Академический Документы

Профессиональный Документы

Культура Документы

Audit Work Guide - Thailand Power Plant - O&M - Helmi

Загружено:

Yanti Binti Mat AminОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Audit Work Guide - Thailand Power Plant - O&M - Helmi

Загружено:

Yanti Binti Mat AminАвторское право:

Доступные форматы

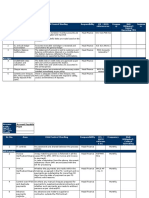

OPERATIONS & MAINTENANCE REVIEW SD Laemchabang Power / SDOMT

Key Areas and Checklist Key Areas A. PLANT OPERATIONS Review the current shift round and validate the data with the Shift Supervisor. Review the emergency action plan when the operator found some abnormal reading during the shift round.dd Observe the filing and monitoring of the data for future reference. Observe the shift hand over regarding any abnormal data recorded. Review the communication practice when dealing with abnormal data recorded. Review the list of Diagnostic Alarm for SCP and SLP. Review the active alarms for LCP and SLP (Mk 5, Mk 6. DCS) Review the shift supervisors log Review filing and data extraction. Observe the creation of Work Notification on the SAP System. Observe daily communication for daily activity Review the weekly communication Review the communication during emergency situation/ incident. Obtain the list of Maintenance Plan for the station. Obtain the backlogs for every department Review the selected procedures of the PM activities for every department. Review the backlogs on the system. 1. FAR for SD Power and SD LCP Power were generated from SAP into Physical Fixed Asset Count Sheet (PFACS) (for asset verification exercise). On 12 Nov 2012, the respective Finance Teams have conducted FA count for both the SDPC and SDLP by documenting the exercise into PFACS. Each PFACS was classified with the asset type & code (e.g. Office Equipment - 7160110) and signed off by the Technician and verified by Finance. Based on the PFACS, noted all assets were in order. Obtained the e-CAPEX FY2013 list for both the SDP and SLP. Total approved CAPEX budget was Focus Points for Audit Check Audit Observation Comments

Shift Rounds

Alarm Logs

Shift Log

Communication

B. MAINTENANCE Preventive Maintenance

2.

3. 4.

5.

6.

7.

recorded at THB185 million (SDP THB138 million; SLP THB46 million). Hence, total utilized at THB147 million (79%) out of the approved budget. Depreciation is calculated on the straight-line basis to write-off the cost of each asset to its residual value over the estimated useful life as follows: a. Building 25 years b. Building improvement 10 years c. Power plant, transmission system and equipment 5, 10, 14,20 and 25 years d. Office equipment 3 and 5 years e. Furniture and fixtures 5 years f. Motor vehicle 5 years A sample of FAR (SAP generated print-out) quoted the assigned asset custodians. Asset tagged number sighted for most of the office assets. FINDING: Absence of any form of reports to reflect the final outcome of the physical asset verification exercise. Hence, there is no visibility of information to Management action for the following: a. Discrepancy noted as compared to the FAR (SAP) b. Summary of asset conditions mainly for addressing the impaired asset verified that subsequently warrants for disposal / write-off activities. Also found that the Fixed Asset Count Sheet Control Form (Control Form) could not cross referenced to the Physical Fixed Asset Count Sheet (Asset Count Sheet) i.e. the reference numbers stated in the Control Form not duly reflected in the Asset Count Sheet. The cash and bank accounts operations are properly segregated for SDP and SLP, where 2 Accounts staff assigned for each company. Based on the List of bank accounts provided, noted

Disturbance Reports

Review the Disturbance Report for the last 3 years. Verify the corrective action reported in the report. Verify the preventive actions/ plans which listed in the report. Review the follow up action to prevent re-occurrence: PM, CM.

1.

2.

Monitoring and implementation of the preventive actions/ plans.

3. 4.

5.

that there are dedicated bank accounts been kept and maintained for 2 Companies i.e. Sime Darby Power Co. Ltd and Sime Darby LCP Power Co. Ltd. 5 bank accounts for SDP and 6 bank accounts for SDLCP. Generally, the bank signatories groupings were established in to 3 groups i.e. Group A, B, and C. Group A representing members are by the Divisional Management unlike for Group B by the MD and Group C by the local Finance Managers. Sighted the bank reconciliation statements from June13 to October13. In order, noted no materially unreconciled amounts and long non cleared payments nor uncredited lodgments.

