Академический Документы

Профессиональный Документы

Культура Документы

Ulster Co. $ale$ Tax To Return To 8%

Загружено:

Elliott AuerbachИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ulster Co. $ale$ Tax To Return To 8%

Загружено:

Elliott AuerbachАвторское право:

Доступные форматы

Publication 718

(1/14)

New York State Sales and Use Tax Rates by Jurisdiction

Effective February 1, 2014

The following list includes the state tax rate combined with any county and city sales tax currently in effect and the reporting codes used on sales tax returns. Jurisdictions whose rates or codes have changed from the previous versions are noted in boldface italics. New York City comprises five counties. These counties are also boroughs whose names are more widely known. The counties, with borough names shown in parentheses, are Bronx (Bronx), Kings (Brooklyn), New York (Manhattan), Queens (Queens), and Richmond (Staten Island). Reporting codes, rather than ZIP codes, should be used for identifying customer location. (Postal zones usually do not coincide with political boundaries, and the use of ZIP codes for tax collection results in a high degree of inaccurate tax reporting.) Use our Sales Tax Jurisdiction and Rate Lookup Service on our Web site at www.tax.ny.gov to determine the correct local taxing jurisdiction, combined state and local sales tax rate, and the local jurisdictional reporting code to use when filing New York State sales tax returns. For sales tax rates previously in effect, see Publication 718-A, Enactment and Effective Dates of Sales and Use Tax Rates.

Tax Reporting rate% code County or other locality Tax Reporting rate% code

County or other locality

Tax Reporting rate% code 0021 0181 0221

County or other locality

New York State only 4 Albany 8 Allegany 8 *Bronxsee New York City *Brooklynsee New York City Broome 8 Cattaraugusexcept 8 Olean (city) 8 Salamanca (city) 8 Cayugaexcept 8 Auburn (city) 8 Chautauqua 7 Chemung 8 Chenangoexcept 8 Norwich (city) 8 Clinton 8 Columbia 8 Cortland 8 Delaware 8 *Dutchess 8 Erie 8 Essex 8 Franklin 8 Fultonexcept 8 Gloversville (city) 8 Johnstown (city) 8 Genesee 8 Greene 8 Hamilton 8

0321 0481 0441 0431 0511 0561 0651 0711 0861 0831 0921 1021 1131 1221 1311 1451 1521 1621 1791 1741 1751 1811 1911 2011

Herkimer 8 2121 Jefferson 7 2221 *Kings (Brooklyn)see New York City Lewis 8 2321 Livingston 8 2411 Madisonexcept 8 2511 Oneida (city) 8 2541 *Manhattansee New York City Monroe 8 2611 Montgomery 8 2781 *Nassau 8 2811 *New York (Manhattan) see New York City *New York City 8 8081 Niagara 8 2911 Oneidaexcept 8 3010 Rome (city) 8 3015 Utica (city) 8 3018 Onondaga 8 3121 Ontario 7 3211 *Orange 8 3321 Orleans 8 3481 Oswegoexcept 8 3501 Oswego (city) 8 3561 Otsego 8 3621 *Putnam 8 3731 *Queenssee New York City Rensselaer 8 3881 *Richmond (Staten Island) see New York City *Rockland 8 3921

St. Lawrence 8 4091 Saratogaexcept 7 4111 Saratoga Springs (city) 7 4131 Schenectady 8 4241 Schoharie 8 4321 Schuyler 8 4411 Seneca 8 4511 *Staten Islandsee New York City Steubenexcept 8 4691 Corning (city) 8 4611 Hornell (city) 8 4641 *Suffolk 8 4711 Sullivan 8 4821 Tioga 8 4921 Tompkinsexcept 8 5081 Ithaca (city) 8 5021 Ulster 8 5111 Warrenexcept 7 5281 Glens Falls (city) 7 5211 Washington 7 5311 Wayne 8 5421 *Westchesterexcept 7 5581 *Mount Vernon (city) 8 5521 *New Rochelle (city) 8 6861 *White Plains (city) 8 6513 *Yonkers (city) 8 6511 Wyoming 8 5621 Yates 8 5721

*Rates in these jurisdictions include 3/8% imposed for the benefit of the Metropolitan Commuter Transportation District.

