Академический Документы

Профессиональный Документы

Культура Документы

3l/epublic of Tbe F'bilippines: Upreme Ourt

Загружено:

Danilo Magallanes SampagaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

3l/epublic of Tbe F'bilippines: Upreme Ourt

Загружено:

Danilo Magallanes SampagaАвторское право:

Доступные форматы

3L\epublic of tbe f'bilippines

Jllantla.

SECOND DIVISION

JOSE I. MEDINA,

Petitioner,

-versus-

HON. COURT OF APPEALS and

HEIRS OF THE LATE ABUNDIO

G.R. No. 137582

Present:

CARPIO, J.,

Chairperson,

BRION,

DEL CASTILLO,

PEREZ, and

PERLAS-BERNABE, JJ.

CASTANARES, Represented by Promulgated:

ANDRES CASTANARES,

. Respondents. AUG 2 9 2012

X

DECISION

PEREZ, J.:

Subject of this petition for review on certiorari are the Decision

1

and

Resolution of tne Court of Appeals in CA-G.R. CV No. 42634, reversing the

. .

Decision

2

of the Regional Trial Court (RTC) of Mas bate, Mas bate,. Branch

46 in Civil Case No. 4080.

Penned by Associate Justice Bennie Adefuin-De La Cruz with Associate Justice Consuelo Ynaresc

Santiago (now a retired Member of this Court) and Associate Justice Presbitero J. Velasco, Jr.

(now a Member of this Com1), concurring. Rollo, pp. 26-49.

Presided by Judge Florante A. Cipres. Id. at 58-63.

Decision 2 G.R. No. 137582

The instant case stemmed from a Complaint for Damages with prayer

for Preliminary Attachment and docketed as Civil Case No. 3561. In a

Decision dated 27 December 1985, the RTC ordered Arles Castaares

(Arles), now deceased and represented by his heirs, to pay damages for

running over and causing injuries to four-year old Wenceslao Mahilum, Jr.

The four-year old victim was left in the custody of petitioner Jose I. Medina,

who also represented the victims father, Wenceslao Mahilum, Sr. in the

aforesaid case.

The Decision in Civil Case No. 3561 became final and executory on 3

June 1987. The motion for issuance of a writ of execution

3

filed by

petitioner was granted on 29 September 1987 and the corresponding Writ of

Execution

4

was issued on 1 October 1987. The Ex-Officio Provincial

Sheriff of the RTC served a Notice of Levy and Seizure on Arles two (2)

parcels of lands located at Goldbag, Syndicate, Aroroy, Masbate described as

follows:

PARCEL- I

A parcel of coconut land located at Goldbag, Syndicate, Aroroy,

Masbate, registered in the name of deceased Arles Castaares under Tax

Dec. No. 1107, bounded on the North, by Abundio Castaares; East, by

public land; South, by Provincial Road and on the West, by Abundio

Castaares with an area of 5.0000 hectares and assessed at P6,810.00.

PARCEL- II

A parcel of coconut, rice, unirrigated & cogon located at Goldbag,

Syndicate, Aroroy, Masbate, registered in the name of Abundio

Castaares, under Tax Dec. No. 1106, bounded on the North, by Masbate

Goldfield Min. C.; East, by Timberland; South, by National Road and on

the West, by National Road with an area of 18.8569 hectares and assessed

at P15,660.00.

5

3

Records, Vol. II, p. 26.

4

Id. at 27.

5

Id. at 28.

Decision 3 G.R. No. 137582

When the heirs of Arles failed to settle their account with petitioner,

Parcel-I under Tax Declaration No. 1107

6

was sold at a public auction. Only

petitioner participated in the bidding, thus the subject lot was awarded to

him and a Certificate of Sale was issued on 24 December 1987.

7

In the

Sheriffs Final Deed of Sale, Parcel-I was transferred to Wenceslao

Mahilum, Sr., represented by Jose I. Medina.

8

A survey was conducted on

the property. On 23 January 1989, the Motion for Issuance of Writ of

Possession was granted by the trial court commanding the sheriff to

physically oust the heirs of Arles and to deliver the subject lot to petitioner.

On 26 April 1991, petitioner applied for the registration of the lot

covered by Tax Declaration No. 1107, docketed as LRC Case No. N-374.

Petitioner alleged that he is the owner in fee simple of such parcel of land by

virtue of a Waiver of Rights and Interests

9

executed by Wenceslao Mahilum,

Sr. in his favor. Attached to the application is the Survey Plan which

particularly described the land as follows:

A parcel of coconut land containing an area of 5.0000 (sic)

hectares located at Goldbag-Syndicate, Aroroy, Masbate, declared for

taxation purposes in the name of Wenceslao Mahilum, Sr. (rep. by Jose I.

Medina) under Tax Dec. No. 7372, and bounded on the North, by Abundio

Castaares, South, by Atlas Mining & Development Corporation and

Provincial Road, East, by Public Land and on the West, by Provincial

Road with the latest assessment at P6,810.00.

10

Andres Castaares (Andres), brother of Arles and representing the

heirs of the late Abundio Castaares (Abundio), filed an Opposition claiming

that after the death of his father Abundio, the tax declaration of the property

6

Tax Declaration No. 1107 was superseded by Tax Declaration No. 6953, which was in

turn, cancelled by Tax Declaration No. 7372. See Records, Vol. I, p. 7 and Records, Vol.

