Академический Документы

Профессиональный Документы

Культура Документы

Al HHP Oilgasnewrules Apr13

Загружено:

Divakumalasari SalsabellaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Al HHP Oilgasnewrules Apr13

Загружено:

Divakumalasari SalsabellaАвторское право:

Доступные форматы

Finance & Projects

Jakarta

Client Alert

Oil and Gas New Rules on Domestic Content: Hard Headed Pragmatism or Impossible Dream?

Introduction

The Ministry of Energy and Mineral Resources ("MEMR") has recently issued new regulations on local content requirements for upstream oil and gas procurement. MEMR Regulation No. 15 of 2013 ("Reg 15") was passed on 22 February 2013 and will become effective in May 2013. In general, the new regulations codify the oil and gas local content guidelines set out in BPMIGAS' (as was) No. 007/Revisi-II/PTK/I/2011 ("PTK 007").

April 2013

What's Changed?

Listed below is a summary of some of the key provisions of this regulation.

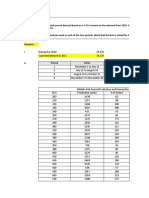

New Local Content Targets and "Roadmap"

Reg 15 provides new more stringent local content requirements to be applied through to 2025. Previously, almost all oil and gas services were subject to a minimum local content requirement of 35%. The new key targets include:

Oil and gas activity

Drilling Offshore EPCI Shipping Services Survey, Seismic and Geology Studies Other services

Current Target

35% (land) 35% (sea) 35% 35% 35% (land) 35% (sea) 35%

New Target

70% (land) 45% (sea) 45% 75% 90% (land) 35% (sea) 75%

Implementation Period

After 2016 After 2016 2013 After 2020 After 2020

To achieve the above targets, the Director General of Oil and Gas will establish a "roadmap" to implement the targets. It is unclear what this roadmap will set out. Reg 15 also raises the domestic content threshold for certain equipment. For example, the targeted local content requirement for wellheads and christmas trees - starting from 2021 - is 40% offshore, 70% onshore; that required for electrical submersible pumps is set to increase to 35% starting from 2021.

Finance & Projects

In the meantime, the procurement of oil and gas goods / equipment will still need to follow the domestic content thresholds set out in the Domestic Products Appreciation Book (Buku Apresiasi Produksi Dalam Negeri) issued and periodically updated by the DGOG.

Calculation of Local Content

It is important to recognize that the calculation of domestic content is based, not on ownership (subject to our comments below), or on final contract price, but on the origin of input costs. For the provision of goods, these costs include material, labour and indirect manufacturing costs (but would seem to exclude certain transport costs). For services, these include material, labour and 1 equipment used in the provision of services. Excluded from this determination are profits, company (HQ) overhead and VAT. In assessing domestic content for services, it will be necessary to burrow down to 3 levels of contractor (i.e. to sub-sub-contractors).

Price Preferences

Under Reg 15, the maximum available price preference based on domestic content consistent with PTK 007 is 15% for goods, 7.5% for services. In addition, previously, under PTK 007, companies supplying goods or services were entitled to an additional price preference if they were Domestic Companies - the applicable price preference percentage could range between 5% to 7.5%, depending on whether the company had entered into a consortium arrangement with a foreign company / Indonesian foreign investment company. A Domestic Company is an Indonesian limited liability company majority owned by an Indonesian individual, the Government of the Republic of Indonesia, a regional government, a State-Owned Enterprise or a Regional Government Owned Enterprise. Reg 15 now scales back the extent of this preference, so that it only applies to suppliers of goods (that are Domestic Companies) reaching the relevant domestic content threshold, and is capped at 2.5%.

Enhanced Supervisory Powers of the Government

One of the key focuses of Reg 15 is compliance, and the expansion of the Government's authority in supervising local content compliance. Under PTK 007, BPMIGAS' supervision over local content compliance was somewhat limited, with the obligation to police compliance with domestic content requirements being passed onto oil and gas companies.

