Академический Документы

Профессиональный Документы

Культура Документы

Markets and Price Laws

Загружено:

nirav87404Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Markets and Price Laws

Загружено:

nirav87404Авторское право:

Доступные форматы

Rules and Facts about PRICE and MARKETS

From Benoit Mandelbrot Markets are Risky Extreme price swings are the norm in financial markets. Price movements do not follow the well-mannered bell curve assumed in modern finance they follow more violent curve that makes and investor!s ride much bumpier. "rouble runs in streaks Market turbulence tends to cluster. Markets have a personality Prices are not driven solely by real world events# news and people. $hen investors# speculators# industrialists# and bankers come together in a real marketplace# a special# new kind of dynamic emerges greater than# and different from# the sum of the parts. %undamental process by which prices react to news does not change. Mandelbrot analysis of cotton price over the past century shows the same broad pattern of price variability at the turn of last century when prices were unregulated# as there was in the &'()!s when prices were regulated as part of the *ew +eal. Markets mislead Patterns are the fool!s gold of financial markets. "he power of chance suffices to create spurious patterns and pseudo-cycles that# for the entire world# appear predictable and bankable. ,ut a financial market is especially prone to such statistical mirages. ,ubbles and crashes are inherent to markets. "hey are the inevitable conse-uence of the human need to find patterns in the pattern less. "he si.e of price changes clearly clusters together. ,ig changes often come together in rapid succession# and then come long stretches of minor price changes. /"rouble runs in streaks0 Price levels1changes exhibit some kind of irregularity regularly. "he charts sometimes rise or fall in long waves# or with small waves superimposed on bigger waves. ,ut none of this phenomenon clusters of volatility# or irregular trends resembles any of the cycles# waves# or other patterns that characteri.e those aspects of nature controlled through well-established science. "here are no familiar sine or cosine waves# with regular periods. "hese peculiar patterns cannot be predicted and so humans who bet on them often lose. 2et there clearly is a system to them. 3t is as if the charts have a memory of past. 3f the price changes start to cluster# or the prices themselves start to rise# they have a slight tendency to keep doing so for a while and then# without warning# the stop. "hey may even flip to opposite trend. Market Timing Matters Greatl ! "ig Gains and #osses Concentrate into Small Packages o$ Time 4oncentration is common across fields. 5ook at a map of gold deposits around the world6 you see clusters of gold mines in 7outh 8frica and 9imbabwe# in the far reaches of 7iberia and elsewhere. "his is not total chance millennia of real tectonic forces gradually worked it that way. :nderstanding concentration is crucial to many businesses# especially insurance. 8 recent study of "exas# 5ouisiana# and Mississippi found '); of the claims came from <ust =; of the insured land area.

3n a financial market# volatility is concentrated# too. "he data demonstrates this. %rom &'>? to @))(# the dollar traced a long# bumpy descent against AP2. ,ut nearly half of that decline occurred in <ust &) out of B?'= trading days. Put another way# B?; of the damage to dollar investors happened on ).@&; of the days. 7imilar statistic applies in other markets. 3n the &'>)s# fully B); of the positive returns from 7CP =)) index came during &) days about ).=; of the time. 7ame can be applied to how most famous investors made big moneyD.their earnings were concentrated on big betsEE Forecasting Prices Ma be Perilous% but one can estimate t&e odds o$ $uture 'olatilit Markets are turbulent# deceptive# and prone to bubbles# infested by false trends. 3t may well be that you cannot forecast prices. ,ut evaluating risk or profiting from it is another matter entirely. Markets can exhibit dependence without correlation. "he key to this paradox lies in the distinction between the si.e and the direction of price changes. 7uppose that the direction is uncorrelated with the past6 The fact that prices fell yesterday does not make them more likely to fall today. It remains possible for the absolute changes to be dependent. A 10% fall yesterday may ell increase the odds of another 10% mo!e today " but pro!ide no ad!ance ay of telling hether it ill be up or do n. If so# correlation !anishes# in spite of the strong dependence. $arge price changes tend to be follo ed by more large changes# positi!e or negati!e. %mall changes tend to be follo ed by more small changes. &olatility clusters. In Financial Markets% t&e Idea o$ (alue &as #imited (alue Falue is a single number that is a rational# solvable function of information. Given a certain set of information about an asset a stock# a bond# or a commodity everybody if e-ually well-placed to act will deduce it has a certain value# they will hang the same price tag on it. Prices can fluctuate around that value and it can be hard to calculate. ,ut value# there is. 3t is a mean# an average# something certain in a chaos of conflicting information. People like comfort of such thinking . There is something in the human condition that abhors uncertainty# une!enness and unpredictability. 'eople like an a!erage to hold onto# a target to aim at " e!en if it is a mo!ing target. The prime mo!er in financial markets is not !alue or price# but price differences( not a!eraging# but arbitraging. 'eople arbitrage bet een places and time. Full understanding of multifractal markets begins ith the reali)ation that mean is not golden.

