Академический Документы

Профессиональный Документы

Культура Документы

Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012

Загружено:

cutiepattotieИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Basic Finance Eliza Mari L. Cabardo Ms. Alfe Solina BSHRM - 3A 07 Sept. 2012

Загружено:

cutiepattotieАвторское право:

Доступные форматы

BASIC FINANCE Eliza Mari L. Cabardo BSHRM 3A ooooooooooMs. Alfe Solina 07 Sept.

2012

1. What is Equity investment? Money that is invested in a firm by its owner(s) or holder(s) of common stock (ordinary shares) but which is not returned in the normal course of the business. Investors recover it only when they sell their shareholdings to other investors, or when the assets of the firm are liquidated and proceeds distributed among them after satisfying the firm's obligations. Also called equity contribution An equity investment generally refers to the buying and holding of shares of stock on a stock market by individuals and firms in anticipation of income from dividends and capital gains, as the value of the stock rises. Typically equity holders receive voting rights, meaning that they can vote on candidates for the board of directors (shown on a proxy statement received by the investor) as well as certain major transactions, and residual rights, meaning that they share the company's profits, as well as recover some of the company's assets in the event that it folds, although they generally have the lowest priority in recovering their investment. It may also refer to the acquisition of equity (ownership) participation in a private (unlisted) company or a startup company. When the investment is in infant companies, it is referred to asventure capital investing and is generally regarded as a higher risk than investment in listed going-concern situations. The equities held by private individuals are often held as mutual funds or as other forms of collective investment scheme, many of which have quoted prices that are listed in financial newspapers or magazines; the mutual funds are typically managed by prominent fund management firms, such as Schroders, Fidelity Investments or The Vanguard Group. Such holdings allow individual investors to obtain the diversification of the fund(s) and to obtain the skill of the professionalfund managers in charge of the fund(s). An alternative, which is usually employed by large private investors and pension funds, is to hold shares directly; in the institutional environment many clients who own portfolios have what are called segregated funds, as opposed to or in addition to the pooled mutual fund alternatives. A calculation can be made to assess whether an equity is over or underpriced, compared with a long-term government bond. This is called the Yield Gap or Yield Ratio. It is the ratio of the dividend yield of an equity and that of the long-term bond.

2. What Are the Benefits of Stock Investing for the Individual Investor? BENEFITS of Stock Investing for the Individual Investor:

Answer: Stock investing is a very good way to take advantage of a growing economy and protect your investments from a declining economy. By following economic indicators, you will know when the economy is growing and when it is declining. You can gradually adjust your investment portfolio, adding more stocks in growth sectors (for example, housing, consumer products, and small businesses) as the economy starts to improve. When the economy starts to decline, that would be a good time to sell some of the growth sector stocks, and possibly purchase bonds or stocks in large corporations. ****Investing in the stock market provides many benefits to individual investors. While this list is by no means exhaustive, we will be discussing the following benefits: Compound Interest Compound Interest is a miracle of the financial world. Compound interest, when given time, helps your money grow faster and faster. Time Value of Money The Time Value of Money is a simple concept. Basically, it means that the more time you give your money to work for you, the more your money will make for you. Tax Deferral Tax Deferral is the greatest investing benefit the U.S. government has given to individual investors. The ability to delay paying taxes on your money can virtually double your investment power. Diversification Diversification enables you to spread out your risk so you dont have to put all of your hopes and dreams behind the success of a single investment. Advantage of Stock Investment:

In terms of an asset class, stocks are very challenging to beat. After a while, they have higher returns as compared to bonds or investing in real estate. However, there are some logical reasons behind the fact that stocks are such a great asset class. The stock market and the related bonds, mutual funds and other financial tools are one of the most accepted options for investing and counting profit, in that way. You can, in fact, save a lot through such investments in the stock market.

