Академический Документы

Профессиональный Документы

Культура Документы

Index

Загружено:

Aldito MedinaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Index

Загружено:

Aldito MedinaАвторское право:

Доступные форматы

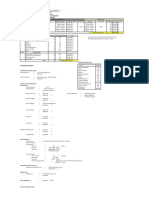

E cono m ic In d ic a to rs

20101

20111

2012i

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

May.'12

Prelim.

Apr.112

May.'l 1

__________

593.8

595.9

581.9

_______________

726.2

730.2

707.5

2004 = 444.2

( 1957-59 = 100)

C f In d e x

E q u ip m e n t

Annual

In d e x :

H eat e xch a n g e rs & tanks _

683.6

686.9

673.0

2005 = 468.2

Process m a c h in e ry

_____

680.1

680.7

663.7

2006 = 499.6

Pipe,valves & fittings

____

926.7

935.7

861.8

2007 = 525.4

Process instrum ents

____

428.9

430.8

441.8

Pum ps & com pressors

__

928.1

921.8

905.4

E lectrical e q u ip m e n t

___

515.2

514.9

503.0

763.8

774.2

755.7

______

322.9

320.7

325.2

________________

527.7

527.1

518.6

328.3

328.4

332.9

S tructural su pp orts & m isc

C o nstructio n la b o r

Buildings

E ngineering & supervision

CURRENT BUSINESS INDICATORS

CPI o u tp u t in de x (2007 = 100)

2009 = 521.9

2010 = 550.8

2011 =585.7

LATEST

F M A M J

Jun. '12

88.4

M a y.'12

87.9

A p r.'l 2

88.7

J u n .'l 1

_____________________

M a y.'l 2

2,133.8

A p r.'12

2,132.6

M a r.'l 2

2,167.3

M a y.'l 1

____________________________

P roducer p rice s,ind u stria l c h e m ic a ls (1982 = 100)

Industrial P roduction in M a n u fa c tu rin g (2007=100)

2,085.9

PREVIOUS

____________________

CPI va lu e of o u tp u t, $ billions

CPI o p e ra tin g rate,%

2008 = 575.4

86.9

J u n .'12

76.3

M a y.'12

75.9

A p r.'l 2

76.6

J u n .'l 1

75.0

__________

J u n .'12

312.7

M a y.'12

324.4

A p r.'l 2

329.6

J u n .'l 1

339.6

_________

J u n .'12

94.7

M a y.'12

94.0

A p r.'l 2

94.7

J u n .'l 1

89.7

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

J u n .'12

156.7

M a y.'12

157.6

A p r.'l 2

160.5

J u n .'l 1

157.6

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

J u n .'12

104.5

M a y.'12

104.0

A p r.'l 2

104.7

J u n .'l 1

107.5

CPI OUTPUT INDEX (2007 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OPERATING RATE (%)

100

90

1600

1300

70

1000

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y IHS G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

apital equipment prices, as reflected in the CE Plant Cost

clining prices for organic chemicals (-1.1%), inorganic chemicals

Index (CEPCI; top), d ropped 2% from April to M ay (the most

(-0.1 %), synthetic rubber (-7.8%), and plastics resins (-2.6%) were

recent data). Meanwhile, all of the Current Business Indicators

only partially offset by a gain in manmade fiber prices (+2.8%).

from IHS Global Insight (middle), including the operating rate,

Feedstock costs fell 21.3% in June following a 3.3% decline in May.

increased slightly from M ay to June.

Specialty chemical prices fell 0.7%, with similar declines in coat

According to the American Chemistry Council (ACC; Washing

ton, D.C.; www.americanchemistry.com), in its most recent weekly

ings and other specialties. Small increases occurred in agricultural

chemicals (0.9%) and consumer chemistry (0.2%).

report at CE press time, overall prices for chemicals fell by 1.0%

Compared to last year, prices for basic chemicals, inorganic

in June after rising 0.5% in May. June prices fell for pharmaceu

chemicals, specialty chemicals, synthetic rubber and plastic resins

ticals (-0.6%) and other chemistry (excluding pharmaceuticals;

are up, ACC says. Prices for bulk petrochemical and organics,

-1.2%), ACC says. Prices for basic chemicals fell by 1.4% as de

however, are off compared to a year ago, down by 1.2%.

64

CHEMICAL ENGINEERING WWW.CHE.COM AUGUST 2012

E cono m ic In d ic a to rs

2009i

20101

20111

2012i

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

( 1957-5 9 = 100)

C f ln d e x

J a n .'12

Prelim.

_ 593.1

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

_

_

D e c .'11

Final

590.1

J a n .'11

Final

564.8

718.7

681.6

670.9

902.1

428.0

910.1

511.5

762.4

331.4

519.1

329.6

681.9

635.8

643.7

859.2

431.1

876.5

495.2

707.4

326.6

505.5

334.8

724.5

683.1

675.7

924.9

427.0

911.6

511.6

768.9

327.0

520.6

329.0

Annual Index:

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

2011 =585.7

CURRENT BUSINESS INDICATORS

Fe b.'l 2

89.2

J a n .'12

89.2

D e c .'l

_____________________

J a n .'12

2,151.5

D e c .'11

2,119.8

Nov.'l

____________________________

CPI va lu e of o u tp u t, $ billions

Producer p rice s,ind u stria l c h e m ic a ls (1982 = 100)

YEAR AGO

P R E V IO U S

____________________

CPI o u tp u t in de x (2007 = 100)

CPI o p e ra tin g rate,%

LATEST

F M A M J

89.2

Feb.'11

2,121.0

J a n .'l 1

86.6

=

1,989.2

F e b.'l 2

77.2

J a n .'12

77.2

D e c .'l

77.1

Feb.'l 1

74.7

__________

F e b.'l 2

318.1

J a n .'12

303.9

D e c .'l

309.6

Feb.'l 1

311.5

_________

F e b.'l 2

94.0

J a n .'12

93.8

D e c .'l

92.8

Feb.'l 1

89.5

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

F e b.'l 2

156.0

J a n .'12

158.8

D e c .'l

158.5

Feb.'l 1

154.0

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

F e b.'l 2

108.7

J a n .'12

109.3

D e c .'l

110.5

Feb.'l 1

112.3

Industrial P roduction in M a n u fa c tu rin g (2007=100)

CPI OUTPUT INDEX (2007 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y IHS G lo b a l Insight, Inc., Lexington, Mass.

MARSHALL & SWIFT EQUIPMENT COST INDEX

( 1926= 100)

4th Q

2011

3 rd Q

2011

2nd Q

2011

Is tQ

2011

4th Q

2 010

1,536.5

1,533.3

1,512.5

1,490.2

1,476.7

Process in d u s trie s ,a v e ra g e .

1,597.7

1,592.5

1,569.0

1,549.8

1,537.0

C e m e n t _________________

1,596.7

1,589.3

1,568.0

1,546.6

1,532.5

C h e m ica ls ______________

1,565.0

1,559.8

1,537.4

1,519.8

1,507.3

C la y p r o d u c ts ___________

1,583.6

1,579.2

1,557.5

1,534.9

1,521.4

G lass ____________________

1,495.7

1,491.1

1,469.2

1,447.2

1,432.7

M & S INDEX

--------

Paint ____________________

1,613.6

1,608.7

1,584.1

1,560.7

1,545.8

P a p e r ____________________

1,507.6

1,502.4

1,480.7

1,459.4

1,447.6

P etroleum p r o d u c ts .

