Академический Документы

Профессиональный Документы

Культура Документы

Flight International 130409-15

Загружено:

justinviktorАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Flight International 130409-15

Загружено:

justinviktorАвторское право:

Доступные форматы

FLIGHT

INTERNATIONAL

OVERHAUL VIEW

WE GET A FIX ON

NORTH AMERICAS

MRO OUTLOOK

MAINTENANCE P40

PARIS PROPOSAL

BA ponders possibility of

displaying its frst A380 at

Le Bourget, but A350 and

CSeries not expected 20

ABC NOT SO EASY

Former navy chief urges

Pentagon to consider

cutting F-35 variants

from three to two 21

FSTA

REACHING

FUEL SPEED

Next stage for the Voyagers as the UK

transforms its tanker/transport feet

ightglobal.com

3.30

9-15 APRIL 2013

YOUR VI SI ON TAKES FLI GHT.

Spirit AeroSystems.

Our body of work is large. And now, extra wide.

At Spirit, were proud to do our part by designing and building advanced, lightweight

components that will help the Airbus A350 XWB fulfill its amazing promise. Were fabricating

composite panels for the center fuselage frame section at our new facility built specifically

for this partnership. Were also supplying the front wing spar and fixed leading edge to

help create the lift that will take this cutting-edge aircraft far. And, not to mention, wide.

Visit us at spiritaero.com.

9-15 April 2013

|

Flight International

|

3 fightglobal.com

FLIGHT

INTERNATIONAL

VOLUME 183 NUMBER 5385 9-15 APRIL 2013

U

S

A

ir

F

o

r

c

e

,

E

m

b

r

a

e

r

Embraers Phenom 300 speeds to trio of records P26.

F-15s tted with y-by-wire to require recertication

campaign P23

FLIGHT

INTERNATIONAL

OVERHAUL VIEW

WE GET AFIXON

NORTHAMERICAS

MROOUTLOOK

MAINTENANCE P40

PARISPROPOSAL

BA ponders possibility of

displaying its frst A380 at

Le Bourget, but A350 and

CSeries not expected 20

ABCNOT SOEASY

Former navy chief urges

Pentagon to consider

cutting F-35 variants

fromthree to two 21

FSTA

REACHING

FUEL SPEED

Next stage for theVoyagers as the UK

transforms its tanker/transport feet

ighcgIebaI.cem

3.30

9-15 APRIL 2013

NEWS

THIS WEEK

8 Bristow prepares for UK SAR duties

9 South Korea weighs up rival fghters

10 SpaceX ramps up bid for reusability

12 Toulouse move brings EADS together

AIR TRANSPORT

14 Crew could have avoided Eva 747s

urgent descent.

Rescue fasco followed turboprop crash

at Rome

16 Storm scrambled Etihad A340 airspeed

data

18 PALs plan to pit A350 against 777X.

Gol 737s go-around and diversion

depletes tanks

19 Probe opens after Boeing 737-800

nearly stalls

20 British A380 could top Paris billing if new

types miss out.

Samoa passengers to pay by weight

NEWS FOCUS

21 Logic of F-35A questioned

DEFENCE

22 Jakarta deals fow for Airbus Military.

MBDA looks to go the distance with

Marte

23 Four bidders to do battle in Polish AJT

competition.

Bedek replaces centre wing box on Israeli

C-130

BUSINESS AVIATION

25 Eclipse 550 clear for assembly, test.

CRJ700s next test for Flying Colours

26 Worn-out gearbox grounded EC225s.

EBACE visitors to get frst look at Pilatus

PC-24

GENERAL AVIATION

29 Tecnam tags Aero Friedrichshafen for

Astore reveal

SPACEFLIGHT

31 NASA tightens security after lapses

BUSINESS

32 Mil and Kamov look to Africa

REGULARS

7 Comment

46 Straight & Level

48 Classied

51 Jobs

55 Working Week

52 JOB OF THE WEEK DELTA, aircraft

technicians, London Heathrow

COVER STORY

34 Fuel change A new role for the Voyager

as the UK proceeds with feet renewal

FEATURES

36 ABACE PREVIEW Wealth of

opportunities Shows popularity

highlights a sharpening appetite for

business jets in Asia

40 MRO Seeking synergies American

Airlines and US Airways must decide

how to join up maintenance operations

43 Out of the ashes The demise of a

Canadian institution, and what came next

PIC OF THE WEEK

YOUR PHOTOGRAPH HERE

AirSpace user Lloyd Horgan posted this shot

of an AgustaWestland WAH-64D Apache

whipping up a storm on Salisbury Plain.

Our latest World Air Forces directory lists

66 Apaches in the British Armys eet. Open

a gallery in Flightglobal.coms AirSpace

community for a chance to feature here

L

lo

y

d

H

g

a

lle

r

y

o

n

f

ig

h

t

g

lo

b

a

l.

c

o

m

/

A

ir

S

p

a

c

e

ightglobal.com/imageoftheday

R

ic

k

I

n

g

h

a

m

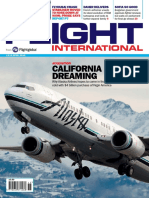

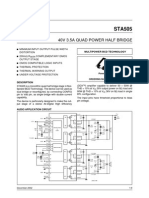

COVER IMAGE

Rick Ingham photographed

Royal Air Force Voyager

ZZ330 on approach to the

services Brize Norton air

transport base during

2012. The type is nearing

service approval for

air-to-air refuelling.

See Cover Story P34

NEXT WEEK UAVS SPECIAL

We assess what the future might hold for

Europes unmanned sector, and bring

programme updates on the Watchkeeper

and Neuron. Plus: a look at IAIs Butterfy

I

A

I

Dcwnlcad The Engine Directcry.

fightglcbal.ccm[CcmEngDirectcry

fightglobal.com

CONTENTS

THE WEEK ON THE WEB

ightglobal.com

For a full list of reader services, editorial

and advertising contacts see P47

EDITORIAL

+44 20 8652 3842

fight.international@fightglobal.com

DISPLAY ADVERTISING

+44 20 8652 3315

gillian.cumming@rbi.co.uk

CLASSIFIED ADVERTISING

+44 20 8652 4897

fight.classifed@fightglobal.com

RECRUITMENT ADVERTISING

+44 20 8652 4900

recruitment.services@rbi.co.uk

WEBMASTER

webmaster@fightglobal.com

SUBSCRIPTIONS

+44 1444 475 682

fightinternational.subs@qss-uk.com

REPRINTS

+44 20 8652 8612

reprints@rbi.co.uk

FLIGHT DAILY NEWS

+44 20 8652 3096

fightdailynews@fightglobal.com

Flightglobal reaches up to 1.3 million visitors from 220

countries viewing 7.1 million pages each month

BEHIND THE

HEADLINES

Vote at ightglobal.com/poll

Find all these items at ightglobal.com/wotw

QUESTION OF THE WEEK

53

%

21

%

26

%

Total votes: 1,478

This week, we ask: What should the Pentagons F-35 strategy be?

Stay the course Cancel the A Cancel the B or C Cancel

the entire programme

Expensive orbital white

elephant

Some uses as a

scientic lab

Technological wonder

that unites mankind

Last week, we asked for your thoughts on the International Space

Station was: You said:

HIGH FLIERS

The top ve stories for the week just gone:

1 Boeing confdent of returning 787 to service soon

2 Boeing looks beyond batteries on latest 787 test fight

3 Storm ice suspected in Etihad A340 cruise incident

4 A350 and CSeries unlikely to feature at Paris air show

5 Former USN chief suggests DoD should cancel F-35A

Our Image of the Day blog marked the 80th anniversary of

frst fight over Mount Everest. Lord Clydesdale and David

McIntyre rose above the worlds highest peak in two

Westland Wallace biplanes

(left). The pioneers would go

on to found Scottish Aviation,

bequeathing the strong

aviation hub that still exists

at Prestwick. The DEW

Line carried video from the

Lockheed Martin F-35Bs frst weapons-separation test

for the Raytheon AIM-120 AMRAAM air-to-air missile at NAS

Patuxent River, Maryland. The sortie was fown by US Navy

test pilot Lt Cdr Michael Burks on 26 March. And the Airline

Business blog noted that Aer Lingus chief Christoph Mueller

has so impressed the Irish government with his turn-

around skills that he has been appointed as chair of

state-owned postal service An Post at what has been

termed, ominously, a critical time for the organisation.

