Академический Документы

Профессиональный Документы

Культура Документы

SG - EM Outlook 2014

Загружено:

Ji YanbinИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SG - EM Outlook 2014

Загружено:

Ji YanbinАвторское право:

Доступные форматы

EMERGING MARKETS 28 November 2013

Important Notice: The circumstances in which this publication has been produced are such that it is not appropriate to characterise it as independent investment research as referred to in MiFID and that it should be treated as a marketing communication even if it contains a research recommendation. This publication is also not subject to any prohibition on dealing ahead of the dissemination of investment research. However, SG is required to have policies to manage the conflicts which may arise in the production of its research, including preventing dealing ahead of investment research.

EM Outlook

GEM in 2014: Doom and Bloom

Head of Emerging Markets Strategy Benot Anne (44) 20 7676 7622

benoit.anne@sgcib.com

Many investors talk about EM in terms of doom and gloom for next year. We oppose this view and instead propose our Doom and Bloom. We believe that after a short-livedalbeit potentially severecorrection around the beginning of Fed tapering projected for March, GEM will burgeon forth in a strong spring rally that will extend until later in the year. Part of that will reflect the impact of the considerably more dovish forward guidance that we anticipate from the Fed. But it will also be driven by attractive GEM valuations and improving growth fundamentals. However, GEM investors will have to be more discerning next year, as differentiation between both asset classes and regions will be a major consideration. To help investors differentiate between markets, we produce an analysis of macro vulnerability across EM, as well as an assessment of EM authorities policy room. We also guide EM investors in navigating the heavy political calendar next year.

Rgis Chatellier (44) 20 7676 7354

regis.chatellier@sgcib.com

Phoenix Kalen (44) 20 7676 7305

phoenix.kalen@sgcib.com

Eamon Aghdasi (1) 212 278 7939

eamon.aghdasi@sgcib.com

Downgrading our short-term call: We turn neutral on GEM for the coming weeks. EM growth picking up: EM growth should gather pace early next year, helped by the US

economy driving the global recovery.

Amit Agrawal (91) 80 6758 4096

amit.agrawal@sgcib.com

EM vulnerability ranking: Ukraine, Venezuela and South Africa appear to be the most

vulnerable while China, the Philippines, and Peru are the least.

CONTENTS Doom and Bloom................................... 2 EM Growth Showing Signs of Recovery............................................... 13 Differentiated Vulnerability Risks..........15 The Haves and The Have Nots: An Assessment of Policy Room in EM......18 EM Sovereign Credit: The Pain Before the Gain.......................................................24 How to Trade EM Politics in 2014........28

Policy room in EM: There is significant differentiation across EM in terms of policy room. Peru,

Korea and Chile have the most, while India, the Czech Republic and Venezuela have the least.

EM FX: LatAm will outperform its peers, and EMEA will underperform. Our top picks are the

liquidity currencies from late April onwards, including the IDR, the INR, the ZAR and the MXN.

EM local debt: We favour EMEA debt in the risk-on phase, especially Hungary and Poland. In

LatAm, our top pick is Mexico.

EM credit: The Philippines, Chile, Poland, Colombia and Peru should be fairly resilient against

the downside in Q1; high beta names from EMEA should outperform in the rally.

EM politics: We see a negative balance of risks for policies in Brazil, but a positive one in

Hungary, India and in Indonesia. EM still growing faster than DM in coming years (GDP, %)

8

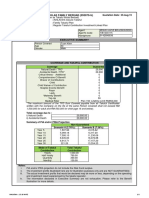

Expected spot returns by region, by quarter

Global EM FX performance, %

3 2

3.8 2.3

6 4 2 0 -2 EM DM

1 0

-1 -2

-3 -4 -5

-6

'00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15

-4

Q4-2013

Q1-2014 EMEA

Q2-2014 LatAm

Q3-2014 Asia

Q4-2014

Source: SG Cross Asset Research/EM

Please see important disclaimer and disclosures at the end of the document

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

GEM in 2014: Doom and Bloom

The global risk backdrop for GEM: a tough start to the year, followed by some major relief

We expect the global risk environment to be challenging for GEM over the next few months, with EM investors remaining concerned about the threat of Fed tapering. SGs official call is for the Feds QE tapering to be initiated in March. Against this backdrop, we choose to turn neutral on GEM from now on up to February. Overall, we have been frustrated by the lack of appetite on the part of EM investors to put cash to work over the past few weeks, and we now think that the chance of a strong rally in December is relatively slim, especially given the seasonality that is turning negative reflecting the year-end portfolio squaring. Moving on to February, the market nervousness will likely intensify as the decision over QE tapering will be looming, ahead of the much-awaited March Fed meeting (19 March). The renewed fear of QE tapering will likely trigger another round of correction in GEM. As highlighted recently, the fear of QE tapering remains the primary risk factor for global emerging market investors. Our informal survey conducted in late October showed that the Fed fear was mentioned as the key reason for the GEMs disappointing performance by 33% of the participants, followed by concerns over EM fundamentals. This overall means that we stand ready to turn outright bearish on GEM by February, expecting local rates to sell off, EM currencies to weaken, local curves to steepen, and credit spreads to widen.

The key reason behind the GEMs disappointing performance what EM investors are saying

35 30 25

20

15 10 5 0 Fed fear fundamentals outflows valuation positioning China seasonality

Notes: based on a survey of 78 accounts. Source: SG Cross Asset Research

At that time, it will make sense to favour defensive EM currencies relative to riskier ones, while favouring rates payers and curve steepeners in EM fixed income. Our carry-to-vol indicator for EM FX gives an excellent overview of which particular currencies produce the strongest defensive characteristics. The TWD, CZK, SGD or ILS are the lowest beta in EM, and are therefore likely to outperform their peers during the sell-off. In contrast, the yield-yielders, especially those that are supported by poor fundamentals, are likely to come under significant pressure. These include the INR, the TRY, the BRL, the ZAR and the HUF. During the phase of correction starting in February, we anticipate that the so-called growth currenciesthose that are leveraged to global growth expectationswill outperform the liquidity currencies,

28 November 2013

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

which tend to be more sensitive to risk aversion shocks, but this will be predicated on EM growth continuing to show signs of recovery (see full classification below).

Fair value of EM rates based on the volatility

12 10 8

Yearly rate (%)

Carry-to-vol. rankings for EM currencies

y = 0.5273x

INR

BRL IDR

RUB

6 4 2 RON

TRY

ZAR

0 -2 -4 3

SGD

CZK TWD

HUF PLN KRW ILS 8

CLP MXN

13

Volatility (%)

INR RUB TRY BRL IDR CLP ZAR PLN HUF KRW RON MXN ILS SGD CZK TWD

Vols (%) 11.7 7.7 9.6 12.9 14.3 9.8 13.2 6.2 7.3 6.8 6.5 10.6 6.5 4.6 4.4 3.4

Rates (%) Fair value 10.5 6.2 6.3 4.0 7.5 5.1 8.9 6.8 9.2 7.5 4.5 5.1 5.7 6.9 2.4 3.3 2.3 3.8 2.1 3.6 1.9 3.4 3.0 5.6 0.6 3.4 0.0 2.4 -0.4 2.3 -1.9 1.8

CTV 0.9 0.8 0.8 0.7 0.6 0.5 0.4 0.4 0.3 0.3 0.3 0.3 0.1 0.0 -0.1 -0.6

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Source: SG Cross Asset Research/Cross-Asset Quant team

Note: PLN, CZK, HUF, RON and RUB are computed vs EUR, the others vs USD. Rates refers to the rates differential as implied from 3M forward, annualized; Vol to the 3M implied volatility; Fair value to the model-value of the regression of aforementioned rates vs vols for different currency pairs.