1,704.9

1,698.7

1,672.0

1,652.5

1,640.4

Rubber ____________

1,644.2

1,641.4

1,617.4

1,596.2

1,581.5

R elated industries

Electrical pow er _

1,515.0

1,517.6

1,494.9

1,461.2

1,434.9

M in in g .m illin g __

1,659.6

1,648.6

1,623.5

1,599.7

1,579.4

R e frig e ra tio n ____

1,889.4

1,884.4

1,856.4

1,827.8

1,809.3

S team pow er ___

1,574.3

1,572.2

1,546.5

1,523.0

1,506.4

CURRENT TRENDS

1545

1530

1515

2004 =1,178.5

2005 = 1,244.5

2006 = 1,302.3

2007 = 1,373.3

2008 =1,449.3

2009 = 1,468.6

2010 = 1,457.4

increased 0.5% from De

1485

cember to January. This

1470

month's issue presents the

1455

annual 2011 CEPCI, 585.7,

1440

which is an 6.3% increase

from 2010 and an 11.4%

1425

increase from 2009. It also

1410

is the first annual number to

1395

surpass the previous peak

1380

of 2008.

V is itwww.che.com/pci for

1365

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2012 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2012. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

84

CHEMICAL ENGINEERING WWW.CHE.COM APRIL 2012

as reflected in the CE

Plant Cost Index (CEPCI),

1500

Annual Index:

2003 = 1,123.6

apital equipment prices,

4th

more information and other

tips on capital cost trends

and methodology.

E cono m ic In d ic a to rs

2011

2012

2013

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

650-

CHEMICAL ENGINEERING PLANT COST INDEX CEPCI

A nnual

In d e x :

J a n .'1 3

Prelim.

D ec.'12

Final

J a n .'12

Final

CE I n d e x

571.4

571.9

593.6

2005 = 468.2

E qu ip m e nt

2006 = 499.6

(1 9 5 7 -5 9 = 100 )

600

69? 9

693.6

726.8

H e at e xch a n q e rs & tanks

P ro ra s m n rh in ^ ry

630 ?

657 7

634.7

686.7

657.6

676.1

2007 = 525.4

Pipe, valves & fittings

890 4

4166

895.8

924.9

2008 = 575.4

Process in strum ents

415.7

427.8

Pum ps & com pressors

913 9

899.6

911.6

Flectrica l e q u ip m e n t

S tructural supp orts & m isc

513 9

511.4

511.6

741 6

734.5

776.1

.319.8

321.3

321.1

C o n stru ctio n la b o r

Buildings

E ngineering & s u p e rv is io n ---------------------

5.31

526.8

520.4

327.1

326.9

329.9

CURRENT BUSINESS INDICATORS

550

500

2009 = 521.9

2010 = 550.8

2011 = 5 8 5 .7

450

2012 = 584.6

400

LATEST

F M

A M

YEAR AGO

PREVIOUS

CPI o u tp u t in de x (2007 = 100')

F e b /1 3

90.0

J a n /1 3

89.9

D e c /1 2

88.3

F e b.'l 2

89.7

CPI va lu e of o u tp u t, $ billions

J a n .'13

2,174.2

D e c /1 2

2,164.3

N o v/12

2,208.7

J a n .'l 2

2,143.7

C P Io p e ra tin a rate.%

F e b /1 3

77.4

J a n /1 3

77.4

D e c /1 2

76.2

F e b.'l 2

77.5

P roducer p rice s.ind u stria l c h e m ic a ls H 98? = 100^

Industrial P roduction in M a n u fa c tu rin a (?007=1 0(T)

F e b/1 3

F ^ h '1 3

=

=

314.2

J a n /1 3

299.7

D e c /1 2

299.7

F e b/1 2

314.9

96.5

J a n /1 3

95.7

D e c /1 2

94.8

F e b/1 2

94.6

______ F e b/1 3

F ^ h '1 3

=

-

155.2

106.6

J a n /1 3

J a n /1 3

=

=

155.0

107.1

D e c /1 2

D e c /1 2

=

=

153.9

105.8

F e b/1 2

F e b/1 2

=

=

157.3

108.7

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 -1 0 0 )

CPI OUTPUT VALUE ($ b il l io n s )

CPI OUTPUT INDEX (2007 = 100)

CPI OPERATING RATE (%)

2500

2200

1900

1600

1300

70

1000

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y IHS G lo b a l Insight, Inc., Lexington, Mass.

Equipment Cost Index Available j | ;e

Exclusively from Marshall & Swift j p

M a rshall & S w ift

'

.: II _

' If IV I

P i

Quarterly updates of our industry-leading Equipment Cost Index

are now available at www.equipment-cost-index.coni.

72

CHEMICAL ENGINEERING WWW.CHE.COM APRIL 2013

CURRENT TRENDS

he overall CE Plant Cost Index

(CEPCI; top) for 2012 was

0.1 9% lower than the end-of-year

average from 2011. Preliminary

data From January 2013 CEPCI

(the most recent available) indicate

that capital equipment prices de

clined from December to January,

by 0.09%. When compared to

year-earlier numbers (from Janu

ary 201 2), the January 2013 pre

liminary Plant Cost Index stands

at 3.74% lower. Meanwhile, the

Current Business Indicators from

IHS Global Insight (middle),

show that the latest CPI output

index value (Feb. 201 3) edged

slightly higher from the previous

month, and producer prices for

industrial chemicals were mod

estly higher.

E cono m ic In d ic a to rs

2010

2009

20081

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

( 1957 -5 9 = 100 )

C f ln d e x

M a y '10

Prelim.

_ 558.2

---------------

_

_

_

_

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

-----Structural supp orts & misc

C o n stru ctio n la b o r

_______

B uildings

_______________

E ngineering & supervision

A p r.110

Final

555.3

M a y '09

Final

509.1

Annual Index:

666.0

596.8

529.9

583.0

748.1

389.0

896.7

458.9

602.4

326.6

485.4

347.9

2003 = 402.0

670.2

629.9

631.8

828.3

424.8

903.1

473.2

697.5

327.4

513.9

339.7

622.6

625.4

829.5

426.7

902.4

472.5

688.7

327.3

508.9

341.4

2002 = 395.6

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

Starting w ith th e A pril 2007 Final num bers, several o f th e d a ta series for la b o r a n d com pressors h ave

b ee n c o n ve rte d to a c c o m m o d a te series IDs th a t w ere d is c o n tin u e d by th e U.S. Bureau o f Labor Statistics

CURRENT BUSINESS INDICATORS

LATEST

F M A M J

P R E V IO U S

____________________

. J u n .'l'10

88.6

M a y.'10

88.6

Apr.

88.7

J u n .'09

82.6

_____________________

. M a y.1

'10

'

1,796.3

A p r.'10

1,854.6

Mar.

1,866.7

M ay.'09

1,519.0

____________________________

CPI o u tp u t in de x (2007 = 100)

CPI va lu e of o u tp u t, $ billions

CPI o p e ra tin g rate,%

P roducer p rice s,ind u stria l c h e m ic a ls (1982 = 100)

. Jun.''10

71.6

M a y.'10

71.4

Apr.

71.5

J u n .'09

65.4

__________

. Jun. '10

267.7

M a y.'10

272.8

Apr.

274.0

J u n .'09

232.8

_________

. J u n .'l'10

89.6

M a y.'10

90.0

Apr.

89.1

J u n .'09

82.7

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

. J u n .'l'10

154.1

M a y.'10

91.0

Apr.

90.1

J u n .'09

83.7

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

. J u n .'l'10

120.6

M a y.'10

92.0

Apr.

91.1

J u n .'09

84.7

Industrial P roduction in M a n u fa c tu rin g (2007=100)

CPI OUTPUT INDEX (2007

CPI OUTPUT VALUE ($ b illio n s )

100 )

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

MARSHALL & SWIFT EQUIPMENT COST INDEX

( 1 9 2 6 = 100 )

2nd

2 00 9

2010

2010

1.461.3

1,448.3

1.446.5

1.446.4

1,462.9

Process in d u s trie s ,a v e ra g e .

