Академический Документы

Профессиональный Документы

Культура Документы

Study On Financial Performance Interpretation: Chapter-1 Introduction To Bank

Загружено:

Vishal VishОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Study On Financial Performance Interpretation: Chapter-1 Introduction To Bank

Загружено:

Vishal VishАвторское право:

Доступные форматы

Study on Financial Performance Interpretation

Chapter-1 INTRODUCTION TO BANK

MEANING OF BANK

A bank is an establishment which makes to individuals such advance of money as may be required and safely made and to which individuals entrust money when not needed by them for use. -Prof Kinlay

ORIGIN OF THE WORD BANK

Opinion is not uniform with regard to the origin of the word bank. According to some authors, the word bank is derived from BANCUS or BANQUET i.e. bench. The early bankers, the Jews in Italy transacted their business on benches in the market place, when a banker failed his bench was broken into pieces by the people which indicated the bankruptcy of the individual banker. Some other said that the word bank is originally derived from the Greek word PACK meaning a joint stock fund, which was Italianized into BANCO when the Germans were masters of a great part of Italy.

Community institute of commerce and management studies

Page 1

Study on Financial Performance Interpretation

The origin of modern financial institutions can be traced to antiquity, where the individuals used to accept money in the form of deposit and lend it to people who needed for meeting their requirements which may be economic or social. As time advanced, the character of economic transactions also changed. Old order of borrowing and lending underwent metamorphic changes. Finance became a powerful instrument for any change. In fact, the innovations in the field of transport and communication, development of energy and manufacturing have resulted in innovations in the sphere of banking.

EARLY HISTORY OF BANKING:

Banking dates back to its history right from the middle ages. As early as 2000 B.C, Babylonians were the earliest of all the people to develop a systematized banking system. It is said that temples of Babylon were used as banks and as such in temples of Ephesus and Delphi were famous great banking institutions. The anti religious feelings which developed after wards led to the collapse of public confidence in depositing money in temples and the priests ceased to perform the banking business. Whenever peace and solidarity were threatened the spread of banking also was affected entirely. However, after the revival of

Community institute of commerce and management studies

Page 2

Study on Financial Performance Interpretation

civilization and with the development of social and economic institutions, money transactions also were revived. It was the 12th century that some banks were established in Venice and Genoa. These banks were simply receiving deposit and lending money to the people. The origin of modern banking may be traced to money dealers in Florence who received money in the form of deposits and lend it to business people. At that time Florence was the centre of money market in Europe.

MODERN BANKING

Modern Banking as a service institution is a large corporate giant with large resources and multi-faceted activities. Since, the nationalization of some big commercial banks in India, there has been a great surge in the banking industry throughout the world with a growing number of banking offices. The banking business today has become highly critical and competitive between various classes of banks in offering a greater variety of services nationally and internationally. With the growth of trade and commerce, banks are also modernizing operations with a view to satisfy their customers. Modern banking institutions have resorted to automation by means of introducing computers and other equipment as well as the wealth of Information Technology (IT).

Community institute of commerce and management studies

Page 3

Study on Financial Performance Interpretation

The main aim of modernizing banking system is to improve bank operations with a view to maintain high standards in banking. This involves applications of better management techniques. In India, class banking has given way to mass banking, thereby bringing in its fold a large number of customers. Banks are now looked upon as development agents instead of purveyors of credit to the large industries and big business companies. The banks apart from providing credit to agriculture, trade industry and commerce are offering a good number of services to the customers such as making pension payments to retired government servants and collection of water and electricity bills, telephone bills, taking buy and sell decisions of behalf of their customers, managing public issues, etc.

BANKS ARE CLASSIFIED INTO SEVERAL TYPES BASED ON THEIR FUNCTION

Commercial Banks Investment or Industrial or Exchange Banks Land Development Banks Savings Bank Central Banks

Community institute of commerce and management studies

Page 4

Study on Financial Performance Interpretation

Co-operative Bank:

Co-operative Banks are promoted to meet the banking requirements of customers not only in urban areas but also in rural areas. They provide short and medium term loans. They are more service oriented than profit.

Co-operative Banking in India:

The Co-operative movement was started in India in 1904 with the object of providing finance to agriculturists for productive and there by receiving them from the clutches and money lenders. A large number of agriculture credit societies were set up in the village under the Co-operative Societies Act 1904. Co-operative was included in India mainly as defensive organization for dealing with problems of rural instrument for achieving the social objective of the national plan. The Co-operative Societies Act 1912 contributed to the establishment of Central Cooperative Bank and State Co-operative Bank to provide refinance to many credit societies, which could not mobilize funds. By facilitating the formation of central Co-operative movements made good progress during and after the First World War of 1914-1918 but during the real depression of 1929-1933, it received the serious setback with the outbreak of the Second World War of 1939-1945 of the Co-operative credit movements made considerable progress once again. The number of co-operative credit institutions has

Community institute of commerce and management studies

Page 5

Study on Financial Performance Interpretation

increased considerably, since then the progress has been maintained. Today an Indian Cooperative movement has become one of the larger voluntary movements in the world. This movement has no doubt record impressive progress in various segments of its activities. Weaker sections have been the focus of attention of Co-operatives. State Development Co-operative, Finery Societies have helped in providing organized support for economic development of weaker section. Thanks to keen interest shown by RBI in the Cooperative credit movement.

Co-operative Banking in Karnataka:

Karnataka had built a tradition and culture for an affective network of Co-operation in the state origin of Co-operative credit movement in Karnataka can be traced to the pursuing of first Co-operative Societies at 1904, based on the friendly Societies Act of England 1874. The urban co-operative society of 18th October 1904 in Dharwad district was the first urban bank formed in Bombay-Karnataka area. The Bangalore city Co-operative credit society was registered on 18th December 1906. In Karnataka there were 302 Cooperative banks by placing the state in 3rd in the country as regrets urban Co-operative banking movement when the banking regulation Act 1949, was made applicable to urban Co-operative banks Karnataka is continuing the same bank having 300 working urban banks in 2002 of this 302 primary co-operative urban banks and 14 are the salary earners.Different

Community institute of commerce and management studies

Page 6

Study on Financial Performance Interpretation

types of banks are working on par with the nationalized and commercial banks and functioning by and large, self supplying and not dependent on outside progress.

Origin of urban co-operative banks:

The urban co-operative credit movements had originated in Germany when Hermans Schultz started such societies for the benefit of artisans in cities. He found the first urban society in 1850. However after 45 years prof. V.R.Alias Bhausahah, Kavathekar, made the first experiment in urban credit in the Baroda state, he found Anyone Sahakari Mandali (1889) for the promotion of thrift and to provide credit to the Maharashtras. The Madras Presidency had developed indigenous societies in Britain. While western India preferred mutual aid societies Act 1940, conferred legal status of credit societies and the first urban Co-operative credit society was registered in 1904 at Conjeevarm in Madras province. However, the real beginning was after the amendment in 1911, enhancing its scope of 1920 severely affected an urban society and urban bank. An urban credit society having Rs. 20000 as working capital and maintaining fluid resources according to a standard fixed by the registration was designated as a bank in Madras, while in Bombay; an urban credit society could be styled as an urban up to 1938. If had Rs.5,000/- as working capital. However, the real growth of urban was only after the extension of the provision of RBI Act 1934 and Banking Regulation Act 1949 to co-operative banks from 1st March 1966. These 2 Community institute of commerce and management studies Page 7

Study on Financial Performance Interpretation

acts showed the right path of development to urban co-operative banks in poor country. Since, then urban co-operative banks had 5 steady growths.

