Академический Документы

Профессиональный Документы

Культура Документы

RossFCF8ce SM Ch11

Загружено:

Alan GainesАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RossFCF8ce SM Ch11

Загружено:

Alan GainesАвторское право:

Доступные форматы

CHAPTER 11 PROJECT ANALYSIS AND EVALUATION

Learning Objectives LO1 LO2 LO LO! LO" How to perform and interpret a sensitivity analysis for a proposed investment. How to perform and interpret a scenario analysis for a proposed investment. How to determine and interpret cash, accounting, and financial break-even points. How the degree of operating leverage can affect the cash flows of a project. How managerial options affect net value.

Ans#ers t$ C$nce%ts Revie# an& Critica' T(in)ing *+esti$ns 1, 2, , -LO1. Forecasting risk is the risk that a poor decision is made because of errors in projected cash flows. The danger is greatest with a new product because the cash flows are probably harder to predict. (LO2) With a sensitivity analysis, one variable is e amined over a broad range of values. With a scenario analysis, all variables are e amined for a limited range of values. (LO3) !ccounting break-even is unaffected "ta es are #ero at that point$. %ash break-even is lower "assuming a ta credit$. Financial break-even will be higher "because of ta es paid$. (LO3) &t is true that if average revenue is less than average cost, the firm is losing money. This much of the statement is therefore correct. !t the margin, however, accepting a project with a marginal revenue in e cess of its marginal cost clearly acts to increase operating cash flow. (LO5) The option to abandon reflects our ability to shut down a project if it is losing money. 'ince this option acts to limit losses, we will underestimate ()* if we ignore it. (LO5) This is a good e ample of the option to e pand. (LO4) &t makes wages and salaries a fi ed cost, driving up operating leverage. (LO4) Fi ed costs are relatively high because airlines are relatively capital intensive "and airplanes are e pensive$. 'killed employees such as pilots and mechanics mean relatively high wages which, because of union agreements, are relatively fi ed. +aintenance e penses are significant and relatively fi ed as well. (LO5) With oil, for e ample, we can simply stop pumping if prices drop too far, and we can do so ,uickly. The oil itself is not affected- it just sits in the ground until prices rise to a point where pumping is profitable. .iven the volatility of natural resource prices, the option to suspend output is very valuable.

!,

", /, 0, 1,

2,

13, -LO14 2. /uro 0isney1s e perience illustrates that profitability is everybody2s concern. Finance and marketing are strongly connected because revenues are the single most important determinant of cash flow and profitability, and marketing is responsible, in large part, for revenue production. !s we have seen in many places, revenue projections are a key part of many types of financial analysis- such projections are best developed in cooperation with marketing.

11-1

11-2

S$'+ti$ns t$ *+esti$ns an& Pr$b'e5s NOTE: All end of chapter problems were solved using a spreadsheet. Many problems require multiple steps. ue to space and readability constraints! when these intermediate steps are included in this solutions manual! rounding may appear to have occurred. "owever! the final answer for each problem is found without rounding during any step in the problem. Basic 1, (LO3) a. The total variable cost per unit is the sum of the two variable costs, so3 Total variable costs per unit 4 567.89 : ;.9< Total variable costs per unit 4 56=.>= b. The total costs include all variable costs and fi ed costs. We need to make sure we are including all variable costs for the number of units produced, so3 Total costs 4 *ariable costs : Fi ed costs Total costs 4 56=.>="?97,777$ : 59=7,777 Total costs 4 5@,=>>,;77 c. The cash breakeven, that is the point where cash flow is #ero, is3 A% 4 59=7,777 B "58<.<< C 6=.>=$ A% 4 ?;,;=7.=@ units !nd the accounting breakeven is3 A! 4 "59=7,777 : 8<7,777$ B "58<.<< C 6=.>=$ A! 4 86,;<?.?6 units 2, (LO3) The total costs include all variable costs and fi ed costs. We need to make sure we are including all variable costs for the number of units produced, so3 Total costs 4 "5>6.9@ : ??.97$"6?7,777$ : 56,=@7,777 Total costs 4 59,>79,777 The marginal cost, or cost of producing one more unit, is the total variable cost per unit, so3 +arginal cost 4 5>6.9@ : ??.97 +arginal cost 4 5@8.;@ The average cost per unit is the total cost of production, divided by the ,uantity produced, so3 !verage cost 4 Total cost B Total ,uantity !verage cost 4 59,>79,777B6?7,777 !verage cost 4 5;<.?> +inimum acceptable total revenue 4 @,777"5@8.;@$ +inimum acceptable total revenue 4 5?=>,?@7 !dditional units should be produced only if the cost of producing those units can be recovered.

11-3

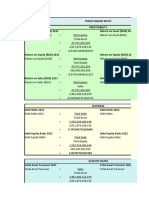

-LO2. The base-case, best-case, and worst-case values are shown below. Demember that in the bestcase, sales and price increase, while costs decrease. &n the worst-case, sales and price decrease, and costs increase. Enit 'cenario Enit 'ales Enit )rice *ariable %ost Fi ed %osts Fase 9@,777 56,877.77 5??7.77 5>,<77,777 Fest <=,=@7 56,;67.77 569=.77 5>,>6@,777 Worst =?,?@7 56,6<7.77 5?@>.77 58,89@,777 -LO1. !n estimate for the impact of changes in price on the profitability of the project can be found from the sensitivity of ()* with respect to price3 ()*B). This measure can be calculated by finding the ()* at any two different price levels and forming the ratio of the changes in these parameters. Whenever a sensitivity analysis is performed, all other variables are held constant at their base-case values. (LO1, 3) a. To calculate the accounting breakeven, we first need to find the depreciation for each year. The depreciation is3 0epreciation 4 5<?8,777B9 0epreciation 4 566@,@77 per year !nd the accounting breakeven is3 A! 4 "59?@,777 : 66@,@77$B"58; C >6$ A! 4 ;?,=77 units To calculate the 0GH at accounting breakeven, we must reali#e at this point "and only this point$, the G%F is e,ual to depreciation. 'o, the 0GH at the accounting breakeven is3 0GH 4 6 : F%BG%F 4 6 : F%B0 0GH 4 6 : I59?@,777B566@,@77J 0GH 4 9.68> b. We will use the ta shield approach to calculate the G%F. The G%F is3 G%Fbase 4 I") C v$A C F%J"6 C tc$ : tc0 G%Fbase 4 I"58; C >6$"=@,777$ C 59?@,777J"7.;@$ : 7.>@"566@,@77$ G%Fbase 4 5?>@,8?@ (ow we can calculate the ()* using our base-case projections. There is no salvage value or (W%, so the ()* is3 ()*base 4 C5<?8,777 : 5?>@,8?@")*&F!6@K,9$ ()*base 4 56>?,8?=.;= To calculate the sensitivity of the ()* to changes in the ,uantity sold, we will calculate the ()* at a different ,uantity. We will use sales of =7,777 units. The ()* at this sales level is3 G%Fnew 4 I"58; C >6$"=7,777$ C 59?@,777J"7.;@$ : 7.>@"566@,@77$ G%Fnew 4 569;,;=@ !nd the ()* is3 ()*new 4 C5<?8,777 : 569;,;=@")*&F!6@K,9$ ()*new 4 -59;,>?<.?;

