Академический Документы

Профессиональный Документы

Культура Документы

The Government:Budget and Economy: Basis Revenue Expenditure Capital Expenditure

Загружено:

samgeorgemaxИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Government:Budget and Economy: Basis Revenue Expenditure Capital Expenditure

Загружено:

samgeorgemaxАвторское право:

Доступные форматы

THE GOVERNMENT:BUDGET AND ECONOMY

Question 1: Explain why public goods must be provided by the government. Answer : A good that is non-rival and non-excludable is referred to as public good. Non-rival means that consumption by one individual does not affect the consumption of another individual. Whereas, nonexcludable implies that no individual can be excluded from using the good. For example, parks, roads, national defence, etc. These goods must be provided by the government because of the following reasons: 1. The benefits of public goods can be easily enjoyed by anyone without affecting the consumption of other individuals. There arises market failure. 2. No individual can be excluded from using public goods as it is available to all. The link between the producer and the consumer becomes non-functional, necessitating government interference through public provisions.

Question 2: Distinguish between revenue expenditure and capital expenditure. Answer : Basis Creation of Assets Reduction of Liability Items Revenue expenditure It does not create assets for the government. These expenditures do not result in the reduction of liability. (a) Aids given to states and others (b) Interest payments (c) Expenditure on defence Capital expenditure It results in the creation of assets.

These expenditures cause a reduction of the liability of the government. (a) Purchase of shares (b) Expenditure on land, building, etc. (c) Grants by the central government to the state government

Question 3: The fiscal deficit gives the borrowing requirement of the government. Elucidate. Answer : Fiscal deficit is the excess of total expenditure over total receipts. That is, when total government expenditure is greater that total government receipts, the government faces fiscal deficit. Fiscal deficit is estimated as: Total Expenditure (revenue + capital) Total Receipts (excluding borrowings).

Fiscal deficit gives an indication to the government about the total borrowing requirements from all sources. Fiscal deficit can be financed through domestic borrowings and/or borrowings from abroad. Greater fiscal deficit implies greater borrowings by the government. Question 4: Give the relationship between the revenue deficit and the fiscal deficit. Answer : The relationship between the revenue deficit and the fiscal deficit can be explained through the following points: 1. Revenue deficit is the difference between governments revenue expenditures and governments receipts. Revenue deficit = Revenue expenditures Revenue receipts On the other hand, fiscal deficit is the difference between the total expenditure and the total receipt of the government. Fiscal deficit = Total Expenditure Total Receipts (excluding borrowings) 2. The term fiscal deficit is used in a broader sense than the term revenue deficit. 3. As revenue deficit increases, the proportion of fiscal deficit also increases. Question 11: Explain the relation between government deficit and government debt. Answer : The relation between government deficit and government debt can be explained through the following points. 1. Government deficit is the excess of total expenditure over total receipt of the government; whereas, government debt is the amount of liability, owed by the government to the public, foreign and other institutions. 2. The term government deficit implies increase in the debt of the government. In other words, if the government continues to borrow to finance deficit, it leads to additional debt. Question 12: Does public debt impose a burden? Explain. Answer : Government debt or public debt refers to the amount or money that a central government owes. This amount may be borrowings of the government from banks, public financial institutions and from other external and internal sources. Public debt definitely imposes a burden on the economy as a whole, which is described through the following points. 1. Adverse effect on productivity and investment

A government may impose taxes or get money printed to repay the debt. This however reduces the peoples ability to work, save and invest, thus hampering the development of a country. 2. Burden on younger generations The government transfers the burden of reduced consumption on future generations. Higher government borrowings in the present leads to higher taxes levied in future in order to repay the past obligations. The government imposes taxes on the younger generations, lowering their consumption, savings and investments. Hence, higher public debt has negative effect on the welfare of the younger generations. 3. Lowers the private investment The government attracts more investment by raising rates of interests on bonds and securities. As a result, a major part of savings of citizens goes in the hands of the government, thus crowding out private investments. 4. Leads to the drain of National wealth The wealth of the country is drained out at the time of repaying loans taken from foreign countries and institutions. Question 13: Are fiscal deficits inflationary? Answer : Fiscal deficits are not necessarily inflationary; though, they are generally regarded as inflationary. When the government expenditure increases and tax reduces, there is a government deficit and there will be a corresponding increase in the aggregate demand. However, the firms might not be able to meet the growing demands, forcing the price to rise. Hence fiscal deficits are inflationary in this sense. But on the other hand, initially if the resources are underutilised (due to insufficient demand) and output is below full employment level, then with the increase in government expenditure, more factor resources will be employed to cater to the increasing demand without exerting much pressure on price to rise. In this situation, a high fiscal deficit is accompanied by high demand, greater output level and lesser inflationary situation. Hence, whether the fiscal deficits are inflationary or not depends on how close is the original output level to the full employment level Question 14: Discuss the issue of deficit reduction. Answer : The ways of government budget deficit reduction are the following: (i) Decreasing expenditure (ii) Increasing revenue (i) Decreasing expenditure

a) The expenditure of government should be decreased by making government activities more planned and effective. b) The government can encourage private sector to undertake capital projects. (ii) Increasing revenue a) Higher taxes imply higher income earned by the government. Also, new taxes may add to the revenues of the government. b) The government can sell shares of Public Sector Undertakings (PSU disinvestment) to increase its revenue.

