Академический Документы

Профессиональный Документы

Культура Документы

Manila Standard Today - Business Daily Stocks Review (January 13, 2014)

Загружено:

Manila Standard TodayАвторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Manila Standard Today - Business Daily Stocks Review (January 13, 2014)

Загружено:

Manila Standard TodayАвторское право:

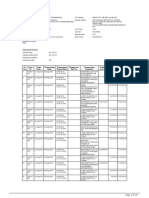

MST Business Daily Stocks Review

M

S

T

Monday, January 13, 2014

52 Weeks

High Low

STOCKS

3.74

105.5

99

114

1.6

78.2

2.42

21

37.85

24

3.07

750

139.5

2.09

38.85

117

145

515

74.5

206.4

1450

160

2.12

56

62.3

79

0.69

50

1.32

16.6

22.75

10.2

2.5

451

76.5

1.64

21.85

65

83.5

353

40.75

105.7

943

106.8

AG Finance

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

COL Financial

Eastwest Bank

Filipino Fund Inc.

I-Remit Inc.

Manulife Fin. Corp.

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

40.5

30

8.75

5

2.26

1.09

1.59

1.2

24.9

15.12

3.12

2.62

29.3

10.02

8.24

0.96

39.5

20

8.6

4.32

22

3.86

7.9

4.94

15.9

8.5

27.45

15.5

113.8

68

27.4

12.5

0.027

0.0120

15.98

12

179.5

99.8

12.24

9.1

3.52

1.8

28.4

11.34

4

1.5

41.4

25

24.2

12.02

22.5

2.52

397

248

13.5

6.8

6.88

4.5

16.3

10.22

11.18

4.8

6.15

3.89

3.74

1.98

5.99

4

125

65.5

750

200

2.1

1.69

0.220

0.102

3.3

1.59

3

1.08

135.4

70

2.18

1.11

2.92

2.120

2.92

2.12

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alsons Cons.

Asiabest Group

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Concepcion

Da Vinci Capital

Del Monte

DNL Industries Inc.

Emperador

Energy Devt. Corp. (EDC)

EEI

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Jollibee Foods Corp.

Lafarge Rep

LMG Chemicals

LT Group

Mabuhay Vinyl Corp.

Manila Water Co. Inc.

Megawide

Melco Crown

Mla. Elect. Co `A

Pancake House Inc.

Pepsi-Cola Products Phil.

Petron Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas Holdings

Salcon Power Corp.

San Miguel Corp `A

San MiguelPure Foods `B

Splash Corporation

Swift Foods, Inc.

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vulcan Indl.

61

40

28.4

14.1

2.7

1.8

1.63

0.9

1.69

0.88

688

417.2

18.1

0.082

61.2

44

6.99

3.9

0.26

0.151

883.5

521

9.3

4.75

50

32.55

7.68

4.48

1.39

0.61

0.81

0.320

2.69

1.400

6.33

4

7.65

4.7

9.66

3

0.0620

0.030

2.7

1.02

0.77

0.45

3.4

2

0.420

0.280

1213

605

2.54

1.5

1.4

1.03

0.315

0.189

Aboitiz Equity

Alliance Global Inc.

Anglo Holdings A

ATN Holdings A

ATN Holdings B

Ayala Corp `A

Cosco Capital

DMCI Holdings

Filinvest Dev. Corp.

Forum Pacific

GT Capital

House of Inv.

JG Summit Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Mabuhay Holdings `A

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

MJCI Investments Inc.

Pacifica `A

Prime Media Hldg

Prime Orion

Republic Glass A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Top Frontier

Unioil Res. & Hldgs

10.42

27

3.28

50.2

2.26

0.240

35.7

7.1

6.73

2.44

0.91

1.21

2.76

2.27

1.73

4.31

0.197

0.680

26.9

4.33

26.9

3.52

21.9

1.35

4.1

2.4

2.92

8990 HLDG

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Alphaland Corp.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

Cyber Bay Corp.