Definitions and Meaning of Co-operative Banking:

In the words of Henry Worff Co-operative banking is an agency which is in a position to deal with the small man on his own terms accepting the security he has and without drawing on the protecting of the rich. Devine defines a Co-operative bank mutual society formed, composed and governed by working proper themselves for encourages regular savings and granting small loans on easy terms of interest and repayment.

Community institute of commerce and management studies

Page 8

Study on Financial Performance Interpretation

INTRODUCTION TO SUBJECT Finance:

In the words of John J. Hampton, the term finance can be defined as the management of the flows of money through an organization, whether it will be a corporation, school, bank or government agency. According to Howard and Upton, finance may be defined as that administrative area or set of administrative functions in an organization which relates with the arrangement of each and credit so that the organization may have the means to carry out the objectives as satisfactorily as possible. Finance directs the flow of economic activity and facilitates the smooth operation. Finance provides the required stimulus for continued business operations of all categories. Finance is essential for expansion, diversification, modernization, establishment, of new projects and so on. The financial policy of any organization to a greater extent, determines not only its existence, and survival but also the performance and success of that organization. Finance is required for investment, purposes as well as to meet substantial capital expenditure projects.

Community institute of commerce and management studies

Page 9

Study on Financial Performance Interpretation

Business Finance:

The term business finance is very comprehensive. It implies finances of business activities. The term, business can be categorized into three groups: commerce, industry and service. It is a process of raising, providing and managing of all the money to be used in connection with business activities.

Corporate Finance:

Corporate finance deals with the financial problems of a corporate enterprise. These problems include the financial aspects of the promotion of new enterprises and their administration during their early period; the accounting problems connected with the distinction between capital and income, the administrative problems arising out of growth and expansion, and finally, the financial adjustments which are necessary to booster up to rehabilitate a corporation which has run into financial difficulties. The term corporate finance includes, apart from the financial environment, the different strategies of financial planning. It includes problems of public deposits, intercompany loans and investments, organized markets such as the stock exchange, the capital market, the money market and the bill market. Corporate finance also covers capital formation and foreign capital and collaborations

Community institute of commerce and management studies

Page 10

Study on Financial Performance Interpretation

Financial analysis:

Financial analysis is the process of identifying the financial strength and weakness of the Bank by properly establishing relationships between the items of the balance sheet and the profit and loss account.

Users of financial analysis:

Trade creditors. Suppliers of long-term debt. Investors. Management.

Financial Statements: DEFINITION OF FINANCIAL STATEMENTS:

The term financial statements refers to the profit and loss account and balance sheet prepared by all the businessmen. The profit and losses account is prepared in order to know results of business operations.

Community institute of commerce and management studies

Page 11

Study on Financial Performance Interpretation

They are the means to present the Banks financial situation to the users. As these statements, are used by investors and financial analyst and examine the Banks performance in order to make investment decisions. Two basic financial statements are prepared for the purpose of external reporting to owners, investors and creditors are: Balance sheet or statement of financial position Profit and loss account or income statement.

Objectives of Financial Statements

The basic objective of financial statement is to assist in decision-making and some of the objectives of preparing the financial statement are,

Resources and obligations:- To provide the financial information about economic

resources and obligations of a business enterprise.

Change in net resources:- To provide reliable information about changes in resources

of an enterprise that result from the profit directed activities

Community institute of commerce and management studies

Page 12

Study on Financial Performance Interpretation

Earnings potential:- To provide financial information that assists in estimating the

earnings potential of the enterprise.

There are various methods or techniques used in analyzing and interpreting the financial statements such as, Common size financial statement. Comparative financial statements. Trend analysis. Break-even analysis. Fund flow analysis. Cash flow analysis. Ratio analysis. All these techniques are one of the powerful tools of financial analysis. These methods are used to review the financial performance of any company. With the help of these techniques

Community institute of commerce and management studies

Page 13

Study on Financial Performance Interpretation

that financial statements can be analyzed more clearly and decision can be made from such analysis. The methods or techniques used for the financial analysis are: Trend analysis. Ratio analysis.

Community institute of commerce and management studies

Page 14

Study on Financial Performance Interpretation

Chapter-2 DESIGN OF STUDY TITLE OF THE STUDY: THE STUDY ON FINANCIAL PERFORMANCE OF BANGALORE CITY CO-OPERATIVE BANK LIMITED. STATEMENT OF THE PROBLEM:

Analysis of financial performance is one of the major requirements for planning. BCCB being a government enterprise, it is very crucial to analyze its performance because, it is required by shareholders, bank, management, creditors and employees, government and financial institutions as they are interested to know the financial soundness of the Bank.

Community institute of commerce and management studies

Page 15

Study on Financial Performance Interpretation

OBJECTIVES OF THE STUDY:

To understand the financial performance indicators of BCCB. To study financial performance and trends through various key financial indicators. To gain practical knowledge in the areas of finance and accounts. To analyze the actual performance of company in the areas of liquidity, profitability through financial indicators and compare the present performance with standard norms.

Community institute of commerce and management studies

Page 16

Study on Financial Performance Interpretation

SCOPE OF THE STUDY: The study was taken up to know the financial activities in BCCB relating to their business

activities and performance of the corporation only. The study is being done to know the financial activities of the corporation and study is limited to BCCB only. Study is being done to ascertain the financial status of the Bank. The study of financial performance comprise of trend analysis, ratio analysis, and comparative statement analysis.

Community institute of commerce and management studies

Page 17

Study on Financial Performance Interpretation

METHODOLOGY AND DATA COLLECTIONS:

Sources of data are classified into two types they are, Primary data Secondary data

PRIMARY DATA:

Primary data may be described as those data that have been observed by the researchers for the first time. Primary data are collected from: General discussions with officers of BCCB. An Unstructured informal interview was followed with high officials of the Bank. Annual reports of BCCB

Community institute of commerce and management studies

Page 18

Study on Financial Performance Interpretation

SECONDARY DATA:

Secondary data are those data that have been compiled already before conducting the research. Secondary data may be internal as well as external. Internal data are collected from the banks records. External data are collected from outside the bank. The various sources of secondary data are: Corporations previous records Various publications and manuals of BCCB Books, magazines and news papers Bank website

Community institute of commerce and management studies

Page 19

Study on Financial Performance Interpretation

RESEARCH INSTRUMENTS:

The analysis interpretation of the financial statement is used to determine the financial position and result and operation as well. A number of methods and devices are used to study the relationship between different statements. The statistical tools adopted for the study are: Financial Ratio Trend analysis

METHOD OF STUDY:

Discussion with the management of the bank to get general information about their activities in bank. Study of the classification of items adopted in profit and loss account and balance sheet and the accounting policies of the concern. Study of the annual reports of 3 years from 2008-2010 for collecting data. Analysis of their adopted techniques and methods available. The study was made to analyze the financial performance with reference to financial statements like profit and loss account and balance sheet with the help of tables, ratios,

Community institute of commerce and management studies

Page 20

Study on Financial Performance Interpretation

and graphs. Providing suggestions for improving the methods and procedures followed by the bank.

Community institute of commerce and management studies

Page 21

Study on Financial Performance Interpretation

LIMITATIONS OF THE STUDY: The effort has been made to study completely and as exhaustively as possible. However the following problems were faced during the study is as follows: 1. The confidentiality of some facts and figures has acted as a limitation, does not include competition from commercial bank, nationalized, foreign banks for which time was a constraint. 2. The study is based on the data given by the officials and reports of the bank. It was not possible to study day-to-day problems faced by the bank. 3. The comparison and analysis are limited only for the past 3 years.

