Академический Документы

Профессиональный Документы

Культура Документы

Memorandum Mann Vs Showalter, CMMSS'R MN MNG'T & Budget

Загружено:

eric_roperИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Memorandum Mann Vs Showalter, CMMSS'R MN MNG'T & Budget

Загружено:

eric_roperАвторское право:

Доступные форматы

Memorandum Mann vs Showalter, Cmmss'r mn mng't & Budget

1/10/14 10:34 AM

State of Minnesota Supreme Court MEMORANDUM IN SUPPORT OF Doug Mann, Linda Mann, David Tilsen PETITION FOR WRIT OF PROHIBITION Petitioners, vs. Supreme Court Case Number:

Jim Showalter, Commissioner of Minnesota Management and Budget Respondent MEMORANDUM IN SUPPORT OF THE PETITION ISSUES

1. Respondent is poised to unlawfully use public funds 2. Petitioner has standing to sue Respondent 3. Petitioner has no other adequate legal remedy. RESPONDENT IS POISED TO UNLAWFULLY USE PUBLIC FUNDS

City of Minneapolis sales tax revenues are to be dedicated to the repayment of state appropriation bonds sold and issued to pay for the construction of a new Vikings Stadium in Minneapolis, as described in point 6 of the petition. This cannot be done. Article X, section 1 of the Minnesota Constitution states: "The power of taxation shall never be surrendered, suspended or contracted away. . ." . . .Under Section 1, Article 9 of the Minnesota Constitution, "a tax cannot be imposed exclusively on any subdivision of the State, to pay an indebtedness or claim which is not peculiarly the debt of such subdivision of the State, or to raise money for any purpose not peculiarly for the benefit of such subdivision." Sanborn v. Rice Cnty. Comm'rs, 9 Minn. 273, 278 (1864). An arrangement whereby the City of Minneapolis would impose a suite of local sales taxes to pay an indebtedness incurred by the State was evidently designed to circumvent a provision of the Minneapolis home rule charter that requires a referendum to incur debt in an amount exceeding $15,000,000 to pay for a stadium.

Page 1 of 4

Memorandum Mann vs Showalter, Cmmss'r mn mng't & Budget

1/10/14 10:34 AM

Minneapolis City Charter, chapter 9 states in pertinent part: Where, with respect to any and all types and forms of obligation or indebtedness authorized by this Charter and by the laws of Minnesota, the aggregate amount of any such obligations or indebtedness to be issued or incurred for any improvement, including but not limited to acquisition, development, construction or betterment, of any public building, stadium, or other capital improvement project, shall in all phases from inception to completion exceed Fifteen Million Dollars ($15,000,000), the Board of Estimate and Taxation shall not issue or sell any bonds or other obligations nor incur any indebtedness for such purpose without the approval of a majority of the electors voting on the question of issuing such obligations or incurring such indebtedness at a general or special election

The Appropriation bonds to be sold and issued to pay for construction of the Vikings Stadium are not valid without the contribution of the City of Minneapolis to the payment of debt service. The Legislature authorized the sale and issue of bonds in an amount up to $498,000,000. The City of Minneapolis is required to pay debt service on its share of a principal amount of $150,000,000 plus interest and the state's liability is limited to payment of debt service on appropriation bonds up to an amount of $348,000,000 plus interest. Without the City's contribution, there is no provision in the 2012 Stadium Act to pay in full the principal and interest on the appropriation bonds. PETITIONER HAS STANDING TO SUE RESPONDENT Petitioners have standing to seek a writ of prohibition because, as a residents of the City of Minneapolis, Minnesota, they have an interest restraining a public ofcial from unlawful use of public funds raised by the imposition of local sales taxes by the City of Minneapolis. The standing of a taxpayer to seek an extraordinary writ to restrain public ofcials from unlawful use of public funds is recognized by the Minnesota Courts and addressed in the following four paragraphs from OLSON v. STATE, No.A06-2324., December 18, 2007 - MN Court of Appeals:! [W]hile the activities of governmental agencies engaged in public service ought not to be hindered merely because a citizen does not agree with the policy or discretion of those charged with the responsibility of executing the law, the right of a taxpayer to maintain an action in the courts to restrain the unlawful use of public funds cannot be denied.! In contrast with standing rules in federal courts, it is generally recognized that a Minnesota taxpayer has a broader basis for standing than a litigant in federal court. Id. at 570.

