Академический Документы

Профессиональный Документы

Культура Документы

Financial Statements Decoded (English)

Загружено:

ytm2014Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Statements Decoded (English)

Загружено:

ytm2014Авторское право:

Доступные форматы

Key Components of Financial Statements

Financial Statements Decoded

The purpose of financial statements is to communicate the Groups financial information to its stakeholders, especially shareholders, investors and lenders. In this chapter we try to help those readers who do not have an accounting background to understand our financial information, by explaining the functions and relationships between three essential financial statements: the statement of comprehensive income, the statement of financial position and the statement of cash flows. For comprehensive and authoritative definitions and explanations, readers should turn to the relevant accounting standards, but we hope this chapter offers useful guidance.

Statement of comprehensive income

Financial performance measured by recording the flow of resources over a period of time

The statement of comprehensive income comprises (a) profit or loss in the same way as the previous years and (b) other comprehensive income (OCI) which represents changes in net assets / equity not arising from transactions with owners (i.e. shareholders). An example of OCI in CLP is the exchange gain arising from the translation of our Australia and India businesses in 2009 which increased our net assets in these two regions. Transactions with owners such as dividends are presented in the statement of changes in equity.

Statement of financial position

A snapshot, taken at a point in time, of all the assets the company owns and all the claims against those assets

The statement of financial position sums up the Groups economic resources (non-current assets and working capital), obligations (debts and other non-current liabilities) and owners equity at a particular point of time. It also shows how the economic resources contributed by lenders and shareholders are used in the business. In the past, we used to call this statement a balance sheet because at any given time, assets must equal liabilities plus owners equity (in other words, be in balance). The new name reflects its function more accurately.

Statement of cash flows

Where the company gets its cash and how it spends it

Profit underlies the operating cash flows, certain non-cash charges or credits, such as depreciation, amortisation and fair value changes on derivatives, mean the operating cash flows and the operating profit are different. Investing cash flows are the cash flows arising from the purchase or disposal of non-current assets. Financing cash flows represent the cash flows between the Group, its shareholders and lenders.

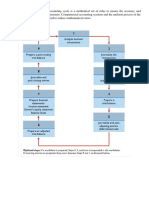

Financial Statements Illustrated

The diagram below illustrates the relationships between the statement of comprehensive income, the statement of financial position, the statement of cash flows, as well as their links with the Groups stakeholders. On the one hand, the Group earns revenue from customers through the deployment of non-current assets and working capital. On the other hand, it pays operating expenses to suppliers of goods and services, incurs staff costs and also invests in additional non-current assets. The net balance of revenue, operating expenses and staff costs is the operating profit. After deducting income taxes charged by tax authorities, this profit is available for payment to lenders (interest expenses and debt repayment) and for distribution to shareholders (dividends) in return for their contribution of funds to the Group in the form of debt and equity. Moreover, the Group also makes investments and advances to its project entities and receives dividend income from them in return.

Financial Statements An Illustration

Statement of comprehensive income

Statement of financial position

Statement of cash flows

Receivable

Customers

Revenue Working capital

Payable

Suppliers of goods & services

Operating activities

Operating expenses

Investments &

Staff Income statement costs Interest expenses Tax authorities Income taxes = Profit Financing activities Equity Non-current assets Investing activities

advances

Project Employees entities

Dividend receipts

Suppliers of fixed

Fixed assets investments

Lenders

assets

Debts and other non-current liabilities Lenders

Debt repayments Debt advances

Other OC I comprehensive income (OCI)

Shareholders

Dividend payments

Cash flow

Accounting flow

Вам также может понравиться

- Finance QuestionsДокумент10 страницFinance QuestionsAkash ChauhanОценок пока нет

- CAE Separate Financial Statements 31-03-2022 EnglishДокумент77 страницCAE Separate Financial Statements 31-03-2022 EnglishMuhammad TohamyОценок пока нет

- Bar and Line GraphsДокумент24 страницыBar and Line GraphsstraitmiОценок пока нет

- Financial StatementsДокумент47 страницFinancial StatementsMonica SharmaОценок пока нет

- Assignment 04 Cash Flow StatementДокумент6 страницAssignment 04 Cash Flow Statementumair iqbalОценок пока нет

- Terminology Balance SheetДокумент3 страницыTerminology Balance SheetMarcel Díaz AdriàОценок пока нет

- Basic Financial StatementsДокумент45 страницBasic Financial StatementsparhОценок пока нет

- Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest VersioДокумент51 страницаSolution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Versiomarcuskenyatta275Оценок пока нет

- Accounting Interview QuestionsДокумент43 страницыAccounting Interview QuestionsArif ullahОценок пока нет

- BVA CheatsheetДокумент3 страницыBVA CheatsheetMina ChangОценок пока нет

- BUSN1001 Tutorial Discussion Questions Week 6 - With AnswersДокумент10 страницBUSN1001 Tutorial Discussion Questions Week 6 - With AnswersXinyue Wang100% (1)

- Statement of Change in Financial Position-5Документ32 страницыStatement of Change in Financial Position-5Amit SinghОценок пока нет