1.522.1

1,510.3

1,511.9

1.515.1

1,534.2

C e m e n t _________________

1.519.2

1,508.1

1.508.2

1.509.7

1.532.5

C h e m ica ls ______________

1.493.5

1,481.8

1.483.1

1.485.8

1.504.8

C la y p r o d u c ts ___________

1.505.6

1,496.0

1.494.3

1.495.8

1.512.9

G lass ____________________

1.416.4

1,403.0

1.400.1

1.400.4

1.420.1

Paint ____________________

1.527.6

1,515.1

1.514.1

1.515.1

1.535.9

P a p e r ____________________

1.430.1

1,416.4

1.415.8

1,416.3

1.435.6

P etroleum p r o d u c ts .

1,625.9

1,615.6

1.617.6

1.625.2

1,643.5

Rubber ____________

1.564.2

1,551.0

1.560.5

1.560.7

1.581.1

Electrical pow er _

1.414.0

1,389.6

1.377.3

1.370.8

1.394.7

M in in g .m illin g __

1.569.1

1.552.1

1.548.1

1,547.6

1.562.9

R e frig e ra tio n ____

1,786.9

1.772.2

1.769.5

1.767.3

1,789.0

S team pow er ___

1,488.0

1,475.0

1.470.8

1.471.4

1.490.8

--------------

Is tQ

3rd Q

2 00 9

4th Q

2 009

M & S INDEX

2nd Q

CURRENT TRENDS

1500

1485

1470

1455

1440

1425

1410

1395

R elated industries

1380

1365

1350

1335

Annual Index:

2002 = 1,1 0 4 .2

2004 = 1 ,1 7 8 .5

2006 = 1 ,3 0 2 .3

2008 = 1,4 4 9.3

2003 = 1,1 2 3 .6

2005 = 1 ,2 4 4 .5

2007 = 1 ,3 7 3 .3

2009 = 1,4 6 8.6

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2010 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2010. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

52

CHEMICAL ENGINEERING WWW.CHE.COM AUGUST 2010

apital equipment prices (as

reflected in the M ay CE Plant

Cost Index) continue to climb

according toward a typical mid

year peak, but the gap between

the 2010 index and the 2008

index is widening.

Meanwhile, Current Business

Indicators from Global Insight, Inc.

show that CPI output was essen

tially flat from May to June, and the

operating rate climbed only slightly.

Note that industrial production,

and hence the CPI output index,

was changed from a 2002=100 to

2007=100 base on June 25. Like

wise, the basis for Industrial Pro

duction in Manufacturing changed.

V is itwww.che.com/pci for

more on capital cost trends and

methodology.

E cono m ic In d ic a to rs

2011

2012

2013

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

650-

CHEMICAL ENGINEERING PLANT COST INDEX CEPCI

A nnual

In d e x :

M a y .'13

Prelim.

A p r.'l 3

Final

M a y .'1 2

Final

CE I n d e x

566.4

569.4

593.8

2005 = 468.2

E qu ip m e nt

2006 = 499.6

(1 9 5 7 -5 9 = 100)

600

685 4

689.5

726.2

H e at e xch a n q e rs & tanks

P ro ra s m n rh in ^ ry

694 3

655 n

626.2

683.6

656.5

680.1

2007 = 525.4

Pipe, valves & fittings

863 4

410 8

875.6

926.7

2008 = 575.4

Process in strum ents

413.2

428.9

Pum ps & com pressors

919 3

924.5

928.1

Flectrica l e q u ip m e n t

S tructural supp orts & m isc

513 1

512.6

515.2

741 7

746.8

763.8

C o n stru ctio n la b o r

.319.1

319.8

322.9

Buildings

5.34.0

536.5

527.7

E ngineering & s u p e rv is io n ---------------------

326.0

327.6

328.3

CURRENT BUSINESS INDICATORS

550

500

2009 = 521.9

2010 = 550.8

2011 = 5 8 5 .7

450

2012 = 584.6

400

LATEST

F M A M J

YEAR AGO

PREVIOUS

CPI o u tp u t in de x (2007 = 100')

J u n .'13

87.9

M a y.'13

88.1

A p r.'l 3

87.7

J u n 'l 2

86.5

CPI va lu e of o u tp u t, $ billions

Mav.'13

2,122.3

A p r.'13

2,098.1

M a r.'l 3

2,126.0

M a y 'l 2

2,127.1

C P Io p e ra tin a rate.%

J u n .'13

74.5

M a y.'13

74.7

A p r.'l 3

74.3

J u n 'l 2

74.0

P roducer prices, industrial c h e m ic a ls H 98? = 1OO'i

Industrial P roduction in M a n u fa c tu rin a (9 0 0 7 = 1 0(T)

J u n .'13

.lun '13

=

=

304.0

M a y.'13

301.7

A p r.'l 3

308.7

J u n 'l 2

299.4

95.7

M a y.'13

95.5

A p r.'l 3

95.2

J u n 'l 2

94.0

______ J u n .'l 3

.lun '13

=

-

156.2

104.0

M a y.'13

M a y.'13

=

=

156.6

104.7

A p r.'l 3

A p r.'l 3

=

=

155.3

104.4

J u n 'l 2

J u n 'l 2

=

=

156.3

105.9

Hourly e arnin g s in dex, c h e m ic a l& allie d p ro d u cts (1992 = 100)

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 -1 0 0 )

CPI OUTPUT INDEX (2007

CPI OUTPUT VALUE ($ b illio n s )

100 )

CPI OPERATING RATE (%)

2500

2200

1900

1600

1300

70

1000

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y IHS G lo b a l Insight, Inc., Lexington, Mass.

Equipment Cost Index Available j | ;e

Exclusively from Marshall & Swift j p

M a rshall & S w ift

'

ii

if

rv

Quarterly updates of our industry-leading Equipment Cost Index

are now available at www.equipment-cost-index.coni.

56

CHEMICAL ENGINEERING WWW.CHE.COM AUGUST 2013

CURRENT TRENDS

reliminary data for the May

2013 CE Plant Cost Index

(CEPCI; top; the most recent

available) indicate that the com

posite index decreased by 0.5%

from the the final April value.

The data for each of the sub

indices decreased in the May

preliminary numbers, except

for the index value for electri

cal equipment, which rose. The

May 201 3 preliminary PCI index

value stands at 4.6% lower than

the corresponding final PCI value

from May 201 2. Meanwhile, the

latest Current Business Indicators

from IHS Global Insight (middle)

moved in both directions, with

the CPI output index edging

slightly downward, while the CPI

value of output increased slightly

in the latest numbers.

E cono m ic In d ic a to rs

20101

20111

2012i

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

( 1957-59 = 100)

C f In d e x

E q u ip m e n t

May.'12

Prelim.

A p r.112

M a y .'l 1

__________

593.8

595.9

581.9

_______________

726.2

730.2

707.5

2004 = 444.2

Annual

In d e x :

H eat e xch a n g e rs & tanks _

683.6

686.9

673.0

2005 = 468.2

Process m a c h in e ry

_____

680.1

680.7

663.7

2006 = 499.6

Pipe,valves & fittings

____

926.7

935.7

861.8

2007 = 525.4

Process instrum ents

____

428.9

430.8

441.8

Pum ps & com pressors

__

928.1

921.8

905.4

E lectrical e q u ip m e n t

___

515.2

514.9

503.0

763.8

774.2

755.7

______

322.9

320.7

325.2

________________

527.7

527.1

518.6

328.3

328.4

332.9

S tructural su pp orts & m isc

C o nstructio n la b o r

Buildings

E ngineering & supervision

CURRENT BUSINESS INDICATORS

CPI o u tp u t in de x (2007 = 100)

2009 = 521.9

2010 = 550.8

2011 = 5 8 5 .7

LATEST

F M A M J

Jun. '12

88.4

M a y.'12

87.9

A p r.'l 2

88.7

J u n .'l 1

_____________________

M a y.'l 2

2,133.8

A p r.'12

2,132.6

M a r.'l 2

2,167.3

M a y.'l 1

____________________________

P roducer p rice s,ind u stria l c h e m ic a ls (1982 = 100)