II, p. 47.

7

Records, Vol. II, pp. 35-36.

8

Id. at 38-39.

9

Records, Vol. I, p. 16.

10

Id. at 1.

Decision 4 G.R. No. 137582

was cancelled and in its place, a tax declaration was issued in his favor; that

during the lifetime of his father and up to his death, Andres had been in

peaceful, open, notorious, public and adverse possession of the lot; that

sometime in 1988, petitioner, through stealth and strategy, encroached and

occupied practically the entirety of the property in question by encircling it

with barbed wires, destroying in the process scores of fruit-bearing coconut

trees; and that there is a pending case, Civil Case No. 4051, for recovery of

ownership and possession of real estate.

11

The pending case mentioned by Andres was later dismissed by the

trial court without prejudice to refiling the same.

12

Thus, on 28 April 1992,

Andres filed another Complaint for Recovery of Possession and Ownership

with Damages and with Prayer for Issuance of Writ of Preliminary

Injunction docketed as Civil Case No. 4080.

13

The action for recovery of possession and ownership in Civil Case

No. 4080 and the land registration case in LRC No. N-374 were jointly tried.

Andres testified that upon Abundios death, the latter left his children

a parcel of agricultural land with an area of 18 hectares,

14

declared for

taxation in Abundios name under Tax Declaration No. 1106, bounded as

follows:

North by Sta. Clara Goldfield (Masbate Goldfield)

East by Timberland

South National Road

11

Id. at 57-58.

12

Id. at 69.

13

The heirs of the late Abundio Castaares are Pastora Vargas, Andres Castaares, Juan Castaares

(now deceased with one child), Ildefonso Castaares (now deceased with wife and 5 children) and

Arles Castaares (now deceased with wife and 4 children). Rollo, pp. 34-35.

14

TSN, 17 September 1992, p. 3.

Decision 5 G.R. No. 137582

West National Road

15

Andres presented a sketch plan on 26 May 1983 of Lots 224 and

2187, Pls-77

16

and pointed out that the alleged lot of Arles covered by Tax

Declaration No. 1107 is outside Lot 224 and lies to the south of Abundios

lot.

17

He averred that petitioner encroached on and fenced a portion of said

lot, occupying an area of about five (5) hectares. Based on the sketch plan,

petitioner fenced Line 2 to Line 8.

18

Petitioner presented Tax Declaration No. 1107 under the name of

Arles showing the boundaries of his lot as follow:

North Abundio Castaares

South Provincial Road

East Public Land

West Abundio Castaares

19

Petitioner insisted that the lots contained in Tax Declaration Nos. 1107

and 1106 are not separate and distinct, but refers to only one parcel of land,

Lot 224. The lot in Tax Declaration No. 1107 is denominated as Lot 224-A

and is derived from Tax Declaration No. 1106, as certified by the wife of

Arles, Patricia Castaares (Patricia).

20

Petitioner likewise submitted a sketch

plan prepared on 12 March 1992 to show the real location of the lot

described in Tax Declaration No. 1107.

On 10 May 1993, the RTC rendered judgment in favor of petitioner.

The dispositive portion reads:

15

Records, Vol. II, p. 68.

16

Id. at 64.

17

Rollo, pp. 37-38.

18

Id. at 38.

19

Records, Vol. II, p. 71.

20

Rollo, p. 40.

Decision 6 G.R. No. 137582

WHEREFORE, premises considered, decision is hereby rendered

in favor of the defendant-applicant, to wit:

1. Ordering the dismissal of the complaint in Civil Case No. 4080 with

costs against the plaintiff-oppositors;

2. Declaring the defendant-applicant, Jose I. Medina, the absolute owner

of the land subject of his application in L.R.C. Case No. 374;

3. Declaring the title of the applicant over the property designated in Plan

Csd-05-009053 together with all the improvements thereon,

CONFIRMED and REGISTERED pursuant to the provision of P.D.

No. 1529; and

4. Ordering the plaintiff-oppositors to pay the defendant-applicant the

amount of P5,000.00 as attorneys fees and P5,000.00 as litigation

expenses.

Once this decision becomes final and executory, let the

corresponding decree of registration issue.

21

The trial court found that petitioner lawfully acquired the land through

a Deed of Waiver of Rights and Interest executed by Wenceslao Mahilum,

Sr., the winning party in the damages suit. The trial court gave credence to a

Certification

22

issued by the Provincial Sheriff and even signed by Patricia,

the wife of Arles, certifying that the sketch plan of Lot 224-A reflects the

true location and area of the property subject of the writ of possession and

execution.

On appeal, however, the Court of Appeals reversed the findings of the

trial court as follows:

WHEREFORE, the appealed decision is hereby REVERSED and

SET ASIDE and a new one is entered, to wit:

1. Ordering the dismissal of the Application of Jose I. Medina

in Land Registration Case No. N-374;

21

Records, Vol. II, p. 109.

22

Id. at 46.

Decision 7 G.R. No. 137582

2. Declaring the heirs of the late Abundio Castaares

represented by Andres Castaares the absolute owner of the

land subject of application in L.R.C. Case No. N-374;

3. Ordering the Applicant Jose I. Medina to pay plaintiffs-

oppositors Heirs of Abundio Castaares the following sum:

a. P20,000.00 as moral damages;

b. [P]1,000.00 rental per month from February 24, 1989 until

fully paid;

c. [P]1,000.00 refund of the yield of the crops of the land

from February 24, 1989 until fully paid, and

d. Costs of suit.