!,

",

11-4

'o, the change in ()* for every unit change in sales is3 ()*B' 4 "-59;,>?<.?; C 6>?,8?=.;=$B"=7,777 C =@,777$ ()*B' 4 :58>.=@ &f sales were to drop by @77 units, then ()* would drop by3 ()* drop 4 58>.=@"@77$ 4 5?6,9=@ Lou may wonder why we chose =7,777 units. Fecause it doesn2t matterM Whatever sales number we use, when we calculate the change in ()* per unit sold, the ratio will be the same. c. To find out how sensitive G%F is to a change in variable costs, we will compute the G%F at a variable cost of 5>7. !gain, the number we choose to use here is irrelevant3 We will get the same ratio of G%F to a one dollar change in variable cost no matter what variable cost we use. 'o, using the ta shield approach, the G%F at a variable cost of 5>7 is3 G%Fnew 4 I"58; C >7$"=@,777$ C 9?@,777J"7.;@$ : 7.>@"566@,@77$ G%Fnew 4 5?98,6=@ 'o, the change in G%F for a 56 change in variable costs is3 G%FBv 4 "5?98,6=@ C ?>@,8?@$B"5>7 C >6$ G%FBv 4 -589,=@7 &f variable costs decrease by 56 then, G%F would increase by 589,=@7 /, -LO2. We will use the ta shield approach to calculate the G%F for the best- and worst-case scenarios. For the best-case scenario, the price and ,uantity increase by 67 percent, so we will multiply the base case numbers by 6.6, a 67 percent increase. The variable and fi ed costs both decrease by 67 percent, so we will multiply the base case numbers by .<, a 67 percent decrease. 0oing so, we get3 G%Fbest 4 NI"58;$"6.6$ C "5>7$"7.<$J"=@,777$"6.6$ C 59?@,777"7.<$O"7.;@$ : 7.>@"566@,@77$ G%Fbest 4 5==@,79=.@7 The best-case ()* is3 ()*best 4 C5<?8,777 : 5==@,79=.@7")*&F!6@K,9$ ()*best 4 5?,@@8,7;;.96 For the worst-case scenario, the price and ,uantity decrease by 67 percent, so we will multiply the base case numbers by .<, a 67 percent decrease. The variable and fi ed costs both increase by 67 percent, so we will multiply the base case numbers by 6.6, a 67 percent increase. 0oing so, we get3 G%Fworst 4 NI"58;$"7.<$ C "5>7$"6.6$J"=@,777$"7.<$ C 59?@,777"6.6$O"7.;@$ : 7.>@"566@,@77$ G%Fworst 4 C5??<,6;?.@7 The worst-case ()* is3 ()*worst 4 C5<?8,777 C 5??<,6;?.@7")*&F!6@K,9$ ()*worst 4 C56,<@?,>?@.9?

11-5

0,

-LO . The cash breakeven e,uation is3 A% 4 F%B") C v$ !nd the accounting breakeven e,uation is3 A! 4 "F% : 0$B") C v$ Esing these e,uations, we find the following cash and accounting breakeven points3 "6$3 A% 4 5<+B"5>,7?7 C ?,?=@$ A% 4 6?,797.@8 "?$3 A% 4 5=>,777B"58; C 86$ A% 4 68,;77 ">$3 A% 4 56,=77B"566 C 8$ A% 4 ?8?.9; A! 4 "5<+ : >.6+$B"5>,7?7 C ?,?=@$ A! 4 6;,?86.;6 A! 4 "5=>,777 : 6@7,777$B"58; C86$ A! 4 88,;77 A! 4 "56,=77 : <>7$B"566 C 8$ A! 4 >=@.=6

1,

-LO . We can use the accounting breakeven e,uation3 A! 4 "F% : 0$B") C v$ to solve for the unknown variable in each case. 0oing so, we find3 "6$3 A! 4 66?,977 4 "59?7,777 : 0$B"5>< C >7$ 0 4 56<@,?77 "?$3 A! 4 6;@,777 4 "5>.?+ : 6.6@+$B") C 5?=$ ) 4 5@>.>; ">$3 A! 4 8,>9@ 4 "56;7,777 : 67@,777$B"5<? C v$ v 4 5>6.@=

2,

-LO . The accounting breakeven for the project is3 A! 4 I56@,@77 : "5?8,777B8$JB"5;? C 86$ A! 4 67?>.96 !nd the cash breakeven is3 A% 4 56@,@77B"5;? C 86$ A% 4 =>9.6 !t the financial breakeven, the project will have a #ero ()*. 'ince this is true, the initial cost of the project must be e,ual to the )* of the cash flows of the project. Esing this relationship, we can find the G%F of the project must be3 ()* 4 7 implies 5?8,777 4 G%F")*&F!6?K,8$ G%F 4 5=,<76.;> Esing this G%F, we can find the financial breakeven is3 AF 4 "56@,@77 : 5=,<76.;>$B"5;? C 86$ 4 6668.>;

11-6

!nd the 0GH of the project is3 0GH 4 6 : "56@,@77B5=,<76.;>$ 4 ?.<;6; 13, -LO . &n order to calculate the financial breakeven, we need the G%F of the project. We can use the cash and accounting breakeven points to find this. First, we will use the cash breakeven to find the price of the product as follows3 A% 4 F%B") C v$ 67,;77 4 56@7,777B") C 5?8$ ) 4 5>9.6@ (ow that we know the product price, we can use the accounting breakeven e,uation to find the depreciation. 0oing so, we find the annual depreciation must be3 A! 4 "F% : 0$B") C v$ 6>,877 4 "56@7,777 : 0$B"5>9.6@ C ?8$ 0epreciation 4 5><,;??.;8 We now know the annual depreciation amount. !ssuming straight-line depreciation is used, the initial investment in e,uipment must be five times the annual depreciation, or3 &nitial investment 4 @"5><,;??.;8$ 4 56<9,66>.?6 The )* of the G%F must be e,ual to this value at the financial breakeven since the ()* is #ero, so3 56<9,66>.?6 4 G%F")*&F! 6?K,@$ G%F 4 5@8,<@9.@> We can now use this G%F in the financial breakeven e,uation to find the financial breakeven sales ,uantity is3 AF 4 "56@7,777 : @8,<@9.@>$B"5>9.6@ C ?8$ AF 4 68,89>.=8 11, -LO!. We know that the 0GH is the percentage change in G%F divided by the percentage change in ,uantity sold. 'ince we have the original and new ,uantity sold, we can use the 0GH e,uation to find the percentage change in G%F. 0oing so, we find3 0GH 4 KG%F B KA 'olving for the percentage change in G%F, we get3 KG%F 4 "0GH$"KA$ KG%F 4 ?.<7I"=9,777 C =>,777$B=>,777J KG%F 4 .6<9; or 6<.9;K The new level of operating leverage is lower since F%BG%F is smaller. 12, -LO!. Esing the 0GH e,uation, we find3 0GH 4 6 : F% B G%F ?.<7 4 6 : 56@7,777BG%F G%F 4 5=9,<8=.>=

