Академический Документы

Профессиональный Документы

Культура Документы

12A15

Загружено:

Ismail MswАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

12A15

Загружено:

Ismail MswАвторское право:

Доступные форматы

1.

DISTINCTION BETWEEN CONTINGENT CONTRACTS AND WAGERING AGREEMENTS;

1.validity A contingent contract is a valid contract in the eyes of law. A wagering agreement is void and even illegal in the states of Gujarat and Maharashtra. 2.Performance A contingent contract depends on the happening or not happening of some uncertain future event collateral to the contract. A wagering contract depends on happening of some uncertain event. 3.Interest In a contingent contract , the parties have real interest in the happening or not happening of the event like insurable interest in the property insured. The parties should not have any interest in the event except for the stake by winning or loosing the bet. 4.Future event In a contingent contract the future uncertain event is merely a collateral event incidental to the main agreement. In a wagering agreement , the future event is the sole determining factor of the contract. 5.Consequences In a wagering agreement, one party wins and the other looses.the loss of the party is the gain of the other party. In a contingent contract the question of the winning or loosing does not arise at all.

6.promises. In a contingent contract the promise on the part of the party is contingent to the happening of an uncertain event. A wagering agreement consists of mutual promises by both the parties conditional on the happening or not happening of an event.

2.Nature and extent of suretys liability

Section 128 of the contracts acts defines the nature and extent of suretys liability .it provides that liability of the surety is co-extensive with that of that of the principal debtor. The liability of the surety arises immediately on the default of the deptor.so, where a debt guaranteed by the surety ,becomes payable only after a notice of demand ,the liability of the surety arises only after such notice.the surety connot be called upon to pay unless the principal debtor has made a default.but the moment the principal debtor defaults immediately the surety becomes liable. The creditor may choose to proceed against the surety first , unless there is an agreement to the contrary.the rule that a surety cannot be held liable if the principal debtor is not liable may not be true in all cases. When the original agreement between the creditor and the principal debtor is void. Similarly a discharge of the principal debtor by the operation of law does not discharge the surety. The nature of suretys liability can be summed up as under. 1.The liability of surety is of secondary nature. A surety is liable only on default of the principal debtor.

2.The liability of the surety arises immediately on the default by the principal debtor.the creditor has a right to sue the surety directly without first proceeding against the principal debtor. 3.Where a creditor is having securities given by the principal debtor against his borrowings in addition to the suretys guarantee, the creditor is under no obligation to realise these securities before proceeding against the surety. 4. The surety is sometimes called a Favoured debtor. 5. this is because ,it is not open to the creditor to call upon the surety to pay under the contract of guarantee unless the creditor has performed his part of the contract.A surety is an object of some favour both at law and at equity.A contract of guarantee must thus be strictly construed in favour of the surety.

Вам также может понравиться

- ObjectiveДокумент2 страницыObjectiveIsmail MswОценок пока нет

- Save As PDF Print ApplicationДокумент1 страницаSave As PDF Print ApplicationIsmail MswОценок пока нет

- Tnpscmar12 2903576Документ3 страницыTnpscmar12 2903576Ismail MswОценок пока нет

- Objective:: J.Keerthiga, 22, TVK2 Street, SellurДокумент2 страницыObjective:: J.Keerthiga, 22, TVK2 Street, SellurIsmail MswОценок пока нет

- chapter IДокумент4 страницыchapter IIsmail MswОценок пока нет

- The of of in Take From The of The Of: Name of Post Scale Grade Rgvised Scale Grade (RS.)Документ1 страницаThe of of in Take From The of The Of: Name of Post Scale Grade Rgvised Scale Grade (RS.)Ismail MswОценок пока нет

- Gender Statistics and Development Policy: Women's Work in IndiaДокумент15 страницGender Statistics and Development Policy: Women's Work in IndiaIsmail MswОценок пока нет

- Engineering & Technology: 1. PhotoДокумент2 страницыEngineering & Technology: 1. PhotoIsmail MswОценок пока нет

- Engineering & Technology: 1. PhotoДокумент2 страницыEngineering & Technology: 1. PhotoIsmail MswОценок пока нет

- Engineering & Technology: 1. PhotoДокумент2 страницыEngineering & Technology: 1. PhotoIsmail MswОценок пока нет

- Rajalakshmi Kannan Tamilnadu State Board 9442028377: M 83, Malligai Nagar Sector 3Rd TNHB Colony Anaiyur Madurai 625017Документ1 страницаRajalakshmi Kannan Tamilnadu State Board 9442028377: M 83, Malligai Nagar Sector 3Rd TNHB Colony Anaiyur Madurai 625017Ismail MswОценок пока нет

- Dear Metha Ajith PandianДокумент1 страницаDear Metha Ajith PandianIsmail MswОценок пока нет