Empire East Land

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

2.21

15

1.16

13

0.53

0.174

21.85

4.25

3.7

1.08

0.49

0.84

1.3

1.35

1.05

2.38

0.077

0.400

17.9

2.4

18.2

1.68

14.24

0.58

3.31

0.51

2.12

3.15

1.62

47

29.8

1.61

1.01

0.95

0.6

16.04

8.9

16.88

8.36

0.2090

0.1090

7.78

2.97

84.8

49.7

6.56

3.72

1300

1000

1670

1058

9.99

7.5

100.5

68.85

0.51

0.355

18.4

5

10

4.65

0.07

0.012

0.0850

0.040

3.1400

1.950

9.9

5.81

3.4

1.45

2.9

2

3.49

1.91

17.5

13.78

7.35

4.2

3.47

1.9

17.04

10.00

3290

2480

0.365

0.250

47.5

28.7

1.87

0.65

2.7

1.68

4.5

1.14

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Asian Terminals Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Discovery World

DFNN Inc.

FEUI

Globe Telecom

GMA Network Inc.

Harbor Star

I.C.T.S.I.

NOW Corp.

Imperial Res. `A

IPeople Inc. `A

IP E-Game Ventures Inc.

Island Info

ISM Communications

Leisure & Resorts

Liberty Telecom

Macroasia Corp.

Manila Jockey

Pacific Online Sys. Corp.

PAL Holdings Inc.

Paxys Inc.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

Robinson RTL

STI Holdings

Transpacific Broadcast

Travellers

Yehey

0.0068

4.95

23.35

0.315

25.5

25

1.35

1.68

20.95

0.6

1.23

1.310

0.066

0.073

28.55

7.13

0.700

4.5

0.026

0.027

7.24

19.76

34.8

0.047

305.8

0.021

Abra Mining

Apex `A

Atlas Cons. `A

Basic Energy Corp.

Benguet Corp `A

Benguet Corp `B

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Oriental Pet. `B

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

0.0036

1.9

11.7

0.238

12

8.3

0.58

0.85

5

0.4

0.3950

0.4250

0.021

0.023

14.72

2.55

0.400

1.16

0.016

0.019

5.8

7.86

8.5

0.033

217

0.010

49.9

28.95

109

100.2

117

101

10.26

7.22

115

104.1

80.5

74.5

84

74.5

1080

1005

ABS-CBN Holdings Corp.

Ayala Corp. Pref B

First Gen F

First Gen G

GMA Holdings Inc.

