Академический Документы

Профессиональный Документы

Культура Документы

Corporate Governes Review

Загружено:

Sajjad AhmedИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Corporate Governes Review

Загружено:

Sajjad AhmedАвторское право:

Доступные форматы

Sahrash Naveed Roll: 32 MBA 6th semester

Corporate Governance

Corporate Governance: Rules, practices and processes controlled by a system in which a company managed and organized. Balancing the interests of stakeholders in corporate governance of a company - these include its, management, shareholders, customers, suppliers, financiers, government and the community. As a company's corporate governance also provides the structure for the purpose of attaining the means to effectively manage every sphere of action plans and performance measures for internal control and corporate publishing to. Evolution of the corporate structure: An organizational structure consists of activities such as task distribution, coordination and management, which are directed towards the success of organizational aims. It can also be considered as the performance or viewpoint through which individuals see their organization and its environment. Organizational structures developed from the early times of hunters and collectors in tribal organizations through highly royal and clerical power structures to industrial structures and today's post-industrial structures. The importance of structure for effectiveness and efficiency was assumed without the least question that whatever structure was needed, people could fashion accordingly. Organizational structure was considered a subject of choice. Characteristics of corporations Professional management The Investors in a corporation need not actively manage the business, as most corporations hire professional managers to operate the business. The investors vote on the Board of Directors who is responsible for hiring the management. Limited liability The liability of stockholders is limited to the amount each has invested in the firm. Personal assets of stockholders are not available to creditors or lenders seeking

payment of amounts owed by the corporation. Creditors are limited to corporate assets for satisfaction of their claims. Separate legal entity The corporation is considered a separate legal entity, conducting business in its own name. Therefore, corporations may own property, enter into compulsory contracts, borrow money, sue and be sued and pay taxes. Stockholders are agents for the corporation only if they are also employees or designated as agents. Transferring ownership rights A person who buys stock in a corporation is called a stockholder and receives a stock certificate indicating the number of shares of the company she/he has purchased. Particularly in a public company, the stock can be easily transferred in part or total at the discretion of the stockholder. The stockholder wishing to transfer stock does not require the approval of the other stockholders to sell the stock. Perpetual life In accordance to the going concern principle of accounting, corporations have an endless life. A corporation exists indefinitely, up to the foreseeable future. There is no connection between the life of a corporation and that of its members. There is a continuous succession of stakeholders (employees, shareholders, managers and debtors). Purpose of the corporations: Business corporations are maybe the most influential organizations in society and have long been recognized as important contributors to the common goods. Society grants corporations unique privileges in order to connect their great capacities to provide its needs. Yet the current description of the business corporation tells a different story; corporations have the sole purpose of maximizing profits for shareholders. The Corporate as a Person: Corporation is an ultimate body, created by law, composed of individuals united under a common name, the members of which succeed each other, so that the body continues the same, notwithstanding the changes of the individuals who compose it, and which for certain purposes is considered as a natural person. Corporate personhood is the legal concept that a corporation may sue and be sued in court in the same way as a natural person or unincorporated associations of persons.

The words person and whoever include corporations, companies, associations, firms, partnerships, societies, and joint stock companies, as well as individuals.

The corporation as a complex adaptive system: Corporate structure was designed to be as very important Machine outsourcing" and it was like a powerful No mischievousness involved - is just the other side of its target of generating wealth. So will do anything can hold on to their income and expenses to push out of balance. This can be done, for example, through legislation that increases the barriers to entry for competitors or limits its liabilities. The life force that is selfperpetuating integrated corporate structure struggle systems intended to impose accountability, and therefore legitimacy."Externality" is the vocabulary of economics. Another way to think about this is to use the vocabulary of science and call it a "complex adaptive system". These systems, whether in physics, biology or economics, patterns can be analyzed as and modes of behaviors that can report the activity in other fields. Only when I understand that companies have is that it is adaptive characteristics, it is clear that change their behavior must come from within organizations. It is not desirable for society to recognize the inefficiency and external restrictions on business activity. Neither the government nor the market has the ability to Corporate performance is required by the public interest. The corporations as a Moral Person: Do corporations, like people, have moral responsibility? What, to put it more broadly, is the moral status of a corporation? Corporations are a special kind of entity. Although they are not persons, they have the same legal rights as persons in the United States, and these rights are protected under the Amendment. This fact is uncontroversial. There is, however, some controversy and disagreement as to what follows from this peculiar legal arrangement particularly with respect to ethical considerations such as moral responsibility. Some hold that corporations like individuals have moral responsibilities, since they like individuals act and affect others with their actions. This position is known as the