Community institute of commerce and management studies

Page 22

Study on Financial Performance Interpretation

Chapter-3 PROFILE OF THE INDUSTRY BANK PROFILE

The Bangalore City Co-operative bank Limited, started in the year 1905 as a credit Cooperative Society. Later on in was converted as First Urban Co-operative Bank in the country wide Registration No.314/cs.encl/4 dated 6/8-4-1907 from the Registrar of cooperative Societies in Karnataka. The bank has already celebrated the Silver Jubilee in the year 1932, Golden Jubilee in the year 1957, Diamond Jubilee in the year 1967 and Platinum Jubilee in the year 1977 and completed 100 years of Co-operative service to the members, depositors and general publics and the board has making all arrangements to celebrate the century of the bank in the month of April 2007. The bank has successfully running since from its inception as Best Urban Cooperative Bank and awarded meritorious certificate and rolling shield during the year 1926, 1927 and 1928 from the erstwhile Maharaja of Mysore Sri Sri Sri. Kanteerava Narasimharaja Wodeyar Bahaddur.

Community institute of commerce and management studies

Page 23

Study on Financial Performance Interpretation

Recently the bank has also adjudged as best Urban Co-operative Bank by the Government of Karnataka in the year 2001-02 and 2003-04 and received the meritorious certificate and rolling shield. Received award for completion of 100 years of banking service from the Government of Karnataka in centenary celebration of Co-operative Movement. Initially bank started with the share capital of 2727/- by 150 members and deposits of Rs. 2265/Apart from administrative office the bank has already opened 12 branches in prestigious locality of Bangalore and now it has applied for 2 additional branches In order to give better customer service to the members, depositors and general publics the bank has already computerized its administrative office as well as entire 12 branches of the bank. Apart from banking business the bank has generously conducted/donated Conduct free eye camp to the members and general public with the assistance of Lions Eye Hospital, Bangalore. Conduct free medical check up to the members and general public.

Community institute of commerce and management studies

Page 24

Study on Financial Performance Interpretation

Donate Rs. 1 lakh to Kidwai Institute of Oncology Bangalore to build the ward in the name of the bank.

Donate Rs. 50,000/- to Regional Institute of Co-operative Management, Bangalore to renovate the class room of MBA.

Donate Rs. 2 lakh to Karnataka State Co-operative Urban Bank Federation for the construction of the building.

The Board of Management has contributed generously Rs. 50,000/along with one day salary of staff members to the following occasions:

Flood victims of India Earth quake victims of Maharashtra and Gujarat

Rehabilitation of Kargil Victims. Educational incentives to the meritorious students of members. The bank has appointed highly qualified and experienced persons to provide better banking services to the members, depositors and customers.

Community institute of commerce and management studies

Page 25

Study on Financial Performance Interpretation

The bank is governed by the Veteran Co-operators who are dedicated in the field of Co-operation.

Shortly the bank is reaching to attain the scheduled Co-operative Banking status prescribed by the Reserve Bank of India.

Ownership

The bank is completely controlled by the President, Vice president and the Directors. Only RBI can interfere in the rules and regulations of the bank. The bank consists of a president, a vice president and 15 directors.

Board of Directors

President Vice president Directors Sri.Avalahalli chandrappa Dr. Devraj T.M Sri Dr. T.P Yoga

Dr. Devraj .T.M Sri B.K. Ashwata Narayana Sri Dayashankar G.S. Rajendra Sri T.D. Dhananjaya Sri K. Krishnappa Sri Anjanappa Sri M. Hanumanayya Sri N. Thimayya Page 26

Community institute of commerce and management studies

Study on Financial Performance Interpretation

Sri U.P Puranik Sri k. Krishna Murthy Sri Basavaraju Smt. L Bhgyalakshmi

General Manager - Sri. N. Manjunatha

ABOUT FOUNDATION:

Branches structure of the Bangalore City Co-operative Bank Ltd .The following 12 branches along with one administration office and all the branch have been computerized under the jurisdiction of Bangalore City Corporation, Bangalore Development Authority and Bangalore Urban and Peripheral areas .

Notes On Formation, Growth And Achievement Of The Bangalore City co-operative bank Ltd., Bangalore-18

The twentieth century of the Indian history has seen two people movements, of which one was the freedom struggle against the British to free the nation from the foreign rule and the other was the Co-operative movement against capitalists with aim to improve the economic condition of the poor and economically backward ones. The Co-operative Community institute of commerce and management studies Page 27

Study on Financial Performance Interpretation

movement was started in India with the introduction of Co-operative societies Act, 1907 and during the initial stages of Co-operative movement, our bank The Bangalore City Cooperative Bank Ltd,. Bangalore came in to existence as credit Co-operative Society during the year 1905 and later converted as urban Co-operative Bank on 06-04-1907 as first urban co-operative bank of the then Mysore province. The Bangalore City Co-operative Bank Ltd ,.with its main objective of promoting thrift and saving habit among its member and to free the members from the clutches of money lenders was formed under the leadership of Sri K Ramaswamaiah ,Head Master ,London Mission School . During the year 1907, our bank has mobilized share capital of Rs.2727/-from 150 members and deposit of Rs.2265/- and also lent Rs.4036/- to its members. The bank has made a profit of Rs.156/- and declared a dividend of 13.02% in the first year. Since the date of inception, the bank never had a setback in mobilization of share capital/deposits and in grant of loans and advances and in its net profit

Community institute of commerce and management studies

Page 28

Study on Financial Performance Interpretation

The financial growth of the bank is given here under in nutshell

Financial year ending 1907 1917 1927 1937 1947 1957 1967 1977 1987 1997 2007 2008 2009 2010 2011

No. of members 156 1110 1535 2545 2172 3348 5360 5496 13579 30980 39912 42191 44518 45500 46000

Share capital

Reserves & other funds

Deposits

Loans advances 4,036 2,36,725 6,06,756 17,40,913 12,26,099 23,13,176 28,16,749 48,69,489 4,15,38,926 35,05,87,887

&

Net profit

2,727 1,26,922 1,77,980 3,65,277 3,51,783 3,79,109 4,10,266 8,95,904 44,45,525 2,76,23,080 11,41,64,541 13,94,22,103 17,33,63,267 20,35,48,167 28,71,12,907 4,003 14,095 15,223 21,257 4,66,337 9,82,631 33,55,252 44,50,551 38,53,63,257 41,57,51,667 44,98,27,118 47,96,00,052 54,26,10,058

2,265 1,17,318 1,15,079 17,07,660 17,57,738 21,00,049 24,87,795 37,58,839 5,42,64,904 53,48,55,407 224,43,62,150 289,10,54,009 378,63,09,868 461,29,68,093 597,62,10,335

156 9,892 20,737 42,216 26,313 36,187 22,054 1,48,615 11,53,581 1,18,83,787 3,55,49,263 4,27,23,786 5,17,00,057 5,34,00,000 7,95,66,288

150,17,47,820 233,67,94,907 294,84,43,368 326,72,71,284 444,12,12,211

Community institute of commerce and management studies

Page 29

Study on Financial Performance Interpretation

Aims:

As per the laws if the bank the following are the aims of the Co-operative Bank; Accepting the deposits for the purpose of promoting saving habits in the minds of public and members. Providing the various types of loan facilities to members and associate members. To open new branches with the permission from the RBI and Registrar of Co-

operative Societies.

Community institute of commerce and management studies

Page 30

Study on Financial Performance Interpretation

Following are some of the Rules and Regulations provided by the bank for the benefit of Customers:

Avail nomination facilities at A/C holders including saving bank A/C current A/C holders. Bank will exchange mutilated currency notes as per RBI guidelines. Bank will give standing instruction for the payment of bills, rents, interests, insurance etc Bank provides required and important guidelines to the locker holders. and

Community institute of commerce and management studies

Page 31

Study on Financial Performance Interpretation

CORPORATE MISSION

To meet the growing aspiration of the customers of the bank in particular and others in general in the changing environment. To bring about total customer satisfaction by providing quality service. To promote socio economic development and employment as national and social objectives. To meet the economic and career aspirations of the society and employees. Generating the deposits from the customers to increase profit and goodwill.