6. Corrective Maintenance Activities Obtain an understanding of the receivables system and controls by performing a walk through assessment of the sales, billing accounts receivables and collection cycles. Examine the aged receivables in relation to the allowance for doubtful accounts and the bad debt history. Analyze the AR ratios at for corresponding FYs 2011/12 and 2012/13. Review the procedure to familiarize the system Interview the process owner for current status Observe the document relating to the procedure. Review the Emergency Response Preparedness procedure. Alalyze the Emergency Response Team organization chart. Review the possible emergency which can affect the local business activities.

Customer Complaint

Emergency Preparedness

Вам также может понравиться

- Audit Work Guide - Thailand Power Plant - O&MДокумент3 страницыAudit Work Guide - Thailand Power Plant - O&MYanti Binti Mat AminОценок пока нет

- An Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsДокумент38 страницAn Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsPhrexilyn PajarilloОценок пока нет

- Audit ProgrammesДокумент11 страницAudit ProgrammesSajjad CheemaОценок пока нет

- AIS Gelinas 10e CH 16Документ33 страницыAIS Gelinas 10e CH 16Samantha AlejandroОценок пока нет

- Guidelines For Conducting Revenue Audit of PSPCLДокумент48 страницGuidelines For Conducting Revenue Audit of PSPCLsahil rohitОценок пока нет

- Wp-Trade, Other Ar & RevДокумент10 страницWp-Trade, Other Ar & RevteresaypilОценок пока нет

- Case 10.1Документ13 страницCase 10.1Chin Figura100% (1)

- Balance Sheet Review Audit Work ProgramДокумент7 страницBalance Sheet Review Audit Work ProgramIrfan KhanОценок пока нет

- The Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcДокумент6 страницThe Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcgatchanessОценок пока нет

- Property, Plant, and Equipment NarrativeДокумент3 страницыProperty, Plant, and Equipment NarrativeCaterina De Luca100% (2)

- FI Concepts: Way To ImproveДокумент8 страницFI Concepts: Way To ImproveSmith F. JohnОценок пока нет

- Government Accounting ReportДокумент48 страницGovernment Accounting ReportReina Regina S. CamusОценок пока нет

- Accounting For ManagersДокумент10 страницAccounting For ManagersThandapani PalaniОценок пока нет

- Futurehind Techies India Forum - The New Horizone of IT in India, August 2013Документ29 страницFuturehind Techies India Forum - The New Horizone of IT in India, August 2013Dr. Paritosh BasuОценок пока нет

- Handbook On Internal Control - Effective Monitoring Using Finacle MenusДокумент28 страницHandbook On Internal Control - Effective Monitoring Using Finacle MenusnitishОценок пока нет

- mf0013Документ14 страницmf0013Raza OshimОценок пока нет

- Disclosure Requirements of AsДокумент75 страницDisclosure Requirements of AsVelayudham ThiyagarajanОценок пока нет

- Basic Features of The New Government Accounting SystemДокумент4 страницыBasic Features of The New Government Accounting SystemabbiecdefgОценок пока нет

- Libby 4ce Solutions Manual - Ch04Документ92 страницыLibby 4ce Solutions Manual - Ch047595522Оценок пока нет

- Financial Reporting Course (Scrib)Документ173 страницыFinancial Reporting Course (Scrib)Nguyen Dac ThichОценок пока нет

- Asset AccountingДокумент9 страницAsset AccountingPrabhu Ramanathan R100% (1)

- Neha Singh: Professional Synopsis - Academic SynopsisДокумент3 страницыNeha Singh: Professional Synopsis - Academic SynopsisaniketОценок пока нет

- Assignment in Specialized AccountingДокумент18 страницAssignment in Specialized Accounting143incomeОценок пока нет

- Close ChecklistДокумент6 страницClose ChecklistShifan Ishak100% (1)

- 11th Class PDFДокумент67 страниц11th Class PDFVikas PandeyОценок пока нет

- Compliance Checklist - PlantДокумент36 страницCompliance Checklist - Plantsaji kumarОценок пока нет

- PR1834 Pipeline MaintenanceДокумент24 страницыPR1834 Pipeline MaintenanceRoshin9980% (5)

