Академический Документы

Профессиональный Документы

Культура Документы

Difference Equations

Загружено:

George MSenoirАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Difference Equations

Загружено:

George MSenoirАвторское право:

Доступные форматы

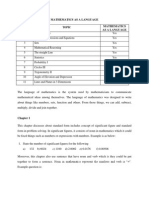

Dierence Equations for Economists

1

preliminary and incomplete

Klaus Neusser

November 22, 2012

1

c _Klaus Neusser

2

Preface

There are, of course, excellent books on dierent equations: for example,

Elaydi Elaydi (1999), Agarwal Agarwal (2000), or Galor Galor (2007). These

books do, however, not go into the specic problems faced in economics.

The books makes use of linear algebra. Very good introduction to this

topic is presented by the books of Strang Strang (2003) and Campbell and

Meyer Campbell and C.D. Meyer (1979).

Bern,

September 2010 Klaus Neusser

Contents

I Linear Deterministic Dierence Equations 5

1 Introduction 7

1.1 Notation and Preliminaries . . . . . . . . . . . . . . . . . . . . 7

2 Linear Dierence Equations 11

2.1 First Order Dierence Equation . . . . . . . . . . . . . . . . . 11

2.1.1 Amortization of a Loan . . . . . . . . . . . . . . . . . . 14

2.2 Steady State and Stability . . . . . . . . . . . . . . . . . . . . 16

2.3 Solutions to the rst order equation . . . . . . . . . . . . . . . 19

2.3.1 Examples . . . . . . . . . . . . . . . . . . . . . . . . . 21

2.4 Dierence Equations of Order p . . . . . . . . . . . . . . . . . 34

2.4.1 Homogeneous Dierence Equation of Order p . . . . . 34

2.4.2 Nonhomogeneous Equation of Order p . . . . . . . . . 37

2.4.3 Limiting Behavior of Solutions . . . . . . . . . . . . . . 37

2.4.4 Examples . . . . . . . . . . . . . . . . . . . . . . . . . 43

3 Systems of Dierence Equations 55

3.1 First Order System of Dierence Equations . . . . . . . . . . . 57

3.1.1 Homogenous First Order System of Dierence Equations 57

3.1.2 Nonhomogeneous First Order System . . . . . . . . . . 63

3.1.3 Stability Theory . . . . . . . . . . . . . . . . . . . . . 64

3.1.4 Two-dimensional Systems . . . . . . . . . . . . . . . . 67

3.1.5 Linearized Systems . . . . . . . . . . . . . . . . . . . . 78

3.2 First Order System under Rational Expectations . . . . . . . . 78

3.3 Examples . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81

3.3.1 Exchange Rate Overshooting . . . . . . . . . . . . . . 81

3.3.2 Optimal Growth Model . . . . . . . . . . . . . . . . . . 87

3.3.3 The New Keynesian Model . . . . . . . . . . . . . . . . 92

3.3.4 Sun Spots . . . . . . . . . . . . . . . . . . . . . . . . . 94

4 Singular Systems of Dierence Equations 95

3

4 CONTENTS

5 Stochastic Dierence Equation 97

5.1 The univariate case . . . . . . . . . . . . . . . . . . . . . . . . 99

5.1.1 Solution to the homogeneous equation . . . . . . . . . 99

5.1.2 Finding a particular solution . . . . . . . . . . . . . . . 100

5.1.3 Example: Cagans model of hyperination . . . . . . . 101

5.2 The multivariate case . . . . . . . . . . . . . . . . . . . . . . . 103

6 Computer Algorithms 109

A Complex Numbers 111

B Matrix Norm 115

Part I

Linear Deterministic Dierence

Equations

5

Chapter 1

Introduction

1.1 Notation and Preliminaries

A dierence equation or dynamical system describes the evolution of some

variable over time. The value of this variable in period t is denoted by X

t

.

The time index t takes on discrete values and typically runs over all integer

numbers Z, e.g. t = . . . , 2, 1, 0, 1, 2, . . . By interpreting t as the time

index, we have automatically introduced the notion of past, present and

future. A dierence equation is then nothing but a rule or a function which

instructs how to compute the value of the variable of interest in period t

given past values of that variable and time. The system may be initialized

at some point t

0

which in most cases is taken to be t

0

= 0. In this case t

runs over all natural numbers, i.e. t N.