Political chaos may reign in

Rome, but respite could be

found in the astonishing, pano-

ramic view of the citys roofs and

monuments from a hotel on via

Vittorio Veneto, where MBDA

(P22) hosted an annual results

briefng attended by Luca

Peruzzi (below). The conference

provided an interesting over-

view on the industrial, govern-

mental and marketing

challenges laying ahead for the

international group, with a focus

on Italy and the programmes

which see the current and future

involvement of the Italian arm of

the group, says Peruzzi.

IN THIS ISSUE

Companies listed

Aero Vodochody ...........................................23

Airbus ....................... 8, 12, 14, 16, 18, 19, 20

Airbus Military ..............................................22

Air France ..............................................16, 19

Alenia Aermacchi .........................................23

Alitalia .........................................................14

Armavia .......................................................33

Aspen Avionics.............................................29

ATR ..............................................................14

Avcorp ...................................................25, 33

BAE Systems .........................................23, 25

Bharat Electronics .......................................... 8

Bigelow Aerospace .......................................31

Boeing ................ 8, 14, 18, 19, 20, 23, 25, 32

Bombardier .....................................20, 25, 26

Bristow Helicopters .................................. 8, 26

British Airways ..............................................20

Britten-Norman ............................................20

Cambodia Airlines ........................................18

Cambodia Angkor Air ....................................18

Cessna ..................................................25, 33

CHC Helicopter ............................................26

Cobham.......................................................29

Dirgantara Indonesia ...................................22

EADS .....................................................12, 33

Eclipse Aerospace ........................................25

EDAC Technologies .......................................33

Elbit Systems ...............................................33

Embraer .................................................25, 26

Etihad Airways ..............................................16

Eurocopter .........................................8, 26, 29

Eva Air .........................................................14

Evektor ........................................................29

Evergreen Apple Nigeria ...............................26

Finnair ........................................................... 8

Flying Colours ..............................................25

General Electric .....................................18, 20

Gol ..............................................................18

Grob Aircraft.................................................33

Hartzell ........................................................25

Hawaiian Airlines ........................................... 8

Hawker Beechcraft .......................................25

Hindustan Aeronautics .................................33

Honeywell ..............................................26, 33

Israel Aerospace Industries ..........................23

Jet Aviation ..................................................26

Korean Air ....................................................20

Lockheed Martin ................................9, 21, 23

Logicalis ......................................................33

London Executive Aviation ............................25

Lufthansa ....................................................20

Malaysia Airlines ..........................................20

MBDA ..........................................................22

NATS............................................................33

Norwegian ...................................................19

Philippine Airlines ........................................18

Pilatus ...................................................26, 32

Piper Aircraft ................................................29

Pipistrel .......................................................29

Pratt & Whitney ......................................25, 26

Qatar Airways ...............................................20

Raisbeck......................................................25

Rizon Jet ......................................................26

Robinson Helicopter ....................................29

Rolls-Royce ......................................18, 29, 33

Russian Helicopters .....................................23

Safran .........................................................33

Samoa Air ....................................................20

Selex ES ......................................................22

SpaceX ........................................................10

StandardAero ..............................................33

Tawazun Precision Industries ........................22

Tecnam ........................................................29

Travira Air .....................................................18

Williams International ..................................26

4

|

Flight International

|

9-15 April 2013

pw.utc.com/DependableServices

YOUR PRIORITIES

ARE OURS.

Dependable services. Customer-focused value.

EXPANDING HORIZONS

In the last fty years, only one new transparent plastic has

been approved by the FAA for aircraft windows. Ours.

At PPG, innovation for the aerospace industry goes beyond our advanced coatings

and sealants that reduce weight for better fuel efciency. Were launching a new

transparent plastic for aircraft windowsthe rst to be approved by the FAA in

50 years. Lightweight, craze- and re-resistant, OPTICOR advanced transparency

material can be formed into complex shapes while maintaining optical clarity.

Larger windows enhanced by our ALTEOS interactive window systems improve

passenger comfort and view. AEROCRON electrocoat primer reduces component

weight. And, our Customized Sealant Solutions simplify aircraft sealing while

reducing process time, waste and weight. Visit ppg.com to learn how PPG

innovation helps our aviation partners expand possibilities and exceed their

performance goals.

The PPG logo, Opticor, Alteos, and Bringing innovation to the surface. are trademarks of PPG Industries Ohio, Inc.

Aerocron is a trademark of PRC-DeSoto International, Inc.

PAINTS - COATINGS - OPTICAL PRODUCTS - SILICAS - GLASS - FIBRE GLASS

Bringing innovation to the surface.

www.baesystems.com/intellicabin

ENJOY THE FLIGHT

Introducing IntelliCabin the next generation cabin system designed to provide the ultimate

flying experience.

COMMENT

9-15 April 2013

|

Flight International

|

7 fightglobal.com

For analysis of the latest F-35

programme news, consult our

defence blog The DEW Line:

ightglobal.com/dewline See This Week P12

Steady as she goes, EADS

A

t the risk of understating the signicance of the

transformative governance overhaul that has been

formally instituted at EADS, now is a good time to ask:

what next?

As in any turnover of rules or leadership and EADS

has both, with a new board of directors, relatively new

chief executive and head of Airbus and, soon, new

head of Eurocopter the rst order of business has got

to be continuity. Even seasoned executives need to

learn the ropes in a new role.

Second, watch the A350. Heaven knows cadres of

management are living this programme day and night,

but the same was, and is, true for Boeings 787 project.

As A380 veterans know all too well, big programmes

have a way of smashing even best-laid plans.

Third, watch Eurocopter. Now is the time to rethink

all the assumptions, to make sure rivals are not quietly

threatening to outank this global market leader.

Fourth, wheel out the big brains and devise, within,

say, a year, a serious defence business strategy. The

Cassidian unit is not in crisis, but neither does it seem

good use of capital, which makes it sound rather like a

zombie division. Getting out may be an option.

EADS has a lot going for it. Tom Enders and his sen-

ior management are in control, protability is rising,

market trends are good and the technological under-

pinnings are solid. No disruptions, please.

See News Focus P21

Threes a crowd?

Power of suggestion

A former US Navy chiefs proposal that the Pentagon consider culling the F-35A was one from

left feld. But for reasons both practical and philosophical, it cannot be dismissed out of hand

T

he Lockheed Martin F-35 is set to become the main-

stay ghter for not only the US Department of

Defense, but also many US allies. However, costs are pro-

jected to be far greater than expected, at $1.1 trillion.

Former US Navy chief of naval operations Adm Gary

Roughead suggests that the Pentagon seriously consider

cancelling the US Air Forces F-35A model aircraft in

favour of the navys carrier-capable F-35C.

While on the surface such a plan might sound like it

borders on the insane, it should not be ruled out with-

out serious consideration.

The idea was briey examined by the DoD during the

Bush administration, but it never gained any serious

traction. Though there are some indications that analysis

is again under way, the DoD ofcially denies this.

The USAF and some foreign allies would ght to

their dying breath to save the F-35A. However, the fact

is that land-based forces can operate a naval aircraft

without any real difculty. A good precedent for this

was set by the McDonnell Douglas F-4 Phantom II,

which ably served with the navy, USAF and US Ma-

rine Corps, as well as numerous foreign allies.