11-7

The percentage change in ,uantity sold at ;=,777 units is3 KPA 4 ";=,777 C =>,777$ B =>,777 KPA 4 C.79?? or C9.??K 'o, using the same e,uation as in the previous problem, we find3 KPG%F 4 ?.<7"C9.??K$ KPA 4 C?>.9>9K 'o, the new G%F level will be3 (ew G%F 4 "6 C .?>9>9$"5=9,<8=.>=$ (ew G%F 4 5;7,89<.8= !nd the new 0GH will be3 (ew 0GH 4 6 : "56@7,777B5;7,89<.8=$ (ew 0GH 4 >.8=<9 1 , -LO!. The 0GH of the project is3 0GH 4 6 : "598,777B5<>,?77$ 0GH 4 6.<76> &f the ,uantity sold changes to 9,777 units, the percentage change in ,uantity sold is3 KA 4 "9,777 C =,@77$B=,@77 KPA 4 .7;;= or ;.;=K 'o, the percentage change in G%F at 9,777 units sold is3 KG%F 4 0GH"KA$ KPG%F 4 6.<76>".7;;=$ KPG%F 4 .6?;9 or 6?.;9K This makes the new G%F3 (ew G%F 4 5<>,?77"6.6?;9$ (ew G%F 4 567@,76>.>> !nd the 0GH at 9,777 units is3 0GH 4 6 : "598,777B567@,76>.>>$ 0GH 4 6.=<<< 1!, -LO!. We can use the e,uation for 0GH to calculate fi ed costs. The fi ed cost must be3 0GH 4 ?.;6 4 6 : F%BG%F F% 4 "?.;6 C 6$5@=,777 F% 4 5<6,==7 &f the output rises to 6;,777 units, the percentage change in ,uantity sold is3 KA 4 "6;,777 C 6@,777$B6@,777 KPA 4 .7;= or ;.=K

11-8

The percentage change in G%F is3 KG%F 4 ?.;6".7;=$ KPG%F 4 .6=8< or 6=.8<K 'o, the operating cash flow at this level of sales will be3 G%F 4 5@=,777"6 : .6=8<$ G%F 4 5;;,<;<.>7 &f the output falls to 68,777 units, the percentage change in ,uantity sold is3 KA 4 "68,777 C 6@,777$B6@,777 KPA 4 C.7;= or C;.=K The percentage change in G%F is3 KG%F 4 ?.;6"C.7;=$ KPG%F 4 C.6=8< or C6=.8<K 'o, the operating cash flow at this level of sales will be3 G%F 4 5@=,777"6 C .6=8<$ G%F 4 58=,7>7.=7 1", -LO!. Esing the e,uation for 0GH, we get3 0GH 4 6 : F%BG%F !t 6;,777 units 0GH 4 6 : 5<6,==7B5;;,<;<.>7 0GH 4 ?.>=7> !t 68,777 units 0GH 4 6 : 5<6,==7B58=,7>7.=7 0GH 4 ?.<@6 Intermediate 1/, (LO3) a. !t the accounting breakeven, the &DD is #ero percent since the project recovers the initial investment. The payback period is ( years, the length of the project since the initial investment is e actly recovered over the project life. The ()* at the accounting breakeven is3 ()* 4 & I"6B($")*&F!DK,($ C 6J b. !t the cash breakeven level, the &DD is C677 percent, the payback period is negative, and the ()* is negative and e,ual to the initial cash outlay. c. The definition of the financial breakeven is where the ()* of the project is #ero. &f this is true, then the &DD of the project is e,ual to the re,uired return. &t is impossible to state the payback period, e cept to say that the payback period must be less than the length of the project. 'ince the discounted cash flows are e,ual to the initial investment, the undiscounted cash flows are greater than the initial investment, so the payback must be less than the project life.

11-9

10, -LO1. Esing the ta shield approach, the G%F at =@,777 units will be3 G%F 4 I") C v$A C F%J"6 C t%$ : t%"0$ G%F 4 I"5?@ C 6;$"=@,777$ C 697,777J"7.;;$ : 7.>8"58?7,777B8$ G%F 4 5>;?,877 We will calculate the G%F at =;,777 units. The choice of the second level of ,uantity sold is arbitrary and irrelevant. (o matter what level of units sold we choose, we will still get the same sensitivity. 'o, the G%F at this level of sales is3 G%F 4 I"5?@ C 6;$"=;,777$ C 697,777J"7.;;$ : 7.>8"58?7,777B8$ G%F 4 5>;9,>87 The sensitivity of the G%F to changes in the ,uantity sold is3 'ensitivity 4 G%FBA 4 "5>;9,>87 C >;?,877$B"=;,777 C =@,777$ G%FBA 4 :5@.<8 G%F will increase by 5@.<8 for every additional unit sold. 11, -LO!. !t =@,777 units, the 0GH is3 0GH 4 6 : F%BG%F 0GH 4 6 : "5697,777B5>;?,877$ 0GH 4 6.8<;= The accounting breakeven is3 A! 4 "F% : 0$B") C v$ A! 4 I5697,777 : "58?7,777B8$JB"5?@ C 6;$ A! 4 >6,;;;.;= !nd, at the accounting breakeven level, the 0GH is3 0GH 4 6 : I5697,777B"58?7,777B8$J 0GH 4 ?.=68> 12, -LO14 24 4 !. a. The base-case, best-case, and worst-case values are shown below. Demember that in the bestcase, sales and price increase, while costs decrease. &n the worst-case, sales and price decrease, and costs increase. 'cenario Fase Fest Worst Enit sales 697 6<9 6;? *ariable cost 5<,977 59,9?7 567,=97 Fi ed costs 58>7,777 5>9=,777 58=>,777

Esing the ta shield approach, the G%F and ()* for the base case estimate is3 G%Fbase 4 I"56;,777 C <,977$"697$ C 58>7,777J"7.;@$ : 7.>@"56,877,777B8$ G%Fbase 4 5@;9,877 ()*base 4 C56,877,777 : 5@;9,877")*&F!6?K,8$ ()*base 4 5>?;,8?<.>=

11-10

The G%F and ()* for the worst case estimate are3 G%Fworst 4 I"56;,777 C 67,=97$"6;?$ C 58=>,777J"7.;@$ : 7.>@"56,877,777B8$ G%Fworst 4 5>;8,=6; ()*worst 4 C56,877,777 : 5>;8,=6;")*&F!6?K,8$ ()*worst 4 C5?<?,?>7.67 !nd the G%F and ()* for the best case estimate are3 G%Fbest 4 I"56;,777 C 9,9?7$"6<9$ C 5>9=,777J"7.;@$ : 7.>@"56,877,777B8$ G%Fbest 4 5=<@,76; ()*best 4 C56,877,777 : 5=<@,76;")*&F!6?K,8$ ()*best 4 56,768,=86.>> b. To calculate the sensitivity of the ()* to changes in fi ed costs we choose another level of fi ed costs. We will use fi ed costs of 5887,777. The G%F using this level of fi ed costs and the other base case values with the ta shield approach, we get3 G%F 4 I"56;,777 C <,977$"697$ C 5887,777J"7.;@$ : 7.>@"56,877,777B8$ G%F 4 5@;6,<77 !nd the ()* is3 ()* 4 C56,877,777 : 5@;6,<77")*&F!6?K,8$ ()* 4 5>7;,;9;.;7 The sensitivity of ()* to changes in fi ed costs is3 ()*BF% 4 "5>7;,;9;.;7 C >?;,8?<.>=$B"5887,777 C 8>7,777$ ()*BF% 4 C56.<=8 For every dollar F% increase, ()* falls by 56.<=8. c. The cash breakeven is3 A% 4 F%B") C v$ A% 4 58>7,777B"56;,777 C <,977$ A% 4 ;<.>@ d. The accounting breakeven is3 A! 4 "F% : 0$B") C v$ A! 4 I58>7,777 : "56,877,777B8$JB"56;,777 C <,977$ A! 4 6?@.96 !t the accounting breakeven, the 0GH is3 0GH 4 6 : F%BG%F 0GH 4 6 : "58>7,777B5@;9,877$ 4 6.=@;@ For each 6K increase in unit sales, G%F will increase by 6.=@;@K.