If you possess a stock for more than a year, your gains (when you prefer to sell your stocks) are taxed at long-standing capital gains rate of 15%, as a replacement for your standard tax rate. The money you gain from interest in a savings account or CD is taxed at your normal tax rate, which can be as high as 35%. Your investment in the right stocks and bonds can protect your financial future to a great extent. Ensure that you have got the right assortment of stocks and bonds, which can provide credibility to your portfolio during a market fall. You should still obtain a large piece of the growth stocks without as much instability. One of the essential criteria to do well in the stock market is to realize the concepts and the market condition in details. There is no other healthier method to bring back. You may trust over some professional experts dealing in stocks or some stock market analysts or consultants, but it is constantly helpful and sensible that you proof yourself a skilled stock broker. In case anyone attempts to trick you out of a deal, your sheer understanding will naturally give you a warning signal. On the other hand, it is not necessary to know everything about stock market so as to start investing. You can harvest gains and provoke good returns even if you have an inadequate initiative concerning to this subject. There are stock professionals who are ready to help you out in this field in return for a particular compensation. Prior to you investment, it is crucial that you make a comprehensive analysis of the market condition and the estimates of a variety of industries including different companies. You must take into account the range of risk factors involved such as credit risk, market risk, inflation risk, liquidity risk, and etc. Obviously, everybody desires to reduce the degree of risk involved. A successful and efficient method of doing so is to regard the option for hedging. It is considered to be the comprehensive process of analyzing and determining the fundamental steps to be taken on a single stock. This type of measure will certainly help you in neutralizing the risk to a feasible extent.

RISK Of stock investment:

Investing in stocks can offer financial rewards, but it also provides an element of risk, even when investing in well-known companies. In general, the higher level of risk you are willing to take, the greater the potential reward and the larger the possible loss. Protecting your financial resources requires responsible investing, which includes being an educated investor and investing based on your personal risk tolerance. Market Risk Financial markets rise and fall based on economic conditions, inflationary pressures, world news and business-specific reports. While trends may be detected over time, it can be difficult to predict the direction the market and individual stocks may head. This variability puts your stock investments at risk of losing value. The value of your stocks may go lower than what you initially paid for them, causing you to lose money when you sell the securities. Reviewing a companys fundamental cash flow and u sing risk measurement tools, such as a stocks beta value, may help minimize your stock -specific risk. Inflation Risk The cost of goods and services tends to rise over time because of inflation. If you invest in stocks that grow slowly or decrease in price, you risk the value of your investment not keeping pace with general market inflation. These no- or low-growth stocks can cause your money to have less purchasing power than when you first made your stock investment. Tracking stock performance and historical trends for a stock may help lower your inflation risk by pinpointing growth stocks that perform above the average rise in inflation. Liquidity Risk You many need cash to make a large purchase, such as a house, or to make other investments. If you place your savings into stocks, you run the risk of not being able to sell the securities easily when you need to convert them to cash. If you invest in stocks with a large market cap that is heavily traded daily, your liquidity risk is lower, but you may lose money if the stock has not risen in value since your purchase. Broker Risk Trading stocks through a broker adds another layer of investing risk. A solid broker will provide research and stock analysis that you may not have the time or resources to conduct yourself. This research may allow you to make more educated investment decisions. Relying on the advice of others for investments is always a risk, as you may not know their motives. Some brokers may push specific stocks and investments based on their potential reward or companys directives without regard to your specific financial objectives. Deception and theft are also possibilities, but reviewing the broker and firms licensing and registrat ion information as well as the firms complaint record can help you minimize broker-related issues.

