Академический Документы

Профессиональный Документы

Культура Документы

AFT's 2-Days Workshop - The Wall Street Club BITS Pilani

Загружено:

i_khandelwalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AFT's 2-Days Workshop - The Wall Street Club BITS Pilani

Загружено:

i_khandelwalАвторское право:

Доступные форматы

The Wall Street Club, BITS, Pilani Learning Objectives Delivery Mode Workshop Outline

2-Days Workshop on

Advanced MS-Excel & Financial Modeling

Learning Key Functions & Utilities, Data Analysis Tools in MS-Excel Understanding Financial Statements (Balance Sheet, Income Statement and Cash Flow) Building a Financial model in MS-Excel for evaluation Overview of the Banking & Financial Services Industry and Career Options in Finance MS-Excel based cases & exercises on functional needs Building a Financial Model based on a Case Study

Discussion on a Business Model of a real-life Indian Financial Conglomerate

Session 1: MS-Excel Exploring the MS-Excel screen and effective use of Keyboard Shortcuts Excel Utilities & Tools: Cell Formatting, Custom Formats, Data Protection, Paste Special, Cell & Range Naming, Views (Freeze-Unfreeze, Group-Ungroup, New Window), Formula Checking, Function Keys: F2 (Cell Modes); F4 (Cell Referencing), F5 (Go-To Tool), F9 (Evaluating a Formula) Excel Functions Library: Mathematical (SUMIF(S), SUBTOTAL); Statistical (COUNTIF(S), AVERAGE, MAX, MIN); Logical (IF, Nested IF, AND, OR, Boolean Logic); Date (EDATE, EOMONTH); Financial (PMT, IRR and XIRR, NPV and XNPV); Lookup & Reference (CHOOSE, VLOOKUP / HLOOKUP (Dynamic VLOOKUP) MATCH, INDEX, OFFSET) Array Calculations that allow shorter formulas Data Analysis Tools like Text-to-column; Advanced Filtering, Data Validation; What-If analysis; Goal Seek, Solver utility, Data Tables for sensitivity analysis

Session 2: Corporate Finance Fundamentals Financial Statements Overview: (a) Income Statement (b) Balance Sheet (c) Cash Flow Statement Understanding the Linkage between Financial Statements Ratio Analysis: Profitability, Turnover (Efficiency), Leverage, Return, etc.

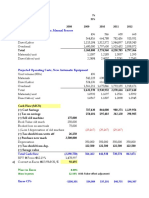

Session 3: Financial Modeling Classroom Exercise Best Practices in Financial Modeling, Preparing Income Statement, Balance Sheet & Cash Flow Statement Calculations such Historical Trends, Depreciation, Working Capital) Calculating Financial Ratios, Balancing the Model, Dealing with Circular References

Session 4: BFSI Industry Overview & Career Options in Finance Understanding the BFSI Industry Structure, i.e. Banks, NBFCs, Insurance, others Discussion on a Business Model / Structure of a real-life Indian Financial Conglomerate: o Investment Banking (including Merchant Banking)

o Institutional Sales / Broking (including Equity Research)

o Retail Broking, Asset Management, Wealth Management

Other Details

Duration: Approx. 12-14 Hour Workshop (over 2 Days) at BITS, Pilani Campus Requirements: Laptops (At least 1 for every 2 participants) to be arranged by the participants Fees: Rs. 750/- per participant

Web: www.ftacademy.in | Email: info@ftacademy.in | Join Us: www.facebook.com/ftacademy.in Phone: +91 98677 51877 or +91 98675 93075

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Coursera Online Course Corporate Finance Essentials Quiz All AnswersДокумент4 страницыCoursera Online Course Corporate Finance Essentials Quiz All AnswersMD GOLAM SARWER100% (5)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Документ4 страницыProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Chapter 13Документ5 страницChapter 13Kirsten FernandoОценок пока нет

- Bank Statment Wells FargoДокумент7 страницBank Statment Wells FargoYu ShilohОценок пока нет

- Solution Manual For Introduction To Corporate Finance 2nd Edition by MegginsonДокумент27 страницSolution Manual For Introduction To Corporate Finance 2nd Edition by Megginsona340726614Оценок пока нет

- The Best Way To Learn Ja... T - Tuts+ Code TutorialДокумент8 страницThe Best Way To Learn Ja... T - Tuts+ Code Tutoriali_khandelwalОценок пока нет

- ACM ICPC World Finals 2017: Solution SketchesДокумент11 страницACM ICPC World Finals 2017: Solution Sketchesi_khandelwalОценок пока нет

- Assignment 1 MarksДокумент2 страницыAssignment 1 Marksi_khandelwalОценок пока нет

- Time Series ClassificationДокумент7 страницTime Series Classificationi_khandelwalОценок пока нет

- Value Points For Women EmpowermentДокумент3 страницыValue Points For Women Empowermenti_khandelwalОценок пока нет

- Computer Mediated Communication AnalysisДокумент20 страницComputer Mediated Communication Analysisi_khandelwal100% (1)

- IIT Delhi Internship - InternshalaДокумент2 страницыIIT Delhi Internship - Internshalai_khandelwalОценок пока нет

- Mid Sem 2012-13Документ2 страницыMid Sem 2012-13i_khandelwalОценок пока нет

- FFT AlgorithmsДокумент9 страницFFT Algorithmsi_khandelwalОценок пока нет

- Introprogramming-Tutorial Sheets-Week 4 Tut 1Документ1 страницаIntroprogramming-Tutorial Sheets-Week 4 Tut 1i_khandelwalОценок пока нет

