Академический Документы

Профессиональный Документы

Культура Документы

Company Final Account 2

Загружено:

Shafique Ur RehmanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Company Final Account 2

Загружено:

Shafique Ur RehmanАвторское право:

Доступные форматы

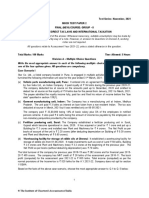

NICCS COLLEGE OF COMMERCE (QILA DIDAR SINGH)

Subject: Advance Accounting Time Allowed: 35 Minutes Examination: B.Com Max. Marks: 20 ======================================================================================== Question: 01 From the following trial balance of Shahid & Bros on 31st December 2012. Prepare Profit & Loss A/c and Balance Sheet. Particulars Rs. Particulars Rs. Opening Stock Salaries Cash in hand Interim Dividend Income Tax Paid Directors Fee Bills Receivable Sinking Fund Investment Postage Sundry Debtors Motorcar Building Machinery Discount to Customers Interest on Debentures 1,175 900 520 300 170 170 150 500 30 800 2,000 4,000 3,000 60 125 13,900 Share Premium General Reserve Share Capital Debenture Sinking Fund 10% Debentures Provision for Taxation Interest on Sinking Fund Investment Sundry Creditors Gross Profit Dividend Payable Profit & Loss Account Allowances for depreciation (Motorcar) Allowances for depreciation (Machinery) Allowances for depreciation (Building) Provision for doubtful debts 400 1,000 4,000 500 2,500 175 40 460 3,075 52 275 400 600 400 23 13,900

Adjustments: a) Depreciation is to be written off on Motorcar and Machinery at 10% and Building at 5%. b) Provision for doubtful debts to be adjusted to 5% on sundry debtors. c) Market value of sinking fund investment on 31st December 2012 is Rs. 475. d) Provide Rs. 225 for further taxation while tax liability for last tax year was Rs. 200. e) Transfer Rs. 250 to debenture sinking fund. f) Directors proposed final dividend at 7.5% on share capital. Question: 02 From the following trial balance of Asim & Sons on 31st December 2012. Prepare Profit & Loss A/c and Balance Sheet. Particulars Rs. Particulars Rs. Opening Stock Land Cash in hand Purchases Other Expenses Wages & Salaries Investment Plant Debtors Goods sent on consignment 272 2,000 173 2,912 182 410 900 800 1,420 72 13,900 Sales Share Capital General Reserve Creditors Provision for Taxation Investment Income Profit & Loss A/c 3,581 4,000 500 203 190 62 605

13,900

Adjustments: a) Sales include Rs. 110 of goods on sales or return basis (Cost price Rs. 40) b) All the goods sent on consignment have been sold for Rs. 90 subject to agent commission of 5%. c) Make a provision of 10% on debtors for doubtful debts after writing off Rs. 75 as bad debts. d) Closing Stock Rs. 1,250 f) Transfer Rs. 60 to general reserve. e) Depreciation Plant at 5% p.a. g) Taxation provision is to be increased to Rs. 300 ------------------------------ Wish You Best of Luck ------------------------------

Вам также может понравиться

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawОт EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Fianl AccountsДокумент10 страницFianl AccountsVikram NaniОценок пока нет

- Business Combinations QuizzerДокумент9 страницBusiness Combinations QuizzerjaysonОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- Statistics MCQ'S I.Com Part 2Документ8 страницStatistics MCQ'S I.Com Part 2Shafique Ur Rehman82% (17)

- Financial Accounting11Документ14 страницFinancial Accounting11AleciafyОценок пока нет

- Audit in Nursing Management and AdministrationДокумент31 страницаAudit in Nursing Management and Administrationbemina jaОценок пока нет

- DCF Valuation ExerciseДокумент18 страницDCF Valuation ExerciseAkram MohiddinОценок пока нет

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)От EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Оценок пока нет

- Accounting quiz with 11 multiple choice questionsДокумент3 страницыAccounting quiz with 11 multiple choice questionsMelu100% (2)

- Accounting - UEB - Mock Test 2 - STDДокумент14 страницAccounting - UEB - Mock Test 2 - STDTiến NguyễnОценок пока нет

- Uw eMBA Wikibook-Managerial-Accounting PDFДокумент103 страницыUw eMBA Wikibook-Managerial-Accounting PDFEswari Gk100% (1)

- Fundamentals of Accountancy Business and Management 1 Lesson 1Документ22 страницыFundamentals of Accountancy Business and Management 1 Lesson 1GAYAB gaming100% (3)

- Rana Institute financial documentsДокумент2 страницыRana Institute financial documentsBilal KhalidОценок пока нет

- Mansa Building Balance Sheet As On 31st Dec, 1999Документ10 страницMansa Building Balance Sheet As On 31st Dec, 1999Nirmal SasidharanОценок пока нет