Page 2 of 4

Memorandum Mann vs Showalter, Cmmss'r mn mng't & Budget

1/10/14 10:34 AM

As early as 1888, the Minnesota Supreme Court held that taxpayers may bring an action to compel county ofcers to perform their public duties. State ex rel. Currie v. Weld, 39 Minn. 426, 428, 40 N.W. 561, 562 (1888). In 1928, the Minnesota Supreme Court stated, it is well settled that a taxpayer may, when the situation warrants, maintain an action to restrain unlawful disbursements of public moneys. Oehler v. City of St. Paul, 174 Minn. 410, 417-18, 219 N.W. 760, 763 (1928). The supreme court has also more recently reafrmed the requirement that the party seeking to challenge legislative action on the basis of his status as a taxpayer must have more than just a disagreement with a discretionary decision. See In re Sandy Pappas Senate Comm., 488 N.W.2d 795, 798 (Minn.1992) (nding that a citizen did not have standing solely as a taxpayer to le a claim seeking judicial review of an election board's disposition of a campaign violation). In Rukavina, we acknowledged that taxpayer status alone does not confer standing. 684 N.W.2d at 531. Simple disagreement with policy or the exercise of discretion by those responsible for executing the law does not supply the unlawful disbursements or illegal action of public funds required for standing to support a taxpayer challenge. Id. When the taxpayer's individual challenges to the state action are based primarily on appellants' disagreement with policy or the exercise of discretion by those responsible for executing the law, they are insufcient to confer standing. Id. PETITIONER HAS NO OTHER ADEQUATE LEGAL REMEDY The 2012 Stadium Act, Article 2 section 1, subd. 10 c. states: "The Minnesota Supreme Court shall have original jurisdiction to determine the validation of appropriation bonds and all matters connected therewith." The commissioner of Minnesota Minnesota is authorized by the 2012 Stadium Act to determine that he has authority to issue appropriation bonds without a validation hearing before the Supreme Court, and has chosen to proceed with the sale and issue of appropriation bonds without a validation hearing. The authority conferred on the commissioner by the Legislature to determine the legality of the bond sales without a validation hearing before the Supreme Court is an attempt to vest judicial powers in the commissioner in violation of Article 3 of the Minnesota constitution. The interpretation of law

Page 3 of 4

Memorandum Mann vs Showalter, Cmmss'r mn mng't & Budget

1/10/14 10:34 AM

is a function properly invested in judicial branch of government. Minnesota Constitution ARTICLE III DISTRIBUTION OF THE POWERS OF GOVERNMENT Section 1. Division of powers. The powers of government shall be divided into three distinct departments: legislative, executive and judicial. No person or persons belonging to or constituting one of these departments shall exercise any of the powers properly belonging to either of the others except in the instances expressly provided in this constitution. CONCLUSION For the forgoing reasons, Petitioners request that the petition for a writ of prohibition be, in all respects, granted.

Dated: 10 January 2014

___________________________ Doug Mann Petitioner, pro se 3706 Logan Avenue N. Minneapolis, MN 55412 Phone: (612) 824-8800 _____________________________ Linda Mann Petitioner, pro se 1821 First Avenue South, #303 Minneapolis, MN 55403 Phone: (612) 871-4102 ______________________________ David M. Tilsen Petitioner, pro se 3220 10th Ave S. Minneapolis, MN 55407 Phone: (612) 823-8169

Page 4 of 4

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Via Electronic Filing: Crown Hydro, LLC, Docket No. P-11175-025Документ7 страницVia Electronic Filing: Crown Hydro, LLC, Docket No. P-11175-025eric_roperОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Lime Signed Bike Share ContractДокумент12 страницLime Signed Bike Share Contracteric_roperОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Felton Review / EMERGE ResponseДокумент37 страницFelton Review / EMERGE Responseeric_roperОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Towerside MCES Presentation Letter 2018.11.12Документ2 страницыTowerside MCES Presentation Letter 2018.11.12eric_roperОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Republic Services FlyerДокумент2 страницыRepublic Services Flyereric_roperОценок пока нет

- American Dream Bond Doc - FinancingДокумент7 страницAmerican Dream Bond Doc - Financingeric_roperОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Permit Fee ReportДокумент32 страницыPermit Fee Reporteric_roper100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Emerge vs. MN DEED ComplaintДокумент27 страницEmerge vs. MN DEED ComplaintFluenceMediaОценок пока нет

