Академический Документы

Профессиональный Документы

Культура Документы

The Friendly Network

Загружено:

Alexa ElfarraАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Friendly Network

Загружено:

Alexa ElfarraАвторское право:

Доступные форматы

The Friendly Network The underwriting transaction is a negotiated one, and negotiations take place between people.

. Therefore underwriters must cultivate relationships with fellow employees and other professionals within the friendly network. These professionals consist of: other underwriting departments, brokers, insured's or applicants, loss control inspectors, loss adjusters, lawyers and other professionals. Benefits of Good Relationships Networking - forming, maintaining, and expanding one's network of professional relationships to help achieve one's business objectives. The more professional relationships an underwriter has, the better they will be able to undertake the many small transactions between people and make any business run smoothly and well. One of the most important benefits is the dissemination of information they make possible. It makes the job easier by giving access to information that can be valuable or even necessary to properly do the underwriting job. It gives the underwriter perspective by understanding the roles of other insurance professionals. It helps build trust between the underwriter and the insurance professional they deal with. That trust can help achieve the most important result of good relationships for the underwriter: attracting and retaining profitable business. Other Underwriters Among the most useful and rewarding relationships any professional can cultivate are relationships with his or her peers. The underwriter may find it useful to call upon the expertise of their counterparts in other branches about operations in those territories, law in those jurisdictions, environmental considerations, business climate, or any other feature and its local circumstances. Underwriters must understand facultative reinsurance as an alternative when they want or have been asked by the broker to authorize coverage or amounts of insurance on a risk beyond what their line guides permit them. Underwriters may need facultative reinsurance for unique or especially hazardous exposures. o Good relationships with facultative reinsurers ensure that facultative insurance will be available when it is needed. o The u/w must share a mix of risks with facultative reinsurers, including both more and less attractive risks. The prudent u/w behaves towards the FR exactly as the u/w hopes brokers will behave towards them. o If the u/w submits only poor risks to the FR - risks that are poorly priced or protected or constructed or especially hazardous or otherwise unattractive - then the FR will be understandably suspicious whenever approached by the u/w. o The u/w must also demonstrate a thorough knowledge of each risk and the u/wing exposures it represents. The FR is farther removed from the risk than the u/w and must decide to extend capacity or not on the basis of less information than is available to the u/w.

o Reinsurers can be a valuable source of knowledge and advice. Reinsurers tend to see a broader spread of risk than do u/w's at primary insurance companies. o Whether or not an u/w has any involvement at all with the insurer's treaties, they should understand their purpose and general structure. o Understanding the purpose and general structure of treaties will also help the u/w recognize that facultative and treaty reinsurance are related; that the u/w credit built with FR and the profits they realize on the risks they share with them will also have a bearing on the availability and cost to the insurer of treaty reinsurance. Agents A good professional relationship permits candor without hard feeling. Brokers act on behalf of the insurance buyer to find an insurance company willing to insure the buyer and then tries to obtain for the buyer the best terms possible. The u/w acts on behalf of the insurance company as a kind of gatekeeper, opening up to attractive risks and closing or negotiating stricter terms for less attractive risks. This can create tension between u/ws and brokers. The u/w must be careful not to let that natural tension lead them to regard the insurer as we or us and the brokers as they or them. This kind of thinking can lead to the relationship with the broker to become adversarial, with negative implications for the u/w's ability to build trust and obtain the information and cooperation the u/w needs from the broker to properly u/w a risk. A broker is liaison between the insurance buyer and the u/w. The prudent, ethical broker will try to protect an insurer's interest even as the broker pursues insurance coverage for the buyer. A good relationship with an u/w might make the difference between the broker's directing the business to that u/w's company and directing it to a competing insurer instead. In a good professional relationship, information is exchanged more readily. It can broaden the basis of negotiation between the u/w and broker. The professional integrity of the broker will require recommending the u/w's quote if it is in the applicant's best interest. The broker will often have several alternatives that would serve the client's interest equally well. The success of the negotiation process in part reflects the strength of the u/w's relationship with the broker. "Improve the source" take the time to help the broker by leading them to expect that certain questions will always need answers and certain information will always need to be included in submissions presented to the u/w. Good working relationships help the u/w to attract and to retain quality business for the insurer. An agent does not represent several insurers but only one. Agents and brokers have similar compensation schemes, both work for a commission. Agents often receive commissions on a sliding scale. One reason for this is the broker owns the book of business the agent's book is owned by the insurer, which usually also has a service department. Therefore agents are responsible for selling new policies not servicing them. An important consideration for an u/w's relationship with an agent is that the agent cannot offer an alternative to the insurance buyer. The relationship is more of a coworker as opposed to an outside vendor. This also makes the relationship more difficult as the agent has no alternative market, the u/w must be even more sensitive to the agent's interest and circumstances. This also means for the agent less opportunity to learn about the practices of Brokers other insurers and about the marketplace generally. This may require the u/w to