Вам также может понравиться

- What Is A Budget DeficitДокумент5 страницWhat Is A Budget DeficitMass GaneshОценок пока нет

- Government BudgetДокумент3 страницыGovernment BudgetNiyati NarulaОценок пока нет

- Sessions 01 Introduction Public FinanceДокумент12 страницSessions 01 Introduction Public Financeskn092Оценок пока нет

- Questions: Answer: Options Are To Reduce Government Spending, Increase Taxes, or SomeДокумент5 страницQuestions: Answer: Options Are To Reduce Government Spending, Increase Taxes, or Somecourse101Оценок пока нет

- Definition of Crowding OutДокумент7 страницDefinition of Crowding OuttawandaОценок пока нет

- Sessions 01 Introduction Public FinanceДокумент12 страницSessions 01 Introduction Public Financerohanfyaz000% (1)

- Government Budget Notes (CBSE) PDFДокумент10 страницGovernment Budget Notes (CBSE) PDFHarshit AgarwalОценок пока нет

- Economics Concept Series - Test 02 (Solutions)Документ10 страницEconomics Concept Series - Test 02 (Solutions)Vivek JhaОценок пока нет

- Public Finance Assignment - WPSДокумент6 страницPublic Finance Assignment - WPSzambogo7Оценок пока нет

- Economic Effects of A Budget DeficitДокумент20 страницEconomic Effects of A Budget DeficitKalu AbuОценок пока нет

- Tutorial Question Practice Section 1 and 2Документ8 страницTutorial Question Practice Section 1 and 2Jennifer YoshuaraОценок пока нет

- B. Tech Cs Vi Semester (Section - C) Eco307 Fundamentals of Economics Assignment - 1Документ6 страницB. Tech Cs Vi Semester (Section - C) Eco307 Fundamentals of Economics Assignment - 1Vartika AgrawalОценок пока нет

- DebtsДокумент14 страницDebtsMohamed AzmyОценок пока нет

- Problem of Internal Debt and External DebtДокумент6 страницProblem of Internal Debt and External DebtFAISAL KHANОценок пока нет

- Public Debt in IndiaДокумент4 страницыPublic Debt in IndiaAashna DОценок пока нет

- Intro Fiscal Policy o-WPS OfficeДокумент7 страницIntro Fiscal Policy o-WPS OfficeJohn NjorogeОценок пока нет

- Economics Handout Public Debt: The Debt Stock Net Budget DeficitДокумент6 страницEconomics Handout Public Debt: The Debt Stock Net Budget DeficitOnella GrantОценок пока нет

- 18e Key Question Answers CH 30Документ3 страницы18e Key Question Answers CH 30pikachu_latias_latiosОценок пока нет

- Crowding Out EffectsДокумент1 страницаCrowding Out EffectsnisaОценок пока нет

- Meaning:: Public Debt: Meaning, Objectives and Problems!Документ5 страницMeaning:: Public Debt: Meaning, Objectives and Problems!document singhОценок пока нет

- Govt Budget Solution 2Документ7 страницGovt Budget Solution 2AvcelОценок пока нет

- Budget Ch04 NewДокумент17 страницBudget Ch04 NewJoe OgleОценок пока нет

- Course No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Документ22 страницыCourse No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Shariful Islam JoyОценок пока нет

- Easy Economics For Class XII - Government Budget and EconomyДокумент5 страницEasy Economics For Class XII - Government Budget and Economypkpal1Оценок пока нет

- Government BudgetДокумент2 страницыGovernment BudgetParth NataniОценок пока нет

- TessДокумент3 страницыTessAsan Godwin JnrОценок пока нет

- Lesson 05 - Fiscal Policy and StabilizationДокумент48 страницLesson 05 - Fiscal Policy and StabilizationMetoo ChyОценок пока нет

- MacroДокумент11 страницMacroAditya RajОценок пока нет

- Case Study - JunayedДокумент2 страницыCase Study - JunayedgurujeeОценок пока нет

- 3 Types of Budget Deficits and Their Measures - Micro EconomicsДокумент8 страниц3 Types of Budget Deficits and Their Measures - Micro EconomicsSatish KuganОценок пока нет

