Академический Документы

Профессиональный Документы

Культура Документы

Economic Growth Class

Загружено:

manish_babbar27Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Economic Growth Class

Загружено:

manish_babbar27Авторское право:

Доступные форматы

ECONOMIC GROWTH

DEBRAJ RAY

OVERVIEW ON GROWTH THEORY

How to study growth?

Observations on growth.

Questions asked in growth theories.

Short history of modern growth theory.

Basic concepts in growth models.

Harrod- Domar model.

Solow model.

OBSERVATIONS ON GROWTH

1. GDP/capita varies a lot from country to

country.

About 50% of the world population live in

countries with GDP/capita less than 10% of

that of the richest countries.

Growth rates vary a lot, but there is no huge

difference between the average growth rates

of developing and developed countries

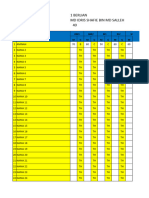

Average per capita growth rate in 16 today's developed countries

(Europe, USA, Canada, Australia)

period growth rate, % per year

1870-1890 - 1.2

1890-1910 - 1.5

1910-1930 - 1.3

1930-1950 - 1.4

1950-1970 - 3.7

1970-1990 - 2.2

Average per capita growth rate in 15 developing countries in Asia

and

South America.

1900-1913 - 1.2

1913-1950 - 0.4

1950-1973 - 2.6

1973-1987- 2.4

Growth rates are not necessarily constant

over time

Ex. India: 1960-97 average growth rate was

2.3%, but

1960-80: 1.3%

1980-1997: 3.5%

China:

1960-1978: 1.9%

1978- 1997: 5%

Countrys relative position in the world

distribution of per capita incomes can change.

Countries can move from being poor to being

rich:

Korea, Taiwan, Singapore, Japan, Hong Kong.

Ex. Korean GDP/capita 7.4 times higher in 1990

than in 1960 (880 -> 6580 USD, 1985 prices).

Or from being rich to being poor:

Ex. Iraq GDP/capita fell from 3300 to 1780 USD

from 1960 to 1990 in 1985 prices).

Growth in output and growth in the volume of

international trade are closely related.

Both skilled and unskilled workers tend to

migrate from poor to rich countries or regions.

QUESTIONS ASKED

Why are some countries poor and others rich?

Why are some countries growing and others

not?

Where does growth come from?

Neoclassical growth

The neoclassical growth model, also known as

the SolowSwan growth model or exogenous

growth model, is a class of economic models

of long-run economic growth set within the

framework of neo classical economics.

Neoclassical growth models attempt to

explain long run economic growth by looking

at productivity, capital accumulation,

population growth and technology.

The neo-classical model was an extension to

the 1946 Harrod - Domar model that included

a new term: productivity growth.

Important contributions to the model came

from the work done by Robert Solow and T. W.

Swan who independently developed relatively

simple growth models.

SHORT HISTORY OF MODERN

GROWTH THEORY

Modern growth theory originates from 1950s

(by Robert Solow)

role of physical capital and technological

progress central.

perfect competition as a starting point.

technology assumed to grow exogenously in

time as manna from heaven

Harrod- Domar Model

Developed by Sir Roy Harrod and Evsey Domar

in the 40s .

The HarrodDomar model is used in

development economics to explain an

economy's growth rate in terms of the level of

saving and productivity of capital.

The Harrod-Domar Model

R. F. Harrod, The

Economic Journal,

Vol. 49, No. 193.

(Mar., 1939), pp. 14-

33.

Econometrica

, Vol. 14, No.

2. (Apr.,

1946), pp.

137-147

Economic Growth is the result of abstention

from current consumption.

Two type of commodities:

1. Consumption Goods: produced to satisfy

human wants and preferences.

2. Capital Goods: Commodities that are

produced to produce other commodities.

16

The Harrod-Domar Growth Model

(continued)

Firms

Households

Wages, Profits,

Rents

Consumption

Expenditure

Outflow

Inflow

Inflow

Outflow

Investment

Savings

BASIC CONCEPTS

Capital (K) and Labor (L) used as inputs to

produce the output (Y).