collaborate with the agent in developing the agent's knowledge and skills. Risk Managers o The discipline of managing pure risk exposures is called risk management. o Definition - Risk Management is both an academic discipline and a profession. It is also a process that allows insurance and risk management professionals to systematically identify and deal with risk exposures. In the broadest sense, then, risk managers are those responsible for managing pure risk exposures within an organization. o Professional risk managers are employed by larger commercial enterprises. o For risks that employ a risk manager, the risk manager represents the risk in negotiations concerning insurance. The risk manager is the u/w's customer. o The risk manager is a critical source of information to the u/w. The risk manager has the knowledge the u/w needs of the workings of the risk's operation, its insurance needs, its claims management and it exposures to loss. o The sophistication of the risk manager often depends on the size of the organization. o A risk manager may know about insurance but may not be an insurance person. o Even where a risk employs a risk manager, the broker often has a critical role to play as liaison between the u/w and the RM. The broker will know which insurer will u/w which kinds of risk and have the expertise to negotiate with the u/w on behalf of the risk. o The broker's role as liaison can be important to mediate tensions. See the example on page 15. Brokers, Agents, RM's, and Market Cycles The market for insurance is subject to the law of supply and demand. The price of insurance is heavily influenced by the relationship between the supply of insurance capacity and the demand for it. The supply comes from Insurers and the demand from insurance buyers. When supply exceeds demand, the market is soft - competition between insurers is keen, prices are driven down and terms are less restrictive. When demand exceeds supply, the market is hard - competition is less intense, prices are driven up and terms are more restrictive. A hard market favors underwriters, a soft market favors brokers. The swing of insurance markets from hard to soft can be a continuing source of strain in an u/w's relations with brokers as well as agents and RM's. If the relationship between an u/w and a broker is based solely on price, there will always be at least one frustrated party, depending on whether the market is hard or soft. The u/w must build a strong working relationship based on more than just the price of the insurance product. The wise u/w uses this natural curiosity to look at the situation from the broker's point of view. The u/w needs to understand the responsibilities of the brokers, as intermediaries, bear to their insureds as well as their insurers. The u/w will also try and understand the needs those responsibilities create for brokers trying to fulfill them, as well as the stresses that accompany brokers' efforts to fulfill their responsibilities. This helps the u/w in avoiding the blame game. The u/w needs to build good relations in the best of times to be prepared for the worst of times. The Claims Department