- Cash Flows AccountingДокумент9 страницCash Flows AccountingRosa Villaluz BanairaОценок пока нет

- A Revisit On The Fundamentals of AccountingДокумент53 страницыA Revisit On The Fundamentals of AccountingGonzalo Jr. Ruales100% (1)

- Cash Flow StatementДокумент19 страницCash Flow StatementGokul KulОценок пока нет

- Lecture 9 M17EFA - Company Valuation 2 1Документ48 страницLecture 9 M17EFA - Company Valuation 2 1822407Оценок пока нет

- Valuation of Goodwill by Arjun SinghДокумент15 страницValuation of Goodwill by Arjun SingharjunОценок пока нет

- FCFE Vs DCFF Module 8 (Class 28)Документ9 страницFCFE Vs DCFF Module 8 (Class 28)Vineet AgarwalОценок пока нет

- The Accounting EquationДокумент49 страницThe Accounting EquationsweetEmie031Оценок пока нет

- Depreciation: Depreciation Is A Term Used inДокумент10 страницDepreciation: Depreciation Is A Term Used inalbertОценок пока нет

- Cash Flow StatementДокумент46 страницCash Flow StatementVikrant GhadgeОценок пока нет

- Introduction To Cost and Management AccountingДокумент3 страницыIntroduction To Cost and Management AccountingTheaОценок пока нет

- Acct 2101 Exam 1 Study GuideДокумент3 страницыAcct 2101 Exam 1 Study GuideDavid Lee100% (1)

- Lecture 2 - Answer Part 2Документ6 страницLecture 2 - Answer Part 2Thắng ThôngОценок пока нет

- Finance Interview QuestionsДокумент3 страницыFinance Interview Questionsk gowtham kumarОценок пока нет

- Funds Flow Statements ProcessДокумент10 страницFunds Flow Statements ProcessNancy VermaОценок пока нет

- 'Basics of AccountingДокумент57 страниц'Basics of AccountingPrasanjeet DebОценок пока нет

- Journal Ledger and Trial BalenceДокумент14 страницJournal Ledger and Trial BalenceMd. Sojib KhanОценок пока нет

- Accounting Financial: General LedgerДокумент8 страницAccounting Financial: General LedgerSumeet KaurОценок пока нет

- Factoring and IngДокумент27 страницFactoring and IngSsudhan SudhanОценок пока нет

- Projected Balance SheetДокумент1 страницаProjected Balance Sheetr.jeyashankar9550100% (1)

- Notes On Financial AccountingДокумент11 страницNotes On Financial AccountingAbu ZakiОценок пока нет

- Acct Theory Investments 1 and Cash Spring 2017Документ3 страницыAcct Theory Investments 1 and Cash Spring 2017Joshna KОценок пока нет

- Ratio AnalysisДокумент24 страницыRatio Analysisrleo_19871982100% (1)

- Meaning of AccountingДокумент50 страницMeaning of AccountingAyushi KhareОценок пока нет

- Valuation of GoodwillДокумент28 страницValuation of GoodwillPatil AnandОценок пока нет

- Galvor CaseДокумент10 страницGalvor CaseLawi AnupamОценок пока нет

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreДокумент6 страницStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniОценок пока нет

- Outline Line GraphsДокумент8 страницOutline Line GraphsHương Nguyễn Hồng SôngОценок пока нет

- Financial Accounting Chapter 3Документ5 страницFinancial Accounting Chapter 3NiraniyaОценок пока нет

- Financial Accounting 123Документ46 страницFinancial Accounting 123shekhar87100% (1)

- Glossary For Capital IQДокумент26 страницGlossary For Capital IQHimanshu RanjanОценок пока нет

- Identifying and Journalizing Transactions: Learning OutcomesДокумент51 страницаIdentifying and Journalizing Transactions: Learning OutcomesTip Tap100% (1)

- Bank ReconciliationДокумент3 страницыBank Reconciliationazwan88Оценок пока нет

- Financial Ratios - Formula SheetДокумент4 страницыFinancial Ratios - Formula SheetAira Dela CruzОценок пока нет

- Assignment Ratio AnalysisДокумент7 страницAssignment Ratio AnalysisMrinal Kanti DasОценок пока нет

- Interview Question AnswersДокумент2 страницыInterview Question AnswersSushilSinghОценок пока нет

- Excel As A Tool in Financial ModellingДокумент5 страницExcel As A Tool in Financial Modellingnikita bajpaiОценок пока нет

- What Is The Indirect MethodДокумент3 страницыWhat Is The Indirect MethodHsin Wua ChiОценок пока нет

- UOL 2091 Financial Reporting Lecture NotesДокумент97 страницUOL 2091 Financial Reporting Lecture NotesDương DươngОценок пока нет

- Financial Statement Analysis A Look at The Balance Sheet PDFДокумент4 страницыFinancial Statement Analysis A Look at The Balance Sheet PDFnixonjl03Оценок пока нет

