Академический Документы

Профессиональный Документы

Культура Документы

Analysis of The Factors Affecting Exchange Rate Variability in Pakistan

Загружено:

Kamran AliОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Analysis of The Factors Affecting Exchange Rate Variability in Pakistan

Загружено:

Kamran AliАвторское право:

Доступные форматы

ISSN-L: 2223-9553, ISSN: 2223-9944

Academic Research International

Vol. 2, No. 3, May 2012

ANALYSIS OF THE FACTORS AFFECTING EXCHANGE RATE VARIABILITY IN PAKISTAN

ShabanaParveen Hazara University, Mansehra PAKISTAN. krn_roshni@yahoo.com Abdul Qayyum Khan COMSATS, WahCantt PAKISTAN. qayyum_72@yahoo.com Muammad Ismail COMSATS, WahCantt PAKISTAN. mimkb80@gmail.com

ABSTRACT

The Paper examines/analyzed the factors contributing exchange rate vitality in Pakistan. The study was conducted on some major factors contributing to exchange rate volatility, and their relative importance. Annual data for the period 1975-2010 is used, taken from Economic Survey of Pakistan (various issues) and International Financial Statistics. The main variables used to check variability are inflation, Growth rate, imports and exports on exchange rate volatility. Simple Linear Regression model with ordinary least method (OLS) is used to analyze the results. The study revealed that inflation is the main factor affecting exchange rate in Pakistan. The study further show that the second important variable which bring more variation in exchange rate is economic growth, while order of export and import in variation lies at third and fourth position. Based on the finding of the study it is recommended to harmonize fiscal policies with monetary policy first and then make effective link of both these policies with trade policy. Keywords: Exchange rate Variability, Inflation, Linear Regression and Economic Growth

INTRODUCTION For most of the twentieth century, exchange rates have been fixed by government action rather than determined in the marketplace. Before World War I the values of the world's major currencies were fixed in terms of gold, while for a generation after World War II the values of most currencies were fixed in terms of the U.S. dollar. However, some of the world's most important exchange rates change frequently. Equilibrium in exchange rate is determined in the foreign exchange market at a point where demand for and supply of foreign currency equates. Demand for a currency comes from net export while supply of the currency comes from net foreign investment. Any change in demand for and supply of currency effect its value just like a good market that is if demand for a currency increases its value (exchange rate) will be increased while increase in supply of the currency will reduce its value(exchange rate) in the foreign exchange market. Pakistani rupee was linked with British Pound Sterling till 1970 but in 1971 it was linked with US dollar because of the increasing influence of US in the region. Until 1982, The Pakistani Rupee was pegged to the US Dollar. The currency depreciated by 38.5% from 1982-1988, when the government of General Zia-Ul-Haq convert it to Managed float, and again depreciated as a result of bad relationship with donors agencies and trade partners due to nuclear test in 1998. The empirical studies relating to the link between exchange rate variability and its factors are not conclusive. Exchange rates are basically the prices of one currency in terms of other currencies driven by the normal forces of supply and demand. There are a fixed number of Euros, Dollars, Yen, etc issued at any given time (although governments can and do print extra money to buy other currencies and impact their currencies value). As the demand increases or decreases for any single currency, it drives the clearing price for that currency. Zada (2010) studied the factors affecting exchange rate of Pakistan for the period 1979 to 2008. The study used multiple regression model in which exchange rate was taken as dependent variable while Inflation, interest rate, Foreign exchange reserves, trade balance, money supply and Gross Domestic Product were the independent variables. The study showed that Inflation, interest rate and foreign