In its most general form a dierence equation can be written as

F(X

t

, X

t1

, X

t2

, . . . , X

tp

, t) = 0 (1.1)

where F is a given function. The variable X

t

is called the endogenous or

dependent variable and is an n-vector, i.e X

t

R

n

, n 1. n is called the

dimension of the system. The dierence between the largest and the smallest

time index of the dependent variable explicitly involved is called the order of

the dierence equation. In the formulation above this is p with p 1. In the

dierence equation above the time index appears explicitly as an argument of

the function F. In this case one speaks of a nonautonomous or a time-variant

equation. If time is not a separate argument and enters only as a time index

of the dependent variable, the equation is said to be autonomous or time-

invariant. In many applications, time-variance enters the dierence equation

by replacing the time index in equation (1.1) by some variable Z

t

R

k

with

k 1. This variable is called the exogenous or independent variable.

7

8 CHAPTER 1. INTRODUCTION

With the exception of chapter 4, we will always assume that it is possible

to solve equation (1.1) uniquely for X

t

:

X

t

= f(X

t1

, X

t2

, . . . , X

tp

, t) (1.2)

The dierence equation is called normal in this case.

Given some starting values x

0

, x

1

, . . . , x

p+1

for X

0

, X

1

, . . . , X

p+1

, the

dierence equation (1.2) uniquely determines all subsequent values of X

t

, t =

1, 2, . . . , by iteratively inserting into equation (1.2).

A solution to the dierence equation is a function g : Z R

n

such that

g(t) fullls the dierence equation, e.g.

F(g(t), g(t 1), g(t 2), . . . , g(t p), t) = 0 holds for all t Z. (1.3)

The aim of the analysis is to assess the existence and uniqueness of a solu-

tion to a given dierence equation; and, in the case of many solutions, to

characterize the set of all solutions.

One way to pin down a particular solution is to require that the solution

must satisfy some boundary conditions. In this case, we speak of a boundary

value problem. The simplest way to specify boundary conditions is to require

that the solution g(t) must be equal to p prescribed values x

1

, . . . , x

p

, called

initial conditions, at given time indices t

1

, . . . , t

p

:

g(t

1

) = x

1

, . . . , g(t

p

) = x

p

. (1.4)

In this case we speak also of an initial value problem. In economics boundary

conditions also arise from the condition that lim

t

g(t) must be nite or

equal to a prescribed value, typically zero. Such terminal conditions often

arise as transversality conditions in optimal control problems.

Dierence equations, like (1.2), transform one sequence (X) = (X

t

) into

another one. The dierence equation therefore denes a function or better

an operator on the set of all sequences, denoted by R

Z

, into itself. Dening

addition and scalar multiplication in the obvious way, R

Z

forms a vector or

linear space over the real numbers. For many economic applications, it makes

sense to concentrate on the set of bounded sequences, i.e. on sequences (X

t

)

for which there exists a real number M such that |X

t

| M for all t Z.

The set of bounded sequences is usually denoted by

. It can be endowed

with a norm |.|

in the following way:

|(X)|

= sup|X

t

|, t Z

where |X

t

| denotes the Euclidean norm of X

t

in R

n

. If n = 1, |X

t

| = [X

t

[.

It can be shown that

endowed with the metric induced by this norm is

1.1. NOTATION AND PRELIMINARIES 9

a linear complete metric space or a Banach space (see, f.e., Naylor and Sell

Naylor and Sell (1982)).

For the analysis of dierence equations it is useful to introduce the lag

operator or back shift operator denoted L. This operator shifts the time index

one period into the past. The sequence (X

t

) is then transformed by the lag

operator into a new sequence (Y

t

) = L(X

t

) such that Y

t

= X

t1

. In order

to ease the notation we write LX

t

instead of L(X

t

). It is easy to see that

the lag operator is a linear operator on R

Z

. Given any two sequences (X

t

)

and (Y

t

) and any two real numbers a and b, L(aX

t

+ bY

t

) = aLX

t

+ bLY

t

=

aX

t1

+ bY

t1

. For any natural number p N, L

p

is dened as the p-times

application of L:

L

p

X

t

= LL L

. .

p-times

X

t

= X

tp

For p = 0, L

p

= I the identity operator. Thus, the action of a lag polynomial

of order p, (L) = I

1

L

2

L

2

p

L

p

on X

t

is

(L)X

t

= (I

1

L

2

L

2

p

L

p

)X

t

= X

t

1

X

t1

2

X

t2

p

X

tp

The minus signs are arbitrary. The polynomial is written in this way as this

is exactly the form in which it will appear later on.

10 CHAPTER 1. INTRODUCTION

Chapter 2

Linear Dierence Equations

with Constant Coecients

This chapter is entirely devoted to the analysis of linear nonhomogeneous

dierence equations of dimension one (n = 1) and order p 1 with constant

coecients:

X

t

=

1

X

t1

+

2

X

t2

+ +

p

X

tp

+ Z

t

,

p

,= 0, (2.1)

where

1

, . . . ,

p

are given constant real numbers. The variable Z

t

repre-

sents the non-autonomous part of the equation and usually denotes some

exogenous or independent variable which inuences the evolution of X

t

over

time.

