Академический Документы

Профессиональный Документы

Культура Документы

Bank of England - Inflation Report - February 2014

Загружено:

Eduardo PetazzeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bank of England - Inflation Report - February 2014

Загружено:

Eduardo PetazzeАвторское право:

Доступные форматы

Bank of England - Inflation Report - February 2014

by Eduardo Petazze Overview - Monetary poli y a! t"e e ono#y re over! $o#plete book %re!! $onferen e - Opening Re#ark! by t"e &overnor - 'edne!day 12 February 2014

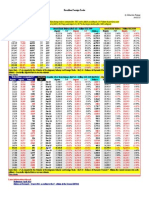

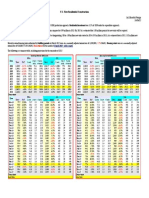

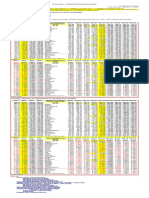

The recovery has gained momentum. . The first phase of the MPCs forward guidance was put in place last summer when, following fears of a triple dip recession, .... pecifically, the MPC set a !" unemployment rate as a threshold for even #eginning to consider whether $an% &ate should #e raised. That was a relatively easy call #ecause the considera#le slac% in the economy at the time ensured that the MPC was not ta%ing undue ris%s with inflation as monetary policy encouraged faster output and employment growth. 'orward guidance is wor%ing. ()pected interest rates have remained low even as the economy has recovered strongly. *ncertainty a#out interest rates has fallen. Most importantly, *+ #usinesses have understood the message. ... ,s a result of e)ceptionally strong -o#s growth . almost half a million more people have found wor% since ,ugust . the unemployment rate has fallen much faster than anticipated to !./", and is li%ely to reach the !" threshold #y the spring. The MPC said last ,ugust that, once unemployment had reached the threshold, we would assess the state of the economy more #roadly, drawing on a wide array of indicators. That assessment is provided in todays &eport. So what have we learned? First, productivity growth has #een disappointing. There remain good reasons to e)pect an eventual revival in productivity #ut, given recent outturns, the MPC has ta%en a cautious approach. Productivity growth is e)pected to return to its pre0crisis average rate only around the end of the forecast 1as descri#ed in the ta#le on page 2/ of the &eport3. Second, there is greater slac% in the la#our mar%et than we would have e)pected, given the strong -o#s growth. 4n part that is #ecause a su#stantial share of the fall in unemployment has #een driven #y a fall in the num#er of long0term unemployed. That means a lower level of unemployment is consistent with sta#le inflation. 4n addition, the share of people wor%ing part0time #ecause they cant find a full0time -o# remains close to a record high, and almost half of the recent increase in employment has #een driven #y self0employment, which is now at a record level. The Committees overall assessment is that spare capacity of / . /5 " of 67P remains concentrated in the la#our mar%et. The effect of this slac% is evident in low wage inflation, which is at around /" so that, even with wea% productivity, unit la#our costs are rising at an annualised rate of -ust 8.9". Third, the inflation environment is more #enign than we had anticipated. 4n particular, inflation has fallen from 9" in :8// #ac% to the target for the first time since :88;. 6lo#al inflation is su#dued, with core inflation in #oth the euro area and * close to /"< commodity prices have fallen, and sterling has appreciated #y /8" since its March trough. ,ll of these developments will hold #ac% imported inflation pressures that have to a great e)tent e)plained the a#ove0 target inflation over the past five years. 