23

The Court of Appeals stated that the lot under Tax Declaration No.

1107 in the name of Arles is separate and distinct from Lots 224 and 2187

declared under Tax Declaration No. 1106. The appellate court took into

consideration the separate and distinct location of the lots, as well as the

difference in their boundaries. It also noted that since there has been no

settlement yet of the estate of Abundio, it was premature for Arles to have

allocated unto himself a distinct portion of Lots 224 and 2187 as his share in

the estate. And even if there was partition among the heirs of Abundio, the

appellate court concluded that the share of Arles is only limited to 3.1432

hectares. The Court of Appeals further observed that the boundary on the

west of the property sought to be registered by petitioner in the land

registration case was changed from Abundio Castanares to Provincial

Road, in conflict with the boundary of the property as stated in Tax

Declaration No. 1107. The appellate court concluded that the changes in the

boundary on the west were purposely made to justify the illegal occupancy

and fencing of the southern portion of Lot 224.

23

Rollo, pp. 48-49.

Decision 8 G.R. No. 137582

Petitioner elevated the case before this Court via petition for review

on certiorari and assigned the following alleged errors committed by the

Court of Appeals, to wit:

1. THE HONORABLE RESPONDENT COURT ERRED IN

REVERSING THE FINDINGS OF THE REGIONAL TRIAL

COURT, BRANCH 46 OF MASBATE.

2. THE HONORABLE RESPONDENT COURT ERRED IN

FINDING THAT THE BOUNDARIES IN THE TAX

DECLARATION WERE [CHANGED] TO SUIT THE PURPOSE

OF JOSE I. MEDINA.

3. THE HONORABLE RESPONDENT COURT ERRED IN NOT

REFERRING PROPERLY TO THE SKETCH PLAN OF THE

LAND IN ARRIVING AT THE CONCLUSION.

4. THE HONORABLE RESPONDENT COURT ERRED IN

STATING THAT THE LAND SUBJECT MATTER OF THE CASE

AT BAR STILL FORMS PART OF THE ESTATE OF THE LATE

ABUNDIO CASTAARES.

5. THE HONORABLE RESPONDENT COURT ERRED IN

AWARDING DAMAGES AS AGAINST PETITIONER-

DEFENDANT-APPLICANT JOSE I. MEDINA, WHO

RECEIVED THE PROPERTY IN GOOD FAITH FROM THE

OFFICER OF THE COURT.

24

Petitioner contends that a comparison of the respective boundaries of

the lots covered by Tax Declaration No. 1107 and Tax Declaration No. 1106

readily shows that Lot 224-A in Tax Declaration No. 1107 is well within the

boundaries of Lot 224 in Tax Declaration No. 1106. Petitioner dismisses the

observation of the appellate court regarding the purported change in

boundaries as a mere typographical error. Petitioner scores the appellate

court for relying on a homestead application of Abundio to establish the

latters ownership on the subject land. Petitioner harps on the inconsistencies

of respondent first, in Civil Case No. 4051 (which was dismissed prior to

the filing of Civil Case No. 4080), respondent claimed that the land of

24

Id. at 18.

Decision 9 G.R. No. 137582

Abundio was transferred to him when his father died but he later changed his

stand and made it appear that the land is still owned by the heirs of Abundio;

second, respondent testified that the share of Arles in the lot was sold to

Ildefonso and Juan Castaares; and third, respondents son, Adrian, had

filed a third party claim during the public auction sale, alleging that the land

is already owned by him by virtue of a sale by the heirs of Abundio.

Petitioner insists that the land is already segregated from the land of

Abundio as evidenced by the mortgage executed by Arles in 1966 with

Masbate Rural Bank, as shown in Tax Declaration No. 876.

In its Comment, respondent points out that the issues raised by

petitioner are factual questions which cannot be reviewed in a petition for

review on certiorari.

As correctly pointed out by respondent, the assigned errors are factual

in character. It is axiomatic that a question of fact is not appropriate for a

petition for review on certiorari under Rule 45. This rule provides that the

parties may raise only questions of law, because the Supreme Court is not a

trier of facts. Generally, we are not duty-bound to analyze again and weigh

the evidence introduced in and considered by the tribunals below. When

supported by substantial evidence, the findings of fact of the Court of

Appeals are conclusive and binding on the parties and are not reviewable by

this Court, unless the case falls under any of the following

recognized exceptions: (1) When the conclusion is a finding grounded

entirely on speculation, surmises and conjectures; (2) When the inference

made is manifestly mistaken, absurd or impossible; (3) Where there is a

grave abuse of discretion; (4) When the judgment is based on a

misapprehension of facts; (5) When the findings of fact are conflicting; (6)

When the Court of Appeals, in making its findings, went beyond

the issues of the case and the same is contrary to the admissions of both

Decision 10 G.R. No. 137582

appellant and appellee; (7) When the findings are contrary to those of the

trial court; (8) When the findings of fact are conclusions without citation of

specific evidence on which they are based; (9) When the facts set forth in the

petition as well as in the petitioners main and reply briefs are not disputed by

the respondents; and (10) When the findings of fact of the Court of Appeals

are premised on the supposed absence of evidence and contradicted by the

evidence on record.