Copyright 2012 SAVAP International

www.savap.org.pk

www.journals.savap.org.pk 670

ISSN-L: 2223-9553, ISSN: 2223-9944

Academic Research International

Vol. 2, No. 3, May 2012

exchange reserves strongly influence the exchange rate and remained significant at 1% level while other variables GDP, Money supply and trade deficit remained insignificant. Hussain and Farooq, (2009) analyzed the effects of exchange rate fluctuations on macroeconomic variables for Pakistan for the period of 1982 to 2007.they used quarterly data and concluded that exchange rate volatility, exports of country and reserve money possess long run positive relationship to the growth of economy. Khan and Sajid, (2005) used the data from 1982-II to 2004-IV to identify both short term and long term relationship of real money balances, rate of inflation, rate of interest both in foreign and at home and real effective exchange rate for Pakistan. Ahmed, Ara and Hyder (2005) used structural vector auto regression (VAR) model and found that external shocks are important in driving economic fluctuations in Pakistan and their importance has increased since September 11, 2001. The primary source of external shocks is foreign remittances. They found that terms of trade shocks appear to have very little effect on Pakistans real exchange rate, domestic output, and domestic prices. However, because the volatility of these shocks is relatively high, they do explain a non-trivial proportion of the fluctuations of these variables, especially the price level, around the baseline. Foreign output shocks lead to a real depreciation of the rupee but their spillover effects on domestic output are rather modest. By contrast positive shocks to remittances from abroad lead subsequently to a significant increase in domestic output and a substantial real exchange rate appreciation . Galati and Ho (2003) showed that news play a role in fluctuation of exchange rate for Euro and dollar. The results of the study showed that good news bring appreciation while bad news depreciates currency. Sanchez-Fung (2003) also studied the same relationship and stated that exchange rate is more responsive in case of depreciation. Xiaopu (2002), MacDonald and Ricci (2003)studied the long term determinants of real exchange rate are Openness of an economy, capital flows and terms of trade. Ejaz, Abbas and Saeed (2002) showed a direct relationship between exchange rate and budget deficit under the managed floating exchange system. Their study covered the period of 1982 to 1998 for Pakistan. It is proved that budget deficit is also playing an active role in determining real exchange rate in Pakistan. In the present study different choices were included to find out the interaction of exchange rate and exogenous factors. OBJECTIVES The main objectives are (1) To analyze the determinants of Foreign Exchange Rate in Pakistan (2) To know which of the determinants is playing the main role in foreign exchange rate, and (3) To make appropriate suggestions for suitable policy implementation for problems arising from the appreciation/depreciation of currency in the light of finding of the study. DATA AND METHODOLOGY This study used annual data for the period 1975-2010. Different sources for the data were approached (Government of Pakistan, private sector, and international organizations) to find out the nature of the available data. The stationarity of data is determined, by using Augmented Dickey-Fuller (ADF) test. To select the optimum ADF lag, Akaike Information Criterion (AIC) is used. Stationarity of the variables are checked once with an intercept is included only, and again when both an intercept and a linear deterministic trend is included. Johansen cointegration test is used to determine the cointegration in the regressions used for analysis. In order to analyze the factors affecting the exchange rate, a linear regression model has been used. The two stage least square method has been used for estimating the important linear regression equation models. The following is the main linear regression model which will be used for analysis: Y= + 1(INF) + 2(GR) + 3(X)+ 4(IMP) + Where Y is Exchange rate, INF is Inflation, GR is Growth rate, X is Exports, IMP is Imports and is the residual term.

Copyright 2012 SAVAP International

www.savap.org.pk

www.journals.savap.org.pk 671

ISSN-L: 2223-9553, ISSN: 2223-9944

Academic Research International

Vol. 2, No. 3, May 2012

RESULTS AND DISCUSSION The Augmented Dickey-Fuller (ADF) Test Result The results in Table I and II of the unit root test indicate that all the variables except Economic Growth, Exchange Rate, Export, Import and Inflation are non-stationary at level whether trend is included or not, while Economic Growth is stationary at level when trend is included. Table1.ADF Test for Stationarity (Includes Intercept but not a Trend)

I(0) Variables Exchange Rate (ER) Economic Growth (EG) Export(x) Import (Imp) Inflation ( infl )

1

I(1) Critical value -3.5814 -3.5814 -3.5814 -3.5814 -3.5814 Test statistics -5.2760[0] -9.8811[1] -9.5202[2] -6.8740[1] -5.7430[0]

I(2) Test statistics1 -3.5850 -3.5850 -3.5850 -3.5850 -3.5850 Critical value Result I(1) I(1) I(1) I(1) I(1)

Test statistics1 .0079[0] -0.6369[2] -1.4207[1] 0.0812[0] -1.4018[0]

Figures in square brackets besides each statistics represent optimum lags, selected using the minimum AIC value. Table 2.ADF Test for Stationary (Includes Intercept and a Trend)

I(0) Variables Exchange Rate (ER) Economic Growth (EG) Export(x) Import (Imp) Inflation ( infl )

1

I(1) Critical value -4.1728 -4.1728 -4.1728 -4.1728 -4.1728 Test statistics -5.1948[0] Critical value -4.1781

I(2) Test statistics Test statistics1

Result

Test statistics1 -1.8765[1] -5.4659[0] -4.0627[0] -2.7585[0] -0.0915[0]

I(1) I(0)

-9.4101[2] -6.8051[1] -6.9744[0]