- Accounts Receivable NarrativeДокумент3 страницыAccounts Receivable NarrativeCaterina De LucaОценок пока нет

- BallДокумент3 страницыBallYsabelle Yu YagoОценок пока нет

- Property ProgramДокумент18 страницProperty ProgramSyarif Muhammad HikmatyarОценок пока нет

- Chapter 8Документ6 страницChapter 8John PaulОценок пока нет

- QSRSAI Q1 2023 - DARPO Davao OrientalДокумент33 страницыQSRSAI Q1 2023 - DARPO Davao OrientalLouie Mark lligan (COA - Louie Mark Iligan)Оценок пока нет

- AC 1101 - CONCEPTUAL FRAMEWORK and ACCOUNTING STANDARDSДокумент15 страницAC 1101 - CONCEPTUAL FRAMEWORK and ACCOUNTING STANDARDShiroxhereОценок пока нет

- Operating Expenses NarrativeДокумент3 страницыOperating Expenses NarrativeCaterina De Luca100% (1)

- Ngas Vol 1 To 6 Acctng PoliciesДокумент184 страницыNgas Vol 1 To 6 Acctng PoliciesresurgumОценок пока нет

- General LedgerДокумент3 страницыGeneral LedgerAnshuman SharmaОценок пока нет

- National College of Business and ArtsДокумент10 страницNational College of Business and ArtsElaiza ReyesОценок пока нет

- Form 1101 FR.01 Financial Management Checklist: Dept / Org Unit (S) : Fiscal Period: Completed byДокумент1 страницаForm 1101 FR.01 Financial Management Checklist: Dept / Org Unit (S) : Fiscal Period: Completed bySrinivasa ReddyОценок пока нет

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Документ107 страницFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1sharon100% (44)

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Документ36 страницFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1richardacostaqibnfpmwxd100% (23)

- Asset Monitoring CbsДокумент14 страницAsset Monitoring CbsSankara NarayananОценок пока нет

- Module 9 - Government Accounting ProcessДокумент10 страницModule 9 - Government Accounting ProcessJeeramel TorresОценок пока нет

- Senior Accountant CPA in Frisco TX Resume Todd VictorsonДокумент3 страницыSenior Accountant CPA in Frisco TX Resume Todd VictorsonToddVictorsonОценок пока нет

- Ngas Vol 1 To 6 Acctng PoliciesДокумент149 страницNgas Vol 1 To 6 Acctng PoliciesKelvin CaldinoОценок пока нет

- Accounting CycleДокумент33 страницыAccounting CycleKristelle JoyceОценок пока нет

- Implementing The Computerized Government Accounting System:: Philippine ExperienceДокумент60 страницImplementing The Computerized Government Accounting System:: Philippine ExperienceJoyce Cabaddu-LimОценок пока нет

- Property ProgramДокумент18 страницProperty ProgramGovind Shriram ChhawsariaОценок пока нет

- Resume of Luis BaezДокумент4 страницыResume of Luis BaezYoginder SinghОценок пока нет

- B07 UTP & WT Non Routine and Estimation ProcessДокумент8 страницB07 UTP & WT Non Routine and Estimation ProcessJamey SimpsonОценок пока нет

- Audit of Banks With The Help of FinacleДокумент8 страницAudit of Banks With The Help of FinacleKartikey RanaОценок пока нет

- Audit Planning and Assessment Group ProjectДокумент7 страницAudit Planning and Assessment Group ProjectAbdifatahОценок пока нет

- 13 NAW To Be - Bank ReconciliationДокумент11 страниц13 NAW To Be - Bank ReconciliationsivasivasapОценок пока нет

- Product CostingДокумент12 страницProduct Costingpricewater houseОценок пока нет

- Notes Chapter 9 FARДокумент8 страницNotes Chapter 9 FARcpacfa100% (9)

- Formal List of Organized Audit Request From The ClientДокумент2 страницыFormal List of Organized Audit Request From The ClientTATYANA PAULA GOLONGОценок пока нет

- Principles of Accounting in New Accounting ModelДокумент43 страницыPrinciples of Accounting in New Accounting ModelMudassar Nawaz100% (1)

- 1A An Overview of Financial StatementsДокумент6 страниц1A An Overview of Financial StatementsKevin ChengОценок пока нет