- Chrysalis ProjectДокумент1 страницаChrysalis ProjectIsmail MswОценок пока нет

- Tho¡Ifahs®Fÿ, Jaîbrœj J FSJ THFD Fis Ï F Ãw J NT©LH .Û¿Dhš Fhtšjiw VL¡F Elto¡If îThf BGHW GšyДокумент4 страницыTho¡Ifahs®Fÿ, Jaîbrœj J FSJ THFD Fis Ï F Ãw J NT©LH .Û¿Dhš Fhtšjiw VL¡F Elto¡If îThf BGHW GšyIsmail MswОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Tvmreviewlecture 131226185711 Phpapp02Документ19 страницTvmreviewlecture 131226185711 Phpapp02Đào Quốc AnhОценок пока нет

- Laundry QuestionnaireДокумент3 страницыLaundry QuestionnaireRIGENE MAGNAYEОценок пока нет

- Banking & Finance: Master in Economics ofДокумент8 страницBanking & Finance: Master in Economics ofAnh LeОценок пока нет

- 2 Discount Rate BSLДокумент44 страницы2 Discount Rate BSLfarОценок пока нет

- 5 AppraisalProcess MBC2015 PDFДокумент70 страниц5 AppraisalProcess MBC2015 PDFRoy John MalaluanОценок пока нет

- 162 005Документ1 страница162 005Angelli LamiqueОценок пока нет

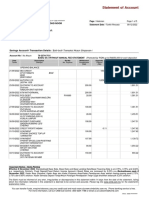

- Statement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, SelangorДокумент5 страницStatement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, Selangorputri nurishaОценок пока нет

- ch12 Principles of AccountingДокумент49 страницch12 Principles of AccountingAdam Rivera100% (2)

- FNB SG Retail 2017-03Документ23 страницыFNB SG Retail 2017-03Arravind UdayakumarОценок пока нет

- TSLA Stock Quote - Tesla Motors IncДокумент2 страницыTSLA Stock Quote - Tesla Motors IncBaikaniОценок пока нет

- Assignemnt 1 Muhammad Awais (NUML-S20-11149)Документ40 страницAssignemnt 1 Muhammad Awais (NUML-S20-11149)Muhammad AwaisОценок пока нет

- ABL Annual Report 2015 UpdatedДокумент266 страницABL Annual Report 2015 Updatedali.khan10Оценок пока нет

- Insync Partnership DeedДокумент5 страницInsync Partnership DeedAbhishek SinghОценок пока нет

- Chapter 13: Dividend PolicyДокумент18 страницChapter 13: Dividend PolicyRezhel Vyrneth TurgoОценок пока нет

- Internship Report MTMДокумент45 страницInternship Report MTMusmanaltafОценок пока нет

- Free CFA Level 2 Mock Exam (300hours)Документ20 страницFree CFA Level 2 Mock Exam (300hours)ShrutiОценок пока нет

- On Consumer Perspective Towards Various Investment Sectors in The Leading SolutionДокумент26 страницOn Consumer Perspective Towards Various Investment Sectors in The Leading SolutionAbhishek Choudhary89% (9)

- Jaguar Land Rover PLC LX000000002046407490Документ409 страницJaguar Land Rover PLC LX000000002046407490mehulssheth50% (2)

- 2021 APC ASM DIS With Attachments 06182021 PSEДокумент146 страниц2021 APC ASM DIS With Attachments 06182021 PSESeifuku ShaОценок пока нет

- Your Bill - 3 February 2018: A Da Silva Pinheiro Franco 1/21 Kilmarnock Street Riccarton Christchurch 8011Документ3 страницыYour Bill - 3 February 2018: A Da Silva Pinheiro Franco 1/21 Kilmarnock Street Riccarton Christchurch 8011Ailton FrancoОценок пока нет

- Lease PresentationДокумент12 страницLease PresentationarthiguruОценок пока нет

- Evidencia 8 Actividad 15Документ10 страницEvidencia 8 Actividad 15Angela Maria Galan NavasОценок пока нет

- Salazar Research#6Документ4 страницыSalazar Research#6Darren Ace SalazarОценок пока нет

- Online Guide For UTP RegistrationДокумент72 страницыOnline Guide For UTP RegistrationwhateveroilОценок пока нет

- Solution Manual For Foundations of Financial Management Block Hirt Danielsen 15th EditionДокумент37 страницSolution Manual For Foundations of Financial Management Block Hirt Danielsen 15th Editionabatisretroactl5z6100% (26)

- Nykaa NDДокумент13 страницNykaa NDNIKETA MODIОценок пока нет

- Level7 Strategic Management and Leadership 2013 Syllabus v01Документ89 страницLevel7 Strategic Management and Leadership 2013 Syllabus v01James Mick0% (1)

- Grade 7 EMS Mid Year Examination 2021Документ7 страницGrade 7 EMS Mid Year Examination 2021nkatekodawn72Оценок пока нет

- Mock Test Paper 2Документ7 страницMock Test Paper 2FarrukhsgОценок пока нет

- Engineering Management Case StudiesДокумент20 страницEngineering Management Case StudiesJohn Ryan Toledo67% (3)