Вам также может понравиться

- Millets: Future of Food & FarmingДокумент16 страницMillets: Future of Food & FarmingKIRAN100% (2)

- Top Ten Helicopter Checkride TipsДокумент35 страницTop Ten Helicopter Checkride TipsAbhiraj Singh SandhuОценок пока нет

- AFAR Problems PrelimДокумент11 страницAFAR Problems PrelimLian Garl100% (8)

- Cdma Sid ListДокумент112 страницCdma Sid Listdilligas1234Оценок пока нет

- Ulster County Milage Reimbursement ReoportДокумент12 страницUlster County Milage Reimbursement ReoportDaily FreemanОценок пока нет

- Avito PresentationДокумент34 страницыAvito PresentationbseawellОценок пока нет

- Study For 33KV Sub-Marine Cable Crossings PDFДокумент80 страницStudy For 33KV Sub-Marine Cable Crossings PDFOGBONNAYA MARTINSОценок пока нет

- Monthly Statistics Report August 2011Документ1 страницаMonthly Statistics Report August 2011Jim LeeОценок пока нет

- US Market Profile Leisure 2011Документ9 страницUS Market Profile Leisure 2011Ghi GustiloОценок пока нет

- Bench Marking 2015 RatesДокумент16 страницBench Marking 2015 RatesrkarlinОценок пока нет

- Sales Tax PDFДокумент1 страницаSales Tax PDFrkarlinОценок пока нет

- Biggest Residential BrokeragesДокумент1 страницаBiggest Residential Brokeragesnews4691Оценок пока нет

- Activity Overview: Key Metrics Historical Sparkbars 8-2013 8-2014 YTD 2013 YTD 2014Документ4 страницыActivity Overview: Key Metrics Historical Sparkbars 8-2013 8-2014 YTD 2013 YTD 2014jspectorОценок пока нет

- Revenue Hearing 2016 BudgetДокумент34 страницыRevenue Hearing 2016 BudgetSpokane City CouncilОценок пока нет

- Sales Tax DocumentДокумент2 страницыSales Tax DocumentTime Warner Cable NewsОценок пока нет

- September 2012 Housing Starts in British Columbia: For Immediate ReleaseДокумент5 страницSeptember 2012 Housing Starts in British Columbia: For Immediate ReleasetflorkoОценок пока нет

- Retail Trade in McAllen, TXДокумент18 страницRetail Trade in McAllen, TXMae GuerraОценок пока нет

- Monthly Statistical Digest January 2012Документ43 страницыMonthly Statistical Digest January 2012Kyren GreiggОценок пока нет

- California Cities and County Sales and Use Tax Rates 2012Документ23 страницыCalifornia Cities and County Sales and Use Tax Rates 2012L. A. PatersonОценок пока нет

- Filing Instructions: Please Follow These Instructions CarefullyДокумент4 страницыFiling Instructions: Please Follow These Instructions CarefullyMafer ChavezОценок пока нет

- Activity Overview: Key Metrics Historical Sparkbars 3-2012 3-2013 YTD 2012 YTD 2013Документ4 страницыActivity Overview: Key Metrics Historical Sparkbars 3-2012 3-2013 YTD 2012 YTD 2013jspectorОценок пока нет

- National Quickstat: As of February 2012Документ4 страницыNational Quickstat: As of February 2012Michael Ian TianoОценок пока нет

- Activity Overview: Key Metrics Historical Sparkbars 7-2011 7-2012 YTD 2011 YTD 2012Документ4 страницыActivity Overview: Key Metrics Historical Sparkbars 7-2011 7-2012 YTD 2011 YTD 2012jspectorОценок пока нет

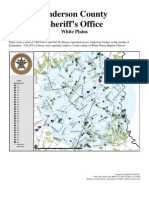

- Anderson County Sheriff's Office: Twin LakesДокумент6 страницAnderson County Sheriff's Office: Twin Lakesalpca8615Оценок пока нет

- Anderson County Sheriff's Office: Country GlenДокумент4 страницыAnderson County Sheriff's Office: Country Glenalpca8615Оценок пока нет

- New York Cities:: An Economic and Fiscal Analysis 1980 - 2010Документ38 страницNew York Cities:: An Economic and Fiscal Analysis 1980 - 2010Casey SeilerОценок пока нет

- Brantford 2011 Financial ReportsДокумент168 страницBrantford 2011 Financial ReportsHugo RodriguesОценок пока нет

- Colliers International Global Retail Highlights MIDYEAR 2012Документ21 страницаColliers International Global Retail Highlights MIDYEAR 2012Colliers International ThailandОценок пока нет

- Anderson County Sheriff's Office: Country GlenДокумент5 страницAnderson County Sheriff's Office: Country Glenalpca8615Оценок пока нет

- Preview of "WWW - Empirecenter.org WP ... WhatTheyMake2013 14.PDF"Документ44 страницыPreview of "WWW - Empirecenter.org WP ... WhatTheyMake2013 14.PDF"Rick KarlinОценок пока нет