- Audit Procedures - ApproachДокумент2 страницыAudit Procedures - ApproachXhimshelozОценок пока нет

- Free Cash Flow Valuation: Wacc FCFF VДокумент6 страницFree Cash Flow Valuation: Wacc FCFF VRam IyerОценок пока нет

- FAPДокумент12 страницFAPAnokye AdamОценок пока нет

- Financial Accounting and AnalysisДокумент8 страницFinancial Accounting and AnalysisRia LapizОценок пока нет

- Accounting DictionaryДокумент5 страницAccounting DictionaryShazad HassanОценок пока нет

- Building Your Financial Future: A Practical Guide For Young AdultsОт EverandBuilding Your Financial Future: A Practical Guide For Young AdultsОценок пока нет

- Statement September 2021Документ1 страницаStatement September 2021Julio DelarozaОценок пока нет

- Sap Fico T100Документ246 страницSap Fico T100Chikkandlapalli VenkateshОценок пока нет

- Practise Question Chap 11Документ20 страницPractise Question Chap 11SaadОценок пока нет

- 24 000 Annual Income (Loss)Документ6 страниц24 000 Annual Income (Loss)Rian EsperanzaОценок пока нет

- Quiz - Stock ValuationДокумент4 страницыQuiz - Stock ValuationMaria Anne Genette Bañez100% (1)

- FAP - Bodie Industrial Supply - LT 2Документ16 страницFAP - Bodie Industrial Supply - LT 2Marcus McWile MorningstarОценок пока нет

- Accounting Principles Volume 1 Canadian 7th Edition Geygandt Solutions ManualДокумент92 страницыAccounting Principles Volume 1 Canadian 7th Edition Geygandt Solutions Manualchadthedad15Оценок пока нет

- Unilever Pakistan Limited Annual Report 2016 Tcm1267 501352 enДокумент71 страницаUnilever Pakistan Limited Annual Report 2016 Tcm1267 501352 enHammad AslamОценок пока нет

- Financial Statement Analysis PracticeДокумент12 страницFinancial Statement Analysis PracticeRain LerogОценок пока нет

- Financial Accounting and Reporting PartДокумент6 страницFinancial Accounting and Reporting PartLalaine De JesusОценок пока нет

- Prelim Fm1Документ5 страницPrelim Fm1SERNADA, SHENA M.Оценок пока нет

- Financial Accounting Course OutlineДокумент2 страницыFinancial Accounting Course OutlineTanveer FarooqОценок пока нет

- Final Annualreport Atulauto 02092022Документ163 страницыFinal Annualreport Atulauto 02092022Khurshid AlamОценок пока нет

- UGBA 120B Discussion Section 7 10 12 12Документ18 страницUGBA 120B Discussion Section 7 10 12 12jennyz365Оценок пока нет

- Chapter 1 ACCOUNTING IN ACTIONДокумент61 страницаChapter 1 ACCOUNTING IN ACTIONWendy Priscilia Manayang100% (1)

- 2022-AC3059 Commentary 2022Документ19 страниц2022-AC3059 Commentary 2022Aishwarya Potdar100% (1)

- AssignmentДокумент7 страницAssignmentGrace MwendeОценок пока нет

- TACN2 Học viện tài chínhДокумент20 страницTACN2 Học viện tài chínhMinh Anh NguyenОценок пока нет

- Excel Drill - CAPM & WACCДокумент8 страницExcel Drill - CAPM & WACCgjlastimozaОценок пока нет

- Hospitality For Chinese Market8Документ4 страницыHospitality For Chinese Market8api-498580117Оценок пока нет

- FM Shah AliДокумент2 страницыFM Shah AliJohn SnowОценок пока нет

- ConvergEx Traders Guide 2014 Q3Документ168 страницConvergEx Traders Guide 2014 Q3thisthat7Оценок пока нет

- Dịch 1Документ2 страницыDịch 1Dung Phạm Hồ ThùyОценок пока нет

- Consumers Product Analysis PresentationДокумент6 страницConsumers Product Analysis PresentationUmar HarizОценок пока нет

- Financial Reporting and Analysis 7th Edition Gibson Test BankДокумент23 страницыFinancial Reporting and Analysis 7th Edition Gibson Test Bankmrsbrianajonesmdkgzxyiatoq100% (32)

- 1 - Fundamentals of Management Accounting and Cost ConceptsДокумент11 страниц1 - Fundamentals of Management Accounting and Cost ConceptsMARK KENNETH RULLEPAОценок пока нет

- Group 10 - Tata MotorsДокумент30 страницGroup 10 - Tata MotorsSayan MondalОценок пока нет

- Capital Budgeting HandoutДокумент15 страницCapital Budgeting HandoutJoshua Cabinas100% (1)

- Rac Bidco Limited: Interim Report and Financial StatementsДокумент27 страницRac Bidco Limited: Interim Report and Financial StatementsMus ChrifiОценок пока нет

- NPV (Discount Rate, Range of Values) +investmentДокумент7 страницNPV (Discount Rate, Range of Values) +investmentNgân NguyễnОценок пока нет