Leisure and Resort

PCOR-Preferred

SMC Preferred A

SMC Preferred C

SMPFC Preferred

LR Warrant

First Metro ETF

Previous

Close

High

Low

FINANCIAL

3

2.95

69.3

68.7

72.00

70.10

84.30

83.40

2.14

2.00

60.50

59.50

1.98

1.98

16

15.92

24.5

24

15.00

15.00

2.84

2.76

830.00

830.00

74.15

71.50

1.51

1.46

22.6

22.5

79.60

76.00

139.50

139.50

306

303

43.85

43.3

119.2

117

1370.00

1370.00

126.00

125.00

INDUSTRIAL

35

35.5

35.2

5.6

5.8

5.2

1.01

1

0.98

1.33

1.35

1.32

11.5

12

11.1

2.90

2.91

2.91

14.5

14.5

14.5

22.5

23

22.6

0.9

0.9

0.86

22.65

22.75

22.5

6.49

6.610

6.48

11.00

11.30

10.80

5.42

5.58

5.42

9.95

10.08

9.95

14.52

15.2

14.52

59

60.95

58.8

21.30

21.20

21.20

0.0110

0.0120

0.0110

15.00

15.50

15.00

165.80

170.00

166.00

8.71

8.79

8.7

3.1

3.06

3.03

15.02

15.18

14.82

2.21

2.25

2.2

23.45

23.75

23

12.200

12.800

12.100

13.7

14.3

13.82

250.20

254.00

250.20

14.68

15.00

14.70

4.51

4.59

4.51

14.02

14.10

14.00

4.75

4.90

4.76

5.60

5.85

5.62

5.73

5.69

5.57

4.3

4.5

4.5

60.00

60.00

58.00

228

238

228

1.81

1.81

1.8

0.119

0.120

0.119

1.87

1.83

1.79

1.50

1.58

1.51

117.00

120.50

117.20

2

2.06

2

0.6

0.62

0.59

1.41

1.40

1.40

HOLDING FIRMS

51.50

53.00

51.65

25.40

26.00

25.45

1.69

1.79

1.68

1.2

1.22

1.13

1.28

1.27

1.18

510

525

511

8.85

8.98

8.84

56.50

58.20

56.50

4.40

4.40

4.25

0.195

0.196

0.196

738.5

750.5

738.5

6.34

6.20

6.16

39.00

39.85

38.50

4.28

4.35

4.21

0.6

0.62

0.61

0.600

0.630

0.600

3.18

3.6

3.2

4.24

4.32

4.23

5.2

5.16

5.1

3.25

3.1

3.1

0.0470

0.0480

0.0420

1.410

1.420

1.400

0.400

0.450

0.450

2.54

2.49

2.47

0.270

0.270

0.265

680.00

710.00

685.00

1.23

1.27

1.20

1.00

1.06

1.06

178.00

104.90

81.00

0.1580

0.1590

0.1590

PROPERTY

6.890

7.400

6.980

13.60

13.48

12.50

1.08

1.08

1.08

17.68

18.4

17

1.460

1.480

1.400

0.189

0.195

0.188

25.70

26.20

25.70

4.89

5

4.9

5.65

5.65

5.6

1.37

1.41

1.37

0.51

0.51

0.51

0.920

0.920

0.920

1.35

1.36

1.35

1.38

1.39

1.35

1.39

1.47

1.40

3.28

3.42

3.28

0.0790

0.0790

0.0720

0.3800

0.3900

0.3900

0.4600

0.4600

0.4600

3.31

3.47

3.25

19.98

20.15

19.90

1.56

1.56

1.56

14.34

14.72

14.40

0.6

0.64

0.61

3.42

3.58

3.56

0.940

0.940

0.900

5.290

5.290

5.200

SERVICES

1.87

1.9

1.86

31.5

31.45

29.8

1.01

1.02

0.94

0.640

0.650

0.630

11

11

11

8.75

9.08

8.75

0.1430

0.1460

0.1420

3.38

3.37

3.31

50.75

51.5

50

2.2

2.25

2

5.06

5.11

5.04

1150

1115

1115

1620

1692

1620

8.10

8.40

8.11

1.24

1.26

1.24

99

100.9

98.85

0.395

0.390

0.375

4.50

5.50

5.50

12

12

11.3

0.013

0.013

0.012

0.0410

0.0440

0.0430

1.9900

1.9900

1.9300

6.34

6.34

6.33

1.98

1.98

1.64

3.34

3.64

3.20

2

2

2

16

15.88

14.96

6.00

6.00

5.86

2.18

2.18

2.16

8.77

8.94

8.77

2690.00

2720.00

2692.00

0.295

0.295

0.295

38.70

39.45

38.55

58.00

58.00

57.50

0.66

0.68

0.65

2.09

2.09

1.91

10.2

10.38

10.14

1.070

1.210

1.080

MINING & OIL

0.0031

0.0031

0.0030

1.76

1.80

1.80

14.62

15.20

14.70

0.250

0.255

0.250

6.7

8.5

6.7

6.6

8.1

6.3

0.6

0.62

0.59

0.83

0.83

0.83

5.20

5.39

5.20

0.405

0.420

0.405

0.365

0.385

0.365

0.375

0.390

0.375

0.0150

0.0160

0.0140

0.0180

0.0190

0.0180

16.06

17.28

16.1

2.03

2.32

2.05

0.3500

0.3500

0.3500

1.520

1.650

1.520

0.0170

0.0180

0.0170

0.0190

0.0190

0.0190

5.53

5.50

5.50

8.20

8.560

8.200

8

8.25

8

0.036

0.037

0.035

303.00

303.40

299.00

0.0110

0.0110

0.0110

PREFERRED

30.5

30.5

29.95

525

526

525

112.5

112

112

108.8

110

108.8

8.1

8.5

8.19

1.03

1.02

1.01

108.3

108.5

108.3

76.25

76.3

75.9

79

79.1

79

1051

1055

1050

WARRANTS & BONDS

0.305

0.28

0.260

EXCHANGE TRADED FUNDS

95.6

95.6

95

2.96

68.7

70.00

84.30

2.00

59.50

2.00

16

24

16.00

2.66

830.00

70.35

1.5

22.8

80.90

139.00

303

43.8

116.9

1365.00

124.50

Close Change Volume

Net Foreign(Peso)