Industrial P roduction in M a n u fa c tu rin g (2007=100)

2,085.9

PREVIOUS

____________________

CPI va lu e of o u tp u t, $ billions

CPI o p e ra tin g rate,%

2008 = 575.4

86.9

J u n .'12

76.3

M a y.'12

75.9

A p r.'l 2

76.6

J u n .'l 1

75.0

__________

J u n .'12

312.7

M a y.'12

324.4

A p r.'l 2

329.6

J u n .'l 1

339.6

_________

J u n .'12

94.7

M a y.'12

94.0

A p r.'l 2

94.7

J u n .'l 1

89.7

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

J u n .'12

156.7

M a y.'12

157.6

A p r.'l 2

160.5

J u n .'l 1

157.6

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

J u n .'12

104.5

M a y.'12

104.0

A p r.'l 2

104.7

J u n .'l 1

107.5

CPI OUTPUT INDEX (2007 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OPERATING RATE (%)

100

90

1600

1300

70

1000

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y IHS G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

apital equipment prices, as reflected in the CE Plant Cost

clining prices for organic chemicals (-1.1%), inorganic chemicals

Index (CEPCI; top), d ropped 2% from April to M ay (the most

(-0.1 %), synthetic rubber (-7.8%), and plastics resins (-2.6%) were

recent data). Meanwhile, all of the Current Business Indicators

only partially offset by a gain in manmade fiber prices (+2.8%).

from IHS Global Insight (middle), including the operating rate,

Feedstock costs fell 21.3% in June following a 3.3% decline in May.

increased slightly from M ay to June.

Specialty chemical prices fell 0.7%, with similar declines in coat

According to the American Chemistry Council (ACC; Washing

ton, D.C.; www.americanchemistry.com), in its most recent weekly

ings and other specialties. Small increases occurred in agricultural

chemicals (0.9%) and consumer chemistry (0.2%).

report at CE press time, overall prices for chemicals fell by 1.0%

Compared to last year, prices for basic chemicals, inorganic

in June after rising 0.5% in May. June prices fell for pharmaceu

chemicals, specialty chemicals, synthetic rubber and plastic resins

ticals (-0.6%) and other chemistry (excluding pharmaceuticals;

are up, ACC says. Prices for bulk petrochemical and organics,

-1.2%), ACC says. Prices for basic chemicals fell by 1.4% as de

however, are off compared to a year ago, down by 1.2%.

64

CHEMICAL ENGINEERING WWW.CHE.COM AUGUST 2012

E cono m ic In d ic a to rs

2009i

2011

20101

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

( 1957-5 9 = 100)

C f ln d e x

J a n .'11

Prelim.

_ 564.8

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

_

_

_

D e c .'10

Final

560.3

J a n .'10

Final

532.9

674.6

627.1

627.6

854.3

426.2

903.6

488.4

696.3

328.1

503.3

335.6

631.8

571.9

601.9

794.5

419.8

903.0

469.2

640.2

331.0

494.8

342.4

681.7

635.8

642.5

859.2

431.0

876.5

495.2

707.4

326.7

505.6

334.8

Annual Index:

2003 = 402.0

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

CURRENT BUSINESS INDICATORS

CPI o u tp u t in de x (2007 = 100)

CPI va lu e of o u tp u t, $ billions

CPI o p e ra tin g rate,%

LATEST

F M A M J

P R E V IO U S

____________________

Fe b.'l 1

91.0

J a n .'11

91.1

D e c.'10

90.6

Feb.'10

87.4

_____________________

J a n .'l 1

2,050.1

D e c .'10

1,974.3

Nov.'lO

1,893.4

J a n .'10

1,786.8

. Fe b.'l 1 =

73.7

J a n .'11

73.8

D e c.'10

73.4

Feb.'l 0

70.3

__________

. Fe b.'l 1 =

304.2

J a n .'11

291.4

D e c.'10

282.8

Feb.'l 0

269.4

_________

____________________________

Producer p rice s,ind u stria l c h e m ic a ls (1982 = 100)

. Fe b.'l 1 =

93.5

J a n .'11

93.1

D e c.'10

92.3

Feb.'l 0

87.5

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

. Fe b.'l 1 =

154.8

J a n .'11

156.3

D e c.'10

154.9

Feb.'l 0

150.4

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

. Fe b.'l 1 =

124.2

J a n .'11

124.1

D e c.'10

123.4

Feb.'l 0

121.0

Industrial P roduction in M a n u fa c tu rin g (2007=100)

CPI OUTPUT INDEX (2007 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

( 1926= 100)

Is t Q

2011

4th Q

2010

3rd Q

2010

2 nd Q

2 010

Is tQ

2 010

1,490.2

1,476.7

1,473.3

1,461.3

1,448.3

Process in d u s trie s ,a v e ra g e .

1,549.8

1,537.0

1,534.4

1,522.1

1,510.3

C e m e n t _________________

1,546.6

1,532.5

1,530.0

1,519.2

1,508.1

C h e m ica ls ______________

1,519.8

1,507.3

1,505.2

1,493.5

1,481.8

C la y p r o d u c ts ___________

1,534.9

1,521.4

1,518.3

1,505.6

1,496.0

G lass ____________________

1,447.2

1,432.7

1,428.5

1,416.4

1,403.0

Paint ____________________

1,560.7

1,545.8

1,542.1

1,527.6

1,515.1

P a p e r ____________________

1,459.4

1,447.6

1,444.5

1,430.1

1,416.4

P etroleum p r o d u c ts .

1,652.5

1,640.4

1,637.0

1,625.9

1,615.6

Rubber ____________

1,596.2

1,581.5

1,579.3

1,564.2

1,551.0

Electrical pow er _

1,461.2

1,434.9

1,419.2

1,414.0

1,389.6

M in in g .m illin g __

1,599.7

1,579.4

1,576.7

1,569.1

1,552.1

R e frig e ra tio n ____

1,827.8

1,809.3

1,804.8

1,786.9

1,772.2

S team pow er ___

1,523.0

1,506.4

1,502.3

1,488.0

1,475.0

M & S INDEX

--------

R elated industries

1500

1485

1470

1455

1440

1425

1410

1395

1380

1365

1350

1335

Annual Index:

2003 = 1,1 2 3 .6

2004 =1,1 7 8 .5

2005 = 1 ,2 4 4 .5

2006 = 1 ,3 0 2.3

2007 = 1 ,3 7 3 .3

2008 =1,4 4 9 .3

2009 = 1 ,4 6 8 .6

2010 = 1 ,4 5 7.4

1320

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

68

CHEMICAL ENGINEERING WWW.CHE.COM APRIL 2011

apital equipment prices (as

reflected in the CE Plant Cost

Index; CEPCI) continued their

increase from December 2010 to

January 2011. With the December

numbers now finalized, the Annual

CEPCI for 2010 has been calcu

lated at 550.8. The following lists

the percent change in the Annual

CEPCI over the past eight years, to

help put the trends in perspective:

2003-2004

10.5%

2004-2005

5.4%

2005-2006

6.7%

2006-2007

5.2%

2007-2008

9.5%

2008-2009

-9.3%

2009-2010

5.5%

V isitwww.che.com/pci for his

torical data and more on capital

cost trends and methodology.

4th

E cono m ic In d ic a to rs

2009i

2011

20101

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

( 1957-5 9 = 100)

C f ln d e x

J u ly '11

Prelim.