- DMTMO Audit ReportДокумент10 страницDMTMO Audit Reporteric_roperОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- West Broadway Study AreaДокумент1 страницаWest Broadway Study Areaeric_roperОценок пока нет

- Lakes and Parks Alliance of Minneapolis V The Metropolitan Council, Order For Summary JudgmentДокумент17 страницLakes and Parks Alliance of Minneapolis V The Metropolitan Council, Order For Summary Judgmentdylanthmsyahoo.comОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Funding Sources UsesДокумент2 страницыFunding Sources Useseric_roperОценок пока нет

- Minnesota Chamber Sick Time LawsuitДокумент37 страницMinnesota Chamber Sick Time Lawsuiteric_roperОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- MLS Stadium Working GroupДокумент2 страницыMLS Stadium Working Grouperic_roperОценок пока нет

- StreetcarsДокумент27 страницStreetcarseric_roperОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Public Opinion Re Authority To Rename Lake CalhounДокумент3 страницыPublic Opinion Re Authority To Rename Lake Calhouneric_roperОценок пока нет

- Parking + Zoning MapДокумент1 страницаParking + Zoning Maperic_roperОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Stadiums and ExemptionsДокумент1 страницаStadiums and Exemptionseric_roperОценок пока нет

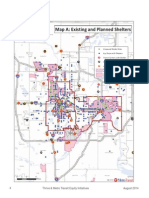

- Shelters ProposedДокумент1 страницаShelters Proposederic_roperОценок пока нет

- Johnson Stadium ResolutionДокумент2 страницыJohnson Stadium Resolutioneric_roperОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Tunheim OrderДокумент46 страницTunheim Ordereric_roperОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Good Cause Denial FAQ - Revised 11-3-2014Документ2 страницыGood Cause Denial FAQ - Revised 11-3-2014eric_roperОценок пока нет

- 2015 02 20 Legislative Consult Letter Daudt GMD PDFДокумент1 страница2015 02 20 Legislative Consult Letter Daudt GMD PDFRachel E. Stassen-BergerОценок пока нет

- Pedestrian Priorities MapДокумент1 страницаPedestrian Priorities Maperic_roperОценок пока нет

- Revised Term Sheet For Block 1 Development RightsДокумент4 страницыRevised Term Sheet For Block 1 Development RightsSarah McKenzieОценок пока нет

- Towing Bid 2014Документ33 страницыTowing Bid 2014eric_roperОценок пока нет

- North Minneapolis Greenway ConceptДокумент1 страницаNorth Minneapolis Greenway Concepteric_roperОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Proposed Shelter LocationsДокумент1 страницаProposed Shelter Locationseric_roperОценок пока нет

- TreehouseДокумент2 страницыTreehouseeric_roperОценок пока нет

- OP7924 Tow BidДокумент30 страницOP7924 Tow Bideric_roperОценок пока нет

- Annulment BlankДокумент2 страницыAnnulment BlankFox Briones AlfonsoОценок пока нет

- Canon 3 - Gallano v. KitoДокумент2 страницыCanon 3 - Gallano v. KitoMonique Allen LoriaОценок пока нет

- United States v. Rivera, 10th Cir. (2015)Документ6 страницUnited States v. Rivera, 10th Cir. (2015)Scribd Government DocsОценок пока нет

- Lorenzo vs. PosadasДокумент16 страницLorenzo vs. PosadasKeith BalbinОценок пока нет

- Malcaba v. ProHealth Pharma Philippines, IncДокумент2 страницыMalcaba v. ProHealth Pharma Philippines, IncCyrus AvelinoОценок пока нет

- Kanye West v. Lloyd's of LondonДокумент15 страницKanye West v. Lloyd's of LondonPitchfork News100% (1)

- P) Benguet Exploration vs. DENR, Feb. 28, 1977Документ4 страницыP) Benguet Exploration vs. DENR, Feb. 28, 1977jusang16Оценок пока нет

- Compromise Agreement: WHEREAS, The FIRST PARTIES and The SECOND PARTY Are The Plaintiffs andДокумент4 страницыCompromise Agreement: WHEREAS, The FIRST PARTIES and The SECOND PARTY Are The Plaintiffs andLacab Shierly100% (1)

- The Province of North CotabatoДокумент13 страницThe Province of North CotabatoAlyssa Marie CagueteОценок пока нет