Potentially, consolidating variants to the C model

could help reduce the F-35s life-cycle costs by sim-

plifying logistics and pilot and maintainer training.

Operationally, the F-35C, despite its comparatively

lower kinematic performance, has much better range

than other variants of the Joint Strike Fighter in-

Adopting the F-35A might

mean refuelling a four-ship

of ghters much faster

creasingly important for operations in the Pacic.

While a USAF tanker can only refuel one ghter at a

time using the ying-boom system, the F-35Cs hose-

and-drogue apparatus would enable the same tanker to

transfer fuel to multiple aircraft simultaneously.

Some will argue the boom system can ofoad fuel at

a rate of about 6,000lb (2,722kg) per minute, but ght-

ers cannot accept fuel at a rate of more than 3,000lb per

minute. Usually the actual rates are far slower. The na-

vys hose-and-drogue system, which is also used

around the world, can transfer fuel at rates of between

1,500lb and 2,000lb per minute. Thus, adopting the

F-35C might mean refuelling a four-ship of ghters

much faster than would be possible with the F-35A.

Moreover, USAF squadrons could potentially be

trained to operate from on board the navys carriers to

increase their basing exibility or to augment carrier air

wings as needed furthering the concept of seamless

integration that the Pentagons much-vaunted Air-Sea

Battle concept espouses.

THIS WEEK

fightglobal.com 8

|

Flight International

|

9-15 April 2013

For a round-up of our latest online news,

feature and multimedia content visit

ightglobal.com/wotw

ROTORCRAFT DOMINIC PERRY LONDON

Bristow prepares

for UK SAR duties

Contest winner confdent preparation for imminent interim

stint will ensure smooth transition to comprehensive role

Sikorsky S-92s will be used alongside AgustaWestland AW189s

AIRBUS TAKES EARLY LEAD IN DELIVERIES RACE

AIRCRAFT Airbus has taken an early lead in its bid to reclaim top

spot in the annual deliveries race, handing over 144 aircraft in the

frst quarter to edge out Boeing, which reached the end of March at

137. For the full year 2012, Boeing took top spot after nearly a dec-

ade in second place, with 601 handovers to Airbuss 588. On the

orders front, Boeing is yet to report Q1 fgures, but Airbus has surged

to a net 410 thanks to Lion Airs huge deal for 169 A320s and

A320neos, as well as 65 A321neos. Airbus fgures also list

Hawaiian Airlines order for 16 A321neos, and reveal the cancella-

tion of a single A350-900 destined for a private customer.

EUROCOPTER, TURBOMECA TO BUILD IN POLAND

TENDER In a bid to secure a zlotych 10 billion ($3.1 billion) contract

from Poland for 70 new multi-role helicopters, Eurocopter has signed

an industrial co-operation agreement with Turbomeca and Wojskowe

Zaklady Lotnicze No 1 (WZL-1) to establish two full assembly lines in

the country for the EC725 Caracal and its Makila 2 turboshaft en-

gines, along with a comprehensive in-country industrial work pack-

age including training and maintenance.

FOLLOW-ON FIGHTER WORK TO BHARAT ELECTRONICS

ELECTRONICS Indias state-owned Bharat Electronics has signed a

follow-on contact with Boeing to make subassemblies for the F/A-

18E/F Super Hornet including the ground power panel, helmet vehi-

cle interface stowage and switch assembly and cockpit power

console panels. Bharat also provides the identifcation friend-or-foe

integrators and Data Link II communications system for P-81 mari-

time surveillance aircraft acquired by the Indian navy.

USS ABRAHAM LINCOLN COMING IN FOR FUEL

NAVAL AVIATION The US Navy is awarding Huntington Ingalls a

$2.6 billion contract to refuel and overhaul the nuclear-powered air-

craft carrier USS Abraham Lincoln. Each of the services 100,000t

Nimitz-class carriers needs to be refuelled once every 25 years. The

work, which will be carried out at the USAs only nuclear-capable ship-

yard, in Newport News, Virginia, and completed by November 2016,

had been delayed by Congressional budget battles. It is not yet

known if the navys budget will allow it to award Ingalls a contract to

begin building the new Gerald Ford-class carrier USS John F Kennedy.

FINNAIR PICKS CARGOTEC EXECUTIVE AS NEW CHIEF

AIRLINES Finnair has named Pekka Vauramo, an executive from

handling company Cargotec, as its new chief, just after outgoing

boss Mika Vehvilainen moved to head the same frm. Vauramo is the

chief operating offcer of Cargotec division MacGregor, but has also

headed its Kalmarbusiness and served as Cargotecs deputy chief.

BAHRAIN APPEARS TO WIND DOWN MRO VENTURE

BUSINESS Bahrains maintenance, repair and overhaul venture Gulf

Technics appears to have been suspended after three turbulent

years of ambitious expansion plans that only led to a single support

contract with state carrier Gulf Air. Government sources have not

responded to calls for clarifcation, but a source familiar with the

project tells Flight International that Gulf Technics has collapsed.

The Bahraini governments Tamkeen funding programme says it is

placing a priority on the aviation sector training programmes it offers

as a result of graduates failing to fnd employment due to the liqui-

dation of Gulf Technics.

BRIEFING

B

ristow Helicopters is now

beginning a two-year work-

up period ahead of its gradual

transition to performing all the

UKs search and rescue activity

from 2015 following its victory

in the countrys Long SAR con-

test last month.

The company was awarded the

1.6 billion ($2.4 billion) deal on

26 March by the UK Department

for Transport and will run the

SAR operation for up to 10 years.

Crew training will take place at

a number of locations across the

country as the operator installs

simulators for the AgustaWest-

land AW189 and Sikorsky S-92 in

Aberdeen. Training aircraft will

be located in Stornoway and In-

verness. Additional lessons will

be delivered at its Bristow Acad-

emy in Gloucestershire, says

Simon Tye, UK SAR project man-

ager at Bristow.

Tye points out its work ahead of

the interim Gap SAR contract

due to commence this summer

from Sumburgh and Stornoway

will ensure it has the building

blocks in place to make a smooth

transition to the new contract.

One of the things we have had

to demonstrate is resilience in the

system we cant afford to go off-

line at any of the bases, he says.

Bristow picked the develop-

mental AW189 for the shorter-

range operations, says Tye, based

on successful experience with the

smaller AW139 in the SAR role.

The AW139 is a proven SAR

machine and we see the benets

of the lessons learned from that

being transferred to the new air-

craft, he says.

Additionally, it is the launch

customer for the type and will re-

ceive its rst example, congured

for oil and gas operations, in Sep-

tember this year allowing it to

gain valuable experience with the

new super-medium rotorcraft.

The rst SAR-roled AW189s will

follow in the rst half of 2014.

Its crewmen are working with

the airframer, which will produce

the helicopters at its Yeovil, UK fac-

tory, to develop a bespoke mission

management system for the rear of

the aircraft, designed to maximise

the available space.

Visit our dedicated section for

helicopter news and analysis at

ightglobal.com/helicopters

The AW139 is a

proven SAR machine

SIMON TYE

SAR project manager, Bristow

THIS WEEK

9-15 April 2013

|

Flight International

|

9 fightglobal.com

SpaceX ramps up

bid for reusability

THIS WEEK P10

POLITICS

Raptors arrival not to deter North

B

oeing and Lockheed Martin

look to be locked into battle

over a 60-ghter export sale to

South Korea, as the US Depart-

ment of Defense has formally no-

tied the US Congress of poten-

tial sales of the Boeing F-15SE

Silent Eagle and Lockheed Martin

F-35 Joint Strike Fighter.

The Euroghter Typhoon is

also up for the F-X III ghter com-

petition, but is regarded by ana-

lysts as an outside contender.

