Академический Документы

Профессиональный Документы

Культура Документы

Uptown Drink LLC Steve Rowland James Rowland Fun Group Inc

Загружено:

CamdenCanaryАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Uptown Drink LLC Steve Rowland James Rowland Fun Group Inc

Загружено:

CamdenCanaryАвторское право:

Доступные форматы

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 1 of 11

hedu|e K-1(Form106) 2010 UPTOW DRINK, LLC 33-1109516 Page 2

This list idetifie the codes 0500on ofht0utK1 for 8partners and provides 50NmII00reprng information for partners wh0fe For 10O. For 00Iat0dr0y0hg

and fling information, see the separate Partner's Instuctons for Scheule K1 and the intructions fr yor inome 1xt0Ium.

1 Ordinar bu$ne8$ inome f1assI. Iermine w0c!hcr !hcincO 0) D888lv

Cde

Or ncn8ssiwande:vcyrbmlllows

K Disabled :crc0l

Report on

Pasive Ioss

FaIve Icome

npasslvIm$

u~t1O

Z Nat~ntaImaIO incme ()

3 l nct MGrome(loss)

Nt Ime

Mk

6wnn

S lnr |nme

6 a Drd|Mdivis

bb Ouafmddmcnm

7 RoyaI!i

8 Not hoMWr <apIUIgan(l ou)

9 M6IIoD-tWcpi\al ain p)

b0Collectibles () g8Ih{wm)

9 C Unrecaptured stcn1Z gain

1r Net sBion1Z3gain (loss)

JJ Or incom (loss)

Cd

A O0erproio incom D)

ImI0nbpmm

C Section 1Z5OVtSm

O M|n|pexIor|oOWrwNc

E Cancellati o00!

F 0 in (ls)

5ecbon 17eduUn

d Oerdedotlon$

A Ca$hOV|0u00$(>)

Cashv|ou0OS(J)

C Nn0shcO0lrlbtl!Dns )

Kh085hcO0lrlbu!|Dn8 (J)

E ilI prDcdyto a 5%

!n\)

f '|wii prD|!y(m)

Oi0vD (1)

H bit e

L

M

0C0 ggQ

559(e)( exditue

3U~moIk(2KA}

D~portofo (o

Aount pal f medicl

1088rm

N Eductoal asistanc benefits

L 0p~mfl0 C0O|8

Q

Ppmdmiwpooexpenses

cmmerclal reiIaiztiodeducI|o Irom

rental roal estate activities

R Pensions ardIRAs

b

U

V

W

Rorestion expense mocto

DmIlc0rodiO|oei w! ies in'oratl

QuaII|l prouOon aq ncomc

EpIoyS Fomw.2 08

OWrd

14 tmpqmg_pzzj

Report on

L d 1 Q

See1helarlncr'>DPCKD

Lmwoc!zoe an r0nw8 00mhl

employment credit

SeeIbelarcrs lnmn$

Form,Iine 3

Schedule . |neW. clumn {g

M Cr ed|l for ineasing teOal.vI.es

Scheule E. IiW2.lumn()

N Credit for 0mp|o/r soial soollty 8n0

See !hPartner's Instructions

>CdO|t. I|~x.clumn Q Mdtr tv Fnrm R6. ll~h

Form `, line 61

Seete Pmt wns

Bpwithhlding

%rcO See te rt!0'8|%H01lOm

Sedule E, lin 2.clumn (!)

See wlm$ Iq

Scedle . l in W. c!umn (

fonn 10,Iiw

fom10,||w5a

F0tm`4.Ii9b

Schedule L.IitR

Sdedu'eD, li . clumn g

Schedule D. line 1Z clumn (

Rate OIn WrKsm I, llne

4 (Schedule DInstuctios)

See te Partner's Instr uctions

SeeFIner' Instuctions

Se VkR |WiOns

5WP Imo

lo6781,|irk1

50cFub

fotm1f,hn/1 O f0m

Scc9cPS Ino

See 9cPartner's QCD

} SvFart|wr's

lnshucIos

49. Im1

Shu'e E.tine 18

Se t Part' tno

5meA,l|2

Smcd1'0A,line 2

Sclledule A, lin I Q

PormJ$D, lm

See t 8t!|kr`>lnslions

Pom2J, line 12

5eev+r8rr'3 |n$mlOn$

5FOtm In$lruUiOnS

Se V r8d5 Ws

See te Parr' I ss

SeeFOrm89 lmDns

foim9Q,I|7b

mQ,I|p1

b0cMcf 8 I< s

16 fonlnlr8OllOh$

Nof c or U.S. pss

}

B Q|rmw*aIISlC

fom1`1b,r8t! I

C Gin s e mmr\m1

Foreign grincome S0u0at partnerhip level

D P mm

}

L Geral cle Fo1J16,ls I

F o

Deductions alloated and apportioned at partner level

U InIex$cnse formJ116,Par I

H kr lOrm1 116, Par I

Deductions allocated and apportioned at partnership level l0

foreign source income

l Pamclego

J Gneral cte

K 0

Ot infrmation

L Total lein Ipid

M ToIaI1crcyt at

N Wh|nTOavailabe lo credit

Foeign Irad||_grms~p

l LwaIerrmome ecus'o

W L*l9rly1 tranons

\1 AH~minimum (AHTIts

A F0st- `WdWciatioadjustment

A}usvd |nor loss

C Deplctlon (other lha o|I&gas)

D Oil, .&@omN-t:Inm

L Ol. .&ommN-dductions

F Or AMT items

18 Tax.xempt incom and nodedutible eXnss

Tax-empt c!cr8l|mw

b Otxexempt |~

L Nbkv

1s iumm

Cammarbesuntie

B Distributon 5bl00t W 8c0!JOn737

C |krptQ0rty

zt Other infonnat

A Iven!incme

B ovestoeoIexencec

L ltk| tax etedt infonmti

D IIedremIIatonGN|Ar8 (D!hrV

mmIreal q!!cj

E iS O| e pope

F e c

p

re of l-incm hsin c4!dc

Repe oI Io|ne hin c4(

H Rre Qim elo

} FUm 1J1b,r8rJ I

fVtm1\16.PotIII

Form 1Jt6, ld II

fotm1``6,fin 1/

fonn73

fotm73

See the Par's Instrucions

} See te Fanrs

ln8trucOns hd

:c Instructions fr

F 1Sl

Ferm10, lin

Se TPart nfs W

SecT l08 woo

} See1Partes

^GOKO

fOrm .Iine 4

0rnZ, IIne$

lormA16

B Jhclar01r8 nstn<I|0n

Se the Fat0\r`s nsIm|om

lOrmB6`1,IitB

FM`1, ||8

o4

_

!ewI =mW

l

J

ROO&m

Lo-t.|nere -cplete

lg-ter cn

SvPm 1SVC

Gfomf7

A Net earings {D)|tom sett-mloyment Sheul SE, Se A o

rD$$1arm|or T>n |coc VO Paner's Iq

L tD$$ |On-|8rmr\cOc See IhePare's Ino

CmcIu

A

_,

__:(setion

~-'

See

_@Partnet's lntlct

B low-nconehousing cr:I(othP(|rom

pre 2 8 buildngs See !he PaHer'8 nIruOIim

C low inmhoing (sectiOn ^)))

!rom>u2001 bu|'d|s Form 8. Iine J1

O lo-mmhousino cre (other) m

p05l/7>|lJ|iQ8

O8I rel\biliee (rtaI

Betate)

F OtrmSIUcC

O0wr~m

H liie cpi gain :t|l

Ak<IWOluOXtofe fues <

J Wok opOil ceit

PARTNER 2: STEVE ROWAND

PorT8G.line J1

} See mP$

Ints

fotm 10D, line 11:d<Uba

lom618,line

FotmQ , line 3

K

loo-ba |n!W -ine

frt method

L Dispsits DIproDr!ywl!h

src!lon179 dductions

M Repur QJo 179Oe0L<!oO

N lnlerel expns fpr crprale par tners

Section 43(Q(3) information

l Ser||o4(c) infnation

Q SccIc JB)infor atio"

R Perel0Dto prouCon cxpcnJ!urcs

> CPmnquatcdw|!ldrawaIs

T Depton 0W%0 O4and

U Azt o remelahon&

V Urela bntmabWine

WPb&n (p)

Sction 10(i) mw

Y OImrnIo ton

See f o&

bc the l|0<f`$

|Osl|u0!ios

llAD:1Z 0JJ! Schedule K-1 (Form 106) 2010

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 2 of 11

651110

Z

fFinal K-1 _ Pmende0K-1 1

Schedule K-1

Partner's Share of Current Year Income,

[mm |||]

(Form 105)

For mlem}8fZ1U,O Deductions, Credlts. and Other Items

Dartment :Im1 reury yeatbeginning 2O19 1 Ordinary business income (oss) 1D Credits

lnIerU| Htv0n|kbcG0

9,551. ending

- -.----.----...