EM currencies: a simple classification Growth currencies RUB CLP KRW PHP MYR THB COP ZAR* Liquidity currencies TRY HUF PLN BRL MXN INR IDR RON ZAR*

Notes: *The ZAR is a hybrid currency, sitting in both categories. Source: SG Cross Asset Research

Safe-haven currencies TWD CZK SGD ILS CNY

Calling for a major GEM rally in the spring

The QE-related correction may be severe, but we also believe that it will be short-lived. By late April, we expect to stand ready to turn bullish on GEM, as global investors will have fully priced in the completion of QE tapering. This process will pave the way for a major rally in GEM, in our view, supported by the Feds strengthening of forward guidance and a much more dovish bias expressed through the lowering of the unemployment threshold. We believe that GEM will return to goldilocks market conditions given that the prospect of a future Fed rate hike will be quite far away. Meanwhile, we would argue that EM valuations will be attractive, reflecting the impact of the February-April correction. This will involve a radical change of strategy approach, of course, focusing on going long high beta EM FX, buying EM bonds, positioning for flatter EM curves, and going long high beta credit.

28 November 2013 3

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

On the FX side, the liquidity currencies may outperform from April onwards. This is because the liquidity currencies will have presumably corrected in a more significant way in the months prior. Growth currencies may also do well, while the safe-haven currencies are set to underperform. Looking at our EM FX forecasts from March 2014 onwards, it transpires that we expect the strongest rebounds to be registered by the IDR, the INR, the ZAR, the MXN, and the TRY during the expected risk rally. In contrast, we are not positive on the KRW, mainly reflecting the fact that the KRWs trading behaviour is converging towards that of a G10 FX, which means that it is not well positioned to take advantage of the more favourable risk environment. We are also not particularly bullish on the BRL, reflecting the poor mix of low growth and high inflation, together with the risk of fiscal slippage.

The recovery phase: our EM FX forecasted spot moves from March 2014 to December 2014

14 12

10

8 6 4 2

0

-2 -4

-6

-8

ILS

PLN

BRL

CLP

COP

SGD

Notes: against the USD. Source: SG Cross Asset Research/EM

Can GEM still perform in the context of rising US rates?

The US rates forecasts produced by our global rates strategy team are very clear. SG calls for the 10y UST to close the year 2014 at 3.75%, amidst a process of sharp UST curve steepening. By end-2014, the US 2s10s should indeed reach some 320bp, or roughly 75bp steeper than the current level. On paper, this should create a market backdrop that should be quite challenging for emerging markets. Yet, we are not convinced. This is because, as a starting point, the historical evidence is rather mixed. Looking at the recent history, it is clear that a sharp steepening of the UST curve is not necessarily associated with a sell-off in GEM assets. We analysed four different episodes over the years 2007-11 during which the UST curve steepened by at least 90bp in a short period of time. For each of those episodes, we measured the GEM asset performance, using three major EM currencies as proxies the MXN, the ZAR and the TRY as well as three rates markets the 10yr TIIE in Mexico, the 10yr ZAR, and the 10yr TRY x-ccy rates. The empirical evidence is quite mixed, pointing to a lack of relationship between UST steepening and GEM asset performance. The Lehman Brothers crisis in Sept./Oct. 2008 produced the strongest evidence, with all three EM currencies falling sharply, while two of the three rates markets sold off aggressively as well. (Amazingly, the South African rates market performed rather well in the immediate aftermath of the Lehman Brothers collapse). However, looking at the average results, EM currency performance as a whole was virtually flat and the correction in local rates was fairly modest.

28 November 2013 4

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

CZK

THB

TRY

ZAR

RON

MYR

MXN

HUF

PHP

TWD

RUB

HKD

CNY

INR

IDR

KRW

EM Outlook

The past episodes of sharp UST curve steepening (2s10s)

350 300 250 200

bp

150

100 50

0

-50 Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Source: SG Cross Asset Research/EM

The impact of UST 2s10s steepening on selected EM assets: a look at the recent history UST 2s10s (bp) Sept. 2007/Jan.2008 Sept./Oct. 2008 March/May 2009 Aug. 2010/Feb. 2011 Average 110 102 104 93 102 MXN (%) ZAR (%) TRY (%) 10y MXN (bp) -13 54 10 123 44 10yr SAF (bp) 8 -31 20 115 28 10yr Turkey (bp) -13 13 -20 -2 -5

1.87 -20.13 5.06 9.04 -1.06

-2.36 -13.15 17.91 0.86 0.82

10.41 -16.39 7.73 -3.92 -0.54

Source: SG Cross Asset Research/EM; Bloomberg

The key lesson that we are drawing from this look back at history is that what matters to EM investors is not the UST curve move itself, but rather the key driver behind it. To be precise, what we are facing next year is a UST correction not triggered by the fear of Fed tightening, but rather by a much stronger growth performance in the US in the absence of imminent tightening threat. Under this scenario, the risk appetite backdrop will not be dented, and we would even argue that this could turn out to produce a risk-positive signal. We recognise that higher US rates render EM rates less attractive on a relative value basis, but this does not negate the risk-positive environment. It is also important to note that the frontend rates in the US will be well anchoredhelped by a strongly dovish forward guidance, which means that the USD will not necessarily gain strong support relative to its G10 peers. Ultimately, higher US rates are supposed to signify that growth and macro conditions are improving globally, which should be supportive of EM FX appreciation and narrowing EM risk premia. The summer sell-off was completely different in nature than all the other ones we have

28 November 2013

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

seen in recent years. USD-EM was negatively correlated with UST yields, but recently this correlation has reversed.

Historical correlation between EM FX and UST: this summer was different

1.30 EM FX index vs USD (GDP-weighted, Jan'01 = 1) 1.25 Correlation, EM FX with UST 10y yield (180d) 1.000 1.20 0.500 1.500

1.15

1.10

0.000

1.05 -0.500 1.00

0.95 '09

Source: SG Cross Asset Research/EM

-1.000 '10 '11 '12 '13

Our outlook for capital flows to EM is fairly constructive

There is no denying that 2013 has been a pretty poor year for capital flows into EM. In fact, the short-term dynamics still show that outflows are ongoing, especially in EM fixed income, where EM funds continue to register large exits week after week. Against this backdrop, we believe that 2014 will show signs of stabilization, albeit from a lower base. The risk of further outflows will remain present in the first few months of the new year but we expect some upturn later on. It is interesting to note that the Institute of International Finance (IIF) does not foresee a major decline in capital flows to EM for 2014 in its latest forecast. While the IIF forecasts capital flows to drop significantly during the 3r quarter of 2013 for which final aggregated data are not yet availablethe path of inflows improves afterwards, with a marked pick-up in the latter part of 2014. On an annual basis, the IIF actually forecasts a moderate increase in total flows to EMboth private and officialin 2014 as a whole over 2013.

EM bond fund flows - cumulative

105,000

100,000 95,000

EM equity fund flows - cumulative

210,000 200,000

90,000 85,000 80,000

75,000 70,000

190,000 180,000

170,000 160,000

65,000 60,000 Dec- Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct12 13 13 13 13 13 13 13 13 13 13

Source: SG Cross Asset Research/EM; EPFR

150,000 140,000

Dec- Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct12 13 13 13 13 13 13 13 13 13 13

28 November 2013

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Total capital flows to EM gradually recover next year according to the IIF

400

300 200 100

USDbn

0 -100

-200

Source: SG Cross Asset Research/EM; The Institute of International Finance

An uninspiring year ahead for GEM FX as a whole

Our market-size weighted index for global EM FX shows very modest appreciationless than 1%from now to end-2014. Using a quarterly profile for FX forecasts, we expect the trough to be registered in Q1, reflecting our top-down call on risk, followed by a risk-on phase. This however masks some significant differentiation between the various types of currencies, as discussed earlier, and between regions.

Global EM FX trajectory

103

101

99 97

95

93 91 Jan-12

Notes: based on our FX-market size-weighted global EM FX index. The market size weights are derived from the BIS (average daily turnover data). Our Global EM FX index is expressed against the USD. Source: SG Cross Asset Research/EM

LatAm FX will outperform its peers next year

We project LatAm FX to appreciate as a whole by 2.8% from now until end-2014, thereby beating the other two regions by a large margin. This outperformance is driven by our bullish view on the MXN, our top pick in the region. The strengthening fundamentals in Mexico, together with the completion of key reforms should help the MXN appreciate all the way to 12.25 by December 2014, in our view. Meanwhile, the BRL will remain a drag on the regions performance, with macro risks still weighing on Brazil in the period ahead.

