Академический Документы

Профессиональный Документы

Культура Документы

Choice Discount Rate

Загружено:

prasad_kcpИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Choice Discount Rate

Загружено:

prasad_kcpАвторское право:

Доступные форматы

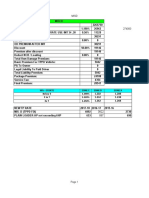

Case with nominal cash flows and using a nominal discount rate Time period Real toll cost

($) Nominal toll cost ($) Cash flow ($) Discount factor ($) Present value ($) Net Present Value ($) 0 0.00 0.00 0.00 1.00 0.00 -3.59 1 0.98 1.00 -1.00 0.89 -0.89 2 0.96 1.00 -1.00 0.79 -0.79 3 0.94 1.00 -1.00 0.71 -0.71

Here you discount nominal cash flows with a nominal discount rate. Since the toll doesn't change w Case with real cash flows and using a real discount rate Time period Real toll cost ($) Cash flow ($) Discount factor ($) Present value ($) Net Present Value ($) Real discount rate (p) Inflation rate (i) Nominal discount rate (r) 0 0.00 0.00 1.00 0.00 -3.59 10% 2% 12% 1 0.98 -0.98 0.91 -0.89 2 0.96 -0.96 0.83 -0.79 3 0.94 -0.94 0.75 -0.71

=> =>

this is the real return (or productivity of money) this is the nominal return

NOTE THAT DISCOUNTING NOMINAL CASH FLOWS WITH A NOMINAL DISCOUNT RATE, OR REAL CA

4 0.92 1.00 -1.00 0.63 -0.63

5 0.91 1.00 -1.00 0.56 -0.56

. Since the toll doesn't change with inflation, you pocket the 2% inflation rate in addition to the real return.

4 0.92 -0.92 0.68 -0.63

5 0.91 -0.91 0.62 -0.56

eturn (or productivity of money)

AL DISCOUNT RATE, OR REAL CASH FLOWS WITH A REAL DISCOUNT RATE, GIVES YOU THE SAME NPV!

n to the real return.

HE SAME NPV!

Case with nominal cash flows and using a nominal discount rate Time period Real bed cost ($) Nominal bed cost ($) Cash flow ($) Discount factor ($) Present value ($) Net Present Value ($) 0 0.00 0.00 0.00 1.00 0.00 -5,686.18 1 1,500.00 1,530.00 -1,530.00 0.89 -1,363.64 2 1,500.00 1,560.60 -1,560.60 0.79 -1,239.67 3 1,500.00 1,591.81 -1,591.81 0.71 -1,126.97

Case with real cash flows and using a real discount rate Time period Real bed cost ($) Cash flow ($) Discount factor ($) Present value ($) Net Present Value ($) Real discount rate (p) Inflation rate (i) Nominal discount rate (r) 0 0.00 0.00 1.00 0.00 -5,686.18 10% 2% 12% 1 1,500.00 -1,500.00 0.91 -1,363.64 2 1,500.00 -1,500.00 0.83 -1,239.67 3 1,500.00 -1,500.00 0.75 -1,126.97

=> =>

this is the real return (or productivity of money) this is the nominal return

Here you discount the real cost of beds every year using a real discount rate. Because the bed cost i

NOTE THAT DISCOUNTING NOMINAL CASH FLOWS WITH A NOMINAL DISCOUNT RATE, OR REAL CA

4 1,500.00 1,623.65 -1,623.65 0.63 -1,024.52

5 1,500.00 1,656.12 -1,656.12 0.56 -931.38

4 1,500.00 -1,500.00 0.68 -1,024.52

5 1,500.00 -1,500.00 0.62 -931.38

eturn (or productivity of money)

ount rate. Because the bed cost increases with inflation, you do not pocket inflation as an additional return.

AL DISCOUNT RATE, OR REAL CASH FLOWS WITH A REAL DISCOUNT RATE, GIVES YOU THE SAME NPV!

an additional return.

HE SAME NPV!