25

We find no cogent reason to apply the exceptions. While we slightly

deviate from one of the findings of the appellate court, we nonetheless

affirm its conclusion. We explain.

The boundaries of the subject lot were clearly delineated and were, as

a matter of fact, undisputed. Lot 224, as stated in Tax Declaration No. 1106,

is bounded by Sta. Clara Goldfield (Masbate Goldfield) in the North, by

Timberland in the East, by National Road in the South, and National Road in

the West. On the other hand, Lot 224-A is bounded on the North by the land

owned by Abundio, on the South by the Provincial Road, on the East by

Public Land, and on the West by Abundio.

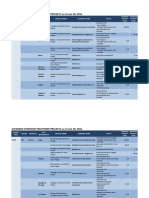

As per the Sketch Plans

26

submitted by the parties, Lot 224 and Lot

224-A are illustrated below:

25

Cirtek Employees Labor Union-Federation of Free Workers v. Cirtek Electronics, Inc., G.R. No.

190515, 6 June 2011, 650 SCRA 656, 660.

26

Records, Vol. II, pp. 45 and 64, respectively.

Decision 11 G.R. No. 137582

SKETCH PLAN FOR ANDRES CASTAARES

Lot 412

LOT 19

1

13 12

2 3

LOT 2187 MASBATE GOLDFIELD

1 4 11 MINING COMPANY

10

9 LOT 224 2

R

O

A 3

D

8

4

7

6

5

SKETCH PLAN FOR ARLES CASTAARES

1

8 7

13 12 MASBATE GOLDFIELD

LOT 2157

10 11

5 6 2

ABUNDIO CASTAARES 8

9 4 LOT 224-B 1 2

ARLES 2 3

CASTAARES

3 LOT 224-A

8 7

ATLAS MINING

7 6

Decision 12 G.R. No. 137582

Comparing the two sketches, it is unmistakable that Lot 224-A forms

part and parcel of Lot 224. Moreover, the boundaries, as admitted by both

parties, more or less established the location of Lot 224-A, which location is

inside and forms part of Lot 224. While it appears that Lot 224-A was a

subdivision of Lot 224, it does not necessarily establish petitioners

ownership over Lot 224-A.

Quite obviously, the two sketches are purportedly referring to only

one lot. Hence, the pith and core of the controversy is the ownership of the

disputed property.

The appellate court is correct in stating that there was no settlement of

the estate of Abundio. There is no showing that Lot 224 has already been

partitioned despite the demise of Abundio. It has been held that an heirs

right of ownership over the properties of the decedent is merely inchoate as

long as the estate has not been fully settled and partitioned. This means that

the impending heir has yet no absolute dominion over any specific property

in the decedents estate that could be specifically levied upon and sold at

public auction. Any encumbrance of attachment over the heirs interests in

the estate, therefore, remains a mere probability, and cannot summarily be

satisfied without the final distribution of the properties in the estate.

27

Therefore, the public auction sale of the property covered by Tax

Declaration No. 1107 is void because the subject property is still covered by

the Estate of Abundio, which up to now, remains unpartitioned. Arles was

not proven to be the owner of the lot under Tax Declaration No. 1107. It

may not be amiss to state that a tax declaration by itself is not sufficient to

prove ownership.

28

27

Into v. Valle, 513 Phil. 264, 272 (2005) citing Estate of Hilario M. Ruiz v. Court of Appeals, 322

Phil. 590, 603 (1996).

28

Republic v. Lagramada, G.R. No. 150741, 12 June 2008, 554 SCRA 355, 363.

Decision 13 G.R. No. 137582

Against a mere tax declaration, respondents were able to present a

more credible proof of ownership over Lot 224. The Court of Appeals relied

on the Certification issued by the Community Environment and Natural

Resources Office (CENRO) Officer of the Department of Environment and

Natural Resources (DENR) which certifies that Abundio, and now the heirs,

is the holder of a homestead application and an order for the issuance of

patent had already been issued as early as 7 July 1952.

29

Pertinent portions of the Certification are reproduced hereunder:

This is to certify that per records of this office, Abundio Castaares

(deceased) now the heirs represented by Juan Castaares is the holder of

Homestead Application No. 178912 (E-96030) which was issued an order:

Issuance of Patent on July 7, 1952.

It is also shown that in BL Conflict No. 220 (N), DLO Conflict No. 274,

entitled F.P.A. No. 11-1-1823 of Exequiela Jaca-Claimant-Protestant

versus H.A. No. 178912 (E-96030) of Abundio Castaares (deceased),

now the heirs rep. by Juan Castaares, B.L. Claim No. 220 (N), R.L.O.

Claim No. 473, D.L.O. Claim No. 274, a decision was rendered on May

19, 1976 the dispositive portion reads:

WHEREFORE, it is ordered that the Homestead

Application No. 178912 (E-96030) of the Heirs of Abundio

Castaares, represented by Juan Castaares shall cover only

Lots No. 224 and 2187 in Pls-77, Aroroy, Masbate and as thus

amended, shall continue to be given further due course.

Likewise, the Free Patent Application No. 11-1-1823 of

Exequiela Jaca for Lot No. 19, in the same subdivision, shall be

given further due course.

30

The Land Management Bureau of the DENR outlines the steps

leading to the issuance of a homestead patent:

1. Filing of application;

2. Preliminary Investigation;

3. Approval of application;

4. Filing of final proof which consists of two (2) parts;

29

Records, Vol. II, p. 65.

