Академический Документы

Профессиональный Документы

Культура Документы

Tutorial 7 Suggested Answers

Загружено:

Yin HauАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tutorial 7 Suggested Answers

Загружено:

Yin HauАвторское право:

Доступные форматы

2009/2010

EC1301 Principles of Economics

Semester 1

Tutorial 7 suggested answers

Q1. Growth rate of real GDP, real GDP per worker and real GDP per capita were 7.8%, -1.3% and 3.3% respectively. How you judge the performance of the country thus depends on which indicator you use. Overall size of the economy grew very fast, but each persons share grew much slower, and labour productivity actually declined. You may be interested to know that the data refers to Singapore. 2007 was a year of high growth, but it was achieved by a massive increase in the number of employed (+9.2%), fuelled by a big inflow of foreign labour.

Q2. This is a question designed to provoke discussion only, and there are no set answers. Students may feel free to put this question aside when doing revision for examinations. The following table shows some answers that students came up with:

Q3 (a) The first thing to note is that you are to approximate, so use the Rule of 70! By that rule, Sinostans real GDP doubles every 7 years, while Ameristans real GDP doubles every 14 years. Second thing to note is that we are looking at size of economy, so the measure to use should be real GDP. Sinostan starts at a real GDP level of 1.2 billion x $6,000 = $7.2 trillion, while Ameristan starts at a real GDP level of 300 million x $48,000 = $14.4 trillion.

2009/2010

EC1301 Principles of Economics

Semester 1

Simply count what Sinostans real GDP becomes every 7 years and what Ameristans real GDP becomes every 14 years. You will find that in 14 years 1, both countries will reach $14.4 trillion and Sinostan will have caught up with Ameristan.

Q3 (b) Here, we are looking at living standards, so the measure to use should real GDP per capita. Fortunately, because both countries have populations that are constant in size, growth rates of real GDP per capita are the same as growth rates of real GDP. Thus, Sinostans real GDP per capita doubles every 7 years, while Ameristans real GDP per capita doubles every 14 years. The starting points are $6,000 for Sinostan and $48,000 for Ameristan. Simply count what Sinostans real GDP per capita becomes every 7 years ($12,000 after 7 years, $24,000 after 14 years, $48,000 after 21 years and so on) and what Ameristans real GDP per capita becomes every 14 years ($96,000 after 14 years, $192,000 after 28 years, and so on). You will find that in 42 years 2, both countries real GDP per capita will reach $384,000 and Sinostan will have caught up with Ameristan.

Q4. D. A trade deficit means borrowing from abroad, which has to be repaid in the future. If the borrowing is used to increase investment, then in the future the economy has grown and will be able to repay the debt (by running a trade surplus) and still have higher future consumption. But if the trade deficit is used to increase consumption, there is no economic growth, and in the future the country can only run a trade surplus by reducing future consumption. Thus, none of the options A, B or C always occur with a trade deficit.

Q5. D. Depreciation is generally a stable percentage of the capital stock. If you have 100 machines, 10 are going to need replacement next year. If you have 1,000 machines, 100 are going to need replacement next year. Thus, the higher the capital stock, the more depreciation occurs. Consequently, for any given amount of gross investment, the actual addition to capital stock (net investment) becomes smaller and smaller because the amount set aside to replace depreciated capital gets bigger and bigger.

The exact answer (not required for exam purposes) is 14.9 years, obtained by solving the following equation n n for n: 7.2(1.1) = 14.4(1.05) 2 The exact answer (not required for exam purposes) is 44.7 years, obtained by solving the following equation n n for n: 6,000(1.1) = 48,000(1.05)

2009/2010

EC1301 Principles of Economics

Semester 1

Q6. D. Diminishing returns apply when you add more workers to a given amount of capital, and also when you add more capital to a given number of workers.

Q7. The 16 chosen countries are all currently developed. 3 Thus, as long as they were somewhat dissimilar in per capita income in 1870 (very likely), one is bound to get some convergence. In other words, the sample is biased towards finding convergence. If a large, more representative set of countries is used (data problems restrict most such studies to 1960 as the starting point), the best fit line turns out to be horizontal, meaning there is no relationship between 1960 real GDP per capita and growth rates after 1960. Poor countries are just as likely to grow faster, slower, or at the same speed as rich countries, and thus there is no convergence.

Q8. D. Growth accounting is concerned with accounting for past growth, not projecting into the future.

Q9. A. The other 3 choices are all unambiguously good for technological progress. But long lasting patents may be good (strong incentives for firms to innovate and create knowledge) or bad (slows down the spread of knowledge).

Q10. B. The other choices may perhaps help economic growth, but they do not involve getting incentives right. Please refer to the textbook, which gives a good account of getting incentives right.

