Академический Документы

Профессиональный Документы

Культура Документы

TN Vat Rates

Загружено:

deepadeepadeepaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

TN Vat Rates

Загружено:

deepadeepadeepaАвторское право:

Доступные форматы

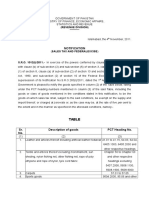

VALUE ADDED TAX COMMODITY COMMODITY CODE 752 752 323 2067 302 518 DESCRIPTION_ OF_ GOODS

5 Fluroyacil.Inj (Life saving drugs ) Abinoside (Life saving drugs ) Abir Abrasive of all types (Industrial input) Absolute alcohol Absus Precatorious- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Abutilon Indicum - Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Acacia Arabica Barks, Gum - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f 1.1.07 Account books (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Acid dyes Acid oil including spent acid oil (Industrial Input) Acids of all kinds other than those specified elsewhere in the Schedule. Aconitum-Hterrophyllumwall -Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Activated Carbon filter (Water pollution control equipments) Adhatoda Vasika- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Adhesive solution Adhesive tapes other than those specified elsewhere in the schedule Adhesives of all kinds Adi Thanda (Goods manufactured by village Blacksmith and Adisarakku items) Adiramycin.Inj (Life saving drugs ) Adosption system ( Water pollution control equipments & Instrumentations) Aeria Lanata- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Aerial, Antennas and Parts Aero Tiller for composting (Water pollution control equipments) After shave lotion Agalvilaku (By Notification No II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Agar-agar (Exempted By Notification G.O.Ms.No.79-23.3.07) w.e.f.1.1.07 Agarbathi (Exempted By Notification G.O.Ms.No.107-23.5.07) w.e.f 23.5.07 I I I IV IV I C C C B B B SCH PART IV IV I I I B B C B C ITEM NO SUB ITEM NO 52 52 22 67 1 23 17 4 a RATE OF TAX1 0 0 14.5 5 14.5 0 RATE RATE OF OF TAX2 TAX3

518

17

518

817 2045 2067 2001 518 2104

17 I I I B B B 45 67A 1 i b

5 5 5 5 0

104

(i)

518 303 303 303 737 752 2104 518 2068 2104 359 814 706 2043

19 2 2 2 37 52 104 11 I I I B B C 68 104 58 14 IV I B B 6 43 8 (i) 1 15 (i) & (ii)

0 14.5 14.5 14.5 0 0 5 0 5 5 14.5 5 0 0

Page 1

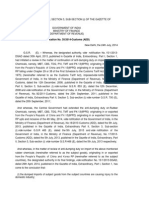

VALUE ADDED TAX COMMODITY COMMODITY CODE 701 DESCRIPTION_ OF_ GOODS Agricultural implements manually operated or animal driven as notified by the Government Agricultural implements not operated manually or not driven by animal including their parts and accessories (including those powered or operated by tractors or by power tillers) as notified by Government Aids and implements for physically challanged persons as notified by the Government Air circulators Air conditioners Air conditioning apparatus and instruments Air Conditioning appliances Air conditioning plants Air coolers Air flotation (Water pollution control equipments) Air guns and pellets used therewith Air refiles and pellets used therewith Alcoholic liquors of all kinds for human consumption, other than liquors falling under items 1 and 3,.(G.O.Ms.No.47 dated 27.03.12 w.e.f. 1.4.12) Alcoholic liquors of all kinds Purchased,procured outside the state (G.O.Ms.No.47 dated 27.03.12 - w.e.f. 1.4.12) Alfa Olefin Alginate (Exempted By Notification - G.O.Ms.No.7923.3.07) w.e.f.1.1.07 Alizarine dyes All Cooling appliances All goods produced or manufactured by village industries as specified in the schedule to the Khadi and village Industries as in the schedule All makes of country ploughs (Agricultural implements animal drawn ) All metal castings All other dyes. All other materials used in painting and varnishing All other non-soft boards Almond Alovera leaves, Resin - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Alovera Products - sale by any dealer whose total turnover does not exceed rupees One crore in a year ( By Notification G.O.Ms.No.33 dated 29.03.10 w.e.f. 1.4.10) Alta Aluminium domestic utensils not operated by pressure and electricity Aluminium conductor steel reinforced (ACSR) Aluminium scraps Aluminium sink (extrusion) and composite panels SCH PART IV B ITEM NO SUB ITEM NO 1(i) RATE OF TAX1 0 RATE RATE OF OF TAX2 TAX3

788

IV

ii

702 332 304 304 304 304 304 2104 306 306 402

IV I I I I I I I I I II

B C C C C C C B C C

2 31 3 3 3 3 3 104 5 5 2 i i i i i (i) iii iii

0 14.5 14.5 14.5 14.5 14.5 14.5 5 14.5 14.5 58 38 14.5

401 2079 706 2045 304 749 701 2089 2045 351 354 326 518

II I IV I I IV IV I I I I I B B B C B B B B C C C

1 79 6 45 3 49 1(i) 89 45 50 53 25 14 ii i 2 II (1) iii xiii vii

58 5 0 5 14.5 0 0 5 5 14.5 14.5 14.5 0

14.5

522 750 703 2005 2122 2067

0 IV IV I I I B B B B B 50 3 5 122 67A 0 0 5 5 5

Page 2

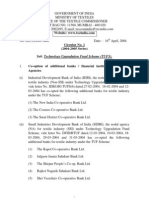

VALUE ADDED TAX COMMODITY COMMODITY CODE DESCRIPTION_ OF_ GOODS Amateur radio equipments (Transmission apparatus other than apparatus for radio or T.V. broadcastings) (Information Technology products) Ambar Charkha Ammoniated latex Ammunitions of all kinds Andaa (Goods manufactured by village Blacksmith and Adisarakku items) Andrographic paniculat - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Andropogan Muricatus - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Angle Brackets (Goods manufactured by village Blacksmith and Adisarakku items) Animal feed including supplement concentrates and additives Animal hair Aniseed (Sombu) sale by any dealer whose total turnover does not exceed rupees three hundred crores in a year ( By Notification G.O.Ms.No.43 dated 05.05.08 - w.e.f. 1.5.08) Aniseed other than those specified in the Fourth Schedule Aniseed powder- sale by any dealer whose total turnover does not exceed rupees three hundred crores in a year ( By Notification G.O.Ms.No.33 dated 29.03.10- w.e.f. 1.4.10) Anklet made of silver Anti-sprouting products Any other goods, not specified in any of the schedule Any other tobacco products, not specified in any of the Schedule Appalam Apparatus for making coffee under pressure, commonly known as espresso Apparatus for obtaining duplicate copies -others Apparatus, components,parts and accessories (Capital goods) Appliances, components,parts and accessories or Electrical installation (Capital goods) Apricots Aquatic feed Arc or cinema carbons Arecanut Arecanut powder Arecanut raw seeval (By Notification II (1) / CTR / 12 (R-23)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Aristiochia Indica - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 5 0 5 14.5 34 0 0 RATE RATE OF OF TAX2 TAX3

2068 717 2119 306 737 518

I IV I I IV

B B B C B

68 17 119 5 37

6(f)

518 737 705 763 520

0 IV IV IV B B B 37 5 63 2 0 0 0 0

2130

130

520 755 791 301 425 704 305 327 2025 2025 326 705 318 2006 2006 829

0 IV IV I II IV I I I I I IV I I I B C C B B C B C B B B B C 55 17A 69 13 4 4 26 25 25 25 5 17 6 6 i a,c a,c (xiii) 0 0 14.5 20 0 14.5 14.5 5 5 14.5 0 14.5 5 5 5

ii

518

18

Page 3

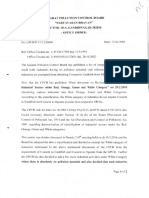

VALUE ADDED TAX COMMODITY COMMODITY CODE 306 778 761 307 334 706 2067 DESCRIPTION_ OF_ GOODS Arms of all kinds Arrack Article such as baskets, (products of palm industry) Articles and equipments for gymnastics Articles made of Fibre glass other than those specifically mentioned in the schedule Articles made of sea shells Artificial graphite,collodial or semi collidial graphite, preparation based on graphite or other carbon in the form of paste, blocks powder and natural graphite (industrial Input) Artificial limbs and parts (Aids for physically challenged persons) Arukamanai (Goods manufactured by village Blacksmith and Adisarakku items) Asafoetida (Hing) sold by any dealer whose total turnover in respect of this item does not exceed rupees three hundred crores in a year Asathioprine (Life saving drugs ) Asbestos sheets and Products Asphaltic roofing (other than those specified in the Fourth Schedule)incl.crog Astronomical instruments Athimaturam - Medicinal herbs and country drug (clyzorrizha or Liquorice roots) (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Atta Attachment and parts of Tractor of all kinds Attachment and parts of Trailor of Tractor of all kinds Audio Casettes including Pre-recording casettes (By Notification No. II (1) / CTR / 12 (R-20)/2011G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Auto print time punching clocks Autoclave for waste treatment (Water pollution control equipments) Avarai saleby any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year ( By Notification G.O.Ms.No.79-23.3.07) w.e.f.23.3.07 Aviation Gasoline Aviation Turbine Fuel including jet fuel Aviation Turbine Fuel sold to a Turbo-Prop Aircraft Azathioprine.Tab (Life saving drugs ) B Oc Incubator (Instrumentation) Baby milk food Baby nappies (Reduced to 5% -By Notification G.O.Ms.No.48 dated 27th March 2012 -w.e.f 1st April 2012) Back grounds Bacterial culture for agriculture purpose Badges (Sports goods) I I C B SCH PART I IV IV I I IV I C B B C C B B ITEM NO SUB ITEM NO 5 78 61 6 33 6 67A d i RATE OF TAX1 14.5 0 0 14.5 14.5 0 5 RATE RATE OF OF TAX2 TAX3

702 737 718 752 308 2022 311 518 2149 2140 2140

IV IV IV IV I I I

B B B B C B C

2 37 18 52 7 22 10

3 3

0 0 0

5 a,d

0 14.5 5 14.5 0

I I I

B B B

149 140 140

iv iv

5 5 5

816 368 2104

16 67 104 (i)