Parner's Share of Income, Deductions,

2 Net rental rCal estate income (loss)

Credits, etc.

.

See separate instrctons

3 Other net rental income (|CSS] 16 oreign transactions

M

Information About the Partnership

J

-.------.....-

LuarWntued payents

A Partnership's employer identification number

- --------. ...-

32-ll095l6 0 Interest inome

B Partnerships name, address, city, state, and ZIP code

- ------

-

......-

Ga Ordinary dividends

UPTOWN DRINK, LLC

- ------.......-

1400 LAGON AV

6b Qualified dividends

MINNEAPOLIS, M 55408

. -------.----.-

L l Lnter where partnership filed return 7 oyaltie s

E

-

FILE

- --..--------.-

D _Check if tis is a pubi cl y traded partnership (P)

8 Ne sht-term Lpitl yin(loss)

9a Net long-term cpital gain (los) 17 Alterntie minimum UK(AM i1ms

lnformation About the Partner

A

_....-...

-

JL

8

.5? -

L artner's identifying number

9b Collectibles (28%) gain (oss)

ress, cit, state, and ZIP coe

- --- --- --------

9c Unrecaptured sction 1250 gain

JAS ROWLAND 10 Net section 1231 gain (loss) 18 Taxexem

p

t income and

492 w. 35TH STREET

nondeduti ble expenses

. 1> t, MN 55116

l1 Utl1r income (|oss)

]General parner or LLC _...--parner or oter l

- -...----.....

merbermanager LLC member

l

.---------.----

H gDomestic partner _Foreign parer

_

.

J

- -..----------

l

. ---.........-.-

I What type of entty is this partner? INDIVIDUAL

19 Distributions

J Partner's share of profi, loss, and capital (see instrucions):

12 C0I0D 1J deduction

l

. ------------.-

Beginning Ending

Profl t ?.,$ % 12.25 %

13 Other deductions

Loss 12. 25 % 12.25 !

------------

3

..

2 Other informtion

Cal 12. 25 % 12.25 !

. ------------..-

|

-............-

K Partner's share of ltaD:lities at year end:

NonreLourse . . ... . . .. . . .... ... . . ... . . $ - --------------

Qualified nonrecourse financing ....... $ $1_4

7

8.

14 Selfemploent earings (los)

Hecourse . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.... ....... U

5

_ 1.

l

-----.-.----.-

L Partner's Lpital account ana|ysi s:

Beginnincapital account .. . . ... .. ... $ 82,291.

*See attached statement for additional information.

Capital contributed during the year .... $

Current year increase (decrease) ...... $ 9, 318.

C

Withdrawals and distributions ......... $

R

Lnding captal aLcount ... .. .. .. . $ 9l 6u9.

..... R

s

Tax basis

.^

_ection 70(b) book u

5

Other (explain) E

M Did the partner contribute property with a builtin gain or loss

_ves gNo

N

L

*t> ti ee ro t

BAA For Paperork Reduction Act Notice, see Instuc:ons for Form 1065.

PARTNER 3 .

Schedule K-1 (Form 1065) 2010

fPd1ZL 1TDl1J

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 3 of 11

cC8dU8 K-1(orm1065) 2010 1WN LbJI, LIt 32-l1u95l6

.

ge 2

This list identifies the code used on Schedule Kl for all parners and provides summarized reporting information for partners who file Form 100. For detailed reporin

and filing information, see the separate Partner's Instructions for Schedule K 1 and te instructon for your income QXreturn.

1 Oinr business Income (loss). erirwhether |h inome (s) passive

LOO

or nossive dent8Ion yur rer a Iotl.

K Disable accs cedit

Report on

r8 k

PaV

Nonpassie Is

Nross1v income

2 Net mralWWW Income (loss)

3 1Inet rntlInC"'o (lo)

Net income

Net k

Guaanteed payments

5 Intrst ineo1

6 Ordinary di dends

6 b Rmdd

7 Ro

8 Netsmn-l4mcala|D(los5}

9 Nc!lon9"torm ca#!zIgoin 0uss)

3UCOiiecbies 1p)gain (Ioss)

9c Unrecapred semn120 qzn

10 N secon 1231 gain (loss)

11 OinCme 0os,

L06

L pli o Inm 0)

mUAmw

C Se 1ZObatN&OSV&C

D Minin exQI0atio osmtecure

E Canellaton of deb

l Othei income (ls)

12 Section 179 deductin

13 W%deuco

A i.n C0IDm|o (

CcwQ$)

C Nh mmw@yj

Nh dw(%)

E Qp|aIgain po l a WX

0I0Z!O0 W]

F p.tgoo..oj

ntribuiOns \l00%)

H Investment lnteresl exense

Duco ~roylly inco

J SOtn 59(c)(2) epenttures

Duco -JOlo (% fo)

L Duco -prtro (ot

m Amdf0 m

mm

N 0UQB0|l55l5lDbif\

L

M

0mHC D

Prepoduclive period 8x20M

mlwItlreliuon deducto from

rental reaI cs|a|e 0II

Pensions an IRA

5

T

u

v

w

Refo|esbIoe1ense dtion

Dc proctio CiP0oD

Qalfie p~w in

Er' FemW2w

D

J Slf.mploymnt Hms(lossj

Report on

S te R Imns

FIi~28, cu()

Scul . IneW.cur j

Sceule .0162.coturm Q

Se the Partnet's Instctions

SCdule t, .ine 2, Cumj)

See the amrInwdon5

5de|cF.In2. cOlum J

om 3, Ine

Om1 Im9a

Fo100, Ie9

Schule E.IIe4

Sceule L. l0 .CIumn g

SeuIe D, Iine 1Z,oI u g

RouOein YuOPc. l|W

(chedule Dlm lo;

See the Partner's lnsfrutlos

SvPartner's Ini

%t PIno

Se 0 F^In

Fo 671

.