Q11. Thailand and Myanmar are compared because they are neighbours, and have rather similar geography and culture. But Thailand turned to market orientation and openness to foreign trade and investment far earlier than Myanmar, which tried central planning instead. Thus, Thailand grew far more rapidly. Only after 1994 did Myanmar begin to open itself to foreign trade and investment.

The countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Norway, Sweden, Switzerland, United Kingdom, and United States.

2009/2010

EC1301 Principles of Economics

Semester 1

Q12. The Gapminder visual is showed in the figure below:

Botswana and Papua New Guinea are compared because they both are rich in natural resources and were extremely poor in 1960. But Botswana has had excellent political stability and rule of law, and consequently has been one of the fastest growing economies in the world over the last 50 years, demonstrating that high growth is possible even in Africa. (Note: by the mid 1990s, the AIDS epidemic began pulling down Botswanas life expectancy and raising its unemployment rate) Papua New Guinea has serious problems with political stability and corruption, and has thus not managed to take advantage of its natural resource abundance. Moral of the story: having natural resources does not help if the economic environment isnt right.

Вам также может понравиться

- Gek 1540 Tut 2 QBДокумент2 страницыGek 1540 Tut 2 QBYin HauОценок пока нет

- Laplace Transform TableДокумент3 страницыLaplace Transform TableYin HauОценок пока нет

- Thermodynamics and Its Application in RefrigerationДокумент8 страницThermodynamics and Its Application in RefrigerationYin HauОценок пока нет

- CA Lab Manual ScopeДокумент10 страницCA Lab Manual Scopea2367916100% (1)

- LSM1301Документ7 страницLSM1301Yin HauОценок пока нет

- Entropy 15 01221Документ11 страницEntropy 15 01221Yin HauОценок пока нет

- Engineers & EnvironmentДокумент8 страницEngineers & EnvironmentYin HauОценок пока нет

- Mechanical Properties and Testing of Materials Chapter 2Документ7 страницMechanical Properties and Testing of Materials Chapter 2Yin HauОценок пока нет

- Gek1540 Chapter 6Документ4 страницыGek1540 Chapter 6Yin HauОценок пока нет

- ME2142E Feedback Control Systems-CheatsheetДокумент2 страницыME2142E Feedback Control Systems-CheatsheetPhyo Wai Aung67% (9)

- Tutorial 7 Suggested AnswersДокумент4 страницыTutorial 7 Suggested AnswersYin HauОценок пока нет

- Heat Transfer Radiation Problem SetДокумент1 страницаHeat Transfer Radiation Problem SetLakshmi BalasubramaniamОценок пока нет

- MLE1101 - Tutorial 6 - Suggested SolutionsДокумент5 страницMLE1101 - Tutorial 6 - Suggested SolutionsYin HauОценок пока нет

- ME3112-PART 2 Tutorial 2 & 3: ShahrokhДокумент14 страницME3112-PART 2 Tutorial 2 & 3: ShahrokhYin HauОценок пока нет

- Heat Transfer Radiation Problem SetДокумент1 страницаHeat Transfer Radiation Problem SetLakshmi BalasubramaniamОценок пока нет

- 12 TransientДокумент39 страниц12 TransientYin HauОценок пока нет

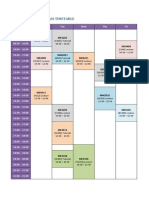

- TimetableДокумент2 страницыTimetableYin HauОценок пока нет

- ME3162 Questions PDFДокумент2 страницыME3162 Questions PDFYin HauОценок пока нет

- MLE1101 - Tutorial 1 - Suggested SolutionsДокумент5 страницMLE1101 - Tutorial 1 - Suggested SolutionsYin HauОценок пока нет

- MNO1001X Cheat SheetДокумент8 страницMNO1001X Cheat SheetYin HauОценок пока нет

- MLE1101 - Tutorial 5 - Suggested SolutionsДокумент5 страницMLE1101 - Tutorial 5 - Suggested SolutionsYin HauОценок пока нет

- Chapter 15Документ2 страницыChapter 15Yin HauОценок пока нет

- MLE1101 Tutorial 4 - Suggested Solutions AnalysisДокумент7 страницMLE1101 Tutorial 4 - Suggested Solutions AnalysisYin HauОценок пока нет

- LSM1301Документ7 страницLSM1301Yin HauОценок пока нет

- MLE1101 - Tutorial 3 - Suggested SolutionsДокумент4 страницыMLE1101 - Tutorial 3 - Suggested SolutionsYin HauОценок пока нет

- L2 - LeadershipДокумент2 страницыL2 - LeadershipYin HauОценок пока нет

- MLE1101 Tutorial 2 - Suggested Solutions for BCC Crystal Structure, Lattice Constant and Element IdentificationДокумент8 страницMLE1101 Tutorial 2 - Suggested Solutions for BCC Crystal Structure, Lattice Constant and Element IdentificationYin HauОценок пока нет