Вам также может понравиться

- Chapter 13. Pricing PracticesДокумент16 страницChapter 13. Pricing PracticesiChiUpОценок пока нет

- Technical Analysis of The Financial Markets - A Comprehensive Guide To Trading Methods and Applications by John J. Murphy (1999)Документ582 страницыTechnical Analysis of The Financial Markets - A Comprehensive Guide To Trading Methods and Applications by John J. Murphy (1999)gss34gs432gw2agОценок пока нет

- Background of The StudyДокумент78 страницBackground of The Studyalkanm750Оценок пока нет

- Stock Trading: Dos And Don’ts To Make Stock Trading Profitable Even In Economic UncertaintiesОт EverandStock Trading: Dos And Don’ts To Make Stock Trading Profitable Even In Economic UncertaintiesРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Develop Your Fundamental Trading SkillДокумент13 страницDevelop Your Fundamental Trading SkillBigFatPillar100% (1)

- World Financial Infrastructure and MoneyДокумент129 страницWorld Financial Infrastructure and MoneyAhmad Fauzi MehatОценок пока нет

- Normal in Vol TimeДокумент6 страницNormal in Vol TimeIgorОценок пока нет

- The Dark Side of DeficitsДокумент10 страницThe Dark Side of Deficitsrichardck50Оценок пока нет

- Manias, Panics and Crashes SynopsisДокумент2 страницыManias, Panics and Crashes SynopsisvideodekhaОценок пока нет

- Why The Excess VolatilityДокумент4 страницыWhy The Excess VolatilitysandeepvempatiОценок пока нет

- (2002 03 20) Is Velocity Like MagicДокумент5 страниц(2002 03 20) Is Velocity Like MagicacedillohОценок пока нет

- Star Weekend Magazine1Документ3 страницыStar Weekend Magazine1himu6749721Оценок пока нет

- Resumen NoiseДокумент5 страницResumen Noisejuanf9104Оценок пока нет

- The Mathematical Equation That Caused The Banks To Crash - Science - The ObserverДокумент4 страницыThe Mathematical Equation That Caused The Banks To Crash - Science - The ObserverlenovojiОценок пока нет

- Bond Spreads - Leading Indicator For CurrenciesДокумент6 страницBond Spreads - Leading Indicator For CurrenciesanandОценок пока нет

- What REALLY Controls The MetalsДокумент4 страницыWhat REALLY Controls The MetalsakathrechaОценок пока нет

- Foundation Principles in Understanding The MarketДокумент3 страницыFoundation Principles in Understanding The Markettano caridiОценок пока нет

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Документ41 страницаAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Liquidity Pref TheoryДокумент2 страницыLiquidity Pref Theoryrohan_jangid8Оценок пока нет

- Ticker Interview With W. D. GannДокумент7 страницTicker Interview With W. D. GannsfhelioОценок пока нет

- Summary of Anna Coulling's A Complete Guide To Volume Price AnalysisОт EverandSummary of Anna Coulling's A Complete Guide To Volume Price AnalysisРейтинг: 5 из 5 звезд5/5 (1)

- Volatility VolatilityДокумент12 страницVolatility Volatilitywegerg123343Оценок пока нет

- Understanding The Inverse Yield CurveДокумент8 страницUnderstanding The Inverse Yield CurveSiyang QuОценок пока нет

- See Into The Future."Документ67 страницSee Into The Future."MatthewmanojОценок пока нет

- Summary: Contrary Investing for the 90s: Review and Analysis of Brand's BookОт EverandSummary: Contrary Investing for the 90s: Review and Analysis of Brand's BookОценок пока нет