_ 593.2

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

_

_

June '11

Final

588.9

J u ly '10

Final

550.7

718.0

678.0

664.5

904.8

440.9

904.7

510.8

760.7

325.6

519.1

332.6

659.2

611.1

626.0

821.7

416.8

902.4

481.6

679.7

328.7

506.7

338.4

724.1

681.8

675.8

915.3

446.9

909.5

512.5

764.7

327.1

520.6

332.1

Annual Index:

2003 = 402.0

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

CURRENT BUSINESS INDICATORS

LATEST

=

87.5

Ju l.'l

J u l.'11

2,100.2

J u n .'l

C P Io p e ra tin a rate.%

A u a .'l 1

75.5

Ju l.'l

P roducer p rin ts, industrial c h e m ic a ls (1 98? = 100")

A u a .'l 1

336.5

Ju l.'l

CPI va lu e of o u tp u t. $ billions

A u a .'l 1

Industrial P roduction in M a n iifa n tu rin q ('9007=1 00")

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

______ A u g .'11

A u a .'l 1

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

=

=

=

YEAR AGO

87.3

J u n .'l

2,073.4

M a y.'l

75.3

J u n .'l

75.0

A u g .'10

72.9

338.0

J u n .'l

342.6

A u g .'10

260.7

87.0

A u g .'10

85.1

2,065.1

Ju l.'10

1,706.3

90.7

Ju l.'l

90.3

J u n .'l

89.8

A u g .'10

87.4

157.7

Ju l.'l

159.2

J u n .'l

158.0

A u g .'10

158.3

110.2

Ju l.'l

111.0

J u n .'l

111.0

A u g .'10

110.9

CPI OUTPUT VALUE ($ b illio n s )

CPI OUTPUT INDEX (2007 = 100)

P R E V IO U S

A u a .'l 1

CPI o u tp u t in de x (9 0 0 7 = 1 00^

F M A M J

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

( 1926= 100)

M & S INDEX

--------

3rd Q

2011

2nd Q

2011

Is t Q

2011

4th Q

2 010

3rd Q

2 010

1,533.3

1,512.5

1,490.2

1,476.7

1,473.3

Process in d u s trie s ,a v e ra g e .

1,592.5

1,569.0

1,549.8

1,537.0

1,534.4

C e m e n t _________________

1,589.3

1,568.0

1,546.6

1,532.5

1,530.0

C h e m ica ls ______________

1,559.8

1,537.4

1,519.8

1,507.3

1,505.2

C la y p r o d u c ts ___________

1,579.2

1,557.5

1,534.9

1,521.4

1,518.3

G lass ____________________

1,491.1

1,469.2

1,447.2

1,432.7

1,428.5

Paint ____________________

1,608.7

1,584.1

1,560.7

1,545.8

1,542.1

P a p e r ____________________

1,502.4

1,480.7

1,459.4

1,447.6

1,444.5

P etroleum p r o d u c ts .

1,698.7

1,672.0

1,652.5

1,640.4

1,637.0

Rubber ____________

1,641.4

1,617.4

1,596.2

1,581.5

1,579.3

Electrical pow er _

1,517.6

1,494.9

1,461.2

1,434.9

1,419.2

M in in g .m illin g __

1,648.6

1,623.5

1,599.7

1,579.4

1,576.7

R e frig e ra tio n ____

1,884.4

1,856.4

1,827.8

1,809.3

1,804.8

S team pow er ___

1,572.2

1,546.5

1,523.0

1,506.4

1,502.3

R elated industries

1545

1515

1500

1485

1470

1455

1440

1425

1410

1395

1380

Annual Index:

2003 = 1,1 2 3 .6

2004 =1,1 7 8 .5

2005 = 1 ,2 4 4 .5

2006 = 1 ,3 0 2.3

2007 = 1 ,3 7 3 .3

2008 =1,4 4 9 .3

2009 = 1 ,4 6 8 .6

2010 = 1 ,4 5 7.4

1365

2nd

3rd

Q ua rte r

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

80

CHEMICAL ENGINEERING WWW.CHE.COM OCTOBER 2011

apital equipment prices,

as reflected in the CE

Plant Cost Index (CEPCI),

increased approximately

0.73% on average from

June to July, after increas

ing approximately 1.2%

from M ay to June.

Meanwhile, according to

the Current Business Indica

tors (see middle table) from

Global Insight, Inc., August

saw increases in the CPI

output index, the CPI value

of output and the CPI operat

ing rate.

V is itwww.che.com/pci for

more information and other

tips on capital cost trends

and methodology.

1530

4th

E cono m ic In d ic a to rs

2009 i

2011

2010 i

DOWNLOAD THE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

(1957-59 = 100)

CE In d e x

650-

Apr. '11

Prelim.

582.4

Mar. '11

Final

575.8

Apr. '10

Final

555.3

708.2

671.4

665.3

868.9

443.7

904 7

502.6

752.8

325 8

698.7

657.5

662.0

862.8

438.7

898.5

499.4

738.6

324.2

514.1

334.3

666.0

622.6

625.4

829.5

426.7

902.4

472.5

688.7

327.3

508.9

341.4

E qu ip m e nt

H e at e xch a n g e rs & tanks

Process m a c h in e ry

Pipe, valves & fittings

Process in strum ents

Pum ps & com pressors

E lectrical e q u ip m e n t

S tructural supp orts & misc

C o n stru ctio n la bo r

Buildings

E ngineering & supervision

517.1

333 6

Annual Index:

600

2003 = 402.0

2004 = 444.2

550

2005 = 468.2

2006 = 499.6

500

2007 = 525.4

2008 = 575.4

450

2009 = 521.9

2010 = 550.8

400

CURRENT BUSINESS INDICATORS

LATEST

F M A M J

YEAR AGO

PREVIOUS

CPI o u tp u t in de x (2007 = 100)

May. '11

87.5

Apr. '1

87.0

Mar. '11

87.4

May. '10

85.1

CPI va lu e of o u tp u t, $ billions

Apr. '11

2,081.2

Mar. '1

2,072.8

Feb. '11

1,990.4

Apr. '10

1,769.7

CPI o p e ra tin g rate, %

May. '11

75.4

Apr. '1

74.9

Mar. '11

75.3

May. '10

72.8

P roducer prices, industrial c h e m ic a ls (1982 = 100)

May. '11

336.0

Apr. '1

322.7

Mar. '11

312.9

May. '10

271.9

May. '11

Industrial P roduction in M a n u fa c tu rin g (2007=100)

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

______ May. '11

May. '11

P roductivity index, c h e m ic a ls & allie d p ro d u cts (1992 = 100)

CPI OUTPUT INDEX (2007 = 100)

=

=

=

89.8

Apr. '1

89.4

Mar. '11

89.9

May. '10

86.7

156.2

Apr. '1

154.9

Mar. '11

156.1

May. '10

152.7

111.0

Apr. '1

110.9

Mar. '11

112.8

May. '10

109.8

CPI OUTPUT VALUE ($ b i lli o n s )

CPI OPERATING RATE (%)

2500

85

2200

80

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

(1926 = 100)

1st Q

2011

4th Q

2010

3rd Q

2010

2 nd Q

2 010

1st Q

2 010

1,490.2

1,476.7

1,473.3

1,461.3

1,448.3

Process industries, a v e r a g e .

1,549.8

1,537.0

1,534.4

1,522.1

1,510.3

C e m e n t _________________

1,546.6

1,532.5

1,530.0

1,519.2

1,508.1

C h e m ica ls ______________

1,519.8

1,507.3

1,505.2

1,493.5

1,481.8

C la y p r o d u c ts ___________

1,534.9

1,521.4

1,518.3

1,505.6

1,496.0

G lass ____________________

1,447.2

1,432.7

1,428.5

1,416.4

1,403.0

Paint ____________________

1,560.7

1,545.8

1,542.1

1,527.6

1,515.1

P a p e r ____________________

1,459.4

1,447.6

1,444.5

1,430.1

1,416.4

P etroleum p r o d u c ts .