3. What are the types and classes of the stocks? There are two main types of stocks: common stock and preferred stock

Common stock is, well, common. When people talk about stocks they are usually referring to this type. In fact, the majority of stock is issued is in this form. We basically went over features of common stock in the last section. Common shares represent ownership in a company and a claim (dividends) on a portion of profits. Investors get one vote per share to elect the board members, who oversee the major decisions made by management. For most companies, this is the only kind of stock available. And the common rule is one share equals one vote. Depending on the company, there may or may not be a dividend. Over the long term, common stock, by means of capital growth, yields higher returns than almost every other investment. This higher return comes at a cost since common stocks entail the most risk. If a company goes bankrupt and liquidates, the common shareholders will not receive money until the creditors, bondholders and preferred shareholders are paid. Preferred stock represents some degree of ownership in a company but usually doesn't come with the same voting rights. (This may vary depending on the company.) With preferred shares, investors are usually guaranteed a fixed dividend forever. This is different than common stock, which has variable dividends that are never guaranteed. Another advantage is that in the event of liquidation, preferred shareholders are paid off before the common shareholder (but still after debt holders). Preferred stock may also be callable, meaning that the company has the option to purchase the shares from shareholders at anytime for any reason (usually for a premium). The only thing certain about preferred shares is that you will get a regular dividend. Other than that, Preferred Stock tends to vary from one company to another. Some include a vote, and others do not. Some will be callable after a given date, others aren't. If they are callable, it means that after the call date passes, they can redeem your preferred shares any time they want, whether you like it or not. The one constant that you can count on, is that all Preferred Shares have a fixed dividend that must be paid on a regular basis. With non-preferred shares dividends are optional. Because the dividend rates of Preferred stocks are fixed, and payout is mandatory, they often behave like mini-bonds and frequently respond more to changes in the interest rate than to events affecting the company. Another difference is that normally, Preferred Shareholders are paid ahead of the other shareholders in the event the company is liquidated. Some people consider preferred stock to be more like debt than equity. A good way to think of these kinds of shares is to see them as being in between bonds and common shares. Stock Classes Although common stock usually entitles you to one vote for every share that you own, this is not always the case. Some companies have different "classes" of common stock that vary based on how many votes are attached to them. So, for example, one share of Class A stock in a certain company might give you 10 votes per share, while one share of Class B stock in the same company might only give you one vote per share. And sometimes it is the case that a certain class of common stock will have no voting rights attached to it at all. So why would some companies choose to do this? Because it's an easy way for the primary owners of the company (e.g. the founders) to retain a great deal of control over the business. The company will typically issue the class of shares with the fewest number of votes attached to it to the public, while reserving the class with the largest number of votes for the owners. Of course, this isn't always the best arrangement for the common shareholder, so if voting rights are important to you, you should probably think carefully before buying stock that is split into different classes. 4. What is portfolio Diversification?

is the act of, or the result of, achieving variety. In finance and investment planning, diversification is a portfolio strategy combining a variety of assets to reduce the overall risk of an investment portfolio. In finance, diversification means reducing risk by investing in a variety of assets. If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of its constituents.[1] Therefore, any risk-averse investor will diversify to at least some extent, with more riskaverse investors diversifying more completely than less risk-averse investors. Diversification is one of two general techniques for reducing investment risk. The other is hedging. Diversification relies on the lack of a tight positive relationship among the assets' returns, and works even when correlations are near zero or somewhat positive. Hedging relies on negative correlation among assets, or shorting assets with positive correlation.

Purpose of Portfolio Diversification The purpose of portfolio diversification is portfolio risk management and optimization. A risk management plan should include diversification rules that are strictly followed. Optimization occurs because risk is minimized, allowing the portfolio manager to seek out higher returns. Your risk management plan should lower the volatility (risk) of a portfolio because not all asset categories, industries, or stocks move together. Holding a variety of non-correlated assets can nearly eliminate unsystematic risk. In other words, by owning a large number of investments in different industries and companies, industry and company specific risk is minimized. This decreases the volatility of the portfolio because different assets should be rising and falling at different times; smoothing out the returns of the portfolio as a whole. In addition, diversification of non-correlated assets can reduce losses in bear markets; preserving capital for investment in bull markets.

Вам также может понравиться

- Insurance As An Investment StrategyДокумент33 страницыInsurance As An Investment StrategySimran khandareОценок пока нет

- Introduction to Index Funds and ETF's - Passive Investing for BeginnersОт EverandIntroduction to Index Funds and ETF's - Passive Investing for BeginnersРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Chapter - 1 Introduction 1.1 Meaning of Risk and Return RelationshipДокумент31 страницаChapter - 1 Introduction 1.1 Meaning of Risk and Return RelationshipMamta SolankiОценок пока нет

- Investing for Beginners 2024: How to Achieve Financial Freedom and Grow Your Wealth Through Real Estate, The Stock Market, Cryptocurrency, Index Funds, Rental Property, Options Trading, and More.От EverandInvesting for Beginners 2024: How to Achieve Financial Freedom and Grow Your Wealth Through Real Estate, The Stock Market, Cryptocurrency, Index Funds, Rental Property, Options Trading, and More.Рейтинг: 5 из 5 звезд5/5 (89)

- Senior High School: Business FinanceДокумент9 страницSenior High School: Business Financesheilame nudaloОценок пока нет