For the potential F-35 sale, the

Defense Security Cooperation

Agency (DSCA) says that South

Korea could order 60 convention-

al A-model aircraft and associat-

ed support equipment for $10.8

billion. There would also be pro-

visions for spares, including nine

additional Pratt & Whitney F135

afterburning turbofans. The pack-

age would also encompass train-

ing including simulators.

Lockheed Martin says it is

pleased the Congressional notica-

tion process is under way, but notes

that competing bids are still being

evaluated by South Korea and price

discussions are ongoing.

Boeings F-15SE Silent Eagle

offering is a somewhat more com-

EXPORTS DAVE MAJUMDAR WASHINGTON DC

South Korea weighs up rival ghters

Eurofghter Typhoon an outsider as US DoD notifes Congress of potential sales of Boeing F-15SE and Lockheed F-35

Seoul is looking to buy 60 new jets to add to its existing fleet of F-15K Slam Eagles

tion of their bid would cost. In a

written statement, Boeing adds:

We are condent our Silent

Eagle offering is best suited to ad-

dress F-X requirements.

While he does not rule out the

possibility that South Korea will

opt for the Typhoon, Raymond

Jaworowski, an analyst with Fore-

cast International, says the con-

test will most like come down to

a battle between the F-35 and the

Silent Eagle.

The F-15 and the F-35 are the

frontrunners, he says. South

Korea has previously bought US

ghter aircraft, and it seems likely

thats the way theyll go for this

buy. In the Silent Eagles favour

is the fact that South Korea al-

ready has the older F-15K Slam

Eagle in service. The commonal-

ity factor will come into play,

Jaworowski says. On the other

hand, the F-35 is more and more

becoming the dominant ghter

on the market.

Other factors that play in the

F-35s favour are the fact that

Japan has already ordered the

stealthy fth-generation jet, and

growing threats in the region.

But given the state of the

South Korean tender, I think at

this point its too early to predict

between the F-35 and the F-15,

Jaworowski says.

See Defence P21

plicated bid, because it is a hybrid

of a direct commercial sale and

government-to-government US

foreign military sale (FMS). As

such, the DSCA notication to

Congress is only for certain equip-

ment that would have to be sold

to South Korea to support the

Silent Eagle sale.

Equipment that would be sold

under the auspices of the US

government FMS programme in-

clude 60 Raytheon-built active

electronically scanned array

radar radars but it is not speci-

ed if those are APG-63 (V)3 or

APG-82 sets.

Additionally, the F-15SE sale

would include 60 digital electron-

ic warfare systems, 60 Lockheed

AN/AAQ-33 Sniper targeting

pods, 60 Lockheed AN/AAS-42

infrared search and track systems

and other ancillary hardware. The

estimated cost of the FMS portion

of the sale would be $2.41 billion,

according to the DSCA.

We do feel we have the lower-

cost, better-value bid here, a

Boeing ofcial says but the

company did not say how much

the direct commercial sale por-

For commentary on defence

aviation news from Asia, visit

ightglobal.com/asianskies

B

o

e

in

g

R

e

x

F

e

a

t

u

r

e

s

A flyover by B-2

stealth bombers

enraged North Korea

The US Air Force has deployed a pair

Lockheed Martin F-22 Raptors to

South Korea as part of the bilateral

Foal Eagle exercise.

However, says the US Department

of Defense, the stealthy ffth-genera-

tion air superiority fghters are sitting

on static display at a US air base

and are not present in South Korea

in order to deter North Korea as has

been widely reported but, rather, to

provide South Korean senior leaders

with an orientation to the aircraft.

The two Raptors, of the Viriginia-

based 94th Fighter Squadron, which

is on a regularly scheduled rotation

to Kadena air base in Japan, arrived

in Korea on 31 March.

Even by its standards, the nucle-

ar-armed Norths rhetorical re-

sponse to the annual joint exercises

has been extraordinarily bellicose.

Of the F-22 deployment, the Norths

Korean Central News agency said

US imperialist warmongers [are]

ceaselessly introducing lots of nu-

clear war hardware into south

Korea. A fyover by B-2 stealth

bombers (pictured) brought this re-

ponse: A nuclear war has turned

out to be an established one on the

Korean Peninsula.

Though outside observers ques-

tion North Koreas ability to deliver

nuclear weapons, KCNA added:

The US nuclear umbrella will never

help protect the puppet group as

it will prove ineffective in face of

the powerful nuclear strikes of

the DPRK.

THIS WEEK

fightglobal.com 10

|

Flight International

|

9-15 April 2013

For a round-up of our latest online news,

feature and multimedia content visit

ightglobal.com/wotw

E

lon Musk, SpaceXs chief ex-

ecutive and chief technolo-

gist, has detailed the next steps in

his bid to open an age of full and

frequent rocket reusability, start-

ing with an effort to recover the

used Falcon 9 core stage on its

next ight. He also released de-

tails on a new, reusable version of

the crewed Dragon capsule.

The next launch of Falcon 9 is

the rst ight of a substantial up-

grade to the rocket, called version

1.1 (v1.1), which incorporates

major changes to the engines and

fuel tanks.

The rst stage will continue

in a ballistic arc and execute a

velocity-reduction burn before

hitting the atmosphere just to

lessen the impact, says Musk.

And then right before splash-

down of the stage its going to

light the engine again.

Musk stressed that he does not

expect success on the rst few at-

tempts, but that in the middle of

next year the company hopes to

land the core stage back at its

launch pad. SpaceX is currently

testing the Grasshopper, a Falcon

9 engine and tank assembly that

takes off and lands vertically, but

testing has not advanced to the

point where it resembles a real-

world launch.

In addition, Musk announced

a substantial upgrade of the

Dragon crew capsule, dubbed the

Dragon v.2, especially outtted

for propulsive landings.

The new Dragon, which Musk

says he hopes to formally unveil

later in 2013, will relocate Dragons

thrusters from the bottom of the

capsule to the sides, and have re-

tractable landing struts.

All capsules built to date, in-

cluding current versions of Dragon,

have landed using parachutes to

slow their velocities. A propulsive-

landing capsule could greatly less-

en the structural stresses of land-

ing, making reusability easier.

Musk acknowledges the chal-

lenge of reusability: just 2-3% of a

rockets mass reaches orbit, and

adding structural robustness and

landing gear will add another

2-3%, so he will need every

weight-saving trick in the book

to orbit a useful payload.

T

he US Army is soliciting tech-

nology concepts for a cargo

pocket unmanned air vehicle

(UAV) capable of providing

around the corner tactical intel-

ligence. The solicitation requires

only that concepts t within cer-

tain size, weight and power re-

quirements, and be capable of

station-keeping hovering in-

doors and outside.

The US Army currently has no

such technology deployed among

eld troops. British soldiers in

Afghanistan have recently been

issued with the Prox Dynamics

Black Hornet, a pocket-sized rota-

ry-wing UAV, which they have

operated with rave reviews.

Similar concepts from US com-

panies have included everything

from a miniature quadrotor to a

live beetle controlled via electric

brain stimulation.

The army did not immediately

respond to inquiries.

FACILITIES

New Boeing delivery centre opens

Boeing has expanded its Everett handover facilities with the opening of

a new delivery centre, which it describes as the home of deliveries for

the 747-8, 767, 777 and 787.

The 180,000ft

2

(16,700m

2

) facility has three times the offce, confer-

ence and delivery operations space as the old delivery centre and is

designed to increase operational effciency.

