Академический Документы

Профессиональный Документы

Культура Документы

Chapter 2

Загружено:

Ajoy Mahajan0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров3 страницыFinancial Statement analysis is to use the information in a company's financial statements, along with other relevant information to make economic decisions. Financial ratios quantify many aspects of a business and are such a significant technique for performance analysis.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документFinancial Statement analysis is to use the information in a company's financial statements, along with other relevant information to make economic decisions. Financial ratios quantify many aspects of a business and are such a significant technique for performance analysis.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров3 страницыChapter 2

Загружено:

Ajoy MahajanFinancial Statement analysis is to use the information in a company's financial statements, along with other relevant information to make economic decisions. Financial ratios quantify many aspects of a business and are such a significant technique for performance analysis.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Chapter 2

CONCEPTual framework

2.1 FINANCIAL STATEMENT ANALYSIS

The role of Financial Statement Analysis is to use the information in a companys financial statements, along with other relevant information to make economic decisions. A financial statement organized according to accounting projects. Its purpose to convey an understanding of some financial aspects of a business firm. It shows a position at a movement in time as in the case of Balance Sheet, or reveals a series of activities, over a given period of time, as in the case of an income statement. The internal users of information need such analysis to evaluate the efficiency of the management. The external users like to rely upon such analysis to take decision regarding making investments and granting credit Financial Statement Analysis implies analysis and interpretation of the Financial Statement for facilitating the drawing of valid conclusions from the reported facts and figures. Analysts use Financial Statement data to evaluate a companys past performance and current financial position in order to form opinions about the companys ability to earn profits and generate cash flow in the future. It is basically a process of identifying the strengths and weakness of the concern by truly setting up the relationship between the items that are usually contain in the financial statement. At present, Financial Statement Analysis does not remain confined within the periphery of financial statement only. It also examines and covers the interval environment in which the firm operates and also the external environment surrounding the firm. The financial statement invariably fails to project all details needed for proper decision making. So, the users of information have to look beyond financial statements also. The efficiency level of the management, the nature of the product and its diversification, employees morale etc. can never be reported by financial statements. Due to paucity of time, in this project, for the purpose of analysis, we have considered only Balance Sheets or Position Statements and Profit and Loss Accounts or Income Statements of Reliance Industries Limited for last five years. Now for the financial performance analysis we need different financial ratios. Financial ratios quantify many aspects of a business and are an integral part of financial statement analysis. Ratio Analysis is such a significant technique for performance analysis.

2.2 RATIO ANALYSIS

2.2.1 Meaning and definition of ratio analysis:

Ratio analysis is a widely used tool of financial analysis. It is defined as the systematic use of ratio to interpret the financial statements so that the strength and weakness of a firm as well as its

historical performance and current financial condition can be determined. The term ratio refers to the numerical or quantitative relationship between two variables.

2.2.2 Importance of ratio analysis:

To workout the profitability To workout the solvency Helpful in analysis of financial statement Helpful in comparative analysis of the performance To simplify the accounting information To workout the operating efficiency To workout short-term financial position It is helpful in budgeting and forecasting

2.2.3 Limitations of Ratios Analysis:

Differences in definitions Limitations of accounting records Lack of proper standards No allowances for price level changes Changes in accounting procedures Quantitative factors are ignored Limited use of single ratio Background is over looked Limited use Personal bias

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Kahneman & Tversky Origin of Behavioural EconomicsДокумент25 страницKahneman & Tversky Origin of Behavioural EconomicsIan Hughes100% (1)

- Pt3 English Module 2018Документ63 страницыPt3 English Module 2018Annie Abdul Rahman50% (4)

- 7400 IC SeriesДокумент16 страниц7400 IC SeriesRaj ZalariaОценок пока нет

- Traveling Salesman ProblemДокумент11 страницTraveling Salesman ProblemdeardestinyОценок пока нет

- Heterogeneity in Macroeconomics: Macroeconomic Theory II (ECO-504) - Spring 2018Документ5 страницHeterogeneity in Macroeconomics: Macroeconomic Theory II (ECO-504) - Spring 2018Gabriel RoblesОценок пока нет