Fixed factor proportions assumed.

The state of technology is given and requires

that inputs to be used in fixed proportion.

The state of technology is given and requires

that inputs to be used in fixed proportion.

Thus production function is of fixed coefficient

type:

= labour output ratio;

= capital output ratio

}

) (

,

) (

min{ ) (

| o

t K t L

t Y =

It is also assumed that the economy is closed and

is producing a single commodity, which is partly

consumed and partly invested.

Labor forces grows at an exogenous determined

constant exponential rate.

Investment is proportional to change in output. It

is also assumed that the capital stock does not

depreciate and there is no technical progress.

The society is inclined to save a constant

proportion of its output all the time.

Entrepreneurs are profit maximizers.

Use of aggregate production

Y(t)= C(t)+ I(t)..1

Y(t)= real GDP in year t.

C(t)= Consumption in period t.

I(t)= Investment in period t.

Use of aggregate income

Y(t)= C(t)+ S(t).2

C(t)= Purchase of consumption in period t.

S(t)= Household saving in period t.

Using the above equations==

S(t)=I(t).savings =investment.

How are capital stock (K) and investment flow (I)

related?

Investment augments the national capital stock K and

replaces that part of it which is wearing out.

I(t)= K(t+1)-K(t) + K(t)

Or, K(t+1) = (1-) K(t) + I(t)

This tells us how capital stock must change over time.

= rate of depreciation of the capital stock

t = index for time

In equilibrium

C +S = C+ I ( from 1 and 2)

<=> S = I..(3)

=> S(t) = K(t+1) (1- ) K(t)

Investment augments the national capital

stock K and replaces that part of it which is

wearing out.

Let Savings rate:

..(4)

Share of income that can be allocated to

investment to increase the growth rate.

) (

) (

) (

t Y

t S

t s =

Define Capital Output ratio=

The amount of capital required to produce a

single unit of output in the economy.

= .(5)

is assumed to be a technologically given

constant.

Combining equation 4 and 5, we get

= g+

H-D Equations

K(t+1) = (1-) K(t) + I(t)

S(t)=I(t)

K(t+1) = (1-) K(t) +S(t)

S(t)=s Y(t)

K(t)= Y(t)

Y(t+1)= (1-) Y(t)+ s Y(t)

Or, [ Y(t+1)- Y(t)]= Y(t) (s-)

or,

o

u

=

+ s

t Y

t Y t Y

) (

) ( ) 1 (

g= overall rate of growth

g=[Y(t+1)-Y(t)]/ Y(t) .

This is the Harrod Domar Equation.

o

u

=

s

g

u

o

s

g = +

is called the warranted rate of growth.

Under the assumption of constant , g

increases proportionally with s.

Because s is considered to increase

proportionally with income per capita, s is

bound to be low.

Hence, g will be low in low-income economies

if savings and investment are left to private

decision in the free market.

The model implies, that promotion of

investment is needed to accelerate economic

growth in low-income economies.

Infact, the Harrod - Domar model provided a

framework for economic planning in

developing economies, such as India's Five

Year Plan.

Suppose = 4 and s = .02 (20%).

The growth rate would then be 20/5 = 5%.

These numbers in fact roughly describes the

Indian economy in the 1980s. Policy makers in

India argued how India needed to increase its

savings rate or make capital more productive

(i.e. lower )

H-D model links growth rate of the economy

to two fundamental variables:

Ability of the economy to save.

Capital output ratio.

Higher saving rate would push up the

economy.

Increasing the rate at which capital produces

output (a lower ), growth would be

enhanced.

What causes growth in this model?

How does the Harrod-Domar model

conceive of growth?

Expanding yields the approximate equation:

Ability to save and invest (s)

Ability to convert capital into output ()

Rate of capital depreciation ()

Rate of population growth (n)

o u + + ~ n g s * /

For developing countries, the key to successful

development is increasing the rate of savings.

Capital created by investment is the main

determinant of growth.

Saving makes investment possible.

The tricks of economic growth, according to this

model, are simply a matter of increasing savings

and investment.