B

o

e

in

g

UNMANNED SYSTEMS ZACH ROSENBERG WASHINGTON DC

US Army sends out call

for nano-UAV concepts

ROCKETS ZACH ROSENBERG WASHINGTON DC

SpaceX ramps up bid for reusability

Musk also reveals Dragon capsule concept as he details plans to soften Falcon 9 core stages return to terra frma

The Grasshopper test vehicle

is built around a Falcon 9 core

Access analysis of the latest

news from the space sector at

ightglobal.com/hyperbola

The Prox Dynamics Black Hornet is being used by UK soldiers

A

n

g

u

s

B

a

t

e

y

The rst stage will

execute a velocity-

reduction burn

before hitting the

atmosphere

ELON MUSK

Chief executive and technologist, SpaceX

S

p

a

c

e

X

Our worldwide Total Component Support TCS

for your Boeing 787. The success of an aircrafts daily operations

depends on awless component support when needed. With decades of experience spanning hundreds of aircraft,

Lufthansa Techniks component team has successfully established an optimum supply process for 787 operators.

Wherever you need us, we are happy to be of service.

Lufthansa Technik AG, Marketing & Sales

marketing.sales@lht.dlh.de

www.lufthansa-technik.com/787

Call us: +49-40-5070-5553

More mobility for the world

Around the clock.

No matter what.

Always in good hands:

Japan Airlines and now

Ethiopian Airlines trust

in our Boeing 787 Total

Component Support - TCS

.

THIS WEEK

fightglobal.com 12

|

Flight International

|

9-15 April 2013

For a round-up of our latest online news,

feature and multimedia content visit

ightglobal.com/wotw

E

ADS chief executive Tom

Enders has consolidated his

grip on the Airbus parent with the

formal creation of a single opera-

tional headquarters in Toulouse, at

the expense of Munich, as part of a

new governance structure that

dramatically reduces the share-

holdings, and inuence, of the

French and German governments.

Enders, who took over last

summer on Louis Galloiss retire-

ment, has long eyed Toulouse as a

single corporate headquarters. In

doing so he sought to sweep away

the last vestiges of a system of

equally shared management dic-

tated by the Franco-German po-

litical deal that created EADS a

decade ago from national aero-

space champions. The company

had already ended the practice of

appointing French and German

co-management; Enders had been

co-chief executive with Gallois

until 2007, when he stepped

down to lead only Airbus.

When the headquarters is fully

operational on 1 September, some

116 jobs currently based in Paris

and 75 in Munich will have been

transferred to Toulouse, which

will host some 500 positions, in-

cluding the integrated functions

of EADS and Airbus human re-

sources and nance, as well as

other key steering functions. The

group will keep around 250 serv-

ice and support functions in Paris

and more than 300 in Munich.

Enders has had a tumultuous

nine months at the helm of EADS.

His preference for Toulouse was

made clear early on in his tenure.

Apart from the obvious opera-

tional efciencies of focusing sen-

ior management in the main loca-

tion of the dominant Airbus

division, Toulouse was seen as a

politic choice to ensure Paris re-

mained comfortable with the

company being led by two Ger-

mans, himself and chief nance

ofcer Harald Wilhelm. Previ-

ously, as with Gallois and his -

nance chief Hans Peter Ring,

those roles were been split be-

tween the two nationalities.

But a bold proposal to resolve

EADSs weak position in military

aerospace by merging with the

UKs BAE Systems was rebuffed

by Berlin. German chancellor

Angela Merkel is believed to have

personally shot down the idea.

Far from being weakened by the

failure of a major initiative, Enders

turned the situation to advantage

by driving for a new governance

deal, agreed in December and for-

mally approved, along with a new

board, on 27 March. Now, the di-

rect and proxy shareholdings of the

French, German and Spanish states

are being cut from nearly half to

less than 30%, and no shareholder

can overrule management.

EADSs new board has ap-

proved a 3.75 billion ($4.8 bil-

lion) buy-back and retirement of

15% of the groups shares. That

move, supported by a cash pile

that at end-2012 stood at 12.3 bil-

lion, should help to maintain a

steady share price as German

proxy holder Daimler and French

counterpart Lagardre sell, possi-

bly on the open market.

STRATEGY DAN THISDELL LONDON

Toulouse move brings EADS together

France embraces consolidated headquarters as German chiefs clear away remnants of shared management structure

Dominant division Airbus is already based in Toulouse

A

ir

b

u

s

(+1) 818 678 6555 ontic.com

Production, Spares and MRO for

Business, Commercial and Military Aircraft

OEM partners include Hamilton Sundstrand, Honeywell, GE Aviation, Goodrich, Woodward, Parker, Eaton, and many more.

Under license or acquisition, Ontic supports your

customers by providing OEM-pedigreed product

for as long as there is a need.

Value for the OEM. Value for the customer.

Avionics, Electronics, Hydraulics, Fuel, Electromechanical, Measurement/Control, Heat Transfer, Power, Major Systems

Yours.

We took the direct approach to finding out what you want in Pratt & Whitney service. We asked.

And heres what you said: Drive down costs without compromising time on wing. Provide

innovative repairs when theyre the best alternative to replacement. Offer a broad portfolio of

services and make them easy to access. Just so were straight your priorities are ours. Learn

more about the Pratt & Whitney service you asked for, at pw.utc.com/DependableServices.

Providing dependable services and customer-focused value.

Dependable Services

AIR TRANSPORT

fightglobal.com 14

|

Flight International

|

9-15 April 2013

Check out our collection of online dynamic

aircraft profles for the latest news, images

and information on civil and military

programmes at ightglobal.com/proles

E

va Air has reinforced training

to enhance its ight crews

awareness and understanding of

cabin altitude anomalies after one

of its aircraft made an emergency

landing last year when the cabin

failed to pressurise properly.

The Boeing 747-400 (B-16411)

was operating on the Taipei Taoy-

uan-Shanghai Pudong route

when the incident happened on

25 March 2012.

The aircraft had taken off at

10:44 and during the climb, it en-

countered a left outlet valve mal-

function and abnormal cabin alti-

tude, Taiwans Aviation Safety

Council says.

The councils ndings show that

the cabin pressure control systems

left outlet valve had failed, result-

ing in it being partially closed at a

nine oclock position. The position

of the valve prevented the aircraft

from pressurising normally and re-

sulted in high cabin altitude.

The continuous leaking of

cabin pressure led the cabin alti-

tude warning to sound when the

aircraft was at 20,800ft (6,340m).

Statements from the ight crew

and data from the cockpit voice re-

corder showed the crew did not

recognise any abnormality until

the cabin altitude was at 8,600ft.

When they found out, the cap-

tain requested for the aircraft to

level to 20,000ft. The pilots per-

formed an outow valve proce-

dure, but the cabin altitude con-

tinued to rise above 10,000ft,

causing a warning to sound.

The captain then declared a

Mayday and initiated an emer-

gency descent, taking over as the

ying pilot. Oxygen masks were

also deployed.

However, an inquiry showed

that the cabin altitude was actu-

ally recovering after the rst of-

cer manually closed the outow

valve, and that the crew failed to

recognise that the cabin altitude

was controllable.

Simulation ights conducted

by the Civil Aeronautics Admin-

istration showed that emergency

descent could be avoided if the

ight crew had applied the

[quick-reference handbook] pro-

cedure correctly.

The safety council reviewed

the carriers training syllabus and

found that most of its training for

emergency descent involved

rapid decompression. It has

since asked Eva to adjust the syl-

labus to enhance its crews aware-

ness and understanding of cabin

altitude anomalies.

I

talian investigators have dis-

closed that emergency vehicles

did not arrive at the scene of an

accident involving an Alitalia

ATR 72 landing in Rome until

10min after the crash alarm.

The aircraft, operated by Ro-

manias Carpatair, landed on

Rome Fiumicinos runway 16L

but veered off, sustaining sub-

stantial damage.

It touched down 567m (1,860ft)

from the threshold but bounced

three times before the nose-gear

as well as the main gear col-

lapsed, says Italian investigation

authority ANSV.

The aircraft slid on its fuselage

for another 500m and spun nearly

180, coming to rest 1,780m from

the threshold and 30m from the

right-hand edge of the runway.

ANSV says the crash site was

almost directly opposite the re

station just 400m away. While

the accident occurred at night,

visibility at the time was more

than 10km.