The costs of equipment that are: produced domestically and owned by Indonesian persons or Domestic Companies shall be valued as 100% domestic content; produced domestically and owned by majority foreign-owned PMA companies shall be valued as 75% domestic content; produced domestically and owned by foreign companies (providing services in a consortium) shall be valued as 50% domestic content; produced outside Indonesia and owned by Indonesian persons or Domestic Companies shall be valued as 75% domestic content; produced outside Indonesia and owned by majority foreign-owned PMA companies shall be valued as 50% domestic content; produced outside Indonesia and owned by foreign companies shall be valued as 0% domestic component.

2 Oil and Gas New Rules on Domestic Content: Hard Headed Pragmatism or Impossible Dream? April 2013

Finance & Projects

Reg 15 increases the Government's supervisory role over local content by way of, among other things, the following: (i) the Directorate General of Oil and Gas ("DGOG")'s authority to witness production processes (if required) previously, the obligation to supervise local content rested primarily with oil and gas companies; compulsory verification process to certify the achievement of the requisite local content previously, oil and gas companies could opt to verify their contractors' local content levels. Verification is now compulsory for procurement activities over a certain value. This obligation sits with the oil and gas company and/or the goods/services provider. Further, the DGOG will determine the institutions / parties able to conduct such verification; granting SKKMigas authority to determine the total local content level that will need to be achieved by an oil and gas company under a Work Program and Budget and/or a Procurement Plan.

(ii)

(iii)

Sanctions

As mentioned above, previously, oil and gas companies were required by PTK 007 to drive the enforcement process of local content obligations and apply the sanctions applicable to any breach of these guidelines. Reg 15, however, introduced new sanctions to be applied by the Government, e.g. the revocation of a manufacturing company's SKUP (Supporting Services Capability Statement / Surat Kemampuan Usaha Penunjang Minyak dan Gas 2 Bumi). The regulation also makes express the ability of the oil and gas companies to withhold payments under their procurement contracts in the event of a contractor's failure to satisfy domestic content.

Impact on PTK 007?

Reg 15 does not expressly revoke the local content provisions of PTK 007. However, to the extent that they contravene the provisions of Reg 15 (or any other regulations referred to by Reg 15), these provisions should be deemed to no longer apply.

Conclusion

In general, Reg 15 does not significantly alter the local content regulatory framework set out in PTK 007. However, oil and gas companies and contractors will need to be aware of the following: Oil and Gas Company Need to ensure procurement process follows domestic content requirements set out in the APDN. Need to verify contractor's local content. Failure to prioritize domestic goods/services in a procurement Contractor Contractors should be prepared to be audited for local content. Contractors, especially services suppliers, will be expected to increase their local content level during the next few years.

An SKUP is a license issued to manufacturing companies that have demonstrated that they supply goods satisfying the relevant domestic content thresholds. It is not clear what will flow from the revocation of the SKUP presumably, this document will be required to participate in tenders, however.

3 Oil and Gas New Rules on Domestic Content: Hard Headed Pragmatism or Impossible Dream? April 2013

Finance & Projects

process may be subject to sanctions from SKKMIGAS. Any services agreement to be entered into by an oil and gas company with a service company should provide the right to set off penalties due to contractor's noncompliance with local content requirements against the total contract value.

Manufacturing companies will be required to obtain an SKUP. Contractors will need to provide bi-annual reports on domestic content capability.

News Alert

The decision of the World Trade Organisation in Canada Certain Measure Affecting the Renewable Energy Generation Sector was issued at the end of last year, but has only fairly recently been publicly available. While, at first blush, the contents of this might seem to be of little relevance, the decision should be of interest to oil and gas (and other) suppliers in Indonesia. In its decision the WTO panel affirmed that domestic content requirements, which entitled electricity suppliers to certain feed-in tariffs for the sale of electricity in Ontario, were contrary to Article III.4 of the General Agreement on Tariffs and Trade 1994 ("GATT"). This was the case even where these requirements had the laudable aim of encouraging green energy generation in Ontario. Article III.4 of the GATT stipulates that: "4. The products of the territory of any contracting party imported into the territory of any other contracting party shall be accorded treatment no less favourable than that accorded to like products of national origin in respect of all laws, regulations and requirements affecting their internal sale, offering for sale, purchase, transportation, distribution or use." In this connection, it might be possible to argue that the provisions of Article III.4 are not applicable, to domestic content requirements in Indonesia, on the basis of Article III.8. This exempts the application of the national treatment principle for procurement by government agencies of products purchased for government purposes and not with a view to resale. However, even though Indonesia is not a party to the WTO Agreement on Government Procurement, any such argument put forward on behalf of the authorities in Indonesia would need to demonstrate that: in the context of Indonesian oil and gas, it is the government that is procuring the equipment. This seems debatable, at least, as the government is not paying for such equipment itself (at least, not until the equipment is cost recovered); oil and gas procurement is being carried out for government purposes (query whether producing and selling oil and gas is a "government purpose"); and such purpose is not with a view to the production of goods for commercial sale (again, this seems debatable).