5 14.5 5

768

IV

68

12

404 405 405 752 2104 2082 358 361 707 2131

II II II IV I I I I IV I B B B C C B B

4 5 5 52 104 82 57 60 7 131 14 (i) & (ii)

29 29 4 0 5 5 5 14.5 0 5

Page 4

VALUE ADDED TAX COMMODITY COMMODITY CODE 2104 708 804 737 309 2067 2028 2009 709 820 2010 2045 2011 2045 357 354 310 306 2012 321 737 788 746 2014 DESCRIPTION_ OF_ GOODS Bag filters (Air Pollution Control Equipments) Bagasse Bajji flour (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Bajji kattai (Goods manufactured by village Blacksmith and Adisarakku items) Bakery products sold with brand name Baking powder, bread improver, cake gel vinegar, wheat gluten and edible gelatin used for confectionery and ice creams (Industrial input) Ball clay Bamboo Bangles other than those made of precious metals Barbed wire (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Bark of plants Bases (dyes) Basic chromium sulphate Basic dyes Bath showers Batten board or soft wall ceiling Batteries and parts thereof Bayonets Bearings Beauty boxes Bed Bolt (Goods manufactured by village Blacksmith and Adisarakku items) Bed Plough (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Bed room lights burning on oil Parts and accessories including wicks and chimneys Bed sheet ,other than those specified in Fourth Schedule Bed sheets made from handlooms and Powerloom other than those made of mill made cloth -By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Beds made of cotton or silk cotton Bee Wax Beedi - w.e.f. 12.7.11 Beedi leaves Beedi Tobacco -w.e.f. 12.7.11 Belt press (Water pollution control equipments) Beltings Beltless napkins (Reduced to 5% -By Notification G.O.Ms.No.48 dated 27th March 2012 -w.e.f 1st April 2012) Benjamine - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Betel leaves I I I I I I I I B B C B C B B C SCH PART I IV B B ITEM NO SUB ITEM NO 104 8 4 IV I I I I IV B C B B B B 37 8 67A 28 9 9 20 I I I I I I I I I I IV IV IV I B B B B C C C C B C B B B B 10 45 11 45 56 53 9 5 12 20 37 1 46 14 e 39 (iii) RATE OF TAX1 5 0 5 0 14.5 5 5 5 0 5 5 5 5 5 14.5 14.5 14.5 14.5 5 14.5 0 0 0 5 RATE RATE OF OF TAX2 TAX3

iii iv

4 ii(13)

516

18

2013 2060 370 2015 370 2104 2016 358

13 60 9-A 15 9-A 104 16 57

ii

(i)

5 5 14.5 5 14.5 5 5 5

518 732

0 IV B 32 0

Page 5

VALUE ADDED TAX COMMODITY COMMODITY CODE 2006 357 518 750 311 311 791 2104 2017 2067 2067 309 518 2018 351 2094 2068 781 518 337 710 312 2011 321 752 354 809 745 351 323 2019 2125 350 321 518 338 Betel nut Bidets Big Galangal roots Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) Bindi Binocular Microscopes Binoculars Bio fertilizers Bio filter ( Water pollution control equipments & Instrumentations) Biomass briquettes Bioxialy oriented polyester film and PVC film (Industrial Input) Bioxialy oriented polypropylene film (Industrial Input) Biscuits of all varieties sold with brand name Bishop weed - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Bitumen Bituminious and coal tar blocks Bituminized water proof paper Black and white or other mono chrome DATA / Graphic Display tubes, other than Picture tubes and parts(Information Technology products) Black boards Black cumin Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Black stone Black sugarcane other than those specified in the Second Schedule Blasting gun powder Bleach liquid (By Notiifcation G.O.Ms.No.68 dated 21.05.09 ) - w.e.f. 01.04.09 Bleaching agents Bleomycin (Life saving drugs ) Block board Blood bags and disposables (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Blood Plasma Blown linseed oil Blue Blue metal Boats Bodies built on motor vehicles , components, spare parts and accessories thereof Body deodarants Boerhaavia Diffusa Linn - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Boilers of all types IV I I IV I I I I I B C C B B B B B C 50 10 10 17A 104 17 67A 67A 8 f g DESCRIPTION_ OF_ GOODS SCH PART I I B C ITEM NO SUB ITEM NO 6 56 RATE OF TAX1 5 14.5 0 0 14.5 14.5 0 5 5 5 5 14.5 0 I I I I IV B C B B B 18 50 94 68 81 5 14.5 5 5 0 0 I IV I I I IV I C B C B C B C 36 10 11 11 20 52 53 9 IV I I I I I I B C C B B C C 45 50 22 19 125 49 20 2 iv 14.5 0 14.5 0 14.5 0 14.5 5 0 14.5 14.5 5 5 14.5 14.5 0 I C 37 14.5 RATE RATE OF OF TAX2 TAX3

ii (i)

iv

15(b)

Page 6

VALUE ADDED TAX COMMODITY COMMODITY CODE 338 2020 518 2021 711 761 711 838 DESCRIPTION_ OF_ GOODS Boilers using agricultural waste as fuel but not including boilers using municipal waste only as fuel Bolts Bondu nut - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Bone meal -(Exempted By Notification G.O.Ms.No.107-23.5.07) w.e.f 23.5.07 Books Braided cord Braille books Branded Coffee powder (other than instant Coffee)(By Notification - II (1) / CTR / 12 (R-29)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Branded Readymix food products (in the form of flour, powder or wet drough) II (1) / CTR / 12 (R29)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Bread (branded or otherwise) -(By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Brick ballast(other than those specified in the Fourth Schedule) incl.crog Brick-bats (other than those specified in the Fourth Schedule) incl.crog Bricks of all kinds (other than those specified in the Fourth Schedule) including crog Broomsticks Brushes (products of palm industry) Bubble gum sold with brand name Buckets made of iron and steel, plastic or other materials (except precious materials) Buckram and similar stiffened textile fabrics Bulbs for all motor vehicles Bulldozers Bullion, that is to say platinum in mass and uncoined, pure or alloy, and specie Bullion, that is to say, gold in mass and uncoined, pure or alloy, and specie Bullion, that is to say,Kora gold in mass and uncoined, pure or alloy, and specie Bullion, that is to say,Palamarel silver in mass and uncoined, pure or alloy, and specie Bullion, that is to say,silver in mass and uncoined, pure or alloy, and specie Bun (branded or otherwise) (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Bund Former (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Bura sugar Bushes Busulphan.Tab (Life saving drugs ) Butter milk without any brand name Butter without any brand name SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 14.5 5 0 I IV IV IV B B B B 21 11 61 11 1 iii 0 0 0 0 5 RATE RATE OF OF TAX2 TAX3

I I

C B

37 20

840

712 2022 2022 2022 713 761 320 2023 798 313 314 101 101 101 101 101 712 788 761 2020 752 721 721

IV I I I IV IV I I IV I I I I I I I IV IV IV I IV IV IV

B B B B B B C B B C C A A A A A B B B B B B B

12 22 22 22 13 61 19 23 77A 12 13 1 1 1 1 1 12 1 61 25 52 21 21 ii(1) 7(i) b,d b,d a,d i

0 5 5 5 0 0 14.5 5 0 14.5 14.5 1 1 1 1 1 0 0 0 5 0 0 0

24

Page 7

VALUE ADDED TAX COMMODITY COMMODITY CODE 310 DESCRIPTION_ OF_ GOODS Button cells Buttons, zippers. Zip fastners, hooks and hoop tape, non woven interlining polyester wadding shoulder pad, packing materials namely hangers,collar band, butterfly, all types of pins and clips (Industrial Input) SCH PART I C ITEM NO SUB ITEM NO 9 RATE OF TAX1 14.5 RATE RATE OF OF TAX2 TAX3

2067

67A

2104 313 788 309 518 2105 2024 714 789 2025 2068

C Oc Apparatus( Instrumentation) I Cables for all motor vehicles I Cage Wheel (Agricultural implements not operated manually or not driven by animal -w.e.f. IV 1.4.12) Cakes sold with brand name I Calamus root - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Calendar other than those specified in the Fourth I Schedule. Camphor in all forms -(By Notification-G.O.Ms.No.79I 23.3.07) w.e.f.1.1.07 Candles IV Cane or beet sugar and chemically pure sucrose in IV solid form Capital goods as described in Secction 2(11) of the I Act. Car telephone (Transmission apparatus other than apparatus for radio or T.V. I broadcastings)(Information Technology products) Carbon black and acetylene black And other form of carbon including activated carbon (Industrial Input) Carbon rods Carbuncle or garnets (precious stone) (whether they are sold loose or as forming part of any article or jewellery in which they are set) Cart driven by animals Cash chests Cash or deed boxes Cashew nuts fresh or dried, whether or not shelled or peeled Cashew shell By Notification No. II (1) / CTR / 30(a2) / 2007 - G.O. Ms.No.79 dated 23.3.07 Cassia Flower - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Castor Shelter (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Cathode ray osilloscopes (Information Technology products) Cats eye (precious stone) (whether they are sold loose or as forming part of any article or jewellery in which they are set) Cattle feed Caulking compounds and other mastics CDs -& its Parts and accessories - w.e.f. 12.7.11 I I I IV I I I

B C B C

104 12 1 8

(ii)

5 14.5 0 14.5 0

ii(2)

B B B B B B

105 24 14 14(a) 25 68 6

5 0 0 0 5 5

2067 310 103 715 360 360 2113 517 518

B C A B C C B

67A 9 3 15 59 59 113 20

5 14.5 1 0 14.5 14.5 5 0 0

788 2068 103 705 351 371

IV I I IV I I

B B A B C C

1 68 3 5 50 13-A

ii(3) 23 (a)

0 5 1 0 14.5 14.5

vi (e)