- Electrical Science: Lecture-5: Topic-Nodal and Mesh AnalysisДокумент13 страницElectrical Science: Lecture-5: Topic-Nodal and Mesh Analysisi_khandelwalОценок пока нет

- Batch List WKND B LotДокумент8 страницBatch List WKND B Loti_khandelwalОценок пока нет

- An Introduction To Websim A Briefing GuideДокумент26 страницAn Introduction To Websim A Briefing Guidei_khandelwalОценок пока нет

- Introprogramming-Tutorial Sheets-Week 4 Tut 2Документ1 страницаIntroprogramming-Tutorial Sheets-Week 4 Tut 2i_khandelwalОценок пока нет

- Stocks 101Документ1 страницаStocks 101i_khandelwalОценок пока нет

- TimeTable PDFДокумент62 страницыTimeTable PDFi_khandelwalОценок пока нет

- Introprogramming-Tutorial Sheets-Week 1 Tut 2Документ1 страницаIntroprogramming-Tutorial Sheets-Week 1 Tut 2i_khandelwalОценок пока нет

- Report WritingДокумент3 страницыReport Writingi_khandelwalОценок пока нет

- Chelsea WolfeДокумент1 страницаChelsea Wolfei_khandelwalОценок пока нет

- Fiitjee Two Year Classroom Program For IIT-JEE 2013 Phase Ii Paper 1 Paper 2 S. NO. Batch Name Enrol. NoДокумент74 страницыFiitjee Two Year Classroom Program For IIT-JEE 2013 Phase Ii Paper 1 Paper 2 S. NO. Batch Name Enrol. Noi_khandelwalОценок пока нет

- Batch - 113 Mark 6 NovДокумент33 страницыBatch - 113 Mark 6 Novi_khandelwalОценок пока нет

- Projectile MotionДокумент38 страницProjectile Motionguptaprabhu75% (12)

- Chapter - 3: Answers To End-Of-Chapter ProblemsДокумент2 страницыChapter - 3: Answers To End-Of-Chapter Problemsi_khandelwalОценок пока нет

- Account Statement: 7045383556 Surat - Katargam AvlonДокумент4 страницыAccount Statement: 7045383556 Surat - Katargam AvlonS'MITH KEVADIYAОценок пока нет

- Sas#10 Acc150Документ4 страницыSas#10 Acc150Mekuh Rouzenne Balisacan PagapongОценок пока нет

- Ap Problems Part 3 Test Bank - CompressДокумент4 страницыAp Problems Part 3 Test Bank - CompressSajj PrrtyОценок пока нет

- Additional Illustrations-5Документ7 страницAdditional Illustrations-5Pritham BajajОценок пока нет

- CH 15Документ24 страницыCH 15sumihosaОценок пока нет

- Victoria Novak Case ScenarioДокумент67 страницVictoria Novak Case ScenarioAstanaОценок пока нет

- Ias 1 SummaryДокумент11 страницIas 1 Summarynur iman qurrataini abdul rahmanОценок пока нет

- Assignment 3 - SolutionsДокумент4 страницыAssignment 3 - SolutionsEsther LiuОценок пока нет

- Parcor For Basic Accountancy - CompressДокумент10 страницParcor For Basic Accountancy - CompressjeramieОценок пока нет

- QNFS31Dec2013 25 2 14 400pm2Документ60 страницQNFS31Dec2013 25 2 14 400pm2AamirKhanОценок пока нет

- Multiple Choice Answers and Solutions: Aquino Locsin David HizonДокумент26 страницMultiple Choice Answers and Solutions: Aquino Locsin David HizonclaudettegasendoОценок пока нет

- The Effects of IFRS Adoption On Taxation in NigeriДокумент15 страницThe Effects of IFRS Adoption On Taxation in NigeriJoseph OlugbamiОценок пока нет

- Financial AccountingДокумент4 страницыFinancial Accountingdarshan patilОценок пока нет

- Capital BudgetingДокумент44 страницыCapital Budgetingrisbd appliancesОценок пока нет

- FA2 Mock Exam 1Документ10 страницFA2 Mock Exam 1smartlearning1977Оценок пока нет

- Irpes Final PMC Pre Bid Minutes of MeetingДокумент13 страницIrpes Final PMC Pre Bid Minutes of MeetingIES-GATEWizОценок пока нет

- Accounting Assignment Document Final DraftДокумент14 страницAccounting Assignment Document Final DraftSarang BatraОценок пока нет

- SAPM Chapter - 19 Bond Portfolio Management StrategiesДокумент10 страницSAPM Chapter - 19 Bond Portfolio Management StrategiesNishant KhandelwalОценок пока нет

- PMT Rate Nper PV FV 0.50% 240 $150,000 0Документ37 страницPMT Rate Nper PV FV 0.50% 240 $150,000 0Pratiksha MisalОценок пока нет

- ICBMFinal Jayantha Dewasiriand ProfДокумент15 страницICBMFinal Jayantha Dewasiriand ProfRobbyShougaraОценок пока нет

- Home Office Books Mandaue Books Date Account Title Debit Credit DateДокумент27 страницHome Office Books Mandaue Books Date Account Title Debit Credit DateVon Andrei MedinaОценок пока нет

- Statement of Cash Flows - OperatingДокумент2 страницыStatement of Cash Flows - OperatingPaula De RuedaОценок пока нет

- NsДокумент2 страницыNsVALEREE ROSE GARCIAОценок пока нет

- Week 4 - ch16Документ52 страницыWeek 4 - ch16bafsvideo4Оценок пока нет

- Presentation On Pre Acquisition and Post Acquisition, Cost of Control and Maturity InterestДокумент7 страницPresentation On Pre Acquisition and Post Acquisition, Cost of Control and Maturity InterestShubham SharmaОценок пока нет