11-11

. 23, (LO5) a. ()*base 4 C5@,@77,777 :6,;@>,=@7")*&F!68K,6;$ 4 58,9;7,98?.>= b. %F2s$ c. The 5?,977,777 is the market value of the project. &f you continue with the project in one year, you forego the 5?,977,777 that could have been used for something else. 21, (LO5) a. 'uccess3 )* future %F2s 4 569<"<,@77$")*&F!68K,6;$ 4 566,7?9,?;?.;? Failure3 )* future %F2s 4 569<"8,>77$")*&F! 68K,6;$ 4 58,<<6,=><.<? / pected value of project at year 6 4 I"66,7?9,?;?.;?.6?: 8,<<6,=><.<?$B?J : 6,;@>,=@7 4 <,;;>,=@6.?= ()* 4 C5@,@77,777 : "<,;;>,=@6.?=$B6.68 4 5?,<=;,<=8.97 b. &f we couldn2t abandon the project, )* future %F2s 4 569<"8,>77$")*&F! 68K,6;$ 4 58,<<6,=><.<? .ain from option to abandon 4 5?,977,777 C 8,<<6,=><.<? 4 -5?,6<6,=><.<? Gption is @7K likely to occur3 value 4 ".@7$"-5?,6<6,=><.<?B6.68 4 -5<;6,?9<.88 22, -LO". 'uccess3 )* future %F2s 4 569<"6=.;77$")*&F!68K,6;$ 4 5?7,8>6,>7=.@< Failure3 from S?7, A 4 Q ?,86= so you will abandon the project- )* 4 5?,977,777 / pected value of project at year 6 4 I"?7,8>6,>7=.@< : ?,977,777$B?J : 6,;@>,=@7 4 56>,?;<,87>.=< ()* 4 C5@,@77,777 : "6>,?;<,87>.=<$B6.68 4 ;,6><,9?=.9< &f no e pansion allowed, )* future %F2s 4 569<"<,@77$")*&F! 68K,6@$ 4 566,7?9,?;?.;? .ain from option to e pand 4 5?7,8>6,>7=.@< C66,7?9,?;?.;? 4 5<,87>,788.<= Gption is @7K likely to occur3 value 4".@7$" <,87>,788.<=$B6.68 4 58,6?8,68?.@> 2 , (LO1, 2) The marketing study and the research and development are both sunk costs and should be ignored. We will calculate the sales and variable costs first. 'ince we will lose sales of the e pensive clubs and gain sales of the cheap clubs, these must be accounted for as erosion. The total sales for the new project will be3 'ales (ew clubs / p. clubs %heap clubs 59?@ @@,777 4 58@,>=@,777 56,677 "C67,777$ 4 C66,777,777 5867 6?,777 4 8,<?7,777 5><,?<@,777 5?,977,777 4 "569<$A")*&F!68K,6;$ - A 4 5?,977,777BI69<";.68??$J 4 ?,866.<9 !bandon the project if A Q ?,866.<9 units, because ()*"abandonment$ R ()* "project

11-12

For the variable costs, we must include the units gained or lost from the e isting clubs. (ote that the variable costs of the e pensive clubs are an inflow. &f we are not producing the sets anymore, we will save these variable costs, which is an inflow. 'o3 *ar. costs (ew clubs / p. clubs %heap clubs C5><@ @@,777 4 C5?6,=?@,777 C5;@7 "C67,777$ 4 ;,@77,777 C569@ 6?,777 4 C?,??7,777 C56=,88@,777

The pro forma income statement will be3 'ales *ariable costs Fi ed %osts 0epreciation /FT Ta es (et income 5><,?<@,777 6=,88@,777 <?77,777 8,?77,777 59,8@7,777 >,>97,777 5@,7=7,777

Esing the bottom up G%F calculation, we get3 G%F 4 (& : 0epreciation 4 55,070,000: 8,?77,777 G%F 4 5<,?=7,777 "5?<,877,777 : 6,877,777$ C > <,?=7,7774 5?,<<7,777 'o, the payback period is3 )ayback period 4 > : 5?,<<7,777B5<,?=7,777 )ayback period 4 >.>?> years The ()* is3 ()* 4 C5?<,877,777 C 6,877,777 : 5<,?=7,777 ")*&F!67K,=$ : 56,877,777B6.67= ()* 4 56@,789,;;>.96 !nd the &DD is3 &DD 4 C5?<,877,777 C 6,877,777 : 5<,?=7,777 ")*&F!&DDK,=$ : 56,877,777B&DD= &DD 4 ?>.8;K 2!, -LO2. The best case and worst cases for the variables are3 Enit sales "new$ )rice "new$ *% "new$ Fi ed costs 'ales lost "e pensive$ 'ales gained "cheap$ Fase %ase @@,777 59?@ 5><@ 5<,?77,777 67,777 6?,777 Fest %ase ;7,@77 5<7=.@7 5>@@.@7 59,?97,777 <,777 6>,?77 Worst %ase 8<,@77 5=8?.@7 58>8.@7 567,6?7,777.77 66,777 67,977

Fest-case We will calculate the sales and variable costs first. 'ince we will lose sales of the e pensive clubs and gain sales of the cheap clubs, these must be accounted for as erosion. The total sales for the new project will be3

11-13

'ales (ew clubs / p. clubs %heap clubs

5<7=.@7 ;7,@77 4 5@8,<7>,=@7 56,677 "C<,777$ 4 C <,<77,777 5867 6>,?77 4 @,86?,777 5@7,86@,=@7

For the variable costs, we must include the units gained or lost from the e isting clubs. (ote that the variable costs of the e pensive clubs are an inflow. &f we are not producing the sets anymore, we will save these variable costs, which is an inflow. 'o3 *ar. costs (ew clubs / p. clubs %heap clubs C5>@@.@7 ;7,@77 4 C5?6,@7=,=@7 C5;@7 "C<,777$ 4 @,9@7,777 C569@ 6>,?77 4 C ?,88?,777 C569,7<<,=@7

The pro forma income statement will be3 'ales *ariable costs %osts 0epreciation /FT Ta es (et income 5@7,86@,=@7 69,7<<,=@7 9,?97,777 8,?77,777 6<,9>;,777 =,<>8,877 566,<76,;77

Esing the bottom up G%F calculation, we get3 G%F 4 (et income : 0epreciation 4 511,901,600: 8,?77,777 G%F 4 56;,676,;77 !nd the best-case ()* is3 ()* 4 C5?<,877,777 C 6,877,777 : 56;,676,;77 ")*&F!67K,=$ : 6,877,777B6.67= ()* 4 589,>7=,=@>.97 Worst-case We will calculate the sales and variable costs first. 'ince we will lose sales of the e pensive clubs and gain sales of the cheap clubs, these must be accounted for as erosion. The total sales for the new project will be3 'ales (ew clubs / p. clubs %heap clubs 5=8?.@7 8<,@77 4 5>;.=@>.=@7 56,677 "C 66,777$ 4 C 6?,677,777 5867 67,977 4 8,8?9,777 5?<,796,=@7

