Академический Документы

Профессиональный Документы

Культура Документы

Trough Fire and Troubled Waters

Загружено:

probandooo12345Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Trough Fire and Troubled Waters

Загружено:

probandooo12345Авторское право:

Доступные форматы

Trough fire and troubled Waters Independent central banks have never been so powerful.

But how might increasing global economic integration affect that power? There have been three great inventions since the beggining of time: fire, the weel and central banking, Will Rogers, an American humorist, once quipped. Last week in Jackson Hole, Wyoming, the first and third of these great inventions did battle, and the central bankers won. Nearby forest fires did not prevent central bankers from around the world from gathering for the annual symposium of the Federal Reserve Bank of Kansas City. The theme of this years meeting was global economic integration. Will economics continue to be integrated by flows of trade and capital? And if so, what will be the effects on economies and on central banks? On the first question, there was disagreement. Michael Mussa, the research director of the International Monetary Fund, argued that the risk of a return to isolationism was small. But Alan Greenspan, the chairman of Americas Federal Reserve, was less cheery: if global growth were to stall, protectionism might well return. But put aside his pessimism as rational prudence, and take the optimistic view: that the globalisation of goods and capital market continues. Though this would bring big benefits to the world economy as a whole, it makes the job of central bankers harder in several ways. For a start, monetary conditions in one country are now increasingly affected by development abroad. In the first half of the 1990s, for example, low interest rates in rich economics caused inverstors to seek higher returns in East Asian economies. Massive inflows of foreign capital stoked up domestic demand, but Asian central banks failed to respond by tightening monetary policy and allowing exchange rates to rise. The result was that economies overheated and financial bubbles inflated. Another example of foreign influence on domestic monetary conditions was in 1998, when the Federal Reserve cut interest rates because the turmoil that followed Russias bond-default threatened a credit crunch. Another way in wich globalisation has affected monetary policy is by changing the channel trough wich interest rates affect demand. Their impact on the economy via the exchange rate has become more important relative to their direct effect on borrowing. As trade expands as a proportion of GDP, so a given movement in the exchange rate has a bigger impact on demand and inflation. At the same time, the increased mobility of capital has also made exchange rates more sensitive to cyclical developments. Fast-growing economies, such as Americas at the moment, tend to see their exchange rates appreciate as foreign money floods into the market that seems to offer the best return. Since a rising dollar has helped to hold down American inflation, the Fed has needed to raise interest rates by less than it otherwise would. The catch is that this may encourage share prices and borrowing to rise to unhealthy levels. The rise in the yen had similar consequencesin Japan in the late 1980s before the bubble burst. Thus global forces may help to hold down the prices of goods and services, but at the increased risk of inflation in asset markets.

Nor are things easy when central bankers don their regulatory hats. Economic integration has blurred the geographic boundaries between markets and between financial institutions. And the creation of global financial institutions has complicated the task of financial supervisors. Cast a float. Central bankers in Jackson Hole largely agreed with the new consensus that in a world of highly mobile capital, countries must opt for either a fully fixed exchange rate against the dollar or the euro, say- or floating exchange rates. Any halfway arangement will sooner or later hit the rocks. European monetary union aside, many countries have opted to float in recent years. But theres a funne thing if they really intend to sitck to a free float, why are central banks still sitting on massive foreign-exchange reserves? The holding of large official rserves is a hangover from the Bretton Woods system of fixed exchange rates, under wich countries were obliged to defend their parities through official intervention. Yet Bretton Woods broke down almost 30 years ago, and the shift to floating exchange rates and the expansion of international capital markets, wich has improved countries access to foreign borrowing should have reduced the need to hold reserves. But global foreign-exchange reserves are now higher in relation to trade flows than at almost any time in history. The ratio of foreign-exchange reserves to imports has risen from 12% in 1969 to 30% this year. Reservers are traditionally seen as a sign of a countrys financial strength. But just as a firm that kept lots of spare cash sitting idle in the bank would be considered badly managed, so should a central bank that keeps too much money in low-yielding treasury securities-let alone gold. New Zealand has not intervened in the foreign-exchange markets since March 1985 when its currency was floated. A few years ago, the countrys central bank even toyed with the idea of eliminating its foreign-exchange reserves altogether, but it rejected the idea.. Central banks still need some reserves to plug temporary gaps in the demand and supply of foreign exchange. Still, more countries do not need to have war chests as large as they are now. With one exception, thought Martin Feldstein, from Harvard University. He argued that emerging economies would be wise to hold even bigger reserves to reduce the risk of future financial crises. To minimise the opportunity cost of holding reseves, he suggested they could invest the money in some sort of global equity fund. A good idea? Imagine a central banker having to explain why a countrys reserves were wip ed out by a stockmarket crash.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Viner (1936) - Keynes On UnemploymentДокумент22 страницыViner (1936) - Keynes On UnemploymentdickseverywhereОценок пока нет