But although the control tower

activated an alarm less than 50s

after the accident, emergency ve-

hicles followed a circuitous route

to the site, arriving almost 10min

later by which time all the oc-

cupants had evacuated them-

selves from the wreckage.

After emerging from the re

station, emergency personnel had

queried the location of the air-

craft, and the tower responded

that the crash site was near link

taxiway DE.

But the vehicles drove along

the main taxiway D, parallel to

the runway, almost to the far end,

before backtracking along the

runway itself.

Ground-track surveillance in-

dicates that the vehicles then

drove past the crash site, travel-

ling 700m beyond, before turning

around and arriving.

ANSV says the evidence sug-

gests the re brigade did not

seem to have full knowledge of

the position of the taxiway.

But it also points out that the

tower did not transmit a grid-

map reference, which would

have positively identied the

crash location.

There was no re but 24 of the

50 on board ight AZ1670 from

Pisa were transported to medical

facilities outside the airport after

the 2 February accident.

ANSV is still investigating the

cause of the crash. But it has is-

sued safety recommendations

pointing out that re and rescue

response times should be 2min

for the runway and no more than

3min for any other area.

It had previously identied,

and highlighted, similar prob-

lems with the time to locate air-

craft wreckage, after the crash of

an Airbus A319 at Palermo in

September 2010.

ROME FIUMICINO CRASH RESPONSE

Flightglobal

19:32:33 Flight AZ1670 comes to rest

19:33:22 Tower activates crash alarm

19:35:22 Rescue vehicles deploy from fre station

19:43:02 Rescue teams arrive at crash site

1

2

3

4

Runway 16L

Taxiway D

1

2

4

3

Link taxiway DE

INVESTIGATION MAVIS TOH SINGAPORE

Crew could have

avoided Eva 747s

urgent descent

Taiwanese inquiry fnds failure to recognise cabin altitudes

recovery from pressure problem led to unnecessary Mayday

Oxygen masks were deployed on board the Shanghai-bound jet

c

o

m

m

e

r

c

ia

l

a

v

ia

t

io

n

g

a

lle

r

y

o

n

f

ig

h

t

g

lo

b

a

l.

c

o

m

/

A

ir

S

p

a

c

e

OPERATIONS DAVID KAMINSKI-MORROW LONDON

Rescue fasco followed

turboprop crash at Rome

ANSV points out the

tower did not transmit

a grid-map reference,

which would have

positively identied

the crash location

our mission's success depends on geIIing Ihe inIormaIion you need, when

and how you need iI. kockwell Collins provides smarI new ways Io deliver IhaI

inIormaIion IasIer, easier and more reliably. Like inIuiIive, conIexI-sensiIive

avionics Ior enhanced awareness. Read-up displays wiIh synIheIic vision Ior

eyes-Iorward Ilying Irom IakeoII Io landing. And inIegraIed IlighI and cabin

inIormaIion sysIems IhaI keep you up-Io-daIe and connecIed. All Iocused on

providing you Ihe righI inIormaIion aI Ihe righI Iime.

Avionics systems

Cabin systems

Flight information solutions

Simulation and training

Life-cycle service and support

rockwellcollins.com]righIinIo

The right

information.

Right now.

20l2 kockwell Collins. All righLs reserved.

AIR TRANSPORT

fightglobal.com 16

|

Flight International

|

9-15 April 2013

Check out our collection of online dynamic

aircraft profles for the latest news, images

and information on civil and military

programmes at ightglobal.com/proles

P

ilots of an Etihad Airways

Airbus A340-600 diverted to

Singapore after a sudden en-

counter with turbulent weather

during cruise generated unrelia-

ble airspeed data and left the jet

unable to maintain altitude sepa-

ration requirements.

While en route to Melbourne at

35,000ft, and approaching the

PIPOV waypoint over the Indian

Ocean, the returns from the air-

crafts weather radar which had

no auto-tilt function suddenly

intensied to indicate surround-

ing convective weather.

Airspeed on the captains pri-

mary ight display rapidly

dropped from 283kt (524km/h) to

77kt before uctuating, and the

standby instrument recorded a

fall from 280kt to 142kt. The rst

ofcers reading stayed stable.

United Arab Emirates investi-

gators from the General Civil Avi-

ation Authority determined that

the autopilot and autothrottle, as

well as the ight directors, disen-

gaged and the A340 switched to

alternate ight-control law a

mode in which angle-of-attack

protection is lost.

The preliminary inquiry says

that the aircraft had started to de-

part from its altitude after the au-

topilot disengaged, performing an

inadvertent climb which took

it 832ft above its assigned

35,000ft cruise level.

Within about 20s, the airspeed

indications recovered and the jet

reverted to normal law. But about

a minute after the initial distur-

bance began, the airspeed began

uctuating again. This second

disturbance, lasting about 44s,

again caused the A340 to drop

into alternate law and discon-

nected the autothrust.

Since the rst ofcers instru-

ments appeared to be functioning

correctly, the captain designated

him as the ying pilot. The rst

ofcer returned the aircraft to its

assigned altitude.

Although the airspeed indica-

tions stabilised, and the auto-

thrust was re-engaged, the crew

could not bring the autopilot back

online, and the rst ofcer con-

tinued to y the jet manually. The

A340 remained in alternate law

for the rest of the ight.

The crew transmitted that the

aircraft (A6-EHF) could not main-

tain altitude owing to the jets

performance and the turbulence,

and that it had lost the capability

to operate in reduced vertical

separation minima airspace.

It subsequently descended to

conventional airspace at 29,000ft

and diverted to Singapore. None of

the 295 occupants was injured.

While the inquiry into the Etihad

A340-600 incident highlights that

icing is notably a cause of unreliable

airspeed indications at high altitude,

it has yet to establish conclusions

about the event.

But the circumstances bear a

similarity to those preceding the Air

France fight AF447 accident in June

2009, when an A330 cruising at

35,000ft (10,700m) few into a

storm cell, resulting in the icing of its

pitot system.

The General Civil Aviation

Authority says that dispatch docu-

mentation provided to the Etihad

crew included charts indicating an

isolated embedded cumulonimbus

cloud up to 45,000ft in the area of

the incident.

Analysis showed that the A340s

weather radar, set on manual tilt,

showed almost no refectivity be-

fore the turbulence started to in-

crease. The radar returns then

sharply intensifed.

An incorrect tilt may lead [the

radar] to only scan the upper, less

refective, part of a cell, the inquiry

notes. As a consequence, a cell

may not be detected or may be

underestimated.

Use of weather radar to avoid

storm-cell penetration emerged as

an issue in the AF447 investigation.

Icing led to airspeed fuctuations

and switching to alternate control

law, and the crews response result-

ed in an advertent climb and high-

altitude stall.

As in the case of the Air France

incident, three pilots one of whom

had returned to the cockpit after a

rest period worked to resolve the

Etihad situation.

Despite resetting all the fight-

control and fight-guidance computers,

as well as other systems, by using

quick-reference handbook procedures,

the pilots were not able to re-engage

either of the two autopilots.

OPERATIONS

Icing suspected as circumstances parallel AF447 event

SAFETY DAVID KAMINSKI-MORROW LONDON

Storm scrambled A340 airspeed data

Investigators examine use of weather radar after unreliable indications and control-law changes led to Singapore diversion

Pilots of the Etihad aircraft were unable to restore the autopilot

J

o

s

e

p

h

H

o

-w

in

g

C

h

e

u

n

g

g

a

lle

r

y

o

n

f

ig

h

t

g

lo

b

a

l.

c

o

m

/

A

ir

S

p

a

c

e

Passenger Convenience Quicker Aircraft Turns

737NG Stowage Bin

www.facebook.com/komymirror

info@komy.co.jp www.komy.com

.

Wide feld of view with fat surface

www.boeing.com/boeingedge/materialservices

Genuine Boeing parts.