4 Oil and Gas New Rules on Domestic Content: Hard Headed Pragmatism or Impossible Dream? April 2013

Finance & Projects

www.hhp.co.id

Similar provisions to Article III are set out in the General Agreement on Trade in Services (although there are more derogations from this). It should be noted that Indonesia is a member of the WTO, and has signed up to both the GATT and GATS. Accordingly, while the WTO panel decision in this case is not directly applicable to Indonesia, query to what extent the current oil and gas procurement regime is WTO-compliant.

For further information please contact Luke Devine Foreign Legal Consultant +62 21 515 4909 luke.devine@bakernet.com Norman Bissett Foreign Legal Consultant +62 21 515 5350 norman.bissett@bakernet.com Muhammad Karnova Partner +62 21 515 4869 muhammad.karnova@bakernet.com John Sitepu Associate +62 21 515 4868 john.p.sitepu@bakernet.com Alamanda Vania Associate +62 21 515 5090 Ext 6104 alamanda.vania@bakernet.com

Hadiputranto, Hadinoto & Partners The Indonesia Stock Exchange Building, Tower II, 21st Floor Sudirman Central Business District Jl. Jenderal Sudirman Kav. 52-53 Jakarta 12190 Indonesia Tel: +62 21 515 5090/91/92/93 Fax: +62 21 515 4840/45/50/55

2013 Hadiputranto, Hadinoto & Partners. All rights reserved. Hadiputranto, Hadinoto & Partners is a member of Baker & McKenzie International, a Swiss Verein with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a partner means a person who is a partner, or equivalent, in such a law firm. Similarly, reference to an office means an office of any such law firm. This may qualify as Attorney Advertising requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.

5 Oil and Gas New Rules on Domestic Content: Hard Headed Pragmatism or Impossible Dream? April 2013

Вам также может понравиться

- General: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterДокумент5 страницGeneral: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterSuraj NaikОценок пока нет

- SPE-203740-MS Implications of Petroleum Industry Fiscal Bill 2018 On Heavy Oil Field EconomicsДокумент19 страницSPE-203740-MS Implications of Petroleum Industry Fiscal Bill 2018 On Heavy Oil Field Economicsipali4christ_5308248Оценок пока нет

- Presentation On PIB 2020Документ27 страницPresentation On PIB 2020Adegbola OluwaseunОценок пока нет

- Transfer Pricing Rules DecodingДокумент74 страницыTransfer Pricing Rules DecodingWaqas AtharОценок пока нет

- Petrobangla: Daily Gas & Condensate Production and Distribution Report I. Production III. LPG ProductionДокумент3 страницыPetrobangla: Daily Gas & Condensate Production and Distribution Report I. Production III. LPG ProductionMohammadОценок пока нет

- Appendix 7 Financials: Income StatementДокумент12 страницAppendix 7 Financials: Income StatementHamza MalikОценок пока нет

- Large PipesДокумент3 страницыLarge Pipesqais bakrОценок пока нет

- Kirkuk Crude Oil AssayДокумент1 страницаKirkuk Crude Oil AssayVentzislav StefanovОценок пока нет

- Abridged Dangote Cement and BCC Scheme of Merger-170910Документ36 страницAbridged Dangote Cement and BCC Scheme of Merger-170910ProshareОценок пока нет

- 1354 Nigeria Country SuДокумент48 страниц1354 Nigeria Country Sudharmendra_kanthariaОценок пока нет

- MNLP (I.e., MINLP) Model For Optimal Synthesis and Operation of Utility PlantsДокумент35 страницMNLP (I.e., MINLP) Model For Optimal Synthesis and Operation of Utility PlantsErhan OğuşОценок пока нет