28 November 2013 7

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

2007Q1 2007Q2 2007Q3 2007Q4 2008Q1 2008Q2 2008Q3 2008Q4 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2e 2013Q3f 2013Q4f 2014Q1f 2014Q2f 2014Q3f 2014Q4f

(Jan 2007 = 100)

actual fcsts

May-12

Sep-12

Jan-13

May-13

Sep-13

Jan-14

May-14

Sep-14

EM Outlook

In contrast to LatAm, EMEA will be the underperformer in the year ahead. There are two main factors that will undermine EMEA FX performance. First, our in-house bearish view on the EUR means that CEE FX is set to fare poorly against the USD, even though we would be positive on CEE FX against the EUR. On top of that, we retain a bearish view on the RUB, mainly reflecting adverse domestic factors.

Expected spot returns by region for the period up-to Dec. 2014

4% 3% 2%

2.00

Our CEE FX forecasted spot moves up to December 2014

3.00 2.50

1%

1.50

0% -1% -2% -3%

EMEA Asia LatAm 1.00

0.50 0.00

HUF

Source: SG Cross Asset Research/EM

RON

CZK

PLN

Notes: based on our FX-market size-weighted global EM FX index. The weights are derived from the BIS (average daily turnover data). Our Global EM FX index is expressed vs. USD. Source: SG Cross Asset Research/EM

Within Central Europe, we are the most bullish on the PLN, as the macro fundamentals improve throughout the period and the National Bank of Poland ultimately engages in some policy normalisation in the latter part of next year. At the same time, we are only modestly bullish on the HUF, as we think that excessive monetary policy easing may undermine the attractiveness of HUF assets.

Our EM FX forecasts by region Expected spot returns by region, by quarter

105 104 103 102 101 100 99 98 97 96 95

Index I (25 Nov 2013 = 100)

forecasts

Global EM FX performance, %

3 2 1 0

-1 -2

-3

EMEA LatAm Asia

-4 -5 Q4-2013 Q1-2014 EMEA

Source: SG Cross Asset Research/EM

Q2-2014 LatAm

Q3-2014 Asia

Q4-2014

Nov -13

Jan-14

Mar-14

May -14

Jul-14

Sep-14

Nov -14

Notes: based on our FX-market size-weighted global EM FX index, with the base 100 set for 25 Nov. 2013. The market size weights are derived from the BIS (average daily turnover data). Our Global EM FX index is expressed against the USD. Source: SG Cross Asset Research/EM

The seasonality of EM FX performance will be a key factor

We expect the strongest quarter to be Q2 in terms of EM FX performance, as the risk-on signals start flashing by late April, once EM investors come to the realisation that QE tapering is now fully in the price. This will follow a first quarter that will likely produce negative returns for EM FX across all regions.

28 November 2013 8

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Risk off, risk on in GEM local debt

We stand ready to turn bullish on EM local debt from April onwards, but only after a phase of correction associated with the initiation of QE tapering by the Fed. Once the risk backdrop improves, we believe that EM investors will be drawn back into EM fixed income, owing to its attractive valuation. Valuations in a number of EM local debt market are indeed quite attractive, in our view.

Real 10yr local bond yields in Poland

10yr yield - CPI yoy inflation 5 4 3 2 1 0 Jan-07 10 8 6 4

2 0 -2 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13

Real 10yr local bond yields in Hungary

10yr yield - CPI yoy inflation

-4 Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Notes: estimated as nominal 10yr yields minus inflation (using daily interpolation) Source: SG Cross Asset Research/EM

However you look at it, there is significant value in EM rates

We adopt a multi-pronged approach to EM rates valuation but the conclusion is that some markets are quite attractive at current levels. This means that EM debt valuation should actually improve further after the early-2014 correction if our scenario materialises. A number of local debt markets are still quite attractive when measured in terms of 10yr bond yields adjusted for inflation. In that category, Colombia, Hungary, Brazil, and Poland come out as the most attractive markets, while Taiwan, Turkey and the Czech Republic do not feature well. It is interesting to note that Turkey, while being a nominal high-yielding market, does not produce a high real rate, suggesting that investors are currently not appropriately compensated for the macro risks. Looking at the nominal spreads over UST, the most attractive local markets at this point include Brazil, Turkey and South Africa, but we attach less significance to this valuation approach, given the problem with domestic fundamentals.

Real 15yr local bond yields in South Africa

6 4 2 0 -2 -4 Jan-07

Real 10yr swap rates in Mexico

10yr swap - CPI yoy inflation 7 6 5 4

3 2 1

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

0 Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Notes: estimated as nominal 10yr yields minus inflation (using daily interpolation) Source: SG Cross Asset Research/EM

In EMEA, our top picks are Hungary, Poland and, to a lesser extent, Russia for the year ahead. In Hungary, it will be important to wait until after the elections scheduled in the spring. One important consideration in favour of Hungary is the high real rate, together with the policy

28 November 2013

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

supportive environment. In Russia, we believe that the domestic fundamentals remain supportive of exposure to fixed income, and positioning is rather light, especially after the recent outflows. From an historical perspective, it is interesting to note that the real yields are trading at attractive levels both in Hungary and Poland. In LatAm, our top pick in EM rates is Mexico, by default. We still want to stay away from Brazil, given the uncertainty surrounding the policy framework and the macro environment, though there could be value in the front-end of the curve if the Copom decides not to meet the market's hawkish expectations. Meanwhile, we are bullish on Mexico from a top-down perspective, and believe that the country is well positioned to take advantage of next years spring rally.

There is value in EM bonds: 10y bond yields minus current inflation

6

5

4 3 2 1

Czech Rep.

Notes: Based on Bloomberg generic 10y quotes. Source: SG Cross Asset Research/EM

Value in EM bonds: 10y local bond yields minus current UST EM ratescarry in the front end: 1y1y fwd over 1y rates yields

10 8 6 4 2 0 -2

140 120 100

bp

80

60 40

20

0

Russia

Israel

Colombia

S. Af rica Brazil

Mexico

Romania

Taiwan

Poland

0

China Korea Chile Turkey S. Africa Russia Israel

Chile

Mexico

Korea

Czech Rep.

Notes: Based on Bloomberg generic 10y quotes. Source: SG Cross Asset Research/EM

EM curves to steepen first, and flatten from the spring onward, in a correlation break with UST dynamics. From April onwards, we anticipate that EM curves will flatten, reflecting the favourable risk environment, despite the pressure coming from the UST steepening. This means that compression trades, namely EM receivers against US payers, will be particularly

28 November 2013

10

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

Czech Rep.

Romania

Colombia

S. Af rica

Hungary

Hungary

Russia

Poland

Mexico

Taiwan

Turkey

Poland

Turkey

Korea

China

Israel

Chile

Brazil

Hungary

Brazil

EM Outlook

attractive, in our view. One obvious candidate for this type of strategy is Mexico, where we think investors will come back in force to gain exposure to the local bond market.

EM Sovereign Credit: The Pain before the Gain

The debate on the timing and the extent of the Tapering is likely to drive the EM credit market, once again. In line with our global view, we think that EM hard currency-denominated bonds will be affected by a risk-off environment which should materialise in February 2014. However, we believe that the sell-off will be more contained than that of last summer (at least in relative terms), essentially due to the ongoing improvement in fundamentals and the fact that spreads are factoring in a much higher probability that tapering measures will be implemented. At the peak of the sell-off (April), we see the EM spread index widening to 370bp.