In a difficult negotiation over renewal terms, a positive experience for the insured with the insurer's claims department in the adjustment of a claim might be a consideration in persuading the insured to stay with the insurer. Tensions between the insured and the claims department could be eased by mediation by an u/w that enjoys good relations with both. Claims dept can be an invaluable source of information about the development of a continuing loss adjustment. An u/w's assessment of a risk depends in part on loss reserves. Claims can help the u/w in estimating the likely future development of incurred losses that are still being adjusted. Claims dept can also be a source of intelligence for the u/w. See the example on page 18. Claims dept can be a valuable resource in the education and continuing professional development of an u/w. The u/w may learn of changes in legal jurisdiction and newly released judgments in legal cases that will affect the u/w's assessment of risks like those involved in such cases. Claims people are often the most expert in the interpretation of policy language. The Actuarial Department U/w's at the branch level rarely deal with the actuaries. The actuarial dept can be a useful tool to the u/w for a more detailed picture of or an additional perspective to the claims dept on loss development. The Loss Control Department Loss control dept is often thought of as the "eyes and ears" of the u/w department. Some insurers will retain a private, independent firm to inspect and report on a risk. Many if not most u/w's heavily rely on the loss control report to form their impressions of a risk. Good relationship with the loss control dept is important. It allows the u/w to direct the LC inspector's attention to any aspects of the risk of special concern. It encourages the inspector to be more forthcoming with observations about the risk and more readily allows the u/w to clarify any points in the report that might be unclear or to ask questions to enhance his or her understanding of the exposures described in the report. An u/w will often encounter risks engaged in specialized or technical operations that are unfamiliar and that he or she must learn about to properly assess the exposure they represent. A related aspect of the decision is which recommendations to make conditions of accepting the risk. See example on page 21. A good relationship with the LC dept is most important in helping the u/w decide which recommendations to insist the risk act on. A loss control inspector will often work closely with the management of a risk to help the risk implement loss control recommendations and mediate between the u/w and the risk to make the risk acceptable for insurance. A good relationship with the LC dept allows the u/w to take advantage of the relationship that the LC dept has formed with the risk. Lawyers The claims dept is more likely than the u/w dept to deal with lawyers directly. Relationships with lawyers can be a valuable supplementary u/w resource. This can be in terms of interpretation of policy language, drafting of manuscript wording. A lawyer can help the u/w understand the legal implications of certain choices of language in such a wording. Lawyers can be a source for new developments in case law and new and revised

legislation. Industry Organizations o Valuable secondary resources for the u/w's continued education and training. o ULC or Underwriter's Laboratories of Canada - is an independent product safety testing and certification organization; it tests products for public safety and evaluates them for their makers. o IBC or the Insurance Bureau of Canada, an organization engaged in, among other things, working with the federal and provincial governments on the legislative framework within which property/casualty insurance is practiced. o CGI Insurance Business Services (formerly the Insurers' Advisory Organization (IAO) provides risk information, loss prevention and control services, commercial inspections, actuarial and other specialized risk management, and insurance consulting services. Customers In a competitive marketplace it becomes increasingly important to focus the attention on the customer. Since an u/w serves not one customer but many, one of the particular challenges is not only to focus on the customer but to identify the customer. The best decision an u/w can make is not the one that silences the loudest complainer but the one that most respects the needs of all the u/w's customers. The u/w must serve all interested customers and have the courage to say no to a customer if that is necessary to be fair to the other customers. The u/w must avoid making decisions that are merely justifiable or defensible. Instead, the u/w should prefer decisions that are sound because they are logical and above all because they are fair. Other Organizations and People Between organizations as between people, relationships reflect a constantly changing balance between their individual good and the common good; between self-interest and their shared interest; between competition and cooperation. Good relationships between organizations and people who work for them allow some exchange of market intelligence in the spirit of trust between professionals who are otherwise in competition with one another. Good u/wing relationships are based on trust, and trust in turn is built on the u/w's regard for personal integrity and for the ability and judgment of other people.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Soul RetrievalДокумент3 страницыSoul Retrievalsimi100% (1)

- The Science of ProphecyДокумент93 страницыThe Science of ProphecyMarius Stefan Olteanu100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- To The Philosophy Of: Senior High SchoolДокумент25 страницTo The Philosophy Of: Senior High SchoolGab Gonzaga100% (3)

- Come Boldly SampleДокумент21 страницаCome Boldly SampleNavPressОценок пока нет

- "Be The Best You Can Be": Things You Can Do To Improve Performance and Maximize PotentialДокумент54 страницы"Be The Best You Can Be": Things You Can Do To Improve Performance and Maximize PotentialJoseph MyersОценок пока нет