- Welch Retail Trade 2012Документ26 страницWelch Retail Trade 2012WelchOKОценок пока нет

- 2012 Fact Sheet Rankings CNTДокумент2 страницы2012 Fact Sheet Rankings CNTbengoldman_sbdcОценок пока нет

- Cscity-Wk Ending 092511Документ1 страницаCscity-Wk Ending 092511htbaОценок пока нет

- Memorandum: Bureau of Asset Management 1 Centre Street Room 736 NEW YORK, N.Y. 10007-2341Документ101 страницаMemorandum: Bureau of Asset Management 1 Centre Street Room 736 NEW YORK, N.Y. 10007-2341davidsun1988Оценок пока нет

- RBA Chart Pack (8 May 2013)Документ34 страницыRBA Chart Pack (8 May 2013)leithvanonselenОценок пока нет

- Maryland Real Estate Market Activity, October 2011, New Listings, Pending Sales, Days On MarketДокумент1 страницаMaryland Real Estate Market Activity, October 2011, New Listings, Pending Sales, Days On MarkettmcintyreОценок пока нет

- UtahsRight Snapshot RapeДокумент1 страницаUtahsRight Snapshot RapeThe Salt Lake TribuneОценок пока нет

- Electronic Banking Statistics Fiscal Year 2011: Item Unit 1-E-Banking InfrastructureДокумент4 страницыElectronic Banking Statistics Fiscal Year 2011: Item Unit 1-E-Banking InfrastructureJunaidKhanОценок пока нет

- Nypd Crash ReportДокумент82 страницыNypd Crash Reportjohnd7463Оценок пока нет

- Capital District Data v36 n3Документ4 страницыCapital District Data v36 n3CDRPCОценок пока нет

- Anderson County Sheriff's Office: Town Creek AcresДокумент7 страницAnderson County Sheriff's Office: Town Creek Acresalpca8615Оценок пока нет

- Public Copy of Auto BE - August 11Документ8 страницPublic Copy of Auto BE - August 11Huntersville Police DepartmentОценок пока нет

- Anderson County Sheriff's Office: White PlainsДокумент9 страницAnderson County Sheriff's Office: White Plainsalpca8615Оценок пока нет

- National Quickstat: As of January 2012Документ4 страницыNational Quickstat: As of January 2012Allan Roelen BacaronОценок пока нет

- REPORT: The "Big 5" New York Cities Opt in To State AssessmentsДокумент5 страницREPORT: The "Big 5" New York Cities Opt in To State AssessmentsMichael Gareth JohnsonОценок пока нет

- KKCL Retail Store Budget 2011 - 2012Документ34 страницыKKCL Retail Store Budget 2011 - 2012Farhan RajaniОценок пока нет

- Anderson County Sheriff's Office: White PlainsДокумент7 страницAnderson County Sheriff's Office: White Plainsalpca8615Оценок пока нет

- Anderson County Sheriff's Office: White PlainsДокумент6 страницAnderson County Sheriff's Office: White Plainsalpca8615Оценок пока нет

- ArielPA MFMIR: NYC Nov 2011Документ16 страницArielPA MFMIR: NYC Nov 2011Ariel Property AdvisorsОценок пока нет

- WCOL-2023-summary-report CópiaДокумент10 страницWCOL-2023-summary-report CópiaRicardo MartinsОценок пока нет

- Account Name: Newstead News Account No: 7313295 Web Returns Submitted Returns Form No: 6061066 Week/Month: 26 Due Date: 1/07/2015Документ2 страницыAccount Name: Newstead News Account No: 7313295 Web Returns Submitted Returns Form No: 6061066 Week/Month: 26 Due Date: 1/07/2015Winston BoonОценок пока нет

- London Crime 2011-08 PDFДокумент3 страницыLondon Crime 2011-08 PDFAdiyat Fikrizal PamungkasОценок пока нет

- Nysar Mmi 2013-10 MediaДокумент4 страницыNysar Mmi 2013-10 MediajspectorОценок пока нет

- Anderson County Sheriff's Office: The OaksДокумент4 страницыAnderson County Sheriff's Office: The Oaksalpca8615Оценок пока нет

- Le Nombre de Surdoses en Colombie-BritanniqueДокумент5 страницLe Nombre de Surdoses en Colombie-BritanniqueRadio-CanadaОценок пока нет

- May Financial Report 2016Документ26 страницMay Financial Report 2016Anonymous Jrvijv4bRAОценок пока нет

- FIN 444 Chapter 2Документ48 страницFIN 444 Chapter 2Abraham ZeusОценок пока нет