The main obstacle to or constraint on

development then is the relatively low level of

new capital formation or investment in most

LDCs.

The Harrod-Domar Model

Consequences

Saving as crucial for growth

The preceding result is valid as long as there

is no labor shortage. If n = s/c population,

capital and income will grow at the same

rate.

Knife-edge dynamics

If n>g , then chronic unemployment

If n<g , then chronic labor shortages, capital

becomes idle.

No endogenous process to bring the

economy to equilibrium

What are the problems with the

Harrod-Domar model?

Model assumes economy grows forever.

Saving as sufficient.

No diminishing returns; no factor substitution.

No technological change.

All three factors (s, n and ) are given facts of

nature .

Constancy of capital output ratio .

Thus, only capital and not labour contributes

to production.

Labour and capital are not substitutable in

Production.

Output does not increase by applying more

labour for a given stock of capital.

Harrod Domar Model is a neutral theory of

economic growth.

39

Beyond Harrod- Domar model

Endogeneity of savings

Savings are influenced by per capita incomes and

distribution of income in an economy

Both of these are influenced by economic growth

Economic growth mirrors the movement of savings

with income

Endogeneity of population growth

Relationship between demographic transition and

per capita income

External policy can prevent an economy from sliding

in to a trap (process of demographic transition)

Endogeneity of capital-output ratio

Captured in Solows model

Solow Model

Solow altered the Harrod - Domar story by

making the capital-output ratio endogenous.

Solows model is based on the diminishing

returns to individual factors of production.

Capital and Labor (L) are both needed to

produce output.

K/Y ratio is no longer fixed but depends e.g.

on the economy with relative endowments of

capital and labor.

Assumptions:

Savings rate (ratio of savings to income), s, is

constant. Savings will be channelled into

investment as previously.

Population growth rate is constant:L/L = n,

where L denotes population or labor.

There is perfect competition: the firm takes

the market wages on labor and rents on

capital as given.

Constant returns to scale. If labor and capital

inputs are doubled, the output gets doubled

as well.

The Solow model is built around two

equations, a production function and a capital

accumulation equation.

The production function is assumed to have

the Cobb-Douglas form and is given by

Y=F(K,L)= K

L

1-

where a is some number between 0 and 1

Production function exhibits constant returns

to scale: if all of the inputs are doubled,

output will exactly double.

Perfect competition prevails and the firms are

price-takers.

w=workers wage

r= rent payment to capital.

Profit maximizing condition implies:

max F(K, L) - rK - wL.

First-order conditions implies:

Firms will hire labor until the marginal product

of labor is equal to the wage and will rent

capital until the marginal product of capital is

equal to the rental price:

w = = (1-)

r= =

wL + rK = Y; payments to the inputs ("factor

payments") completely exhaust the value of

output produced so that there are no

economic profits to be earned.

share of output paid to labor is:

wL/Y = 1 -

the share paid to capital is:

rK/Y =

These factor shares are constant over time.

Rewrite the production function as

output per worker, y = Y/L,

capital per worker, k = K/L:

k

y

o

=

Equation on Capital Accumulation:

=K

t+l

K

t

=

sY = gross investment; dK = depreciation.

dK sY K =

.

we assume that workers/consumers save a

constant fraction, s, of their combined wage

and rental income, Y = wL + rK.

a constant fraction, d, of the capital stock

depreciates every period (regardless of how

much output is produced).

Rewrite the capital accumulation equation in

terms of capital per person.

The production function in equation will tell

us the amount of output per person produced

for whatever capital stock per person is

present in the economy.

k= K/L= log k= log K-log L

Also, , so that

Or,

Capital accumulation equation in per worker

terms:

This equation says that the change in capital

per worker each period is determined by three

terms:

Investment per worker, sy.

depreciation per worker, dk.

population growth n.

SOLVING THE BASIC SOLOW MODEL

1 ... .......... ..........

k

y

o

=

2 ......... .......... ) (

.

k d n sy k + =

The first equation shows how output is

produced from capital and labour.

The 2

nd

equation shows how capital is

accumulated over time.

Y and K are endogenous variables, so is y and

k .