4n addition, administered and regulated prices now appear li%ely to put less upward pressure on inflation over the forecast period. Fourth, weve learned that as yet the recovery is neither #alanced nor sustaina#le. , few =uarters of a#ove trend growth driven #y household spending are a good start #ut they arent sufficient for sustained momentum. ,ctivity is still #elow its pre0crisis level. >age growth remains wea%, and the household savings rate is li%ely to fall further. The pic%0up in #usiness investment is still in its earliest stages. The glo#al outloo%, though improved in the advanced world, entails growing downside ris%s in emerging mar%ets. So whats next? The MPC has today outlined the ne)t phase of guidance, setting out the factors that will guide its decisions and how $an% &ate is li%ely to evolve once the !" unemployment threshold is reached. That guidance 1which is summarised in the #o) on pages ? and ; of the &eport3 has five elements. First, the MPC is for the first time today providing guidance that it is see%ing to a#sor# all the spare capacity in the economy over the ne)t two to three years. That recognises that spare capacity is #oth wasteful and increases the ris% that inflation will undershoot the target in the medium term. Second, the MPC is giving guidance that it -udges that there remains scope to a#sor# spare capacity further #efore raising $an% &ate. Third, the MPC is giving guidance that, if and when the time comes that the economy can sustain higher interest rates, $an% &ate is e)pected to rise only gradually. 'or a sustained and #alanced recovery, the degree of stimulus will need to remain e)ceptional for some time. The timing and pace of any increase in $an% &ate will reflect the degree of spare capacity and the pace with which it is #eing a#sor#ed. The MPC will #e monitoring a #road range of indicators including unemployment, participation in the la#our mar%et, average hours wor%ed and the e)tent of involuntary part0 time wor%ing, surveys of spare capacity in companies, la#our productivity, and wages. To allow others to monitor how the economy is evolving relative to our pro-ections, today we are pu#lishing for the first time forecasts of /? more economic indicators. @ne thing we can guarantee is that the future outturns will differ from these forecasts, #ut pu#lishing them should help others understand our %ey -udgements and anticipate how monetary policy will respond to the evolution of the economy. Fourth, the MPC is giving guidance that any increases in $an% &ate should #e limited. This recognises that many of the headwinds holding #ac% the economy will remain for some time yet. Pu#lic and private #alance sheets continue to #e repaired. >ea% world demand and the appreciation of sterling will hold #ac% the e)pansion of net e)ports. ,nd there remain strains in the financial system despite good progress on post0crisis repair. These persistent headwinds mean that, even in the medium term, the level of interest rates necessary to sustain low unemployment and price sta#ility will #e materially lower than #efore the crisis. >hile it is hard to #e precise, one illustration of the possi#le level of $an% &ate in the medium term can #e derived from the latest forecast #ased on a mar%et curve which approaches only :" three years from now. 4n this forecast, inflation is near #ut a little #elow target and the spare capacity gap narrows #ut does not =uite close. Finally, the MPC intends to maintain the stoc% of asset purchases until the first rise in $an% &ate. The first phase of guidance was a#out the conditions that would have to #e met #efore we would even #egin to thin% a#out raising $an% &ate. Aow we are outliningB what we intend to doB close the spare capacity gap over the ne)t few years< why we intend to do itB to %eep inflation at target and avoid wasteful spare capacity, particularly in the la#our mar%et< and how we intend to do itB first #y waiting to raise $an% &ate until spare capacity has #een a#sor#ed further and then eventually through gradual and limited rate increases. $an% &ate may need to stay at low levels for some time to come. The first phase of guidance gave #usinesses confidence that $an% &ate would not #e raised at least until -o#s, incomes and spending were growing at sustaina#le rates. ,s guidance evolves, that remains the caseB the MPC will not ta%e ris%s with the recovery. (l!o !ee) Bank of England !et! out e*pe ted our!e for intere!t rate! +Markit,