2.1 First Order Dierence Equation

As a starting point of the analysis consider the simplest case, namely the

rst order (p = 1) linear nonhomogeneous equation:

X

t

= X

t1

+ Z

t

, ,= 0. (2.2)

To this nonhomogeneous equation corresponds a rst order linear homoge-

nous equation:

X

t

= X

t1

. (2.3)

Starting in period 0 at some initial value X

0

= x

0

, all subsequent values can

be recursively computed by iteratively inserting into the dierence equation

11

12 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

(2.3)

X

1

= x

0

X

2

= X

1

=

2

x

0

. . .

X

t

= X

t1

=

t

x

0

.

This suggests to take

X

t

=

t

c (2.4)

as the general solution of the rst order linear homogenous dierence equa-

tion (2.3). Actually, equation (2.4) provides a whole family of solutions

indexed by the parameter c R. This parameter can be pinned down using

a single boundary condition such as: X

t

0

= x

t

0

at some period t

0

. The value

of c can then be retrieved by solving the equation x

t

0

=

t

0

c for c. This leads

to the solution: c =

x

t

0

t

0

. In many instances we are given the value at t

0

= 0

so that c = x

0

.

Suppose that we are given two solutions of the homogenous equation,

(X

(1)

t

) and (X

(2)

t

). Then it is easy to verify that any linear combination of

the two solutions, a

1

(X

(1)

t

) + a

2

(X

(2)

t

), a

1

, a

2

R, is also a solution. This

implies that the set of all solutions to the homogenous equation forms a

linear space. In order to nd out the dimension of this linear space and its

algebraic structure, it is necessary to introduce the following three important

denitions.

Denition 1. The r sequences (X

(1)

), (X

(2)

), . . . , (X

(r)

) with r 1 are said

to be linearly dependent for t t

0

if there exist constants a

1

, a

2

, . . . , a

r

R,

not all zero, such that

a

1

X

(1)

t

+ a

2

X

(2)

t

+ + a

r

X

(r)

t

= 0 t t

0

.

This denition is equivalent to saying that there exists a nontrivial linear

combination of the solutions which is zero. If the solutions are not linearly

dependent, they are said to be linearly independent.

Denition 2. A set of r linearly independent solutions of the homogenous

equation is called a fundamental set of solutions.

Denition 3. The Casarotian matrix ((t) of (X

(1)

), (X

(2)

), . . . , (X

(r)

) with

r 1 is dened as

((t) =

_

_

_

_

_

X

(1)

t

X

(2)

t

. . . X

(r)

t

X

(1)

t+1

X

(2)

t+1

. . . X

(r)

t+1

.

.

.

.

.

.

.

.

.

.

.

.

X

(1)

t+r1

X

(2)

t+r1

. . . X

(r)

t+r1

_

_

_

_

_

.

2.1. FIRST ORDER DIFFERENCE EQUATION 13

These denitions allow us to the tackle the issue of the dimension of

the linear space given by all solutions to the homogenous rst order linear

dierence equation.

Theorem 1. The set of solutions to the homogenous rst order linear dif-

ference equation (2.3) is a linear space of dimension one.

Proof. Suppose we are given two linearly independent solution (X

(1)

) and

(X

(2)

). Then according to denition 1, for all constants a

1

and a

2

, not both

equal to zero,

a

1

X

(1)

t

+ a

2

X

(2)

t

,= 0

a

1

X

(1)

t+1

+ a

2

X

(2)

t+1

,= 0.

Inserting in the second inequality X

(1)

t

for X

(1)

t+1

and X

(2)

t

for X

(2)

t+1

leads to

a

1

X

(1)

t

+ a

2

X

(2)

t

,= 0

a

1

X

(1)

t

+ a

2

X

(2)

t

,= 0.

Since this must hold for any a

1

, a

2

, not both equal to zero, the determinant

of the Casarotian matrix (see denition 3)

((t) =

_

X

(1)

t

X

(2)

t

X

(1)

t

X

(2)

t

_

must be nonzero. However, det ((t) = X

(1)

t

X

(2)

t

X

(1)

t

X

(2)

t

= 0. This

is a contradiction to the initial assumption. Thus, there can only be one

independent solution.

The only independent solution is therefore given by (2.4). In section 2.4

we will give a general proof and show that the dimension of the linear space

generated by the solutions to the homogenous equation of order p is p.

Consider now two solutions of the nonhomogeneous dierence equation

(2.2), (X

(1)

t

) and (X

(2)

t

), then, as can be easily veried, (X

(1)

t

) (X

(2)

t

) sat-

ises the homogenous equation (2.3). This fact is called the superposition

principle.