Page 8

VALUE ADDED TAX COMMODITY COMMODITY CODE 371 DESCRIPTION_ OF_ GOODS Cellular Telephone (Mobile Phone) & its Parts and accessories - w.e.f. 12.7.11 Cellulose lacquers, nitro -cellulose, lacquers , clear and pigments and nitro-cellulose ancillaries in liquid, semi solid or pasty forms (Industrial Input) Cement and their substitutes Cement based water paints Cement hollow blocks (other than those specified in the Fourth Schedule) incl.crog Cement products in combination with other materials not elsewhere mentioned in this schedule Cement Products of all kinds Cement tiles Centrifugal pump sets for water handling and parts thereof Centrifugal latex Centrifuge (Water pollution control equipments) Ceramic tiles Ceramic Wall tiles CeramicRoofing tiles Cereals (Declared goods) Chaff Cutter (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Chalk sticks Channel Former (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Charcoal Charkha Chassis of motor vehicles , components, spare pars and accessories thereof Cheese sold without a brand name other than those specified in the Fourth Schedule. Chemical fertilizers and combination thereof Chemicals of all kinds other than those specified elsewhere in the Schedule. Chenille fabrics of wool Cheques, loose or in book form Cheroots Chewing gum sold with brand name Chewing tobacco Chicory Children tri-cycles and carriages parts and accessories including tyres, tubes and flaps used therewith, Childrens playground equipments Chillies Other than those specified in the Fourth Schedule Chillies sold by any dealer whose total turnover in respect of this item does not exceed rupees three hundred crores in a year SCH PART I C ITEM NO SUB ITEM NO 13-A (a) RATE OF TAX1 14.5 RATE RATE OF OF TAX2 TAX3

2067 315 351 2022 308 316 316 2026 2119 2104 337 337 337 2041 788 774 788 716 717 350 2051 790 2001 797 757 415 320 419 2030 2040 2131 2052 718

I I I I I I I I I I I I I I IV IV IV IV IV I I IV I IV IV II I II I I I I IV

B C C B C C C B B B C C C B B B B B B C B B B B B C B B B B B

67A 14 50 22 7 15 15 26 119 104 36 36 36 41 1 74 1 16 17 49 51 17A 1 77A 57 13 19 13 30 40 131 52 18

ad(ii)

5 14.5 14.5 5 14.5 14.5 14.5 5

iii b,d

(i) i i i

5 5 14.5 14.5 14.5 5 0 0

ii(4)

ii(5)

0 0 0 14.5 5

0 5

6(i) (iii) (vii)

0 0 20 14.5 20 5 5 5 5 0

Page 9

VALUE ADDED TAX COMMODITY COMMODITY CODE 718 317 2051 788 320 2051 415 415 415 318 318 318 321 752 518 DESCRIPTION_ OF_ GOODS Chilly powder sold by any dealer whose total turnover in respect of this item does not exceed rupees three hundred crores in a year Chinaware artcicles Chips sold without a brand name other than those specified in the Fourth Schedule. Chisel plough (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Chocolate sold with brand name Chocolates sold without a brand name other than those specified in the Fourth Schedule. Cigarettes Cigarillos of tobacco or of tobacco substitutes Cigars Cinema slides Cinematographic equipments Cinmeatogrphic lenses cinnamon oil Cisplatin.Inj (Life saving drugs ) Citrullus Colocynthis - Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Clamps used in pump sets (Goods manufactured by village Blacksmith and Adisarakku items) Clay Clay for manufacture of Bricks Exempted (By Notification - G.O.No.107 - w.e.f.23.5.07) Cleaning liquids cleaning powder and liquids of all kinds Cleome Inosandra- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Clinker. Clocks Cloth bag By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Cloth lined paper envelopes (whether printed or not) (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Cloth rags Clytoria Ternatea- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Coal ash of all kinds Coal tar Coal,including coke in all its forms, but excluding charcoal Coarse grains Coarse screen / micro screen (Satinless steel / mild steel) - (Water pollution control equipments) Cocoa pod and beans I I I IV I I B B B B B B IV I B B I I B C IV I I I I B B B C C SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 0 14.5 5 ii(13) 0 14.5 5 (iii) (iii) (iii) 20 20 20 14.5 14.5 14.5 14.5 0 0 RATE RATE OF OF TAX2 TAX3

IV I I IV I I II II II I I I I IV

B C B B C B

18 16 51 1 19 51 13 13 13 17 17 17 20 52 27

C C C C B

16

737 2028 2028 321 323 518 2050 368 511

37 28 28 20 22 38 50 67 13

0 5 0 14.5 14.5 0 5 14.5 0

759 2122 518 2050 2029 2041 719 2104 2030

59 122 6 50 29 41 19 104 30 (i)

0 5 0 5 5 5 0 5 5

Page 10

VALUE ADDED TAX COMMODITY COMMODITY CODE 761 761 777 777 2051 DESCRIPTION_ OF_ GOODS Coconut husk Coconut leaves Coconut milk (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Coconut milk powder (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Coconut milk powder sold without a brand name other than those specified in the Fourth Schedule. Coconut other than Copra By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Coconut shell and its chips Coconut shell powder By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 w.e.f - 1.1.07 Coconut thatches Coffee beans and seeds Coffee coolers Coffee roasting appliances (Electrical domestic and commercial appliances) coir (excluding coir products) Coir dusts (excluding coir products) Coir fibre (excluding coir products) Coir husk (excluding coir products) Coir mattings Coir products excluding mattresses Cold storage equipments, components,parts and accessories(Capital goods) Collapsible gates Colour - DATA / Graphic Display tubes, other than Picture tubes and parts (Colour) (Information Technology products) Colour boxes and brushes used therein Colour pencils Coloured matches Colours Combined harvesters , attachments and parts Combs Commodes Communication equipments such as Private Branch Exchange (PBX) Compact Fluorescent Lamps (G.O.Ms.No.47 dated 27.3.12-w.e.f. 1.4.2012) Compact Fluorescent Tubes (G.O.Ms.No.47 dated 27.3.12-w.e.f. 1.4.2012) complexion rouge Compressor of refrigerating equipments (Industrial Input) Computer peripherals (Information Technology products) Computer stationery Computer Systems - Parts and accessories (Information Technology products) Computer systems (Information Technology products) SCH PART IV IV IV IV I B B B B B ITEM NO SUB ITEM NO 61 61 77 77 51 iv i RATE OF TAX1 0 0 0 0 5 RATE RATE OF OF TAX2 TAX3

505 761 508 761 2030 304 329 761 761 761 761 741 2031 2025 319 2068 2032 781 336 351 2140 2033 357 2034 2151 2151 321 2067 2068 2035 2068 2068

5 IV B 61 8 IV I I I IV IV IV IV IV I I I I I IV I I I I I I I I I I I I I I B B C C B B B B B B B C B B B C C B B C B B B C B B B B B 61 30 3 28 61 61 61 61 41 31 25 18 68 32 81 35 50 140 33 56 34 34-A 34-A 20 67A 68 35 68 68 22(a) 22 (a) j 22(a) 15(a) i i i i i ii ii 0 0 0 5 14.5 14.5 0 0 0 0 0 5 5 14.5 5 5 0 14.5 14.5 5 5 14.5 5 5 5 14.5 5 5 5 5 5

b,c

ii iii,iv

Page 11

VALUE ADDED TAX COMMODITY COMMODITY CODE 315 2104 720 2104 320 2051 369 2129 367 752 2104 720 332 329 346 755 2132 103 DESCRIPTION_ OF_ GOODS Concrete mixture Condenser for waste recovery ( Water pollution control equipments & Instrumentations) Condoms Conductivity Meter ( Instrumentation) Confectionery sold with brand name Confectionery sold without a brand name other than those specified in the Fourth Schedule. Conical measures Contact lens Containers and vessels- vacuum flask Continuous Ambulatory Peritoneal Dialysis (CAPD) fluids used for treatment in renal failure cases (Life saving drugs ) Continuous Chemical Dosing Equipments (Water pollution control equipments) Contraceptives Controlling systems Cooking ranges (Electrical domestic and commercial appliances) Copper - clad board or sheets Copy books manufactured out of paper purchased from Registered dealers liable to pay under this Act Copy books other than those specified in the Fourth Schedule Coral (precious stone) (whether they are sold loose or as forming part of any article or jewellery in which they are set) Cordless handset (Transmission apparatus other than apparatus for radio or T.V. broadcastings)(Information Technology products) Coriander powder sold by any dealer whose total turnover in respect of this item does not exceed rupees three hundred crores in a year Coriander sold by any dealer whose total turnover in respect of this item does not exceed rupees three hundred crores in a year Cork Cork sheets Corriander Other than those specified in the Fourth Schedule Cosmetics Cottage cheese Cotton or manmade fibres Cotton rope Cotton seed husk Cotton waste Cotton Yarn Cotton, that is to say- all kinds of Cotton (indigenous or imported) in its unmanufactured state, whether ginned or unginned, baled, pressed or otherwise, but excluding cotton waste. Counter scales parts and accessories and weights used therewith SCH PART I I IV I I I I I I IV I IV I I I IV I I C B B B C B C B C B B B C C C B B A ITEM NO SUB ITEM NO 14 104 20 104 19 51 68 129 66 52 104 20 31 28 45 55 132 3 ii(b) (ii) (ii) RATE OF TAX1 14.5 5 0 5 14.5 5 14.5 5 14.5 0 5 0 14.5 14.5 14.5 0 5 1 RATE RATE OF OF TAX2 TAX3

29 (i) & (ii)

2068

68

6(b)

718

IV

18

718 2094 2094 2052 321 2036 797 761 761 2037 2041

IV I I I I I IV IV IV I I

B B B B C B B B B B B

18 94 94 52 20 36 77A 61 61 37 41

0 5 5 5 14.5 5 0 0 0 5 5

6(i) iii iv

2041

41

369

68

ii(a)