- Alfonso Rodriquez - The Murder of Dru SjodinДокумент14 страницAlfonso Rodriquez - The Murder of Dru SjodinMaria AthanasiadouОценок пока нет

- Excutive Oeder 2023Документ1 страницаExcutive Oeder 2023Catherine Parinas0% (1)

- 48 Practice Problems For CH 17Документ9 страниц48 Practice Problems For CH 17Hasantha PereraОценок пока нет

- J2534 VCI Driver Installation GuideДокумент3 страницыJ2534 VCI Driver Installation GuideHartini SusiawanОценок пока нет

- Stock Investing Mastermind - Zebra Learn-171Документ2 страницыStock Investing Mastermind - Zebra Learn-171RGNitinDevaОценок пока нет

- Trust and Reliability: Chap 6Документ24 страницыTrust and Reliability: Chap 6Zain AliОценок пока нет

- Reyes v. CA 216 SCRA 25 (1993)Документ7 страницReyes v. CA 216 SCRA 25 (1993)Karla KanashiiОценок пока нет

- Fortigate 400f SeriesДокумент10 страницFortigate 400f SeriesDaniel MontanoОценок пока нет

- Module LAW 4 101 Unit1Документ12 страницModule LAW 4 101 Unit1Ella Mae LayarОценок пока нет

- Kant 9 ThesisДокумент6 страницKant 9 ThesisMary Montoya100% (1)

- Doctrine of Necessity - Sec 81 Indian Penal Code - Criminal Law ReviewДокумент10 страницDoctrine of Necessity - Sec 81 Indian Penal Code - Criminal Law ReviewJagriti Singh KhatriОценок пока нет

- 000.000pd 451Документ6 страниц000.000pd 451remy vegim tevesОценок пока нет

- Constitution of India - SyllabusДокумент1 страницаConstitution of India - SyllabusDavidОценок пока нет

- Case No. 83-3Документ3 страницыCase No. 83-3angelo macatangayОценок пока нет

- Peoria County Inmates 12/20/12Документ6 страницPeoria County Inmates 12/20/12Journal Star police documentsОценок пока нет

- Rental ApplicationДокумент1 страницаRental Applicationnicholas alexanderОценок пока нет

- Cyber LawsДокумент19 страницCyber LawsAnonymous vH4lUgV9Оценок пока нет

- Code of Ethics BSEEДокумент3 страницыCode of Ethics BSEEVánz Zeidlegor Sanchez VillanezoОценок пока нет

- Unit-4 Cloud ComputingДокумент42 страницыUnit-4 Cloud ComputingBella SОценок пока нет

- Employee Fraud PDFДокумент15 страницEmployee Fraud PDFmanzoorОценок пока нет

- Legal Importance of Due Diligence ReportДокумент6 страницLegal Importance of Due Diligence Reportmanish88raiОценок пока нет

- StalinДокумент25 страницStalinsairahОценок пока нет

- INCOME TAX Ready Reckoner - by CA HARSHIL SHETHДокумент38 страницINCOME TAX Ready Reckoner - by CA HARSHIL SHETHCA Harshil ShethОценок пока нет

- Subcontract For ScaffoldingДокумент23 страницыSubcontract For ScaffoldingSarin100% (1)

- Republic Vs OrtigasДокумент2 страницыRepublic Vs OrtigasJan Kristelle BarlaanОценок пока нет

- Knapp St. Safety Petition 1Документ5 страницKnapp St. Safety Petition 1WXMIОценок пока нет

- Exploring The World's First Successful Truth Commission Argentina's CONADEP and The Role of Victims in Truth-SeekingДокумент19 страницExploring The World's First Successful Truth Commission Argentina's CONADEP and The Role of Victims in Truth-SeekingEugenia CabralОценок пока нет

- Sir Arthur Helps - The Spanish Conquest in America - and Its Relation To The History of Slavery and To The Government of Colonies (Vol. 1) (1855)Документ552 страницыSir Arthur Helps - The Spanish Conquest in America - and Its Relation To The History of Slavery and To The Government of Colonies (Vol. 1) (1855)chyoungОценок пока нет

- Irr SSMДокумент25 страницIrr SSMPaulo Edrian Dela PenaОценок пока нет

- Hazrat Abu Bakr and Hazrat UmarДокумент22 страницыHazrat Abu Bakr and Hazrat UmarUzair siddiquiОценок пока нет