Академический Документы

Профессиональный Документы

Культура Документы

Banking Notes

Загружено:

Priyanka SharmaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Banking Notes

Загружено:

Priyanka SharmaАвторское право:

Доступные форматы

BANKING NOTES

Functions of Commercial Banks

a) Short-term loan: These loans may be given as personal loans, loans to finance working

capital or as priority sector advances. These are made against some security and entire loan amount is transferred to the loan account of the borrower.

3. Over-Draft

Banks advance loans to its customers upto a certain amount through over -drafts, if there are no deposits in the current account. For this banks demand a security from the customers and charge very high rate of interest.

4. Discounting of Bills of Exchange

This is the most prevalent and important method of advancing loans to the traders for shortterm purposes. Under this system, banks advance loans to the traders and business firms by discounting their bills. In this way, businessmen get loans on the basis of their bills of exchange before the time of their maturity.

5. Investment of Funds

The banks invest their surplus funds in three types of securitiesGovernment securities, other approved securities and other securities. Government securities include both, central and state governments, such as treasury bills, national savings certificate etc. Other securities include securities of state associated bodies like electricity boards, housing boards, debentures of Land Development Banks units of UTI, shares of Regional Rural banks etc.

6. Agency Functions

Banks function in the form of agents and representatives of their customers. Customers give their consent for performing such functions. The important functions of these types are as follows: a) Banks collect cheques, drafts, bills of exchange and dividends of the shares for their customers. b) Banks make payment for their clients and at times accept the bills of exchange: of their customers for which payment is made at the fixed time.

c) Banks pay insurance premium of their customers. Besides this, they also deposit loan installments, income-tax, interest etc. as per directions. d) Banks purchase and sell securities, shares and debentures on behalf of their customers. e) Banks arrange to send money from one place to another for the convenience of their customers.

7. Miscellaneous Functions

Besides the functions mentioned above, banks perform many other functions of general utility which are as follows: a) Banks make arrangement of lockers for the safe custody of valuable assets of their customers such as gold, silver, legal documents etc. b) Banks give reference for their customers. c) Banks collect necessary and useful statistics relating to trade and industry. d) For facilitating foreign trade, banks undertake to sell and purchase foreign exchange. e) Banks advise their clients relating to investment decisions as specialist f) Bank does the under-writing of shares and debentures also. g) Banks issue letters of credit. h) During natural calamities, banks are highly useful in mobilizing funds and donations. i) Banks provide loans for consumer durables like Car, Air-conditioner, and Fridge etc.

Credit creation

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Ec210b Pub20021241-I PDFДокумент1 046 страницEc210b Pub20021241-I PDFCholif 'oliph' Fadhilah100% (16)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ilmu KhotifДокумент28 страницIlmu KhotifAndré Martins78% (27)

- Advanced Logic Synthesis: Multiple Choice QuestionsДокумент16 страницAdvanced Logic Synthesis: Multiple Choice QuestionsmanojkumarОценок пока нет

- Textbook of Surgery For Dental Students-smile4DrДокумент400 страницTextbook of Surgery For Dental Students-smile4DrRotariu Ana Maria100% (8)

- Pigging Training Course Mod 7 Rev 1Документ26 страницPigging Training Course Mod 7 Rev 1Suparerk Sirivedin100% (1)

- DPWH ReviewerДокумент597 страницDPWH Reviewercharles sedigoОценок пока нет

- English Grammar 2Документ12 страницEnglish Grammar 2Priyanka SharmaОценок пока нет

- Money Market FinalДокумент6 страницMoney Market FinalPriyanka SharmaОценок пока нет

- Capital Market in IndiaДокумент12 страницCapital Market in IndiaPriyanka SharmaОценок пока нет

- Axis BankДокумент10 страницAxis BankPriyanka SharmaОценок пока нет

- Entrepreneurship Training ModelДокумент9 страницEntrepreneurship Training ModelPriyanka SharmaОценок пока нет

- Kala Raksha:: Treasure The Tradition: A Study of The Market of Ethnic Products For Kala RakshaДокумент68 страницKala Raksha:: Treasure The Tradition: A Study of The Market of Ethnic Products For Kala RakshaPriyanka SharmaОценок пока нет

- Submitted To: Hemchanracharya University, PatanДокумент32 страницыSubmitted To: Hemchanracharya University, PatanPriyanka SharmaОценок пока нет