When you order genuine Boeing parts, you get the same OEM parts that are delivered on a new Boeing airplane. Parts

delivered with complete certication, built to the highest production standards and backed by a warranty of up to four years.

The quality and support you get with genuine Boeing parts saves time and money and delivers what nothing else can:

total condence.

AIR TRANSPORT

fightglobal.com 18

|

Flight International

|

9-15 April 2013

Check out our collection of online dynamic

aircraft profles for the latest news, images

and information on civil and military

programmes at ightglobal.com/proles

P

hilippine Airlines is studying

the proposed Boeing 777X as

well as the Airbus A350 as part of

its reeeting plans, with the car-

rier looking at 10-20 of either air-

craft type.

Last year the ag carrier inked

orders with Airbus for 34 A321s,

10 A321neos and 20 heavier-

weight A330-300s. It had previ-

ously said that it aimed to pur-

chase 100 new aircraft and retire

its older and uneconomical wide-

bodies to compete more effective-

ly in the long-haul market.

PAL is evaluating the 777X

versus the A350, president

Ramon Ang conrms to Flight In-

ternational, but declines to give

further details.

Boeing is still rening the de-

sign and business case for the

777X before requesting authority

from the companys board to

launch the programme.

Judging by the development

schedule of the General Electric

GE9X, the exclusive powerplant

Boeing has chosen for the 777X,

the aircraft will probably enter

service only after mid-2019.

PAL has not indicated which

variant of the A350 is being con-

sidered but Boeing views the

A350-1000 as competition to fu-

ture 777 developments. The

A350-1000, powered exclusively

by Rolls-Royce Trent XWB en-

gines, is intended to enter service

in 2017.

FLEET MAVIS TOH SINGAPORE

PALs plan to pit A350 against 777X

Filipino carrier to examine new widebodies from both Airbus and Boeing as focus switches from short to long haul

A

p

is

it

J

g

a

lle

r

y

o

n

f

ig

h

t

g

lo

b

a

l.

c

o

m

/

A

ir

s

p

a

c

e

Ageing A340-300s ply some of the Asia-Pacific carriers routes

START-UP

Pact to create Cambodian operator

Philippine Airlines has agreed to set

up a Cambodian joint-venture carrier

with Cambodian conglomerate The

Royal Group.

The agreement was signed by

Philippine Airlines president

Ramon Ang and Royal Group chair-

man Kith Meng in Phnom Penh on

2 April.

A source close to the discus-

sions says PAL will likely take a

49% stake in the new carrier,

Cambodia Airlines, while its partner

will hold 51%. It will operate both

domestic and regional routes, prob-

ably with Cambodian-registered

Airbus A321s, although it is unclear

when it will begin operations.

San Miguel, which holds a 49%

stake in PAL, declines to comment.

Cambodia Airlines will compete

with fag carrier and A321 operator

Cambodia Angkor Air, which is ma-

jority owned by the local govern-

ment. Vietnam Airlines holds 49%.

Several airlines have started up

in Cambodia over the years, only to

cease due to mounting losses.

B

razilian investigators are prob-

ing an emergency landing by

a Gol Boeing 737-700 after which

the aircraft was found to have less

than 600kg (1,320lb) of fuel left.

The budget airlines crew de-

clared an emergency following

two go-arounds while attempting

to land at Imperatriz, in darkness,

on 5 February.

In a report citing information

from Brazilian investigation au-

thority CENIPA, the US National

Transportation Safety Board says

the crew had executed a go-

around during the initial attempt

to land as a result of an unstabi-

lised approach.

The crew then performed an-

other go-around on the second ap-

proach because fog was obscuring

the runway, the NTSB says.

Weather data appears to indicate

the presence of thunderstorm ac-

tivity but good visibility.

This second missed approach

was followed by the declaration of

an emergency due to low fuel.

Following a diversion to Sao

Luis, some 260nm (480km) to the

north, the aircraft (PR-VBI) land-

ed uneventfully. The NTSB states

that after the aircrafts CFM Inter-

national CFM56 engines were

shut down inspectors discovered

just 550kg of fuel remaining. The

US agency is assisting in the

CENIPA-led investigation.

None of the 52 passengers was

injured, and the aircraft was not

damaged, says the NTSB.

Gol 737s go-around and diversion depletes tanks

INVESTIGATION GHIM-LAY YEO WASHINGTON DC

J

o

e

G

W

a

lk

e

r

After two missed landings at Imperatriz, the Brazilian carriers crew opted to fly instead to Sao Luis

fightglobal.com

AIR TRANSPORT

SAFETY

Protection activated on Marseille A320

French investigators have said the

stall-protection system activated on an

Air France Airbus A320 during the fnal

stages of an approach to Marseille.

The aircraft had been operating a

domestic service from Paris Charles

de Gaulle on 11 March, says the

French investigation authority BEA.

Surveillance data indicates that

the aircraft (F-HBNE) started de-

scending towards Marseille from the

northwest as it passed Clermont-

Ferrand at about 14:00 local time.

BEA says it was performing a visual

approach to runway 31L requiring

the aircraft to pass the airport and

turn back and that the incident oc-

curred as it made its fnal turn.

High angle-of-attack protection

activated, says the BEA in a bulletin,

without further detail on the circum-

stances. The aircraft descended to a

minimum height of 700ft (210m).

Meteorological data from the time

of the incident, around 14:30, con-

frms good visibility and winds of 9kt

(17km/h) from the west.

BEA says the crew executed a go-

around before performing another

visual approach and landing. None of

the A320s occupants was injured.

Marseille has two parallel run-

ways, of which 31L is the shorter at

2,370m (7,776ft).

N

orwegian investigators have

opened an inquiry into a

near-stall incident involving a

Boeing 737-800 on approach.

The aircraft, operated by low-

cost carrier Norwegian, had been

conducting a domestic Finnish

service from Helsinki to Kittila.

Norways investigation author-

ity SHT says ight DY5630 had

been established on the instru-

ment landing system approach to

runway 34.

But as the aircraft descended

through 3,250ft (990m), with its

autopilot engaged, it began an

unintentional steep climb under

full engine power, SHT says.

The aircrafts trailing-edge de-

vices had been congured in the

aps 5 position.

SHT says the aircraft climbed

1,500ft but adds that the airspeed

bled away. The aircraft came

close to a stall, it says, although

it does not indicate whether any

alarms or protections activated.

However, the pilots managed to

regain control of the aircraft.

It landed safety at Kittila and

subsequent test ights of the twin-

jet (LN-DYM), which had been de-

livered new to Norwegian in 2011,

did not indicate any problems.

Weather conditions at Kittila on

the day indicate good visibility

and temperatures around -20C.

SHT has classied the 26 De-

cember 2012 incident as a seri-

ous event. It has obtained ight-

data recordings and opened a

probe, in co-operation with Boe-

ing and the US National Trans-

portation Safety Board.

INQUIRY DAVID KAMINSKI-MORROW LONDON

Probe opens after

737 nearly stalls

Investigators examine sudden climb and loss of airspeed as

Norwegian-operated twinjet was descending towards Kittila

M

a

r

t

in

N

e

e

d

h

a

m

Pilots managed to regain control of the aircraft and land safely

AIR TRANSPORT

fightglobal.com 20

|

Flight International

|

9-15 April 2013

Check out our collection of online dynamic

aircraft profles for the latest news, images

and information on civil and military

programmes at ightglobal.com/proles

P

acic regional carrier Samoa

Air is introducing a fare

structure based on the individual

weight of its passengers and their

baggage.

Serving a network that in-

cludes Tonga and American

Samoa, the carrier uses a eet of

small aircraft, including the Brit-

ten-Norman BN2 Islander. This

means the weight of passengers is

a critical factor in its operations.