lin 1

>0u0O3O

00 , Ire21 0I Form 98

See th Partners Instructions

See tt>e rneI's lO9lIt\k

} 5mPr's

Intro

Form 4952, Ire

Sceule E. ll001d

>0VAPa Instti ons

Sceule A Iine 2

5muIeAIm2

Sule A Irx 0

w1,1tmD

b% the P lntios

0%J.tine 12

See the Patner's Inions

Sec 0tMBllH!IUOl0J5

See th Partners Instrutis

5th Ps Itti

S Folrts

D8.\mb

f&, I<17

Se the Pas Ints

N0.DWasct I 7 ctk o tmtm|dm.W the

Ps Insttions wkcomk0nedu

E

P NeIcamns(l03S] from selfcmployment ScheuIe SE. Section F or B

B Gross farmin Q fishin Inom See th Partner's lnstclios

C Gros nn-farm Inom See th I!ml5 lm5

1 Cmmu

Lwn hin cit {1~Q

W p-20blin

Lnm huin OmlI JOxt]}00

I8-Z d0ul0z@

C wwincome ho n

Odit (5600OO4Q0\l

fr p0stW 7 bui ldings

D __.ot (oth) from

L QuIifi0d t0hBl|l!@!0n 0xQ6O0lf25 (I6O!Bl

!6l eslate)

l Other I0llml Ielesme ctu

D<I0"lcet

H Uis.rib tIQ| W

I PWcIIuIHIls CR

J W 0pit DW

b1NLb 2 UL W1NL

Se th Pa Im0|W

Fam ,lO8 11

rQ gline lI

} See th COeI5

M\OM

w1 line 1,C wx

w6,Ino 8

Fen . line 3

L Eret tenwIO|y

wciI

M Cit f0O q

N $R 10f empszIS0I|1y lW

Mdicre Ix85

Ba wit hhdng

C0ctco|h

Jb Forei\n trnsactions

See &e Parner's Insons

Fcm.Iin

See WPanners kmo

For &. line 5

Orm 1. lO8 1

Sec the Parner's ln!tructiono

P Name or cuntry or U.S. possio

}

Gmr<onel| 5UO

0I0 1116, P8rt I

C G moms.orced at 9H!eveI

Foreign gross income sourced at partnership level

D Pscle

}

c GtaImm Fo 1116, P I

F LI

OJCl'0OS 8008l0Oand BDOO|OD60 &Ipartner 0v0

W Interest e.pnse Form 111,Part I

N Or Form 11,Part I

0OJCl/0OS 8l0C8l0Oand BDOO|OD60 at partnership level to

foreign source |DCOD

Passiv mIgq

}

J GIcteoory F0m 1116, Part I

O

Other information

L otl foreign XWQW

m o| foeg0Xacre

N Reution n taxes ailable 0Icedit

Foign tranQ goss recipts

P EwaIon|onalinOe cxclustoO

Q LBT0Im1ans1o

J7 mmmrntum %|AMf}its

P Pot-I 98depl ajut

B A or o ts

C UIe|w(or tan oII&p)

D Oi,

, &ge0trmI -gros inc

E OI,q,&gotmmI -dUco

F Other M Iems

:s Ta>-xet InCme and nondeductible xpenses

P 1e-exe| lnleIel Inm

B Other \Bxx8hl I000e

C PKD00UOl8 8x05

19 Distributns

P LndmwSuI|\M

B rb>mb;to seion 737

C W 8ItIy

Z OInforation

P Invtment income

Investment fnses

C luIwxcre6it informtion

Form 1116, P:rt II

Form II16, Part II

0I0 1116, tin 1Z

0I0 d1

Otm ?[

See th Par's lnstrtios

} ce0C 5

ImW

the Instuons fa

form 621

Form 1040, line 8h

See the Prtners In5tos

See te Partner's Instrucons

} 5P&

ntto

0I0 4952, line

Form 4952. line

FoI0 4136

Q QzIIedhabI|oncx8lKIuI85 (oter than

f06|Icl 85IIe] See t Parner's Instructi0ns

E Bai o gI@ See mPWner's Instrcos

F Rerre omnmmhsing o1(on

0 Fw811, W

Reptre Nloin hon at (other) Fo 8611, Ii

H Repr o1Pcri MM ZU

I

J

K

Reptre otohr cdlu

m -nteres -completed

lontenn contracts

u -mlnlercst -income

foecast metd

L _wit

M Reap!c cf017 dedin

N In exnle mmmnm

Section 453(() infoatin

P Secion 4) 1nfallon

Q Secti on 1W(] ln0ma!01

R Interest alloc0le W 0roduIcn ex9w:di imres

> CnuzIedw|h0|awaIs

0ep'el|onnfor mato+-oiInd ga

U Am <~reforestation cost

V LnIelacdbsntaxabl mcme

WPrecntibult ga ()

7 S0n JWinfatin

Y IeIinl

--~-~:-.:.

mFom897

See Im dM

ee 8 PI\net`s

Instructions

PrA31_ 01TI ChcdUc K-1 (Form 1065) 2010

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 4 of 11

Schedule K-1 Z

(Form 1065 Forcamda|jpZ1, o|1ax

Drtment of the reu>uq

e; heyino|og 210

lnkmaIRevsnSerce

emiog

Partner's Share of Income, Deductions,

Credits, c\C.

v

Se separate instuctons

.

Information About the Partnership

A Partnership's employer identification number

33-1109516

B Partnership's name, address, cit, state, and ZIP code

UPTOWN DRINK, 11L

1400 LAGOON AV

MINNEAPOLIS, MN 55408

L IRS Center where partnership filed return

E-FILE

_Check if this is a publicly traded partnership (PTP)

_ I

Information About the Partner

number

F rcrI|nI

.

5 name, address, Ll[, state, cIUZIF code

FUN GROUP, INC.

510 lST AVENUE 4500

MIPOLIS, MN 55-103

@ General partner or LLC

member -manager

_ imited parner or oter

LLC member

H

J

K

L

M

_.---.cpart|er _oreign partner

What type of entity is this partner? S CORPORATION

Partner's share of profit, loss, and capital (see instructions):

Beginning

Profit 51

Loss 51 %

Ctal 51 %

Partner's share of liabilities at ]ear end:

Nonrecourse ... ... .... .. .. . .. .

Ending

DJ

51

51

%

%

Qualified nonrecourse financing ....... 243,459.

Hecourse . ..... . . . .. . .. . .... ........

Parner's capital account analysis:

Beginning capital account .. . .. . . . . .. .

Capital contributed during the year . ..

Current year iDcrease (decrease) . . . . ..

Withdrawals and distibuions . ... ... ..

Ending capital account . . . . .... .....

$ 342 605.

$

$ 38 794.

381,399.

Tax basis 0GAAP 0 Section 704(b) book

Other (explain)

Did te partner contribute property wit a built-in gain or loss?

0Yes No

tat eet a at

651110

_Final K-1 _Amended 1

o.1

Partner's Share of Current Year Income,

l

Deductions Credits, and Other Items

1 Ordinary business income (oss) :s Credits

39,763.

.............

2 Net rental real 6>QRIN0000(loss)

d Other net rental income (loss) 1b F\reign transactions

..............

Guaranteed payments

.-............

5 nterest income

. ...-..-..-...

6a Ordinar dividends

-.-...........

6b Lual ified dividends

..............

oyalties

. ............-

s Net short-term capital gain (loss)

9a Net long-term capital gain (loss) 1z A|lorralIvo m|0mu0Ut(AMT) items

A

......!:

7

-2

9b Cllectibles (28%) gain (loss)

.........-...

9c Unrecaptured section 1250 gain

:v Net section 1231 gain (loss) :s Tax-exempt inc\me and

nondeductible expenses

11 LtHer Incme (loss)

'

. .-............

l

.............-.

'

.............

l

..-............

19 Distributions

1Z uC!|OD 1JOc0U0l|D

-.............

13 Other deductions

!

.......... ..1

6

20 Other information

l

...-.---.......

|

. .............

- .............-

1 Self-employment earnings (loss)

+

.........-..-..

l

.............-

*See attached statement for additional information.

R

I

R

s

u

s

6

N

L

BAA For Paperwork Reduction Act Notice, see Instructions for Form 1065.

PARTNR 4

Schedule K-1 (Form 1065) 2010

PTPA03J2. 01OI

.

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 5 of 11

Schedule K-1 (o!m 1065) 2010 UPTOWN DRINK, LLC 33-1109516 2

1|5 5I08|8a 1P8 0088 b8t00B5D0r0uc h ! \0Id8!\8Ia 8J |0v!0t8 8umf!I0 R!g 0D!