- Carpio Morales V Ca GR NO. 217126-27 November 10, 2015Документ6 страницCarpio Morales V Ca GR NO. 217126-27 November 10, 2015Phi SalvadorОценок пока нет

- Araneta, Zaragoza, Araneta & Bautista For Petitioners. Benito Soliven For RespondentsДокумент4 страницыAraneta, Zaragoza, Araneta & Bautista For Petitioners. Benito Soliven For RespondentsRonnel FilioОценок пока нет

- Estipona v. LobrigoДокумент2 страницыEstipona v. LobrigoDGDelfin100% (1)

- Republic vs. Dimarucot FactsДокумент2 страницыRepublic vs. Dimarucot FactsMish FerrerОценок пока нет

- B Trevor D'Lima & 2 Ors. Vs M S. Fortune Infrastructure & 4 .Документ6 страницB Trevor D'Lima & 2 Ors. Vs M S. Fortune Infrastructure & 4 .siddharthОценок пока нет

- Fontanilla Vs MaliamanДокумент1 страницаFontanilla Vs MaliamanMingОценок пока нет

- Case Digest: Bonifacio Et Al., Vs RTC Makati and Jessie John Gimenez GR No 184800Документ2 страницыCase Digest: Bonifacio Et Al., Vs RTC Makati and Jessie John Gimenez GR No 184800Wresen AnnОценок пока нет

- Kingfisher Airlines and Deccan AviationДокумент9 страницKingfisher Airlines and Deccan AviationPunit KariaОценок пока нет

- Abercrombie and Fitch V Hunting WorldДокумент2 страницыAbercrombie and Fitch V Hunting WorldGenevieve Kristine ManalacОценок пока нет

- PFR Art 40 - 86Документ99 страницPFR Art 40 - 86troy roqueОценок пока нет

- A. Administrative Sanctions: Section 54, SRCДокумент6 страницA. Administrative Sanctions: Section 54, SRCDoneli PuruggananОценок пока нет

- People of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Документ3 страницыPeople of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Lexa L. DotyalОценок пока нет

- SEM APME 2024 - Institutional Waiver 2Документ4 страницыSEM APME 2024 - Institutional Waiver 2Rishab DОценок пока нет

- (25225) - F01 - Exclusive Seller Listing Agreement (2012)Документ7 страниц(25225) - F01 - Exclusive Seller Listing Agreement (2012)Angel KnightОценок пока нет

- SpMats ManualДокумент112 страницSpMats ManualjulesjusayanОценок пока нет

- Dunn V PalermoДокумент7 страницDunn V Palermocmv mendozaОценок пока нет

- Mock Aqe 1Документ17 страницMock Aqe 1Albert Ocno Almine100% (4)

- ARO Confidentiality and Arbitration Talk 050504Документ26 страницARO Confidentiality and Arbitration Talk 050504Ko Ka KunОценок пока нет

- Bankr. L. Rep. P 74,064 in Re Andrew J. Lane, Debtor. Peter H. McCallion v. Andrew J. Lane, 937 F.2d 694, 1st Cir. (1991)Документ9 страницBankr. L. Rep. P 74,064 in Re Andrew J. Lane, Debtor. Peter H. McCallion v. Andrew J. Lane, 937 F.2d 694, 1st Cir. (1991)Scribd Government DocsОценок пока нет

- Samaniego Vs VillajinДокумент7 страницSamaniego Vs VillajinSittenor AbdulОценок пока нет

- Metropolitan Property and Liability Insurance Co. v. Bonnie McCosker Kirkwood, 729 F.2d 61, 1st Cir. (1984)Документ5 страницMetropolitan Property and Liability Insurance Co. v. Bonnie McCosker Kirkwood, 729 F.2d 61, 1st Cir. (1984)Scribd Government DocsОценок пока нет

- The Courage to Be Free: Florida's Blueprint for America's RevivalОт EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalОценок пока нет

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesОт EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesОценок пока нет

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonОт EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonРейтинг: 4.5 из 5 звезд4.5/5 (21)

- Modern Warriors: Real Stories from Real HeroesОт EverandModern Warriors: Real Stories from Real HeroesРейтинг: 3.5 из 5 звезд3.5/5 (3)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpОт EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpРейтинг: 4.5 из 5 звезд4.5/5 (11)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteОт EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteРейтинг: 4.5 из 5 звезд4.5/5 (16)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldОт EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldРейтинг: 3.5 из 5 звезд3.5/5 (9)