- Poseidon - Summary Crude Oil Assay Report: Source of Sample Light Hydrocarbon Analysis Assay Summary / TBP DataДокумент3 страницыPoseidon - Summary Crude Oil Assay Report: Source of Sample Light Hydrocarbon Analysis Assay Summary / TBP DataAdrian David Castillo SabinoОценок пока нет

- Economic Evaluation and Sensitivity Analysis of Some Fuel Oil Upgrading ProcessesДокумент11 страницEconomic Evaluation and Sensitivity Analysis of Some Fuel Oil Upgrading ProcessesamitОценок пока нет

- Re-Engineering The Uk Construction Industry: The Process ProtocolДокумент12 страницRe-Engineering The Uk Construction Industry: The Process ProtocolGeeta RamsinghОценок пока нет

- The Role of Big DataДокумент27 страницThe Role of Big DataNina FilipovićОценок пока нет

- Cost of ProductionДокумент1 страницаCost of ProductionPRATIK P. BHOIRОценок пока нет

- Rao 2018Документ81 страницаRao 2018Sultan AlmaghrabiОценок пока нет

- BXPДокумент53 страницыBXPkaranx16Оценок пока нет

- Hadoop Notes Unit2Документ24 страницыHadoop Notes Unit2manyamlakshmiprasannaОценок пока нет

- Lecture-3 Crude Oil PropertiesДокумент61 страницаLecture-3 Crude Oil PropertiesMrHemFun100% (1)

- Big DataДокумент14 страницBig DataZubair Ahmad loneОценок пока нет

- What Is Big Data & Why Is Big Data Important in Today's EraДокумент13 страницWhat Is Big Data & Why Is Big Data Important in Today's EraMaanit Singal100% (1)

- Understanding The Big Data Problems and Their Solutions Using Hadoop and Map-ReduceДокумент7 страницUnderstanding The Big Data Problems and Their Solutions Using Hadoop and Map-ReduceInternational Journal of Application or Innovation in Engineering & ManagementОценок пока нет

- Aspen Basic EngineeringДокумент5 страницAspen Basic Engineeringnaren_013Оценок пока нет

- Securitization - Past Present and Future in IndiaДокумент24 страницыSecuritization - Past Present and Future in IndiaPriya Ranjan SinghОценок пока нет

- Oil Processing PDFДокумент65 страницOil Processing PDFsegunoyesОценок пока нет

- ACF5950-Assignment-2801656-kaidi ZhangДокумент13 страницACF5950-Assignment-2801656-kaidi ZhangkietОценок пока нет

- 5NRJHL Saipem FY2020 Results JMEEBOДокумент42 страницы5NRJHL Saipem FY2020 Results JMEEBOsudhakarrrrrrОценок пока нет

- Compro Humpuss Aromatic PDFДокумент6 страницCompro Humpuss Aromatic PDFArya26Оценок пока нет

- NP EX19 9a JinruiDong 2Документ9 страницNP EX19 9a JinruiDong 2Ike DongОценок пока нет

- Igcc Power Plants: (A New Technology To Answer Global Warming)Документ16 страницIgcc Power Plants: (A New Technology To Answer Global Warming)venky123456789Оценок пока нет

- Chapter-1-2, EMC DSA NotesДокумент8 страницChapter-1-2, EMC DSA NotesakragnarockОценок пока нет

- BalderДокумент8 страницBalderAhmed HossamОценок пока нет

- Processing Model From Mining ProspectiveДокумент5 страницProcessing Model From Mining ProspectiveijsretОценок пока нет

- Opus Quiz 1Документ2 страницыOpus Quiz 1KaRol PadillaОценок пока нет

- Ior in NigeriaДокумент6 страницIor in NigeriaTayo AwololaОценок пока нет

- Petroleum Exploration & Production POLICY 2011: Government of Pakistan Ministry of Petroleum & Natural ResourcesДокумент54 страницыPetroleum Exploration & Production POLICY 2011: Government of Pakistan Ministry of Petroleum & Natural ResourcesShaista IshaqОценок пока нет

- CIMA GBC 2015 Case StudyДокумент25 страницCIMA GBC 2015 Case StudyPasanPethiyagodeОценок пока нет