14.5

Page 12

VALUE ADDED TAX COMMODITY COMMODITY CODE 2022 DESCRIPTION_ OF_ GOODS Country bricks made of baked clay and other machine made or hand made (other than those specified in the Fourth Schedule) incl.crog Country tiles made of baked clay and other machine made or hand made (other than those specified in the Fourth Schedule) incl. Crog Crataeva Relingiso - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Crayons Crockery (other than those specified elsewhere in the schedule) Cross made of gold and used as symbol of wedlock without chain (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Crow bar (Agricultural implements manually operated ) Crucibles Crude oil (ie) Crude petroleum oils/ obtained from Bituminous minerals Crumb rubber Crutches (Aids for physically challenged persons) Cuddapah stone slabs Cultipacker (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Cultivator (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Cumin seed - sale by any dealer whose total turnover does not exceed rupees three hundred crores in a year ( By Notification G.O.Ms.No.67 dated 21.05.09 w.e.f. 1.4.09) Cumin seed other than those specified in the Fourth Schedule Cumin seed powder - sale by any dealer whose total turnover does not exceed rupees three hundred crores in a year ( By Notification G.O.Ms.No.33 dated 29.03.10 - w.e.f. 1.4.10) Cups manufctured out of Areca palm leaf (BY Notification G.O.Ms.No.33 dated 29.03.10w.e.f.1.4.10) Cups (sports goods) Cups,made of paper & plastic Curd maker (Electrical domestic and commercial appliances) Curd without any brand name curtain backgrounds Cut tobacco Cutlery (other than those specified elsewhere in the schedule) Cycle carriage for invalid persons (Aids for physically challenged persons) Cycle dynamo lights I I IV IV I I I IV I IV B C B B B B B B C B SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 5 RATE RATE OF OF TAX2 TAX3

22

c,d

2022

22

c,d

518 2032 322 755 701 2038 2041 2119 702 337 788

36 32 21 55 1(i) 38 41 119 2 36 1 3 ii ii(6) b I (1)

0 5 14.5 0 0 5 5 5 0 14.5 0

788

IV

ii(7)

521

2130

130

521

524 2131 2039 329 721 361 424 322 702 2040

ii I I I IV I II I IV I B B C B C C B B 131 39 28 21 60 13 21 2 40 3

0 5 5 14.5 0 14.5 20 14.5 0 5

(xii)

Page 13

VALUE ADDED TAX COMMODITY COMMODITY CODE 2040 2040 722 2040 2040 2104 752 752 752 369 518 752 752 761 807 DESCRIPTION_ OF_ GOODS Cycle locks Cycle pumps Cycle rickshaw (without motor) Cycle Seat covers Cycles, bi-cycles parts and accessories including tyres, tubes and flaps used therewith Cyclones (Air Pollution Control Equipments) Cyclophosphamide.Inj (Life saving drugs ) Cyclophosphamide.Tab (Life saving drugs ) Cyclosporin (Life saving drugs ) Cylinderical measures Cyperus Rotundus- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Cystosine (Life saving drugs ) Danazol.Cap (Life saving drugs ) Date leaves Date syrup (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 DC Micromotors of an output not exceeding 37.5W and parts (Information Technology products) DC Micromotors of an output not exceeding 750 W and parts (Information Technology products) Deccan hemp fibre (excluding deccan hemp products) Declared goods as specified in section 14 of the Central Sales Tax Act, 1956, other than those specified elsewhere in any of the Schedules Decolam Deep fat fryer (Electrical domestic and commercial appliances) Deep freezers Demineraliser for effluent treatment (Water pollution control equipments) Demodulators (Information Technology products) Denatured Spirit Deodorants De-oiled cake De-oiled cakes sale by any dealer whose total turnover on the sales of these goods does not exceed rupees five crores per year De-oiled rice bran Desiccated coconut (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Detectors (for grass) (Air Pollution Control Equipments) Detergents whether cakes, liquid or powder - (other than those specified else where in the schedule) Detonators Caps Dhoop IV IV IV B B B SCH PART I I IV I I I IV IV IV I B B B B B B B B B C ITEM NO SUB ITEM NO 40 40 22 40 40 104 52 52 52 68 12 52 52 61 6 3 27 i (iii) 20 21 1 ii(b) RATE OF TAX1 5 5 0 5 5 5 0 0 0 14.5 0 0 0 0 5 RATE RATE OF OF TAX2 TAX3

2068 2068 761 2041 346 329 304 2104 2068 302 365 705 766 762 777 2104 323 306 2043

I I IV I I I I I I I I IV IV IV IV I I I I

B B B B C C C B B C C B B B B B C C B

68 68 61 41 45 28 3 104 68 1 64 5 66 62 77 104 22 5 43

25 (a), 26 25 (b), 26 i

5 5 0 5 14.5 14.5

ii

14.5 5

7(b)

5 14.5 14.5 0 0 0 0

(iii)

5 14.5

iii

14.5 5

Page 14

VALUE ADDED TAX COMMODITY COMMODITY CODE 809 DESCRIPTION_ OF_ GOODS Diagonstic Kits (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Diagonstic reagents (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Diamine-Diphonyl Sylphone (DAPSONE).Tab Diamonds (whether they are sold loose or as forming part of any article or jewellery in which they are set) Diaries (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Diary other than those specified in the Fourth Schedule. Didanosine (Drugs used for the treatment of AIDS patients) (Life saving drugs ) Dies (Capital goods) Diesel engine , their spare parts Diesel locomotive and parts and accessories thereof Diffraction apparatus and mounding thereof Diffuse of all types for supply of air, in liquid waste treatment (Water pollution control equipments) Digestors (Water pollution control equipments) Digging fork (Agricultural implements manually operated ) Dill seeds - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) Diluents and thinners Diodes, transistors and similar semi-conductor device Dippers Dipping measures Direct dyes Direct Paddy Seeder(Agricultural implements manually operated ) Directly reconstituted milk Disc for laser reading systems for reproducing phenomena other than sound or image (IT Software of any media) - (Information Technology products) Disc harrow (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Disc plough (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Dish washer (Electrical domestic and commercial appliances) Disinfectants Disposable diapers (Reduced to 5% -By Notification G.O.Ms.No.48 dated 27th March 2012 -w.e.f 1st April 2012) Dissection boxes. SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 5 RATE RATE OF OF TAX2 TAX3

809 752 103

9 IV I B A 52 3 13

5 0 1

817 2105 752 2025 345 324 311 2104 2104 701 518 351 2068 314 369 2045 701 731 2068

17 I IV I I I I I I IV B B B C C C B B B 105 52 25 44 23 10 104 104 1(i) (i) (i) I (11) 30 (4) d

5 5 0 5 14.5 14.5 14.5 5 5 0 0

I I I I I IV IV I

C B C C B B B B

50 68 13 68 45 1(i) 31 68

v 16 ii(b) v I (17)

14.5 5 14.5 14.5 5 0 0

5(a)

788

IV

ii(8)

788 329 791 358 781

IV I IV I IV

B C B C B

1 28 17A 57 81

ii(13)

0 14.5

ii

0 5 0

Page 15

VALUE ADDED TAX COMMODITY COMMODITY CODE 2104 2093 814 737 737 737 2042 737 DESCRIPTION_ OF_ GOODS Dissolved Air Flotation (Water pollution control equipments) Dolomite Doopakal (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Door Chains (Goods manufactured by village Blacksmith and Adisarakku items) Door Jakki (Goods manufactured by village Blacksmith and Adisarakku items) Door Kundu (Goods manufactured by village Blacksmith and Adisarakku items) Door mats made of jute Door Pattas (Goods manufactured by village Blacksmith and Adisarakku items) Doors frames made of R.C.C and R.C.C. pipes (without input tax credit on purchase of Cement) (By Notification No. II (1) / CTR / 12 (R-20)/2011G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Doors made of any materials other than those specified in the schedule Dosai Chatti (Goods manufactured by village Blacksmith and Adisarakku items) Dosai kal (Goods manufactured by village Blacksmith and Adisarakku items) Double boiled linseed oil Drag harrow (Agricultural implements not operated manually or not driven by animal -w.e.f. 1.4.12) Drawing boards and brushes used therein Drawing ink whether or not concentrated or solid, excluding toner and cartridges other than those specified in the Fourth Schedule Dressed Hides & Skins Dressed hides and skins Drier (Electrical domestic and commercial appliances) Drugs and medicines including vaccines Dry block rubber Dry cells Dry crepe rubber Dry distempers Dry fish(other than branded, processed and packed items ) , Dry flower Dry fruits Dry fruits nuts and kernals -other than those specified in the schedule Dry grapes (Kismis) -- Reduced to 5% (By Notification -G.O.Ms.No.78 dated 11th July 2011 w.e.f. -12th July 2011) Dry leaves (manthara leaves, coconut thatches,) Dry Plant Dry ribbed sheets of RMA grades I IV IV I IV I I I I I I I I I I IV I I I I IV I I C B B C B B B B B C B B C B C B B C C C B B B SCH PART I I B B ITEM NO SUB ITEM NO 104 93 14 IV IV IV I IV B B B B B 37 37 37 42 37 9 6 7 8 (i) RATE OF TAX1 5 5 5 0 0 0 5 0 RATE RATE OF OF TAX2 TAX3

811

11

325 737 737 351 788 2032 2106 2041 2041 329 2044 2119 310 2119 351 754 2010 326 326 326 761 2010 2119

24 37 37 50 1 32 106 41 41 28 44 119 9 119 50 54 10 25 25 25 61 10 119 i 10 36 v ii(9)