Trade/Buying

2.95 -0.34

69.3 0.87

71.80 2.57

84.00 -0.36

2.10 5.00

59.50 0.00

1.98 -1.00

15.92 -0.50

24.45 1.88

15.00 -6.25

2.84 6.77

830.00 0.00

73.75 4.83

1.51 0.67

22.5 -1.32

78.85 -2.53

139.50 0.36

306 0.99

43.55 -0.57

118

0.94

1370.00 0.37

126.00 1.20

109,000

73,240

4,088,500

1,636,120

459,000

18,730

1,000

28,300

63,300

600

11,000

30

4,174,780

20,000

18,300

107,320

30

2,970

214,200.00

296,620

5

4,550

79,650.00

35.45

5.2

0.98

1.33

12

2.91

14.5

22.9

0.9

22.5

6.59

10.80

5.48

10.04

15

60

21.20

0.0120

15.00

167.50

8.71

3.05

15.1

2.25

23.75

12.760

14.2

251.80

14.70

4.54

14.10

4.76

5.78

5.67

4.5

58.05

238

1.8

0.120

1.80

1.58

119.50

2.05

0.6

1.40

1.29

-7.14

-2.97

0.00

4.35

0.34

0.00

1.78

0.00

-0.66

1.54

-1.82

1.11

0.90

3.31

1.69

-0.47

9.09

0.00

1.03

0.00

-1.61

0.53

1.81

1.28

4.59

3.65

0.64

0.14

0.67

0.57

0.21

3.21

-1.05

4.65

-3.25

4.39

-0.55

0.84

-3.74

5.33

2.14

2.50

0.00

-0.71

3,517,700

7,600

53,000

452,000

9,400

5,000

3,200

99,700

63,000

56,200

2,831,100

3,785,700

4,148,400

149,100

5,629,300

519,500

8,500

6,400,000

2,000

822,170

764,800

117,000

2,694,000

19,000

3,570,000

119,400

3,168,400

113,390

700

5,590,000

1,177,200

417,000

804,600

570,500

2,000

447,250

18,300

30,000

1,010,000

174,000

5,325,000

3,491,430

3,863,000

930,000

10,000

47,181,305.00

52.35

25.50

1.68

1.22

1.26

525

8.86

57.35

4.40

0.196

745

6.20

38.60

4.31

0.62

0.620

3.5

4.23

5.16

3.1

0.0420

1.400

0.450

2.49

0.265

710.00

1.23

1.06

98.95

0.1590

1.65

0.39

-0.59

1.67

-1.56

2.94

0.11

1.50

0.00

0.51

0.88

-2.21

-1.03

0.70

3.33

3.33

10.06

-0.24

-0.77

-4.62

-10.64

-0.71

12.50

-1.97

-1.85

4.41

0.00

6.00

-44.41

0.63

1,024,290.00

3,788,200

556,000

27,000

164,000

171,780

2,863,700

2,938,880

45,000

10,000

79,110

254,800

1,460,500

1,154,000

21,000

204,000

11,036,000

6,163,000

23,100

2,000

17,900,000

78,000

180,000

4,000

120,000

263,180

492,000

1,000

893,980

20,000

-26,604,587.00

-37,062,975.00

7.190

13.40

1.08

17

1.480

0.195

26.10

4.92

5.6

1.38

0.51

0.920

1.36

1.35

1.41

3.36

0.0790

0.3900

0.4600

3.40

19.92

1.56

14.68

0.61

3.58

0.920

5.250

4.35

-1.47

0.00

-3.85

1.37

3.17

1.56

0.61

-0.88

0.73

0.00

0.00

0.74

-2.17

1.44

2.44

0.00

2.63

0.00

2.72

-0.30

0.00

2.37

1.67

4.68

-2.13

-0.76

217,300

24,100

1,000,000

45,200

6,000

200,000

2,382,900

3,745,000

162,200

11,442,000

5,000

969,000

1,632,000

20,605,000

1,065,000

38,641,000

420,000

10,000

10,000

66,000

7,194,100

174,000

65,331,400

1,803,000

38,000

283,000

12,587,500

79,142,081.50

44,519,125.50

-403,120.00

1,145,625.00

51,659,803.50

-20.00

3,670,034.50

-2,038,090.00

17,183,665.00

572,089.00

-3,000.00

-2,245,440.00

-1,006,205.00

6,729,466.00