moral person view of the corporation. Proponents of this view take corporations to be full moral agents, with rights as well as moral responsibilities. Morality governs the actions of rational beings insofar as they affect other rational beings. Formal organizations hires and fires people, pays them wages, pays taxes, recalls defective models. Not only do businesses act, they also act rationally according to a rational decision-making procedure. Because their rational actions affect people, these actions can be evaluated from a moral point of view. If it is immoral for an individual to discriminate, it is also immoral for a corporation to discriminate. If it is laudable for an individual to give to charity, it is praiseworthy for a business to give to charityActions can be morally evaluated whether done by an individual or by an entity such as a company, corporation, or a nation. The corporation in society: The role of the corporation to be shareholder value maximization, but According to this view, meeting the needs of other stakeholders along social and environmental dimensions should only be done if it contributes to creating shareholder value. Globalization, frequent crises in the world's capital markets and the failure of companies to adequately manage risk are also contributing to a growing debate about the role of corporations should have in society today. Creative capitalism is representative of a growing school of thought that business should not only decrease its negative impact on society, but actively work to develop solutions to social and environmental problems or at least help distribute the benefits of the private sector more widely. The corporate and Marketplace: Corporate social responsibility are about doing what you do right, then the marketplace issues are about doing the right thing. Doing the right things can be the single most important aspect of your business in terms of securing its longer term viability. Future directions of the corporations: As corporations expand their operations and markets into virtually all parts of the world, we must begin to develop a more consistent and coherent approach. In order to do that, we must, whenever possible, integrate the most important legislated standards with the realities of the economic laws. One of the problems that are presented by this task is finding some way to balance the need for long-term planning with the need for presentday assurances that whatever is planned for the long term is indeed likely to happen.

Corporations must have as their primary and overriding goal the generation of long-term Value. A commitment to the satisfaction of employees, suppliers, customers, and the community is essential for achieving this goal. It has three functions: To broaden the dialogue on corporate governance. To exchange experience and good practice; and to coordinate activities and identify. And fill gaps in the provision of technical assistance. Corporate power Corporate governance also has its checks and balances (including the government). In order to maintain legitimacy and credibility, corporate management needs to be effectively accountable to some independent, competent, and motivated representative. Following are the power that a corporation may have: Competitive power Agency power Institutionalize power Control of scarce resources Control of knowledge and information

Corporate performance Corporate Performance Management encompasses strategic planning, budgeting, forecasting, workflow, reporting, modeling, scenario planning, and profitability analysis. Factors help to evaluate the corporation performance: Change In Profitability Change In Strategy Enhance Shareholder Value Redesign Of Business Processes New Technology New Competition Attract/Retain People

Corporate crime Corporate crime, also called white-collar crime or organized crime, refers to criminal offenses that are committed by persons during the course of legitimate business activities. The crimes are often non-violent and involve such crimes as fraud, insider trading, and money laundering.

Probation of corporations

It is a supervision Order imposed by the court on a company that has committed a criminal offence. You cannot, of course, send a company to prison and fines are often ineffective, so a corporate probation or remedial Order is the most effective means whereby a court can require a company and its officers and directors to alter their conduct in a particular way. Among the optional probation conditions available are: Making restitution/ refund. Communication those policies, standards, and procedures to its representatives. Reporting to the court on the implementation of those policies, standards and procedures identifying the senior officer responsible for compliance with those policies standards and procedures. Corporation and government: co-opting Market Corporate power depends critically on government intervention in the marketplace. This is obvious enough in the case of the more overt forms of government favoritism such as subsidies, bailouts, and other forms of corporate welfare; protectionist tariffs; explicit grants of monopoly privilege; and the seizing of private property for corporate. Defenders of the free market are often accused of being apologists for big business and shills for the corporate elite. Because corporate power and the free market are actually antithetical; genuine competition is big businesss worst nightmare. Measuring corporate performance: Measuring Corporate Performance In the knowledge economy, a company's success rests as much on its ability to measure the performance of its intangible assets (such as customer relationships, internal business processes, and employee learning) as on its aptitude for monitoring traditional financial measures. Yet the tasks of evaluating the latest performance measures and aligning your corporate strategy accordingly pose serious challenges to managers who must balance daily business demands with longterm strategic goals. How can anyone shareholders, directors, or managers evaluate a companys performance if they cannot predict its future? Balancing interest: It is impossible to determine whether a new benefit program for employees will be justified by the increased loyalty and enthusiasm it inspires. There are so many opportunities for mistakes and even self-dealing that this area requires oversight and accountability. The way it is handled is a strong indicator of the merits of any corporate governance system.