- Weekly Market Update Week Ending 2015 October 25Документ5 страницWeekly Market Update Week Ending 2015 October 25Australian Property ForumОценок пока нет

- Pest Exterminator Report AnnualДокумент4 страницыPest Exterminator Report AnnualMehedi HasanОценок пока нет

- 2014 August - CREO ForecastДокумент4 страницы2014 August - CREO ForecastNational Association of REALTORS®Оценок пока нет

- Ndia S Rade Olicy: Foreign Trade Balance of Payments Trade Policies Foreign Trade Policy (FTP)Документ20 страницNdia S Rade Olicy: Foreign Trade Balance of Payments Trade Policies Foreign Trade Policy (FTP)Murtaza BharthooОценок пока нет

- City of Troy Financial PresentationДокумент62 страницыCity of Troy Financial PresentationThe Saratogian and Troy RecordОценок пока нет

- Electrical & Electronic Goods Agents & Brokers Revenues World Summary: Market Values & Financials by CountryОт EverandElectrical & Electronic Goods Agents & Brokers Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Accounting For $500K of Inmate Funds PRESS RELEASEДокумент1 страницаAccounting For $500K of Inmate Funds PRESS RELEASEElliott AuerbachОценок пока нет

- 2014 Public Auction Brochure 1Документ29 страниц2014 Public Auction Brochure 1Elliott AuerbachОценок пока нет

- Town by Town Exemption StatsДокумент56 страницTown by Town Exemption StatsElliott AuerbachОценок пока нет

- PROPOSED PROPERTY TAX RELIEF-A Quick OverviewДокумент2 страницыPROPOSED PROPERTY TAX RELIEF-A Quick OverviewElliott AuerbachОценок пока нет

- Wholly Exempt Property Report 12.31.2013Документ3 страницыWholly Exempt Property Report 12.31.2013Elliott AuerbachОценок пока нет

- Elliott Auerbach: Avoiding The "Tax Tinderbox"Документ2 страницыElliott Auerbach: Avoiding The "Tax Tinderbox"Elliott AuerbachОценок пока нет

- Thousands Saved On Mileage Reimbursements 09Документ1 страницаThousands Saved On Mileage Reimbursements 09Elliott AuerbachОценок пока нет

- Economic Indicators - Non-Property Tax RevenueДокумент2 страницыEconomic Indicators - Non-Property Tax RevenueElliott AuerbachОценок пока нет

- UCSO Inmate Account Review FinalДокумент17 страницUCSO Inmate Account Review FinalElliott AuerbachОценок пока нет

- Golden Hill Health Care Center Separation Payout 09.23.13Документ29 страницGolden Hill Health Care Center Separation Payout 09.23.13Elliott AuerbachОценок пока нет

- VIGILENCE NEEDED - Golden Hill Separation Pay Press ReleaseДокумент1 страницаVIGILENCE NEEDED - Golden Hill Separation Pay Press ReleaseElliott AuerbachОценок пока нет

- 1st Quarter of 2013. Press ReleaseДокумент1 страница1st Quarter of 2013. Press ReleaseElliott AuerbachОценок пока нет

- Economic Indicators - Dangerous Times For Sales Tax PoliticsДокумент1 страницаEconomic Indicators - Dangerous Times For Sales Tax PoliticsElliott AuerbachОценок пока нет

- Find Forgotten Funds at Expo 09.16.13Документ1 страницаFind Forgotten Funds at Expo 09.16.13Elliott AuerbachОценок пока нет

- DSS Child Care Carelessness Press Release.05.13.2013Документ2 страницыDSS Child Care Carelessness Press Release.05.13.2013Elliott AuerbachОценок пока нет

- 2ND Quarter of 2013.press Release 08.19.13pdfДокумент1 страница2ND Quarter of 2013.press Release 08.19.13pdfElliott AuerbachОценок пока нет

- Rail Trail+Railroad Win WinДокумент1 страницаRail Trail+Railroad Win WinElliott AuerbachОценок пока нет

- Recognizing Success: 11 Students..11 Schools... 11 StoriesДокумент2 страницыRecognizing Success: 11 Students..11 Schools... 11 StoriesElliott AuerbachОценок пока нет

- Fall 2013 Internship Prgoram at Ulster County ComptrollerДокумент1 страницаFall 2013 Internship Prgoram at Ulster County ComptrollerElliott AuerbachОценок пока нет

- Child Care Block Grant 05.01.2013.C-2 FINAL Report W. AttachementsДокумент42 страницыChild Care Block Grant 05.01.2013.C-2 FINAL Report W. AttachementsElliott AuerbachОценок пока нет