Community institute of commerce and management studies

Page 32

Study on Financial Performance Interpretation

IMPORTANT DECLARATION

Bank declares and undertakes: To provide professional, efficient, courteous, diligent and speedy services on the matter of retail deposits. Not to discriminate on the basis of religion, caste, sex, descent or any of them. To be fair and honest in advertisement and marketing of deposit products. To provide customer with accurate and timely disclosure of terms, costs, rights and liabilities as regard deposit transactions. If sought, to provide such assistance or advice to customers. To attempt a good faith to resolve any disputes or differences with customers by setting up complaint redress cells within the organizations. To comply with all regulatory requirements in good faith. To spread general awareness about potential risks contracting deposits and encourages customers to take up independent financial advice and not act only on representation from the bank.

Community institute of commerce and management studies

Page 33

Study on Financial Performance Interpretation

CHAPTER-4 ANALYSIS AND INTERPRETATION OPERATIONAL DEFINITION OF CONCEPTS: Financial Statements:

Financial statements contain summarized information of the Banks financial affairs organized systematically. These are the means of presenting financial status of the Banks to the users. Two basic financial statements prepared for the purpose of external reporting to managers, investors and creditors are, Balance sheet Profit and Loss account

It is the most significant financial statement. It indicates the financial conditions or the state of affairs of a business at a particular moment of time; balance sheet contains information about resources and obligations of a business entity and about its bankers interest in the business at a particular point in time.

Community institute of commerce and management studies

Page 34

Study on Financial Performance Interpretation

Assets:

Assets represent economic resources. These are the valuable possessions owned by the Bank. These possessions should be capable of being measured in monetary terms. Assets are the future benefits fixed assets are used in business for more than an accounting period of one year, while current assets are converted into cash with an accounting period

Liabilities:

Are the amount payable by the Bank to the outsiders liabilities are payable within an accounting period are called current liabilities and those payable after a year or so are called long term liabilities.

Revenues:

Revenue is the value of amount supplied to the customers, more specifically; revenue is the gross inflow of assets or the gross decrease in liabilities that result from a Banks activities that change bankers equity.

Community institute of commerce and management studies

Page 35

Study on Financial Performance Interpretation

Expenses:

Expenses occur when assets are consumed or liabilities are increased in order to produce revenue, more specifically expenses represent a gross decrease in assets or gross increase in liabilities.

Profit:

The difference between the revenue and expenses

Ratio Analysis:

In financial analysis, ratios as a bench mark for evaluating the financial position and performance of a Bank. Is a process of identifying the financial strength and weaknesses of the Bank.

Capital employed:

Is equal to total of fixed assets are reduced by current liabilities.

Community institute of commerce and management studies

Page 36

Study on Financial Performance Interpretation

Fund: The term fund can be defined in 3 ways, it may mean cash, and working capital and financial resources fund flow statement provide an analysis of changes in the Banks working capital position. Profit and loss account:

Profit and loss account presents the summary of revenue, expenses and net income (or net loss) of a Banks profitability.

Financial Ratio Analysis INTRODUCTION

The most important task of a financial manager is to interpret the financial ratios the ratio analysis is the most powerful tool in the hands of any product management as it offers immediately on insight into the working of the corporate enterprises. It is the process of establishing the financial ratios about the trend in terms of its financials can draw inferences.

Community institute of commerce and management studies

Page 37

Study on Financial Performance Interpretation

Meaning

Ratio analysis is a powerful tool of financial analysis a ratio is defined as the indicated quotient of two mathematical expressions and as the relationship between two or more things. In financial analysis a ratio is used as a bench mark for evaluating financial positions and performances of a bank the absolute accounting figures respected in the financial statement do not provide a meaningful understanding of a performance and position of a bank. The relationship between two or more accounting figures groups is called a financial ratio. Ratio helps to summarize large quantities of financial data and to make qualities judgment about the banks financial performance

Types of ratios:

Several ratios calculated from the accounting data, can be grouped into various classes according to financial activity or functions to be evaluated. As stated earlier, the parties interested in the financial analysis are short and long terms creditors, owners and management. Short-term creditors main interest in the liquidity position or the short-term solvency of the bank. Long term creditors on the other hand, are more interested in the bank profitability and financial conditions.

Community institute of commerce and management studies

Page 38

Study on Financial Performance Interpretation

Management is interested in evaluating every aspect of the bank performance. They have to protect the interest of all parties and see that the bank grows profitability. In view of the requirement of ratios, we may classify them into the following four important categories: Liquidity ratios Leverage ratios Activity ratios Profitability ratios

LIQUIDITY RATIO:

Liquidity ratios measure the ability of the firm to meet its current obligation. In the fact, analysis of liquidity needs the preparation of cash and fund flow statements: but liquidity ratios, by establishing a relationship between cash and others current assets to current obligations, provide a quick measure of liquidity. A bank should ensure that it does not suffer from lack of liquidity, and also that it does not have excess liquidity , will result in a poor creditworthiness, loss of creditors confidence or even in legal tangles resulting in the closer of the bank. A very high degree of liquidity is also bad ideal assets earn nothing. The firms fund will be unnecessary tied up in current asset. Therefore, it is necessary to strike a proper balance between high liquidity and lack of liquidity.

Community institute of commerce and management studies

Page 39

Study on Financial Performance Interpretation

The most common ratios that indicate the extent of liquidity or lack of it are: (1) current ratio and (2) Quick ratio. Other ratios include cash ratio, interval measures and net working capital ratio.

Leverage ratio:

Financial leverage refers to the use of debit finance while doubt capital is a chapter source of financial it is a riskier source of financial leverage ratios help in assessing the risk arising from the rise of debit capital. The important leverage ratios are: Debit Asset Ratio Debit Equity Ratio

Intrest Coverage Ratio

Community institute of commerce and management studies

Page 40

Study on Financial Performance Interpretation

Activity/efficiency/turnover ratio:

Activity ratios are employed to evaluate the efficiency with which the bank managers and utilize its assets these ratios are also called turnover ratios because they indicates the speed with which into sales. Activity ratios thus involve a relationship between sale and assets generally reflect that assets are managed well. Important activity ratios are: Inventory turnover ratios Debtors turnover ratio

Fixed assets turnover ratio

PROFITABELITY RATIOS:

Profitability reflects the final result of business operations profitability rate on are calculates operations efficiency of the bank. Important profitability ratios are: Gross profit margin ratio Net profit margin ratio

Community institute of commerce and management studies

Page 41

Study on Financial Performance Interpretation

Return on total asset.

1. Current Ratio

It may be defined as the relationship between current assets and current liabilities. It shows a banks ability to cover its current liabilities with its current assets. It can be expressed as follows;

Current ratio =

Current assets Current liabilities

Table showing current ratio Year Current assets (Rs) 2008-09 2009-10 2010-11 26,68,70,523 31,70,74,391 38,04,63,029 Current Liabilities (Rs) Ratio

17,98,43,972 21,25,71,023 21,66,40,367

1.48 1.49 1.75

Community institute of commerce and management studies

Page 42

Study on Financial Performance Interpretation

1.75 1.7 1.65 1.6 1.55 1.5 1.45 1.4 1.35 1.3 17,98,43,972 21,25,71,023 21,66,40,367 (Rs) 26,68,70,523 31,70,74,391 38,04,63,029 2008-09 2009-10 2010-11

Ratio

Interpretation Of Current Ratio

A relatively high current ratio is an indicator that the firm is liquid and has ability to pay its current obligations in time when they become due. On the other hand, relatively low current ratio represents that the liquidity position of the firm is not good and the firm shall not be able to pay its current liabilities in time without facing difficulties. The standard current ratio of the bank for the years 2009, 2010, 2011 is 1.48, 1.49, and 1.75 respectively.