- Thermally Curable Polystyrene Via Click ChemistryДокумент4 страницыThermally Curable Polystyrene Via Click ChemistryDanesh AzОценок пока нет

- Presentation 11Документ14 страницPresentation 11stellabrown535Оценок пока нет

- Tplink Eap110 Qig EngДокумент20 страницTplink Eap110 Qig EngMaciejОценок пока нет

- Hima OPC Server ManualДокумент36 страницHima OPC Server ManualAshkan Khajouie100% (3)

- Objective & Scope of ProjectДокумент8 страницObjective & Scope of ProjectPraveen SehgalОценок пока нет

- Chapter 1 To 5 For Printing.2Документ86 страницChapter 1 To 5 For Printing.2Senku ishigamiОценок пока нет

- Monkey Says, Monkey Does Security andДокумент11 страницMonkey Says, Monkey Does Security andNudeОценок пока нет

- Hamstring - WikipediaДокумент21 страницаHamstring - WikipediaOmar MarwanОценок пока нет

- 2009 2011 DS Manual - Club Car (001-061)Документ61 страница2009 2011 DS Manual - Club Car (001-061)misaОценок пока нет

- Impact of Advertising On Consumers' Buying Behavior Through Persuasiveness, Brand Image, and Celebrity EndorsementДокумент10 страницImpact of Advertising On Consumers' Buying Behavior Through Persuasiveness, Brand Image, and Celebrity Endorsementvikram singhОценок пока нет

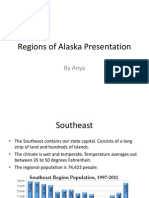

- Regions of Alaska PresentationДокумент15 страницRegions of Alaska Presentationapi-260890532Оценок пока нет

- Snapdragon 435 Processor Product Brief PDFДокумент2 страницыSnapdragon 435 Processor Product Brief PDFrichardtao89Оценок пока нет

- Waterstop TechnologyДокумент69 страницWaterstop TechnologygertjaniОценок пока нет

- Turn Around Coordinator Job DescriptionДокумент2 страницыTurn Around Coordinator Job DescriptionMikeОценок пока нет

- PLC Laboratory Activity 2Документ3 страницыPLC Laboratory Activity 2Kate AlindajaoОценок пока нет

- History of The Sikhs by Major Henry Cour PDFДокумент338 страницHistory of The Sikhs by Major Henry Cour PDFDr. Kamalroop SinghОценок пока нет

- 04 - Fetch Decode Execute Cycle PDFДокумент3 страницы04 - Fetch Decode Execute Cycle PDFShaun HaxaelОценок пока нет

- Appendix - Pcmc2Документ8 страницAppendix - Pcmc2Siva PОценок пока нет

- User S Manual AURORA 1.2K - 2.2KДокумент288 страницUser S Manual AURORA 1.2K - 2.2KEprom ServisОценок пока нет

- Rockaway Times 11818Документ40 страницRockaway Times 11818Peter J. MahonОценок пока нет

- Post Appraisal InterviewДокумент3 страницыPost Appraisal InterviewNidhi D100% (1)

- Ricoh IM C2000 IM C2500: Full Colour Multi Function PrinterДокумент4 страницыRicoh IM C2000 IM C2500: Full Colour Multi Function PrinterKothapalli ChiranjeeviОценок пока нет

- in Strategic Management What Are The Problems With Maintaining A High Inventory As Experienced Previously With Apple?Документ5 страницin Strategic Management What Are The Problems With Maintaining A High Inventory As Experienced Previously With Apple?Priyanka MurthyОценок пока нет

- Playful Homeschool Planner - FULLДокумент13 страницPlayful Homeschool Planner - FULLamandalecuyer88Оценок пока нет

- Soft Ground Improvement Using Electro-Osmosis.Документ6 страницSoft Ground Improvement Using Electro-Osmosis.Vincent Ling M SОценок пока нет