- First Quarter ReportДокумент11 страницFirst Quarter ReportDaily FreemanОценок пока нет

- Deputy Comptroller Addresses Nation's Gov't Finance OfficersДокумент1 страницаDeputy Comptroller Addresses Nation's Gov't Finance OfficersElliott AuerbachОценок пока нет

- 2nd Q 2013final Report 08.19.13Документ14 страниц2nd Q 2013final Report 08.19.13Elliott AuerbachОценок пока нет

- On The Eve of Foreclosure.... 04.15.13Документ2 страницыOn The Eve of Foreclosure.... 04.15.13Elliott AuerbachОценок пока нет

- FORECLOSURE... FAST FORWARD..,Update 4/12/13Документ2 страницыFORECLOSURE... FAST FORWARD..,Update 4/12/13Elliott AuerbachОценок пока нет

- Procurement Cards - Final Audit Report.04.11.13Документ11 страницProcurement Cards - Final Audit Report.04.11.13Elliott AuerbachОценок пока нет

- School's Made Whole For Unpaid Taxes 04.09Документ1 страницаSchool's Made Whole For Unpaid Taxes 04.09Elliott AuerbachОценок пока нет

- In The Cards.Документ1 страницаIn The Cards.Elliott AuerbachОценок пока нет

- Transportation Problem VAMДокумент16 страницTransportation Problem VAMLia AmmuОценок пока нет

- CV Najim Square Pharma 4 Years ExperienceДокумент2 страницыCV Najim Square Pharma 4 Years ExperienceDelwarОценок пока нет

- Huzaima ResultДокумент2 страницыHuzaima ResultSaif Ali KhanОценок пока нет

- Management and Entrepreneurship Important QuestionsДокумент1 страницаManagement and Entrepreneurship Important QuestionslambazОценок пока нет

- Transport Phenomena 18.4.CДокумент3 страницыTransport Phenomena 18.4.CDelyana RatnasariОценок пока нет

- Tankguard AR: Technical Data SheetДокумент5 страницTankguard AR: Technical Data SheetAzar SKОценок пока нет

- ANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)Документ3 страницыANNEX C LIST OF EXCEPTIONS (Non-Disslosure of Information)ryujinxxcastorОценок пока нет

- B&G 3DX LiteratureДокумент2 страницыB&G 3DX LiteratureAnonymous 7xHNgoKE6eОценок пока нет

- Student Application Form BCIS - 2077Документ2 страницыStudent Application Form BCIS - 2077Raaz Key Run ChhatkuliОценок пока нет

- RS485 ManualДокумент7 страницRS485 Manualndtruc100% (2)

- Reterta V MoresДокумент13 страницReterta V MoresRam Migue SaintОценок пока нет

- New VLSIДокумент2 страницыNew VLSIRanjit KumarОценок пока нет

- Cap. 1Документ34 страницыCap. 1Paola Medina GarnicaОценок пока нет

- RFBT - Law On Sales Cont. Week 11Документ1 страницаRFBT - Law On Sales Cont. Week 11Jennela VeraОценок пока нет

- GGSB MibДокумент4 страницыGGSB MibShrey BudhirajaОценок пока нет

- Traffic Speed StudyДокумент55 страницTraffic Speed StudyAnika Tabassum SarkarОценок пока нет

- AW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20Документ8 страницAW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20eldi_yeОценок пока нет

- Bemts-I (A) : Air Uni IsbДокумент11 страницBemts-I (A) : Air Uni IsbUmair AzizОценок пока нет

- Home Work (Satistics AIUB)Документ5 страницHome Work (Satistics AIUB)fukscribdОценок пока нет

- MODULE 5 - WeirДокумент11 страницMODULE 5 - WeirGrace MagbooОценок пока нет

- Mobilcut 102 Hoja TecnicaДокумент2 страницыMobilcut 102 Hoja TecnicaCAGERIGOОценок пока нет

- San Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintДокумент25 страницSan Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintFindLawОценок пока нет

- Chinaware - Zen PDFДокумент111 страницChinaware - Zen PDFMixo LogiОценок пока нет

- Enabling Trade Report 2013, World Trade ForumДокумент52 страницыEnabling Trade Report 2013, World Trade ForumNancy Islam100% (1)

- Problems of Spun Concrete Piles Constructed in Soft Soil in HCMC and Mekong Delta - VietnamДокумент6 страницProblems of Spun Concrete Piles Constructed in Soft Soil in HCMC and Mekong Delta - VietnamThaoОценок пока нет

- Mio Digiwalker c220/c220sДокумент32 страницыMio Digiwalker c220/c220sTОценок пока нет