14.5 0 0 14.5 0 5 5 5 5 14.5 5 5 14.5 5 14.5 0 5 14.5 14.5 5 0 5 5

iii

Page 16

VALUE ADDED TAX COMMODITY COMMODITY CODE 2104 2100 314 327 327 781 371 2119 723 2022 314 321 515 DESCRIPTION_ OF_ GOODS Dry Scrubber ( Water pollution control equipments & Instrumentations) Ductile pipes Dumpers Duplicating machines Duplicators Dusters DVDs -& its Parts and accessories - w.e.f. 12.7.11 Earth scrap all grades and qualities Earthern pot and pottery items Earthern tiles and refractory monolithic (other than those specified in the Fourth Schedule) incl.crog Earthmovers Eau de cologne Ebonite ball pens By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f 1.1.07 Ebonite pens By Notification No. II (1) / CTR / 30(a2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f 1.1.07 Eclipta Alba - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Educational charts Efafinavir (Drugs used for the treatment of AIDS patients) (Life saving drugs ) Eggs Electoral rolls Electric detonators Electric hair dryer (Electrical domestic and commercial appliances) Electric hair removers (Electrical domestic and commercial appliances) Electric iron (Electrical domestic and commercial appliances) Electric kettle (Electrical domestic and commercial appliances) Electric knife (Electrical domestic and commercial appliances) Electric motor Electric Storage batteries including containers, covers and plates Electric time switches (Electrical domestic and commercial appliances) Electrical apparatus for line telephony on telegraphy (Information Technology products) Electrical capacitors, fixed, variables and parts Electrical domestic and commercial appliances other than those specified in the schedule Electrical energy Electrical hearing aids (Aids for physically challenged persons) Electrical meters for digestors (Water pollution control equipments) SCH PART I I I I I IV I I IV I I I B B C C C B C B B B C C ITEM NO SUB ITEM NO 104 100 13 26 26 81 13-A 119 23 22 13 20 17 a,d (e) (i) RATE OF TAX1 5 5 14.5 14.5 14.5 0 14.5 5 0 5 14.5 14.5 0 RATE RATE OF OF TAX2 TAX3

515

17

518 711 752 754 724 306 329 329 329 329 329 328 330 329 2068 2068 329 725 702 2104

5 IV IV IV IV I I I I I I I I I I I I IV IV I B B B B C C C C C C C C C B B C B B B 11 52 54 24 5 28 28 28 28 28 27 29 28 68 68 28 25 2 104 1 (ii) 29 10 30 (6)

0 0 0 0 0 14.5 14.5 14.5 14.5 14.5 14.5 14.5 14.5 14.5 5 5 14.5 0 0 5

iii

Page 17

VALUE ADDED TAX COMMODITY COMMODITY CODE 2068 2152 2046 824 331 2068 368 2068 2068 2034 331 2068 2104 347 2133 797 103 351 351 805 726 318 2067 2025 515 752 752 2104 518 DESCRIPTION_ OF_ GOODS Electrical resistors (Information Technology products) Electrically Operated two wheelers (E-bikes) (G.O.Ms.No.47 dated 27.3.12-w.e.f. 1.4.2012) Electrodes (G.O.Ms.No.47 dated 27.3.12-w.e.f. 1.4.2012) Electroflux (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Electronic Games Electronic calculators, parts and accessories (Information Technology products) Electronic devices - watches Electronic diaries Electronic integrated circuits and Micro-assemblies Electronic Private Automatic Branch Exchange (EPABX) Electronic toys and Games Electronic typewriters, parts and accessories (Information Technology products) Electrostatic precipitators (Air Pollution Control Equipments) Elevators - whether operated by electricity, hydraulic power, mechanical power or steam Ellu Mittai (Exempted By Notification G.O.Ms.No.107-23.5.07) w.e.f 23.5.07 Embroidery in the piece, in stripes or in motifs Emeralds (whether they are sold loose or as forming part of any article or jewellery in which they are set) Emery clothes Enamels not otherwise specified in this schedule Energy (Sathu Mavu) flour (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Energy saving choolas Enlarges,plates an cloth required for use therewith (Cinematographic) Enzymes of all kinds (Industrial Input) Equipment (Capital goods) Erasers By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Ethambutol.Tab Etoposide.Inj (Life saving drugs ) Evaportor (Water pollution control equipments) Evolvulus Alsinoides- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Examination board clip (By Notification - II (1) / CTR / 12 (R-28)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Excavators I C IV IV I B B B SCH PART I I I B B B ITEM NO SUB ITEM NO 68 46 46-A 25 I I I I I I I I I I I IV I I I C B C B B B C B B C B B A C C 30 68 67 68 68 34 30 68 104 46 133 77A 3 50 50 5 IV I I I B C B B 26 17 67A 25 17 52 52 104 9 11 22 I k a,c vii i 6(v) 1(b),24 (iii) 11,24 22(b) 17 12 RATE OF TAX1 5 5 5 5 14.5 5 14.5 5 5 5 14.5 5 5 14.5 5 0 1 14.5 14.5 5 0 14.5 5 5 0 0 0 5 0 RATE RATE OF OF TAX2 TAX3

836 314

5 13

5 14.5

Page 18

VALUE ADDED TAX COMMODITY COMMODITY CODE 2047 346 306 318 2089 321 321 2094 2104 798 321 351 332 761 313 2020 333 2048 DESCRIPTION_ OF_ GOODS Exercise book other than those specified in Fourth Schedule Expanded polystyrene of all kinds of mica Explosives of all kinds Exposed films (cinematographic) Extrusions of non-ferrous metals such as aluminium, copper, and zinc. Eye lashes Eye liners Fabric based paper Fabric filters (Air Pollution Control Equipments) Fabrics covered partially or fully with textile flocks or with preparation containing textile flocks Face packs False ceiling or the like Fans Fans manufactured out of palm leaves. Fare meters for all motor vehicles Fasteners Fax machines Feeding bottles and nipples ( By Notification G.O.Ms.No.48 dated 27.03.12) w.e.f. 01.04.2012 Fenugreek (menthi) sale by any dealer whose total turnover does not exceed rupees three hundred crores in a year ( By Notification G.O.Ms.No.43 dated 05.05.08 - w.e.f. 1.5.08) Fertilizer mixture manufacured out of chemical fertilizer for which tax has been paid locally No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Fibre galss sheets Fibre glass sleeves, fibre glass tapes, milinex paper lethoroid paper, empire cloth (Industrial Input) Fibres of all types and their waste other than those specified in the Fourth Schedule Figs Files and folders made of paper board (By Notification II (1) / CTR / 12 (R-23)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Film packs and plates Film stips (cinematographic) Filter head assembly (Air Pollution Control Equipments) Filter press (Water pollution control equipments) Filters (Fabric filters, bag filter, vacuum filters) (Air Pollution Control Equipments) Filtration units such as (pressure filter, activated carbon filter, reverse osmosis , micro filter) (Water pollution control equipments) Fine china clay Fire clay Fire fighting devices Fire fighting equipments I I I I I I I I I I C C B B B B B B C C SCH PART I I I I I I I I I IV I I I IV I I I I B C C C B C C B B B C C C B C B C B ITEM NO SUB ITEM NO 47 45 5 17 89 20 20 94 104 77A 20 50 31 61 12 20 32 48 iv RATE OF TAX1 5 14.5 14.5 14.5 5 14.5 14.5 5 5 0 14.5 14.5 14.5 0 14.5 5 14.5 0 RATE RATE OF OF TAX2 TAX3

(iii) 7(iv) vi i

520

502 334 2067 2049 326 831 352 318 2104 2104 2104 2104 2028 2028 335 335

2 I I I I C B B C 33 67A 49 25 iii 51 17 104 104 104 104 28 28 34 34 (iii) (i) (iii) (i) l

0 14.5 5 5 14.5 5 14.5 14.5 5 5 5 5 5 5 14.5 14.5

Page 19

VALUE ADDED TAX COMMODITY COMMODITY CODE 336 727 754 728 728 728 728 352 762 2082 2067 351 337 354 329 760 760 760 760 760 760 760 760 338 357 2022 2050 729 2051 730 Fire works Firewood, excluding casurina and eucalyptus timber Fish (other than branded, processed and packed items ) , Fish seeds Fishing hooks Fishnet Fishnet fabrics Flash light apparatus Flattened or beaten rice Flavoured milk (Tinned, bottled or packed) Flavouring essence and synthetic food colour (Industrial Input) Flint papers Floor and wall tiles of all varieties - others Floor boards whether or not containing any other material othen than wood Floor polishers (Electrical domestic and commercial appliances) Flour, brokens and bran of kudiraivalai (Product of millets) Flour, brokens and bran of milo (Product of millets) Flour, brokens and bran of ragi (Product of millets) Flour, brokens and bran of samai (Product of millets) Flour, brokens and bran of thinai (Product of millets) Flour, brokens and bran of cholam (Product of millets) Flour, brokens and bran of varagu (Product of millets) Flour,brokens and bran of cumbu (Product of millets) Fludized bed boilers Flushing cisterns Fly ash bricks(other than those specified in the Fourth Schedule) Fly ash other those specified in Fourth schedule Fly Ash sold to brick manufacturers Foods and food preparations and mixes sold without a brand name other than those specified in the Fourth Schedule. Footwear with sale value less than two hundred rupees Foreign liquors, that is to say, wines, spirits and beers imported into India from foreign countries - (By Notification -G.O.Ms.No.65 dated 01.07.08 - w.e.f. 01.07.08) Forks Formica French polish Fresh flowers Fresh fruits DESCRIPTION_ OF_ GOODS SCH PART I IV IV IV IV IV IV I IV I I I i I I IV IV IV IV IV IV IV IV I I I I IV I IV C B B B B B B C B B B C C C C B B B B B B B B C C B B B B B ITEM NO SUB ITEM NO 35 27 54 28 28 28 28 51 62 82 67A 50 36 53 28 60 60 60 60 60 60 60 60 37 56 22 50 29 51 30 a,d m vii ii RATE OF TAX1 14.5 0 0 0 0 0 0 14.5 0 5 5 14.5 14.5 14.5 14.5 0 0 0 0 0 0 0 0 14.5 14.5 5 5 0 5 0 RATE RATE OF OF TAX2 TAX3