- Sip Report On Investment OptionsДокумент17 страницSip Report On Investment OptionsSravani Reddy BodduОценок пока нет

- Investment ExplainДокумент8 страницInvestment ExplainRameezОценок пока нет

- Analysis of Investment DecisionsДокумент55 страницAnalysis of Investment DecisionscityОценок пока нет

- Certain Features Characterize AllДокумент5 страницCertain Features Characterize Allprabin ghimireОценок пока нет

- INVESTMENTДокумент3 страницыINVESTMENTCaroline B CodinoОценок пока нет

- Investment ObjctivДокумент4 страницыInvestment Objctivkaustubh_gamreОценок пока нет

- Welcome To The Mutual Funds Resource CenterДокумент6 страницWelcome To The Mutual Funds Resource CentersivaranjinirathinamОценок пока нет

- A Assignment On Investment AvenueДокумент33 страницыA Assignment On Investment Avenuegyaneshwari14Оценок пока нет

- A Brief of How Mutual Funds WorkДокумент12 страницA Brief of How Mutual Funds WorkAitham Anil KumarОценок пока нет

- How To Begin Investing In The Stock Market: Obtaining Financial FreedomОт EverandHow To Begin Investing In The Stock Market: Obtaining Financial FreedomОценок пока нет

- INVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)От EverandINVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)Оценок пока нет

- Spam Unit 1-5Документ84 страницыSpam Unit 1-5kaipulla1234567Оценок пока нет

- Investing Demystified: A Beginner's Guide to Building Wealth in the Stock MarketОт EverandInvesting Demystified: A Beginner's Guide to Building Wealth in the Stock MarketОценок пока нет

- At A Price Below Your Buying Price: SH Are Various Financial InstrumentsДокумент7 страницAt A Price Below Your Buying Price: SH Are Various Financial InstrumentsrahulsmankameОценок пока нет

- Sequrity Analysis and Portfolio ManagementДокумент55 страницSequrity Analysis and Portfolio ManagementMohit PalОценок пока нет

- Stock Market Simplified: A Beginner's Guide to Investing Stocks, Growing Your Money and Securing Your Financial Future: Personal Finance and Stock Investment StrategiesОт EverandStock Market Simplified: A Beginner's Guide to Investing Stocks, Growing Your Money and Securing Your Financial Future: Personal Finance and Stock Investment StrategiesРейтинг: 5 из 5 звезд5/5 (1)

- International Investment and Portfolio Management: AssignmentДокумент8 страницInternational Investment and Portfolio Management: AssignmentJebin JamesОценок пока нет

- What Is InvestmentsДокумент9 страницWhat Is InvestmentsRidwan RamdassОценок пока нет

- What Are They? How Do They Differ From "Traditional" Investments?Документ3 страницыWhat Are They? How Do They Differ From "Traditional" Investments?api-118535366Оценок пока нет

- Project 3 InvestmentsДокумент23 страницыProject 3 InvestmentsPhương LêОценок пока нет

- Chapter-Ii Review of LiteratureДокумент57 страницChapter-Ii Review of LiteratureRiyaz AliОценок пока нет

- Low Risk InvestmentsДокумент6 страницLow Risk Investmentsmyschool90Оценок пока нет

- Market Secrets: Step-By-Step Guide to Develop Your Financial Freedom - Best Stock Trading Strategies, Complete Explanations, Tips and Finished InstructionsОт EverandMarket Secrets: Step-By-Step Guide to Develop Your Financial Freedom - Best Stock Trading Strategies, Complete Explanations, Tips and Finished InstructionsОценок пока нет

- Things To Consider Before You Make Investing DecisionsДокумент3 страницыThings To Consider Before You Make Investing DecisionsJoel AttariОценок пока нет

- 1.1 Introduction To Investment DecisionsДокумент55 страниц1.1 Introduction To Investment DecisionsPREETОценок пока нет

- Chapter 1Документ13 страницChapter 1shahulsuccessОценок пока нет

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.От EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Оценок пока нет

- The Benefits of Stock Market For InvestorsFLORIBELLE SANCHEZДокумент2 страницыThe Benefits of Stock Market For InvestorsFLORIBELLE SANCHEZRonalie SustuedoОценок пока нет