- IFFCOДокумент54 страницыIFFCOPriyanka Sharma67% (3)

- Chap 21 PДокумент0 страницChap 21 PPriyanka SharmaОценок пока нет

- Capital StructureДокумент15 страницCapital StructurePriyanka SharmaОценок пока нет

- IFFCOДокумент69 страницIFFCOPriyanka Sharma50% (2)

- 2006 - Dong Et Al - Bulk and Dispersed Aqueous Phase Behavior of PhytantriolДокумент7 страниц2006 - Dong Et Al - Bulk and Dispersed Aqueous Phase Behavior of PhytantriolHe ZeeОценок пока нет

- The Church of Kapnikarea in Athens - N. GkiolesДокумент13 страницThe Church of Kapnikarea in Athens - N. GkiolesMaronasОценок пока нет

- DRS Rev.0 GTP-TR1!01!002 Condensate RecyclingДокумент4 страницыDRS Rev.0 GTP-TR1!01!002 Condensate RecyclingBalasubramanianОценок пока нет

- Barium Chloride 2h2o LRG MsdsДокумент3 страницыBarium Chloride 2h2o LRG MsdsAnas GiselОценок пока нет

- Power - Distribution Transformers @2020V2Документ34 страницыPower - Distribution Transformers @2020V2Musfiqul AzadОценок пока нет

- Anish Pandey ResumeДокумент4 страницыAnish Pandey ResumeAnubhav ChaturvediОценок пока нет

- The Practice of Veterinary Anesthesia - Small Animals, Birds, Fish, and ReptilesДокумент382 страницыThe Practice of Veterinary Anesthesia - Small Animals, Birds, Fish, and ReptilesMárcio MoreiraОценок пока нет

- 5 - Oral Mucosa and Salivary Glands (Mahmoud Bakr)Документ115 страниц5 - Oral Mucosa and Salivary Glands (Mahmoud Bakr)MobarobberОценок пока нет

- Biology Unit 4Документ44 страницыBiology Unit 4Mohammad KhanОценок пока нет

- Environmental and Sustainability Issues - 1Документ21 страницаEnvironmental and Sustainability Issues - 121. PLT PAGALILAUAN, EDITHA MОценок пока нет

- API 571 Quick ReviewДокумент32 страницыAPI 571 Quick ReviewMahmoud Hagag100% (1)

- Electro-Mechanical SectorДокумент22 страницыElectro-Mechanical SectorKen LeeОценок пока нет

- Soal Test All GrammarДокумент2 страницыSoal Test All GrammarAnonymous D7lnJMJYОценок пока нет

- History of Costa RicaДокумент2 страницыHistory of Costa Ricakrishnan MishraОценок пока нет

- Black Mamba Vs Mongoose Vs King Cobra Vs Komodo Vs PhythonДокумент44 страницыBlack Mamba Vs Mongoose Vs King Cobra Vs Komodo Vs PhythonmarcОценок пока нет

- Ingles y Español Unidad 7Документ9 страницIngles y Español Unidad 7Pier Jhoani Ñañez LlanosОценок пока нет

- Gastritis: Department of Gastroenterology General Hospital of Ningxia Medical University Si Cen MDДокумент82 страницыGastritis: Department of Gastroenterology General Hospital of Ningxia Medical University Si Cen MDAvi Themessy100% (1)

- Manual Elspec SPG 4420Документ303 страницыManual Elspec SPG 4420Bairon Alvira ManiosОценок пока нет

- Donali Lalich Literature ReviewДокумент4 страницыDonali Lalich Literature Reviewapi-519746057Оценок пока нет

- Department of Mechanical EnginneringДокумент11 страницDepartment of Mechanical EnginneringViraj SukaleОценок пока нет

- 1753-Article Text-39640-3-10-20220815Документ9 страниц1753-Article Text-39640-3-10-20220815Inah SaritaОценок пока нет

- Backlash SDPДокумент11 страницBacklash SDPPatrick Cyr GagnéОценок пока нет

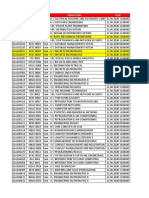

- Staff Code Subject Code Subject Data FromДокумент36 страницStaff Code Subject Code Subject Data FromPooja PathakОценок пока нет

- BIOC32 Practice QuestionsДокумент7 страницBIOC32 Practice QuestionsLydia DuncanОценок пока нет