80hfor pars W0cForm 1010.l0!068I !80|lIBg

@0 h I|0fM3I0,888 06 588!88l3II8f8 lR8!u0008 |0ft60uI8h1 800 IhcI 0a|u

003 0!your mD0mcUXlt0P

1 rdinar busiou income (los). Oni Wh6fPC0(s) pasive

LO00 Report '

Or0[85$v08mW!M on your Bfollow.

K Dmld ooess cedit See the Parte's Intoh

PaSSe los

B inme

Nivlos

NDass^n

z Ne\mral estate Income (loss)

3 \hef net rental income (loss)

Cl inome

ml0$5

Guaranteed payments

b Itrincom

6 M Winary d|m

6 b Qulifi cd

7 Royalt

s anshor-I.capitl gan (loss)

SNc lontenn capItalgain (los)

bColkctlbWs Q9)gin(lss)

9 C Unrecptured secton 120 gin

10 Net section Z1 gain (loss)

11 oer incme (axx

L"

L0r po irc (oss)

B lnvunry conersios

C S 1256 C 0stracde

D Mining exloratio C recapture

L Lncllat ion of debt

F LlhI 0DmC[l0$5)

2 ction 179 dducli

'

1 Oudeductons '

A L5h c|bm(5%)

Chcwo%)

MUm0|we(%)

D N cbi o (3%)

iWl g prc1 a 5%

orga nition (30%)

F Gapltl gain prOpe11) (2)

Otibut ios (10%)

H

I

J

K

L

M

V8!m0l itrest expnse

DduC>"tojlQIhcm

Secton 59(e)(2) expnditure

80u000S"pio Q8g

Du"m(other)

POM pid kmeicl

in

N EuCml asisanc bnfit

UOOlcare bnefits

Pprouctive perio e.penses

Cmmercial revltatlzaUon deduction mm

r!lI88lestate activities

R Pnion and IRAs

b

U

V

W

Iatevoxpns 0%|Kl|0

RpfO1 eces irtoratn

Qlif pruedon aie ine

Empls 0W2

O<

14 Slf,employmcnt bmin@s om}

Report on

SmPrs Ino

Se,line Dlu @

bO80UME, 0WWQ ()

dmE. lihe 28. omn

b8vePaMer' In ns

Scedule E. lin 2. clumn (g)

be8 veParr's Insts

bchNUl0. lin W,c0lu0! (j)

For 10, lin Sa

Fo 10. lin 9a

For 100, lin W

Sl E, lin4

Suedu|e D.lVe 5, ol<tm (f)

bCl|e0ule L. lic 12, colun g

xateCin Worlhet, une

4 5edule DInstuctions)

See the Partner's Inuctions

See te Partner's Inctions

WPrs l ons

See te ParLon

Fo1m 6781, lin 1

be8 u0535

cta:a.line 21 or Fonn 98

be8 h0Partr*Insn

bec !he Partnr's DW

} Se t Par

Icn

Form 4952, line I

Schedue E, liDe 18

5W4f\Df`SI0l|vC0hS

5edde A.line 2

5A,lin

Sce A, lin l Q

Form talint! 2

5WPartner's Insructions

For 241, lin 12

Se< the Partner's Inructioh

See For 8582 Instructions

See the arn6r Inctions

See IInctions

bc8 Fo W0lnlction

O8, lW

For 8, lin 17

b0WPs In n

Note. I y h-Ose 17 dt Oany prlnerfeve/ dn, R

Parnors nstti beor m(Scde

Nt earnDgs oss) fro $lPl0/PD\ Ch0ulc L.SeCion A o B

B GotW inor stng Inom See the Fa|l ner's Instrcon

L Ghon farm incme See te Paers In0tions

15 c w

9

N (sn <g@

B -rmO\ (ot) T

pr e-2buildn

LOwDomCh u5|_credit {$hR)(J)

fm ps2007 0ul0Q

Q I w.|Drmr I:`~rrcit (other) 1

05 4 7bildins

E Qualfied rehabilil<on expenditures (rental

real estate)

r Other f6W r88l estate crdit

O Cret crcd

H licapial gmm0

I A an lulol OO TLaet

J W >pW00

PARTNR 4: FUN GOUP, INC.

See the Ps Ion

See V68A'5 1D0

Form 8. lin 11

Form 8, lin 11

} See t Partr's

Ihstructios

Fo 10, line 71; Q bx a

fOm /, I|m8

Fo 58 4. line 3

L Empnt tone and renal cmunlty

empn! ct

M Cedij fo ine8swre m

N

redit fo orloyr r.ial qa

MM1r11r IAY"'f

UOUwDMl0tg

Oer crei ts

16 Foreign trnnctlons

Fu @ ,am3

5eeWPans l ns

Form Q, lin

P , line 61

See the P8rer's Ini ons

Nm OCuhtry ot >pssession

}

B Gros income fro all sorces

Form 1116, Part I

C Gross InDmc $0urdprer levl

Foreign gross income sourced at parterhip lv

D Pasm

}

L Gral c Fom t 16,r! I

F Or

dOJCI`OD5 dh0CldOand a oned at prtner level

Intere\ expnse Form1116, 8| I

H O0t ForU1116, Part I

Deducti ons allcated and apportioned at partnership levl to

forign source income

I P ve mlgo

}

J Gnerl C!@ 0|m1116, I

K O

Other information

L 1o|tIWrc boxe paid

M Tom| Y!ig txes acrued

N Reto t8xe available for Cr63l

Foreig trading grss recipts

P raterritoial +om cxCU$tD

@ mt f areigtrWaton

I 7 Altert minimum ta (AM WD

0tdao ajut

B Aju gin wI

Dpleti {othr !m oil g)

D Ol, gs, geotrml QK

b o1, cs. aeothelmaf ~O00S

F Lr PItems

18 Tax-xempt Income and nondeductble expnses

Taxexempt intcr$t ioom

B Other taxe xempt Incom

Ncb<expenses

1S Distnbution

18mmmNste

B > $jH!!o seion 737

C O proprty

20 Oe informaton

Investment Income

B

c

D

lnvestment t1pense5

Fuel tax credit information

LUlJ0 I0h0ll8!lb1 6k0lU85 J0v0rth

f6!8l r88l estate)

L Bis of energ pq

] Rte O lwine mmy oN(

Rpn of KlcO1hon aeit (oth)

N

I

J

Rptre Oinvestment cdN

^P0rc of other credits

JO back |er$l ~Celed

tong-tenn conlr1ts

K

loobock iteres! - incme

foreast mllo

L

t

__=h

M Rpte OS 17 mmo

N In!C]mm

545mo

P Sn A(c) 0fP!0D

Secton 1260(b) informaUon

R Intest 8lK8bl0U produ xpedi!ue$

S C 00U8lIf60 w!xI=l

00!0 f0Im&D Dlagas

U Prtution of reforestation co

V Urelatd buiness texable rom

WPmn0onqnq)

5ion 10(i) ifraton

Y Or ii n

For 1116, rbD II

Form 1116, Part II

Form 1I1 6, lin 12

OrU3

0rm\3

06V Parer's Instructions

} B &1!f`S

moa

the Instsfor

Form t

Foon 10, lihe

5eevPartner's Instrucons

Se WPartnr's Instrucon

} 5rcVePaers

lnon

Form 4952,ie4

Form 4952. l|he

F0rm413

See th6Partnr's lnstrue1io1'

SIDI$ ln$clo

Mm811, HW

Fom 811. lin 8

Form 4255

5vePar's l5uclm

eU0DY b7

cDfn886

Sccthe f!cl`5

DlfJll05

PTA0312. 01125111 CcCUCK-1 (orm 1065) 2010

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 6 of 11

Form bZ

IH A 1K rcSuiy

ltcrn

Depreciation and Amortization

(Including Information on Listed Property)

Sr\e 5MuC1UP5, PICh \D _Our\X re\uH,

o..

