Financial StatementsHEM CHEA100% (4)

- Yr 12 Accounting VCE Notes On Study DesignДокумент15 страницYr 12 Accounting VCE Notes On Study DesigncaseyraedengОценок пока нет

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewДокумент8 страницTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaОценок пока нет

- Chap 004Документ16 страницChap 004Ela PelariОценок пока нет

- Equation Expanded To Show Operating ActivitiesДокумент21 страницаEquation Expanded To Show Operating ActivitiesShaila MarceloОценок пока нет

- Survey of Accounting 7th Edition Warren Test BankДокумент22 страницыSurvey of Accounting 7th Edition Warren Test Bankbonifacethang1vj7om100% (24)