1

The superposition principle implies that X

(1)

t

X

(2)

t

=

t

c which

leads to following theorem.

1

The superposition principle means that the net response of X

t

caused by two or

more stimuli is the sum of the responses which would have been caused by each stimulus

individually. In the rst order case one stimulus comes from the general solution to the

homogeneous equation, the other from the particular solution to the nonhomogeneous

equation.

14 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

Theorem 2 (Superposition Principle). Every solution, (X

t

), to the rst or-

der nonhomogeneous linear dierence equation (2.2) can be represented as

the sum of the general solution to homogenous equation (2.3), (X

(g)

t

), and a

particular solution to the nonhomogeneous equation, (X

(p)

t

):

X

t

= X

(g)

t

+ X

(p)

t

. (2.5)

The proof of this theorem is easily established and is left as an exercise to

the reader. In the case of a rst order equation X

(g)

t

=

t

c. The Superposition

Principle then implies that the solution of the rst order equation is given

by:

X

t

=

t

c + X

(p)

t

.

Below we will discuss how to obtain a particular solution. We will also

see in subsection 2.4 that this principle extends to higher order equations.

The superposition principle thus delivers a general recipe for solving linear

dierence equations in three steps:

1. Find the general solution of the homogeneous equation (X

(g)

). This is

usually a technical issue that can be resolved mechanically.

2. Find a particular solution to the nonhomogeneous equation (X

(p)

).

This step is usually more involved and requires additional (economic)

arguments. For example, we might argue that if the forcing variable Z

t

remains bounded then also X

t

should remain bounded.

3. The superposition principle (see Theorem 2) then delivers the general

solution of the nonhomogeneous equation as the sum of (X

(g)

) and

(X

(p)

). However, this solution still depends through (X

(g)

) on some

constants. To pin down the solution uniquely and therefore solving

the boundary value problem requires additional conditions. These con-

ditions can come in the form of initial values (starting values) or in

the form of requirements that the solution must obey some qualitative

feature. A typical feature in this context is boundedness, a condition

which usually can be given an economic interpretation.

Before continuing with the theoretical analysis consider the following ba-

sic example.

2.1.1 Amortization of a Loan

One of the simplest settings in economics where a dierence equation arises

naturally, is the compound interest calculation. Take, for example, the evolu-

tion of debt. Denote by D

t

the debt outstanding at the beginning of period t,

2.1. FIRST ORDER DIFFERENCE EQUATION 15

then the debt in the subsequent period t +1, D

t+1

, is obtained by the simple

accounting rule:

D

t+1

= D

t

+ rD

t

Z

t

= (1 + r)D

t

Z

t

(2.6)

where rD

t

is the interest accruing at the end of period t. Here we are using a

constant interest rate r. The debt contract is serviced by paying the amount

Z

t

at the end of period t. This payment typically includes a payment for the

interest and a repayment of the principal. Equation (2.6) constitutes a linear

nonhomogeneous rst order dierence with = 1 + r.

Given the initial debt at the beginning of period 0, D

0

, the amount of

debt outstanding in subsequent periods can be computed recursively using

(2.6):

D

1

= (1 + r)D

0

Z

0

D

2

= (1 + r)D

1

Z

1

= (1 + r)

2

D

0

(1 + r)Z

0

Z

1

. . .

D

t+1

= (1 + r)

t+1

D

0

(1 + r)

t

Z

t

Z

t

(1 + r)Z

t1

(1 + r)

t

Z

0

= (1 + r)

t+1

D

0

i=0

(1 + r)

i

Z

ti

Note how D

t+1

is determined as the sum of two parts: (1 + r)

t+1

D

0

and

t

i=0

(1 +r)

i

Z

ti

which correspond to the general solution to the homoge-

neous equation and a particular solution to the nonhomogeneous equation in

accordance with Theorem 2.

2

As the initial value of the debt is given, this

value naturally pins down the parameter c to equal D

0

.

If the repayments Z

t

are constant over time and equal to Z, as is often

the case, we can bring Z outside the summation sign and use the formula for

geometric sums to obtain:

D

t+1

= (1 + r)

t+1

D

0

_

(1 + r)

t+1

1

_

Z

r

Suppose that the debt must be completely repaid by the beginning of period

T +1, then the corresponding constant period payment Z can be calculated

by setting D

T+1

= 0 in the above equation and solving for Z.

3

. This gives:

Z =

r

1 (1 + r)

T1

D

0

2

The reader is invited to check that the second expression is really a solution to the

nonhomogeneous equation.