EM Sovereign spread index forecast (bp)

400

350

300

Historical Spread

250 Forecast Upper and Lower Range 200 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14

Source: SG Cross Asset Research

Favouring the low-beta names, for now. As the EM credit market is likely to be under pressure during the four to five months of next year, the high beta names may underperform over the period. This should be particularly the case for Venezuela, Serbia, Croatia, Indonesia, South Africa and, to a minor degree, Turkey. In the low beta space, we believe that Brazil is also likely to underperform the index due to deteriorating fundamentals. The strong low beta credits should be fairly resilient to the downside, especially the Philippines, Chile, Poland, Colombia and Peru. During the phase of rally (May/December 2014), high beta names should logically outperform the index, including Ukraine, Serbia, Hungary and Croatia. We also see Indonesian and Turkish dollar bonds performing well in such scenario. Although Venezuelan assets should remain under pressure due to the sharp deterioration of the economic situation, the very high carry should partially protect the absolute return. In terms of positioning, we favour short duration exposures during the first part of the year, the steepness of the curves remaining very directional. More specifically in the high beta space, we favour the short end of Ukraine as the curve is likely to des-invert, we believe. In Venezuela, we favour low-dollar priced bonds, overall, and would move away from the belly to favour the wings for the curve. In Hungary, short-dated assets should also perform relatively well. Lastly regarding Brazil, we tend to favour short- to mid-dated bonds over the long end, as we expect the credit curve to bear-steepen.

28 November 2013

11

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

EM remaining strongly anchored in the IG category. Over the course of next year, we expect several important rating actions, including the downgrade of India, Brazil, Venezuela and South Africa, while the Philippines, Colombia, Mexico (S&P) and Peru should be upgraded. Overall, the EM asset class should benefit from a slight upgrade from, and remain strongly anchored in the BBB- category.

An asset allocation view of Global Emerging Markets: Some differentiation between asset classes and regions

Given the high market significance of US rates, hard-currency debt appears to be the safest EM asset class. Both the local currency debt and EM FX tend to be more vulnerable to swings in investor sentiment. Meanwhile, EM equities are usually high-risk but they may continue to be well supported if we continue to see signs of strengthening EM growth. In our latest EM investor survey, EM investors signalled that EM Equities were the preferred asset class for both RM and HF investors, followed by external debt (EXD) and local debt (LCD). Meanwhile, EMFX was the least preferred asset class in November, reflecting the poor score registered for real-money investors.

EM Asset preference: Equities the preferred asset class amongst EM investors

5 4 3 2 1

0

-1 -2 -3 -4 -5 EXD EMFX LCD EM Equities Investors asset preference (HF+RM)

Notes: from our November EM investor survey Bullish sentiment signal, but EM investors dont want to invest, 21 November 2013. Source: SG Cross Asset Research

We will favour defensive strategies in the first few months of the year. This means that investors that have some EM asset allocation flexibility should prefer EM hard-currency creditwith a strong focus on the low-beta creditsover FX and rates. In local fixed income, we will focus on shorter duration and more defensive rates markets, such as Israel, the Czech Republic or Chile. In principle, payer positions in some of the higher-beta markets would make sense, although timing and valuation will be two key considerations. In EM FX, we will favour the safe-haven currencies, followed by the growth currencies, while the liquidity currencies will outperform. Relative value strategies with a defensive bias will also be appropriate. Adding the regional exposure, we would initially favour exposure to Asia FX, given the high proportion of low-beta growth safe-haven currencies in the region. Once the spring rally kicks off, our favourite asset class will be EMEA fixed income, reflecting the attractive valuation of both FX and rates in the region. In hard-currency debt, we stand ready to build up exposure to high beta names.

28 November 2013

12

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

EM Growth Showing Signs of Recovery

EM growth prospects remain attractive

EM growth is picking up. Between Q2 and Q3 2013, the majority of EM countries have seen a jump in their economic activity with the notable exception of Israel, Lithuania and Peru. The rebound is particularly tangible in Eastern Europe, more specifically in Serbia, Romania, Hungary and Poland (see table of growth momentum below). This comes as a confirmation of Q2 data, which were already flagging some improvement relative to Q1 (see EM Weekly: EM Growth is Back, 4 October 2013). Note that GDP growth numbers are not available yet for Turkey and Brazil, but judging by the change in industrial production (+2.2% in Q3 vs. Q2 for Turkey, and +1% for Brazil), the momentum seems to be also positive in these two countries. On aggregate, we estimate that EM growth went from 4.5% to 4.7% y/y between Q1 and Q2 2013, and reached 4.9% in Q3. Excluding China, EM growth was 3.1% in Q3, up from 3.0% in Q2.

EM Growth momentum: Changes in real GDP from Q2 to Q3 2013*

4.0

Change in GDP growth (%)

3.0

2.0

1.0

0.0

-1.0

-2.0

-3.0

LITH PER ISR

MEX UKR INDIA*

SOAF

COL*

PHI*

POL

KOR

HUN

TURK*

THAI

INDO

CHINA

MAL

RUS

CHILE

Source: SG Cross Asset Research * Q2 vs. Q1 2013 for Brazil, Colombia, India, Philippines and Turkey

The positive move can also be perceived through PMI numbers, the latter showing a continuous improvement in the EM economic environment since July (see graph next page). Based on IMF forecasts, EM growth should gather pace early next year, the US economy driving the global recovery. China should continue to play an important role in that respect; our economic team see the Chinese economy to decelerate a bit next year, but the country should still grow at a sustained pace (7.4% y/y expected in 2014, vs. 7.6% for 2013).

28 November 2013

13

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

SERB

BRZ*

CZH

ROM

EM Outlook

PMI on the rise since July

GDP-weighted average EM PMI

53.0

52.5 52.0

EM growing faster than DM in coming years

EM and DM growth, GDP weighted (excl. China)

8.0

6.0 4.0 2.0

51.5

51.0

3.8 2.3

0.0 -2.0

-4.0 -6.0

50.5 50.0

49.5

'00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15

EM DM

49.0 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13

Source: SG Cross Asset Research/EM

Source: SG Cross Asset Research, based on IMF data

EM should continue to grow faster than developed economies. Growth in Asia should outpace that of other regions in the coming years. In Latin America, the Andean countries (Peru, Chile and Colombia) should continue to show strong economic performance (in part due to the high volumes of exports to Asia), while growth in Mexico and Brazil is likely to remain more modest. Turkey stands out as the leading country in terms of growth performance in the EMEA region.

2014 real GDP growth forecast (%, y/y)

7.0

Expected GDP growth (%)

6.0

5.0

Asia Latam

EMEA 4.0

3.0

2.0

1.0

0.0

VEN MEX

UKR

PER

ISR

POL

LTU

HUN

SOAF

KOR

INDIA

THAI

COL

MAL

TURK

Source: IMF WEO

Overall, EM countries are expected to grow well above developed markets: based on IMF forecasts, EM aggregate growth should be around 4.6% in 2013, rising to 4.9% in 2014 and reach 5.1% in 2015 (excluding China, EM growth should be 2.7% in 2013, 3.3% in 2014 and 3.8%, which is still substantially above DM).

Expected GDP growth for Emerging and Developed Markets

Percentage, based on IMF data

Emerging Markets EM ex China Developed Markets

Source: IMF WEO, SG Cross Asset Research

2012 4.8 3.0 1.5

2013 (F) 4.6 2.7 1.1

CHILE

2014 (F) 4.9 3.3 1.9

INDO

CRO

ROM

RUS

BRZ

CZE

2015 (F) 5.1 3.8 2.3

28 November 2013

14

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

PHI

EM Outlook

Differentiated Vulnerability Risks

Indebtedness in EM is considerably lower than in developed markets. Following the selloff of last summer, crossover investors have become worried about EM fundamentals, the latter being considered as vulnerable to global liquidity conditions. At the initial stage of the sell-off, investors made very little differentiation among EM, all countries being adversely affected in relatively similar proportions. As far as we are concerned, we argue that the fundamental backdrop in EM is relatively sound (especially compared to DM) and that a great deal of differentiation must be operated, EM countries showing very different level of vulnerability to external shocks. Higher growth... As a starting point, we would say that EM fundamentals remain attractive, especially versus developed markets. As mentioned earlier, the economic growth in EM is likely to stay much higher than in DM: based on IMF forecasts, EM GDP growth should be around 5% on average in the next two years (+3% ex China), well above the 2.1% average expected for DM countries. ... and less debt. Moreover, the level of indebtedness in EM is still considerably less than in DM: in fact, we calculate that the average public debt to GDP is 44% in EM, which is nearly twice as less than in DM. As far as the level of external debt is concerned, it has remained quite stable in the last ten years at around 50% of GDP for EM, when it has jumped from 120% to 170% over the same period see graphs below.