-4.1781 -4.1781 -4.1781

I(1) I(1) I(1)

Figures in square brackets besides each statistics represent optimum lags, selected using the minimum AIC value Johanson Co-Integration Test Table 3 Johansen co integration test result with intercept (no trend) in CE and no intercept in VAR. ER = c1(EG) + c2X + c3Imp + c4Infl. (Variables included in the co integrating vector: ER, EG, X Imp and Infl)Test assumption: No deterministic trend in the data. Lag interval is 1 to 2

Eigen value 0.7413 0.4988 0.3865 0.3063 0.1500 Likelihood 137.15 79.01 49.30 28.29 12.57 5 Percent 102.14 76.07 53.12 34.91 19.96 1 Percent 111.01 84.45 60.16 41.07 24.60 Hypothesized None ** At most 1 * At most 2 At most 3 At most 4

*(**) denotes rejection of the hypothesis at 5 %( 1%) significance level L.R. test indicates 2 co integrating equation(s) at 5% significance level

Copyright 2012 SAVAP International

www.savap.org.pk

www.journals.savap.org.pk 672

ISSN-L: 2223-9553, ISSN: 2223-9944

Academic Research International

Vol. 2, No. 3, May 2012

The results of Likelihood Ratio (LR) test is presented in Table 3. There is possibility of spurious regression, due to non-stationary time series variables. But when performed Johansens cointegration test, long run relationships were found. The Likelihood Ratio (LR) test results reject the assumption of no cointegration, and indicate the existence of one cointegrating equation as the calculated value of Likelihood Ratio (LR) is greater than the critical values at 1 percent. REGRESSION ANALYSIS The regression equation is ER = 9.66 + .170 GR + 0.384 INF +0.08818 X - 0.0764 Imp 0.03221 5.28 0.07569 5.08 0.03008 2.93 0.02720 -2.81 t-stast = 4.25 S = 3.194 StDev = 2.270

R-Sq = 98.2%

R-Sq (adj) = 98.0%, DW statistic = 1.10

Given above are the results of the regression of Exchange Rate on Growth Rate (GR), Inflation (INF), Exports(X) and Imports (Imp). It is evident from the p-values and t-statistic of each variable that all the variables including constant term in the model are highly significant. As far as the overall fit of the model is concerned the coefficient of Determination(R-Sq) and the adjusted coefficient of determination(R-Sq (adj) show that the model is a very good fit. It is quite clear from the above results that regression is a good fit as adjusted R-square is 98.2% which means that 98.2% of the variations in exchange rates are explained by this model. The main factors determined here are economic growth, inflation, exports and imports or we can say on the basis of the model that 98.20% variation in exchange rate is due to the four factors that is growth rate, Inflation, exports and imports model whereas only 1.80% of the variation in Exchange Rate is due to other factors that have not been taken into account. Further the Model shows that Increase in growth rate, inflation and export would increase exchange rate pretty clear from coefficient signs. While increase in import would reflect in decreasing exchange rate value (-ve sign of coefficient). The Durbin Watson statistic for the model shows that there is no evidence of the presence of autocorrelation. CONCLUSION AND RECOMMENDATIONS The present study revealed that inflation is the most important factor that bring volatility in exchange rate in the country as it contributes more to variations in exchange rate. The results further indicate that due to high inflation the currency got devalues in exchange. Inflation has a negative effect on exchange rate as when inflation increases it reduce the value of currency. The result further shows that second important variable which bring more variation in exchange rate is economic growth, while order of export and import in variation lies at third and fourth position. Based on these evidences it is clear that in Pakistan fiscal and monetary policies play important role in exchange rate variation. It is recommended to harmonize fiscal policies with monetary policy first and then make effective link of both these policies with trade policy. Effective and smooth running of fiscal and monetary policies are required to reduce inflation and boost up economic growth. The gap between policy formation and its implementation both in fiscal and in monetary policy required to reduce.