Good and bad factor of the corporations Positive factors Create wealth and jobs around the world. Their size and scale of operation enables them to benefit from economies of scale enabling lower average costs and prices for consumers. Large profits can be used for research & development Ensure minimum standards. The success of multinationals is often because consumers like to buy goods and services where they can rely on minimum standards. Criticisms of Multinational Corporations

Companies are often interested in profit at the expense of the consumer. Multinational companies often have monopoly power which enables them to make excess profit. Their market dominance makes it difficult for local small firms to flourish. In developing economies, big multinationals can use their economies of scale to push local firms out of business. In the pursuit of profit, multinational companies often contribute to pollution and use of non renewable resources which is putting the environment under threat. MNCs have been criticized for using slave labor workers who are paid a pittance by Western standards.

Equilibrium the Cadbury paradigm : Corporations must balance many competing considerations: Long- and short-term notions of gain Cash and accounting concepts of value Democracy and authority Power and accountability

Three levels of company responsibility: The primary level comprises the companys responsibilities to meet its material obligations to shareholders, employees, customers, suppliers and creditors, to pay its taxes and to meet its statutory duties. Communitys human resources Avoiding damage to the environment GAAP

The common set of accounting principles, standards and procedures that companies use to compile their financial statements. GAAP are a combination of authoritative standards (set by policy boards) and simply the commonly accepted ways of recording and reporting accounting information. GAAP are imposed on companies so that investors have a minimum level of consistency in the financial statements they use when analyzing companies for investment purposes. GAAP cover such things as revenue recognition, balance sheet item classification and outstanding share measurements. Dubious practices and violation of GAAP Premature recognition of revenue: A dubious practice by accountant to show the future income in current year income, to make financial statement effective for users. Misapplication of accounting principles: Include immaterial items in financial statement for window dressing purpose e.g. (Good will) Big bath: Big Bath in accounting is an earnings management technique whereby a onetime charge is taken against income in order to reduce assets, which results in lower expenses in the future. The write-off removes or reduces the asset from the financial books and results in lower net income for that year. The objective is to take one big bath in a single year so future years will show increased net income. Cookie jar accounting or cookie jar reserves: Is an accounting practice in which a company uses generous reserves from good years against losses that might be incurred in bad years. Market value The market capitalization represents the public consensus on the value of the equity of the company. Market capitalization is calculated by multiplying a company's shares outstanding by the current market price of a share. Earnings per share EPS represents the portion of a company's profit allocated to each outstanding shareholder.Net, for a quarter, EPS is often overlooked quarter. An important aspect of this calculation is divided by the total number of shares outstanding during the earnings (net income) required to create is the capital. The two companies could produce the same EPS number, but one less capital (investment) and I could do it - would be a more efficient use of capital for the Company to generate income, and all other things being equal, a "good" company will be.

Knowledge capital: An intangible asset shall include the information and skills of their employees, their experience with business processes, teamwork and on-the-job learning. Companies develop knowledge capital by encouraging employees to share information through white papers, seminars and communication from person to person. Knowledge capital is important because it reduces the likelihood that a company has to "reinvent the wheel" each time a process is undertaken in particular because their employees have access to documents that detail the steps and staff who have been active like. EVA: Economic Value Added: The concept of EVA is very important now a day. According to EVA means total equity (shareholders+ debt) has some cost of capital and on that equity net profit amount must be greater than the cost of capital amount then it must have some value in investor, s eye. Otherwise that corporation would be considered riskier because of high cost of capital then earnings because investor wants to see increase in their wealth. EVA can be calculated as EVA = after tax profit (Weighted average cost of capital*Total Capital) Human Capital: Human capital is one of the critical elements in a corporation success or failure. Today studies shows that investing in human capital rather than purchasing real property gives you benefit more than 30% in the long run. Those organizations get competitive advantage and become the leading organizations in the world whose are people oriented and always in search of competent, reliable and talented employees those can compete in today, s technological and competitive environment. After that organization must give them training about work and about ethical standards and satisfied them that they feel positive and perform well without any greed. Also organization must have a system of rewarded their employees financially and give them recognition based on performance of their work. The value of Cash: Company is always analyzed by it financial performance. Investor will be attracted toward those corporation generated more cash flows because cash flows reflect the actual performance of company in utilization of it, s resources their competency and creditworthiness in the eyes of shareholders, investors and financial institutions as well. So cash has huge value. It also reflects the value of the company and it, s products or services offerings like COCA COLA.