Community institute of commerce and management studies

Page 43

Study on Financial Performance Interpretation

2.Cash Ratio

Cash is the most liquid asset a financial analysis may examine cash ratio and its equivalent to current liabilities. Trade investments or marketable securities are equivalent of cash therefore they may be included in the computation of cash ratio. It can be calculated as

Cash+ Marketable securities Cash Ratio = Current Liabilities Table showing Cash Ratio Year Cash+Securities Current (Rs) 2008-09 2009-10 2010-11 3,43,68,746 3,12,62,897 3,35,90,290 Liabilities Ratio(%)

17,98,43,972 21,25,71,023 21,66,40,367

0.19 0.14 0.16

Community institute of commerce and management studies

Page 44

Study on Financial Performance Interpretation

0.19 0.2 0.14 0.15 0.1 0.05 0 17,98,43,972 21,25,71,023 21,66,40,367 (Rs) 3,43,68,746 2008-09 3,12,62,897 2009-10 Ratio(%) 3,35,90,290 2010-11 0.16

Interpretation of cash ratio:

This ratio indicates the proportion of cash and bank balance. i.e., it shows the ability of firms to pay its current liabilities by using most liquid asset, cash and bank balance. Here the cash ratio the bank shows that the bank is holding only little cash to maintain its day today needs. That is not a bad sign to the banks

Community institute of commerce and management studies

Page 45

Study on Financial Performance Interpretation

3. DEBT EQUITY RATIO

Debt equity ratio is the ratio, which express the relationship between debit and equity or relationship between borrowed capital and owners.

Total debt Debt equity ratio = Net worth Table showing debt equity ratio Year 2008-09 2009-10 2010-11 Debt (Rs) 259,99,96,639 92,90,02,709 82,73,41,790 Equity (Rs) 62,31,90,385 70,10,31,633 75,25,62,573 Ratio (%) 4.17 1.32 1.09

Community institute of commerce and management studies

Page 46

Study on Financial Performance Interpretation

Ratio (%)

4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 debt equity ratio

62,31,90,385 259,99,96,639 2008-09 4.17

70,10,31,633 92,90,02,709 2009-10 1.32

75,25,62,573 82,73,41,790 2010-11 1.09

Ratio (%)

Interpretation Of Debt Equity Ratio

The debt equity ratio is calculated to measure the extent to which debit financing has been used in a business. The ratio indicates the proportion claims of owners and the outsiders against the banks assets.

Community institute of commerce and management studies

Page 47

Study on Financial Performance Interpretation

4 TOTAL DEBT RATIO

Debt ratios are used to analysis the long-term solvency of a firm. The firm may be interested in knowing the interest bearing debt in capital structure. Total debt ratio may, therefore, compute the debit ratio by following.

Total debt Total Debt Ratio = Total debt + net worth Table showing total debt ratio Year Total Debt (Rs) Total Debt + Net Ratio(%) worth 2008-09 2009-10 2010-11 277,98,40,611 114,15,73,732 82,73,41,790 340,30,30,996 184,26,05,365 152,81,73,423 0.79 0.61 0.54

Community institute of commerce and management studies

Page 48

Study on Financial Performance Interpretation

Ratio(%)

0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 340,30,30,996 277,98,40,611 2008-09 184,26,05,365 114,15,73,732 2009-10 152,81,73,423 82,73,41,790 2010-11

Ratio(%)

Interpretation Of Total- Debt Ratio

From the above analysis we come to know the debit equity ratio has decreased in the years 2011, 2010, compare to 2009. This shows that there is a increase and decrease fluctuation and the debit is decreased in the bank. It indicates the percentage of funds being financial through borrowings is decreased and it is in good condition.

Community institute of commerce and management studies

Page 49

Study on Financial Performance Interpretation

5 Proprietary Ratio Or Equity Ratio

The proprietary ratio relates to the proprietors funds to total assets. It reveals the owners contribution to the total value of assets. This ratio shows the long term solvency of the firm. It is calculated by dividing proprietors fund by the total tangible assets.

Shareholders fund Proprietary Ratio = Total assets Table Showing Proprietary Ratio Year Share Holders Fund 2008-09 2009-10 2010-11 62,31,90,385 70,10,31,633 75,25,62,573 624,83,35,122 9.97 793,07,52,606 8.83 957,92,34,219 7.85 Total Assets Ratio (%) 100

Community institute of commerce and management studies

Page 50

Study on Financial Performance Interpretation

10 8 6 4 2 0 624,83,35,122 62,31,90,385 2008-09 Ratio (%) 793,07,52,606 70,10,31,633 2009-10 Axis Title 957,92,34,219 75,25,62,573 2010-11

Interpretation of Proprietary Ratio

As equity ratio represents the relationship of owners funds to total assets, higher the ratio, better in long term solvency position of the company. The long term solvency of the bank is lower with 7.85 in the year 2010-11.

Community institute of commerce and management studies

Equity ratio

Page 51

Study on Financial Performance Interpretation

6 Absolute Liquidity Ratio.

This ratio is also called as Super Quick Ratio. Through the receivables are generally more liquid then inventories, there may be debit having doubt regarding their real stability in time. Both receivables and inventories are excluded from current assets and only absolute liquid assets, such as cash in hand, at bank, and readily realizable securities are taken into consideration.

Cash in hand and bank + short-term marketable securities A L RATIO = Current Liabilities

Community institute of commerce and management studies

Page 52

Study on Financial Performance Interpretation

Table Showing Absolute Liquid Ratio Year Cash in hand and bank Current liabilities Ratio (%)

2008-09 2009-10 2010-11

13,44,81,798 16,26,36,709 20,85,98,232

17,98,43,972 21,25,71,023 21,66,40,367

0.74 0.76 0.96

Community institute of commerce and management studies

Page 53

Study on Financial Performance Interpretation

Ratio (%)

1.2 absolute liquid ratio 1 0.8 0.6 0.4 0.2 0 17,98,43,972 13,44,81,798 2008-09 21,25,71,023 16,26,36,709 2009-10 21,66,40,367 20,85,98,232 2010-11 Ratio (%), 0.96

Interpretation Of Absolute Liquid Ratio

As ratio represents the relationship between worth of absolute liquid assets and worth of current liabilities. Even the ratio gives a more meaning full measure of liquidity; it is not in much use because the idea of keeping large cash balance has been disproved.