- Creating and Monitoring A Diversified Stock PortfolioДокумент11 страницCreating and Monitoring A Diversified Stock Portfolioసతీష్ మండవОценок пока нет

- Dividend Investing for Beginners: How to Build Your Investment Strategy, Find The Best Dividend Stocks to Buy, and Generate Passive Income: Investing for Beginners, #1От EverandDividend Investing for Beginners: How to Build Your Investment Strategy, Find The Best Dividend Stocks to Buy, and Generate Passive Income: Investing for Beginners, #1Оценок пока нет

- Investment and Portfolio ManagementДокумент36 страницInvestment and Portfolio ManagementMiguel MartinezОценок пока нет

- Construct Your Own Wealth: A Guide to Making Profit From The Stock MarketОт EverandConstruct Your Own Wealth: A Guide to Making Profit From The Stock MarketОценок пока нет

- Res Mutual-Funds enДокумент13 страницRes Mutual-Funds enghjkl927Оценок пока нет

- Unit 1Документ78 страницUnit 1Himanshi SinghОценок пока нет

- SHORT WRITE ABOUT STOCK SHARE AND RISK Electiva CPCДокумент7 страницSHORT WRITE ABOUT STOCK SHARE AND RISK Electiva CPCyarima paterninaОценок пока нет

- Money Market ConceptsДокумент3 страницыMoney Market ConceptsSubhasish DasОценок пока нет

- IapmДокумент8 страницIapmjohn doeОценок пока нет

- Babasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceДокумент8 страницBabasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceShivani ShuklaОценок пока нет

- Res Mutual-Funds enДокумент13 страницRes Mutual-Funds enRyan ArdyansyahОценок пока нет

- What Is A Mutual Fund?Документ6 страницWhat Is A Mutual Fund?vanajaОценок пока нет

- Don't Invest and Forget: A Look at the Importance of Having a Comprehensive, Dynamic Investment PlanОт EverandDon't Invest and Forget: A Look at the Importance of Having a Comprehensive, Dynamic Investment PlanОценок пока нет

- Stocks and BondsДокумент20 страницStocks and BondsChristian CorchilОценок пока нет

- 2 SampДокумент15 страниц2 SampFATHIMATH THABASSAMAОценок пока нет

- Investing - BVC ArticleДокумент3 страницыInvesting - BVC ArticleayraОценок пока нет

- Investing Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeОт EverandInvesting Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeОценок пока нет

- Ojt - Narrative FormatДокумент1 страницаOjt - Narrative FormatcutiepattotieОценок пока нет

- Culture AntropologyДокумент4 страницыCulture AntropologycutiepattotieОценок пока нет

- Culture AntropologyДокумент4 страницыCulture AntropologycutiepattotieОценок пока нет

- Ojt - Narrative FormatДокумент1 страницаOjt - Narrative FormatcutiepattotieОценок пока нет

- Coco MangoДокумент1 страницаCoco MangocutiepattotieОценок пока нет

- TOURISMДокумент2 страницыTOURISMcutiepattotieОценок пока нет

- VEALДокумент8 страницVEALcutiepattotieОценок пока нет

- "Coco Mango ": IngredientsДокумент5 страниц"Coco Mango ": IngredientscutiepattotieОценок пока нет

- Information Technology ThingДокумент9 страницInformation Technology ThingcutiepattotieОценок пока нет

- Principles of Meet CookeryДокумент19 страницPrinciples of Meet CookerycutiepattotieОценок пока нет

- Egg and BreakfastДокумент25 страницEgg and BreakfastcutiepattotieОценок пока нет

- Republic of The Philippines Cavite State University Imus, CampusДокумент1 страницаRepublic of The Philippines Cavite State University Imus, CampuscutiepattotieОценок пока нет

- Feasibility StudyДокумент5 страницFeasibility Studycutiepattotie50% (4)

- POULTRYДокумент16 страницPOULTRYcutiepattotieОценок пока нет

- Feasibility StudyДокумент5 страницFeasibility Studycutiepattotie50% (4)

- Feasibility StudyДокумент5 страницFeasibility Studycutiepattotie50% (4)

- Feasibility StudyДокумент5 страницFeasibility Studycutiepattotie50% (4)