Вам также может понравиться

- Chapter 9 - Responsibility AccountingДокумент44 страницыChapter 9 - Responsibility Accountingsathishiim1985Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Internship Report - SudanДокумент63 страницыInternship Report - Sudanraazoo19Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- 7110 s18 QP 23Документ24 страницы7110 s18 QP 23Shahzaib ShahbazОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Marketing Pro CoirДокумент23 страницыMarketing Pro Coirlamiya laljiОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Ecobank Ghana IPO Prospectus 2006Документ102 страницыEcobank Ghana IPO Prospectus 2006x4pxvyppn6Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- 5 Market Efficiency and InefficiencyДокумент9 страниц5 Market Efficiency and InefficiencyMelciades FilhoОценок пока нет

- Instruments of International Trade PolicyДокумент43 страницыInstruments of International Trade PolicyThe logical humanОценок пока нет

- HRM in Nishat MillsДокумент6 страницHRM in Nishat MillsSabaОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- AD Course Handbook-EngДокумент68 страницAD Course Handbook-EngJohn HambreyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Challenges Faced and Roles Played by Women Entrepreneurs in India EconomyДокумент70 страницChallenges Faced and Roles Played by Women Entrepreneurs in India Economyacademic researchОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

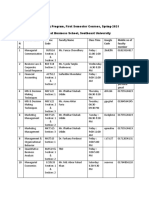

- SL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty MemberДокумент2 страницыSL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty Memberএ.বি.এস. আশিকОценок пока нет

- Nism X A - Investment Adviser Level 1 - Last Day Revision Test 1 PDFДокумент42 страницыNism X A - Investment Adviser Level 1 - Last Day Revision Test 1 PDFavik bose25% (4)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Cashbacks and Discounts Treatment Under AS and Ind AS by CA Ramakant MishraДокумент3 страницыCashbacks and Discounts Treatment Under AS and Ind AS by CA Ramakant MishracamanojraneОценок пока нет

- Offer Letter For Marketing ExecutivesДокумент2 страницыOffer Letter For Marketing ExecutivesRahul SinghОценок пока нет

- IQ&a - SAP MM Book by Mukesh ShuklaДокумент4 страницыIQ&a - SAP MM Book by Mukesh ShuklarajivkshriОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- PTI Energy PolicyДокумент52 страницыPTI Energy PolicyPTI Official100% (9)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- DPM 4106 WK 8 Contemporary Approach To SM Total Quality ManagementДокумент12 страницDPM 4106 WK 8 Contemporary Approach To SM Total Quality ManagementSeanОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- IAS 16 Property Plant and EquipmentДокумент40 страницIAS 16 Property Plant and EquipmentAram NawaisehОценок пока нет

- SM ch04Документ54 страницыSM ch04Rendy Kurniawan100% (1)

- Current Sanitation Practices in The Philippines (Final)Документ7 страницCurrent Sanitation Practices in The Philippines (Final)Mara Benzon-BarrientosОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Modern Global EconomyДокумент10 страницThe Modern Global EconomyLinh HoangОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- Chapter 1. The Role of Business in Social and Economic DevelopmentДокумент4 страницыChapter 1. The Role of Business in Social and Economic DevelopmentArk KnightОценок пока нет

- Financial Analysis of Krishna Maruti LTDДокумент7 страницFinancial Analysis of Krishna Maruti LTDAnsh SardanaОценок пока нет

- BE Operation Question and AnswerДокумент5 страницBE Operation Question and AnswerJhanella Faith FagarОценок пока нет

- BUSI8141-Strategic Leadership Course Outline PDFДокумент4 страницыBUSI8141-Strategic Leadership Course Outline PDFlak gallageОценок пока нет

- Chapter 3Документ12 страницChapter 3mohammed alqurashiОценок пока нет

- Logistics Management PJT GLS VS VRJДокумент20 страницLogistics Management PJT GLS VS VRJSHABNAMH HASANОценок пока нет

- Self Balancing LedgersДокумент7 страницSelf Balancing LedgersPrakash PuniyaОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Oxford Closes $200,000 Private PlacementДокумент2 страницыOxford Closes $200,000 Private PlacementPR.comОценок пока нет

- International Payment Methods Clean Payments Advance Payment Open Account Payment Collection of Bills in InternaДокумент2 страницыInternational Payment Methods Clean Payments Advance Payment Open Account Payment Collection of Bills in InternaPankaj SinghОценок пока нет