- Petrochemical Technology (Interview)Документ23 страницыPetrochemical Technology (Interview)Ohol Rohan BhaskarОценок пока нет

- Demand Dignity: Petrol, Pollution + Poverty in The Niger DeltaДокумент24 страницыDemand Dignity: Petrol, Pollution + Poverty in The Niger Deltasouleymane2013Оценок пока нет

- Petrochemical Engineering S1314 160114 SOLUTIONS 2Документ9 страницPetrochemical Engineering S1314 160114 SOLUTIONS 2ollie4hortonОценок пока нет

- IB Final ShellДокумент25 страницIB Final ShellsnehakopadeОценок пока нет

- Gas Aggregation Company of Nigeria Investor Forum PresentationДокумент23 страницыGas Aggregation Company of Nigeria Investor Forum PresentationsegunoyesОценок пока нет

- Power Sector Retreat Presentations - Jan 20-21 2012 - NNPC GasДокумент29 страницPower Sector Retreat Presentations - Jan 20-21 2012 - NNPC Gass_kohli2000Оценок пока нет

- Informacion Sobre FCC, Boquillas y Parametros A OptimizarДокумент14 страницInformacion Sobre FCC, Boquillas y Parametros A OptimizarEQP1210Оценок пока нет

- Neste Oil: Esa Kokko Guillermo Avila Jürgen Suls Teresa Luoma-AhДокумент13 страницNeste Oil: Esa Kokko Guillermo Avila Jürgen Suls Teresa Luoma-Ahmemoavila71Оценок пока нет

- Hybrid Fuel Cell Gas Turbine SystemsДокумент32 страницыHybrid Fuel Cell Gas Turbine Systemsİsmail Cem OktayОценок пока нет

- UOP CCR Catalysts Target A Range of Objectives Tech Paper1Документ5 страницUOP CCR Catalysts Target A Range of Objectives Tech Paper1nikitaambeОценок пока нет

- Bg-2 Aramco MR Al Gouhi Best-practice-For-InnovationДокумент11 страницBg-2 Aramco MR Al Gouhi Best-practice-For-InnovationClash SellОценок пока нет

- Production Sharing Agreement - Wikipedia, The Free EncyclopediaДокумент3 страницыProduction Sharing Agreement - Wikipedia, The Free EncyclopediaandinumailОценок пока нет

- Pengerang Integrated Petroleum Complex (PIPC) : Malaysia ThematicДокумент44 страницыPengerang Integrated Petroleum Complex (PIPC) : Malaysia ThematicSumner TingОценок пока нет

- PMC IpdДокумент19 страницPMC IpdAbhik BhattacharjeeОценок пока нет

- Sokol15F: 3225 Gallows Road, 4B0418 Fairfax, Virginia 22037-0001Документ1 страницаSokol15F: 3225 Gallows Road, 4B0418 Fairfax, Virginia 22037-0001asad razaОценок пока нет

- MGC Company BrochureДокумент4 страницыMGC Company BrochureN TanejaОценок пока нет

- Compressor Data Sheet Rev3 - Updated by EFXДокумент9 страницCompressor Data Sheet Rev3 - Updated by EFXmanuОценок пока нет

- Nigerian Local Content Oil and GasДокумент4 страницыNigerian Local Content Oil and GasBalogun Ruth Oluwatosin100% (1)

- The 9f PlatformДокумент8 страницThe 9f Platformsevero97Оценок пока нет

- An Ea 2020 EДокумент284 страницыAn Ea 2020 Eyumin WangОценок пока нет

- THE PETROLEUM ACT ReviewДокумент5 страницTHE PETROLEUM ACT ReviewPatMbwileОценок пока нет

- PWC Indonesia Energy, Utilities & Mining NewsflashДокумент16 страницPWC Indonesia Energy, Utilities & Mining Newsflash'El'KahfiRahmatОценок пока нет

- Practice For Those Who Are DyingДокумент10 страницPractice For Those Who Are DyingBecze István / Stephen Becze100% (1)

- EXPE222Документ6 страницEXPE222K-yanVehraaYomomaОценок пока нет

- LEGO Group A Strategic and Valuation AnalysisДокумент85 страницLEGO Group A Strategic and Valuation AnalysisRudmila Ahmed50% (2)