For the variable costs, we must include the units gained or lost from the e isting clubs. (ote that the variable costs of the e pensive clubs are an inflow. &f we are not producing the sets anymore, we will save these variable costs, which is an inflow. 'o3 *ar. costs (ew clubs / p. clubs C58>8.@7 8<,@77 4 C5?6,@7=,=@7 C5;@7 "C 66,777$ 4 =,6@7,777

11-14

%heap clubs

C569@ 67,977 4

C 6,<<9,777 C56;,>@@,=@7

The pro forma income statement will be3 'ales *ariable costs %osts 0epreciation /FT Ta es (et income 5?<,796,=@7 6;,>@@,=@7 67,6?7,777 8,?77,777 C 6,@<8,777 ;>=,;77 C5<@;,877

Tassumes a ta credit

Esing the bottom up G%F calculation, we get3 G%F 4 (& : 0epreciation 4 C59@;,877 : 8,?77,777 G%F 4 5>,?8>,;77 !nd the worst-case ()* is3 ()* 4 C5?<,877,777 C 6,877,777 : 5>,?8>,;77 ")*&F!67K,=$ : 6,877,777B6.67= ()* 4 C568,?<;,>=@.>; 2", -LO1. To calculate the sensitivity of the ()* to changes in the price of the new club, we simply need to change the price of the new club. We will choose 5977, but the choice is irrelevant as the sensitivity will be the same no matter what price we choose. We will calculate the sales and variable costs first. 'ince we will lose sales of the e pensive clubs and gain sales of the cheap clubs, these must be accounted for as erosion. The total sales for the new project will be3 'ales (ew clubs / p. clubs %heap clubs 5977 @@,777 4 588,777,777 56,677 "C67,777$ 4 C66,777,777 5867 6?,777 4 8,<?7,777 5>=,<?7,777

For the variable costs, we must include the units gained or lost from the e isting clubs. (ote that the variable costs of the e pensive clubs are an inflow. &f we are not producing the sets anymore, we will save these variable costs, which is an inflow. 'o3 *ar. costs (ew clubs / p. clubs %heap clubs C5><@ @@,777 4 C5?6,=?@,777 C5;@7 "C67,777$ 4 ;,@77,777 C569@ 6?,777 4 C?,??7,777 C56=,88@,777

The pro forma income statement will be3 'ales *ariable costs 5>=,<?7,777 6=,88@,777

11-15

%osts 0epreciation /FT Ta es (et income

<,?77,777 8,?77,777 =,=7@,777 ?,9>7,777 5 8,?8@,777

Esing the bottom up G%F calculation, we get3 G%F 4 (& : 0epreciation 4 58,?8@,777 : 8,?77,777 G%F 4 59,88@,777 !nd the ()* is3 ()* 4 C5?<,877,777 C 6,877,777 : 59,88@,777 ")*&F!67K,=$ : 6,877,777B6.67= ()* 4 566,7>?,?69.?9 'o, the sensitivity of the ()* to changes in the price of the new club is3 ()*B) 4 "566,7>?,?69.?9 - 6@,889,;;>.96$B"5977 C 9?@$ ()*B) 4 56;7,;@=.9? For every dollar increase "decrease$ in the price of the clubs, the ()* increases "decreases$ by 56;7,;@=.9?. To calculate the sensitivity of the ()* to changes in the ,uantity sold of the new club, we simply need to change the ,uantity sold. We will choose @;,777 units, but the choice is irrelevant as the sensitivity will be the same no matter what ,uantity we choose. We will calculate the sales and variable costs first. 'ince we will lose sales of the e pensive clubs and gain sales of the cheap clubs, these must be accounted for as erosion. The total sales for the new project will be3 'ales (ew clubs / p. clubs %heap clubs 59?@ @;777 4 58;,?77,777 56,677 "C67,777$ 4 C66,777,777 5867 6?,777 4 8,<?7,777 587,6?7,777

For the variable costs, we must include the units gained or lost from the e isting clubs. (ote that the variable costs of the e pensive clubs are an inflow. &f we are not producing the sets anymore, we will save these variable costs, which is an inflow. 'o3 *ar. costs (ew clubs / p. clubs %heap clubs C5><@ @;,777 4 C5??,6?7,777 C5;@7 "C67,777$ 4 ;,@77,777 C569@ 6?,777 4 C?,??7,777 C56=,987,777

The pro forma income statement will be3 'ales *ariable costs Fi ed %osts 0epreciation /FT 587,6?7,777 6=,987,777 <,?77,777 8,?77,777 9,997,777

11-16

Ta es (et income

>,@@?,777 5 @,>?9,777

Esing the bottom up G%F calculation, we get3 G%F 4 (& : 0epreciation 4 5@,>?9,777 : 8,?77,777 G%F 4 5<,@?9,777 The ()* at this ,uantity is3 ()* 4 C5?<,877,777 C 56,877,777 : 5<,@?9,777 ")*&F!67K,=$ : 56,877,777B6.67= ()* 4 56;,>78,=6@.9; 'o, the sensitivity of the ()* to changes in the ,uantity sold is3 ()*BA 4 "56;,>78,=6@.9; - 6@,789,;;>.96$B"@;,777 C @@,777$ ()*BA 4 56,?@;.7@ For an increase "decrease$ of one set of clubs sold per year, the ()* increases "decreases$ by 59@;.7@. 2/, -LO . a. First we need to determine the total additional cost of the hybrid. The hybrid costs more to purchase and more ownership costs each year, so the total additional cost is3 Total additional cost 4 5@,@;@ : ; "5>77$ Total additional cost 4 5=>;@ (e t, we need to determine the cost per kilometre for each vehicle. The cost per km is the litres of gasoline per 677 km multiplied by the cost per litre and divided by 677, or3 %ost per km for traditional 4 ";.=$ 56.>@ B 677 %ost per km for traditional 4 57.7<78@ %ost per km for hybrid 4 "@$ 56.>@ B 677 %ost per km for hybrid 4 57.7;=@ 'o, the savings per km driven for the hybrid will be3 'avings per km 4 57.7<78@ C 7.7;=@ 'avings per km 4 57.7??<@ We can now determine the breakeven point by dividing the total additional cost by the savings per km, which is3 Total breakeven kms 4 5=,>;@ B 57.7??<@ Total breakeven kms 4 >?7,<6@.7> 'o, the kilometres you would need to drive per year is the total breakeven kms divided by the number of years of ownership, or3 Ums per year 4 >?7,<6@.7>kms B ; years Ums per year 4 @>,89@.98 kmsByear b. First, we need to determine the total kms driven over the life of either vehicle, which will be3