Copyright 2012 SAVAP International

www.savap.org.pk

www.journals.savap.org.pk 673

ISSN-L: 2223-9553, ISSN: 2223-9944

Academic Research International

Vol. 2, No. 3, May 2012

REFERENCES Afridi, u. (1995).Determining the exchange rate: The Pakistan Development Review 34,263-276. Ahmad,S., Ara,I&Hyder, K(2005). How External Shocks and Exchange Rate Depreciations Affect Pakistan? Implications for Choice of an Exchange Rate Regime. Ahmed, M. (1992). Pakistans Exchange Rate Policy: An Econometric Investigation.: Pakistan Development Review, 31, 49-74. Dornbusch, Rudiger. (1982). PPP Exchange Rate Rules and Macroeconomic Stability.Journal of Political Economy, Vol. 90 (February), pp. 158-65 Ejaz, R.A k ,Abbas A, A &Saeed, A R (2002).Relationshiop Between Exchange Rate and BughetaryDeficit:Empirical Evidence from Pakistan. Pakistan Journal of Applied Sciences2(8):839842,2002 Galati, G. & Ho, C.(2003) Macroeconomics News and the Euro/Dollar Exchange Rate. Economic Notes, 32(3), 371-398. Gujarati, D.N.. (2003) .Basic Econometrics. 4th ed. New York: McGraw-Hill. Hussain, Z J &Farooq M (2009).Economic Growth and Exchange Rate Volatility in Case of Pakistan.Pakistan journal of life and social sciences,7(2):112-118PPakistan Kalra, S(2005).Note on Determinants of Foreign Exchange Rate.December 13.2005. Khan, A. M., Sajid, Z. M.(2005). The Exchange Rate and Monetary Dynamics in Pakistan: An Autoregressive Distributed lag (ARDL) Approach. The Lahore Journal of Economics 2005, 10: 87-99. Lane, Philips R. &Grian Maria Milesi-Ferretti(2000). The Transfer Problems Revisited: Net Foreign Assets and Real Exchange Rates.CEPR Discussion Paper no. 2511. Mac Donald R. & Ricci L.(2003).Estimation of the equilibrium real exchange rate for South Africa.IMF Working paper,2003/44, Washington, D.C.:IMF Sanchez-Fung, J.R.(2003). Non-Linear Modeling of Daily Exchange Rate Returns, Volatility and News in s Small Developing Economy.Applies Economics letters,10(4), 247-250 SaqibGulzar and Hui Xiao Feng, Thirty years of chronic current account deficit 1972-2001: The case of PakistanJournal of Harbin Institute of Technology (new series). Volume 13 No.5 (2006) P559 Stockman, A. C. (1987).The Equilibrium Approach to Exchange Rates.Economic Review, Federal Reserve Bank of Richmond. pp. 22-30. Xiaopu Z.(2002). Equilibrium and Misalignment: an assessment of the RMB exchange rate from 1978 to 1999. Center for Research on Economic development and policy Reform Working Paper, No 127. Zada, B. (2010), An Analysis of Factors Affecting Exchange Rate of Pakistan1979-2008. (Unpublished master thesis).Hazara university, .Pakistan.

Copyright 2012 SAVAP International

www.savap.org.pk

www.journals.savap.org.pk 674

Вам также может понравиться

- Factors Affecting Exchange RatesДокумент5 страницFactors Affecting Exchange RatesFahim Jan100% (1)

- Applied-Modelling Exchange-Alayande, S. Ayinla - PH.DДокумент8 страницApplied-Modelling Exchange-Alayande, S. Ayinla - PH.DImpact JournalsОценок пока нет

- Impact of Exchange Rate On Trade and GDP For India A Study of Last Four DecadeДокумент17 страницImpact of Exchange Rate On Trade and GDP For India A Study of Last Four DecadeHimanshuChaurasiaОценок пока нет

- Articles 8 PDFДокумент8 страницArticles 8 PDFTaufik Nur ArifinОценок пока нет

- The Impact of Exchange Rate Fluctuation PDFДокумент9 страницThe Impact of Exchange Rate Fluctuation PDFVee veeОценок пока нет

- Impact of Exchange RateДокумент9 страницImpact of Exchange RateEr Akhilesh SinghОценок пока нет

- Impact of Exchange Rate On Exports in Case of PakistanДокумент5 страницImpact of Exchange Rate On Exports in Case of PakistanAmna AroojОценок пока нет

- 1510 4415 1 PB PDFДокумент4 страницы1510 4415 1 PB PDFyogesh KannaiahОценок пока нет

- Effects of Exchange Rate Fluctuations On The Balance of Payment in The Nigerian EconomyДокумент8 страницEffects of Exchange Rate Fluctuations On The Balance of Payment in The Nigerian EconomyRev. Kolawole, John AОценок пока нет

- Effectiveness of Exchange Rate in Pakistan: Causality AnalysisДокумент14 страницEffectiveness of Exchange Rate in Pakistan: Causality AnalysisMuhammad Arslan UsmanОценок пока нет

- Macroeconomic Variables Impact on Pakistan Stock PricesДокумент9 страницMacroeconomic Variables Impact on Pakistan Stock PricesBabar NawazОценок пока нет