7 Return On Capital Employed Ratio

This ratio is an indicator of the earning capacity employed in the business. It is also called as Overall Profitability Ratio. It is calculated as Community institute of commerce and management studies Page 54

Study on Financial Performance Interpretation

Operating Profit Return on capital employed = Capital Employed *100

Table showing Return on capital employed Year Operating profit 2008-09 2009-10 2010-11 5,17,00,057 4,27,23,786 7,95,66,288 Capital employed 63,44,95,854 59,96,36,953 54,26,10,058 8.14 7.12 14.66 Ratio (%)

Community institute of commerce and management studies

Page 55

Study on Financial Performance Interpretation

Ratio (%)

5,17,00,057 4,27,23,786 7,95,66,288

2010-11

54,26,10,058

2009-10

59,96,36,953

Ratio (%)

2008-09

63,44,95,854

10

15

20

Interpretation of Return on Share Capital Employed This ratio is considered to be the most important because it reflects the overall efficiency with which capital is used. In the above ratio there is a increase in the year 2010- 11 as compared to 2009 and 2008, as both indicates decrease in ratio,

Community institute of commerce and management studies

Page 56

Study on Financial Performance Interpretation

8. RETURN ON SHARE HOLDERS FUND

When it is desired to work out the profitability of the company from the share holders point of view, then this ratio is calculated by the following formula;

Net profit after interest and tax Return On Share Holders Fund= Share holders fund *100

Table Showing Return On Share Holders Fund Year Net profit Share holders Ratio (%) fund 2008-09 2009-10 2010-11 5,17,00,057 5,33,77,802 7,95,66,288 48,28,49,830 53,44,02,390 75,25,62,573 10.70 9.98 10.57

Community institute of commerce and management studies

Page 57

Study on Financial Performance Interpretation

Ratio (%)

5,17,00,0 5,33,77,8 7,95,66,2 57 02 88 2010-11

75,25,62,573

2009-10

53,44,02,390

Ratio (%)

2008-09

48,28,49,830 9.6 9.8 10 10.2 10.4 10.6 10.8

Interpretation of Return on Share Holders Fund

If the net profit after tax is Rs 7,95,66,288, and share holders fund then the ratio will be 10.57 It shows the extent to which profitability objective is being achieved. Higher the ratio, the better it is. 75,26,62,573

Community institute of commerce and management studies

Page 58

Study on Financial Performance Interpretation

9. SOLVENCY RATIO

Solvency ratio is the ratio between the total assets and that total liabilities of the concern this ratio measures the ability of the concern to meet its total liabilities out of its total assets. It is expressed as following;

Total assets Solvency ratio = Total liabilities

Table Showing Solvency Ratio Year Total assets Total liabilities 2008-09 2009-10 2010-11 624,83,35,122 619,66,35,064 1.00 477,92,91,939 473,65,68,152 1.00 957,92,34,219 949,96,67,930 1.00 Ratio (%)

Community institute of commerce and management studies

Page 59

Study on Financial Performance Interpretation

Ratio (%)

624,83,3 477,92,9 957,92,3 5,122 1,939 4,219 2010-11

949,96,67,930

2009-10

473,65,68,152

Ratio (%)

2008-09

619,66,35,064 0 0.2 0.4 0.6 0.8 1

Interpretation Of Solvency Ratio

From the above we can understand there has been equal in the solvency ratios from 2008-09 to 2011 that means the bank is in normal (good) position.

Community institute of commerce and management studies

Page 60

Study on Financial Performance Interpretation

10 LIQUID RATIO.

This is a ratio of liquid assets and current (liquid) liabilities. It shows the firms ability to meet current liabilities with its most liquid assets.

Liquid assets Liquid assets = Current liabilities

Table 10 Showing Liquid Ratio Year Liquid assets Current liabilities 2008-09 2009-10 2010-11 16,67,57,510 18,57,00579, 19,20,37,009 17,98,43,972 21,25,71,023 21,66,40,367 0.92 0.87 0.89 Ratio (%)

Community institute of commerce and management studies

Page 61

Study on Financial Performance Interpretation

Ratio (%)

2008-09 16,67,57,510 17,98,43,972 2009-10 18,57,00579, 21,25,71,023 2010-11 19,20,37,009 21,66,40,367

Interpretation Of Liquidity Ratio

From the above analysis, indicates that there is an increase in ratio from current year to year, where slight difference in past year 2011 which shows decrease in ratio, which is not good for bank.

Community institute of commerce and management studies

Page 62

Study on Financial Performance Interpretation

FINDINGS AND SUGGESTION

FINDINGS

Their has been fluctuating trend for a current year liquidity pointing i.e., 0.89% The banks current ratio is satisfactory compared to cash ratio of the bank from past 3 years i.e., 1.48 in 2009, 1.49 in 2010 and 1,75 in 2011. The total debt ratio of the bank is in good condition without loss. The proprietary ratio of the bank is seen to be slightly decreasing trend in the past 3 years i.e., in 2009 it was increased by 9.97% and in 2010 and 2011 it was increased by 8.83%, 7.85 respectively. The returns on share holders fund is increasing in past 3 years. i.e. 10.70% in 2009 , 9.98% in 2010 and 10.57% in 2011. The banks solvency ratio is in break-even point means where no profit and no loss. The banks ability in creating return on capital employed is satisfactory. It is increased by 8.14% to 14.66% when comparison made between 2009 to 2011.

Community institute of commerce and management studies

Page 63

Study on Financial Performance Interpretation

SUGGESTIONS:

The management must achieve the targets by managing both current assets and current liabilities in a proper way. It is suggested that bank should decrease its liabilities and more concentrate on managing its current assets. The bank should utilize the cash resource to the optimum; else the liquidity position will be affected. It can do well if those resources are utilized effectively. The banks total assets should be utilized to optimum. It should concentrate more on utilizing its available assets, so as to avoid expenses. The bank should maintain its overall profitability position in order to retain current deposits.

Fixed assets used for long term of time must be sold off changing with less deprecation to increase the value of assets to meet the expected liability. The bank should put much emphasis on modern advertising media in order to improve the banks transactions to attract its customers.

Community institute of commerce and management studies

Page 64

Study on Financial Performance Interpretation

CONCLUSION The investment and deposits shall be proportionate to loans and advances and the liability of interest payable shall be reduced which increased net profit. The bank should see the improvement of balance in cash and with bank deposit. To gain competitive edge over the competition in the market, the bank must minimize the default and should be in contact with the customer to know about their specification. The bank may introduce new products to complete with other bank and adopt suitable procedure for obtaining details from the borrowers in order to facilitate faster disbursement of

Community institute of commerce and management studies

Page 65

Study on Financial Performance Interpretation

advances and regulatory repayments as done in other banks before sanctioning credit. The bank must be more professional in credit collections and allocation. The mobilization of deposit and investment decision shall be thoroughly analyzed by the financial manager to gain maximum return with minimum risk.

Community institute of commerce and management studies

Page 66

Study on Financial Performance Interpretation

Community institute of commerce and management studies

Page 67

Вам также может понравиться

- Corporation Bank BBM ProjectДокумент83 страницыCorporation Bank BBM Projectshweta kashikarОценок пока нет

- Retail Loans On Abhudya BankДокумент76 страницRetail Loans On Abhudya BankShubham SinghОценок пока нет

- Final FA RiddhiДокумент14 страницFinal FA RiddhiriddhiОценок пока нет

- Corporation Bank BBM ProjectДокумент83 страницыCorporation Bank BBM Projectshivakumar5280% (15)

- Chapter - 01 Introduction of BankДокумент37 страницChapter - 01 Introduction of BankJeeva JeevaОценок пока нет

- Banking Laws U 1.5 Notes SDДокумент28 страницBanking Laws U 1.5 Notes SDAddyyy 2OPОценок пока нет

- What Is A Payment Bank PDFДокумент76 страницWhat Is A Payment Bank PDFsmithОценок пока нет

- Banking and Financial Services: Unit 1Документ48 страницBanking and Financial Services: Unit 1swarnalata JohnОценок пока нет

- Bank of Baroda Project On ProductivityДокумент76 страницBank of Baroda Project On ProductivityRachit Joshi100% (2)

- Banking LawДокумент22 страницыBanking LawRASHIKA TRIVEDIОценок пока нет

- BANKING LAW AND NEGOTIABLE INSTRUMENTSДокумент47 страницBANKING LAW AND NEGOTIABLE INSTRUMENTSakshay yadavОценок пока нет

- Banking Innovation.: EtymologyДокумент78 страницBanking Innovation.: EtymologyFaisal AnsariОценок пока нет