Solving a model means obtaining the values of

each endogenous variable when given values

for the exogenous variables and parameters.

The Solow Diagram:

(n+d)k

Investment: sy

Investment, depreciation

Capital, k k*

Net investment

k0

Steady state.

The first curve is the amount of investment

per person, sy = sk

. This curve has the same

shape as the production function.

The second curve is the line (n + d)k, which

represents the amount of new investment per

person required to keep the amount of capital

per worker constant .

The difference between these two curves is the

change in the amount of capital per worker.

When this change is positive and the economy is

increasing its capital per worker, we say that

capital deepening is occurring.

When this per worker change is zero but the

actual capital stock K is growing (because of

population growth), we say that only capital

widening is occurring.

At k

o

, the amount of investment per worker

exceeds the amount needed to keep capital

per worker constant, so that capital deepening

occurs-that is, k increases over time.

This capital deepening will continue until k =

k*, at which point sy = (n + d)k, so that = 0.

At this point, the amount of capital per worker

remains constant, and we call such a point a

steady state.

k

At points to the right of k* the amount of

investment per worker provided by the

economy is less than the amount needed to

keep the capital-labor ratio constant.

The term k is negative, and therefore the

amount of capital per worker begins to decline

in this economy.

This decline occurs until the amount of capital

per worker falls to k*.

The Solow diagram determines the steady-

state value of capital per worker.

The production function of equation then

determines the steady-state value of output

per worker, y*, as a function of k*.

The Solow Diagram and the Production Function

Investment, depreciation,

and output

Capital, k

Y0

k0

y*

k*

Consumption

sy

Output: Y

(n+d)k

Long run capital output ratio must be

constant.

Per capita capital stock settles to some steady

state.

Per capita income also settles to some steady

state.

Thus, no long run growth of per capita output.

Total output grows at the rate of growth of

population.

Savings do no have any long run effect on the

rate of growth rate of per capita income. But

affects the L-R level of income.

Diminishing returns to capital creates

endogenous changes in capital output ratio.

This chokes off growth.

How Parameters affect the steady

state

What happens to per capita income in an

economy that begins in steady state but then

experiences a "shock."

Increase in the saving rate, s.

Increase in the population growth rate, n.

Investment, depreciation

Capital, k

New investment

exceeds depreciation

Depreciation: d K

k

**

k

*

Old investment: sy

An Increase in the Saving Rate

sy

A Rise in the Population Growth Rate

Investment, depreciation

Capital, k

k

**

k

*

sy

(n+d)k

(n+d)k

PROPERTIES OF THE STEADY STATE

o

o

+

=

=

+ =

1

1

*

.

.

) (

0

) (

d n

s

k

k

k d n sk k

In steady state =0

k

Substituting the above in the production

function:

Thus, we have a solution for the model at

steady state.

o

o

+

=

1

*

) (

d n

s

y

This equation reveals the Solow model's answer :

"Why are we so rich and they so poor?"

Countries that have high investment rates will

tend to be richer, ceteris paribus.

Countries that have population growth rates, in

contrast, will tend to be poorer.

A higher fraction of savings in these economies

must go simply to keep the capital-labor ratio

constant in the face of a growing population

This capital-widening requirement makes

capital deepening more difficult, and these

economies tend to accumulate less capital per

worker.

Empirically, countries with higher investment rates have higher

capital to output ratios:

ECONOMIC GROWTH IN THE SIMPLE

MODEL

k/k

1

=

o

sk

k

sy

n+d

k*

k

What does economic growth look like in the

steady state of this simple version of the

Solow model?

There is no per capita growth in this version of

the model!

Output per worker is constant in the steady

state.

Output itself, Y, is growing, of course, but only

at the rate of population growth.

there is no long-run economic growth in the

Solow model.

in the steady state: output, capital, output per

person, and consumption per person are all

constant and growth stops.

An economy that begins with a stock of capital

per worker below its steady-state value will

experience growth in k and y along the

transition path to the steady state.

Over time, however, growth slows down as

the economy approaches its steady state, and

eventually growth stops altogether.

The further an economy is below its steady-

state value of k, the faster the economy grows.