Z

OwAO

Cen1ytPUmI

UPTOW DRINK_ LLC

33-1109516

usIssrctivlyt hh on

tL 1UOD

@Election To Expense Certain Proper Under Section 179

Note: If you have anylisted proper, complete BH Vbefore you complete G I.

1 NXmUm muun\(see instuctions . .................... ..... .. .. ... .. .............. .. . . . . . . . . . t--1

-

--------

7 Total COS\ Dt 66C\lOO 11DIOeI!y plaed in serice (see instons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ,2

_

,_ ___

3 Threshold CO5\O1 50D 17 property before reduction in limitation (see instructions) . . . . . . . . . . . . . . . . . . . . . t-3 -t--------

4 HeUUC\IOn I nllm\\IOD. >Ub1IC\ lne 3 from !Ile 2. If 2eru uf less, enIel -. ... . . . . . .

.

_____

5 LOr limltBtotfor \BX year. Subtract line from line 1 . If zero or less, enter O. lI RBITBO fll inQ

se aIa\el ee n5\rUtIon ... ..... ...... .. .... . ........... .... ........

..... ...... .. .....

() 0s1p11on Ofpcity Cs osnz uso n C1 toct

7 |I5\eO proer. Enter the amount from lin Z . . . . . . . . . . . . . . . . . . . . . . L.. 7------

---

b Total eeC\ Ucost of seCiCn 11 prOper. Ad amounts O column (c), lines b and . . .

. . . . . . . . . . . . . . . .

______

9 Tentative deduction. Ct1eIthe 5lcfD1liOe 5 or Ite d . . . . . . . . . . .. .............. . . . . . . . . . . . . . . _____

1 t Carryover DdI6uweU UeduCiun IDm I% 13 of yOuI 20 Form 4562 , , . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . t

_______

11 BusinMs incme limittion. cn1eI\hfsmaller of Du5nf55 IOCume (nu\ less wn 2ru) uf line 5 (sef In5\f5) ,

j_

_1

_____

12 >eCbOn 17 exeOe UeUUOOn. PUU Oe59 and 1,but Uo not enter more than line 1 1 . . . . . . . . . . . . . . . . . . . . 12

13 Car over OI Ul5BOWfC CfduC\IOO \O 201 1 . PdU Ilf5 BtU \, le55 lDe \2 . . . . .. 13

;

ND\. not use Par II or Part Ill below for listed propert. Instead. use Part V.

14 Special depreciation allowance !Or qualified property (other than listed property) IBCG n 5efvCf UHrItg 1Ie

JBX year (5Ct5VuCtons). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . t-1-4

-

--------

15 Property subject O sction 16(1)(1) eeCtOt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . t-- 15

-

--------

ee instrctions

Section A

17 MCRS deductions for 55e\ Ce0 n5eIvCe O tax yef beginnin before Z\. . . . . . . . . . . . . .

1

8

: 0'i. "

as

I

''

d

D

"

\

_*

.

t

-

"

"

I

Nonresidential real

property . . . . . . . . . . . . . .

C I ICI1I0

b:x51 nx U

oy se

he CenemI Oe

(d) (e)

Recoveiy priod Ctn

25

27. 5 M

27. 5 rs M

39 M

M

(f

hW1O

SIL

SIL

SIL

SIL

SIL

(@) MICI1I0A

C.tIO

2010 e

?

P P1

Vle0 I0C1u Iem

_____

e

__

u

P__

P

??

I

?

0 P

e

C

_

e

,@, @, f

D

,@_

......

2 lss life . . . . . . . . . . . . . . . SIL

b1 2 ear

.

. . . . . . . . . . . . . . . . 12 IS SIL

40 M SIL

('ee instructions.

.

Listed proper

t

y. Enter amount TrDm De Zb. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_

1

_______

Z 10l.ddNunLfro lW\Z,m \4togh \7,I19 an 2in clumn {g), an hn 21. Enler MNan 0

Wf0IWline 01yur 0M8C$hI0$ anSt0I0I\0h5 8N lh:0u00h8 .................................... 2

2 Orassets shown BbV and placed in serice during \!e CLrre!\ yer, eOff

t e I\ID of \e 5l51\IID\Dle \u 5eut cost ...... . ...,.,

PP Ur P8pewOrK H 0uC\lODPC! NU1Ce, 5ee sepr!f Ins1ruC@OD5. (!W 1JJ Form Z (2010)

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 7 of 11

Minnesota Revenue

Partnership Return ZJ

Tax year bglnning 1/0]

8tS

S

UPTOW 1, LLC

0 g0USID5 5

EE1 OCfCS

14 LAG N AV

Ch

, 2010 , ending 12/31/2010

1 D

tl I I

WIx5O12 uIDnmt

1b11b31 3I15o1b

tCIC II & t1I

M3

H1L1S, M ob4b

T

J

N Q@-

1

4

Check if:

_--.

DD

_LPQSlI

I0OnMQ

Round amount to nearest whole dollar

_MtEtn 8%0T

1OC15TI01O1Q

_Ouali>dJJspciar

a JZ zn _

LLL

DI1i&

IC1t1D

Minimum fee from line 10 of M3A (see M3A instructions)

2 \omposite income tax for nonresident individual partners . .

_(enclose M3A)

_(enclose Schedules KP!)

3 Minnesota income tax withheld for nonresident individual

partners. If you received a Form PYL Tom a partner, check box: | 3 _ nclose Fors AWG

4 PdO lines 1 through 3. + + + + + + . + + + + + + + + A + A + + + + ......................... l __

5 Employer transit pass c!edi t not passed trough partners. limited

O the amount of the minimum fee OO line 1 (enloe Schedule E + + + + , + + + + + + . + + + , + . + ( + _

6 Subtract line 5 from !ie 4. . , , , , , , , . . . . . . . 6 1, .

7 EOterprise zone credit Oot DBSBO thfouQh to

partners (enclose Schedule EPC) . . . . . . . . . . . 7

8 Job Opportunity uillng Zone jobs credit not passed

through to partners enclose Schedule JOBZ + + ~ + + + + + + + + + + + + + + + + ~ ~ ~ ~ ~ ~ + 1 _

9 Credit for tuberculosis testing on cattle (see instrctions) + + + 1 + + + + + + _

10 Estiated tax and/or extension payments made for 2010 + ~ ~ + + A + + + ^ + ^ ^ + ^

11 Add liOes 7 through 10 + + + + + + + + + + + + + ( + + + + + + + + + + + + + + + + + + + + + + + + _

1Z Tax due. If line bis more than line 1 1 , subtfO line 1 1 from lin b+ + + + + + + + + . + + + + . + + + + + A ( . (

j

_

____ _ _0 _0 _0

13 Penalty (see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . _

14 IOterest (see instuctons). . . + + + + + + + + + + + + + + + + + + + + + + + + + ] + + q ( ] + ( + ( ] ( + A A + + + + + + + _

15 Additional charge for uOderpayiQestimated tax (enclose Schedule M15) + . . + . + . . + + + + . . + . 1 1 A 1 ( + __ ______ _ 3__ .

16 AMOUNT DUE. If you entereC < amouOt on line 12, add lines 12 through 15.

Check payment method: _clectonic (see inst.), or

_

ChecK (atach 0tU PV4). + + + + +

,

____

..

_l __ 3__ .

1 7 Overpayment. If lIne 1 1 is more than the sum O! !tIc5 b and 15,

5UD1IBC! lld band line 1 5 from line 1 1 . If linB 11 is le than

the sum of !DBS band 15, see tOSUUOIOOS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 7 0 .