- Overview of BKGДокумент14 страницOverview of BKGsnehsanghaiОценок пока нет

- 3.2 PuneetДокумент48 страниц3.2 PuneetNandini JaganОценок пока нет

- Banking Law NotesДокумент8 страницBanking Law NotesGeetika DhamaОценок пока нет

- CANARA BANK INTRODUCTION TO BANKINGДокумент63 страницыCANARA BANK INTRODUCTION TO BANKINGRahul Rao MK100% (1)

- Project On Credit Management 222Документ82 страницыProject On Credit Management 222Karthik Kartu J71% (7)

- Organizational Study On Primary Cooperative Agricultural and Rural Development Bank LimitedДокумент43 страницыOrganizational Study On Primary Cooperative Agricultural and Rural Development Bank Limitedಬಿ ಆರ್ ವೇಣು ಗೋಪಾಲ್Оценок пока нет

- A Study On The Mananthavady Urban Co-Operative Society Ltd. No: W 221 A Study On The Mananthavady Urban Co-Operative Society Ltd. No: W 221Документ41 страницаA Study On The Mananthavady Urban Co-Operative Society Ltd. No: W 221 A Study On The Mananthavady Urban Co-Operative Society Ltd. No: W 221Wendy BattleОценок пока нет

- Industry Profile: Introduction To BankingДокумент6 страницIndustry Profile: Introduction To Bankinganjali565Оценок пока нет

- Emergency Services To Customer by BankДокумент53 страницыEmergency Services To Customer by BankNinad PatilОценок пока нет

- Introduction Black Book Project.Документ26 страницIntroduction Black Book Project.Anonymous HackerОценок пока нет

- Unit IДокумент11 страницUnit IShahid AfreedОценок пока нет

- A Study On Lending and Recovery Project-1Документ96 страницA Study On Lending and Recovery Project-1Cenu Roman67% (3)

- Banking Module History and FunctionsДокумент63 страницыBanking Module History and FunctionsSupriyo GhoshОценок пока нет

- Internship - Report 9097676765677Документ80 страницInternship - Report 9097676765677Abhijeet MohantyОценок пока нет

- Indian Banking Industry AnalysisДокумент80 страницIndian Banking Industry AnalysisAbhijeet MohantyОценок пока нет

- General Introduction Statement of Problem Objectives of Study Period of Study Methodology Limitations of The Study Chapter SchemeДокумент66 страницGeneral Introduction Statement of Problem Objectives of Study Period of Study Methodology Limitations of The Study Chapter SchemeGikku GeOrgeОценок пока нет

- Introduction to SbankingДокумент53 страницыIntroduction to SbankingLove NijaiОценок пока нет

- Banking 1Документ29 страницBanking 1Vandana SharmaОценок пока нет

- Tula's Institute: Prepared By: Devesh JoshiДокумент17 страницTula's Institute: Prepared By: Devesh JoshiVikas BhattОценок пока нет

- Chapter One History of Banking Evolution of Banking The Origin of The Word "Bank"Документ60 страницChapter One History of Banking Evolution of Banking The Origin of The Word "Bank"sheikhkhalidОценок пока нет

- History Of Banking In India: From Early Origins To Modern ReformsДокумент92 страницыHistory Of Banking In India: From Early Origins To Modern ReformssrikantamailboxОценок пока нет

- History of SBI in 38Документ57 страницHistory of SBI in 38Mitali AmagdavОценок пока нет

- Project: Comparative Study Between Privatesector Banks Anp Public Sector BanksДокумент24 страницыProject: Comparative Study Between Privatesector Banks Anp Public Sector BanksRama RaoОценок пока нет

- Banking Law Model Answers-2021Документ38 страницBanking Law Model Answers-2021AnjanaNairОценок пока нет

- 11 - Chapter 4Документ34 страницы11 - Chapter 4BEPF 32 Sharma RohitОценок пока нет

- COMPARATIVE STUDY OF PRIVATE AND PUBLIC SECTOR BANKS' SERVICESДокумент42 страницыCOMPARATIVE STUDY OF PRIVATE AND PUBLIC SECTOR BANKS' SERVICESSidharth GeraОценок пока нет

- Submitted To: Submitted By: Mrs. Sumeet Kaur Srishti Pahwa Professor-G.G.D.S.D College, Sem. Chandigarh Roll No-1515021Документ7 страницSubmitted To: Submitted By: Mrs. Sumeet Kaur Srishti Pahwa Professor-G.G.D.S.D College, Sem. Chandigarh Roll No-1515021radhika marwahОценок пока нет

- Banking Structure IntroДокумент9 страницBanking Structure IntroJAIDEEP SINGHОценок пока нет

- Industry ProfileДокумент34 страницыIndustry ProfileRamya Gowda75% (4)

- Origin and Development of Banking in IndiaДокумент71 страницаOrigin and Development of Banking in IndiacyndrellaОценок пока нет

- Banking & Finacial Institution UGC NET - COMMERCEДокумент15 страницBanking & Finacial Institution UGC NET - COMMERCEamit kumar shukla100% (1)

- Banking Acknowledgement SummaryДокумент78 страницBanking Acknowledgement SummaryDhaval ShahОценок пока нет

- Department of Business School: Success Strategies of HDFC Bank in Jammu & KashmirДокумент62 страницыDepartment of Business School: Success Strategies of HDFC Bank in Jammu & KashmirTrue ChallengerОценок пока нет

- Introduction of BankingДокумент49 страницIntroduction of BankingLance SchmidtОценок пока нет

- Analysis of Evolution and Development of Banking Sector in PakistanДокумент38 страницAnalysis of Evolution and Development of Banking Sector in Pakistanuthmankheil89Оценок пока нет

- Kar BankДокумент29 страницKar BankSmartvijay KulaОценок пока нет

- Banking System in IndiaДокумент62 страницыBanking System in IndiaRashi JoshiОценок пока нет

- Banking and Working System of BanksДокумент25 страницBanking and Working System of BanksMohitJangidОценок пока нет

- BFS PDFДокумент183 страницыBFS PDFNagesh JindeОценок пока нет

- Comparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankДокумент74 страницыComparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankAakash SonarОценок пока нет

- History of Banking and Commercial BanksДокумент21 страницаHistory of Banking and Commercial BanksAbhijit WankhedeОценок пока нет

- What is a Bank? Understanding the Fundamental ConceptДокумент76 страницWhat is a Bank? Understanding the Fundamental Conceptpratikkarkera97Оценок пока нет

- Mcom ProjectДокумент68 страницMcom Projectpratikkarkera97Оценок пока нет

- Mcom ProjectДокумент76 страницMcom Projectpratikkarkera97Оценок пока нет

- Mcom ProjectДокумент69 страницMcom Projectpratikkarkera97Оценок пока нет

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- DolasdДокумент13 страницDolasdVishal VishОценок пока нет

- Services Marketing 2Документ1 страницаServices Marketing 2Vishal VishОценок пока нет

- GWAW13000563 Product Brochure 18x24cm Part2Документ23 страницыGWAW13000563 Product Brochure 18x24cm Part2Vishal VishОценок пока нет

- GWAW13000563 Product Brochure 18x24cm Part1Документ37 страницGWAW13000563 Product Brochure 18x24cm Part1Vishal VishОценок пока нет

- HSBC 1052938.html?utm Source Ref ArticleДокумент1 страницаHSBC 1052938.html?utm Source Ref ArticleVishal VishОценок пока нет

- Aptitude:: DefinationДокумент17 страницAptitude:: DefinationVishal Vish100% (1)

- Understanding Customer ExpectationsДокумент33 страницыUnderstanding Customer ExpectationsVishal VishОценок пока нет