Half the Public Debt of DM

Public Debt/GDP for EM and DM countries (%)

90 80 70 60 50 40 30 20 10 0 EM DM 83.9

One third the external debt* of DM

External Debt/GDP for EM and DM countries (%)

200 180 160 140 120 100 80 60 40 20 0 EM DM

169.3

44.3

51.4

'99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14

'99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14

Source: World Bank, SG Cross Asset Research/EM

Source: World Bank, SG Cross Asset Research *Defined as the public and private debt held by non-domestic investors

Foreign direct investments covering current account deficits. Many have argued that the majority of EM countries are showing current accounts deficits, and this has become the main weakness for the asset class. Indeed, EM countries show an average C/A deficit of 1.2% of GDP, in sharp contrast with the average surplus of 1.9% for DM. But we would highlight two points in that respect: 1.) A current account deficit of 1.2% is still a manageable level in our view, especially considering that most of the external deficits are funded via FDI (which by nature are less volatile than portfolio investments), and 2.) EM countries have built a considerable cushion of FX reserves, in such a way than they cover an average of 7 months of imports for EM, versus only 4 months for DM countries. A great deal of differentiation among EM countries is necessary. Considering other fundamentals, it is also necessary to look at individual situations as they considerably vary from one country to another. For our purpose, we have computed scorecards based on

28 November 2013

15

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

eleven macroeconomic critieria, including GDP growth, inflation, vulnerability to external shocks and sustainability of fiscal dynamics. We present below the results of each scorecards:

Vulnerability Indicators*

See grey box next page to see criteria included in the vulnerability indicator

Ukraine Venezuela South Africa India Hungary Turkey Poland Czech Rep. Croatia Chile Indonesia Lithuania Brazil Mexico Romania Colombia Malaysia Israel Russia Thailand Korea Peru Philippines China 0 5 10 Vulnerability indicator

Source: SG Cross Asset Research/EM

Latam EMEA Asia

15

20

The results of this scorecard are quite compelling and highlight the high disparity among EM countries, in our view. Notably, EMEA countries are the most vulnerable, with an average score of 14.4, due to a combination of slower growth, high external and public debt burdens, low levels of foreign reserves. LatAm countries, with an average score of 12.7, are moderately vulnerable, while Asian countries, with an average score of 9.6, are the least vulnerable among emerging markets. Ukraine, Venezuela and South Africa the most vulnerable. At the top of the vulnerability ranking, we logically find Ukraine and Venezuela. For these two countries, pretty much all indicators are showing distressed situations apart from the current account surplus for Venezuela (although sharply declining in the last few years), and the low level of inflation for Ukraine (which also reflects an economy on the verge of deflation). Surprisingly (or not), South Africa shows one of the worst fundamentals in EM, due to particularly slow growth and its twin deficit. Then follows India, Hungary, Turkey and Poland (the external and public debt levels are indeed relatively high for the latter). Asian economies the strongest. At the other hand of the spectrum, we find the Asian countries which clearly appear as the strongest economies overall, starting with China. Second to China comes the Philippines: despite its BBB- rating, the country shows very

28 November 2013 16

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

strong fundamentals and is very likely to be upgraded during the course of next year, we believe. In Latin America, we highlight the strength of the Peruvian economy, which has been able to sustain high growth performance while keeping inflation at relatively low level. We note also that Russia also compares relatively well in this ranking (due to its very high level of FX reserves, as well as its very low level of public debt relative to GDP). In view of this analysis, it is therefore necessary to differentiate among EM countries when the market experiences higher volatility than usual, the fundamental risk being considerably different depending on the credit profile. Note that the market risk associated to each country (as measured in the present case by the FX volatility) is strongly correlated to our indicator (correlation is around 86%), which reinforces the relevance of the Vulnerability indicator.

FX volatility vs. Vulnerability Indicator

20

18

16 14

FX v olatility

R = 0.7452 TRY CLP

CZK

INR

PLN HUF

ZAR

12

10 8 THB CNY PHP PEN

MYR ILS

COP

RUB

IDR BRL MXN

RON

6

4 2

KRW

0 0 2 4 6 8 10 12 14 16

Vulnerability Indicator

Source: SG Cross Asset Research/EM

VULNERABILITY INDICATOR: METHODOLOGY We compute the Vulnerability Indicator using 11 macroeconomic criteria, including: * Growth performance: We assess growth performance and changes in GDP. * Inflation: We gauge inflation pressure as well as the change in inflation dynamics. * FX vulnerability: Valuation of the real effective exchange rates. * External vulnerability: Current account, foreign direct investment, gross international reserves (relative to imports and relative to short-term liabilities) and level of external debt. * Fiscal Position: Overall fiscal position, the primary balance and the level of public debt relative to GDP.

28 November 2013

17

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

The Haves and the Have Nots: An Assessment of Policy Room in EM

Extent of policy space likely to determine economic resilience

Across global emerging markets, policy makers are facing the daunting reality of declining policy space, amidst a global financial environment sensitive to the readjustment and normalization of monetary policy led foremost by the US Federal Reserve and still sluggish growth prospects. Against this backdrop, a gradually declining inflation trajectory in emerging markets has helped to create much-needed policy space. Nonetheless, investors remain skittish. Indeed, the lack of conviction may linger over the coming months until there is clarity on Fed policy and on the liquidity available to emerging markets once tapering commences. In this tentative environment, investors will likely differentiate between countries that have the policy room to respond to external shocks, versus those that face difficult trade-offs between promoting growth and protecting financial stability.

Declining inflation in GEM creates much-needed policy space (headline CPI, %)

25%

EM Asia

20%

CEEMEA Latam

15%

10%

5%

0%

'01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13

Notes: Based on GDP-weighted indices Source: SG Cross Asset Research/EM.

We think that a key determinant of a countrys economic resilience to the potentially violent period of financial markets readjustment ahead is the extent of its policy space. Some countries notably Turkey, India, and Indonesia have had to resort to rate hikes, in many instances to support their currencies. We would argue that in the case of Turkey, Indonesia, and India, lack of monetary policy room forced the hands of the central banks to hike, accepting the concomitant adverse impact on growth.

28 November 2013

18

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Real policy rates reflect the extent of remaining monetary policy space

12

10 8 Policy rate (%) Latest CPI (Y oY %) Real policy rate (%)

6

4 2 0 -2 -4

Russia Malay sia South Af rica

Romania

Colombia

Croatia

Lithuania

Ukraine

Mexico

Israel

Chile

Peru

China

Philippines

Indonesia

Korea

Brazil

Poland

Hungary

Thailand

Turkey

Source: SG Cross Asset Research/EM

POLICY ROOM INDICATOR: METHODOLOGY To gauge differences between countries remaining monetary and fiscal policy space, we have created a rough measure called the Policy Room Indicator. It assesses the remaining policy space among our major emerging market countries, and considers the following factors: * The level of real interest rate: high real policy rates enable more scope for monetary policy accommodation to support domestic growth * Primary balance, as a percentage of GDP: high primary surpluses enable more fiscal flexibility to spend on priorities * Public debt, as a percentage of GDP: high general government debt may constrain the countrys borrowing capacity, raise borrowing costs, and destabilize the financial markets in times of stress * Official FX reserves, as a percentage of GDP: high levels of reserves can be deployed to support the currency We note that this rough gauge does not capture all relevant considerations, such as the varying amounts of policy credibility across our markets, or the momentum of inflation pressures.