30

Id.

Decision 14 G.R. No. 137582

a. Notice of intention to make Final Proof which is posted for

30 days.

b. Testimony of the homesteader corroborated by two (2)

witnesses mentioned in the notice.

The Final Proof is filed not earlier than 1 year after the approval of the

application but within 5 years from the said date.

5. Confirmatory Final Investigation;

6. Order of Issuance of Patent;

7. Preparation of patent using Judicial Form No. 67 and 67-D and the

technical description duly inscribed at the back thereof;

8. Transmittal of the Homestead patent to the Register of Deeds

concerned.

31

(Emphasis supplied.)

In Director of Lands v. Court of Appeals,

32

citing the early case of

Balboa v. Farrales

33

we ruled that when a homesteader has complied with

all the terms and conditions which entitle him to a patent for a particular

tract of public land, he acquires a vested interest therein, enough to be

regarded as the equitable owner thereof. Where the right to a patent to land

has once become vested in a purchaser of public lands, it is equivalent to a

patent actually issued. The execution and delivery of patent, after

the right to a particular parcel of land has become complete, are the mere

ministerial acts of the officer charged with that duty. Even without a patent,

a perfected homestead is a property right in the fullest sense, unaffected by

the fact that the paramount title to the land is still in the government. Such

land may be conveyed or inherited.

Also, in Nieto v. Quines and Pio

34

involving ownership over a

contested lot, it was held that:

x x x As a homestead applicant, [Quines had] religiously complied with all

the requirements of the Public Land Act and, on August 29, 1930, a

homestead patent was issued in his favor. Considering the requirement

31

http://lmb.gov.ph/Homestead_Patent.aspx. (visited 17 August 2012).

32

260 Phil. 477, 486-487 (1990).

33

51 Phil. 498, 502-503 (1928).

34

110 Phil. 823, 827-828 (1961).

Decision 15 G.R. No. 137582

that the final proof must be presented within 5 years from the approval of

the homestead application x x x, it is safe to assume that Bartolome

Quines submitted his final proof way back yet in 1923 and that the

Director of Lands approved the same not long thereafter or before the land

became the subject of the cadastral proceedings in 1927. Unfortunately,

there was some delay in the ministerial act of issuing the patent and the

same was actually issued only after the cadastral court had adjudicated the

land to Maria Florentino. Nevertheless, having complied with all the terms

and conditions which would entitle him to a patent, Bartolome Quines,

even without a patent actually issued, has unquestionably acquired a

vested right on the land and is to be regarded as the equitable owner

thereof (citation omitted). Under these circumstances and applying by

analogy the principles governing sales of immovable property to two

different persons by the same vendor, Bartolome Quines title must prevail

over that of Maria Florentino not only because he had always been in

possession of the land but also because he obtained title to the land prior to

that of Maria Florentino.

In the instant case, it was clear that there has been an issuance of

patent way back in 7 July 1952. The only two acts left for the CENRO to do

are to prepare the patent and to transmit it to the Register of Deeds. As to

whether these acts have already been complied with is not borne in the

records, but the fact remains that these acts are merely ministerial.

Respondents have already acquired vested rights to a patent which is

equivalent to actual issuance of patent. They have become owners of the

land.

As evidence of ownership of land, a homestead patent prevails over a

land tax declaration.

WHEREFORE, premises considered, the petition is DENIED and

the assailed decision of the Court of Appeals dated 11 September 1998 in

CA-G.R. CV No. 42634 is hereby AFFIRMED.

Decision

SO ORDERED.

WE CONCUR:

G l ~ ~ ~

Associate Justice

16

JOS

ANTONIO T. CARPIO

Associate Justice

Chairperson

GR. No. 137582

~ ~ ~

MARIANO C. DEL CASTILLO

Associate Justice

W ~ ~ w

ESTELA M!PjERLAS-BERNABE

Associate Justice

Decision 17 GR. No. 137582

ATTESTATION

I attest that the conclusions in the above Decision had been reached in

consultation before the case was assigned to the writer of the opinion of the

Court's Division.

ANTONIOT. C

Associate Justice

Chairperson

CERTIFICATION

Pursuant to Section 13, Article VIII of the Constitution, and the

Division Chairperson'sAttestation, it is hereby certified that the conclusions

in the above Decision had been reached in consultation before the case was

assigned to the writer of the opinion of the Court's Division.

MARIA LOURDES P. A. SERENO

Chief Justice

Вам также может понравиться

- Del Fierro vs. SeguiranДокумент8 страницDel Fierro vs. SeguiranMj BrionesОценок пока нет

- Del Fierro v. SeguiranДокумент12 страницDel Fierro v. SeguiranJoanne CamacamОценок пока нет

- Sta. Monica Industrial and Development Corporation vs. Court of Appeals (189 SCRA 792)Документ8 страницSta. Monica Industrial and Development Corporation vs. Court of Appeals (189 SCRA 792)dondzОценок пока нет

- Land Tittles CasesДокумент76 страницLand Tittles CasesChe PulidoОценок пока нет

- Dolleton Vs Fil-EstateДокумент8 страницDolleton Vs Fil-EstateheyoooОценок пока нет

- Cureg Vs IAC GR No 73465Документ4 страницыCureg Vs IAC GR No 73465Bart Teope GatonОценок пока нет

- Republic v. AgunoyДокумент11 страницRepublic v. AgunoyPaolo Ervin PerezОценок пока нет