3

The repayments are, of course, only constant as long as D

t

> 0. Once the debt is paid

back fully, payments cease and Z = 0 from then on.

16 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

Note that the payment Z required to pay back the debt diminishes with

T. If T approaches innity Z equals rD

0

. In this case the payment is just

equal to interest accruing in each period so that there is no repayment of the

principal. In this case the debt is never paid back and equals the initial debt

D

0

in each period. If the payment Z exceeds rD

0

, the debt is repaid in a

nite amount of time.

Suppose that instead of requiring that the debt must be zero at some

point in time (including innity), we impose the condition that the present

discounted value of the debt must be non-positive as T goes to innity:

lim

T

D

T+1

(1 + r)

T+1

0 (2.7)

This condition is referred to as the no Ponzi game (NPG) condition in eco-

nomics. A Ponzi game is a scheme where all principal repayments and interest

payments are rolled over perpetually by issuing new debt.

4

If the above limit

is positive, the borrower would be able to extract resources (in present value

terms) from the lenders (See OConnell and Zeldes (1988) and the literature

cited therein for an assessment of the signicance of the NPG condition in

economics). Given the dierence equation for the evolution of debt, the NPG

condition with constant payment per period is equivalent to:

lim

T

D

T+1

(1 + r)

T+1

= lim

T

D

0

_

1 (1 + r)

T1

_

Z

r

= D

0

Z

r

0

which implies that Z rD

0

. Thus, the NPG condition holds if the constant

repayments Z are at least as great as the interest.

2.2 Steady State and Stability

Usually we are not only interested in describing the evolution of the depen-

dent variable over time, but we also want to know some qualitative proper-

ties of the solution. Just for the sake of the denition consider the nonau-

tonomous n-dimensional rst order, possibly nonlinear, dierence equation

X

t

= f(X

t1

, t) R

n

. Then we can give the following denition of an

equilibrium point.

Denition 4. A point X

R

n

is called an equilibrium point or a steady

state if it is a xed point of the function f(X, t), i.e. if X

satises the

4

Charles Ponzi was an Italian immigrant who promised to pay exorbitant returns to

investors out of an ever-increasing pool of deposits. A historic account of Ponzi games can

be found in Kindleberger (1978).

2.2. STEADY STATE AND STABILITY 17

equation

X

= f(X

, t) (2.8)

In the case of a rst order autonomous equation of dimension one, it is

convenient to represent the location of equilibrium points and the dynamics

of (X

t

) as a graph in the (X

t

, X

t+1

)-plane. For this purpose draw rst the

graph of the function y = f(x) in the (X

t

, X

t+1

) plane. Then draw the graph

of the identity function y = x which is just a line through the origin having

an angle of 45

0

with the x-axis. The equilibrium points are the points where

the 45

0

-line intersects with the graph of the function y = f(x). Starting

at some initial value X

0

= x

0

, the evolution of X

t

is then represented in

the (X

t

, X

t+1

)-plane by the following sequence of points: (0, x

0

), (x

0

, f(x

0

)),

(f(x

0

), f(f(x

0

))), (f(f(x

0

))), f(f(f(x

0

)))), . . . . Connecting these points by

line segments gives the so-called stair step or Cobweb diagram.

The logistic function with > 0

f(x) =

_

x(1 x), if 0 x 1;

0, otherwise.

(2.9)

provides an example with two steady states. The steady states are deter-

mined by the equation: X

= X

(1 X

). This leads to two steady states

given by X

= 0 and X

=

1

. Figure 2.1 shows the two steady states and

the evolution of X

t

starting at X

0

= x

0

= 0.1 and taking = 2.5.

Consider the linear rst order nonhomogeneous dierence equation where

the independent variable Z

t

is constant over time, i.e. Z

t

= Z. It is easy to

compute the steady in this simple case:

X

= X

+ Z X

=

Z

1

for ,= 1 (2.10)

For = 1, there exists no equilibrium point, unless Z = 0 in which case

every point is an equilibrium point. As the steady state fullls the dierence

equation, it is a valid candidate for a particular solution. Thus, the general

solution in this case is:

X

t

=

t

c + X

=

t

c +

Z

1

for ,= 1.

Sometimes it is convenient to rewrite the nonhomogeneous equation as a

homogeneous equation in terms of deviations from steady state, X

t

X

:

X

t

X

= (X

t1

X

)

18 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

X

t

X

t

+

1

f(x)

45

0

line

steady

state

steady

state

Figure 2.1: Equilibrium points of the logistic function: y = 2.5x(1 x) and

x

0

= 0.1

A major objective of the study of dierence equations is to analyze its be-

havior near an equilibrium point. This topic is called stability theory. In the

context of linear dierence equations the following basic concepts of stability

are sucient.