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- China - Price IndicesДокумент1 страницаChina - Price IndicesEduardo PetazzeОценок пока нет

- WTI Spot PriceДокумент4 страницыWTI Spot PriceEduardo Petazze100% (1)

- México, PBI 2015Документ1 страницаMéxico, PBI 2015Eduardo PetazzeОценок пока нет

- Retail Sales in The UKДокумент1 страницаRetail Sales in The UKEduardo PetazzeОценок пока нет

- Brazilian Foreign TradeДокумент1 страницаBrazilian Foreign TradeEduardo PetazzeОценок пока нет

- U.S. New Residential ConstructionДокумент1 страницаU.S. New Residential ConstructionEduardo PetazzeОценок пока нет

- Euro Area - Industrial Production IndexДокумент1 страницаEuro Area - Industrial Production IndexEduardo PetazzeОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Lifecycle Practice For Call Center AttritionДокумент14 страницLifecycle Practice For Call Center Attritionlwimberly100% (4)

- Employee Background Check Services - FadzaiДокумент6 страницEmployee Background Check Services - FadzaiNicole ChimwamafukuОценок пока нет

- Myra PowerpointДокумент12 страницMyra PowerpointJepoy dizon Ng Tondo Revengerz gangОценок пока нет

- Ethical DilemmaДокумент5 страницEthical DilemmaSean LoranОценок пока нет

- HRM in Focus - North America Europe India and ChinaДокумент29 страницHRM in Focus - North America Europe India and Chinajugal adesaraОценок пока нет

- AMERICAN POWER CONVERSION CORPORATION Vs LIMДокумент23 страницыAMERICAN POWER CONVERSION CORPORATION Vs LIMRothea SimonОценок пока нет

- Wolf Creek Amphitheatre Audit Report-Final 11-4-16Документ21 страницаWolf Creek Amphitheatre Audit Report-Final 11-4-16Julie WolfeОценок пока нет

- How To Legally End A Construction ContractДокумент111 страницHow To Legally End A Construction ContractexistenceunlimitedОценок пока нет

- Company VisitДокумент9 страницCompany Visitdaovansang100% (1)

- A Qualitative Study On Work Life Balance of Employees Working in Private SectorДокумент8 страницA Qualitative Study On Work Life Balance of Employees Working in Private SectorFarzana Bano100% (1)

- Artillery Observer Nontechnical)Документ5 страницArtillery Observer Nontechnical)Tye_Arnett_3551Оценок пока нет

- Day Pitney Report of Investigation AddendumДокумент476 страницDay Pitney Report of Investigation AddendumHelen BennettОценок пока нет

- Competency-Based Performance ManagementДокумент22 страницыCompetency-Based Performance ManagementhitensinhОценок пока нет

- Metro AuditДокумент50 страницMetro AuditABC7NewsОценок пока нет

- Fuqua Case Book 2002Документ106 страницFuqua Case Book 2002Anandapadmanabhan RamabhadranОценок пока нет

- ResumeДокумент3 страницыResumetinjorjОценок пока нет

- Mini Case On Organizational BehaviorДокумент3 страницыMini Case On Organizational BehaviorMd. Asif ZamanОценок пока нет

- Accenture Cover Letter AddressДокумент6 страницAccenture Cover Letter Addressafdnaaxuc100% (1)

- Preparing For Employment in Travel and TourismДокумент16 страницPreparing For Employment in Travel and Tourismapi-310870809Оценок пока нет

- Government of Andhra Pradesh: Revenue DepartmentДокумент33 страницыGovernment of Andhra Pradesh: Revenue DepartmentRoja GuthiReddyОценок пока нет

- Pacific Cultural Competencies FrameworkДокумент22 страницыPacific Cultural Competencies FrameworkSándor TóthОценок пока нет

- Chapter 8Документ50 страницChapter 8Amirul Izan100% (1)

- Lesson 4 TranscriptionДокумент11 страницLesson 4 TranscriptionErica Joy M. SalvaneraОценок пока нет

- Post Covid 19 Situations in BangladeshДокумент2 страницыPost Covid 19 Situations in BangladeshMd FaysalОценок пока нет

- Rack Safety Inspection GuideДокумент26 страницRack Safety Inspection GuideFfttОценок пока нет

- Air India CPL VacancyДокумент3 страницыAir India CPL VacancyArjunJainОценок пока нет

- Resume Format For Freshers - Sample Resume For Freshers - Freshers CV Format - BiodataДокумент6 страницResume Format For Freshers - Sample Resume For Freshers - Freshers CV Format - BiodataDiwakar Pratap SinghОценок пока нет

- How To Convert Family Visit Visa To Residence Visa in QatarДокумент2 страницыHow To Convert Family Visit Visa To Residence Visa in QatarmrdvirusОценок пока нет

- Chapter 6 Applied Performance PracticesДокумент3 страницыChapter 6 Applied Performance PracticesJustine Louise Bravo Ferrer100% (1)

- High Patient Nurse RatiosДокумент2 страницыHigh Patient Nurse Ratiosrachel lorenОценок пока нет