18 PfQun1of line 17 bcrediteto ]QQf 2U11 eS1Ined tax . . . . . . . . . . . . . . . . . . . . 8 _ _________

19 REFUND. Subract line 18 fom li 17 . . . .

2 To have your refund direct dEQ5!!E, enter thllowing. Otherise, you will receive a check.

You must use an account not associated with any foreign banks(

Account Type:

__________

_\heckiOg _Savings ____________

g1uI8 g8n8rl DI

YIk1 DmeofQ8r=I1

c-m& mc55 Ycm> ,6mted

FU GROUP, INC.

o nnr

5Igfw1UICITf-

PCCOUH! HU0!

d~

131

1e

s & ddw V5S

LF L P|dp

1

1

IuwtwhNn01

[ blo ..

L

ww l m

(763) 533-0340

lpS PIN

P00009061

Include a omplete copy of federal For 1065, Schedules Kand K-1, and other federal schedules.

Mail to: Minnesota Partnership OX, Mail Station 1760, St. Paul, MN 55145-1760

NMHP1JL 1!!311 ! ! ! 2

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 8 of 11

UPTOW DRINK, LLC

Minnesota Revenue

Apportionment and Minimum Fee ZJ

All parnerships must complete M3A to determine its Minnesota source income and minimum fee.

See M3A instructions. Enclose a copy of your balance sheet.

oo11UbJb

M3A

If you LOnducted all your business in Minnesota

CUrnQ te year, complete only Column P

and enter 1.00000 on line 6.

A

In Minnesota

OW

C

Factor (A B)

(crto5 decimalplces)

D

Factor

Weight

E

Weighted ratio

(C ? D)

Property factor

1 aAverage value of inventory . . . . . . . . . . . .

bAverage value of buildings, machinery

and O\her laOgble rCerly owned . . . . +

c Average value of land owned . . . . . . . . . . . . . +

Total averge value of tani le

owned at original Ost adlines ra - . . . .

Z [aptalzed rents paid by partnership

(grosrent paid 7 8). . . . . . . . . . . . . . . . . . . . .

3 Add lnes 1 and 2 . . . . , , . . . . . . . . . . . . . . . . ..

la 1Z_0 .

1 b 1O124d,

1L

1 1boZ4d.

Z Z1b11b0.

3 AbZ44Ud.

(If ln3, column is zero, see 're factor formula. J

Payroll factor

l l

4 Total payroll, ncludng guaranteed

payent Wpartners. ... . - - __ OO 4

U

....... .. .....

(l BOA, 1olumn Bis zero, see 'hree.fctor formula.)

Sales factor

5 les (including rents received) . . _5_

44 4 _d _

U

_ .............

(If line 5, column is zero, see 'ree-fctor formula. )

Apportionment factor

6 tal of lnes 3, 4 and 5 n clumn E. an carry result to five decimal places (e.g = enter 50% as .50000).

If all your business conduted in Minnesota during the X year, entfr 1.0000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . _

_ 1__0_U0

_

U U

Minimum fee calculation

7 TotBl of lines 3, 4and 5 in column A . . . . . . 7 JAb4Z.

8 Adjustments (see instructions). . . . . . . . . . . , s

9 Combine nes'and s. . . . . . . . . . . . . . . . . . . . s JA5b4ZZ,

1 MinimuHfe (determinusing 0amunt

lne 9 and the WDbelow). . + + + + + .= +

Minimum Fee Table

1 I 0.

I f line sof M3A is: your minimum fee is:

less tan $500,00. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0

$500,000 to $999.999. . . . . . . . . . . . . . . . . . . . . . . . . . . $100

$1 ,000,000 lo $,999,999. . . . . . . . . . . . . . . . . . . . . . . . $300

$5,00,000 to $9,999,999. . . . . . . . . . . . . . . . . . . . . . . . $1 ,000

$10,00,000 to $19,999.999 . . . . . . . . . . . . . . . . . . . . + +

$20,000,00 or more + . + + + + + + + + + + + +

$2,000

$5,00

(Identif pass-through entit and enclose sCule.)

Enter thi samount line of your N.

" Dfollowing rmCr9h19 do nO1vC 1o

pay a minimum fee:

Farm partnrships wtU more than BO

ercnt of income from farming, and

Qalife Dusinesse participating in a

JOBZ zone in Minnesota that have all of

lfr ropery and pyroll within the zone.

If you are exempt from the URHUC fee,

enter zero on line 10 above and on lin 1 of

FOrH M3.

MNA021L 0111311 1 1 11 2

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 9 of 11

MINNESOTA REVENUE

Underpayment of Estimated Income Tax Z0J0

For I ndividuals (Form Ml), Trusts (Form M2) and Parnerships (Form M3)

Schedule M15

Sequence #10

ourfi 6 no LB B2H6 SocialSccuri ynumbr

UPTOWN DRINK, LLC 33-1109516

Required annual payment

MiOnkO income tax for 2010 (fom line of FormM1;

line 12O!CO m, or partnerhips, see instuctions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

2 Minnowithhodi

n

and credits for 201 (add Imes25 and27-30of FormM,

ad lines 13a 13f of ForM or parerhips, see instruct. . . . .

Subtract linK Zfm line 1. If !$ than $500, So here; you do not owe an underpayment penall) . . . . .

4 Mul0ply line 1 by 90% (.90). Faners and commrcial fishermen: Nltipy line 1 by 66.7% (.667) . . . . . .

5 Minnesota incme tax for Z9 (m line 2 of Form Ml; line 13 of Form M. See instruc t i ons if yu8t0

a aOnershl_ IyCul Z federal adjusted gross ncome (individuals) or Minsota asslgnable adjusted

gross income (trust) was more than $1 50,000 or if you did not file a 2009 retur. . . . . . . . . . . . . . ..

6 Required nnuZl payment. Amount from line A or lie 5, wiChever is leSS . . . . + + + + + + + 1 1

If line 6 is less than or equal to line 2, stop here; you do not owe an underpayment penalty.

If li 6 lS h0rC \! line 2, continue with line 7 or line 13, depending on which method you use.

Optional short method (see instructions to determine which method to use)

2

3

7 Estimted Ux ayfenUyou made for 2010. . . . . . . . . . . . . . . . . + + + + . . . . . . . . . . .. . . . .. . ..... . . J

d Add line 2 and line 1 . . ................... . .................... . ........ . ............ . .... . . . ..... d

Total underpayment foth year. Subtract line 8 from line 6

(if result is <ero or less, stop here; you Onot owe an underpayment penalt} . . . . . . . . . . . . . . . . . . . . . . . 9

10 Mul1iply !ine D/?(.02. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 If the amount on liOe 9 will be paid on Orafter AJril 18, 201 1 , enter 0.

lt b& amoUriS p;id h=1re April 18. D1 !, 11P lhP following computation and enter the result

on line 1 1 :

amount on _ num0r of da

y

s paid

line 9 before 11 811 1 00008. . . . . . . . . . . . . . . . . . 11

12 Penalty. Subtract line 1 1 from l ine 10. Enter result here and on line 35

of Form Ml , lO6 17 of Form M2, or line 1D of Form M3 . . . . . . . . . . . . . . . . . . . . . . .

Regular method

13 LnVr 2% (15 Mlteheh

wmhKu88de1N0NWm

WhhJt80 inm iUtllmnt

w0mIf uthe mkN

or l08farmer or fsherman,

seeinstrions . . 13

14 Credits. See nstruCtion . . . 14

15 Overpayment. If line 14 is

more than line 13, subtract

line 13 from lin6 14. Enter

the result here and add it to

line 14 in the next column.

Overpayments lOany

quarter 1OllOwl!g an

underpayment must first

0 applied to making up

revious undeRaymenW. ...

1b nd8qym8ht If Iim 1- is les

hline 13, $000lin14 1r0m

li 13. Entr t rul heand

qMlin 17 8l0w. . . . . . . . . . . 16

17 cnter the date of payment or

April 18, 2011, WiLeVer is

earlier (see instuctions). . . . 17

18 Number of day between

the payment due date and

the date on line 17. 18

19 Divide line 1 8

y

365.