11-17

Total kms driven 4 ; "6@,777$ Total kms driven 4 <7,777 'ince we know the total additional cost of the hybrid from part a, we can determine the necessary savings per km to make the hybrid financially attractive. The necessary cost savings per km will be3 %ost savings needed per km 4 5=,>;@ B <7,777 %ost savings needed per km 4 57.7969>> (ow we can find the price per litre for the kms driven. &f we let ) be the price per litre, the necessary price per litre will be3 ) B "677B;.=$ C ) B "677B@$ 4 57.7969>> ) ";.=B677 C @B677$ 4 57. .7969>> ) 4 58.96 c. To find the number of km it is necessary to drive, we need the present value of the costs and savings to be e,ual to #ero. &f we let U0)L e,ual the kilometres driven per year, the breakeven e,uation for the hybrid car as3 %ost 4 7 4 C5@,@;@ C 5>77")*&F!67K,;$ : 57.7??<@"U0)L$")*&F!67K,;$ The savings per km driven, 57.7??<@, is the same as we calculated in part a. 'olving this e,uation for the number of kms driven per year, we find3 57.7??<@"U0)L$")*&F! 67K,;$ 4 5;,9=6.@9 U0)L")*&F!67K,;$ 4 ?<<,86@.6= Ums driven per year 4 ;9,8=8.<> To find the cost per litre of gasoline necessary to make the hybrid break even in a financial sense, if we let %')H e,ual the cost savings per litre of gas, the cost e,uation is3 %ost 4 7 4 C5@,@;@ C 5>77")*&F!67K,;$ : %')H"6@,777$")*&F! 67K,;$ 'olving this e,uation for the cost savings per litre of gas necessary for the hybrid to breakeven from a financial sense, we find3 %')H"?7,777$")*&F! 67K,;$ 4 5;,9=6.@9 %')H")*&F! 67K,;$ 4 57.8@967@ %ost savings per litre of gas 4 57.67@698 (ow we can find the price per litre for the kms driven. &f we let ) be the price per litre, the necessary price per litre will be3 )B"677B;.=$ C )B"677B@$ 4 57.67@698 )";.=B677 C @B677$ 4 57.67@698 ) 4 5;.6< d. The implicit assumption in the previous analysis is that each car depreciates by the same dollar amount.

20, -LO . a. The cash flow per plane is the initial cost divided by the breakeven number of planes, or3 %ash flow per plane 4 56>,777,777,777 B ?8<

11-18

%ash flow per plane 4 5@?,?79,9>@.>8 b. &n this case the cash flows are a perpetuity. 'ince we know the cash flow per plane, we need to determine the annual cash flow necessary to deliver a ?7 percent return. Esing the perpetuity e,uation, we find3 )* 4 % BD 56>,777,777,777 4 % B .?7 % 4 5?,;77,777,777 This is the total cash flow, so the number of planes that must be sold is the total cash flow divided by the cash flow per plane, or3 (umber of planes 4 5?,;77,777,777 B 5@?,?79,9>@.>8 (umber of planes 4 8<.97 or about @7 planes per year c. &n this case the cash flows are an annuity. 'ince we know the cash flow per plane, we need to determine the annual cash flow necessary to deliver a ?7 percent return. Esing the present value of an annuity e,uation, we find3 )* 4 %")*&F!?7K,67$ 56>,777,777,777 4 %")*&F!?7K,67$ % 4 5>,677,=<@,9><.89 This is the total cash flow, so the number of planes that must be sold is the total cash flow divided by the cash flow per plane, or3 (umber of planes 4 5>,677,=<@,9><.89 B 5@?,?79,9>@.>8 (umber of planes 4 @<.>< or about ;7 planes per year Challenge 21, -LO . a. The ta shield definition of G%F is3 G%F 4 I") C v$A C F% J"6 C t%$ : t%0 Dearranging and solving for A, we find3 "G%F C t%0$B"6 C t%$ 4 ") C v$A C F% A 4 NF% : I"G%F C t%0$B"6 C t%$JOB") C v$ b. The cash breakeven is3 A% 4 5@77,777B"587,777 C ?7,777$ A% 4 ?@ !nd the accounting breakeven is3 A! 4 N5@77,777 : I"5=77,777 C 5=77,777"7.>9$$B7.;?JOB"587,777 C ?7,777$ A! 4 ;7 The financial breakeven is the point at which the ()* is #ero, so3 G%FF 4 5>,@77,777B)*&F!?7K,@ G%FF 4 56,6=7,>?9.<;

11-19

'o3 AF 4 IF% : "G%F C t% V 0$JB") C v$ AF 4 N5@77,777 : I56,6=7,>?9.<; C .>9"5=77,777$JOB"587,777 C ?7,777$ AF 4 =7.?? =6 c. !t the accounting break-even point, the net income is #ero. This using the bottom up definition of G%F3 G%F 4 (& : 0 We can see that G%F must be e,ual to depreciation. 'o, the accounting breakeven is3 A! 4 NF% : I"0 C t%0$B"6 C t$JOB") C v$ A! 4 "F% : 0$B") C v$ A! 4 "F% : G%F$B") C v$ The ta rate has cancelled out in this case. 22, (LO4) The 0GH is e pressed as3 0GH 4 KG%F B KA 0GH 4 NI"G%F6 C G%F7$BG%F7J B I"A6 C A7$BA7JO The G%F for the initial period and the first period is3 G%F6 4 I") C v$A6 C F%J"6 C t%$ : t%0 G%F7 4 I") C v$A7 C F%J"6 C t%$ : t%0 The difference between these two cash flows is3 G%F6 C G%F7 4 ") C v$"6 C t%$"A6 C A7$ 0ividing both sides by the initial G%F we get3 "G%F6 C G%F7$BG%F7 4 ") C v$" 6C t%$"A6 C A7$ B G%F7 Dearranging we get3 I"G%F6 C G%F7$BG%F7JI"A6 C A7$BA7J 4 I") C v$"6 C t%$A7JBG%F7 4 IG%F7 C t%0 : F%"6 C t$JBG%F7 0GH 4 6 : IF%"6 C t$ C t%0JBG%F7 3,

(LO2) a. We can calculate the G%F year-by-year, allowing for the half-year rule and a %%! that is calculated on a declining balance basis. %%!6 4 ">,;77,777B?$".?$ 4 5>;7,777 %%!? 4 ">,?87,777$".?$ 4 5;89,777 %%!> 4 "?,@<?,777$".?$ 4 5@69,877 %%!8 4 "?,7=>,;77$".?$ 4 5868,=?7 %%!@ 4 "6,;@9,997$".?$ 4 5>>6,==; G%F6 4 I"5?97 C 69@$"?@,777$ C 9@7,777J"7.;7$ : 7.87"5>;7,777$ 4 56,7@<,777

11-20

G%F? G%F> G%F8 G%F@

4 I"5?97 C 69@$"?@,777$ C 9@7,777J"7.;7$ : 7.87"5;89,777$ 4 56,6=8,?77 4 I"5?97 C 69@$"?@,777$ C 9@7,777J"7.;7$ : 7.87"5@69,877$ 4 56,6??,>;7 4 I"5?97 C 69@$"?@,777$ C 9@7,777J"7.;7$ : 7.87"5868,=?7$ 4 56,797,999 4 I"5?97 C 69@$"?@,777$ C 9@7,777J"7.;7$ : 7.87"5>>6,==;$ 4 56,78=,=67.87

To find the ()* we need the after-ta net revenue each year as well as the present value of the %%! ta shield and the initial and ending cash flows. &nitial %ash Flow year 7 4 -5>,;77,777 C >;7,777 4 -5>,<;7,777 !fter-ta net revenue years 6-@ 4 I"' C %$ - F%J "6 C T c$ 4 I"5=,777,777 C 8,;?@,777$ - F%J "6 C 7.87$ 4 5<6@,777 /nding cash flows "year @$ 4 recovery of (W% : salvage value 4 5>;7,777 : @77,777 4 59;7,777 )* of %%!T' 4 >,;77,777".?$".87$ 6 : .6> @77,777".?$".87$ "6.6>$@ 4 5=@;,=>=.7; ()* 4 C5>,<;7,777 : 5<6@,777")*&F! 6>K,@$ : 5=@;,=>=.7; : 59;7,777B6.6>@ 4 5896,===.?6 The firm should pursue this project because the ()* is positive. b. &tem &nitial cost "5$ 'alvage value "5$ )rice "5$ (W% "5$ Fase case >,;77,777 @77,777 ?97 >;7,777 Worst case 8,687,777 8?@,777 ?@? >=9,777 Fest case >,7;7,777 @=@,777 >79 >8?,777 6 .6> : .? "6 : .@".6>$$ C .6> : .?

