Академический Документы

Профессиональный Документы

Культура Документы

Venture Capital Calculations

Загружено:

Mohd IzwanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Venture Capital Calculations

Загружено:

Mohd IzwanАвторское право:

Доступные форматы

You can adjust the green cells freely Total Market Size $17,000,000.00 Percentage Captured 40.

00% Operating Margin 60.00% Years to Exit 5 Compareable P/E 13 Desired IRR 40.00% Desired Investment $1,000,000.00 Currently Issued Shares 500,000 Fixed costs are only used for comparison purposes in the graph(s). All valuations only account for variable costs Yearly Fixed Costs $400,000.00 Capitalization rate is used to determine the residual value in the discounted cash flow valuations Capitalization Rate 18%

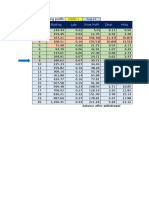

The Discount Cash Flows require additional input to run which needs to be entered on the worksheets DCF and DCF2 respectively. Classic VC Method First Chicago Method DCF Linear DCF Exponential Average PV of Company Shares to IssueShare Price Weighting $6,574,641.52 89692 $11.15 25% $5,489,825.67 111363 $8.98 25% $4,963,235.09 126160 $7.93 25% $3,917,250.09 171394 $5.83 25% 1 $5,236,238.09 $124,652.15 $8.47

Classic VC Method Evaluation Estimated PV of Company $6,574,641.52 Shares to Issue to VC 89692 Share Price $11.15

The first Chicago method uses a weighted average of multiple scenarios, in this case three. Once again you can change the green cells. Percentage of Original Market Capture Estimate Likelihood of Occurrence Terminal Net Income Terminal Value Present Value Weighted Value First Chicago Estimated PV of Company Required Ownership % Shares to Issue to VC Share Price Good Exit Mediocre Exit 150% 60% 40% 35% Failure 10% 25%

100%

$4,080,000.00 $1,632,000.00 $272,000.00 $53,040,000.00 $21,216,000.00 $3,536,000.00 $9,861,962.28 $3,944,784.91 $657,464.15 $3,944,784.91 $1,380,674.72 $164,366.04 $5,489,825.67 18.22% 111363 $8.98

Uses the inputed values to calculate DCF when you change the green cell to alter % of market captured in year one, assumes roughly linear growth. Initial % of Market Captured Linear Growth Rate 3% 9.25%

DCF NPV $4,963,235.09 Required Ownership % 20.15% Shares to issue to VC 126160 Share price $7.93 Don't edit below this line Excel outputs there Year Net Income PV of Cash Flow NPV Residual 1 $204,000.00 $145,714.29 $145,714.29 $2,809,675.86 2 $833,000.00 $425,000.00 $570,714.29 3 $1,462,000.00 $532,798.83 $1,103,513.12 4 $2,091,000.00 $544,304.46 $1,647,817.58 5 $2,720,000.00 $505,741.66 $2,153,559.23

Uses the inputed values to calculate DCF when you change the green cell to alter % of market captured in year one, assumes roughly linear growth.

The graph is generated automatically when the linear discount cash flows are calculated. Fixed costs are not factored into income.

Yearly Net Income

$3,000,000.00

$2,500,000.00

$2,000,000.00

$1,500,000.00

Fixed Costs Income

$1,000,000.00

$500,000.00

$0.00 1 2 3 4 5

This discount cash flow does not use a linear growth model and allows for multiple years after investment before product reaches the market place. Years until cash flow 2

DCF NPV $3,917,250.09 Required Ownership % 25.53% Shares to issue to VC 171394 Share price $5.83 Don't edit below this line Excel outputs there Year Net Income PV of Cash Flow Residual 1 $0.00 $0.00 $2,809,675.86 2 $0.00 $0.00 3 $680,000.00 $247,813.41 4 $1,360,000.00 $354,019.16 5 $2,720,000.00 $505,741.66

The graph is generated automatically when the non-linear discount cash flows are calculated. Fixed costs are not factored into income.

Yearly Net Income

$3,000,000.00

$2,500,000.00

$2,000,000.00

$1,500,000.00

Fixed Costs Income

$1,000,000.00

$500,000.00

$0.00 1 2 3 4 5

The graph is generated automatically when the non-linear discount cash flows are calculated. Fixed costs are not factored into income.

This worksheet uses the inputed data except Desired IRR Once again change the green cell. Excel alters the orange cell automatically IRR VC Ownership % Final Value of VC Investment Shares to Issue to VC Share Price Calculated Goal 111% 118.19% $41,792,658.23 -3248475 -$0.31 50%

This sheet uses all the inputed data but Desired Investment. Once again change the green cell. Excel alters the orange cell automatically VC Investment VC Ownership % Final Value of VC Investment Shares to Issue to VC Share Price Calculated Goal $2,887,733.33 $600,000 44% $15,530,922.92 391620 $7.37

This sheet uses all the inputed values but Desired Investment Change the green cell, Excel changes the orange Calculated Goal Founder Ownership % 84.42% VC Money Available $1,024,536.67 VC Ownership % Shares to Issue to VC Share Price 15.58% 92299 $11.10 25%

Interim Calculations Orange Cells used by Macros Terminal Net Income $2,720,000.00 Terminal Value $35,360,000.00 Required Ownership % 0.152099548 Last Row Of Data Last Row Of DCF Last Row Of DCF2 14 14 14 DCF Fixed Costs $400,000.00 $400,000.00 $400,000.00 $400,000.00 $400,000.00

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Sample Employment Letter MalaysiaДокумент5 страницSample Employment Letter MalaysiaMohd Izwan88% (24)

- A Practical Guide To Swing TradingДокумент76 страницA Practical Guide To Swing TradingHemlata Gupta100% (1)