1,652.5

1,640.4

1,637.0

1,625.9

1,615.6

Rubber ____________

1,596.2

1,581.5

1,579.3

1,564.2

1,551.0

Electrical pow er _

1,461.2

1,434.9

1,419.2

1,414.0

1,389.6

Mining, m illin g __

1,599.7

1,579.4

1,576.7

1,569.1

1,552.1

R e frig e ra tio n ____

1,827.8

1,809.3

1,804.8

1,786.9

1,772.2

S team pow er ___

1,523.0

1,506.4

1,502.3

1,488.0

1,475.0

M & S IN D E X

---------

R elated industries

1500

1485

1470

1455

1440

1425

1410

1395

1380

1365

1350

1335

Annual Index:

2003 = 1,123.6

2004 =1,178.5

2005 = 1,244.5

2006 = 1,302.3

2007 = 1,373.3

2008 =1,449.3

2009 = 1,468.6

2010 = 1,457.4

1320

1st

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

64

CHEMICAL ENGINEERING WWW.CHE.COM JULY 2011

apital equipment prices,

as reflected in the CE Plant

Cost Index (CEPCI), increased

approximately 1.14% on av

erage from March to A pril.

Meanwhile, according to the

American Chemistry Council's

(Washington, D.C.; www.

americanchemistry.com) most

recent weekly economic re

port at CE press time, indus

trial production increases in

M ay were led by pharmaceu

ticals and specialty chemicals,

while production actually fell

in basic chemicals.

Visit www.che.com/pci for

more information and other

tips on capital cost trends

and methodology.

4th

2008 i

E cono m ic In d ic a to rs

2009 i

20111

2010 i

DOWNLOAD THE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

(1957-59 = 100)

CE In d e x

-------------

650

Dec. '10

Prelim.

560.4

Nov. '10

Final

556.7

D ec. '09

Final

524.2

Annual Index:

674.7

627.2

627.6

854.3

426.2

903.6

488.4

696.3

328.5

503.4

335.6

669.0

618.3

627.0

847.0

426.1

904.0

487.1

688.2

328.8

501.4

336.1

618.4

554.2

597.9

776.3

417.5

895.2

467.2

620.0

331.2

494.6

343.2

2003 = 402.0

E q u ip m e n t

-------------------H e at e xch a n g e rs & tanks

Process m a c h in e ry

------Pipe, valves & fittings

__

Process instrum ents

-----Pum ps & com pressors

_

E lectrical e q u ip m e n t

__

Structural supp orts & misc

C o n stru ctio n la b o r

_____

B uildings

_____________

E ngineering & supervision ______________

2002 = 395.6

2004 =444.2

550

2005 = 468.2

2006 = 499.6

500

2007 = 525.4

2008 = 575.4

450

2009=521.9

Starting w ith th e A pril 2007 Final num bers, several o f th e d a ta series for la b o r a n d com pressors h ave

b ee n c o n ve rte d to a c c o m m o d a te series IDs th a t w ere d is c o n tin u e d by th e U.S. Bureau o f Labor Statistics

CURRENT BUSINESS INDICATORS

600

400

LATEST

F M A M J

YEAR AGO

PREVIOUS

CPI o u tp u t in de x (2007 = 100)

Jan. '11

91.4

Dec. '10

91.5

Nov. '10

90.2

Jan. '10

87.7

CPI va lu e of o u tp u t, $ billions

Dec. '10

1,956.6

Nov. '10

1,893.4

O ct. '10

1,836.7

Dec. '09

1,765.7

CPI o p e ra tin g rate, %

Jan. '11

74.0

Dec. '10

74.1

Nov. '10

72.9

Jan. '10

70.3

P roducer prices, industrial c h e m ic a ls (1982 = 100)

Jan. '11

291.4

Dec. '10

282.8

Nov. '10

276.0

Jan. '10

261.7

Jan. '11

92.6

Dec. '10

92.3

Nov. '10

91.6

Jan. '10

87.8

______ Jan. '11

156.1

Dec. '10

154.6

Nov. '10

154.9

Jan. '10

150.4

Jan. '11

124.9

Dec. '10

125.4

Nov. '10

123.3

Jan. '10

117.8

Industrial P roduction in M a n u fa c tu rin g (2007=100)

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

P roductivity index, c h e m ic a ls & allie d p ro d u cts (1992 = 100)

CPI OUTPUT INDEX (2007 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OPERATING RATE (%)

2500

85

2200

80

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

(1926 = 100)

M & S INDEX

--------

Process industries, a v e r a g e .

4th Q

2010

3rd Q

2010

2nd Q

2010

1st Q

2 010

4th Q

2 00 9

1,476.7

1,473.3

1,461.3

1,448.3

1,446.5

1,537.0

1,534.4

1,522.1

1,510.3

1,511.9

C e m e n t _________________

1,532.5

1,530.0

1,519.2

1,508.1

1,508.2

C h e m ica ls ______________

1,507.3

1,505.2

1,493.5

1,481.8

1,483.1

C la y p r o d u c ts ___________

1,521.4

1,518.3

1,505.6

1,496.0

1,494.3

G lass ____________________

1,432.7

1,428.5

1,416.4

1,403.0

1,400.1

Paint ____________________

1,545.8

1,542.1

1,527.6

1,515.1

1,514.1

P a p e r ____________________

1,447.6

1,444.5

1,430.1

1,416.4

1,415.8

P etroleum p r o d u c ts .

1,640.4

1,637.0

1,625.9

1,615.6

1,617.6

Rubber ____________

1,581.5

1,579.3

1,564.2

1,551.0

1,560.5

Electrical pow er _

1,434.9

1,419.2

1,414.0

1,389.6

1,377.3

Mining, m illin g __

1,579.4

1,576.7

1,569.1

1,552.1

1,548.1

R e frig e ra tio n ____

1,809.3

1,804.8

1,786.9

1,772.2

1,769.5

S team pow er ___

1,506.4

1,502.3

1,488.0

1,475.0

1,470.8

1500

1485

1470

1455

1440

1425

1410

1395

R elated industries

1380

1365

1350

1335

Annual Index:

2003 = 1,123.6

2004 =1,178.5

2005 = 1,244.5

2006 = 1,302.3

2007 = 1,373.3

2008 =1,449.3

2009 = 1,468.6

2010 = 1,457.4

1st

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

64

CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2011

apital equipment prices (as

reflected in the CE Plant Cost

Index) increased from November

to December. Meanwhile, Global

Insight's CPI operating rate and

output index were relatively flat.

According to the American

Chemistry Council's (Arlington,

Va.; www.americanchemistry.

com) most-recent weekly economic

report at CE press time, inflation

in the U.S. at the consumer level

"remains tame," but inflation pres

sures are building in China, Eu

rope and many emerging markets.

Also, industrial production gains

in overseas markets seem to be

moderating, the report adds.

Visit www.che.com/pci for his

torical data and more on capital

cost trends and methodology.

4th

E cono m ic In d ic a to rs

2009i

2011

20101

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

M a r.'l 1

Prelim.