Denition 5. An equilibrium point X

is called

stable if for all > 0 there exists a

> 0 such that

|X

0

X

| <

implies |X

t

X

| < t > 0. (2.11)

If X

is not stable, its is called unstable.

The point X

is called attracting if there exists > 0 such that

|X

0

X

| < implies lim

t

X

t

= X

. (2.12)

If = , X

is called globally attracting.

The point X

is asymptotically stable or is an asymptotically stable

equilibrium point

5

if it is stable and attracting. If = , X

is called

globally asymptotically stable.

In this denition |X| denotes the norm of X R

n

. If n = 1 the norm

can be replaced by the absolute value of X.

5

In economics this is sometimes called stable

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 19

2.3 Solutions to the rst order linear dier-

ence equation

This section discusses a more systematic way of nding a particular solution

to the rst order linear dierence equation (2.2). For this purpose insert

recursively equation (2.2) into itself:

X

t

= X

t1

+ Z

t

X

t

= (X

t2

+ Z

t1

) + Z

t

=

2

X

t2

+ Z

t1

+ Z

t

. . .

X

t

=

t

X

0

+

t1

Z

1

+

t2

Z

2

+ + Z

t1

+ Z

t

=

t

X

0

+

t1

j=0

j

Z

tj

Taking the norm of the dierence between X

t

and the second term of the

right hand side of the equation leads to:

_

_

_

_

_

X

t

t1

j=0

j

Z

tj

_

_

_

_

_

=

_

_

t

X

0

_

_

= [

t

[|X

0

|

When there is a starting period as in the example of the amortization of a

loan, say period 0 without loss of generality, we stop the backwards iteration

at this period and take X

(p)

t

=

t1

j=0

j

Z

tj

as the particular solution. How-

ever in many instances there is no natural starting period so that it makes

sense to continue the above iteration into the innite past. As [

t

[ vanishes

as t if [[ < 1, this suggests to consider

X

(b)

t

=

j=0

j

Z

tj

(2.13)

as a particular solution to the equation (2.2). The superscript (b) indicates

that the solution was obtained by iterating the dierence equation backward

in time. For this to be a meaningful choice, the innite sum must be well

dened. This is, for example, the case if (Z

t

) is a bounded sequence, i.e. if

(Z)

. In particular, if Z

t

is constant and equal to Z, the above particular

solution becomes

X

(b)

t

=

j=0

j

Z =

Z

1

which is just the steady state solution described in equation (2.10) of section

2.2. The requirement that Z

t

remains bounded is, for example, violated if Z

t

20 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

itself satises the homogenous dierence equation Z

t

= Z

t1

which implies

that Z

t

=

t

c for some c ,= 0. Inserting this into equation (2.13) then leads

to

X

(b)

t

=

j=0

tj

c =

j=0

t

c =

This shows besides that besides the stability condition [[ < 1, some addi-

tional requirements with respect to the sequence of the exogenous variable are

necessary to render X

(b)

t

in equation (2.13) a meaningful particular solution.

Consider now the case [[ > 1. In this situation the above iteration is

no longer successful because X

(b)

t

in equation (2.13) is not well dened even

when Z

t

is constant. A way out of this problem is to consider the iteration

forward in time instead of backward in time:

X

t

=

1

X

t+1

1

Z

t+1

=

1

_

1

X

t+2

1

Z

t+2

_

1

Z

t+1

=

2

X

t+2

2

Z

t+2

1

Z

t+1

. . .

=

h

X

t+h

1

h

j=1

j+1

Z

t+j

for h 1.

Taking the norm of the dierence between X

t

and the second term on the

right hand side of the equation leads to:

_

_

_

_

_

X

t

+

1

h

j=1

j+1

Z

t+j

_

_

_

_

_

=

_

_

h

X

t+h

_

_

= [

h

[|X

t+h

|.

As the economy is expected to live forever, there is no end period and the

forward iteration can be carried out indenitely into the future. Because

[[ > 1, the right hand side of the equation converges to zero as h ,

provided that X

t+h

remains bounded. This suggests the following particular

solution:

X

(f)

t

=

1

j=1

j+1

Z

t+j

where the superscript (f) indicates that the solution was obtained by iter-

ating the dierence equation forward in time. For this to be a meaningful

choice, the innite sum must be well-dened. This will be guaranteed if, for

example, Z

t

remains bounded, i.e if (Z)

.

In the case [[ = 1 neither the backward nor the forward iteration strategy

leads to a sensible solution even when Z

t

is constant and equal to Z ,=

0. Either an equilibrium point does not exist as in the case = 1 or the

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 21

equilibrium point exists as is the case for = 1, but X

t

oscillates forever

between X

0

and X

0

+ Z so that the equilibrium point is unstable.