- CFA I QBank, Cost of CapitalДокумент15 страницCFA I QBank, Cost of CapitalGasimovskyОценок пока нет

- Brand ConsultationДокумент10 страницBrand Consultationapi-571605038Оценок пока нет

- Organization and Management: Module 4: Quarter 1, Week 3 & 4Документ18 страницOrganization and Management: Module 4: Quarter 1, Week 3 & 4juvelyn luegoОценок пока нет

- Managing Investor Relations: Strategies For Effective CommunicationДокумент7 страницManaging Investor Relations: Strategies For Effective CommunicationBusiness Expert PressОценок пока нет

- Capitalism and Socialism ReportДокумент17 страницCapitalism and Socialism ReportRaisen Esperanza100% (1)

- Philippine Politics MODULE 3Документ26 страницPhilippine Politics MODULE 3jonas arsenue100% (1)

- Analyzing Spa CeylonДокумент7 страницAnalyzing Spa CeylonPra DheenaОценок пока нет

- ExpiringMonthly - Trading With or Against The Skew 0410Документ4 страницыExpiringMonthly - Trading With or Against The Skew 0410Samoila RemusОценок пока нет

- Neighborhood Laundry Marketing Plan (SWOT ANAYLYSIS)Документ2 страницыNeighborhood Laundry Marketing Plan (SWOT ANAYLYSIS)Den Mark Pallogan SilawonОценок пока нет

- Hiba Ben HassanaДокумент16 страницHiba Ben HassanaHiba Ben HОценок пока нет

- FM Sheet 4 (JUHI RAJWANI)Документ8 страницFM Sheet 4 (JUHI RAJWANI)Mukesh SinghОценок пока нет

- Financial Markets and InstitutionsДокумент5 страницFinancial Markets and InstitutionsEng Abdikarim WalhadОценок пока нет

- Chapter 12-The Cost of Capital: Multiple ChoiceДокумент27 страницChapter 12-The Cost of Capital: Multiple ChoiceJean CabigaoОценок пока нет

- Practitioner Guide To Forex Market-Part 1Документ10 страницPractitioner Guide To Forex Market-Part 1acreddiОценок пока нет

- Advertising & Sales PromotionДокумент75 страницAdvertising & Sales Promotionalkanm750100% (1)

- Unit I-Mefa Final NotesДокумент24 страницыUnit I-Mefa Final NotesMuskan TambiОценок пока нет

- Depository SystemДокумент36 страницDepository SystemRabia PearlОценок пока нет

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsДокумент18 страницFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsHamis Rabiam MagundaОценок пока нет

- Chapter No.3 Research Methodology 3.1 IntroductionДокумент15 страницChapter No.3 Research Methodology 3.1 Introductionpooja shandilyaОценок пока нет

- Convetibility of Indian RupeeДокумент2 страницыConvetibility of Indian RupeeAmanSharmaОценок пока нет

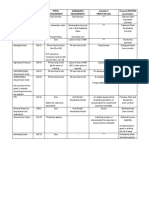

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationДокумент3 страницыAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezОценок пока нет

- Project of MtsДокумент30 страницProject of MtsviveshuklaОценок пока нет

- Secondary Market by Prajwal LoniДокумент26 страницSecondary Market by Prajwal LoniPrajwalloni LoniОценок пока нет

- Unit 7 Student Book Outcome LOAДокумент33 страницыUnit 7 Student Book Outcome LOAnoora alsuwaidiОценок пока нет

- Reading-Product Standardization or AdaptationДокумент20 страницReading-Product Standardization or AdaptationfarbwnОценок пока нет

- Case Study ExampleДокумент6 страницCase Study ExampleNurhafizah RamliОценок пока нет

- Branding: Prepared By: Ben Abdeslam Souhaib BZIOUI DrissДокумент9 страницBranding: Prepared By: Ben Abdeslam Souhaib BZIOUI DrissManal ElОценок пока нет

- Amazon Goes Global 2020 - Case StudyДокумент13 страницAmazon Goes Global 2020 - Case Studyagarwalharshini17Оценок пока нет

- Marketing PlanДокумент21 страницаMarketing PlanKathleen Kaye CastilloОценок пока нет

- A Report On Structures of GlobalizationДокумент6 страницA Report On Structures of GlobalizationMeg Guarin100% (1)