_ 575.9

(1957-59= 100)

C f ln d e x

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

_

_

698.7

657.5

662.1

862.8

438.7

898.5

499.4

738.6

324.3

514.2

334.3

F e b .'ll

Final

574.6

M a r.'l 0

Final

541.8

696.6

654.4

653.5

868.3

440.8

892.6

498.0

732.1

326.2

509.9

334.9

645.5

592.5

614.0

801.7

421.0

903.4

472.1

665.6

328.2

504.3

341.8

Annual Index:

2003 = 402.0

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

CURRENT BUSINESS INDICATORS

LATEST

A p r.'l

87.3

M a r.'l

CPI va lu e of o u tp u t. $ billions

M a r.'l 1

2,068.5

Feb.'l

C P Io p e ra tin a rate.%

A p r.'l

75.2

M a r.'l

P roducer p rin ts, industrial c h e m ic a ls (1 98? = 100")

A p r.'l 1

322.7

M a r.'l

YEAR AGO

87.4

Feb.'l

86.6

Apr. 10

1,990.4

J a n .'l

85.1

1,989.2

Mar. 10

1,770.2

75.3

=

312.9

Feb.'l

74.6

Apr. 10

72.6

Feb.'l

304.2

Apr. 10

275.1

A p r.'l 1

89.7

M a r.'l

90.1

Feb.'l

89.5

Apr. 10

85.7

______ A p r.'l 1

155.3

M a r.'l

156.2

Feb.'l

154.2

Apr. 10

151.2

A p r.'l 1

111.8

M a r.'l

113.0

Feb.'l

112.9

Apr. 10

110.8

Industrial P roduction in M n n iifn n tu rin q ("9007=1 00")

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OUTPUT INDEX (2007 = 100)

P R E V IO U S

CPI o u tp u t in de x (9 0 0 7 = 1 00^

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

F M A M J

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

(1 9 2 6 = 100)

Is t Q

2011

4th Q

2010

3rd Q

2010

2 nd Q

2 010

Is tQ

2 010

1,490.2

1,476.7

1,473.3

1,461.3

1,448.3

Process in d u s trie s ,a v e ra g e .

1,549.8

1,537.0

1,534.4

1,522.1

1,510.3

C e m e n t _________________

1,546.6

1,532.5

1,530.0

1,519.2

1,508.1

C h e m ica ls ______________

1,519.8

1,507.3

1,505.2

1,493.5

1,481.8

C la y p r o d u c ts ___________

1,534.9

1,521.4

1,518.3

1,505.6

1,496.0

G lass ____________________

1,447.2

1,432.7

1,428.5

1,416.4

1,403.0

Paint ____________________

1,560.7

1,545.8

1,542.1

1,527.6

1,515.1

P a p e r ____________________

1,459.4

1,447.6

1,444.5

1,430.1

1,416.4

P etroleum p r o d u c ts .

1,652.5

1,640.4

1,637.0

1,625.9

1,615.6

Rubber ____________

1,596.2

1,581.5

1,579.3

1,564.2

1,551.0

Electrical pow er _

1,461.2

1,434.9

1,419.2

1,414.0

1,389.6

M in in g .m illin g __

1,599.7

1,579.4

1,576.7

1,569.1

1,552.1

R e frig e ra tio n ____

1,827.8

1,809.3

1,804.8

1,786.9

1,772.2

S team pow er ___

1,523.0

1,506.4

1,502.3

1,488.0

1,475.0

M & S INDEX

--------

R elated industries

1500

1485

1470

1455

1440

1425

1410

1395

1380

1365

1350

1335

Annual Index:

2003 = 1,1 2 3 .6

2004 =1,1 7 8 .5

2005 = 1 ,2 4 4 .5

2006 = 1 ,3 0 2.3

2007 = 1 ,3 7 3 .3

2008 =1,4 4 9 .3

2009 = 1 ,4 6 8 .6

2010 = 1 ,4 5 7.4

1320

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

64

CHEMICAL ENGINEERING WWW.CHE.COM JUNE 2011

apital equipment prices,

as reflected in the CE Plant

Cost Index (CEPCI), increased

slightly from February to

March. But the year-on-year

margin narrowed slightly.

Meanwhile, according to the

American Chemistry Council's

most-recent weekly economic re

port at CE press time (Arlington,

Va.; www.americanchemistry.

com), overall production rose

strongly in April with gains

centered in specialty chemicals,

plastics resins, synthetic rubber

and man-made fibers. The railcar-loadings data indicate that

this growth continued into May.

V isitwww.che.com/pci for

more and other tips on capital

cost trends and methodology.

4th

E cono m ic In d ic a to rs

2009i

2011

20101

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

M a y .'l 1

Prelim.

_ 581.7

(1957-59= 100)

C f ln d e x

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

_

_

_

_

707.3

673.0

663.7

861.8

440.1

904.4

503.0

755.7

325.0

518.2

332.9

A p r.'l 1

Final

582.3

M a y .'l 0

Final

558.2

708.0

671.4

665.3

867.9

443.7

904.7

502.6

752.8

325.8

517.1

333.6

670.2

629.9

631.8

828.3

424.8

903.1

473.2

697.5

327.8

513.9

339.7

Annual Index:

2003 = 402.0

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

CURRENT BUSINESS INDICATORS

LATEST

J u n .'11

87.4

M a y.'11

CPI va lu e of o u tp u t. $ billions

M a v .'ll

2,072.3

A p r.'11

C P Io p e ra tin a rate.%

J u n .'11

75.4

M a y.'11

P roducer p rin ts, industrial c h e m ic a ls (1 98? = 100")

J u n .'11

342.6

M a y.'11

87.2

YEAR AGO

A p r.'l 1

M a r .'ll

87.4

J u n .'10

85.1

2,072.8

M a y.'l 0

1,711.0

2,072.8

75.1

A p r.'l 1

75.3

J u n .'10

72.8

336.0

A p r.'l 1

322.7

J u n .'10

264.1

J u n .'11

89.8

M a y.'11

89.7

A p r.'l 1

89.7

J u n .'10

86.6

______ J u n .'l 1

157.4

M a y.'11

157.0

A p r.'l 1

155.4

J u n .'10

153.6

J u n .'11

112.1

M a y.'11

110.9

A p r.'l 1

111.1

J u n .'10

112.2

Industrial P roduction in M n n iifn n tu rin q ("9007=1 00")

P roductivity in d e x ,c h e m ic a ls & allie d p ro d u cts (1992 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OUTPUT INDEX (2007 = 100)

P R E V IO U S

CPI o u tp u t in de x (9 0 0 7 = 1 00^

Hourly e arnin g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

F M A M J

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

(1 9 2 6 = 100)

2nd Q

2011

Is tQ

2011

4th Q

2010

3rd Q

2 010

2ndQ

2 010

1,512.5

1,490.2

1,476.7

1,473.3

1,461.3

Process in d u s trie s ,a v e ra g e .

1,569.0

1,549.8

1,537.0

1,534.4

1,522.1

C e m e n t _________________

1,568.0

1,546.6

1,532.5

1,530.0

1,519.2

C h e m ica ls ______________

1,537.4

1,519.8

1,507.3

1,505.2

1,493.5

C la y p r o d u c ts ___________

1,557.5

1,534.9

1,521.4

1,518.3

1,505.6

G lass ____________________

1,469.2

1,447.2

1,432.7

1,428.5

1,416.4

Paint ____________________

1,584.1

1,560.7

1,545.8

1,542.1

1,527.6

P a p e r ____________________

1,480.7

1,459.4

1,447.6

1,444.5

1,430.1

P etroleum p r o d u c ts .

1,672.0

1,652.5

1,640.4

1,637.0

1,625.9

Rubber ____________

1,617.4

1,596.2

1,581.5

1,579.3

1,564.2

Electrical pow er _

1,494.9

1,461.2

1,434.9

1,419.2

1,414.0

M in in g .m illin g __

1,623.5

1,599.7

1,579.4

1,576.7

1,569.1

R e frig e ra tio n ____

1,856.4

1,827.8

1,809.3

1,804.8

1,786.9

S team pow er ___

1,546.5

1,523.0

1,506.4

1,502.3

1,488.0

M & S INDEX

--------

R elated industries

1515

1500

1485

1470

1455

1440

1425

1410

1395

1380

Annual Index:

2003 = 1,1 2 3 .6

2004 =1,1 7 8 .5

2005 = 1 ,2 4 4 .5

2006 = 1 ,3 0 2.3

2007 = 1 ,3 7 3 .3

2008 =1,4 4 9 .3

2009 = 1 ,4 6 8 .6

2010 = 1 ,4 5 7.4

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

56

CHEMICAL ENGINEERING WWW.CHE.COM AUGUST 2011

apital equipment prices,

as reflected in the CE

Plant Cost Index (CEPCI),

decreased approximately

0.10% on average from

A p ril to May, after increasing

approximately 1.14% from

March to A pril.