- TM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Документ1 страницаTM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Nicky Galang IIОценок пока нет

- The Nervous System 1ae60 62e99ab3Документ1 страницаThe Nervous System 1ae60 62e99ab3shamshadОценок пока нет

- S1-TITAN Overview BrochureДокумент8 страницS1-TITAN Overview BrochureصصОценок пока нет

- Gardens Illustrated FernandoДокумент4 страницыGardens Illustrated FernandoMariaОценок пока нет

- Upload A Document To Access Your Download: Social Studies of HealthДокумент3 страницыUpload A Document To Access Your Download: Social Studies of Health1filicupEОценок пока нет

- Lesson PlansДокумент9 страницLesson Plansapi-238729751Оценок пока нет

- CEO - CaninesДокумент17 страницCEO - CaninesAlina EsanuОценок пока нет

- Affin Bank V Zulkifli - 2006Документ15 страницAffin Bank V Zulkifli - 2006sheika_11Оценок пока нет

- Republic of The Philippines Legal Education BoardДокумент25 страницRepublic of The Philippines Legal Education BoardPam NolascoОценок пока нет

- Connecting Microsoft Teams Direct Routing Using AudioCodes Mediant Virtual Edition (VE) and Avaya Aura v8.0Документ173 страницыConnecting Microsoft Teams Direct Routing Using AudioCodes Mediant Virtual Edition (VE) and Avaya Aura v8.0erikaОценок пока нет

- Athletic KnitДокумент31 страницаAthletic KnitNish A0% (1)

- The Old Rugged Cross - George Bennard: RefrainДокумент5 страницThe Old Rugged Cross - George Bennard: RefrainwilsonОценок пока нет

- Caterpillar Cat 304.5 Mini Hydraulic Excavator (Prefix WAK) Service Repair Manual (WAK00001 and Up)Документ23 страницыCaterpillar Cat 304.5 Mini Hydraulic Excavator (Prefix WAK) Service Repair Manual (WAK00001 and Up)kfmuseddk100% (1)

- 21 and 22 Case DigestДокумент3 страницы21 and 22 Case DigestRosalia L. Completano LptОценок пока нет

- English File: Grammar, Vocabulary, and PronunciationДокумент4 страницыEnglish File: Grammar, Vocabulary, and PronunciationFirstName100% (2)

- Two Steps Individualized ACTH Therapy For West SyndromeДокумент1 страницаTwo Steps Individualized ACTH Therapy For West SyndromeDrAmjad MirzanaikОценок пока нет

- Movie ReviewДокумент2 страницыMovie ReviewJohanna Gwenn Taganahan LomaadОценок пока нет

- Operations Management-CP PDFДокумент4 страницыOperations Management-CP PDFrey cedricОценок пока нет

- Rhipodon: Huge Legendary Black DragonДокумент2 страницыRhipodon: Huge Legendary Black DragonFigo FigueiraОценок пока нет

- ColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingДокумент10 страницColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingBalazs RaymondОценок пока нет

- Task 1: Choose The Present Simple, The Present Continuous, The PresentДокумент5 страницTask 1: Choose The Present Simple, The Present Continuous, The PresentAlexandra KupriyenkoОценок пока нет

- Journal of Exceptional Experiences and PДокумент62 страницыJournal of Exceptional Experiences and Pbinzegger100% (1)

- Mse Return DemonstrationДокумент7 страницMse Return DemonstrationMaggay LarsОценок пока нет

- MELSEC System Q: QJ71MES96 MES Interface ModuleДокумент364 страницыMELSEC System Q: QJ71MES96 MES Interface ModuleFajri AsyukronОценок пока нет

- Sound Culture: COMS 350 (001) - Winter 2018Документ12 страницSound Culture: COMS 350 (001) - Winter 2018Sakshi Dhirendra MishraОценок пока нет

- Pronoun AntecedentДокумент4 страницыPronoun AntecedentJanna Rose AregadasОценок пока нет

- 2007.01 What Does Jesus Think of Science?Документ2 страницы2007.01 What Does Jesus Think of Science?William T. PelletierОценок пока нет