-18,350,758.00

3,290,320.00

1,021,250.00

23,807,044.00

18,037,155.50

-15,000.00

15,827,526.00

1,500,732.00

-5,497,596.00

-26,831,930.00

683,168.00

743,508.00

-12,732,550.00

-2,035,500.00

-5,054,230.00

926,730.00

-5,503,605.00

-2,769,304.00

2,215,160.00

22,570,317.00

108,560.00

-2,900,450.00

17,866,504.00

47,159,660.50

-17,895,655.00

-1,561,160.00

-3,007,505.00

-419,130.00

-1,229,600.00

-1,133,650.00

-72,000.00

61,239,930.00

-494,460.00

-477,462.50

446,120.00

5,660.00

-10,794,995.00

-407,470.00

-655,400.00

-5,429,290.00

-1,353,000.00

4,024,560.00

948,370.00

10,442,440.00

-42,115,898.00

-49,963,378.00

-17,580,521.00

1.9

1.60

29.8 -5.40

1.01 0.00

0.650 1.56

11

0.00

8.75 0.00

0.1430 0.00

3.32 -1.78

51.5 1.48

2.25 2.27

5.04 -0.40

1115 -3.04

1670 3.09

8.35 3.09

1.24 0.00

98.95 -0.05

0.390 -1.27

5.50 22.22

12

0.00

0.013 0.00

0.0430 4.88

1.9900 0.00

6.33 -0.16

1.97 -0.51

3.47 3.89

2

0.00

15.84 -1.00

5.86 -2.33

2.16 -0.92

8.94 1.94

2710.00 0.74

0.295 0.00

39.00 0.78

58.00 0.00

0.66 0.00

2.09 0.00

10.16 -0.39

1.210 13.08

13,000

52,800

23,000

47,000

2,500

1,734,600

27,780,000

16,000

57,050

30,000

107,500

250

118,935

4,807,600

113,000

1,495,670

110,000

1,000

24,600

6,200,000

6,800,000

16,000

8,300

12,000

1,115,000

4,000

25,700

2,600

50,000

337,500

259,900

1,000,000

112,714,855

378,260

2,823,000

8,000

4,995,500

4,000

0.0031

1.80

15.14

0.255

7.9

8

0.62

0.83

5.39

0.420

0.380

0.380

0.0140

0.0180

16.98

2.22

0.3500

1.590

0.0170

0.0190

5.50

8.33

8

0.036

303.20

0.0110

0.00

2.27

3.56

2.00

17.91

21.21

3.33

0.00

3.65

3.70

4.11

1.33

-6.67

0.00

5.73

9.36

0.00

4.61

0.00

0.00

-0.54

1.59

0.00

0.00

0.07

0.00

11,000,000

124,000

2,729,700

280,000

46,500

25,400

789,000

125,000

51,100

2,990,000

20,490,000

12,300,000

526,000,000

29,000,000

4,264,200

1,990,000

20,000

6,007,000

45,700,000

29,900,000

3,100

928,200

272,700

9,800,000

64,910

100,000

30

525

112

109

8.3

1.01

108.3

76.2

79.1

1055

-1.64

0.00

-0.44

0.18

2.47

-1.94

0.00

-0.07

0.13

0.38

85,600

6,040

2,760

8,000

410,300

3,570,000

12,270

976,720

33,780

615

-1,697,385.00

0.280 -8.20

260,000

-5,500.00

95.5

30,770

-0.10

-5,198,839.00

721,899.00

5,050.00

89,692,150.00

-51,515,659.00

-1,159,290.00

1,229,580.00

64,870,850.00

-5,204,341.50

571,690.00

-8,280,712.00

-7,354,350.00

-41,500.00

-41,000.00

2,426,366.00

-4,488,370.00

-3,779,616.00

275,172.00

-39,600.00

2,952,784.00

-885,820.00

-53,620,744.00

-52,550.00

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Federal Reserve Routing NumbersДокумент19 страницFederal Reserve Routing NumbersLor-ron Wade100% (3)

- 8 Top Questions You Should Prepare For Bank InterviewsДокумент10 страниц8 Top Questions You Should Prepare For Bank InterviewsAbdulgafoor NellogiОценок пока нет