- IBF AssignmentДокумент8 страницIBF AssignmentAbdelazim Nabil ElhakimОценок пока нет

- The Impact of Macroeconomic Variables On Stock Prices in PakistanДокумент10 страницThe Impact of Macroeconomic Variables On Stock Prices in PakistanJosep CorbynОценок пока нет

- Relationship between stock volatility and macro variables in PakistanДокумент21 страницаRelationship between stock volatility and macro variables in PakistanMuhammadIjazAslamОценок пока нет

- Juwaira RER AND ECON GROWT DR MudiДокумент12 страницJuwaira RER AND ECON GROWT DR MudiMOHAMMED ABDULMALIKОценок пока нет

- Ijer2012v3i5 (12) FinalДокумент14 страницIjer2012v3i5 (12) FinalgosangОценок пока нет

- Finaqf AssignmentДокумент13 страницFinaqf AssignmentnhoporegОценок пока нет

- Root,+journal+manager,+05 IJEFI 6041+elfaki+okey 20180208 V1Документ7 страницRoot,+journal+manager,+05 IJEFI 6041+elfaki+okey 20180208 V1Mesba HoqueОценок пока нет

- Research Paper On Exchange Rate VolatilityДокумент4 страницыResearch Paper On Exchange Rate Volatilityfyrj7h9z100% (1)

- Macroeconomic Variables' Effect on Jordan's Economic GrowthДокумент12 страницMacroeconomic Variables' Effect on Jordan's Economic Growthmirika3shirinОценок пока нет

- Impact of Exchange Rate On Exports and ImportsДокумент8 страницImpact of Exchange Rate On Exports and ImportsAli RazaОценок пока нет

- A Study of Exchange Rates Movement and Stock Market VolatilityДокумент12 страницA Study of Exchange Rates Movement and Stock Market Volatilityyaqoob008Оценок пока нет

- Macro Economics Final Report 2020.Документ43 страницыMacro Economics Final Report 2020.Talal AsifОценок пока нет

- Impacts of Exports, Imports, Exchange Rates on Indonesia's GDPДокумент29 страницImpacts of Exports, Imports, Exchange Rates on Indonesia's GDPhikmah olaОценок пока нет

- Abdullah If ProjectДокумент11 страницAbdullah If Projectabdullah akhtarОценок пока нет

- The Effect of Global Liquidity On Macroeconomic ParametersДокумент15 страницThe Effect of Global Liquidity On Macroeconomic ParameterseditoraessОценок пока нет

- Rafi Sir's Paper Empirical Result Section 5Документ23 страницыRafi Sir's Paper Empirical Result Section 5geetikaeco24Оценок пока нет

- The Exchange Rate Volatility and The Effects of Exchange Rate On The Price Level and International Trade of Bangladesh A ReviewДокумент5 страницThe Exchange Rate Volatility and The Effects of Exchange Rate On The Price Level and International Trade of Bangladesh A ReviewInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Stock and Foreign Exchange Markets Relationship StudyДокумент24 страницыStock and Foreign Exchange Markets Relationship StudyDr. Sajid Mohy Ul DinОценок пока нет

- The Effect of Exchange Rates On Exports and Imports of Emerging CountriesДокумент14 страницThe Effect of Exchange Rates On Exports and Imports of Emerging CountriesAnwar ul Haq ShahОценок пока нет

- Value of Foreign AssetsДокумент17 страницValue of Foreign AssetsNauman NawazОценок пока нет

- Impact of Real Exchange Rate On Foreign DirectДокумент13 страницImpact of Real Exchange Rate On Foreign DirectADE FEBRI YANTIОценок пока нет

- International Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioДокумент19 страницInternational Financial Flows On India'S Economic Growth - in View of Changing Financial Market ScenarioIkrar KhanОценок пока нет

- An Economic Analysis of The Welfare Effects of Higher Import Price Induced by Naira DevaluationДокумент9 страницAn Economic Analysis of The Welfare Effects of Higher Import Price Induced by Naira DevaluationGaniyuОценок пока нет

- A Dissertation Synopsis On " A Study On Exchange Rate Fluctuation and Its Impact On Export IN INDIA"Документ7 страницA Dissertation Synopsis On " A Study On Exchange Rate Fluctuation and Its Impact On Export IN INDIA"Vimal JiОценок пока нет

- MPRA Paper 60791Документ10 страницMPRA Paper 60791Hameeda AkhtarОценок пока нет