The result is a deci al . . . . . 19

20 Multiply liOe 19 by 3% (.03).

Enter as a decimal. . . . . . . . . 20

21 Multiply line 20 by line 1 6. . . X

A B

April 15, 2010 June 15, 2010

225. 225 .

SEE WORSHEET

Penalt. Add columns A-D on line 21. ntr result herM uon

. . . . . . . . . . . . . . . . . 12

L

Septmber 15, 201 U

225.

line 3 of Form Ml, line 1 7 of Form M2 or line 1 5 of Form M3. . . . .. . . . ..... . .......... . .... . ......... Z

You must include this schedWle wit your Fonn Ml, For M2, or Form M3.

MIAQ1L 12/1110

1 , 000.

.

900.

1,000.

900.

D

January 1, 2011

ZZD,

30.

1112

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 10 of 11

Z4 L M1 bYLhHLL

UPTOWN DRINK, LLC

Undeent Pena

Installment

Period

Amount From To

Interest Rate Periods Rate LW

1

225. 4/15/10 4/18/11 7 6 4/01/10 - 6/30/10 5 . 00%

92 7/01/10 - 9/30/10 5 . 00%

92 0/01/10 - 12/31/10 5 . 00%

90 1/01/11 - 3/31/11 5 . 00%

18 4/01/11 - 6/30/11 5 . 00%

TOTALS 225.

2

225. 6/15/10 4/18/11 15 4/01/10 - 6/30/10 5 . 00%

92 7/01/10 - 9/30/10 5 . 00%

92 0/01/10 - 12/31/10 5. 00%

90 1/01/11 - 3/31/11 5 . 00%

18 4/01/11 - 6/30/11 5 . 00%

TOTALS 225.

3

225. 9/15/10 4/18/11 15 7/01/10 - 9/30/10 5 . 00%

92 0/01/10 - 12/31/10 5 . 00%

90 1/01/11 - 3/31/11 5 . 00%

0 4/01/11 - 6/30/11 5 . 00%

TOTALS 225.

4

225. 1/18/11 4/18/11 72 1/01/11 - 3/31/11 5 . 00%

10 4/01/ JJ 6/30/11 5 . 00'

TOTALS 225.

!otal Underpayment Penalty + + + + + + + + + + + + + + + + _ [ + _ _ + + _ _ _ + + +

Underpayment x

Da:is Late

x Rate

h or oh

PL J

3-1109516

Pena

2 . 34

2 . 84

2 . 84

2 . 77

0 . 55

11 . 34

0. 46

2 . 84

2 . 84

2 . 77

0 . 55

9. 4

0 . 46

2 . 84

2 . 77

0 . 55

6. 62

2 . 22

0 . 55

-.1

30

C 1301L 051051 !

Case 11-47016 Doc 15-1 Filed 11/14/11 Entered 11/14/11 12:12:27 Desc Initial

Financial Report Part 2 Page 11 of 11

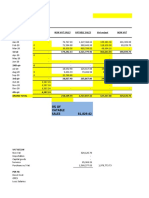

3:53PM

11/08/11

Accrual Basis

ASSETS

Ug1own OrkLLU.

BBDC0D00I

A of Septembr 30, 2011

CurrentAsset

Checking/Savings

Gm

CROWN BANK-1115963

Uptown Operating 0

Totl Checking/Saving

Other Current Asset

Prepaid Expense

Prepaid Wages

VC Due Frm

Inventory-NIABeveage

Inventory-Beer/ine

Inventory-Liquor

Inventory-Poulty

Inventory-Dairy

Inventory-Produce

Inventory-Other Meat

Inventory-Se

Inventory-Prepared Food

Inventory-OtherFood

Inventory-Bar Other

Deposit

Total Other Current Asset

Sep m, 11

14,00.00

-75,379.04

13,812.89

-7,566.15

6,296.57

2,403.40

15,417.54

22.00

17,665.87

6.924.61

650.63

777.60

590.25

3,278.34

730.59

315.22

14,909.40

7,065.56

1,791.56

78,839.14

Total Current Asset

Fixed Asset

BarRest Fixed Asset

Furiture

Totl Fixed Asset

Other Asset

Start Up Cost

Total Other Asset

TOTALASSETS

LIABILITIES EQUITY

Liabilities

Current Llablltles

Account Payable

Account Payable

Totl Account Payable

Other Current Liabiities

Gif LO

SalesTax

Food

Liquor

Sales Tax - Other

Totl Sales Tax

Leaehold Improvements

Loan- Misc.

Payroll Liabilit

Payroll Liabilities

Totl Othr Current Uablltles

Total Current Liabilities

31,272.99

22,397.92

2,995.91

25,393.83

444,652.72

444,652.72

V1,Jb.0

259,901.74

259,901.74

-1,305.99

279,908.20

242,781.48

-504,427.44

18,262.24

-5,814.00

29,366.67

99,089.92

10,000.00

-68,581.00

191,320.74

Page 1

Вам также может понравиться

- World Wide Funding and Investments Inc Andrei Gill Minnesota Filing 6713 ColfaxДокумент5 страницWorld Wide Funding and Investments Inc Andrei Gill Minnesota Filing 6713 ColfaxCamdenCanaryОценок пока нет

- Kenneth Jacqueline King Bankruptcy Adv Darlla GravdalДокумент14 страницKenneth Jacqueline King Bankruptcy Adv Darlla GravdalCamdenCanaryОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Advisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupДокумент24 страницыAdvisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupCamdenCanaryОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Petters Company Alan M Miller A M Aero Inc DismissalДокумент2 страницыPetters Company Alan M Miller A M Aero Inc DismissalCamdenCanaryОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- On Time Contractors Real Estate Division LLC Minnesota Filing 842 Cannon Way Victoria 651-235-8972Документ3 страницыOn Time Contractors Real Estate Division LLC Minnesota Filing 842 Cannon Way Victoria 651-235-8972CamdenCanaryОценок пока нет

- Kenneth King StipulationДокумент3 страницыKenneth King StipulationCamdenCanaryОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- PAVEL SAKURETS Notary Application 842 Cannon 651-235-8972Документ1 страницаPAVEL SAKURETS Notary Application 842 Cannon 651-235-8972CamdenCanaryОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Order Barring Andrei Gill BankruptcyДокумент1 страницаOrder Barring Andrei Gill BankruptcyCamdenCanaryОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Kenneth King Andrei Gill ExhibitsДокумент11 страницKenneth King Andrei Gill ExhibitsCamdenCanaryОценок пока нет

- Kenneth King Jacqueline King Ken King Personal Property ScheduleДокумент5 страницKenneth King Jacqueline King Ken King Personal Property ScheduleCamdenCanaryОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- MICHELLE VRIEZE - Michelle Koenig Minnesota Notary Application 1001 4th Place NW 507-421-8483Документ2 страницыMICHELLE VRIEZE - Michelle Koenig Minnesota Notary Application 1001 4th Place NW 507-421-8483CamdenCanaryОценок пока нет

- Answer and Affirmative Defenses Alan M Miller AM Aero Inc Tom Petters PonziДокумент18 страницAnswer and Affirmative Defenses Alan M Miller AM Aero Inc Tom Petters PonziCamdenCanaryОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- JAVAN INVESTMENTS LLC 2401 Lyndale Ave N Business Filing Andrei Gill Debora Gill Smith 763-443-7699Документ3 страницыJAVAN INVESTMENTS LLC 2401 Lyndale Ave N Business Filing Andrei Gill Debora Gill Smith 763-443-7699CamdenCanaryОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- My Dinh Lam Felony InformationДокумент6 страницMy Dinh Lam Felony InformationCamdenCanaryОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Kenneth Jacqueline King Bankruptcy Adv Darlla GravdalДокумент14 страницKenneth Jacqueline King Bankruptcy Adv Darlla GravdalCamdenCanaryОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- IGOR KOMISARCHIK 1425 Colorado Ave 309 Main ST 651-260-7890 952-938-0730 Minnesota Notary ApplicationДокумент2 страницыIGOR KOMISARCHIK 1425 Colorado Ave 309 Main ST 651-260-7890 952-938-0730 Minnesota Notary ApplicationCamdenCanaryОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Judgment Kenneth Roy King SR Jacqueline Marie KingДокумент1 страницаJudgment Kenneth Roy King SR Jacqueline Marie KingCamdenCanaryОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Kenneth King Discharge of DebtorsДокумент2 страницыKenneth King Discharge of DebtorsCamdenCanaryОценок пока нет