%%!6,worst 4 "8,687,777B?$".?$ 4 5868,777 )roceed in the same way to calculate the %%! in each of the remaining 8 years. G%F6,worst 4 NI?@? C 69@J"?@,777$ C 9@7,777O"7.;7$ : 7.87"5868,777$ 4 5;;7,;77 )roceed in the same way to calculate the G%F in each of the remaining 8 years. To find the ()* in the worst-case scenario, we need the after-ta net revenue each year as well as the present value of the %%! ta shield and the initial and ending cash flows based on the worstcase assumptions. &nitial %ash Flow year 7 4 -58,687,777 C >=9,777 4 -58,@69,777 !fter-ta net revenue years 6-@ 4 I"' C %$-F%J "6 C T c$ 4 I"5;,>77,777 C 8,;?@,777$ C 9@7,777J "6 C 7.87$ 4 8<@,777 /nding cash flows "year @$ 4 recovery of (W% : salvage value 4 5>=9,777 : 8?@,777 4 597>,777 )* of %%!T' 4 8,687,777".?$".87$ 6 : .6> "6 : .@".6>$$ C .6> : .?

11-21

8?@,777".?$".87$ "6.6>$@ 4 599<,<98.>@

6 .6> : .?

()*worst 4 -58,@69,777 : 58<@,777")*&F!6>K,@$ : 599<,<98.>@ : 597>,777B6.6>@ 4 -56,8@6,68<.<@ %%!6,best 4 ">,7;7,777B?$".?$ 4 5>7;,777 )roceed in the same way to calculate the %%! in each of the remaining 8 years. G%F6,best 4 NI>79C 69@J"?@,777$ C 9@7,777O"7.;7$ : 7.87"5>7;,777$ 456,8@=,877 )roceed in the same way to calculate the G%F in each of the remaining 8 years. To find the ()* in the best-case scenario, we need the after-ta net revenue each year as well as the present value of the %%! ta shield and the initial and ending cash flows based on the bestcase assumptions. !fter-ta net revenue year 7 4 -5>,7;7,777 C >8?,777 4 -5>,87?,777 !fter-ta net revenue years 6-@ 4 I"' C %$ C F%J "6 C T c$ 4 I"5=,=77,777 C 8,;?@,777$ C 9@7,777J "6 C 7.87$ 4 6,>>@,777 /nding cash flows "year @$ 4 recovery of (W% : salvage value 4 5>8?,777 : @=@,777 4 5<6=,777 )* of %%!T' 4 >,7;7,777".?$".87$ 6 : .6> @=@,777".?$".87$ "6.6>$@ 4 5;?>,89<.=9 ()*best 4 -5>,87?,777 : 56,>@@,777")*&F!6>K,@$ : 5;?>,89<.=9 : 5<6=,777B6.6>@ 4 5?,89@,789.=7 While the base case ()* is positive, the e pected ()* will depend on the probabilities of the three alternatives3 ()* 4 )robbase ()*base : )robworst ()*worst : )robbest ()*best. 'o the choice of whether or not to pursue the project may depend upon the estimate of those probabilities. 31. (LO1) We will examine the sensitivity of OCF to Q by increasing Q by 1,000 tons, from 25,000 to 26,000, and comparing the change in OCF for the base case: A 4 ?;,7773 G%F6 4 I"5?97 C 69@$"?;,777$ C 9@7,777J"7.;7$ : 7.87"5>;7,777$ 4 56,66;,777 The G%F for each of the remaining four years of the project can be found in the same way. 'ensitivity per 6,777 ton change in A is calculated as3 G%FBA 4 "56,66;,777 C 6,7@<,777$B"?;,777 C ?@,777$ 4 :5@=.77 To find the ()* we need the after-ta net revenue each year as well as the present value of the %%! ta shield and the initial and ending cash flows. We will again use an increased A of ?;,777 tons3 6 .6> : .? "6 : .@".6>$$ .6> : .?

11-22

&nitial %ash Flow year 7 4 -5>,;77,777 C >;7,777 4 -5>,<;7,777 !fter-ta net revenue years 6-@ 4 I"' C %$ - F%J "6 C T c$ 4 I"5=,?97,777 C 8,967,777$ C 9@7,777J C 7.87$ 4 5<=?,777 /nding cash flows "year @$ 4 recovery of (W% : salvage value 4 5>;7,777 : @77,777 4 59;7,777 )* of %%!T' 4 5=@;,=>=.7; ()* 4 C5>,<;7,777 : 5<=?,777")*&F!6>K,@$ : 5=@;,=>=.7; : 59;7,777B6.6>@ 4 5;9?,?@<.>< ()*BA 4 "5;9?,?@<.>< C 5896,===.?6$B"?;,777 C ?@,777$ 4 :5?77.89 Lou wouldn2t want A to fall below the point where ()* 4 73 5896,===.?6 4 5?77.89"A$ A 4 ?87>.66 Amin 4 ?@,777 : ?,87>.66 4 ?=,87>.66 Auantity needs to be a minimum of ?=,87>.666 tons under the base conditions.

"6

2, -LO . For year 63 !t Ac, G%F6 4 73

Ac = F% +

7 7,87 ( >?74 777 ) G%F-T 0 8@74 777 + 6-7.87 6-T = = @4 ?@< )-v ?>7-69@

For year 63 Aa 4 I59@7,777 : 5=?7,777JB"5?97 C 69@$- Aa 4 6;,@?;.>? From Auestion S>6, Af 4 >;,>@7.8; , -LO!. For year 63 0GH6 4 6 : I59@7,777"6 C 7.87$ C 7.87"5>;7,777$JB 56,7@<,777 4 6.>8@; Thus a 6K rise in ,uantity A leads to a 6.>8@;K rise in G%F. &f A rises to ?;,777, then A 4 "?;,777 C ?@,777$B?@,777 4 8K, so KG%F 4 8K"6.>8@;$ 4 @.>9?8K From Auestion S>6, G%FBG%F 4 "56,66;,777 C 6,7@<,777$B56,7@<,777 4 7.7@>9?8 4 @.>9?8K &n general, if A rises by 6,777 units, G%F rises by @,>9?8K.