- Impact of Exchange Rate On Stock Market: International Review of Economics & Finance January 2015Документ5 страницImpact of Exchange Rate On Stock Market: International Review of Economics & Finance January 2015Thanh NgânОценок пока нет

- Exchange Rate VolatilityДокумент31 страницаExchange Rate Volatilitykhoerul mubinОценок пока нет

- Does The Exchange Rate Volatility Affect The Foreign Direct Investment? The Case of ThailandДокумент21 страницаDoes The Exchange Rate Volatility Affect The Foreign Direct Investment? The Case of ThailandTonettisОценок пока нет

- Thesis BodyДокумент28 страницThesis BodyshohagОценок пока нет

- Factors Affecting The Fluctuations in Exchange Rate of The Indian Rupee Group 9 C2Документ13 страницFactors Affecting The Fluctuations in Exchange Rate of The Indian Rupee Group 9 C2muralib4u5Оценок пока нет

- Stock Market Volatility and Macro Economic Variables Volatility in Nigeria An Exponential GARCH ApproachДокумент15 страницStock Market Volatility and Macro Economic Variables Volatility in Nigeria An Exponential GARCH ApproachiisteОценок пока нет

- Exchange Rate Volatility and Export Growth in India: An Empirical InvestigationДокумент26 страницExchange Rate Volatility and Export Growth in India: An Empirical InvestigationYagya RajawatОценок пока нет

- Impact of Trade Openness, FDI, Exchange Rate and Inflation On Economic Growth: A Case Study of PakistanДокумент22 страницыImpact of Trade Openness, FDI, Exchange Rate and Inflation On Economic Growth: A Case Study of PakistanAmna QadeerОценок пока нет

- Abdoh 1Документ6 страницAbdoh 1Chan Hui YanОценок пока нет

- BRICSДокумент34 страницыBRICSMOHITA YADAVОценок пока нет

- Factors affecting fluctuations in INRДокумент11 страницFactors affecting fluctuations in INRKarishma Satheesh KumarОценок пока нет

- Cia - Iii: Final Model and Report BY Raghav Agarwal 2028004Документ12 страницCia - Iii: Final Model and Report BY Raghav Agarwal 2028004Raghav AgrawalОценок пока нет

- Determinants of Stock Market Liquidity A Macroeconomic PerspectiveДокумент22 страницыDeterminants of Stock Market Liquidity A Macroeconomic PerspectiveMuhammad MansoorОценок пока нет

- Impact of Macro Economic Variables On Stock Market Volatility: A Study of GCC Stock MarketsДокумент9 страницImpact of Macro Economic Variables On Stock Market Volatility: A Study of GCC Stock MarketsajmrdОценок пока нет

- 4b386paper 2Документ12 страниц4b386paper 2hhhhhhhОценок пока нет

- Causes and Consequences of Trade Deficit in PakistanДокумент11 страницCauses and Consequences of Trade Deficit in PakistanMaham SajjadОценок пока нет

- MPRA Paper 49395Документ8 страницMPRA Paper 49395Esha NadeemОценок пока нет

- Exchange Rate Volatility, Stock Market Performance and Output in NigeriaДокумент14 страницExchange Rate Volatility, Stock Market Performance and Output in NigeriaIjahss JournalОценок пока нет

- The Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketДокумент11 страницThe Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketAssociation for Pure and Applied ResearchesОценок пока нет

- Sadaf Alam and Mishal Nadeem 2015 Capital MarketДокумент13 страницSadaf Alam and Mishal Nadeem 2015 Capital MarketBabar NawazОценок пока нет

- Lje 2009Документ23 страницыLje 2009Arshad HasanОценок пока нет

- Synopsis 1Документ20 страницSynopsis 1Kalsoom AkhtarОценок пока нет

- NBER Macroeconomics Annual 2016От EverandNBER Macroeconomics Annual 2016Martin EichenbaumОценок пока нет

- Foreign Direct Investment: Analysis of Aggregate FlowsОт EverandForeign Direct Investment: Analysis of Aggregate FlowsРейтинг: 1 из 5 звезд1/5 (1)

- Content Weightages University of Chitral Chitral Khyber PakhtunkhwaДокумент5 страницContent Weightages University of Chitral Chitral Khyber PakhtunkhwaKamran AliОценок пока нет

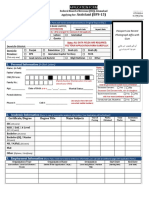

- FRU Kohat Job Application FormДокумент3 страницыFRU Kohat Job Application FormKamran AliОценок пока нет