Passengers booking with the

carrier are asked to provide an es-

timated weight, although Samoa

Air says that they will be re-

weighed at the airport. The fare is

then calculated on this basis and

guarantees the individual a pre-

paid personal weight allocation

for the ight. You travel happy

knowing full well that you are

only paying for exactly what you

weigh nothing more, says the

carrier. You are the master of

how much, or little, your air

ticket will cost.

B

ritish Airways is considering

a proposal to display its rst

Airbus A380 at the 50th Paris air

show, lifting the air transport side

of a event from which other high-

prole aircraft appear destined to

be absent.

The Airbus A350 and Bombar-

dier CSeries are unlikely to make

an appearance, while the Boeing

787 will need to be cleared to y

before participating.

Paris air show managing direc-

tor Gilles Fournier says the A350

and CSeries could not be ready

for Paris. They will probably go

to Farnborough or Berlin, he

says. Both shows will be held in

2014. The A350 is due to make its

maiden ight this summer, while

the rst CSeries prototype, FTV-1,

is scheduled for rst ight by late

June. Two 787s one from Qatar

Airways and one from Boeing

are planned to feature in the

shows static display. Fournier

says, however, that the 787s pres-

ence at the show is contingent on

whether US regulators clear the

aircraft to y to Paris.

If its ready, it will y, he

says. The Paris air show will be

held from 17 to 21 June.

British Airways is due to take

delivery of its rst Rolls-Royce

Trent 900-powered aircraft in July

a month after the Paris show.

One of Korean Airs A380s was

recruited as a stand-in demonstra-

tor during the last Paris event in

2011, after the regular Airbus test

aircraft was slightly damaged in a

taxiing accident. The display ight

proved popular and Airbus subse-

quently showed off a Malaysia

Airlines A380 at last years Farn-

borough show. BA says it has re-

ceived a similar proposition.

Were looking at it, says a source

at the carrier familiar with the situ-

ation, but adds that the carrier has

yet to make a nal decision.

Once delivered, the BA aircraft

congured with 469 seats will

be deployed on short-haul routes

for training. The carrier has already

disclosed that Los Angeles and

Hong Kong will be among the rst

long-haul destinations for the jet,

with A380 services starting to these

cities in October-November. Three

of the ag-carriers A380s have been

own to the Airbus facility at Ham-

burg Finkenwerder the latest on

25 March to be nished and

painted in the airlines livery.

L

ufthansa expects to place a

major order for long-range air-

craft to replace its Airbus A340s

and Boeing 747-400s in the fourth

quarter.

The carrier is still waiting for

information from the airframers,

says Jurgen Weber, the chairman

of the carriers supervisory board.

We will make the decision on

long-range aircraft in the last

quarter of this year, he said dur-

ing a brieng in Washington DC

at the end of March. Weber de-

clined to specify the number of

aircraft the airline would order

but said two-thirds will be re-

placement jets for its A340s and

747-400s, while the remaining

third will be for growth.

It will be a major order, says

Weber. He adds that the airline

would have placed an order for

long-range aircraft earlier, but it

did not have the necessary data

on future long-haul types such as

the Boeing 777X and Airbus

A350. Boeing has not said when

the 777X will enter service, but

the General Electric GE9X power-

ing the type is not scheduled to

be certicated until May 2018.

Airbus plans rst deliveries of

the A350-900 to take place in the

second half of 2014.

The longest-range variant of

the A350, the -1000, will enter

into service in 2017.

Lufthansa operates 48 A340s

equally split between -300s and

-600s plus 18 747-400s. The air-

lines newly-released 2012 annu-

al report shows it is due to take

delivery of 15 Boeing 747-8s,

seven A380s, three A330s and

ve 777Fs in 2013-2016.

AIRFRAMES DAVID KAMINSKI-MORROW LONDON

British A380 could top Paris

billing if new types miss out

UK carrier considers displaying at 50th show amid probable absence of A350 and CSeries

FLEET

MICHAEL GUBISCH LONDON

Lufthansa gears

up to decide on

long-range order

BA is set to take delivery of the 469-seat aircraft in July and open Los Angeles flights in October

Samoa passengers to pay by weight

OPERATIONS

We will make

the decision in

the last quarter

of this year

JURGEN WEBER

Chairman, Lufthansa supervisory board

The Airline Business blog offers

commentary on airline news, at

ightglobal.com/abblog

9-15 April 2013

|

Flight International

|

21 fightglobal.com

Jakarta deals fow

for Airbus Military

DEFENCE P22

NEWS FOCUS

F

ormer US Navy chief of naval

operations Adm Gary Roug-

head says the US Department of

Defense (DoD) should consider

eliminating the F-35A version of

the Lockheed Martin Joint Strike

Fighter (JSF) in favour of the

carrier-based F-35C.

In recent weeks the idea has

gathered momentum, with cur-

rent and former defence ofcials

saying the Pentagons ofce of

Cost Assessment and Program

Evaluation (CAPE) is studying

the idea although the DoD of-

cially denies these claims.

Roughead says the question

must be asked as to whether it is

better to reduce the number of

F-35 variants to two a short

take-off and vertical landing vari-

ant and one version that can take-

off and land conventionally. My

simple logic says it probably is,

but there are a lot of factors that

go into it, he says.

Roughead says it makes sense

to have the US Air Force adopt

the C-model jet because it can

operate from land bases as well as

from the US Navys 11 big deck

aircraft carriers, whereas the

A model cannot. The reason that

I said to go with the C is because

you will still want to be able to

use the JSF from aircraft carriers,

he says.

REDUCED COSTS

While a lot of analytical work

would have to be carried out,

Roughead says it is possible that

reducing the number of variants

could reduce the F-35s consider-

able life-cycle costs currently

estimated to top $1.1 trillion.

Roughead says he has not

talked to anyone at the DoD

about his suggestion, but a

number of current and former

defence ofcials say CAPE is ex-

amining the idea. Im sure

CAPE is looking at this, says

one senior government ofcial,

although he adds that he does

not know how serious a look.

Another senior ofcial also says

CAPE is looking at eliminating the

A-model. During the latest se-

questration drill, CAPE took an-

other run on cutting out one of the

variants of the JSF, he says. The

argument is the air force should

do it and buy the C version.

The Ofce of the Secretary of

Defense (OSD), however, insists

CAPE is not looking at cancelling

the F-35A.

Meanwhile, after spending 12

years fronting the F-35 pro-

gramme, retiring Lockheed ex-

ecutive vice-president Tom Bur-

bage is now able to look back in

hindsight on a few key lessons

that could have spared the pro-

gramme a costly redesign and a

troubled relationship with

international partners. Leading

the rst globalised defence pro-

gramme, the F-35 team initially did

not fully understand the challenges

of sharing information between

hundreds of suppliers spanning

across multiple countries. I dont

think anybody really understood,

because it had never been done be-

fore, what it means to have nine

countries all competing for work,

Burbage says.

On previous programmes most

foreign involvement was handled

through the US government

through the foreign military sales

system. On this programme, up-

front, we had to gure out how

you go involve industry early on

and how does the system work,

he says.

One of the lessons Burbage

says he learned is that all of the

companies involved in a project

the size and scope of the F-35

need to be on the same informa-

tion technology systems to share

data seamlessly. You want to

have them all on the same set of

tools when you start, he says.

Discoveries happen during

every aircraft developmental ef-

fort, but the F-35 encountered

several unanticipated problems

that Burbage says could not have

been foreseen. Certainly there

are some things looking back that

we would have changed to avoid

the weight issue and things like

that, had we known it was lurk-

ing in the models, Burbage says.

UNFORESEEN DIFFICULTIES

During the early years of the

programme between 2004 and

2005, company and government

parametric engineering models

began to show that the weight of

the F-35B short take-off vertical

landing version of the aircraft was

getting too high.

Somewhere along the way we

made an error in our parametric

weight models, Burbage says.

Turned out we were predicting

the things that we knew about