11-23

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Financial Policy at Apple-NiveДокумент19 страницFinancial Policy at Apple-NiveUtsavОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Test03 ENGДокумент32 страницыTest03 ENGApurva Joshi100% (1)

- Hotel ProjectДокумент38 страницHotel ProjectMelat MakonnenОценок пока нет

- STANDARD BANK Co Applicant Application FormДокумент4 страницыSTANDARD BANK Co Applicant Application Formpokipanda69100% (1)

- Vsphere Esxi Vcenter Server 50 Installation Setup GuideДокумент234 страницыVsphere Esxi Vcenter Server 50 Installation Setup GuideAlan GainesОценок пока нет

- Xi31 Bip Pattern Win enДокумент288 страницXi31 Bip Pattern Win enAlan GainesОценок пока нет

- SAP Netweaver Basis Admin Syllabus & Demo Recordings v032014Документ10 страницSAP Netweaver Basis Admin Syllabus & Demo Recordings v032014Alan GainesОценок пока нет

- Isaca Cisa Success GuideДокумент35 страницIsaca Cisa Success GuideAlan GainesОценок пока нет

- GRC Basic-1 PDFДокумент42 страницыGRC Basic-1 PDFsupriyacnaikОценок пока нет

- BOPE 53 Configuring Security enДокумент100 страницBOPE 53 Configuring Security enAlan GainesОценок пока нет

- RossFCF8ce SM Ch06Документ47 страницRossFCF8ce SM Ch06Alan GainesОценок пока нет

- C 1Документ16 страницC 1Alan GainesОценок пока нет

- Chapter 2 Lecture Problem Solutions (6e)Документ7 страницChapter 2 Lecture Problem Solutions (6e)uzma batoolОценок пока нет

- RossFCF8ce SM Ch18Документ14 страницRossFCF8ce SM Ch18Alan GainesОценок пока нет

- 70 410Документ222 страницы70 410Alan Gaines100% (2)

- 640 911 FormattedДокумент42 страницы640 911 FormattedAlan GainesОценок пока нет

- RossFCF8ce SM Ch21Документ9 страницRossFCF8ce SM Ch21Alan GainesОценок пока нет

- Linear Programming Sensitivity Analysis: © 2007 Pearson EducationДокумент37 страницLinear Programming Sensitivity Analysis: © 2007 Pearson Educationhussain.aabid309Оценок пока нет

- RossFCF8ce SM Ch21Документ9 страницRossFCF8ce SM Ch21Alan GainesОценок пока нет

- RossFCF8ce SM Ch19Документ7 страницRossFCF8ce SM Ch19Alan GainesОценок пока нет

- RossFCF8ce SM Ch23Документ11 страницRossFCF8ce SM Ch23Alan GainesОценок пока нет

- RossFCF8ce SM Ch25Документ15 страницRossFCF8ce SM Ch25Alan GainesОценок пока нет

- RossFCF8ce SM Ch23Документ11 страницRossFCF8ce SM Ch23Alan GainesОценок пока нет

- New SylДокумент8 страницNew SylAlan GainesОценок пока нет

- New SylДокумент8 страницNew SylAlan GainesОценок пока нет

- Deriving Multiple Roles: Access ControlДокумент2 страницыDeriving Multiple Roles: Access ControlAlan GainesОценок пока нет

- Ecm RFPДокумент57 страницEcm RFPAlan GainesОценок пока нет

- Excel Tutorial7Документ42 страницыExcel Tutorial7Alan GainesОценок пока нет

- Project Management Leave A CommentДокумент7 страницProject Management Leave A CommentAlan GainesОценок пока нет

- New Text DocumentДокумент1 страницаNew Text DocumentAlan GainesОценок пока нет

- We Did Two Things in The Lab A) Creating Domain Object. B) Working With File Sy StemДокумент1 страницаWe Did Two Things in The Lab A) Creating Domain Object. B) Working With File Sy StemAlan GainesОценок пока нет

- GCG MC No. 2012-07 - Code of Corp Governance PDFДокумент31 страницаGCG MC No. 2012-07 - Code of Corp Governance PDFakalamoОценок пока нет

- 201120020118700048000000Документ3 страницы201120020118700048000000shubhamОценок пока нет

- Chapter 8 - Tangible Non-Current AssetsДокумент23 страницыChapter 8 - Tangible Non-Current AssetsSyed Huzaifa SamiОценок пока нет

- Instant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF ScribdДокумент23 страницыInstant Download Ebook PDF Financial Accounting 4th Edition by J David Spiceland PDF Scribdmarian.hillis984100% (38)

- Financial StatementsДокумент21 страницаFinancial Statementsastute kidОценок пока нет

- Liberty Media Corporation Annual Report Proxy Statement BookmarkedДокумент232 страницыLiberty Media Corporation Annual Report Proxy Statement BookmarkedWillОценок пока нет

- Maddy - Make Wealth From Intraday Trading - Based On Price Action, 5 Setups For Day Trading (2021)Документ30 страницMaddy - Make Wealth From Intraday Trading - Based On Price Action, 5 Setups For Day Trading (2021)pardhunani143Оценок пока нет

- Fabm2121 Week 11 19Документ40 страницFabm2121 Week 11 19Mikhaela CoronelОценок пока нет

- Role of Information Technology in Indian Banking SectorДокумент5 страницRole of Information Technology in Indian Banking SectorIOSRjournal100% (1)

- Introduction of Chartered AccountantДокумент2 страницыIntroduction of Chartered AccountantAashish Aashri100% (1)

- Tds - Tax Deducted at Source: FCA Vishal PoddarДокумент22 страницыTds - Tax Deducted at Source: FCA Vishal PoddarPalak PunjabiОценок пока нет

- Agreed Upn Procedures Report 3 PDFДокумент4 страницыAgreed Upn Procedures Report 3 PDFirfanОценок пока нет

- Chapter 5 - Fund Flow Statement (FFS)Документ36 страницChapter 5 - Fund Flow Statement (FFS)T- SeriesОценок пока нет

- Transaction Confirmation Report en GB f79637Документ1 страницаTransaction Confirmation Report en GB f79637sam5083mzkОценок пока нет

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Документ5 страницBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )PNDОценок пока нет

- Jeans Business PlanДокумент34 страницыJeans Business PlanNancy Goel ッ67% (3)

- L5 Financial PlansДокумент55 страницL5 Financial Plansfairylucas708Оценок пока нет

- Proyeksi INAF - Kelompok 3Документ43 страницыProyeksi INAF - Kelompok 3Fairly 288Оценок пока нет

- Wire Transfer Form 08Документ2 страницыWire Transfer Form 08eghideafesumeОценок пока нет

- FINA3080 Assignment 1 Q&AДокумент4 страницыFINA3080 Assignment 1 Q&AJason LeungОценок пока нет

- Techno 2023Документ34 страницыTechno 2023John Lester PaltepОценок пока нет

- Guideline For Synopsis, Thesis Submission MDMS Post Graduate CoursesДокумент2 страницыGuideline For Synopsis, Thesis Submission MDMS Post Graduate Courses365mohiseenОценок пока нет

- Mymaxicare Rates 2021Документ2 страницыMymaxicare Rates 2021Ariane ComboyОценок пока нет

- WP CI IFC MCF Field Note 11 Digital Social Payments PUBLICДокумент13 страницWP CI IFC MCF Field Note 11 Digital Social Payments PUBLICAbdullah MutaharОценок пока нет

- BCom CAmCOM (BPCG) PDFДокумент176 страницBCom CAmCOM (BPCG) PDFRudresh SanuОценок пока нет

- KYC - W-Link - ISR-1 - Request Form For Registering Pan - Bank - KYCДокумент2 страницыKYC - W-Link - ISR-1 - Request Form For Registering Pan - Bank - KYCJashan BelagurОценок пока нет

- All Sections of Companies Act 2013Документ66 страницAll Sections of Companies Act 2013RICHA SHARMAОценок пока нет