- FATA University, FR Kohat: Application Form FOR Employment in Bps 1-16Документ3 страницыFATA University, FR Kohat: Application Form FOR Employment in Bps 1-16Kamran AliОценок пока нет

- Advertisement Faculty Staff 2018 FinalДокумент3 страницыAdvertisement Faculty Staff 2018 FinalKamran AliОценок пока нет

- WAPDA Job Openings for Legal, Security, Admin PositionsДокумент3 страницыWAPDA Job Openings for Legal, Security, Admin PositionsLft Gen RussGulla KhanОценок пока нет

- 54 614Документ3 страницы54 614Bilal1044Оценок пока нет

- Content Weightages Khyber Pakhtunkhwa Revenue Authority (KPRA)Документ3 страницыContent Weightages Khyber Pakhtunkhwa Revenue Authority (KPRA)Kamran AliОценок пока нет

- Fair Combined Ad No.06-2017 PDFДокумент32 страницыFair Combined Ad No.06-2017 PDFKamran AliОценок пока нет

- Combined Ad No 01-2017Документ29 страницCombined Ad No 01-2017Naul NbnОценок пока нет

- Section I: Subjective: (30%) : Syllabus For Recruitment Against Post in Bps - 17 To Bps-19Документ1 страницаSection I: Subjective: (30%) : Syllabus For Recruitment Against Post in Bps - 17 To Bps-19Zama PataОценок пока нет

- TADA Rules Revised PDFДокумент4 страницыTADA Rules Revised PDFKamran AliОценок пока нет

- Daily Allowance 2012Документ2 страницыDaily Allowance 2012Kamran AliОценок пока нет

- Sales Tax Actupdatedupto 30062015 AmendedversionДокумент180 страницSales Tax Actupdatedupto 30062015 AmendedversionKamran AliОценок пока нет

- New Doc 2017-06-02Документ6 страницNew Doc 2017-06-02Kamran AliОценок пока нет

- JOBS in Public Service Commission Peshawar - Advertisement No 02 2017Документ13 страницJOBS in Public Service Commission Peshawar - Advertisement No 02 2017Haroon HAОценок пока нет

- KPPSC Advertisement for 191 Headmaster and Professor PostsДокумент8 страницKPPSC Advertisement for 191 Headmaster and Professor PostsKamran AliОценок пока нет

- Content Weightages For Pakhtunkhwa Highways AuthorityДокумент2 страницыContent Weightages For Pakhtunkhwa Highways AuthorityKamran AliОценок пока нет

- Khyber Pakhtunkhwa Revenue AuthorityДокумент1 страницаKhyber Pakhtunkhwa Revenue AuthorityKamran AliОценок пока нет

- Secretariat Instructions For Employees of Federal Government in PakistanДокумент129 страницSecretariat Instructions For Employees of Federal Government in PakistanNasir Hasan Khan100% (7)

- Section I: Subjective: (30%) : Syllabus For Recruitment Against Post in Bps - 17 To Bps-19Документ1 страницаSection I: Subjective: (30%) : Syllabus For Recruitment Against Post in Bps - 17 To Bps-19Zama PataОценок пока нет

- Assistant Director Test Mcqs PDFДокумент6 страницAssistant Director Test Mcqs PDFFahadKhanОценок пока нет

- Branchwise Report 11-4-2017Документ1 страницаBranchwise Report 11-4-2017Kamran AliОценок пока нет

- WAPDA Job Openings for Legal, Security, Admin PositionsДокумент3 страницыWAPDA Job Openings for Legal, Security, Admin PositionsLft Gen RussGulla KhanОценок пока нет

- Weekly Report 6 March-2017Документ1 страницаWeekly Report 6 March-2017Kamran AliОценок пока нет

- Collection ReportДокумент1 страницаCollection ReportKamran AliОценок пока нет

- Khyber Pakhtunkhwa Revenue Authority (KPRA) : Weekly Collection of Sales Tax On ServicesДокумент2 страницыKhyber Pakhtunkhwa Revenue Authority (KPRA) : Weekly Collection of Sales Tax On ServicesKamran AliОценок пока нет

- Agricultural Credit-Meaning, Definition, Need and ClassificationДокумент4 страницыAgricultural Credit-Meaning, Definition, Need and ClassificationKamran AliОценок пока нет

- AgricrditДокумент161 страницаAgricrditmerakonaОценок пока нет

- Agricultural Credit: Monetary and Banking DevelopmentsДокумент3 страницыAgricultural Credit: Monetary and Banking DevelopmentsGauri SrivastavaОценок пока нет