Also, the further an economy is above its

steady-state value of k, the faster k declines.

empirically, economies appear to continue to

grow over time

thus capital accumulation is not the engine of

long-run economic growth

saving and investment are beneficial in the short-

run, but diminishing returns to capital do not

sustain long-run growth

in other words, after we reach the steady state,

there is no long-run growth in Y

t

(unless L

t

or A

increases)

Level effects and Growth effects.

C

D

F

B

A

E

Time

(

L

o

g

)

p

e

r

c

a

p

i

t

a

i

n

c

o

m

e

A growth effect : Changes the rate of growth

of a variable.

A level effect leaves the rate of growth

unchanged.

Savings rate has a level effect only in the

Solow model.

Savings rate, s, and population growth ,n,

only has level effects.

Solow Model with Technology

To generate sustained growth in per capita

income , we must introduce technological

progress to the model.

Y = F(K, AL) = K

(AL)

1-

Technology variable: A

The technology variable A is said to be "labor

augmenting. Technological progress occurs when

A increases over time - a unit of labor, for

example, is more productive when the level of

technology is higher.

exogenous technical progress

Consider the labour-augmenting production

function:

Technical progress occurs when A rises over

time, with labour becoming more productive

when the level of technology is higher.

Let,

Y F(K, AL) =

g

A

A

=

Capital accumulation equation:

Production function in terms of output per

worker:

y= k

A

1-

Taking log and differentiating:

d

K

Y

s

K

K

=

A

A

k

k

y

y

) 1 ( o o + =

From the capital accumulation equation we

can see that the growth rate of K will be

constant if and only if Y / K is constant.

If Y / K is constant, y/k is also constant.

y and k will be growing at the same rate.

A situation in which capital, output,

consumption, and population are growing at

constant rates is called a balanced growth

path.

Let, g, to denote the growth rate of some

variable x along a balanced growth path.

Then, along a balanced growth path, g

y

= g

k

Recalling that,

g

y

=g

k

=g

g

A

A

=

Along a balanced growth path , output per

worker and capital per worker both grow at

the rate of exogenous technological change.

No technological progress, and therefore

there was no long-run growth in output per

worker or capital per worker; g

y

= g

k

= g = 0.

Technological progress is the source of

sustained per capita growth.

THE SOLOW DIAGRAM WITH

TECHNOLOGY

k is no longer constant in the long run.

The new state variable will be:

= ratio of capital per worker to technology

or capital technology ratio and is equal to k/A

and constant along the balanced growth path.

o

k y

~

~

=

k

~

AL

K

k

~

A

y

AL

Y

y =

~

= y

~

Output technology

ratio

Rewriting the capital accumulation equations

in terms of

Combining it with capital accumulation

equation:

k

~

L

L

A

A

K

K

k

k

=

~

~

k d g n y s k

~

) (

~

~

+ + =

the Solow diagram with technical progress

f (k)

k

(d n g)k + +

y s

~

0

~

k

*

~

k

Capital techology ratio converges to a

stationary steady state.

Long run increase in per capita income takes

place at the rate of technical progress.

Steady-state income and growth

Setting

Substituting this into the production function

gives

1/(1 )

*

s

k

n d g

o

| |

=

|

+ +

\ .

/(1 )

*

s

y

n d g

o o

| |

=

|

+ +

\ .

0

~

= k

Recall the capital accumulation equation :

This can be re-written as

k sy (n g d)k = + +

k y

s (n g d)

k k

= + +

An Increase in Investment

y s

~

y s

~

'

k d g n

~

) ( + +

* *

~

k

*

~

k

k

~

a rise in the saving rate

k

n+g+d

1

s' k

o

*

k

**

k

1

sk

o

k / k

THE EFFECT OF AN INCREASE IN

INVESTMENT ON GROWTH

y

y

Time

g

*

t

THE EFFECT OF AN INCREASE IN

INVESTMENT ON y

Level Effect

*

t

Time

Log y

EVALUATING THE SOLOW MODEL

How does the Solow model answer the key

questions of growth and development?