Вам также может понравиться

- Discount PointsДокумент3 страницыDiscount PointsChandra Shekhar Bhatnagar0% (1)

- Car Rental CodeДокумент2 страницыCar Rental CodeTwilightDawn0% (1)

- AsgДокумент307 страницAsgAlexandr TrotskyОценок пока нет

- 2010 1040a Federal Tax FormДокумент2 страницы2010 1040a Federal Tax FormesvrasОценок пока нет

- Screen Name Test Title Test Script # Test Objectives:: Login Page LM Test Functionality of Login LM Access LP - LM - 001Документ8 страницScreen Name Test Title Test Script # Test Objectives:: Login Page LM Test Functionality of Login LM Access LP - LM - 001sadim22Оценок пока нет

- Marriott Consumer Incentives Overview: Who We AreДокумент46 страницMarriott Consumer Incentives Overview: Who We AreAshleyFurnitureОценок пока нет

- Employee DiscountsДокумент2 страницыEmployee DiscountsBlake Griffin100% (1)

- Rental CarДокумент79 страницRental CarNavit Srivastava0% (6)

- RARES DiscountsДокумент2 страницыRARES DiscountsSelarom AnthonyОценок пока нет

- Groupon A63EFA1D2BДокумент1 страницаGroupon A63EFA1D2BSalif NdiayeОценок пока нет

- Hotel Booking WebsitesДокумент8 страницHotel Booking WebsitesYuppy Kanal100% (1)

- Employee DiscountДокумент1 страницаEmployee DiscountHailey Patrick100% (1)

- 2 Night Welcome Home Quarantine Packages: Confirm Details + BookДокумент2 страницы2 Night Welcome Home Quarantine Packages: Confirm Details + BookVibinОценок пока нет

- SNДокумент2 страницыSNEddy Rafizal100% (1)

- Hotel Friends & Family VoucherДокумент1 страницаHotel Friends & Family VouchermarkballanОценок пока нет

- ReadmeДокумент1 страницаReadmeposa akhilОценок пока нет

- LSOP - Explore Authorization Form - Associate Non-Room Discount CardДокумент2 страницыLSOP - Explore Authorization Form - Associate Non-Room Discount Card9899659344Оценок пока нет

- Hotel VoucherДокумент2 страницыHotel VoucherjoserslealОценок пока нет

- HotelsДокумент1 страницаHotelsTMОценок пока нет

- Unlock Order Form DirectUnlocksДокумент1 страницаUnlock Order Form DirectUnlocksDaniel GrekinОценок пока нет

- Account Transfer Bank of The Philippine Islands-Family Bank Paseo de Roxas Cor. HV Dela Costa BranchДокумент20 страницAccount Transfer Bank of The Philippine Islands-Family Bank Paseo de Roxas Cor. HV Dela Costa BranchGeorge Palaganas100% (1)

- ProxyДокумент5 страницProxyNathanael Lilik SugiyantoОценок пока нет

- Hotel Transportation and Discount Information Chart - February 2013Документ29 страницHotel Transportation and Discount Information Chart - February 2013scfp4091Оценок пока нет

- Introduction To Fleet CardДокумент5 страницIntroduction To Fleet CardAbhinaw SurekaОценок пока нет

- Hotel Discount GridДокумент85 страницHotel Discount Gridmanishpandey1972Оценок пока нет

- Electronic Funds Transfer (EFT) GuideДокумент92 страницыElectronic Funds Transfer (EFT) GuideGaurav PandeyОценок пока нет

- Sub Credit, Debit PDFДокумент3 страницыSub Credit, Debit PDFprasanth0% (1)

- Giftcard ListДокумент7 страницGiftcard ListLuxОценок пока нет

- Application For Internet Generation Internet ServicesДокумент4 страницыApplication For Internet Generation Internet ServicesJuan-Pierre StrijdomОценок пока нет

- Nueces County Game Room RegulationsДокумент24 страницыNueces County Game Room RegulationscallertimesОценок пока нет

- US Discounts and Offers PDFДокумент31 страницаUS Discounts and Offers PDFFernanda Daly100% (3)

- Personal Info SlavePaulДокумент1 страницаPersonal Info SlavePaulsluttyslavepaulОценок пока нет

- Hotel Booking Confirmed, Pack Your Bags Now !: Apr 19 Apr 20Документ2 страницыHotel Booking Confirmed, Pack Your Bags Now !: Apr 19 Apr 20Zamirtalent Tr100% (1)

- HackedДокумент3 страницыHackedIsmi Damha Habibi Al-FarisiОценок пока нет

- Marriott Promo Codes 2014Документ4 страницыMarriott Promo Codes 2014Dave Ortiz100% (1)

- Direct Bill Authorization FormДокумент8 страницDirect Bill Authorization Formzodaq50% (2)

- Earnings Releases 7. February - 11.february 2011Документ4 страницыEarnings Releases 7. February - 11.february 2011Trading FloorОценок пока нет

- Codes CorpДокумент1 страницаCodes CorpDanielle SeveranceОценок пока нет

- Police Credit Card ChargesДокумент114 страницPolice Credit Card ChargesIsaac Gonzalez0% (1)