- Chapt.1 Job AnalysisДокумент43 страницыChapt.1 Job AnalysisVishal VishОценок пока нет

- Understanding Customer ExpectationsДокумент33 страницыUnderstanding Customer ExpectationsVishal VishОценок пока нет

- Question ErsquesrioДокумент3 страницыQuestion ErsquesrioVishal VishОценок пока нет

- Mba-III-Industrial Relations & Legislations (14mbahr301) - NotesДокумент179 страницMba-III-Industrial Relations & Legislations (14mbahr301) - NotesVishal Vish78% (9)

- Definition of 'Fund Flow'Документ2 страницыDefinition of 'Fund Flow'Vishal VishОценок пока нет

- Understanding Customer ExpectationsДокумент33 страницыUnderstanding Customer ExpectationsVishal VishОценок пока нет

- A Study On Promotional Strategies and Its Impact On The Courses Offered at Aptech PVT LMT.Документ5 страницA Study On Promotional Strategies and Its Impact On The Courses Offered at Aptech PVT LMT.Vishal VishОценок пока нет

- Introduction To The Study of Consumer BehaviorДокумент3 страницыIntroduction To The Study of Consumer BehaviorVishal VishОценок пока нет

- Chapt.1 Job AnalysisДокумент43 страницыChapt.1 Job AnalysisVishal VishОценок пока нет

- P ProjectДокумент27 страницP ProjectVishal VishОценок пока нет

- 1st Session-Services MarketingДокумент16 страниц1st Session-Services MarketingVishal VishОценок пока нет

- Project PraveenДокумент10 страницProject PraveenVishal VishОценок пока нет

- Financial Statement Analysis Through Common Size at Nexteer CompanyДокумент74 страницыFinancial Statement Analysis Through Common Size at Nexteer CompanyVishal VishОценок пока нет

- Bank Customer QuestionnaireДокумент4 страницыBank Customer QuestionnaireVishal VishОценок пока нет

- Age of Customers Dealing With J&K Bank: Below 25 Years 25 To 40 Years 40 To 60 Years Above 60 YearsДокумент2 страницыAge of Customers Dealing With J&K Bank: Below 25 Years 25 To 40 Years 40 To 60 Years Above 60 YearsVishal VishОценок пока нет

- Age of Customers Dealing With J&K Bank: Below 25 Years 25 To 40 Years 40 To 60 Years Above 60 YearsДокумент2 страницыAge of Customers Dealing With J&K Bank: Below 25 Years 25 To 40 Years 40 To 60 Years Above 60 YearsVishal VishОценок пока нет

- BCCB Bal SHTДокумент6 страницBCCB Bal SHTVishal VishОценок пока нет

- Swot Analysis of Private BanksДокумент2 страницыSwot Analysis of Private BanksVishal VishОценок пока нет

- Financial Statement Analysis Through Common Size at Nexteer CompanyДокумент74 страницыFinancial Statement Analysis Through Common Size at Nexteer CompanyVishal VishОценок пока нет

- 75 Annual Report JkbankДокумент10 страниц75 Annual Report JkbankVishal VishОценок пока нет

- 7 P's of Private Sector BankДокумент21 страница7 P's of Private Sector BankMinal DalviОценок пока нет

- Study on loans and advances in bankingДокумент97 страницStudy on loans and advances in bankingVishal Vish50% (4)

- ProjectДокумент22 страницыProjectVishal VishОценок пока нет

- UAPPДокумент91 страницаUAPPMassimiliano de StellaОценок пока нет

- Coffee Table Book Design With Community ParticipationДокумент12 страницCoffee Table Book Design With Community ParticipationAJHSSR JournalОценок пока нет

- PLC Networking with Profibus and TCP/IP for Industrial ControlДокумент12 страницPLC Networking with Profibus and TCP/IP for Industrial Controltolasa lamessaОценок пока нет

- 15142800Документ16 страниц15142800Sanjeev PradhanОценок пока нет

- System: Boehringer Mannheim/Hitachi AnalysisДокумент20 страницSystem: Boehringer Mannheim/Hitachi Analysismaran.suguОценок пока нет

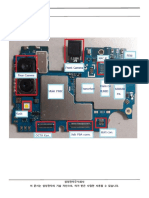

- Level 3 Repair PBA Parts LayoutДокумент32 страницыLevel 3 Repair PBA Parts LayoutabivecueОценок пока нет

- Important Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMДокумент17 страницImportant Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMC052 Diksha PawarОценок пока нет

- 3 - Performance Measurement of Mining Equipments by Utilizing OEEДокумент8 страниц3 - Performance Measurement of Mining Equipments by Utilizing OEEGonzalo GarciaОценок пока нет

- Interpretation of Arterial Blood Gases (ABGs)Документ6 страницInterpretation of Arterial Blood Gases (ABGs)afalfitraОценок пока нет

- Budgetary ControlsДокумент2 страницыBudgetary Controlssiva_lordОценок пока нет

- FS2004 - The Aircraft - CFG FileДокумент5 страницFS2004 - The Aircraft - CFG FiletumbОценок пока нет

- 17BCE0552 Java DA1 PDFДокумент10 страниц17BCE0552 Java DA1 PDFABHIMAYU JENAОценок пока нет

- Experiences from OJT ImmersionДокумент3 страницыExperiences from OJT ImmersionTrisha Camille OrtegaОценок пока нет

- ERP Complete Cycle of ERP From Order To DispatchДокумент316 страницERP Complete Cycle of ERP From Order To DispatchgynxОценок пока нет

- Acne Treatment Strategies and TherapiesДокумент32 страницыAcne Treatment Strategies and TherapiesdokterasadОценок пока нет

- DLP in Health 4Документ15 страницDLP in Health 4Nina Claire Bustamante100% (1)

- DLL - The Firm and Its EnvironmentДокумент5 страницDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- NLL - Elementary - Coursebook 2019 PDFДокумент24 страницыNLL - Elementary - Coursebook 2019 PDFgilmolto100% (1)

- Nursing Care Management of a Client with Multiple Medical ConditionsДокумент25 страницNursing Care Management of a Client with Multiple Medical ConditionsDeannОценок пока нет

- 2014 mlc703 AssignmentДокумент6 страниц2014 mlc703 AssignmentToral ShahОценок пока нет

- STAT455 Assignment 1 - Part AДокумент2 страницыSTAT455 Assignment 1 - Part AAndyОценок пока нет

- RACI Matrix: Phase 1 - Initiaton/Set UpДокумент3 страницыRACI Matrix: Phase 1 - Initiaton/Set UpHarshpreet BhatiaОценок пока нет

- 1.each of The Solids Shown in The Diagram Has The Same MassДокумент12 страниц1.each of The Solids Shown in The Diagram Has The Same MassrehanОценок пока нет

- PointerДокумент26 страницPointerpravin2mОценок пока нет

- Antenna VisualizationДокумент4 страницыAntenna Visualizationashok_patil_1Оценок пока нет

- Rohit Patil Black BookДокумент19 страницRohit Patil Black BookNaresh KhutikarОценок пока нет

- Wi FiДокумент22 страницыWi FiDaljeet Singh MottonОценок пока нет

- S5-42 DatasheetДокумент2 страницыS5-42 Datasheetchillin_in_bots100% (1)

- Liebert PSP: Quick-Start Guide - 500VA/650VA, 230VДокумент2 страницыLiebert PSP: Quick-Start Guide - 500VA/650VA, 230VsinoОценок пока нет

- On The Behavior of Gravitational Force at Small ScalesДокумент6 страницOn The Behavior of Gravitational Force at Small ScalesMassimiliano VellaОценок пока нет