To summarize, the rst order linear dierence equation (2.2) led us to

consider the following two representations of the general solutions:

X

t

=

t

c

b

+ X

(b)

t

, whereby X

(b)

t

=

j=0

j

Z

tj

X

t

=

t

c

f

+ X

(f)

t

, whereby X

(f)

t

=

1

j=1

j+1

Z

t+j

Note that these equations imply that c

b

= X

0

X

(b)

0

, respectively that c

f

=

X

0

X

(f)

0

. Depending on the value of , we have the following situation:

[[ < 1: the backward solution is asymptotically stable in the sense that X

t

approaches X

(b)

t

as t . Any deviation of X

t

from X

(b)

t

vanishes

over time, irrespective of the value chosen for c

b

. The forward solution,

usually, makes no sense because X

(f)

t

does not remain bounded even if

the forcing variable Z

t

is constant over time.

[[ > 1: both solution have an explosive behavior due to the term

t

. Even

small deviations from either X

(b)

t

or X

(f)

t

will grow without bounds.

There is, however, one solution which remains remains bounded. It is

given by c

f

= 0 which implies that X

t

always equals its equilibrium

value X

(f)

t

.

[[ = 1: neither the backward nor the forward solution converge for constant

Z

t

,= 0.

Which solution is appropriate depends on the nature of the economic prob-

lem at hand. In particular the choice of the boundary condition requires

some additional thoughts and cannot be determined on general grounds. As

the exercises below demonstrate, the nature of the expectations formation

mechanism is sometimes decisive.

2.3.1 Examples

The simple Cobweb model

The Cobweb model, originally introduced by Moore Moore (1914) to analyze

the cyclical behavior of agricultural markets, was one of the rst dynamic

models in economics. It inspired an enormous empirical as well as theoretical

22 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

literature. Its analysis culminated in the introduction of rational expections

by Muth Muth (1961). The model, in its simplest form, analyzes the short-

run price uctuations in a single market where, in each period, the price level

is determined to equate demand and supply denoted by D

t

and S

t

, respec-

tively. The good exchanged on this market is not storable and is produced

with a xed production lag of one period. The supply decision of producers

in period t 1 is based on the price they expect to get for their product

in period t. Denoting the logarithm of the price level in period t by p

t

and

assuming a negatively sloped demand curve, the simple Cobweb model can

be summarized by the following four equations:

6

D

t

= p

t

, > 0 (demand)

S

t

= p

e

t

+ u

t

, > 0 (supply)

S

t

= D

t

(market clearing)

p

e

t

= p

t1

(expectations formation)

where u

t

denotes a supply shock. In agricultural markets u

t

represents. for

example, weather conditions. Given the naive expectations formation, p

e

t

=

p

t1

, the model can be solved to yield a linear rst order dierence equation

in p

t

:

p

t

=

p

t1

u

t

= p

t1

+ Z

t

(2.14)

where =

and Z

t

=

u

t

. Due to the negative value of , the price

oscillates: high prices tend to be followed by low prices which are again

followed by high prices. If u

t

is independent of time and equal to u, the

equilibrium price of the Cobweb model can be computed as follows:

p

=

u

+

(2.15)

The gure 2.2 depicts several possible cases depending on the relative

slopes of supply and demand. In the rst panel = 0.8 so that we have

an asymptotically stable equilibrium. Starting at p

0

, the price approaches

the steady state by oscillating around it. In the second panel = 1 so

that independently of the starting value, the price oscillates forever between

p

0

and p

1

. In the third panel, we have an unstable equilibrium. Starting at

p

0

,= p

, p

t

diverges.

6

The logarithm of the price level is taken to ensure a positive price level.

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 23

0

0

.

2

0

.

4

0

.

6

0

.

8

1

1

.

2

1

.

4

0

0

.

2

0

.

4

0

.

6

0

.

8 1

1

.

2

1

.

4

P

t

P

t + 1

P

1

P

2

P

0

P

1

s

t

e

a

d

y

s

t

a

t

e 4

5

l

i

n

e

)

p

t

+

1

(

a

)

c

o

n

v

e

r

g

e

n

c

e

(

=

1

a

n

d

=

0

.

8

)

0

0

.

2

0

.

4

0

.

6

0

.

8

1

0

0

.

1

0

.

2

0

.

3

0

.

4

0

.

5

0

.

6

0

.

7

0

.

8

0

.

9 1

P

t

P

t + 1

s

t

e

a

d

y

s

t

a

t

e

p

1

p

2

p

0

p

1

4

5

l

i

n

e

)

p

t

+

1

(

b

)

o

s

c

i

l

l

a

t

i

n

g

(

=

1

a

n

d

=

1

)

0

0

.