- American Express Bluebird Cardholder AgreementДокумент2 страницыAmerican Express Bluebird Cardholder AgreementGreg Johnson0% (1)

- Test Credit Card NumbersДокумент2 страницыTest Credit Card NumbersJoycelyn Sampaio Wan100% (2)

- Login InformationДокумент1 страницаLogin InformationmohamestОценок пока нет

- American Express® International Dollar CardДокумент1 страницаAmerican Express® International Dollar Cardfranck petbeamОценок пока нет

- Credit Profile Report: Product SheetДокумент8 страницCredit Profile Report: Product SheetPendi AgarwalОценок пока нет

- Instant Issuance of Credit Card - Process Flow-1Документ15 страницInstant Issuance of Credit Card - Process Flow-1pawanОценок пока нет

- Com Android CtsДокумент1 страницаCom Android CtsKeith cantelОценок пока нет

- Hotel Discount CodesДокумент1 страницаHotel Discount CodeslearnandliveОценок пока нет

- New Text DocumentДокумент5 страницNew Text Documentarshadsanandr0% (1)

- Benefits of Being HiltonДокумент3 страницыBenefits of Being HiltonMariaMcDermott100% (1)

- Credit Card Approval SystemДокумент28 страницCredit Card Approval SystemNandini Mehta100% (1)

- Lit Kitchen LLC - Approval Letter (2) - 1Документ1 страницаLit Kitchen LLC - Approval Letter (2) - 1api-3716194Оценок пока нет

- How To Install DVWA in Kali Linux 2018.1Документ2 страницыHow To Install DVWA in Kali Linux 2018.1posa akhilОценок пока нет

- MinidumpДокумент2 страницыMinidumpMilanisti22Оценок пока нет

- Magtek 1-380 Manual IntellicoderДокумент31 страницаMagtek 1-380 Manual IntellicoderSelvolОценок пока нет

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОт EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОценок пока нет

- Rectangular Tank CalculationДокумент28 страницRectangular Tank CalculationHiếu Nguyên78% (32)

- Agent List - All CountriesДокумент294 страницыAgent List - All Countriesg4goharОценок пока нет

- Agitator DesignДокумент7 страницAgitator DesignTint Tiger100% (4)

- Contrast and Latitude Comparisons: Source 1 Source 2Документ3 страницыContrast and Latitude Comparisons: Source 1 Source 2prasad_kcpОценок пока нет

- PV Elite Manual PDFДокумент39 страницPV Elite Manual PDFDarshJhaОценок пока нет

- Casti CourseДокумент43 страницыCasti CoursekazumiyutoriОценок пока нет

- Section Properties IPE HEAB UBC AnglesДокумент6 страницSection Properties IPE HEAB UBC Anglesprasad_kcpОценок пока нет

- Spec - WeldingДокумент6 страницSpec - Weldingprasad_kcpОценок пока нет

- Radiographic Depth Determinitation - Rigid Method: Distance From Film (D)Документ2 страницыRadiographic Depth Determinitation - Rigid Method: Distance From Film (D)prasad_kcpОценок пока нет

- Iim ChapterДокумент9 страницIim Chapterprasad_kcpОценок пока нет

- PQR GMAW IN06C (Total)Документ8 страницPQR GMAW IN06C (Total)Wellington S. FrançaОценок пока нет

- Perhitungan Matematis Untuk Rim and Face Alignment Method Mathematic Calculation For Rim and Face Alignment MethodДокумент6 страницPerhitungan Matematis Untuk Rim and Face Alignment Method Mathematic Calculation For Rim and Face Alignment Methodprasad_kcpОценок пока нет

- ASNT Standards ListДокумент3 страницыASNT Standards Listprasad_kcpОценок пока нет

- Biometric Chennai Campus StudentsДокумент50 страницBiometric Chennai Campus Studentsprasad_kcpОценок пока нет

- Iris Report For Heat Exchanger: Tables of ContentsДокумент4 страницыIris Report For Heat Exchanger: Tables of Contentsprasad_kcpОценок пока нет

- Project Report Capital Cost X Machine Y MachineДокумент11 страницProject Report Capital Cost X Machine Y Machineprasad_kcpОценок пока нет

- Academic Calendar Winter 2013-14newДокумент2 страницыAcademic Calendar Winter 2013-14newprasad_kcpОценок пока нет

- Total Depreciation : (At Any Time During The Year)Документ10 страницTotal Depreciation : (At Any Time During The Year)prasad_kcpОценок пока нет