403 322 346 351 732 733

II I I I IV IV C C C B B

3 21 45 50 32 33

58 14.5 14.5 14.5 0 0

iv

Page 20

VALUE ADDED TAX COMMODITY COMMODITY CODE 731 732 733 2052 768 2053 507 320 320 2107 DESCRIPTION_ OF_ GOODS Fresh milk Fresh plants Fresh vegetables Fried and roasted grams Other than those specified in the Fourth Schedule Fried grams sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year Fried groundnet kernel Fried Peas By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Frozen confectionery sold with brand name Frozen desert sold with brand name Fruit drink whether in sealed containers or otherwise), other than those specified in the Fourth Schedule Fruit jam (whether in sealed containers or otherwise), other than those specified in the Fourth Schedule Fruit squash (whether in sealed containers or otherwise), other than those specified in the Fourth Schedule FruitJuice whether in sealed containers or otherwise), other than those specified in the Fourth Schedule Frying pans (Electrical domestic and commercial appliances) Fuel manufactured out of municipal solid dry waste (BY Notification G.O.Ms.No.33 dated 29.03.10w.e.f.1.4.10) Fungicides and combinations thereof Furnace oil Furnaces of all types Fuses and other blasting powder Galangal roots - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Gandhi Topi. Garlic Gas holding tanks for digestors (Water pollution control equipments) Gas meters parts and accessories thereof Gas meters for digestors (Water pollution control equipments) Gas ovens - other than those mentioned in any of the schedule Gas stoves - other than those mentioned in any of the Schedule Gases of all kinds other than Liquified Petroleum Gas Gauze Gauze or bandage cloth produced or manufactured in power loom sold by a dealer whose aggregate turnover does not exceed Rupees One crore in a year I I I C C B SCH PART IV IV IV I IV I B B B B B B ITEM NO SUB ITEM NO 31 32 33 52 68 53 7 19 19 107 RATE OF TAX1 0 0 0 5 0 5 0 14.5 14.5 5 RATE RATE OF OF TAX2 TAX3

2107

107

2107

107

2107 329 523 791 2067 338 306 518 717 734 2104 369 2104 339 339 2067 797 735

I I

B C

107 28 i

5 14.5 0 ii n iii 0 5 14.5 14.5 0

IV I I I

B B C C

17A 67A 37 5

IV IV I I I I I I IV IV

B B B C B C C B B B

17 34 104 68 104 38 38 67A 77A 35 p 6(iii) (i) i (i)

0 0 5 14.5 5 14.5 14.5 5 0 0

Page 21

VALUE ADDED TAX COMMODITY COMMODITY CODE 306 2067 836 340 340 833 781 791 737 DESCRIPTION_ OF_ GOODS Gelatin sticks Gelatine capsules (empty) Gem clip (By Notification - II (1) / CTR / 12 (R28)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Generating sets Generators Generators used for producing electricity (By Notification II (1) / CTR / 12 (R-23)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Geometry boxes Germicides and combinations thereof Ghamellas or Santhu Chatti (Goods manufactured by village Blacksmith and Adisarakku items) Ghee with brand name- Reduced to 5% (By Notification -G.O.Ms.No.78 dated 11th July 2011 w.e.f.12th July 2011) Ginger Ginger grass oil Glass -other than those specified elsewhere in the schedule Glass Beads and Glass marbles (Goligundu) Glass bottles whether old or used Glass frit and other glass in the form of powder, granules or flakes Glassware -other than those specified elsewhere in the schedule Glazed floor tiles Glaziers putty Globe Gloriasa Superba - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Glucose Glue Gold and jewellery made of it and articles made of gold Goods covered by Public Distribution System (except kerosene) Goods manufactured by village Blacksmith and Adisarakku items as notified by the Government Goods taken under customs bond for re-export after manufacturing or otherwise Grafting putty Gram or gulab gram sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year Granite blocks (rough or raw) Granulated slag (slag sand) from manufacturing of iron or steel (Industrial Input) I I I IV IV IV I IV I I B C A B B B C B C B IV IV IV B B B SCH PART I I I I C B C C ITEM NO SUB ITEM NO 5 67A 5 39 39 v 81 17A 37 iii o RATE OF TAX1 14.5 5 5 14.5 14.5 5 0 0 0 RATE RATE OF OF TAX2 TAX3

ii 11

341 734 2076 342 2054 2055 2067 342 337 351 711 518 2056 303 102 736 737 738 351 768 337 2067

I IV I I I I I I I I IV

C B B C B B B C C C B

40 34 76 41 54 55 67A 41 36 50 11 26 56 2 2 36 37 38 50 68 36 67A vi 1 iii(a) r i vi q

5 0 5 14.5 5 5 5 14.5 14.5 14.5 0 0 5 14.5 1 0 0 0 14.5 0 14.5 5

Page 22

VALUE ADDED TAX COMMODITY COMMODITY CODE 513 2047 705 732 707 732 319 329 761 788 303 739 303 2067 303 303 306 2094 414 518 791 2058 321 321 321 321 321 715 306 835 DESCRIPTION_ OF_ GOODS Graph and exercise note book By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Graph book other than those specified in Fourth Schedule Grass Green leaves Green manure seeds excluding oil seeds Green tea leaves Grills made of iron and steel Grinder (Electrical domestic and commercial appliances) Groundnut shell Groundnut Thresher (Agricultural implements not operated manually or not driven by animal w.e.f. 1.4.12) Gum Gum Benzoin in the form of tablets or sticks Gum Paste Gum resin, gum arabica, gum gel and gum glue (Industrial Input) Gum tapes Gummed tapes Gun Powder Gunny bags Gutkha Gymnena Sylvestra - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) Gypsum of all forms and descriptions Hair and body cleaning powders Hair creams Hair dyes Hair oil Hair removers Hair sprayers Hand carts Hand grenades Hand made iron safe -(By Notification - II (1) / CTR / 12 (R-28)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Hand made Locks (By Notification G.O.Ms.No.47 dated 27.3.2012 - w.e.f. 01.04.2012) Hand made shampoos Hand made soaps Hand needles used for tailoring-(By Notification - II (1) / CTR / 12 (R-29)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Hand operated sprayers and dusters (Agricultural implements manually operated ) Hand pumps Handicrafts Handicrafts made of jute Handloom fabrics Handloom made woven durries, IV I I I I I I IV I B B C C C C C B C 17A 58 20 20 20 20 20 15 5 3 ii iii SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 0 5 0 0 0 0 14.5 14.5 ii ii(10) 0 0 14.5 0 14.5 s 5 14.5 14.5 14.5 5 20 0 0 5 14.5 14.5 14.5 14.5 14.5 0 14.5 5 RATE RATE OF OF TAX2 TAX3

15 I IV IV IV IV I I IV IV I IV I I I I I I II B B B B B C C B B C B C B C C C B 47 5 32 7 32 18 28 61 1 2 39 2 67A 2 2 5 94 13

iii (ii)

ii

902 2058 2058 839 701 742 740 2042 717 741

IV I I

B B B

41-A 58 58 4 iii iii iii I (7)

0 5 5 5 0 0 0 5 0 0

IV IV IV I IV IV

B B B B B B

1(i) 42 40 42 17 41

Page 23

VALUE ADDED TAX COMMODITY COMMODITY CODE 717 2057 2057 2133 2057 2057 743 786 787 2057 2057 741 717 744 354 2084 705 2094 2094 2094 2104 2068 307 702 DESCRIPTION_ OF_ GOODS SCH PART B B B B B B B B B B B B B B C B B B B B B B C B ITEM NO SUB ITEM NO 17 57 57 133 57 57 43 41-B 41-C 57 57 41 17 44 53 84 5 94 94 94 104 68 6 2 (i) 2 1 ii iii RATE OF TAX1 0 5 5 0 5 5 0 0 0 5 5 0 0 0 14.5 5 0 5 5 5 5 5 14.5 0 RATE RATE OF OF TAX2 TAX3

Handlooms IV Handmade embroidery products I Handmade laundry brightners of all its forms I Handmade Mittai (Exempted By Notification I G.O.Ms.No.107-23.5.07) w.e.f 23.5.07 Handmade paper & Board I Handmade robin blue I Handmade safety matches IV Handmade Steel Trunk boxes IV Handmade tin containers IV Handmade ultramarine blue I Handmade washing blue I Handmademade woven durries, IV Handspun yarn IV Hank yarn IV Hard board I Hawai chappals and straps thereof other than those I specified in the Fourth Schedule Hay IV HDPE/PP woven fabrics I HDPE/PP circular strips I HDPE/PP woven strips I Headers and laterals with accessories for trickling filters (Water pollution control equipments) Headphones (Information Technology products) Health fitness equipments Hearing aid cords (Aids for physically challenged persons) Helicteres Isora- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Helmets ( By Notification - G.O.Ms.No.48 dated 27.03.12) w.e.f. 01.04.2012 Hemidusmus - Medicinal herbs and country drug(By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Herbicides and combinations thereof Hessian based paper Hessian cloth High density polythene High Speed Diesel Oil ( By Notification G.O.Ms.No.57 dated 5th June 08) - w.e.f. 6.6.08 High voltage cables (Industrial cables) High volume sampler (Air Pollution Control Equipments) Hoes(Agricultural implements manually operated ) Hoists - whether operated by electricity, hydraulic power, mechanical power or steam Hollow block bricks(other than those specified in the Fourth Schedule) incl.crog Homogenised or reconstituted tobacco Honey Hoodku tobacco I I I I IV

i iii

iii iii

518

29

2059 518 791 2094 2094 2094 407 2066 2104 701 347 2022 418 2060 416

59

5 0

IV I I I II I I IV I I II I II

B B B B

17A 94 94 94 7

ii

0 5 5 5 21.43 5

B B B C B B

66 104 1(i) 46 22 13 60 13 b,d (vi) i (iv) (iii) I (15)