- A New Approach To Measure Financial ContagionДокумент57 страницA New Approach To Measure Financial ContagionAhmedОценок пока нет

- Rabin A Monetary Theory - 271 275Документ5 страницRabin A Monetary Theory - 271 275Anonymous T2LhplUОценок пока нет

- Rhyme and Reason: Dr. G. Terry Madonna and Dr. Michael YounДокумент19 страницRhyme and Reason: Dr. G. Terry Madonna and Dr. Michael Younrichardck61Оценок пока нет

- Princeton Economics Archive Crisis-In-Democracy1987Документ9 страницPrinceton Economics Archive Crisis-In-Democracy1987KrisОценок пока нет

- Market Skill-Builder: Is That All !?Документ21 страницаMarket Skill-Builder: Is That All !?Visu SamyОценок пока нет

- A Scary Story For Emerging MarketsДокумент16 страницA Scary Story For Emerging Marketsrichardck61Оценок пока нет

- Stiglitz The Non-Existent HandДокумент9 страницStiglitz The Non-Existent HandAndreea MitrofanОценок пока нет

- Convexity Maven - A Guide For The PerplexedДокумент11 страницConvexity Maven - A Guide For The Perplexedbuckybad2Оценок пока нет

- The Stock MarketДокумент4 страницыThe Stock MarketBhumika BhardwajОценок пока нет

- Understanding Market CyclesДокумент7 страницUnderstanding Market CyclesAndyОценок пока нет

- Man Versus NatureДокумент2 страницыMan Versus Naturemika2k01Оценок пока нет

- This Is The Exchange Rate That Is Currently Applicable.: This Is An Exchange Rate That Is Currently Quoted and Used For TradingДокумент28 страницThis Is The Exchange Rate That Is Currently Applicable.: This Is An Exchange Rate That Is Currently Quoted and Used For TradingSujit GuptaОценок пока нет

- Déjà Vu All Over Again 03 - 19 - 12.unlockedДокумент11 страницDéjà Vu All Over Again 03 - 19 - 12.unlockeddpbasicОценок пока нет

- Suggested End of Chapter 5 SolutionsДокумент8 страницSuggested End of Chapter 5 SolutionsgoodwynjОценок пока нет

- Understanding Asset Values by Keith SillДокумент11 страницUnderstanding Asset Values by Keith SillVinit DhullaОценок пока нет

- Bursting The Bond BubbleДокумент10 страницBursting The Bond BubbleIbn Faqir Al ComillaОценок пока нет

- What Are Marxist Explanations For The Current Economic Crisis?Документ13 страницWhat Are Marxist Explanations For The Current Economic Crisis?iancusilvanoОценок пока нет

- C S F C: Onsumer Pending and Oreign UrrencyДокумент7 страницC S F C: Onsumer Pending and Oreign UrrencyKushal PandyaОценок пока нет

- The Ef Cient Market Hypothesis and Its Critics: Burton G. MalkielДокумент24 страницыThe Ef Cient Market Hypothesis and Its Critics: Burton G. MalkielNguyen Thi Thu HaОценок пока нет

- Chapter - 1: 1.1 OverviewДокумент33 страницыChapter - 1: 1.1 OverviewAshish KotianОценок пока нет

- Fat Tail Insurance Scenarios - SocGenДокумент7 страницFat Tail Insurance Scenarios - SocGenfcamargoeОценок пока нет

- Exploring The Volatility of Stock Markets: Indian ExperienceДокумент19 страницExploring The Volatility of Stock Markets: Indian ExperienceAnantdeep Singh PuriОценок пока нет

- Mauldin October 20Документ18 страницMauldin October 20richardck61Оценок пока нет

- Random Walk Hypothesis, 1Документ25 страницRandom Walk Hypothesis, 1Jyoti SinghalОценок пока нет

- Olivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)Документ473 страницыOlivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)João Henrique Reis MenegottoОценок пока нет

- Forecasting Security Prices 1925Документ7 страницForecasting Security Prices 1925profkaplanОценок пока нет

- Simple Methods For Detecting Buying and Selling Points in Securities - EnglishДокумент73 страницыSimple Methods For Detecting Buying and Selling Points in Securities - EnglishPhạm Khánh TâmОценок пока нет

- Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderОт EverandFed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro TraderОценок пока нет

- World Bond Market Watch: Fri., Jan. 17, 2014Документ2 страницыWorld Bond Market Watch: Fri., Jan. 17, 2014nirav87404Оценок пока нет

- Scott Ramsey - Hedge Fund Market WizardsДокумент2 страницыScott Ramsey - Hedge Fund Market Wizardsnirav87404Оценок пока нет

- Djind M GMW 1929 2013Документ47 страницDjind M GMW 1929 2013nirav87404Оценок пока нет

- Theorist Oct 2012Документ11 страницTheorist Oct 2012nirav87404Оценок пока нет

- World Metals Market Watch: Fri., Jan. 17, 2014Документ2 страницыWorld Metals Market Watch: Fri., Jan. 17, 2014nirav87404Оценок пока нет

- Hedge Fund Market Wizard NotesДокумент3 страницыHedge Fund Market Wizard Notesnirav87404Оценок пока нет

- Rudyard KiplingДокумент1 страницаRudyard Kiplingm26gil9396Оценок пока нет

- Understanding Is A Poor Substitute For Convexity - Nassim TalebДокумент5 страницUnderstanding Is A Poor Substitute For Convexity - Nassim Talebnirav87404Оценок пока нет

- World Foreign Exchange Watch: Fri., Jan. 17, 2014Документ4 страницыWorld Foreign Exchange Watch: Fri., Jan. 17, 2014nirav87404Оценок пока нет

- World Foreign Exchange Watch: Tue., Jan. 14, 2014Документ4 страницыWorld Foreign Exchange Watch: Tue., Jan. 14, 2014nirav87404Оценок пока нет

- World Metals Market Watch: Tue., Jan. 14, 2014Документ2 страницыWorld Metals Market Watch: Tue., Jan. 14, 2014nirav87404Оценок пока нет

- GMW 1Документ3 страницыGMW 1nirav87404Оценок пока нет

- Stkpgso 01 17 2014Документ4 страницыStkpgso 01 17 2014nirav87404Оценок пока нет

- World Share Market Watch: Tue., Jan. 14, 2014Документ4 страницыWorld Share Market Watch: Tue., Jan. 14, 2014nirav87404Оценок пока нет

- World Share Market Watch: Mon., Jan. 13, 2014Документ4 страницыWorld Share Market Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- World Metals Market Watch: Mon., Jan. 13, 2014Документ2 страницыWorld Metals Market Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- Idea VelocityДокумент2 страницыIdea Velocitynirav87404Оценок пока нет

- World Bond Market Watch: Mon., Jan. 13, 2014Документ2 страницыWorld Bond Market Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- World Energy Market Watch: Mon., Jan. 13, 2014Документ2 страницыWorld Energy Market Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- World Agriculture Market Watch: Mon., Jan. 13, 2014Документ3 страницыWorld Agriculture Market Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- Theorist Oct 2012Документ11 страницTheorist Oct 2012nirav87404Оценок пока нет

- Felix Zulauf: Developing EuphoriaДокумент9 страницFelix Zulauf: Developing EuphoriaFriedrich HayekОценок пока нет

- World Foreign Exchange Watch: Mon., Jan. 13, 2014Документ4 страницыWorld Foreign Exchange Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- World Bond Market Watch: Mon., Jan. 13, 2014Документ2 страницыWorld Bond Market Watch: Mon., Jan. 13, 2014nirav87404Оценок пока нет

- Idea VelocityДокумент2 страницыIdea Velocitynirav87404Оценок пока нет

- Armstrong Economics Manual ModelsДокумент93 страницыArmstrong Economics Manual ModelsLotus NagaОценок пока нет

- Djind M GMW 1929 2013Документ47 страницDjind M GMW 1929 2013nirav87404Оценок пока нет

- World Agriculture Market Watch: Fri., Jan. 10, 2014Документ3 страницыWorld Agriculture Market Watch: Fri., Jan. 10, 2014nirav87404Оценок пока нет

- World Foreign Exchange Watch: Fri., Jan. 10, 2014Документ4 страницыWorld Foreign Exchange Watch: Fri., Jan. 10, 2014nirav87404Оценок пока нет