- A Best Practice Oversight Approach For Securities Lending PDFДокумент5 страницA Best Practice Oversight Approach For Securities Lending PDFFierDaus MfmmОценок пока нет

- High Yield CDsДокумент4 страницыHigh Yield CDsAnonymous hWRGcOe4XОценок пока нет

- Asset Liability ManagementДокумент35 страницAsset Liability ManagementNiket Dattani100% (1)

- Level 1 NISMДокумент13 страницLevel 1 NISMGautam KhannaОценок пока нет

- Nabil Standard Final ProjectДокумент29 страницNabil Standard Final ProjectKafle BpnОценок пока нет

- Global Insurance Trends Analysis 2016Документ29 страницGlobal Insurance Trends Analysis 2016Rahul MandalОценок пока нет

- Cause Title - Judgement-Entry 6Документ4 страницыCause Title - Judgement-Entry 6Lalsiemlien LungtauОценок пока нет

- The Financial Statements of Banks and Their Principal CompetitorsДокумент50 страницThe Financial Statements of Banks and Their Principal CompetitorsyeehawwwwОценок пока нет

- FM FormulasДокумент24 страницыFM FormulasMd. Nafiz ShahrierОценок пока нет

- Ch02 Asset Classes and Financial InstrumentsДокумент39 страницCh02 Asset Classes and Financial InstrumentsA_StudentsОценок пока нет

- MIDTERM FinMar 1Документ11 страницMIDTERM FinMar 1Aira ArabitОценок пока нет

- 1st Assignement CasesДокумент11 страниц1st Assignement CasesCloie Anne SullaОценок пока нет

- CHAPTER 6: Risk and ReturnДокумент20 страницCHAPTER 6: Risk and ReturnMauricio BedonОценок пока нет

- Question Bank - Engineering EconomicsДокумент18 страницQuestion Bank - Engineering EconomicsRAMESH BABU S MECОценок пока нет

- The 2022 Mckinsey Global Payments ReportДокумент53 страницыThe 2022 Mckinsey Global Payments ReportIrene SkorlifeОценок пока нет

- Monetary Policy in The 21st CenturyДокумент7 страницMonetary Policy in The 21st CenturyRomeo RomeОценок пока нет

- Money and Financial Markets: PD Dr. M. Pasche Friedrich Schiller University JenaДокумент65 страницMoney and Financial Markets: PD Dr. M. Pasche Friedrich Schiller University JenaMuhammad KashifОценок пока нет

- M03Berk148315 - 02 - CorpFin - C03 - GEДокумент80 страницM03Berk148315 - 02 - CorpFin - C03 - GEMuhammad Dwiki fajarОценок пока нет

- BSP PresentationДокумент27 страницBSP PresentationMika AlimurongОценок пока нет

- Quant Short Tricks PDFДокумент183 страницыQuant Short Tricks PDFAarushi SaxenaОценок пока нет

- Drobny 121712 10 24 13Документ4 страницыDrobny 121712 10 24 13fbdhaОценок пока нет

- VBM Book!!!Документ254 страницыVBM Book!!!Buba AtanasovaОценок пока нет

- Engineering Economics Notes 11Документ88 страницEngineering Economics Notes 11Tanmay WakchaureОценок пока нет

- Indian Money MarketДокумент11 страницIndian Money MarketPradeepKumarОценок пока нет

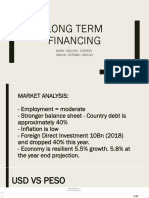

- LONG TERM FINANCING Finma FinalДокумент36 страницLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Công Ty TNHH Một Mình TaoДокумент6 страницCông Ty TNHH Một Mình TaoLong VũОценок пока нет

- Practice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)Документ8 страницPractice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)api-3834751Оценок пока нет

- Money MarketsДокумент41 страницаMoney MarketsFaheem GulОценок пока нет

- Pcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureДокумент15 страницPcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureErika EsguerraОценок пока нет