The results of our Policy Room Indicator suggest that Peru, Korea, Chile, and Hungary may have among the most flexibility to steer their economies in the coming year. These countries benefit from a combination of high real interest rates, strong primary balances, and with the exception of Hungary low public debt. Regionally, LatAm countries, with an average score of 14.3, have the most policy room, thanks to high real interest rates, strong primary balances, and low public debt. Asian countries, with an average score of 12.2, have moderate policy space, while EMEA countries, scoring 11.7 on average, have the least policy flexibility. We discuss below our key thoughts on the available policy space by region.

28 November 2013

19

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

Czech Republic

India

EM Outlook

EM Policy Room Indicator: a gauge of countries remaining fiscal and monetary flexibility

Peru Korea Chile Brazil Hungary Thailand China Romania Philippines Croatia Colombia Ukraine Russia Poland Turkey Mexico Lithuania Malaysia Israel Indonesia South Africa Venezuela Czech Republic India 0 2 4 6 8 10 12 14 16

EMEA Latam Asia

18

20

Source: SG Cross Asset Research/EM

EMEA

Czech Republic: Lack of policy room prompts the authorities to be creative

The country is recovering slowly out of a recession, with growth remaining fragile. Monetary policy space remains low, with nominal policy rates essentially at zero. Disinflationary pressures have prompted the central bank to intervene directly in the FX markets and avoid the deflationary trap. We expect the CNB to defend the desired 27.00 level of EURCZK with unlimited sales of CZK, and to postpone interest rate hikes until 2016. Early elections held in October have removed some tail risks, and the coalition government is likely to embark on a pro-growth fiscal policy, while still maintaining the budget deficit within the 3% of GDP threshold.

Hungary: Largest policy room in the region

Fiscal space is constrained by the governments commitment to meet its fiscal deficit target of 3% of GDP, having so recently escaped the shackles of the EUs excessive deficit procedure. However, real interest rates are still among the highest in the region, while inflation is on the decline. Against a backdrop of weak growth, this combination creates the space for Hungary to provide more monetary policy accommodation, which is what we foresee the central bank continuing to do ahead of general elections in the spring.

Israel: Some difficult choices in the context of constrained policy room

Negative real interest rates, a weak primary balance, and high levels of public debt restrict policy space in Israel. Fiscal space is hampered by a large budget deficit and an ambitious target to keep the deficit within 3% of GDP next year, which will require extensive policy measures. ILSs appreciation continues to adversely impact exports. The countrys growth is slowing, while inflation expectations remain benign. Notably, concerns regarding the rapid growth of the housing market and the risk to the banking system weigh on central bank policy

28 November 2013

20

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

making. One consideration in favour of Israel is the strong credibility that the Bank of Israel has enjoyed over recent years.

Poland: Committed to preserving monetary ammunition at a cost

The countrys fiscal space is constrained by a large fiscal deficit and ongoing efforts to exit the EUs excessive deficit procedure. Space remains on monetary policy side, in light of relatively high real yields. However, the central bank has completed its easing cycle earlier this year, and is committed to maintaining the current level of policy rates at 2.5% until mid-2014 at the earliest. In the absence of fiscal space, Poland has embarked on pension reforms, which are likely to significantly improve the near-term fiscal balance, but entail long-term costs for the government.

Romania: A strengthening policy framework

The country has higher than average policy room, benefiting from its positive real interest rate, lower than average public debt, and adequate FX reserves. The central bank remains in easing mode, helped by declining inflation. Romania is continuing to make progress in fiscal consolidation, in restructuring its economy toward external demand, and in strengthening its financial sector stability. As a result, fiscal policy space remains low. Improved absorption of EU structural and cohesion funds from the current low capacity may help to boost investment activity, as well as increase budgetary flexibility.

Russia: Assessment helped by its low debt

Despite negative real interest rates, Russias primary surplus and low public debt profile contribute to Russias moderate level of policy room. As a result of the countrys continued reliance on commodity exports, declining oil prices are exerting budgetary pressures and eroding the current account surplus. Reforms by the central bank and the ministry of finance are slow-moving, and as yet ineffective at reviving the stagnant economy. The business climate remains poor, while industry faces declining competitiveness.

South Africa: Serious policy challenges

A worsening primary balance, negative real interest rates, and an elevated stock of government debt conspire to restrict policy makers ability to revive the slowing economy. Internal resistance from powerful labour unions and entrenched politics impede the pace of reforms. We expect that the SARB will maintain an accommodative policy stance, with policy rates on hold at 5%, and that fiscal loosening will be limited. But with relatively little in the way of FX reserves to defend the currency, the SARB lacks adequate policy tools to respond in a stress scenario.

Turkey: Fiscal outperformance, monetary underperformance

The central bank has limited policy room, and is becoming more vigilant in protecting financial stability. It has recently tightened local liquidity conditions and raised the interest rate corridor, although more tightening in monetary policy may still be needed to restore market confidence and tame inflation. Positively, the country is showing signs of fiscal outperformance, with the budget deficit likely to be substantially smaller this year than the government previously projected.

LatAm

Brazil: A false positive of our Policy Room Indicator

The country faces high amounts of policy constraints, despite its appearance near the top of our Policy Room rankings (consequence of its high real interest rate and primary surplus). Headline inflation is running well above the Copom's 4.5% target even after 275bp in Selic hikes in 2013, and core inflation is now above 7%. Fiscal stimulus does not seem to be an

28 November 2013 21

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

option, either, with markets showing increasing concern over Brazil's long-term debt trajectory. Policy makers could aim to ease conditions ahead of the October elections, but not without risking more damage to the inflation outlook.

Chile: Plenty of policy ammunition

Although the Chilean Central Bank cut rates by 50bp in Q4, we still see ample room for further monetary easing. Chile's economy and the central bank are highly sensitive to external conditions, rendering policy responsive to global pressures. Inflation levels and expectations remain extremely mild. Meanwhile, both nominal and real rates are much higher than in most EM economies a fact which has bolstered the rationale for the recent easing cycle.

Colombia: Policy status quo

We view further policy stimulus in the country as unlikely, as with Mexico. Policy makers have provided both monetary and fiscal stimulus earlier this year, and expects a gradual recovery through next year.

Mexico: Focus shifting to reforms

After 100bp of rate cuts in 2013 and plans for a slightly looser fiscal balance next year, further stimulus appears unlikely. Growth is expected to accelerate next year, amid signs of recovery in manufacturing and an expected increase in public spending. Meanwhile, inflation expectations for 2014 have risen well above target, perhaps reflecting the uncertainty regarding the impact of reforms on prices.

Peru: A solid policy framework

The country may be a candidate for looser policies next year, thanks to relatively high real rates and solid fiscal accounts. However, the central banks tight inflation target (2%), combined with the upward trajectory of core inflation, may constrain policy makers from further easing.

Asia

India: Facing enormous policy challenges

The country is running tight on the fiscal policy front. Meanwhile, higher inflation is posing constraints on monetary policy, as evident from Indias lowest rank in our EM Policy Room Indicator. The fiscal deficit for FY2012-13 stood at 5.2% of GDP. The government aims to improve it to 4.8% of GDP for FY2013-14, while the medium term goal for fiscal deficit reduction remains at 3% for FY2016-17. The Reserve Bank of India (RBI) is facing a growthinflation dilemma. GDP growth slumped below 5%, well below the RBIs estimated potential GDP growth of 7%, while WPI inflation has remained persistently higher. Near term inflation risks are present from second round effects and diesel price pass-through effects. We expect the RBI to reduce repo rates to 7.25% by the end of 2014, as inflation is expected to soften starting the next fiscal year on demand slowdown.

Indonesia: Policy pressures are mounting

Oil subsidies are putting pressure on the budget balance, with 3-4.5% of GDP in oil subsidies. The Bank of Indonesia (BI) has hiked the benchmark rate by 25bp to 7.5% as the CPI has remained above 8%, much higher than the target level of 4.51%. We believe that the BI will remain hawkish during 1H 2014 on higher inflation and a weak IDR, while some base effects can ease inflation in 2H 2014.