- Application For Leave To Apply For Judicial Review - Rev.1Документ7 страницApplication For Leave To Apply For Judicial Review - Rev.1David HundeyinОценок пока нет

- Banking Out Lets - Branch Details04032020Документ840 страницBanking Out Lets - Branch Details04032020GVPT ECEОценок пока нет

- Mba II 2021-22 Project TitleДокумент5 страницMba II 2021-22 Project TitlePankaj VishwakarmaОценок пока нет

- The Standard - Business Daily Stocks Review (June 4, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 2, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 5, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 8, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 3, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 26, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Документ1 страницаManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 7, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 7, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 25, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 22, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 20, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 18, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 11, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 13, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 6, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Документ1 страницаManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 4, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 28, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 5, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 22, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 17, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Документ1 страницаManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 30, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 29, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Weekly Stocks Review (April 19, 2015)Документ1 страницаThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 23, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 16, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (April 24, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayОценок пока нет

- FiidebtДокумент8 страницFiidebtRashi SrivastavaОценок пока нет

- 4 July 22 IOCL VascoДокумент33 страницы4 July 22 IOCL VascoSuraj ZineОценок пока нет

- BloombergBrief HF Newsletter 201458Документ12 страницBloombergBrief HF Newsletter 201458Himanshu GoyalОценок пока нет

- IPO ScheduleДокумент3 страницыIPO Scheduleashish.in.iitr6614Оценок пока нет

- Catalogo de Productos de Politicas Dev Prov 06.08.20Документ109 страницCatalogo de Productos de Politicas Dev Prov 06.08.20Juliamm MartОценок пока нет

- Political Contributions DinkelackerДокумент5 страницPolitical Contributions DinkelackerFriends of Juvenile JusticeОценок пока нет

- Kotak Nifty ETF PDFДокумент4 страницыKotak Nifty ETF PDFkayОценок пока нет

- AZN Bonds and Risk Hellenic Republic 2042Документ52 страницыAZN Bonds and Risk Hellenic Republic 2042zghdОценок пока нет

- 1 Address of BranchesДокумент2 страницы1 Address of BranchesPritam SaikiaОценок пока нет

- Chairpersons: Karam Chand ThaparДокумент3 страницыChairpersons: Karam Chand ThaparRachit KushwahaОценок пока нет

- Gapki Conference 2014 - List of ParticipantДокумент36 страницGapki Conference 2014 - List of ParticipantadiОценок пока нет

- List Exchange CryptoДокумент18 страницList Exchange CryptoduylongpisОценок пока нет

- Punjab National Bank - WikipediaДокумент11 страницPunjab National Bank - WikipediaJayaОценок пока нет

- S.No Student'S Name A/C Holder Name A/C Number Ifsc Code Bank Name RemittanceДокумент8 страницS.No Student'S Name A/C Holder Name A/C Number Ifsc Code Bank Name Remittancejyoti kumariОценок пока нет

- Listafintech 5484664Документ11 страницListafintech 5484664Bruno DanzerОценок пока нет

- Banking Seminar Report Sem 1Документ6 страницBanking Seminar Report Sem 1Farukh ShaikhОценок пока нет

- Detailed StatementДокумент18 страницDetailed Statementwolf8585.inОценок пока нет

- May 22Документ2 страницыMay 22digiloansОценок пока нет

- Adhaar Aadhaar Adhar Aadhar Update Centre CenterДокумент2 страницыAdhaar Aadhaar Adhar Aadhar Update Centre CenterMatt RileyОценок пока нет

- History of Banking in IndiaДокумент5 страницHistory of Banking in IndiamylahОценок пока нет

- Banking 18-4-2022Документ17 страницBanking 18-4-2022KAMLESH DEWANGANОценок пока нет

- Banklist UKДокумент5 страницBanklist UKPV BhaskarОценок пока нет

- Correspondent Bank Charges For International Transfers Fixed ChargesДокумент5 страницCorrespondent Bank Charges For International Transfers Fixed ChargesManikandanОценок пока нет

- Challenges Faced by Banking Sector in UAEДокумент12 страницChallenges Faced by Banking Sector in UAESyed Ahsan Ali ShahОценок пока нет

- Bank Questions and SolutionДокумент4 страницыBank Questions and SolutionMehedi Hasan50% (6)