- Trading Setups (Observable)Документ2 страницыTrading Setups (Observable)Mohd IzwanОценок пока нет

- Crude Oil 001Документ14 страницCrude Oil 001upendra1616Оценок пока нет

- DELL LBO Model Part 2 Completed (Excel)Документ9 страницDELL LBO Model Part 2 Completed (Excel)Mohd IzwanОценок пока нет

- # Trade Starting Lots Gross Profit Zakat Infaq: Month 1 Aug-16Документ5 страниц# Trade Starting Lots Gross Profit Zakat Infaq: Month 1 Aug-16Mohd IzwanОценок пока нет

- DELL LBO Model Part 1 CompletedДокумент21 страницаDELL LBO Model Part 1 CompletedMohd IzwanОценок пока нет

- Loan and Revolver For Debt Modelling Practice On ExcelДокумент2 страницыLoan and Revolver For Debt Modelling Practice On ExcelMohd IzwanОценок пока нет

- Gold Production StatisticsДокумент9 страницGold Production StatisticsMohd IzwanОценок пока нет

- Marxism UnmaskedДокумент125 страницMarxism UnmaskedjakethejakeОценок пока нет

- Capital Market Malaysia OverviewДокумент12 страницCapital Market Malaysia OverviewAmylia IsmailОценок пока нет

- Ajinomoto HistoryДокумент4 страницыAjinomoto HistoryMohd Izwan100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Ch3 AgileДокумент72 страницыCh3 Agilesaid Abdulkadir GacalОценок пока нет

- Final Paper DraftДокумент112 страницFinal Paper DraftMasresha TasewОценок пока нет

- Complete List of Published Papers Papers and PresentationsДокумент15 страницComplete List of Published Papers Papers and PresentationsWayne H WagnerОценок пока нет

- Cisa PDFДокумент71 страницаCisa PDFVierdy Sulfianto RahmadaniОценок пока нет

- Jamal Din Wali Sugar Mills ProjectДокумент9 страницJamal Din Wali Sugar Mills ProjectWaqas CheemaОценок пока нет

- Steps On How To Start Your BusinessДокумент65 страницSteps On How To Start Your BusinessAnna Rose T. MarcelinoОценок пока нет

- Delhi University - BMS Syllabus PDFДокумент72 страницыDelhi University - BMS Syllabus PDFthakkar030Оценок пока нет

- Icon 2019Документ12 страницIcon 2019Luriel AndreОценок пока нет

- OAM 680 - Spring 2024 - SyllabusДокумент15 страницOAM 680 - Spring 2024 - SyllabusVishal KhemaniОценок пока нет

- Sample Template For XXX Co. Ltd. Remuneration Committee Charter20200603Документ3 страницыSample Template For XXX Co. Ltd. Remuneration Committee Charter20200603GeorgeОценок пока нет

- Analysing Recruitment and Selection Process at Spectrum Talent ManagementДокумент95 страницAnalysing Recruitment and Selection Process at Spectrum Talent ManagementAnonymous ZWB3xQUhUkОценок пока нет

- Linear Project Management Framework: Dr. Rupali KalekarДокумент59 страницLinear Project Management Framework: Dr. Rupali Kalekargopi patilОценок пока нет

- The Miller-Orr (Model)Документ4 страницыThe Miller-Orr (Model)Veve EvelynОценок пока нет

- Cash and Cash EqДокумент18 страницCash and Cash EqElaine YapОценок пока нет

- The Capital Budgeting Decision: Block, Hirt, and DanielsenДокумент25 страницThe Capital Budgeting Decision: Block, Hirt, and DanielsenOona NiallОценок пока нет

- Ownership and Management PlanДокумент18 страницOwnership and Management PlanAnonymous jOl3Tt3u100% (1)

- SCORE Annual Marketing Budget TemplateДокумент1 страницаSCORE Annual Marketing Budget TemplateFadiОценок пока нет

- Income Taxation - Ampongan (SolMan)Документ56 страницIncome Taxation - Ampongan (SolMan)John Dale Mondejar75% (12)

- Bank Managemnet SystemДокумент34 страницыBank Managemnet SystemManas Chhonker100% (1)

- Case Study On E-Commerce - EBay & GoogleДокумент44 страницыCase Study On E-Commerce - EBay & GoogleSukanya ChatterjeeОценок пока нет

- The Business Research Process: An OverviewДокумент24 страницыThe Business Research Process: An OverviewsatahОценок пока нет

- I. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)Документ2 страницыI. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)LuiОценок пока нет

- Intelectual Property Law RA 8293 1Документ5 страницIntelectual Property Law RA 8293 1Alfred Joseph ZuluetaОценок пока нет

- Implementing Total Quality Management at WiproДокумент4 страницыImplementing Total Quality Management at WiproDullStar MOTOОценок пока нет

- FBM FinalДокумент24 страницыFBM FinalShaluОценок пока нет

- Gurarsh's Final AssignmentДокумент15 страницGurarsh's Final AssignmentGuntaaj Kaur SranОценок пока нет

- 13.BSBLDR602 Assessment 4 LearnerДокумент16 страниц13.BSBLDR602 Assessment 4 LearnerSabik NeupaneОценок пока нет

- BR Sustainability Report 2021 ENДокумент155 страницBR Sustainability Report 2021 ENyuri roseroОценок пока нет

- Credit Note: Morgan Stanley 12 Floor 25 Cabot Square Canary Wharf London E14 4QAДокумент1 страницаCredit Note: Morgan Stanley 12 Floor 25 Cabot Square Canary Wharf London E14 4QAapi-3701571Оценок пока нет

- Sap PM TablesДокумент1 страницаSap PM TablesSimón PlazaОценок пока нет