Korea: A lot of breathing room

We believe that South Korea has the most policy room of the countries in the region. We anticipate a gradual recovery, despite a considerable period of a negative output gap. Inflation is likely to remain below the Bank of Korea's target range of 2.5%-3.5% throughout 2014.

28 November 2013 22

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Hence, a pick-up in inflation is unlikely to be a major trigger for rate hikes. Upside surprises in economic growth and downside surprises in inflation continued over recent months. In our view, this development justifies a neutral, wait-and-see stance towards monetary policy until the end of 2014.

Malaysia: Below average

The Bank Negara Malaysia (BNM) has maintained an overnight policy rate at 3% since May 2011, while inflation has remained stable in a range of 1.3%-3.5% YoY, with the latest October print at 2.8%. Amid a slower pace of government spending, improving export dynamics are supporting GDP growth. According to the BNM, inflation is expected to pick up on domestic cost factors. Risks to the inflation outlook are present from the external price environment and domestic demand pressures. The BNM continues to see uncertainties in the balance of risks surrounding the outlook for domestic growth and inflation. We anticipate that the BNM will remain on hold, with a hawkish bias.

Philippines: Well positioned on the policy front

The Bangko Sentral ng Pilipinas (BSP) targets inflation in the range of 41% for 2012-2014 and 31% for 2015. Although inflation expectations have been in line with the forecast, with the latest print at 2.9% YoY for October, damage due to typhoon Haiyan from earlier this month is likely to push inflation higher as commodity prices rise. We believe that developments will stay within the BSPs tolerance band.

Thailand: Some room to manoeuvre

The Bank of Thailand (BoT) targets core inflation between 0.5-3%. This past year, core inflation has ranged between 0.7%-1.7% YoY this year, with last month's inflation at 0.71% YoY. Ongoing political uncertainty in the country puts further pressure on the growth outlook, consumer confidence, and demand. With core inflation hovering near the lower end of the range, the BoT has reduced policy rate to 2.25% on weaker Q3 growth and downside risks. We expect growth to improve next year and for inflation to trend higher, placing the BoT in neutral mode for 2014.

28 November 2013

23

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Sovereign Credit: The Pain before the Gain

US Treasuries to drive the market

In the short term, we think EM dollar-denominated bonds will tend to outperform US Treasuries, although to a limited extent. For now, downward pressure should ease a bit: SG expects the 10Y UST yield to be around 2.70% by year end, which is in line with the current level. In this context, EM sovereign bonds may be supported by relatively attractive valuations (especially vs. US high yield and high grade bonds) and benign technicals (EM funds remain underweight risk vs. their benchmark). We believe the EMBI spread index could tighten by around 25bp to trade in the 310bp area by the end of January 2014. The pain before the gain. Considering the outlook for 2014, the debate on the timing and the extent of the Tapering is likely to drive the market, once again. We believe the gradual rise in UST yields may prompt another correction in EM, possibly by February as the Fed scales down its USD85 billion monthly bond-buying program as expected by our US Economics team. In this scenario, concerns that EM assets will be affected by another wave of outflows should resurface, resulting in higher sovereign spreads across the board. At the peak of the sell-off (April), we see the EM spread index widening to 370bp. Later in the spring of next year, as most of the risk may be priced in, EM spreads should tend to compress until year end, following the improvement in fundamentals (see graph below).

EM Sovereign spread index forecast (bp)

400

350

300

Historical Spread

250 Forecast Upper and Lower Range 200 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14

Source: SG Cross Asset Research

EM dollar bonds more resilient to the downside. We believe the next sell-off could last two to three months (from February until April/May), but the correction in the EM credit space is likely to be more contained than that of last summer. We see four reasons why the EM credit market should be more resilient against the downside:

Interest rate risk better reflected in EM valuations. As opposed to six months ago, EM

spreads are now incorporating a much higher probability that tapering measures will be implemented, which is reflected into cheaper valuations. In fact, even assuming that the EMBI spread index would trade at 310bp by early next year (our base case scenario), it would still

28 November 2013

24

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

be 35bp wider than prior to the sell-off of last summer. In yield terms, EM bonds are currently trading 140bp wider than a year ago.

EM fundamentals still strong. The last episode of EM sell-off may have been

disproportionate in light of fundamentals. In many aspects, the EM backdrop remains more attractive than in developed markets, especially in terms of growth prospects and debt levels (see EM vulnerability section).

Growth picking up, stronger exports. By the time the Fed implements the Tapering, EM

growth may have strengthened further; at current pace, we would expect GDP growth in EM to be around 5%yoy by Q1 2014. Also, the pressure on current accounts may be less after the drastic depreciation of EM currencies that we saw last summer. In fact, we expect this depreciation to boost EM exports, in particular towards the US.

Less opportunistic investment, better technicals. The majority of crossover investors

have considerably reduced their exposure to EM. The withdraw of opportunistic/fast money investments is therefore less of a threat for our market, most of EM hard currency bonds now being held by dedicated investors typically driven by long-term macroeconomic criteria, the latter still comparing positively for EM, in our view.

EM rating strongly anchored to the IG category

EM fundamentals holding better than DM. Although credit ratings are imperfect measures of the overall sovereign risk (they indeed tend to underestimate the potential impact of global factors, such as quantitative easing or tapering measures from the major central banks), the changes in credit ratings still reflect relatively well the evolution of EM fundamentals over long periods. Considering the EM and DM average ratings since 1996, it clearly appears that EM fundamentals have considerably improved in the last ten years; they have therefore become more resilient to global turbulence, including during the subprime and the EU Periphery debt crises (see graph below). This evolution is in sharp contrast with that of DM countries, which in average have been downgraded by 2.5 notches since 2007. We expect EM to benefit from a slight upgrade in 2014, the asset class remaining well anchored in the investment grade (BBB-) category.

EM average rating* vs. Developed Markets

BBB AAA

EM (LHS) BBBAA+

BB+

DM (RHS)

AA

BB

AA-

BB-

A+

'96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14

Source: SG Cross Asset Research *Based on simple average S&P, Moodys and Fitch ratings.

28 November 2013

25

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Although the overall rating of EM sovereign bonds should marginally improve in 2014, we expect some important rating actions to be undertaken over the next twelve months, including: Potential upgrades: Philippines, Colombia, Mexico, Peru, Uruguay, Latvia, Lithuania Kazakhstan, Romania and Ukraine; Potential downgrades: India, Brazil, Venezuela, South Africa, Croatia, Slovenia and Czech Republic.

SG expected 1Y change in sovereign rating (notches)

Korea Chile Estonia Czech Rep. Israel Slovakia Poland Malaysia Thailand Lithuania Latvia Kazakhstan Peru Mexico South Africa Slovenia Russia Panama Brazil Bulgaria Colombia Philippines India Uruguay Indonesia Turkey Romania Croatia Hungary Sri Lanka Vietnam Venezuela Ukraine Argentina

Many of these rating actions are already priced in by the market (such as the likely upgrade of the Philippines or Colombia, or the downgrade of South Africa), but some of them may not be fully anticipated by investors, which could imply a significant repricing, in our view. These changes include:

Brazil to be downgraded. We see a continuous deterioration in inflation and fiscal balance,

while GDP growth may disappoint on the upside. We therefore believe a downgrade of Brazil to BBB- by one or two rating agencies is very likely, in spite of the very high level of FX reserves. The downgrade should send a negative signal on the credit, and Brazilian bonds could significantly underperform the EM sovereign credit index.

Mexico likely to be upgraded by S&P. The implementation of economic reforms

(especially regarding the status of Pemex) has long been considered a precondition to any upgrade. However, the relatively poor GDP performance has had a significant impact on the credit rating; according to the IMF forecasts for 2014, Mexico should see a jump in GDP growth from 1.2% in 2013 to 3.0% in 2014, representing the best improvement among Latin American countries. We believe this improvement could trigger an upgrade from S&P to BBB+, to be in line with Moodys and Fitch (S&P downgraded Mexico to BBB in Dec. 2009).