- Note To A - CДокумент16 страницNote To A - CKeeZan LimОценок пока нет

- QuestionsДокумент7 страницQuestionsMyra RidОценок пока нет

- 2012 Final Exam SolutionДокумент14 страниц2012 Final Exam SolutionOmar Ahmed ElkhalilОценок пока нет

- 2022 FIA132 Term Test 1 FinalДокумент9 страниц2022 FIA132 Term Test 1 FinalkaityОценок пока нет

- Sample ACCT101 final exam questions and solutionsДокумент12 страницSample ACCT101 final exam questions and solutionshappystoneОценок пока нет

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsДокумент3 страницыAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhОценок пока нет

- Gls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking CompaniesДокумент11 страницGls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking Companiessumathi psgcas0% (1)

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingДокумент25 страницCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghОценок пока нет

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationДокумент3 страницыTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifОценок пока нет

- Merger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Документ10 страницMerger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Ragil Kuning ManikОценок пока нет

- Corporate Finance AssignmentДокумент5 страницCorporate Finance AssignmentKashif KhurshidОценок пока нет

- AB Co. Ltd. Trial Balance StatementДокумент10 страницAB Co. Ltd. Trial Balance StatementMd. Iqbal Hasan0% (1)

- Assignment - FSAB - Submission 06 May 2023Документ4 страницыAssignment - FSAB - Submission 06 May 2023Amisha BoolkanОценок пока нет

- YuyutuДокумент15 страницYuyutuDeepak R GoradОценок пока нет

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationДокумент5 страницKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254Оценок пока нет

- CCP102Документ22 страницыCCP102api-3849444Оценок пока нет

- Final AccountsДокумент27 страницFinal AccountsNafis Siddiqui100% (1)

- FIA132 - Supplementary and Special Assessment NOVEMBER 2022Документ8 страницFIA132 - Supplementary and Special Assessment NOVEMBER 2022kaityОценок пока нет

- CA IPCC Nov 2010 Accounts Solved AnswersДокумент13 страницCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerОценок пока нет

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionДокумент9 страницTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarОценок пока нет

- P5 Syl2012 InterДокумент12 страницP5 Syl2012 InterVimal ShuklaОценок пока нет

- Aafr Updated Past PapersДокумент491 страницаAafr Updated Past PapersSummama Ahmad LodhraОценок пока нет

- Ecomprehensiveexam eДокумент12 страницEcomprehensiveexam eDominic SociaОценок пока нет

- CHAPTER - 5 - Exercise & ProblemsДокумент6 страницCHAPTER - 5 - Exercise & ProblemsFahad Mushtaq20% (5)

- AIU Advanced Accounting Checklist Spring 2021Документ4 страницыAIU Advanced Accounting Checklist Spring 2021ilyas muhammadОценок пока нет

- P5 Syl2012 InterДокумент27 страницP5 Syl2012 InterViswanathan SrkОценок пока нет

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Документ26 страницChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- 629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNДокумент19 страниц629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNMukesh kannan MahiОценок пока нет

- MT Principles of Accounting Fall 2023 UGДокумент5 страницMT Principles of Accounting Fall 2023 UGwww.kazimarzanjsbmsc570Оценок пока нет

- Financial Accounting Mock Test PaperДокумент7 страницFinancial Accounting Mock Test PaperBharathFrnzbookОценок пока нет

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountДокумент7 страницSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirОценок пока нет

- B.Com Corporate Accounting II exam questionsДокумент5 страницB.Com Corporate Accounting II exam questionsjeganrajrajОценок пока нет

- Financial Accounting Topics from College of Modern SciencesДокумент27 страницFinancial Accounting Topics from College of Modern SciencesRubab MirzaОценок пока нет

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocДокумент6 страницFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukОценок пока нет

- Wa0003.Документ173 страницыWa0003.labiot324Оценок пока нет

- FR Pipfa Paper CompleteДокумент20 страницFR Pipfa Paper CompleteGENIUS15070% (1)

- 5419 Advance AccountingДокумент5 страниц5419 Advance AccountingmansoorОценок пока нет

- Comprehensive Assignment FAR-IIДокумент7 страницComprehensive Assignment FAR-IISonu MalikОценок пока нет

- Answers and Marking Scheme for Pakistan Taxation (PKN) December 2012 ExamДокумент13 страницAnswers and Marking Scheme for Pakistan Taxation (PKN) December 2012 Examabby bendarasОценок пока нет

- Unsolved Paper Part IДокумент107 страницUnsolved Paper Part IAdnan KazmiОценок пока нет

- Finance, Accounting and Risk Management: Code: AMIL38Документ9 страницFinance, Accounting and Risk Management: Code: AMIL38ilayanambiОценок пока нет