- The Sky Over DimasДокумент5 страницThe Sky Over DimasMiguel MartinezОценок пока нет

- Project On Central Coal FieldДокумент100 страницProject On Central Coal Fieldankitghosh73% (11)

- Gajendra StutiДокумент2 страницыGajendra StutiRADHAKRISHNANОценок пока нет

- 2nd Session NVC. Short Version. Part BДокумент20 страниц2nd Session NVC. Short Version. Part BAngeli SalapayneОценок пока нет

- Cdvs in The NewsДокумент3 страницыCdvs in The Newsapi-250757402Оценок пока нет

- Communication Plan Watson AET 560Документ17 страницCommunication Plan Watson AET 560tenayawatsonОценок пока нет

- Activity No. 1 (25pts.) : Informative CommunicationДокумент4 страницыActivity No. 1 (25pts.) : Informative CommunicationGFJFFGGFD JNHUHОценок пока нет

- Psychoanalytic Literary Criticism On The Corpse of Anna FritzДокумент1 страницаPsychoanalytic Literary Criticism On The Corpse of Anna FritzJulius AlcantaraОценок пока нет

- AbstractДокумент25 страницAbstractMargledPriciliaОценок пока нет

- Imama Ahmad Raza Khan BeraliviДокумент10 страницImama Ahmad Raza Khan BeraliviMuhammad Ali Saqib100% (1)

- Online Test Series Syllabus Class 10 2019Документ6 страницOnline Test Series Syllabus Class 10 2019ABHISHEK SURYAОценок пока нет

- PTO2 Reflection Rolando EspinozaДокумент3 страницыPTO2 Reflection Rolando Espinozaleonel gavilanesОценок пока нет

- Practice Test (CH 10 - Projectile Motion - Kepler Laws)Документ7 страницPractice Test (CH 10 - Projectile Motion - Kepler Laws)Totoy D'sОценок пока нет

- LFCH10Документ28 страницLFCH10sadsad100% (2)

- Assessment Draft - Indra GunawanДокумент2 страницыAssessment Draft - Indra Gunawanpeserta23 HamidОценок пока нет

- Hebrews - Vol 2 - DelitzschДокумент512 страницHebrews - Vol 2 - DelitzschLeonardo AlvesОценок пока нет

- KM Process IIДокумент9 страницKM Process IITriadi MaulanaОценок пока нет

- Exercises On Parallel StructureДокумент2 страницыExercises On Parallel StructureAviance JenkinsОценок пока нет

- Pere Binet, S.J. - Divine Favors Granted To St. JosephДокумент57 страницPere Binet, S.J. - Divine Favors Granted To St. JosephgogelОценок пока нет

- Reclaiming The Now: The Babaylan Is Us: Come. Learn. Remember. HonorДокумент40 страницReclaiming The Now: The Babaylan Is Us: Come. Learn. Remember. Honorrobin joel iguisОценок пока нет

- Barriers To Effective CommunicationДокумент15 страницBarriers To Effective CommunicationpRiNcE DuDhAtRa100% (1)

- Empathy Map: WHO Are We Empathizing With? What Do They Need To DO?Документ1 страницаEmpathy Map: WHO Are We Empathizing With? What Do They Need To DO?Ioana PintilieОценок пока нет

- Unit - I (General Management) : HRM and Labour Welfare, Paper Code: 55, UGC NET Dec 2019Документ3 страницыUnit - I (General Management) : HRM and Labour Welfare, Paper Code: 55, UGC NET Dec 2019TarunPanwarОценок пока нет

- Module On PT 1 REAL1Документ63 страницыModule On PT 1 REAL1William R. PosadasОценок пока нет

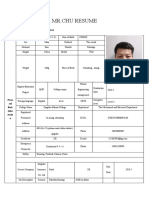

- Mr. Chu ResumeДокумент3 страницыMr. Chu Resume楚亚东Оценок пока нет