- CSWIP Tough QuestionsДокумент2 страницыCSWIP Tough Questionsprasad_kcp50% (4)

- Unlocked Excel SheetДокумент92 страницыUnlocked Excel Sheetprasad_kcpОценок пока нет

- Insurance Note Taking GuideДокумент2 страницыInsurance Note Taking Guideapi-252384641Оценок пока нет

- Third Party InsuranceДокумент22 страницыThird Party InsurancePulkit Mago 1703887Оценок пока нет

- Life InsuranceДокумент36 страницLife InsuranceDinesh Godhani0% (1)

- Illustration of Benefits: Pioneer Life IncДокумент2 страницыIllustration of Benefits: Pioneer Life IncRon CatalanОценок пока нет

- Ba323 - Exam 1 Study GuideДокумент1 страницаBa323 - Exam 1 Study Guideemily kleitschОценок пока нет

- Financial Planning For Individual InvestorДокумент83 страницыFinancial Planning For Individual Investorrathodsantosh101100% (2)

- Questions - Business Valuation, Capital Structure and Risk ManagementДокумент5 страницQuestions - Business Valuation, Capital Structure and Risk Managementpercy mapetereОценок пока нет

- Renewal Premium Receipt: Har Pal Aapke Sath!!Документ1 страницаRenewal Premium Receipt: Har Pal Aapke Sath!!Ritu SoniОценок пока нет

- BCOM V Sem - Principles of Insurance Business - Unit II NotesДокумент3 страницыBCOM V Sem - Principles of Insurance Business - Unit II NotesMona Sharma DudhaleОценок пока нет

- Ccounting Basics and Interview Questions AnswersДокумент18 страницCcounting Basics and Interview Questions AnswersAamir100% (1)

- Chapter 9Документ14 страницChapter 9Cindy permatasariОценок пока нет

- Isk and TS Reatment: A. Objective Risk or Degree of RiskДокумент27 страницIsk and TS Reatment: A. Objective Risk or Degree of RiskKRZ. Arpon Root HackerОценок пока нет

- Credit Risk ModelingДокумент131 страницаCredit Risk ModelingFrancisco Perez MendozaОценок пока нет

- Fire-Surya ElectricalДокумент6 страницFire-Surya ElectricalSURAJ PratapОценок пока нет

- HowtoMasterManagedFutures ElectronicДокумент91 страницаHowtoMasterManagedFutures ElectronicAllen Bains100% (1)

- 0002 T en - Ar.enДокумент33 страницы0002 T en - Ar.enriyasudheenmhОценок пока нет

- SniperTradingSetups ManualДокумент63 страницыSniperTradingSetups ManualDavid SheehanОценок пока нет

- Project Report On Underwriting in InsuranceДокумент48 страницProject Report On Underwriting in InsuranceMukesh Lal75% (4)

- Report of Business Plan (Corrugated Box)Документ30 страницReport of Business Plan (Corrugated Box)jugal0% (2)

- Markowitz MCQДокумент11 страницMarkowitz MCQvarunbhardwaj26100% (6)

- PD No. 1460, As Amended by RA 10607: Insurance LawДокумент35 страницPD No. 1460, As Amended by RA 10607: Insurance Lawmarizenoc100% (1)

- Bcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFДокумент3 страницыBcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFDeepak KumarОценок пока нет

- LoginДокумент12 страницLoginMuzamel AbdellaОценок пока нет

- Motor Renewal Notice: Date: 30/10/2023Документ25 страницMotor Renewal Notice: Date: 30/10/2023hogonbakerikadeОценок пока нет

- GCV Premium - Calculators - With - New - TPДокумент11 страницGCV Premium - Calculators - With - New - TPGunjan NimjeОценок пока нет

- Module 1 Treasury ManagementДокумент11 страницModule 1 Treasury ManagementJordan Loren MaeОценок пока нет

- Mutual FundsДокумент12 страницMutual Fundsramyadav00Оценок пока нет

- A Legal Guide To Contract Works and Construction Liability Insurance in Australia - PDF UnlockedДокумент168 страницA Legal Guide To Contract Works and Construction Liability Insurance in Australia - PDF Unlockedsgk9494Оценок пока нет

- Investments 12Th Edition Zvi Bodie Full ChapterДокумент51 страницаInvestments 12Th Edition Zvi Bodie Full Chapterbob.purtell881Оценок пока нет

- 03 - LLMIT CH 3 Feb 08 PDFДокумент20 страниц03 - LLMIT CH 3 Feb 08 PDFPradyut TiwariОценок пока нет