- EC1301 Mid-Term Exam Questions (09102009 - Make-Up Exam)Документ11 страницEC1301 Mid-Term Exam Questions (09102009 - Make-Up Exam)Yin Hau100% (1)

- EC1301 - Tutorial 4 (14-18 September 2009) - AnswersДокумент9 страницEC1301 - Tutorial 4 (14-18 September 2009) - AnswersYin HauОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Rupay Lounge ListДокумент2 страницыRupay Lounge ListKorean kocchaОценок пока нет

- Lecture Notes On Mathematics For Business: International School of Business, UEH, VietnamДокумент185 страницLecture Notes On Mathematics For Business: International School of Business, UEH, VietnamQuyền Nguyễn Khánh HàОценок пока нет

- Foreign-Affiliate-Issues-in-Troubled TimesДокумент17 страницForeign-Affiliate-Issues-in-Troubled TimesMelly AnastasyaОценок пока нет

- Silica Sand LOIДокумент3 страницыSilica Sand LOIJody SubiyantoroОценок пока нет

- Culture and Economy of Asia's Far EastДокумент5 страницCulture and Economy of Asia's Far EastDavid YazoОценок пока нет

- Key Theories On International Trade: Why Firms Pursue International Business?Документ5 страницKey Theories On International Trade: Why Firms Pursue International Business?Ashis KashyapОценок пока нет

- Finman Groupwork PDF FreeДокумент4 страницыFinman Groupwork PDF FreeAbegiel MendozaОценок пока нет

- ID Pembentukan Portofolio Optimal Dengan MoДокумент9 страницID Pembentukan Portofolio Optimal Dengan MoIlham AlfianОценок пока нет

- 2.2.2 Gunvor Annual Report 2020Документ84 страницы2.2.2 Gunvor Annual Report 2020Andres SerranoОценок пока нет

- Security Plus - QuestionДокумент7 страницSecurity Plus - QuestionAman DattaОценок пока нет

- Art of Answer Writing Mains Marks Booster SeriesДокумент30 страницArt of Answer Writing Mains Marks Booster SeriesAman ChouhanОценок пока нет

- Quantpedia Com Strategies Asset Class Trend FollowingДокумент7 страницQuantpedia Com Strategies Asset Class Trend FollowingToby RufeoОценок пока нет

- Unemployment, NAIRU and The Phillips CurveДокумент25 страницUnemployment, NAIRU and The Phillips Curveapi-3825580100% (3)

- Galiani - On Money PDFДокумент165 страницGaliani - On Money PDFDavid Sargsyan100% (1)

- Yale 2013 Residential Price BookДокумент68 страницYale 2013 Residential Price BookSecurity Lock DistributorsОценок пока нет

- Documents Used in International TradeДокумент31 страницаDocuments Used in International Tradeelite76Оценок пока нет

- Week 10 - UrbanizationДокумент9 страницWeek 10 - UrbanizationSami UllahОценок пока нет

- CSS Chronicles July 2021Документ84 страницыCSS Chronicles July 2021aman awaisОценок пока нет

- Introduction&Lec 1Документ45 страницIntroduction&Lec 1JayHatОценок пока нет

- BiptДокумент1 страницаBiptArputОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)hameed dec13Оценок пока нет

- Dry CleanersДокумент12 страницDry CleanersDarshan ChinnuОценок пока нет

- Dandi MarchДокумент3 страницыDandi March27911Оценок пока нет

- The Myth of Asia's Miracle Paul Krugman: A Cautionary FableДокумент17 страницThe Myth of Asia's Miracle Paul Krugman: A Cautionary Fable0shaka0Оценок пока нет

- Epcc of Ngds of Pipeline Project Procedure: Procurement PlanДокумент22 страницыEpcc of Ngds of Pipeline Project Procedure: Procurement PlanApiz Travolta100% (1)

- Perfectly Competitive Firm Decisions and EquilibriumДокумент2 страницыPerfectly Competitive Firm Decisions and Equilibriumanon_954124867Оценок пока нет

- ARaymondTinnerman 2016 Catalog 34Документ2 страницыARaymondTinnerman 2016 Catalog 34Gustavo HofstatterОценок пока нет

- CH 3 - IED - LPG - TEXT - Sandeep GargДокумент41 страницаCH 3 - IED - LPG - TEXT - Sandeep GargVishesh PandeyОценок пока нет

- FORWARD REMITTANCESДокумент6 страницFORWARD REMITTANCESSusmita JakkinapalliОценок пока нет

- Tittytainment PDFДокумент2 страницыTittytainment PDFerinОценок пока нет