Meanwhile, according to the

American Chemistry Council's

(Washington, D.C.; www.

americanchemistry.com) mid

year economic report, total

output for the global chemical

industry is expected to grow

by 4.8% in 2 0 1 1,5 .3 % in

2012, and 4.7% in 2013.

V is itwww.che.com/pci for

more information and other

tips on capital cost trends

and methodology.

4th

E cono m ic In d ic a to rs

2009i

2011

20101

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

(1957-59= 100)

C f ln d e x

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

J une '11

Prelim.

588.9

_

_

_

_

_

_

_

_

M a y .'l

Final

581.9

718.1

678.1

664.5

904.8

440.9

904.7

510.8

760.7

325.4

519.0

332.6

J u n e '10

Final

556.4

707.5

673.0

663.7

861.8

441.8

905.4

503.0

755.7

325.2

518.6

332.9

Annual Index:

2003 = 402.0

668.1

628.7

632.1

818.5

419.4

898.4

482.2

697.5

326.7

509.4

339.1

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

CURRENT BUSINESS INDICATORS

Jul.'.'11

_____________________

Jun.'.'11

____________________________

CPI va lu e of o u tp u t, $ billions

CPI o p e ra tin g rate,%

LATEST

____________________

CPI o u tp u t in de x (2007 = 100)

P roducer p rice s,ind u stria l c h e m ic a ls (1982 = 100)

F M A M J

P R E V IO U S

87.7

J u n .'l

2,067.0

M a y.'l

Jul.'.'11

75.6

J u n .'l

__________

Jul.'.'11

338.0

J u n .'l

_________

87.4

=

2,065.1

75.3

342.6

M a y.'l 1

87.3

J u l.'10

85.1

2,072.8

J u n .'10

1,691.3

M a y.'l 1

75.3

J u l.'10

72.9

M a y.'l 1

336.0

J u l.'10

257.8

A p r .'ll

Jul.'.'11

90.6

J u n .'l

90.0

M a y.'l 1

89.9

J u l.'10

87.3

Hourly e a rn in g s in dex, c h e m ic a l & a llie d p ro d u cts (1992 = 100)

Jul.'.'11

158.8

J u n .'l

156.9

M a y.'l 1

157.0

J u l.'10

153.6

P roductivity index, c h e m ic a ls & allie d p ro d u cts (1992 = 100)

Jul.'.'11

112.3

J u n .'l

112.1

M a y.'l 1

111.0

Ju l.'10

111.8

Industrial P roduction in M a n u fa c tu rin g (2007=100)

CPI OUTPUT INDEX (2007 = 100)

CPI OUTPUT VALUE ($ b illio n s )

CPI OPERATING RATE (%)

100

90

80

70

F M A M J

J A S O N D

F M A M J

J A S O N D

F M A M J

J A S O N D

C u rre n t Business Ind ica tors p ro vide d b y G lo b a l Insight, Inc., Lexington, Mass.

CURRENT TRENDS

MARSHALL & SWIFT EQUIPMENT COST INDEX

(1 9 2 6 = 100)

2nd Q

2011

Is tQ

2011

4th Q

2010

3rd Q

2 010

2ndQ

2 010

1,512.5

1,490.2

1,476.7

1,473.3

1,461.3

Process in d u s trie s ,a v e ra g e .

1,569.0

1,549.8

1,537.0

1,534.4

1,522.1

C e m e n t _________________

1,568.0

1,546.6

1,532.5

1,530.0

1,519.2

C h e m ica ls ______________

1,537.4

1,519.8

1,507.3

1,505.2

1,493.5

C la y p r o d u c ts ___________

1,557.5

1,534.9

1,521.4

1,518.3

1,505.6

G lass ____________________

1,469.2

1,447.2

1,432.7

1,428.5

1,416.4

Paint ____________________

1,584.1

1,560.7

1,545.8

1,542.1

1,527.6

P a p e r ____________________

1,480.7

1,459.4

1,447.6

1,444.5

1,430.1

P etroleum p r o d u c ts .

1,672.0

1,652.5

1,640.4

1,637.0

1,625.9

Rubber ____________

1,617.4

1,596.2

1,581.5

1,579.3

1,564.2

Electrical pow er _

1,494.9

1,461.2

1,434.9

1,419.2

1,414.0

M in in g .m illin g __

1,623.5

1,599.7

1,579.4

1,576.7

1,569.1

R e frig e ra tio n ____

1,856.4

1,827.8

1,809.3

1,804.8

1,786.9

S team pow er ___

1,546.5

1,523.0

1,506.4

1,502.3

1,488.0

M & S INDEX

--------

R elated industries

1515

1500

1485

1470

1455

1440

1425

1410

1395

1380

Annual Index:

2003 = 1,1 2 3 .6

2004 =1,1 7 8 .5

2005 = 1 ,2 4 4 .5

2006 = 1 ,3 0 2.3

2007 = 1 ,3 7 3 .3

2008 =1,4 4 9 .3

2009 = 1 ,4 6 8 .6

2010 = 1 ,4 5 7.4

2nd

3rd

Quarter

M arshall & Swift's M arshall V a lu a tio n Service m a n u a l. 2011 E q u ip m e n t C o st Index Num bers re printed a n d

p u b lish e d w ith th e perm ission o f M arshall & S w ift/B oeckh, LLC a n d its licensors, c o p y rig h t 2011. M a y n o t be

reprinted, c o p ie d , a u to m a te d or used for va lu a tio n w ith o u t M arshall & S w ift/B oeckh's prio r perm ission.

72

CHEMICAL ENGINEERING WWW.CHE.COM SEPTEMBER 2011

apital equipment prices,

as reflected in the CE Plant

Cost Index (CEPCI), increased

approximately 1.2% on aver

age from M ay to June, after

decreasing approximately

0.10% from A p ril to May.

Meanwhile, according to the

American Chemistry Council's

(Washington, D.C.; www.

americanchemistry.com) lat

estweekly economic report,

overall production in the U.S.

chemical sector fell in July by

0.3%, to continue an uneven

pattern in 2011.

V is itwww.che.com/pci for

more information and other

tips on capital cost trends

and methodology.

4th

E cono m ic In d ic a to rs

2009i

2011

20101

DOWNLOADTHE C E P C I TWO WEEKS SOONER AT W W W .C H E .C O M /PC I

CHEMICAL ENGINEERING PLANT COST INDEX (CEPCI)

(1957-59= 100)

C f ln d e x

---------------

E q u ip m e n t

----------------------H e at e xch a n g e rs & ta n ks

Process m a c h in e ry

--------Pipe, valves & fittings

____

Process instrum ents

-------Pum ps & com pressors

___

E lectrical e q u ip m e n t

____

Structural supp orts & misc

C o n stru ctio n la b o r

_______

Buildings

E ngineering & supervision

F e b .'ll

Prelim.

_ 577.9

J a n .'11

Final

564.8

F eb.'10

Final

539.1

- 701.8

- 668.8

- 653.5

- 868.3

- 440.8

_ 892.6

- 498.0

- 732.1

- 325.0

- 509.9

_ 334.9

681.9

635.8

643.7

859.2

431.1

876.5

495.2

707.4

326.6

505.5

334.8

641.1

587.3

610.3

796.1

420.5

903.4

468.4

660.0

330.2

500.5

342.4

Annual Index:

2003 = 402.0

2004 = 444.2

2005 = 468.2

2006 = 499.6

2007 = 525.4

2008 = 575.4

2009 = 521.9

2010 = 550.8

CURRENT BUSINESS INDICATORS

CPI o u tp u t in de x (2007 = 100)

CPI va lu e of o u tp u t, $ billions

CPI o p e ra tin g rate,%

LATEST

____________________

_____________________

88.1