- ANDREY SOKUREC 1573 Fox Hunt Way 612-325-0542 Asokurec Minnesota Notary ApplicationДокумент3 страницыANDREY SOKUREC 1573 Fox Hunt Way 612-325-0542 Asokurec Minnesota Notary ApplicationCamdenCanaryОценок пока нет

- Andrei Gill Order Authorizing Rule 2004 ExaminationДокумент7 страницAndrei Gill Order Authorizing Rule 2004 ExaminationCamdenCanaryОценок пока нет

- Andrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012Документ71 страницаAndrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012CamdenCanaryОценок пока нет

- Affidavit Lourdes Rodriguez Bradley Loch Roberto Rodriguez IREP Risk AHR ConstructionДокумент1 страницаAffidavit Lourdes Rodriguez Bradley Loch Roberto Rodriguez IREP Risk AHR ConstructionCamdenCanaryОценок пока нет

- Andrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaДокумент22 страницыAndrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaCamdenCanaryОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ken King Bankruptcy Petition Kenneth Roy King 6713 ColfaxДокумент60 страницKen King Bankruptcy Petition Kenneth Roy King 6713 ColfaxCamdenCanaryОценок пока нет

- 2219 29th Ave N Purchase Agreement Gregg Karnis Steven MeldahlДокумент7 страниц2219 29th Ave N Purchase Agreement Gregg Karnis Steven MeldahlCamdenCanaryОценок пока нет

- Damascus Group LLC 185 Mccarrons Andrei Gill Afcmw Minnesota FilingДокумент3 страницыDamascus Group LLC 185 Mccarrons Andrei Gill Afcmw Minnesota FilingCamdenCanaryОценок пока нет

- First Equity Group LLC Business FilingДокумент3 страницыFirst Equity Group LLC Business FilingCamdenCanaryОценок пока нет

- Affidavit Lourdes Rodriguez Bradley Loch Roberto Rodriguez IREP Risk AHR ConstructionДокумент1 страницаAffidavit Lourdes Rodriguez Bradley Loch Roberto Rodriguez IREP Risk AHR ConstructionCamdenCanaryОценок пока нет

- Roberto Miguel Rodriguez Notary ApplicationДокумент4 страницыRoberto Miguel Rodriguez Notary ApplicationCamdenCanaryОценок пока нет

- USA V Dennis Christ Kevin Christ ComplaintДокумент19 страницUSA V Dennis Christ Kevin Christ ComplaintCamdenCanaryОценок пока нет

- Brand Equity HPДокумент32 страницыBrand Equity HPgakare_rakeshОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Limited Liability Partnership Act, 2008Документ13 страницLimited Liability Partnership Act, 2008Yogendra PoswalОценок пока нет

- To Take Into Account 2Документ12 страницTo Take Into Account 2Anii HurtadoОценок пока нет

- AFR 2020 VAT Reconciliation and Accounts Payable Aging ReportДокумент35 страницAFR 2020 VAT Reconciliation and Accounts Payable Aging ReportTristan John MagrareОценок пока нет

- Johor Corp 2008Документ209 страницJohor Corp 2008khairulkamarudinОценок пока нет

- FINAL KRA of Finance HeadДокумент3 страницыFINAL KRA of Finance HeadRuchita AngreОценок пока нет

- Hershey's Detailed Study and Competitor AnalysisДокумент87 страницHershey's Detailed Study and Competitor AnalysisAnkush SharmaОценок пока нет

- National Power Corporation Vs Provincial Government of BataanДокумент2 страницыNational Power Corporation Vs Provincial Government of BataanRachel LeachonОценок пока нет

- Budgeting CTRLДокумент9 страницBudgeting CTRLJoseph PamaongОценок пока нет

- Case StudyДокумент22 страницыCase StudyAbhishek SoniОценок пока нет

- Tushar Tybbi Project Sem 5Документ73 страницыTushar Tybbi Project Sem 5Omkar ChavanОценок пока нет

- (HUNTER WARFIELD INC) & (THE PNC FINANCIAL SERVICES GROUP) - UCC1 Financial Statement LIENДокумент7 страниц(HUNTER WARFIELD INC) & (THE PNC FINANCIAL SERVICES GROUP) - UCC1 Financial Statement LIENHakim-Aarifah Bey0% (1)

- SAP FI General Tcodes (Transaction Codes) (Financial Accounting)Документ9 страницSAP FI General Tcodes (Transaction Codes) (Financial Accounting)adipradanaОценок пока нет

- Procedure For The Context of The OrganizationДокумент3 страницыProcedure For The Context of The OrganizationSabari Raj100% (2)

- MIL HDBK 57 Bolt Identification MarkingsДокумент260 страницMIL HDBK 57 Bolt Identification MarkingsuqrdobesОценок пока нет

- Nasipit V NLRC SCRAДокумент20 страницNasipit V NLRC SCRARenz R.Оценок пока нет

- Ebook Cierre Fiscal y ContableДокумент125 страницEbook Cierre Fiscal y ContableAngel RejosОценок пока нет

- Request Ltr2Bank For OIDsДокумент2 страницыRequest Ltr2Bank For OIDsricetech100% (15)

- 85th SB Minutes, Jan 05,2022Документ3 страницы85th SB Minutes, Jan 05,2022LoLoY RadazaОценок пока нет

- FBM KLCI up 8.64 points as DRB-HICOM to exit ProtonДокумент33 страницыFBM KLCI up 8.64 points as DRB-HICOM to exit ProtonChan Keng ChunОценок пока нет

- Yamaha Corporation (13035676)Документ13 страницYamaha Corporation (13035676)NguyenZumОценок пока нет

- The Parmalat ScandalДокумент3 страницыThe Parmalat ScandalChristia Sandee SuanОценок пока нет

- Citi Portfolio CorpДокумент2 страницыCiti Portfolio CorpCarrieonicОценок пока нет

- EY CEO and CFO Partner For PerformanceДокумент37 страницEY CEO and CFO Partner For PerformanceDeepti AgarwalОценок пока нет

- Cairo University Chemical Engineering Exam Notes and Solutions 2002-2009Документ95 страницCairo University Chemical Engineering Exam Notes and Solutions 2002-2009fanus100% (1)

- What Really Happened To Lucent TechnologiesДокумент7 страницWhat Really Happened To Lucent TechnologiessteveОценок пока нет

- New Chemicals Projects in Andhra PradeshДокумент3 страницыNew Chemicals Projects in Andhra PradeshPradeep RajasekeranОценок пока нет

- Government Budgeting and Accounting ReportДокумент91 страницаGovernment Budgeting and Accounting ReportMurphy Red100% (1)

- Mifid Ii Quick Reference GuideДокумент5 страницMifid Ii Quick Reference GuideRanit BanerjeeОценок пока нет

- Quick Ref Guide: Booking Easyjet Through AmadeusДокумент21 страницаQuick Ref Guide: Booking Easyjet Through AmadeusAkinsanya Adeshina AdewaleОценок пока нет

- University of Chicago Press Fall 2009 Distributed TitlesОт EverandUniversity of Chicago Press Fall 2009 Distributed TitlesРейтинг: 1 из 5 звезд1/5 (1)