5 0 14.5 5 20 5 20

Page 24

VALUE ADDED TAX COMMODITY COMMODITY CODE 416 313 737 737 2100 2061 329 745 2062 746 2063 2063 DESCRIPTION_ OF_ GOODS Hookah tobacco Horns for all motor vehicles Horse-shoe (Goods manufactured by village Blacksmith and Adisarakku items) Horse-shoe nails (Goods manufactured by village Blacksmith and Adisarakku items) Hose pipes Hosiery goods Hot food cabinet (Electrical domestic and commercial appliances) Human blood including blood components Human hair Hurricane lights burning on oil Parts and accessories including wicks and chimneys Husk and bran of all pulses and grams (other than those specified in the Fourth Schedule) Husk and bran of all cereals (other than those specified in the Fourth Schedule) Hygrophila Spinosa- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Ice Ice bars -Exempted by Notification G.O.Ms.No.33 dated 29.03.10 -w.e.f. 1.4.10 Ice blocks -Exempted by Notification G.O.Ms.No.33 dated 29.03.10 -w.e.f. 1.4.10 Ice buckets or boxes Ice cake sold with brand name Ice candy sold with brand name Ice creams sold with brand name Ice creams sold without brand name Ice jelly sold with brand name Identity Card clip (By Notification - II (1) / CTR / 12 (R-28)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Ignifluid boilers Igniters Imitation jewellery Incinerator ( Water pollution control equipments & Instrumentations) Indian musical instruments Indigenous handmade musical instruments Indigenous raw silk Indigenous Sericulture products Indigenous silk yarn Indigofera-Tinctoria Linn - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Indinavir (Drugs used for the treatment of AIDS patients) (Life saving drugs ) indoor walls Industrial inputs Any goods falling under Part C of First Schedule to the Tamil Nadu Value Added Tax Act, 2006 I B SCH PART II I IV IV I I I IV I IV I I ITEM NO SUB ITEM NO 13 12 37 37 100 61 28 45 62 46 63 63 i (iv) 40 40 RATE OF TAX1 20 14.5 0 0 5 5 14.5 0 5 0 5 5 RATE RATE OF OF TAX2 TAX3

C B B B B C B B B B B

518 2064 2064 2064 367 320 320 343 2065 320 836 338 306 2007 2104 747 747 773 748 773 518 752 351 2067

34 64 iv iv I I I I I I I I I I IV IV IV IV IV C C C C B C C C B B B B B B B 66 19 19 42 65 19 5 37 5 7 104 47 47 73 48 73 -

0 5 0 0 14.5 14.5 14.5 14.5 5 14.5 5 14.5 14.5 5 5 0 0 0 0 0 0

iii b (ii)

IV I I

B C B

52 50 67

30 (8) vi

0 14.5 5

Page 25

VALUE ADDED TAX COMMODITY COMMODITY CODE 369 2067 2068 752 2027 2027 791 344 2051 739 344 368 512 2067 354 2069 903 2070 808 345 702 2104 371 371 DESCRIPTION_ OF_ GOODS Industrial thermometers parts and accessories thereof Industrial valves of all kinds and industrial fans (Industrial Input) Information Technology products as notified by the Government - others INH.Tab (Life saving drugs ) Insect repellent coils, mats, liquids and creams and Insect killer devices including heating devices used with insect repellant mats and Insecticides and combinations thereof Instant coffee Instant foods sold without a brand name other than those specified in the Fourth Schedule. Instant Sambirani in the form of tablets or sticks Instant tea Instrument panel clocks of all kinds parts and accessories thereof Instruments for drawing and dissection By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Insulating varnish (Industrial Input) Insulation board Insulators Insulin of all Types By Notification G.O.Ms.No.47 dated 27.3.2012 - w.e.f. 01.04.2012) Intangible goods like copyright Interesterified vegetable oil fat (Vanaspathi) (By Notification No. II (1) / CTR / 12 (R-20)/2011G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Internal combustion engine, their spare parts Intra-ocular lenses (Aids for physically challenged persons) Ion Analyser ( Instrumentation) i-phone - & its Parts and accessories w.e.f. 12.7.11 i-pod & its Parts and accessories - w.e.f. 12.7.11 Ipomoba digitata - Medicinal herbs and country drug( By Notification No.II (1) / CTR / 30 (a-2) / 2007 G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Iron karandi (Goods manufactured by village Blacksmith and Adisarakku items) Iron & steel Iron aduppu (Goods manufactured by village Blacksmith and Adisarakku items) Iron idiappa ural (Goods manufactured by village Blacksmith and Adisarakku items) Iron Koodai (Goods manufactured by village Blacksmith and Adisarakku items) Iron Muram (Goods manufactured by village Blacksmith and Adisarakku items) IV I IV IV IV IV B B B B B B I IV I I I C B B C C SCH PART I I I IV I I IV I I IV I I C B B B B B B C B B C C ITEM NO SUB ITEM NO 68 67A 68 52 27 27 17A 43 51 39 43 67 14 I I I IV I B C B B B 67A 53 69 48-A 70 7 44 2 104 13-A 13-A 4 (ii) (b) 5 5 14.5 0 5 14.5 14.5 u 10 iii iv ii i t RATE OF TAX1 14.5 5 5 0 5 5 0 14.5 5 0 14.5 14.5 0 5 14.5 5 RATE RATE OF OF TAX2 TAX3

518

16

737 2041 737 737 737 737

37 41 37 37 37 37

30

0 5

29 31 35 35

0 0 0 0

Page 26

VALUE ADDED TAX COMMODITY COMMODITY CODE 737 737 737 701 782 741 421 2071 783 783 2107 2066 2007 2025 DESCRIPTION_ OF_ GOODS Iron murukku (Goods manufactured by village Blacksmith and Adisarakku items) Iron salladai (Goods manufactured by village Blacksmith and Adisarakku items) Iron vadai chatti (Goods manufactured by village Blacksmith and Adisarakku items) Iron water shifting cover (Agricultural implements animal drawn ) Jaggery and gur including Jaggery powder Jamakalams Jarda Jari of all kinds -others Jatropha oil Jatropha seeds Jelly - (processed Vegetables/fruits)(whether in sealed containers or otherwise), other than those specified in the Fourth Schedule Jelly filled cables (Industrial cables) Jewellery made of rolled gold and imitation gold Jigs and fixtures (Capital goods) Jolly frames made of R.C.C and R.C.C. pipes (without input tax credit on purchase of Cement) (By Notification No. II (1) / CTR / 12 (R-20)/2011G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Journals including maps Jute Jute twine Kadalai Mittai ((Exempted By Notification G.O.Ms.No.107-23.5.07) w.e.f 23.5.07 Kaempeearia-galang - Medicinal herbs and country drug(By Notification G.O. Ms.No.5 dated 1.1.07) w.e.f - 1.1.07 kajal Kamalai Thoni (Agricultural implements animal drawn ) Karamani sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year ( By Notification - G.O.Ms.No.79-23.3.07) w.e.f.23.3.07 Karbogarisi - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f 1.1.07 Karpoorathattu (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Karthikai vilakku (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Karukamani made of gold and used as symbol of wedlock without chain (By Notification G.O.Ms.No.36 dated 1.4.08 w.e.f 1.4.08) Kasu Aani used in ploughs (Goods manufactured by village Blacksmith and Adisarakku items) IV I I I B B B B SCH PART IV IV IV IV IV IV II I IV IV I I I I B B B B B B B B B B B B B ITEM NO SUB ITEM NO 37 37 37 1(i) 48-B 41 13 71 48-C 48-C 107 66 7 25 31 38 28 II (4) RATE OF TAX1 0 0 0 0 0 0 20 5 0 0 5 5 5 5 RATE RATE OF OF TAX2 TAX3

(ix)

a d

811

11

711 2041 2094 2133 518 750 701

11 41 94 133

0 5 5 0 0

IV IV

B B

50 1(i) II (2)

0 0

768

IV

68

518

814

14

814

14

755 737

IV IV

B B

55 37

b 17

0 0

Page 27

VALUE ADDED TAX COMMODITY COMMODITY CODE 737 737 746 409 501 2072 746 749 2041 2073 737 2074 839 701 737 DESCRIPTION_ OF_ GOODS Keels (Goods manufactured by village Blacksmith and Adisarakku items) Keels used in pump sets (Goods manufactured by village Blacksmith and Adisarakku items) Kerosene lamps (other than gas lights and petromax lights) Parts and accessories including wicks and chimneys Kerosene other than those sold through Public Distribution System Kerosene Pressure stove By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07w.e.f - 1.1.07 Kerosene sold through Public Distribution System Kerosene stoves Parts and accessories including wicks and chimneys Khadi garments / goods and made-ups as notified by the Government Khandasari sugar Khoya / khoa Kinatru Urulai (Goods manufactured by village Blacksmith and Adisarakku items) Knitting wool Knives - (By Notification - II (1) / CTR / 12 (R29)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Knives (Agricultural implements manually operated ) Kokki Bolt (Goods manufactured by village Blacksmith and Adisarakku items) Kollu sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year ( By Notification G.O.Ms.No.79-23.3.07) w.e.f.23.3.07 Kolu Aani (Goods manufactured by village Blacksmith and Adisarakku items) Kolu Pattai (Goods manufactured by village Blacksmith and Adisarakku items) Kolu Pattai used in tractor (Goods manufactured by village Blacksmith and Adisarakku items) Kondis (Goods manufactured by village Blacksmith and Adisarakku items) Koonthalam (Agricultural implements manually operated ) Kora stone Korai grass and korai mats Kovilmani (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated11th July 2011) w.e.f. 12.7.11 Kozhu (Agricultural implements manually operated ) Kudams made of iron and steel, plastic or other materials (except precious materials) Kulfi sold with brand name SCH PART IV IV IV II B B B ITEM NO SUB ITEM NO 37 37 46 9 1 I IV IV I I IV I B B B B B B B 72 46 49 41 73 37 74 4 IV IV B B 1(i) 37 i I (4) 14 36 12 13 RATE OF TAX1 0 0 0 25 0 5 0 0 5 5 0 5 5 0 0 RATE RATE OF OF TAX2 TAX3

768

IV

68

11

737 737 737 737 701 337 761 814 701 2023 320

IV IV IV IV IV I IV

B B B B B C B

37 37 37 37 1(i) 36 61 14

17 16 15 19 I (9) iv i

0 0 0 0 0 14.5 0 5

IV I I

B B C

1(i) 23 19

I (8)