First, the Solow model appeals to differences

in investment rates and population growth

rates and (perhaps) to exogenous differences

in technology to explain differences in per

capita incomes.

Why are we so rich and they so poor?

Invest more and have lower population growth

rates, both of which allow us to accumulate more

capital per worker and thus increase labor

productivity.

Second, why do economies exhibit sustained

growth in the Solow model?

Technological progress.

Without technological progress, per capita

growth will eventually cease as diminishing

returns to capital set in.

Technological progress, can offset the

tendency for the marginal product of capital

to fall.

In the long run, countries exhibit per capita

growth at the rate of technological progress.

How, then, does the Solow model account for

differences in growth rates across countries?

Transition dynamics can allow countries to

grow at rates different from their long-run

growth rates.

An economy with a capital-technology ratio

below its long-run level will grow rapidly until

the capital-technology ratio reaches its

steady-state level.

The principle of transition dynamics says that

the farther below its steady state an economy

is, in percentage terms, the faster the

economy will grow

Similarly, the farther above its steady state, in

percentage terms, the slower the economy

will grow

This principle allows us to understand why

economies may grow at different rates at the

same time

How do we understand the discrepancy between

Harrod-

Domar and Solow models?

In the former the savings rate, for example,

affected the long run growth rate, while in the

Solow model savings rate does not affect the

growth rate.

There is no sustained growth to begin with in

this version of the Solow model!

This is because there are diminishing returns

to capital, which create endogenous changes

in capital-output ratio.

This chokes off growth in the Solow model. If

capital were to grow faster than labor, each

unit of capital had less labor to work with it,

and the output per unit of capital would be

reduced.

There can be no steady state growth.

Unconditional Convergence

(

L

o

g

)

p

e

r

c

a

p

i

t

a

i

n

c

o

m

e

Time

B

A

AB plots the time path of per capita income at the steady state.

If Countries in the long run have the same rates

of technical progress, savings, population growth

and capital depreciation .

Solow model predicts that all countries , capital

per efficiency unit of labour converges to the

common vales of k*.

If a country starts below the steady state level

per efficiency unit , the country will initially

display a rate of growth that exceeds the steady

state level and over time growth will decelerate

to steady state level. Vice versa.

Convergence shows a strong relationship

between growth rate of per capita income and

the initial value of per capita income.

Poor countries grow faster than the rich ones.

A country which is poor initially (with low per

capita income and capital stock) will then grow

faster than the rich country.

Relative income differences between countries

must die away in the LR.

Evidence

Option 1. Small number of countries, long

horizon.

Option 2. Large number of countries, short

horizon.

Empirical evidence

The growth rates of homogenous countries do

converge more clearly than the growth rates

of non-homogenous countries (the US states,

OECD vs. the world).

Homogenous countries are more likely to have

the same steady state.

Conditional convergence:

Unconditional convergence assumes all

parameters are the same.

Parameters, population, capital depreciation,

savings differ.

The steady state could be different from

country to country.

Countries need not converge to other.

Weaker hypothesis called conditional

convergence.

Assume that knowledge flows freely across

countries.

Technical progress determines the growth rate

of per capita income in the long run.

This leads to the prediction of convergence in

growth rates.

Long run per capita incomes vary from

country to country.

Long run per capita growth rates off all

countries are predicted to be the same.

(

L

o

g

)

p

e

r

c

a

p

i

t

a

i

n

c

o

m

e

Time

Conditional convergence implies convergence

in growth rates.

Growth rate convergence implies that a

country that is below its own steady state

grows faster than its steady state growth rate.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PETITION For Declaration of NullityДокумент7 страницPETITION For Declaration of NullityKira Jorgio100% (3)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Tribebook Wendigo Revised Edition 6244638Документ109 страницTribebook Wendigo Revised Edition 6244638PedroОценок пока нет

- Treason Cases Digested (Crim Law 2)Документ5 страницTreason Cases Digested (Crim Law 2)Jacob Castro100% (2)

- AWSCertifiedBigDataSlides PDFДокумент414 страницAWSCertifiedBigDataSlides PDFUtsav PatelОценок пока нет