- What Is Crowding Out Effect How Does It Affect EconomiesДокумент3 страницыWhat Is Crowding Out Effect How Does It Affect EconomiesAjinath DahiphaleОценок пока нет

- Some Important TopicsДокумент5 страницSome Important TopicsStuti DeopaОценок пока нет

- Fiscal SystemДокумент8 страницFiscal SystemCodMwОценок пока нет

- Principles of Macro EconomicsДокумент2 страницыPrinciples of Macro Economicshassaanyousaf014Оценок пока нет

- Economics TermsДокумент11 страницEconomics TermsAhmad Zia JamiliОценок пока нет

- CHAPTER I - Introduction-to-Public-FinanceДокумент12 страницCHAPTER I - Introduction-to-Public-FinanceMaricel GoОценок пока нет

- Topic 1-Meaning and Nature of Public FinanceДокумент12 страницTopic 1-Meaning and Nature of Public FinanceNiphaОценок пока нет

- John Leur C. Virtucio Written ReportДокумент12 страницJohn Leur C. Virtucio Written ReportLeMignonD.RoxasОценок пока нет

- Fiscal Policy WrittenДокумент4 страницыFiscal Policy WrittenKenneth Rae QuirimoОценок пока нет

- Two Aspects of Deficit FinancingДокумент5 страницTwo Aspects of Deficit FinancingQamar AliОценок пока нет

- Fiscal Policy Notes ECON UNIT 2 CAPEДокумент7 страницFiscal Policy Notes ECON UNIT 2 CAPErobert903Оценок пока нет

- Name-Shyam A Pithadia ROLL NO-081 Div-B Sub-F.C Topic-Public FinanceДокумент18 страницName-Shyam A Pithadia ROLL NO-081 Div-B Sub-F.C Topic-Public FinanceDevil KongОценок пока нет

- Effects of Public BorrowingДокумент2 страницыEffects of Public BorrowingPhanHiềnLươngОценок пока нет

- Public Finance and Taxation Chapter 1 & 2Документ31 страницаPublic Finance and Taxation Chapter 1 & 2adisesegedeОценок пока нет

- Fiscal Policy 2019Документ23 страницыFiscal Policy 2019DNLОценок пока нет

- This Chapter For The Course Public Finance Focuses OnДокумент19 страницThis Chapter For The Course Public Finance Focuses OnJamaОценок пока нет

- Types of Finance DeficitДокумент8 страницTypes of Finance DeficitRezel FuntilarОценок пока нет

- UNIT - 4 Handout PurposeДокумент47 страницUNIT - 4 Handout PurposemelaОценок пока нет

- Fiscalpolics : Tax, On National ProductionДокумент5 страницFiscalpolics : Tax, On National ProductionAnkitОценок пока нет

- Wagners Hypothesis With Public ExpendituresДокумент3 страницыWagners Hypothesis With Public ExpendituresSamad Raza KhanОценок пока нет

- Public DebtДокумент3 страницыPublic DebtMohamed AzmyОценок пока нет

- Do Budget Deficits Cause in Ation?: by Keith SillДокумент8 страницDo Budget Deficits Cause in Ation?: by Keith SillluminaОценок пока нет

- Topic 6 Instruments of Fiscal PolicyДокумент24 страницыTopic 6 Instruments of Fiscal Policyjadyn nicholasОценок пока нет

- Burden of Public DebtДокумент4 страницыBurden of Public DebtAmrit KaurОценок пока нет

- Balanced Budget Eco Cia3Документ18 страницBalanced Budget Eco Cia3SAYANEE MITRA 21214098Оценок пока нет

- Economics Project: Meaning of Revenue DeficitДокумент22 страницыEconomics Project: Meaning of Revenue DeficitAuro BhattacharyaОценок пока нет

- Effect of Public ExpenditureДокумент5 страницEffect of Public ExpenditureSantosh ChhetriОценок пока нет

- BEE (2019-20) Handout 08 (Fiscal Policy)Документ4 страницыBEE (2019-20) Handout 08 (Fiscal Policy)Saurabh SinghОценок пока нет

- CaassfadfadДокумент86 страницCaassfadfadsamgeorgemaxОценок пока нет

- YedooriyadfgДокумент1 страницаYedooriyadfgsamgeorgemaxОценок пока нет

- Feb 20 SdasdadfsadsfДокумент1 страницаFeb 20 SdasdadfsadsfsamgeorgemaxОценок пока нет

- My Heart Will Go OnДокумент1 страницаMy Heart Will Go OnsamgeorgemaxОценок пока нет