0 5 14.5

Page 28

VALUE ADDED TAX COMMODITY COMMODITY CODE 737 750 814 737 737 737 737 2025 2047 2075 797 325 354 346 752 303 2119 2119 2076 371 2094 371 DESCRIPTION_ OF_ GOODS Kumizh sets (Goods manufactured by village Blacksmith and Adisarakku items) Kumkum Kuthuvilakku (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Kuzhavi (Goods manufactured by village Blacksmith and Adisarakku items) L Brackets (Goods manufactured by village Blacksmith and Adisarakku items) Laadam (Goods manufactured by village Blacksmith and Adisarakku items) Laadam aani (Goods manufactured by village Blacksmith and Adisarakku items) Laboratory equipments, components,parts and accessories(Capital goods) Laboratory note book, other than those specified in Fourth Schedule Lac Lace in the piece in stripes or in motifs of cotton or manmade fibres Ladders made of any materials other than those specified in the schedule Lamin board Laminated board of sheet of all varieties and description Lamivudine (Drugs used for the treatment of AIDS patients) (Life saving drugs ) Lapping compound Latex all grades and qualities Latex concentrate all grades and qualities Laurel oil LCD Panels & its Parts and accessories w.e.f. 12.7.11 LDPE plastic bags for milk pouches LED Panels & its Parts and accessories - w.e.f. 12.7.11 Lekh or khesari sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year Lemon grass oil Lens cleaner Levellers (Agricultural implements animal drawn ) Levellers(Agricultural implements manually operated ) Licenced software with complete Tamil version Life saving drugs as notified by the Government Lifts - whether operated by electricity, hydraulic power, mechanical power or steam Light Diesel Oil Light liquid paraffin of IP grade Light roofing sheets obtained by immersing paper mat in bitumen Lighting control reflectors Lignite SCH PART IV IV B B ITEM NO SUB ITEM NO 37 50 14 IV IV IV IV I I I IV I I I IV I I I I I I I B B B B B B B B C C C B C B B B C B C 37 37 37 37 25 47 75 77A 24 53 45 52 2 119 119 76 13-A 94 13-A (d) 30 (2) 6(iv) 39 20 41 41 b,c 18 RATE OF TAX1 0 0 5 0 0 0 0 5 5 5 0 14.5 14.5 14.5 0 14.5 5 5 5 14.5 5 14.5 RATE RATE OF OF TAX2 TAX3

ii (d)

768 2076 2129 701 701 751 752 347 408 2044 2077 361 2078

IV I I IV IV IV IV I II I I I I

B B B B B B B C B B C B

68 76 129 1(i) 1(i) 51 52 46 8 44 77 60 78

7 iii II (5) I (14)

0 5 5 0 0 0 0 14.5 25 5 5 14.5 5

Page 29

VALUE ADDED TAX COMMODITY COMMODITY CODE 2093 2093 2079 321 2041 2068 2067 303 754 360 364 721 348 2025 2068 311 518 2149 2080 321 701 357 337 337 337 337 337 337 345 2068 DESCRIPTION_ OF_ GOODS Lime Lime stone Linear alkyl benzene (LAB) Lipsticks Liquefied petroleum gas for domestic purpose Liquid Crystal devices, flat panel display devices and parts Liquid glucose dextrose syrup (non-medicinal) (Industrial Input) Liquid M-Seal epoxy Livestock (other than race horses) Locker cabinets Logs - other than those specified elsewhere in the schedule Lussi without any brand name Machine made matches Machinery, components,parts and accessories (Capital goods) Magnetic tapes for reproducing phenomena other than sound or image( IT Software of any media) (Information Technology products) Magnifying glasses Magnolia-Fuscata Andr - Medicinal herbs and country drug (By Notification G.O. Ms.No.5 dated 1.1.07) -w.e.f - 1.1.07 Maida Maize products Make up articles Mamooty fork (Agricultural implements manually operated ) Man-hole cover used in connection with drainage and sewage disposables Marble boulders or lumps Marble chips Marble dusts Marble floor tiles Marble slabs Marble wall tiles Marine Engine , their spare parts Marine radio communication equipment (Transmission apparatus other than apparatus for radio or T.V. broadcastings) (Information Technology products) Masala powder or paste whether or not with oil or additives, sold without a brand name Masala Powder with brand name (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11thJuly 2011) w.e.f. 12.7.11 Massage apparatus (Electrical domestic and commercial appliances) Master batches Masur or lentil sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year Match wax SCH PART I I I I I I I I IV I I IV I I I I B B B C B B B C B C C B C B B C ITEM NO SUB ITEM NO 93 93 79 20 41 68 67A 2 54 59 63 21 47 25 68 10 a,c 5(b) 21 v RATE OF TAX1 5 5 5 14.5 5 5 5 14.5 0 14.5 14.5 0 14.5 5 5 14.5 0 I I I IV I I I I I I I I I B B C B C C C C C C C C B 149 80 20 1(i) 56 36 36 36 36 36 36 44 68 v(a) I (12) 5 5 14.5 0 14.5 14.5 14.5 14.5 14.5 14.5 14.5 14.5 5 RATE RATE OF OF TAX2 TAX3

v(b)

6(e)

753 802 329 2102 768 2097

IV

53 2

0 5 14.5 5 4 0 5

I I IV I

C B B B

28 102 68 97

Page 30

VALUE ADDED TAX COMMODITY COMMODITY CODE DESCRIPTION_ OF_ GOODS Materials used for making footwear (By Notification No.II (1) / CTR / 12 (R-22)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Mathematical learning instruments By Notification No. II (1) / CTR / 30(a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07 -w.e.f - 1.1.07 Mathu (Goods manufactured by village Blacksmith and Adisarakku items) Mats, (products of palm industry) Measuring tapes Meat(other than branded, processed and packed items ) , Mechanical Flocculator (Water pollution control equipments) Mechanical timers Mechanical times (Electrical domestic and commercial appliances) Mechanical water coolers Medals (Sports goods) Medical equipment / devices Medical implant Medicated body powder and forms Medicated ointments produced under drugs licence Melia Azadirachita (neem) barks,leaves,flowersMedicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Mercury Analyser ( Instrumentation) Metal powder including metal pastes of all types and grades other than those falling under the declared goods Metal scraps other than those falling under the declared goods Metallic jari yarn Metallic plastic yarn Metallic yarn Meter scales Methotrexate.inj (Life saving drugs ) Methotrexate.Tab (Life saving drugs ) Methyl alcohol Metric pouring measures Metti made of silver Micro filter (Water pollution control equipments) Micro nutrients Microphones (Information Technology products) Microscopes Milk food (Tinned, bottled or packed) Milk powder Milk products (Tinned, bottled or packed) Mill made hand kerchiefs Minerals Minuspora Elangi ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 - G.O. Ms.No.79 dated 23.3.07) w.e.f - 1.1.07 SCH PART ITEM NO SUB ITEM NO RATE OF TAX1 5 RATE RATE OF OF TAX2 TAX3

827

iii

514 737 761 369 754 2104 368 329 304 2131 2081 2081 321 2044

16 IV IV I IV I I I I I I I I I B B C B B C C C B B B C B 37 61 68 54 104 67 28 3 131 81 81 20 44 ii (i) 39 i ii(b)

0 0 0 14.5 0 5 14.5 14.5 14.5 5 5 5 14.5 5

518 2104 2089 2089 2071 2071 2071 369 752 752 302 369 755 2104 791 2068 311 2082 2082 2082 776 2093 518

2 I I I I I I I IV IV I I IV I IV I I I I I IV I B B B B B B C B B C C B B B B C B B B B B 104 89 89 71 71 71 68 52 52 1 68 55 104 17A 68 10 82 82 82 76 93 37 (ii) ii ii

0 5 5 5 5 5 5 14.5 0 0 14.5 14.5 0 5 0 5 14.5 5 5 5 0 5 0

ii(b) 25 26 ii(b) (i) ii 2(a)

Page 31

VALUE ADDED TAX COMMODITY COMMODITY CODE 349 2104 752 2083 329 DESCRIPTION_ OF_ GOODS Mirrors of all kinds Mist eliminator (Air Pollution Control Equipments) Mitomycin-C.Inj (Life saving drugs ) Mixed PVC stabilizer Mixer (Electrical domestic and commercial appliances) Mochai saleby any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year ( By Notification G.O.Ms.No.79-23.3.07) w.e.f.23.3.07 Modifiers Moisturizers Molasses Monoblock pump sets for water handling and parts thereof Monoculars Mookanam Kayiru Chains (Goods manufactured by village Blacksmith and Adisarakku items) Moong or green gram sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year Mop made of cotton yarn (By Notification No. II (1) / CTR / 12 (R-20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Mopeds , components, spare pars and accessories thereof Morinda Citufolia- Medicinal herbs and country drug ( By Notification No.II (1) / CTR / 30 (a-2) / 2007 G.O. Ms.No.79 dated 23.3.07) -w.e.f - 1.1.07 Mosaic chips -(By Notification II (1) / CTR / 12 (R23)/2011 G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 Mosaic powder Mosaic tiles Mosquito destroyers Mosquito nets of all kinds Moth sale by any dealer whose turnover in respect of the goods in each item does not exceed rupees five hundred crores in a year Motor bodies built on chasis on motor vehicles , components, spare pars and accessories thereof Motor combinations , components, spare pars and accessories thereof Motor cycles , components, spare pars and accessories thereof Motor engines , components, spare pars and accessories thereof Motor scooters , components, spare pars and accessories thereof Motor vehicle on value addition without input tax credit (By Notification No. II (1) / CTR / 12 (R20)/2011- G.O.Ms.No.78 dated 11th July 2011) w.e.f. 12.7.11 SCH PART I I IV I I C B B B C ITEM NO SUB ITEM NO 48 104 52 83 28 RATE OF TAX1 14.5 5 0 5 14.5 RATE RATE OF OF TAX2 TAX3

(iii) 18

768

IV

68

361 321 410 2026 311 737

I I II I I IV

C C B C B

60 20 10 26 10 37 21

14.5 14.5 30 5 14.5 0

768

IV

68

821 350

21 I C 49

5 14.5

518

21

830 337 337 2027 2027 768 350 350 350 350 350

ii I I I I IV I I I I I C C B B B C C C C C 36 36 27 27 68 49 49 49 49 49

5 14.5 14.5 5 5 0 14.5 14.5 14.5 14.5 14.5

iv iv 6

822

22

Page 32