- The Value Relevance of Financial Statements and Their Impact On Stock PricesДокумент18 страницThe Value Relevance of Financial Statements and Their Impact On Stock Pricesanubha srivastavaОценок пока нет

- Creative WritingДокумент13 страницCreative WritingBeberly Kim AmaroОценок пока нет

- Downloaded From Manuals Search EngineДокумент29 страницDownloaded From Manuals Search EnginehaivermelosantanderОценок пока нет

- MKT305 (Module 6 Segmentation)Документ53 страницыMKT305 (Module 6 Segmentation)Ngọc AnhhОценок пока нет

- Events ProposalsДокумент19 страницEvents ProposalsRam-tech Jackolito FernandezОценок пока нет

- Business Analytics Case Study - NetflixДокумент2 страницыBusiness Analytics Case Study - NetflixPurav PatelОценок пока нет

- 3 - Accounting For Loans and ImpairmentДокумент1 страница3 - Accounting For Loans and ImpairmentReese AyessaОценок пока нет

- Case Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022Документ4 страницыCase Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022ShravanОценок пока нет

- Bibliografia Antenas y RadioДокумент3 страницыBibliografia Antenas y RadioJorge HerreraОценок пока нет

- Click To Enlarge (The Skeptic's Annotated Bible, Hosea)Документ11 страницClick To Enlarge (The Skeptic's Annotated Bible, Hosea)Philip WellsОценок пока нет

- Bill Vaskis ObitДокумент1 страницаBill Vaskis ObitSarah TorribioОценок пока нет

- Kanne Gerber Et Al Vineland 2010Документ12 страницKanne Gerber Et Al Vineland 2010Gh8jfyjnОценок пока нет

- Nursing Process Guide: St. Anthony's College Nursing DepartmentДокумент10 страницNursing Process Guide: St. Anthony's College Nursing DepartmentAngie MandeoyaОценок пока нет

- Assignment 1684490923Документ16 страницAssignment 1684490923neha.engg45755Оценок пока нет

- Pass The TOEIC TestДокумент2 страницыPass The TOEIC TesteispupilОценок пока нет

- TEMPLATE Keputusan Peperiksaan THP 1Документ49 страницTEMPLATE Keputusan Peperiksaan THP 1SABERI BIN BANDU KPM-GuruОценок пока нет

- Memorandum For APDSA Indonesia 2Документ3 страницыMemorandum For APDSA Indonesia 2Renanda Rifki Ikhsandarujati RyanОценок пока нет

- Atf Fire Research Laboratory - Technical Bulletin 02 0Документ7 страницAtf Fire Research Laboratory - Technical Bulletin 02 0Mauricio Gallego GilОценок пока нет

- IC Product Marketing Plan 8609Документ7 страницIC Product Marketing Plan 8609Pandi IndraОценок пока нет

- Digitek Company Pre - QualificationДокумент103 страницыDigitek Company Pre - QualificationRey MichaelОценок пока нет

- FAN XR UP1 - E7Документ26 страницFAN XR UP1 - E7Mathieu MaesОценок пока нет

- แบบฝึกหัด subjuctiveДокумент6 страницแบบฝึกหัด subjuctiveรัฐพล ทองแตงОценок пока нет

- Easy Trade Manager Forex RobotДокумент10 страницEasy Trade Manager Forex RobotPinda DhanoyaОценок пока нет

- To Hemiette (Hette) Sitter-Zoetlief-Tromp Oegstgeest, Holland Bernhard (Ben) T Agnes Zoe/lief-Tromp Tournesol-, Breteuil Sur Lton, FranceДокумент45 страницTo Hemiette (Hette) Sitter-Zoetlief-Tromp Oegstgeest, Holland Bernhard (Ben) T Agnes Zoe/lief-Tromp Tournesol-, Breteuil Sur Lton, FrancerathkiraniОценок пока нет

- Synopsis On Employee LifecycleДокумент12 страницSynopsis On Employee LifecycleDeepak SinghОценок пока нет

- Commercial Dispatch Eedition 6-13-19Документ12 страницCommercial Dispatch Eedition 6-13-19The Dispatch100% (1)