South Africa: At least two agencies triggering a downgrade. The deterioration in South

Africans fundamentals has been continuous since 2009. In fact, the fiscal balance and the C/A deficit stand at preoccupying levels, and an average rating of BBB will be very difficult to sustain for the country. We therefore expect South Africa to be downgraded by at least two rating agencies next year, although the country should remain in the investment grade category. Nevertheless, we cannot rule out that these rating actions will be associated with negative outlooks.

Ukraine should retrieve its single B status. As we write these lines, we assume that the

government will not sign the trade agreement with the EU this Friday. For the majority of Ukraines watchers, the decision of M. Yanukovych is sending a negative signal, as in the long

-1.5 -1 -0.5 0 0.5 1 1.5

term the country would have greatly benefitted from such trade agreement. However, we believe that the reestablishment of the economic and political ties with Russia substantially reduces the credit risk in the short term. Independently from political considerations, it is likely that the rating agencies will revert their recent downgrades to reflect the lower risk of default of the country (we assign a high probability that Russia will eventually provide financing facilities and/or a gas deal to Ukraine).

Source: SG Cross Asset Research

28 November 2013

26

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

Underweight risk for the coming months

Favouring the low-beta names, for now. As the EM credit market is likely to be under pressure during the four to five months of next year, the high beta names may underperform over the period. This should be particularly the case for Venezuela, Serbia, Croatia, Indonesia, South Africa and to a minor degree Turkey. In the low beta space, we believe that Brazil is also likely to underperform the index due to deteriorating fundamentals. The strong low beta credits should be fairly resilient to the downside, especially the Philippines, Chile, Poland, Colombia and Peru (see table below). Starting in the spring, we think that EM dollar bonds will significantly outperform US Treasuries, reflecting the continuous improvement in fundamentals. The adverse impact of UST may not be fully compensated by spread compressions before this summer, but EM bonds return should be back to positive territory during the second half of the year.

10Y dollar bonds spread to UST forecasts

Current 10Y Yield Current Spread Q4 '13 10Y benchmark spread forecast Q1 '14 Q2 '14 Q3 '14 Q4 '14 Spread Change

10Y UST (Yield) Chile Philippines Mexico Poland Lithuania Colombia Peru Brazil Russia Romania Turkey South Africa Indonesia Morocco Hungary Croatia Serbia Ukraine Venezuela EM Index

Source: SG Cross Asset Research

2.7 3.53 3.22 4.08 4.09 4.11 4.12 4.34 4.49 4.51 4.81 5.04 5.05 5.14 5.32 5.57 6.01 6.42 9.66 13.58 5.86

83 52 138 139 141 142 164 179 181 211 234 235 244 262 287 331 372 696 1088 328

2.7 93 62 123 125 127 127 150 163 166 193 212 215 222 240 268 312 351 674 1059 310

3 113 97 152 148 151 155 160 196 195 233 269 262 247 294 312 356 401 679 1141 350

3.35 88 72 113 110 113 116 121 157 156 193 228 222 206 253 271 315 361 637 1098 310

3.5 83 67 96 91 94 97 103 138 136 173 207 201 181 232 251 295 340 616 1075 290

3.75 73 52 83 77 80 84 89 128 124 163 200 193 166 225 242 286 332 610 1074 280

-10 0 -55 -62 -61 -58 -75 -51 -57 -48 -34 -42 -78 -37 -45 -45 -40 -86 -14 -48

During the phase of rally, high beta names should logically outperform the index, including Ukraine, Serbia, Hungary and Croatia. We also see Indonesia and Turkey performing well in such scenario. Although Venezuelan assets should remain under pressure due to the sharp deterioration of the economic situation, the very high carry should partially protect the absolute return. In terms of positioning, we favour short duration exposures during the first part of the year, the steepness of the curves remaining very directional. More specifically in the high beta space, we favour the short end of Ukraine as the curve is likely to des-invert, we believe. In Venezuela, we favour low-dollar priced bonds, overall, and would move away from the belly to favour the wings for the curve. In Hungary, short-dated assets should also perform relatively well. Lastly regarding Brazil, we tend to favour short- to mid-dated bonds over the long end, as we expect the credit curve to bear-steepen.

28 November 2013 27

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

How to Trade EM Politics in 2014

Beyond election outcomes, changes in the political landscape can drive long term value

This past year, politics once again played a significant role for emerging markets. European sovereign issues took somewhat of a backseat, thanks largely to the actions taken by the ECB in 2012 and some modest but sorely-needed steps towards a banking union early this year. US politics, on the other hand, threatened EM and other risky assets in the form of fiscal headwinds and yet another debt ceiling standoff. Within EM itself, for that matter, there was no shortage of storylines. Most importantly, the Chinese Communist Partys Plenum meeting yielded a set of reform goals that, however vague for the time being, raised hopes for gradual economic reforms and a more sustainable growth path in the coming years. Mexicos push towards landmark reforms, meanwhile, gained the attention of many investors looking for a new EM darling. Hungary and Poland, conversely, raised eyebrows over monetary policy independence questions and pension reform, respectively. Next year, we expect political headlines to continue to help determine value within EM. In a number of markets, the focus will be on scheduled elections, while in others, political issues outside the voting booth will demand attention. Below, we discuss by region the key political events and trends we think will prove most important in 2014.

EMEA

Hungary: Chance of a positive policy surprise

The key question in the upcoming Hungarian elections next April / May is whether Viktor Orban and his Fidesz administration will retain a supermajority in Parliament. We expect that Fidesz will hang firmly onto power, but that the party may not achieve the supermajority that will enable them to so easily push laws through Parliament. Opposition parties E14, led by former technocratic Prime Minister Gordon Bajnai, have teamed up with the Socialist Party (MSZP) after intense feuding and are attempting to appeal to disparate segments of voters, but face what may be an insurmountable uphill climb. Post elections, we expect that Fidesz may ease up slightly on some of the punishing policies toward the banking sector and utilities, providing the chance of a positive policy surprise (relative to the dire current state of affairs). Many countries in the region are keenly watching developments in Hungary, and contemplating using Viktor Orbans policies as a template.

Poland: Stability

The latest government reshuffle included the replacement of Finance Minister Rostowski by Mateusz Szczurek, formerly INGs chief economist for CEE countries. We believe that existing fiscal policy is likely to remain intact. The country will hold local elections next year, followed by parliamentary and presidential elections in 2015. Despite gains by the opposition Law and Justice (PiS) party in recent polls, we expect the ruling PO party to remain in power, and will focus on reviving growth next year ahead of the 2015 elections.

Romania: Expect some noise, as usual

The country will see a change in the office of the president following presidential elections in 2014, with current president Traian Basescu likely replaced by Crin Antonescu, current leader of the National Liberal Party (PNL) and head of the senate. Ahead of the presidential elections,

28 November 2013

28

This document is being provided for the exclusive use of QIAO CAI (SGCIB)

EM Outlook

there is a risk that the government may stray slightly from current structural reforms and budget objectives.

South Africa: Low political risk

With the African National Congress firmly entrenched in power, South African elections next June are less about a change in power, and more a forum to witness the erosion of the ANC's appeal. Pro-business Democratic Alliance - traditionally perceived as a white-led party - is likely to hang on to strongholds in the Western Cape and gain incremental ground from the ANC. Meanwhile, newly launched party Agang SA and its ideological star Mamphela Ramphele will not have sufficient time to attract a broad following. One positive note for markets will be the return of Cyril Ramaphosa to the ANC's leadership as deputy president, as he brings with him clout from private industry and the potential to mend some of the strained relationships between government and business.

Turkey: Expect some politics-driven volatility

Local elections next March will test the appeal of ruling AKP, following the protests that erupted earlier this year. Opposition parties remain weak, and do not constitute a credible threat. However, they are likely to encourage protestors to return to voice concerns against Prime Minister Erdogan's increasingly autocratic rule. And unless Erdogan manages to change AKP's rules to enable him to stand as prime minister for a fourth term in the 2015 general and parliamentary elections, he may have to opt instead to run for the presidential post opening up in August 2014.

LatAm

Brazil: A negative balance of risks