- DHL AWB Sweden2 30-4-21Документ5 страницDHL AWB Sweden2 30-4-21Ajay KumarОценок пока нет

- Analysis of Pakistan Cement SectorДокумент43 страницыAnalysis of Pakistan Cement SectorLeena SaleemОценок пока нет

- 100% Free - Forex MetaTrader IndicatorsДокумент5 страниц100% Free - Forex MetaTrader IndicatorsMuhammad Hannan100% (1)

- Agrarian Crisis and Farmer SuicidesДокумент38 страницAgrarian Crisis and Farmer SuicidesbtnaveenkumarОценок пока нет

- Topic: Financial Management Function: Advantages of Profit MaximizationДокумент4 страницыTopic: Financial Management Function: Advantages of Profit MaximizationDilah PhsОценок пока нет

- VAT Guidance For Retailers: 375,000 / 12 MonthsДокумент1 страницаVAT Guidance For Retailers: 375,000 / 12 MonthsMuhammad Suhaib FaryadОценок пока нет

- Summary of Angelina Hernandez Defendant Estafa CaseДокумент1 страницаSummary of Angelina Hernandez Defendant Estafa CaseJay Mark Albis SantosОценок пока нет

- Feasibility Study-Rimrock Kayak Rentals and MoreДокумент20 страницFeasibility Study-Rimrock Kayak Rentals and Moreapi-335709436Оценок пока нет

- National Bank of Pakistan Internship ReportДокумент58 страницNational Bank of Pakistan Internship Reportbbaahmad89Оценок пока нет

- The Rule in Clayton's Case Revisited.Документ20 страницThe Rule in Clayton's Case Revisited.Adam Channing100% (2)

- Questionnaire Revised 2Документ7 страницQuestionnaire Revised 2Anish MarwahОценок пока нет

- 1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYДокумент7 страниц1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDin Rose Gonzales50% (2)

- SolutionsChpt 08Документ12 страницSolutionsChpt 08Brenda LeonОценок пока нет

- PPP Program Philippines PDFДокумент21 страницаPPP Program Philippines PDFJosielynОценок пока нет

- (C501) (Team Nexus) Assignment 1Документ14 страниц(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimОценок пока нет

- Wire Transfer Form 08Документ2 страницыWire Transfer Form 08eghideafesumeОценок пока нет

- Assignment 1Документ2 страницыAssignment 1WINFRED KYALOОценок пока нет

- 7 Eleven AssignmentДокумент3 страницы7 Eleven AssignmentAnna DoanОценок пока нет

- FM 415 Money MarketsДокумент50 страницFM 415 Money MarketsMarc Charles UsonОценок пока нет

- HR Functions and ProceduresДокумент7 страницHR Functions and ProceduresSandeep KumarОценок пока нет

- CTD-20211125-MP VietcapДокумент15 страницCTD-20211125-MP VietcapĐức Anh NguyễnОценок пока нет

- Santa Clara County (CA) FY 2013 Recommended BudgetДокумент720 страницSanta Clara County (CA) FY 2013 Recommended Budgetwmartin46Оценок пока нет

- Crown Valley Financial Plaza 100% Leased!Документ2 страницыCrown Valley Financial Plaza 100% Leased!Scott W JohnstoneОценок пока нет

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Документ20 страницCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariОценок пока нет

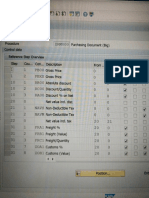

- Data ": Overview: Purchasing (Big)Документ3 страницыData ": Overview: Purchasing (Big)preeti singhОценок пока нет

- Chapter 6 Financial Statements Tools For Decision MakingДокумент25 страницChapter 6 Financial Statements Tools For Decision MakingEunice NunezОценок пока нет

- UNIBIC Foods India PVT LTDДокумент8 страницUNIBIC Foods India PVT LTDkalimaniОценок пока нет

- Forensic Audit Report Press StatementДокумент3 страницыForensic Audit Report Press StatementNation OnlineОценок пока нет

- Syndicate 6 - Gainesboro Machine Tools CorporationДокумент12 страницSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickОценок пока нет

- UAE MacroeconomicsДокумент31 страницаUAE Macroeconomicsapi-372042367% (3)