- 19 08 2013 785Документ411 страниц19 08 2013 785samgeorgemaxОценок пока нет

- Work MeasurementДокумент7 страницWork MeasurementsamgeorgemaxОценок пока нет

- Gaxa Carlton Wallace Brazil Livermore Zakuani Rankin Gardner Aidan White Leeds United Sinclair For Peterborough Theo RobinsonДокумент1 страницаGaxa Carlton Wallace Brazil Livermore Zakuani Rankin Gardner Aidan White Leeds United Sinclair For Peterborough Theo RobinsonsamgeorgemaxОценок пока нет

- Praise The LordДокумент2 страницыPraise The LordsamgeorgemaxОценок пока нет

- AkДокумент7 страницAkDavid BakcyumОценок пока нет

- Introduction Into Post Go-Live SizingsДокумент26 страницIntroduction Into Post Go-Live SizingsCiao BentosoОценок пока нет

- Customer Satisfaction-ICICI Bank-Priyanka DhamijaДокумент85 страницCustomer Satisfaction-ICICI Bank-Priyanka DhamijaVarun GuptaОценок пока нет

- BPL-DF 2617aedrДокумент3 страницыBPL-DF 2617aedrBiomedical Incharge SRM TrichyОценок пока нет

- YeetДокумент8 страницYeetBeLoopersОценок пока нет

- TT Class XII PDFДокумент96 страницTT Class XII PDFUday Beer100% (2)

- CNG Fabrication Certificate16217Документ1 страницаCNG Fabrication Certificate16217pune2019officeОценок пока нет

- Powerpoint Presentation R.A 7877 - Anti Sexual Harassment ActДокумент14 страницPowerpoint Presentation R.A 7877 - Anti Sexual Harassment ActApple100% (1)

- TQM BisleriДокумент27 страницTQM BisleriDishank ShahОценок пока нет

- Remuneration Is Defined As Payment or Compensation Received For Services or Employment andДокумент3 страницыRemuneration Is Defined As Payment or Compensation Received For Services or Employment andWitty BlinkzОценок пока нет

- tdr100 - DeviceДокумент4 страницыtdr100 - DeviceSrđan PavićОценок пока нет

- Te 1569 Web PDFДокумент272 страницыTe 1569 Web PDFdavid19890109Оценок пока нет

- Shopnil Tower 45KVA EicherДокумент4 страницыShopnil Tower 45KVA EicherBrown builderОценок пока нет

- Design & Construction of New River Bridge On Mula RiverДокумент133 страницыDesign & Construction of New River Bridge On Mula RiverJalal TamboliОценок пока нет

- List of People in Playboy 1953Документ57 страницList of People in Playboy 1953Paulo Prado De Medeiros100% (1)

- Capsule Research ProposalДокумент4 страницыCapsule Research ProposalAilyn Ursal80% (5)

- Principles of SOAДокумент36 страницPrinciples of SOANgoc LeОценок пока нет

- Power For All - Myth or RealityДокумент11 страницPower For All - Myth or RealityAshutosh BhaktaОценок пока нет

- Descriptive Statistics - SPSS Annotated OutputДокумент13 страницDescriptive Statistics - SPSS Annotated OutputLAM NGUYEN VO PHIОценок пока нет

- PanasonicДокумент35 страницPanasonicAsif Shaikh0% (1)

- 1grade 9 Daily Lesson Log For Demo 1 4Документ5 страниц1grade 9 Daily Lesson Log For Demo 1 4cristy olivaОценок пока нет

- Kicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonДокумент8 страницKicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonYudyChenОценок пока нет

- Mobile Based IVR SystemДокумент17 страницMobile Based IVR SystemIndraysh Vijay [EC - 76]Оценок пока нет

- Introduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions ManualДокумент12 страницIntroduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions Manualethelbertsangffz100% (34)

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseДокумент6 страницA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftОценок пока нет

- Hardware Architecture For Nanorobot Application in Cancer TherapyДокумент7 страницHardware Architecture For Nanorobot Application in Cancer TherapyCynthia CarolineОценок пока нет

- Reference: Digital Image Processing Rafael C. Gonzalez Richard E. WoodsДокумент43 страницыReference: Digital Image Processing Rafael C. Gonzalez Richard E. WoodsNisha JosephОценок пока нет

- MCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingДокумент4 страницыMCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingTerry SmithОценок пока нет

- FBW Manual-Jan 2012-Revised and Corrected CS2Документ68 страницFBW Manual-Jan 2012-Revised and Corrected CS2Dinesh CandassamyОценок пока нет

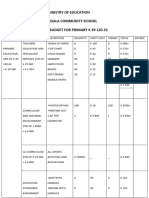

- Ministry of Education Musala SCHДокумент5 страницMinistry of Education Musala SCHlaonimosesОценок пока нет