- The Determinants of Industrialization in Developing Countries, 1960-2005Документ26 страницThe Determinants of Industrialization in Developing Countries, 1960-2005Kamran AliОценок пока нет

- An Introduction To TeluguДокумент5 страницAn Introduction To TeluguAnonymous 86cyUE2Оценок пока нет

- Revision FinalДокумент6 страницRevision Finalnermeen mosaОценок пока нет

- Syllabus For M. Phil. Course Part - I Paper - I Title: General Survey of Buddhism in India and Abroad 100 Marks Section - AДокумент6 страницSyllabus For M. Phil. Course Part - I Paper - I Title: General Survey of Buddhism in India and Abroad 100 Marks Section - ASunil SОценок пока нет

- Political Behavior: The Handbook ofДокумент22 страницыPolitical Behavior: The Handbook ofnonyelum EzeonuОценок пока нет

- EAR Policy KhedaДокумент40 страницEAR Policy KhedaArvind SahaniОценок пока нет

- Christ The Redemers Secondary SchoolДокумент36 страницChrist The Redemers Secondary Schoolisrael_tmjesОценок пока нет

- Website Vulnerability Scanner Report (Light)Документ6 страницWebsite Vulnerability Scanner Report (Light)Stevi NangonОценок пока нет

- Neat Veg Report Final PDFДокумент50 страницNeat Veg Report Final PDFshishirhomeОценок пока нет

- A Taste of AgileДокумент89 страницA Taste of AgileBhaskar Das70% (10)

- Charity Extends Help To Seniors: Donating Is Made EasierДокумент16 страницCharity Extends Help To Seniors: Donating Is Made EasierelauwitОценок пока нет

- Codex Magica Texe MarrsДокумент588 страницCodex Magica Texe MarrsAndrew D WadeОценок пока нет

- Navodaya Vidyalaya Samiti Notice for TGT InterviewsДокумент19 страницNavodaya Vidyalaya Samiti Notice for TGT Interviewsram vermaОценок пока нет

- Human Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksДокумент25 страницHuman Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksExtreme TronersОценок пока нет

- History of Cisco and IBMДокумент1 страницаHistory of Cisco and IBMSven SpenceОценок пока нет

- Tech Refresh & Recycle Program: 2,100PB+ of Competitive GearДокумент1 страницаTech Refresh & Recycle Program: 2,100PB+ of Competitive GearRafi AdamОценок пока нет

- Subject and Object Questions WorksheetДокумент3 страницыSubject and Object Questions WorksheetLucas jofreОценок пока нет

- Place of Provision of Services RulesДокумент4 страницыPlace of Provision of Services RulesParth UpadhyayОценок пока нет

- JNMF Scholarship Application Form-1Документ7 страницJNMF Scholarship Application Form-1arudhayОценок пока нет

- Tayug Rural Bank v. CBPДокумент2 страницыTayug Rural Bank v. CBPGracia SullanoОценок пока нет

- Maxwell McCombs BioДокумент3 страницыMaxwell McCombs BioCameron KauderОценок пока нет

- Pindyck Solutions Chapter 5Документ13 страницPindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- Adw Ethical Stewardship of Artifacts For New Museum ProfessionalsДокумент15 страницAdw Ethical Stewardship of Artifacts For New Museum Professionalsapi-517778833Оценок пока нет

- Assign 01 (8612) Wajahat Ali Ghulam BU607455 B.ed 1.5 YearsДокумент8 страницAssign 01 (8612) Wajahat Ali Ghulam BU607455 B.ed 1.5 YearsAima Kha KhanОценок пока нет

- Vodafone service grievance unresolvedДокумент2 страницыVodafone service grievance unresolvedSojan PaulОценок пока нет

- Music Business PlanДокумент51 страницаMusic Business PlandrkayalabОценок пока нет

- CPAR and UCSP classes inspire passion for healthcareДокумент2 страницыCPAR and UCSP classes inspire passion for healthcareMARIAPATRICIA MENDOZAОценок пока нет

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerДокумент40 страницPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshОценок пока нет

- Grace Song List PDFДокумент11 страницGrace Song List PDFGrace LyynОценок пока нет

- Business Planning and Project Management GuideДокумент20 страницBusiness Planning and Project Management GuideTaha MerchantОценок пока нет

- Week 1 and 2 Literature LessonsДокумент8 страницWeek 1 and 2 Literature LessonsSalve Maria CardenasОценок пока нет