- 31divina v. Court of AppealsДокумент3 страницы31divina v. Court of AppealsFox TailОценок пока нет

- Trinidad II vs. PaladДокумент13 страницTrinidad II vs. Paladvince005Оценок пока нет

- Collado v. CA - CaseДокумент16 страницCollado v. CA - CaseRobehgene Atud-JavinarОценок пока нет

- Cristina de KnechtДокумент14 страницCristina de KnechtLiza Marie Lanuza SabadoОценок пока нет

- Plaintiff-Appellant vs. vs. Defendant-Appellee San Juan, Africa & Benedicto Eduardo P. Arboleda Jose S. RodriguezДокумент7 страницPlaintiff-Appellant vs. vs. Defendant-Appellee San Juan, Africa & Benedicto Eduardo P. Arboleda Jose S. RodriguezEmary GutierrezОценок пока нет

- 5 ColladoДокумент18 страниц5 ColladoMichelle SulitОценок пока нет

- Republic vs. Agunoy GR No. 155394 Feb. 17, 2005Документ13 страницRepublic vs. Agunoy GR No. 155394 Feb. 17, 2005Marco ArponОценок пока нет

- 9 Agunoy vs. CAДокумент8 страниц9 Agunoy vs. CAchristopher d. balubayanОценок пока нет

- Golloy Vs Court of AppealsДокумент3 страницыGolloy Vs Court of AppealsMack Hale BunaganОценок пока нет

- Republic vs. Court of Appeals: 78 Supreme Court Reports AnnotatedДокумент6 страницRepublic vs. Court of Appeals: 78 Supreme Court Reports AnnotatedAngelie FloresОценок пока нет

- PropДокумент73 страницыPropMarc Armand Balubal MaruzzoОценок пока нет

- WILLS (Ilagan & Taleon) Full Text 01 Arts. 774-803Документ137 страницWILLS (Ilagan & Taleon) Full Text 01 Arts. 774-803kayeОценок пока нет

- Intestate Vs CAДокумент17 страницIntestate Vs CAKodeconОценок пока нет

- LTD Case DigestsДокумент33 страницыLTD Case DigestsGeeОценок пока нет

- G.R. No. 117734 February 22, 2001 VICENTE G. DIVINA, Petitioner, Hon. Court of Appeals and Vilma Gajo-Sy, Respondets. Quisumbing, J.Документ5 страницG.R. No. 117734 February 22, 2001 VICENTE G. DIVINA, Petitioner, Hon. Court of Appeals and Vilma Gajo-Sy, Respondets. Quisumbing, J.Marjo PachecoОценок пока нет

- Heirs of Dolleton v. FilEstate Management, Inc., G.R. No. 170750, April 7, 2009Документ16 страницHeirs of Dolleton v. FilEstate Management, Inc., G.R. No. 170750, April 7, 2009Katrina PerezОценок пока нет

- GR 153850 2006Документ8 страницGR 153850 2006Kalos AntroposОценок пока нет

- 03 Leonidas V VargasДокумент14 страниц03 Leonidas V VargasSheenОценок пока нет

- "Iltppi R:Irn: &upreme QcourtДокумент17 страниц"Iltppi R:Irn: &upreme QcourtAnonymous KgPX1oCfrОценок пока нет

- Almagro Vs Sps Amaya - G.R. No. 179685Документ17 страницAlmagro Vs Sps Amaya - G.R. No. 179685patricia.aniyaОценок пока нет

- G.R. No. 158646, 461 SCRA 186Документ6 страницG.R. No. 158646, 461 SCRA 186Shannon GayleОценок пока нет

- Cristina de Knecht vs. Court of Appeals, G.R. No. 108015, May 20, 1998Документ9 страницCristina de Knecht vs. Court of Appeals, G.R. No. 108015, May 20, 1998AkiNiHandiongОценок пока нет

- 26-Seriña Vs Caballero, G.R. No. 127382, August 17, 2004Документ3 страницы26-Seriña Vs Caballero, G.R. No. 127382, August 17, 2004Elaika OrioОценок пока нет

- 34 NHA Vs Baello 2013Документ11 страниц34 NHA Vs Baello 2013SDN HelplineОценок пока нет

- Villanueva v. Malaya (330 SCRA 278)Документ10 страницVillanueva v. Malaya (330 SCRA 278)Jomarc MalicdemОценок пока нет

- Petitioner Vs VS: First DivisionДокумент12 страницPetitioner Vs VS: First DivisionSamanthaОценок пока нет

- 6 130761-1990-Alvarez v. Intermediate Appellate CourtДокумент9 страниц6 130761-1990-Alvarez v. Intermediate Appellate CourtCamille CruzОценок пока нет

- G.R. No. 175763 Heirs of Spouses Tanyag v. Gabriel PDFДокумент12 страницG.R. No. 175763 Heirs of Spouses Tanyag v. Gabriel PDFmehОценок пока нет

- G.R. No. 175763 - Heirs of Spouses Tanyag v. Gabriel PDFДокумент12 страницG.R. No. 175763 - Heirs of Spouses Tanyag v. Gabriel PDFFranco AguiluzОценок пока нет

- Petitioners Vs VS: First DivisionДокумент12 страницPetitioners Vs VS: First DivisionBingkat MacarimbangОценок пока нет