- Mock Test Paper - 1: 1) A) The Following Details Are Furnished To YouДокумент18 страницMock Test Paper - 1: 1) A) The Following Details Are Furnished To YouKailash KumarОценок пока нет

- Final AccountsДокумент12 страницFinal Accountsanandm1986100% (1)

- Trading and Profit Loss Accounts from Trial BalancesДокумент7 страницTrading and Profit Loss Accounts from Trial Balancesdharamraj22Оценок пока нет

- FEDERAL PUBLIC SERVICE COMMISSION COMPETITIVE EXAMINATIONДокумент3 страницыFEDERAL PUBLIC SERVICE COMMISSION COMPETITIVE EXAMINATIONRana Zafar ArshadОценок пока нет

- Institute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsДокумент3 страницыInstitute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsAli SheikhОценок пока нет

- Application Level Corporate Laws Practices Nov Dec 2013Документ3 страницыApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieОценок пока нет

- CA Final G2 SFM Paper 2 SolutionДокумент13 страницCA Final G2 SFM Paper 2 SolutionDEVANSHОценок пока нет

- CAP-III Advanced Financial ReportingДокумент17 страницCAP-III Advanced Financial ReportingcasarokarОценок пока нет

- Financial Management (MBOF 912 D) 1Документ5 страницFinancial Management (MBOF 912 D) 1Siva KumarОценок пока нет

- FA 4 Chapter 3 - Q2Документ3 страницыFA 4 Chapter 3 - Q2Vasant SriudomОценок пока нет

- Company Final AccountДокумент1 страницаCompany Final AccountShafique Ur RehmanОценок пока нет

- Bonus Issue & Right IssueДокумент1 страницаBonus Issue & Right IssueShafique Ur RehmanОценок пока нет

- Analysis of Accounting RatiosДокумент1 страницаAnalysis of Accounting RatiosShafique Ur RehmanОценок пока нет

- Theories and Enron ScandalДокумент6 страницTheories and Enron ScandalMansi MalikОценок пока нет

- Linkedin-Skill-Assessments-Quizzes - Accounting-Quiz - MD at Main Ebazhanov - Linkedin-Skill-Assessments-Quizzes GitHubДокумент15 страницLinkedin-Skill-Assessments-Quizzes - Accounting-Quiz - MD at Main Ebazhanov - Linkedin-Skill-Assessments-Quizzes GitHubAnkit RajОценок пока нет

- Reviewer in AccountingДокумент22 страницыReviewer in AccountingMIKASAОценок пока нет

- Module 3 Quiz 3 CagnayoДокумент3 страницыModule 3 Quiz 3 CagnayoAzir ShurimaОценок пока нет

- 07 JUNE QuestionДокумент11 страниц07 JUNE Questionkhengmai67% (3)

- Protection Technology v. SOLEДокумент4 страницыProtection Technology v. SOLECristelle Elaine ColleraОценок пока нет

- Sec Form Exa-001Документ3 страницыSec Form Exa-001Rheneir MoraОценок пока нет

- SU14 Deloitte Cover Letter ReviewДокумент1 страницаSU14 Deloitte Cover Letter ReviewĐinh Như Thủy HằngОценок пока нет

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersДокумент4 страницы2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakОценок пока нет

- AcFn 611-ch VII Revised PDFДокумент63 страницыAcFn 611-ch VII Revised PDFtemedebereОценок пока нет

- Bill of SupplyДокумент1 страницаBill of Supplysbos1100% (2)

- Accounting Level 3: LCCI International QualificationsДокумент21 страницаAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- Mis Group 5 Deliverable 4 Final SubmissionДокумент72 страницыMis Group 5 Deliverable 4 Final SubmissionMinh Thư NguyễnОценок пока нет

- WendysДокумент13 страницWendysJomariVillanuevaОценок пока нет

- Time of Supply of GoodsДокумент5 страницTime of Supply of GoodsSuman AnandОценок пока нет

- EY Good Group Australia Limited December 2017Документ190 страницEY Good Group Australia Limited December 2017yasinОценок пока нет

- UTS-Bhs Inggris Akuntansi MalamДокумент1 страницаUTS-Bhs Inggris Akuntansi MalamAnonymous Fn7Ko5riKT100% (1)

- RPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSДокумент13 страницRPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSaulia endiniОценок пока нет

- EXAM ABM 11 Jan 29Документ1 страницаEXAM ABM 11 Jan 29Roz AdaОценок пока нет

- Accounting Adjusting EntriesДокумент6 страницAccounting Adjusting EntriescamilleОценок пока нет

- A211 MC4 MFRS108 Mfrs110-StudentДокумент6 страницA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingОценок пока нет

- ACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFДокумент7 страницACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFnixn135Оценок пока нет

- AU 9 Consideration of ICДокумент11 страницAU 9 Consideration of ICJb MejiaОценок пока нет