- G, Upreme Court: 11.lepublit ofДокумент18 страницG, Upreme Court: 11.lepublit ofBeboy Paylangco EvardoОценок пока нет

- LTD Cases 08-10Документ42 страницыLTD Cases 08-10Rich Lopez AlmarioОценок пока нет

- Erlinda M. Villanueva, Herein Represented by Her Attorney-In-fact Leopoldo San Buenaventura, Teofila N. AlbertoДокумент11 страницErlinda M. Villanueva, Herein Represented by Her Attorney-In-fact Leopoldo San Buenaventura, Teofila N. AlbertoLove HatredОценок пока нет

- Case No. 9: PetitionerДокумент61 страницаCase No. 9: PetitionerCatherine Rona DalicanoОценок пока нет

- Villena v. RupisanДокумент13 страницVillena v. Rupisancarla_cariaga_2Оценок пока нет

- 3 Divina VS CaДокумент5 страниц3 Divina VS CaJasper LimОценок пока нет

- 06 Villena V RupisanДокумент15 страниц06 Villena V Rupisanfammy jesseОценок пока нет

- Salinas vs. FaustinoДокумент10 страницSalinas vs. FaustinoSherily CuaОценок пока нет

- 4 MarcellaДокумент5 страниц4 MarcellaChrislynОценок пока нет

- Petitioners: First DivisionДокумент13 страницPetitioners: First DivisionAbijah Gus P. BitangjolОценок пока нет

- Marquez v. EspejoДокумент14 страницMarquez v. EspejoBeya AmaroОценок пока нет

- 12 Dadizon V CAДокумент6 страниц12 Dadizon V CAA SОценок пока нет

- Free Patent Over A Private Land Is Null and VoidДокумент13 страницFree Patent Over A Private Land Is Null and VoidrusselsithliОценок пока нет

- Lorenzana vs. LelinaДокумент12 страницLorenzana vs. LelinaDexter CircaОценок пока нет

- Collado v. CaДокумент18 страницCollado v. CaMarian's PreloveОценок пока нет

- Jaugaling vs. CAДокумент6 страницJaugaling vs. CAEmОценок пока нет

- Alvarez v. Intermediate Appellate CourtДокумент10 страницAlvarez v. Intermediate Appellate Courtnv.graceОценок пока нет

- Intestate Estate of Don Mariano San Pedro v. Court of AppealsДокумент19 страницIntestate Estate of Don Mariano San Pedro v. Court of AppealsCarty MarianoОценок пока нет

- Collado Vs CA - 107764 - October 4, 2002 - J. Carpio - First DivisionДокумент20 страницCollado Vs CA - 107764 - October 4, 2002 - J. Carpio - First DivisionJenny DagunОценок пока нет

- Heirs of Herman Santos v. CAДокумент5 страницHeirs of Herman Santos v. CAKristienne Carol PuruggananОценок пока нет

- Heirs of Herman Santos v. CAДокумент5 страницHeirs of Herman Santos v. CAKristienne Carol PuruggananОценок пока нет

- Report of the Decision of the Supreme Court of the United States, and the Opinions of the Judges Thereof, in the Case of Dred Scott versus John F.A. Sandford December Term, 1856.От EverandReport of the Decision of the Supreme Court of the United States, and the Opinions of the Judges Thereof, in the Case of Dred Scott versus John F.A. Sandford December Term, 1856.Оценок пока нет

- TR4 Dodeca CertificateOfAcceptance3Документ1 страницаTR4 Dodeca CertificateOfAcceptance3Danilo Magallanes SampagaОценок пока нет

- Civil Law Bqa 1975-2019Документ2 страницыCivil Law Bqa 1975-2019Danilo Magallanes Sampaga0% (1)

- Standard Plan For Multi Span PCDG BridgeДокумент2 страницыStandard Plan For Multi Span PCDG BridgeDanilo Magallanes SampagaОценок пока нет

- 15 Qualities of A Good Project ManagerДокумент8 страниц15 Qualities of A Good Project ManagerDanilo Magallanes SampagaОценок пока нет

- TR4 ProjectДокумент1 страницаTR4 ProjectDanilo Magallanes SampagaОценок пока нет

- De Lima Et - Al vs. Gatdula Case DigestДокумент2 страницыDe Lima Et - Al vs. Gatdula Case DigestDanilo Magallanes SampagaОценок пока нет

- General Plan Rev. 01-General PlanДокумент1 страницаGeneral Plan Rev. 01-General PlanDanilo Magallanes SampagaОценок пока нет

- Design of A Small Hydro-Power Plant PDFДокумент61 страницаDesign of A Small Hydro-Power Plant PDFDanilo Magallanes Sampaga67% (3)

- 2019 BAR EXAMINATIONS CIVIL LAW (Questions and Suggested Answers)Документ14 страниц2019 BAR EXAMINATIONS CIVIL LAW (Questions and Suggested Answers)Danilo Magallanes SampagaОценок пока нет

- Suggested Answers To The 2017 Bar Examination Questions in Political Law UP Law ComplexДокумент20 страницSuggested Answers To The 2017 Bar Examination Questions in Political Law UP Law ComplexDanilo Magallanes Sampaga100% (1)

- Awarded Hydropower 2016-06-30Документ38 страницAwarded Hydropower 2016-06-30Danilo Magallanes SampagaОценок пока нет

- Deed of Sale - LandДокумент2 страницыDeed of Sale - LandDanilo Magallanes SampagaОценок пока нет

- Axial Fan CatalogueДокумент40 страницAxial Fan CatalogueDanilo Magallanes SampagaОценок пока нет

- In The Supreme Court of Bangladesh Appellate Division (Civil Appellate Jurisdiction)Документ42 страницыIn The Supreme Court of Bangladesh Appellate Division (Civil Appellate Jurisdiction)Noor Ul Matin JotyОценок пока нет

- Provisional RemediesДокумент34 страницыProvisional Remediesrheamae888Оценок пока нет

- Akhil Gangesh 14, Ipc Sem 5thДокумент11 страницAkhil Gangesh 14, Ipc Sem 5thakhilgangeshОценок пока нет

- Latin TermsДокумент3 страницыLatin TermsEd PilaresОценок пока нет

- Kerajaan Malaysia V GovДокумент15 страницKerajaan Malaysia V Govchen mingОценок пока нет

- Tumbagahan vs. CA. 165 Scra 485Документ3 страницыTumbagahan vs. CA. 165 Scra 485Mariel D. PortilloОценок пока нет

- New Frontier Sugar Corp. Vs RTC of Iloilo GR 165001 Jan 31, 2007Документ3 страницыNew Frontier Sugar Corp. Vs RTC of Iloilo GR 165001 Jan 31, 2007Mesuella Bugao100% (1)

- Resume of Carterbean69Документ15 страницResume of Carterbean69api-24486527Оценок пока нет

- Digest Eastern Telecomvs. ICCДокумент2 страницыDigest Eastern Telecomvs. ICCBern MoncupaОценок пока нет

- Rule 14, Rules of CourtДокумент66 страницRule 14, Rules of CourtLou StellarОценок пока нет

- Memory Aid - Midterm ExamДокумент14 страницMemory Aid - Midterm ExamAianna Bianca Birao (fluffyeol)Оценок пока нет

- Contempt of CourtДокумент5 страницContempt of Courtsneha joshiОценок пока нет

- Laburada v. LRA DigestДокумент1 страницаLaburada v. LRA Digestdexter lingbananОценок пока нет

- AS Law Unit 1Документ22 страницыAS Law Unit 1Natalie MudavanhuОценок пока нет

- Sital Das V Sant Ram and Others MarkedДокумент27 страницSital Das V Sant Ram and Others MarkedChintakayala SaikrishnaОценок пока нет

- Submitted By: Adeeb Ul Hasan A3256118044: Project On Suit by or Against GovernmentДокумент11 страницSubmitted By: Adeeb Ul Hasan A3256118044: Project On Suit by or Against GovernmentNabeel Choudhary100% (1)

- In Re Cecil Carl Varney, Debtor. Cecil Carl Varney v. Angela Lea Varney, 81 F.3d 152, 4th Cir. (1996)Документ5 страницIn Re Cecil Carl Varney, Debtor. Cecil Carl Varney v. Angela Lea Varney, 81 F.3d 152, 4th Cir. (1996)Scribd Government DocsОценок пока нет

- D.R. HORTON, INC. v. LIBERTY MUTUAL FIRE INSURANCE COMPANY Et Al DocketДокумент4 страницыD.R. HORTON, INC. v. LIBERTY MUTUAL FIRE INSURANCE COMPANY Et Al DocketACELitigationWatchОценок пока нет

- Philip Turner V LOrenzo Shipping Corp G.R. No. 157479, November 24, 2010Документ15 страницPhilip Turner V LOrenzo Shipping Corp G.R. No. 157479, November 24, 2010ChatОценок пока нет

- De La Rosa Vs HeirsДокумент12 страницDe La Rosa Vs HeirsHannah EscuderoОценок пока нет

- Zafar Ali Shah CaseДокумент3 страницыZafar Ali Shah CaseIqra Masud78% (9)

- Campanano, Jr. v. DatuinДокумент8 страницCampanano, Jr. v. DatuinChristopher Martin GunsatОценок пока нет

- Pecuniary Jurisdiction of The Court Under Section 6 of Code of Civil Procedure 1908 Lecture No. 18 - YouTubeДокумент5 страницPecuniary Jurisdiction of The Court Under Section 6 of Code of Civil Procedure 1908 Lecture No. 18 - YouTubeRaja IbrahimОценок пока нет

- Valcaruza V TamparongДокумент13 страницValcaruza V TamparongFox TailОценок пока нет

- Sanjay Bhalkar Vs State of Maharashtra On 13 January 2020Документ25 страницSanjay Bhalkar Vs State of Maharashtra On 13 January 2020SandeepPamaratiОценок пока нет

- E. Due Process and Eminent Domain Digested Cases: Case #1 Solgen Vs Ayala LandДокумент9 страницE. Due Process and Eminent Domain Digested Cases: Case #1 Solgen Vs Ayala LandNhaz PasandalanОценок пока нет

- Ledoux v. LouisianaДокумент2 страницыLedoux v. Louisianajwooden3Оценок пока нет

- Mayor Miguel Paderanga Vs Judge Cesar AzuraДокумент2 страницыMayor Miguel Paderanga Vs Judge Cesar AzuraewnesssОценок пока нет

- Samalio Vs CAДокумент10 страницSamalio Vs CALourdes LescanoОценок пока нет

- Villalongha Vs CAДокумент9 страницVillalongha Vs CAFacio BoniОценок пока нет