2

0

.

4

0

.

6

0

.

8

1

0

0

.

1

0

.

2

0

.

3

0

.

4

0

.

5

0

.

6

0

.

7

0

.

8

0

.

9 1

P

t

P

t + 1

4

5

l

i

n

e

)

p

t

+

1

s

t

e

a

d

y

s

t

a

t

e

p

0

p

1

p

2

p

1

(

c

)

e

x

p

l

o

d

i

n

g

(

=

1

a

n

d

=

1

.

1

)

F

i

g

u

r

e

2

.

2

:

P

r

i

c

e

d

y

n

a

m

i

c

s

i

n

t

h

e

c

o

b

w

e

b

m

o

d

e

l

24 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

The Solow Growth Model

Although this monograph only deals with linear dierence equations, the

local behavior of nonlinear dierence equations can be studied by linearizing

the dierence equation around the steady state. A general treatment of this

subject is postponed to until section 3.1.5. We will exemplify this technique

by studying the famous Solow (see Solow (1956)) growth model. A simple

version of this model describes a closed economy with no technical progress.

Output in period t, denoted by Y

t

, is produced with two essential production

factors: capital, K

t

, and labor, L

t

. Production possibilities of this economy

in period t are described by a neoclassical production function Y

t

= F(K

t

, L

t

).

The production function is assumed to have the following properties:

F is twice continuously dierentiable;

strictly positive marginal products, i.e.

F(K,L)

K

> 0 and

F(K,L)

L

> 0;

diminishing marginal products, i.e.

2

F(K,L)

K

2

< 0 and

2

F(K,L)

L

2

< 0;

F has constant returns-to-scale, i.e. F(K, L) = F(K, L) for all

> 0;

F satises the Inada conditions:

lim

K

F(K, L)

K

= 0, lim

L

F(K, L)

L

= 0

lim

K0

F(K, L)

K

= , lim

L0

F(K, L)

L

=

The classic example for a production function with these properties is the

Cobb-Douglas production function: F(K, L) = AK

(1)

L

, A > 0, 0 < <

1. The Inada conditions are usually not listed among the properties of a

neoclassical production function, however, they turn out to be necessary to

guarantee a strictly positive steady state.

Output can be used either for consumption, C

t

, or investment, I

t

:

Y

t

= C

t

+ I

t

. (2.16)

The economy saves a constant fraction s (0, 1) of the output. Because

saving equals investment in a closed economy, we have

I

t

= sY

t

. (2.17)

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 25

Investment adds to the existing capital stock which depreciates in each period

by constant rate (0, 1):

K

t+1

= (1 )K

t

+ I

t

= (1 )K

t

+ sY

t

= (1 )K

t

+ sF(K

t

, L

t

) (2.18)

Whereas capital is a reproducible factor of production, labor is a xed factor

of production which grows at the exogenously given constant rate > 0.

Thus, L

t

evolves as L

t+1

= (1 + )L

t

. Dividing equation (2.18) by L

t+1

and

making use of the constant returns to scale assumption results in:

k

t+1

=

K

t+1

L

t+1

=

1

1 +

k

t

+

s

1 +

f(k

t

) = g(k

t

) (2.19)

where k

t

=

K

t

L

t

denotes the capital intensity and f(k

t

) = F

_

K

t

L

t

, 1

_

.

The economy starts in period zero with an initial capital intensity k

0

> 0.

The nonlinear rst order dierence equation (2.19) together with the initial

condition uniquely determines the evolution of the capital intensity over time,

and consequently of all other variables in the model. Note that the concavity

of F is inherited by f and thus by g so that we have g

> 0 and g

< 0.

Moreover, lim

k0

g(k) = 0 and lim

k

g(k) = .

The nonlinear dierence equation has two steady states. The rst one is

given by zero because g(0) = 0. This point is of no economic signicance.

The existence and uniqueness of the second strictly positive steady state can

be deduced from the following properties of g(.): g(0) = 0, lim

k0

g

(k) =

, lim

k

g

(k) =

1

1+

< 1, and g

(k) > 0. These properties ensure that

the function g is suciently steep at the origin and becomes eventually at

enough to cross the 45-degree line once. The situation is described by gure

2.3. Note that the derivative g

(k

) must be smaller than one for g to cross

the 45-degree line.

The asymptotic stability of k

is easily established by observing that (k

t

)

is monotonically increasing for k

0

(0, k

) and monotonically decreasing

for k

0

> k

. Thus, (k

t

) converges monotonically to k

independently of the

initial value k

0

> 0.

The local behavior of (k

t

) around the steady state can be analyzed by

linearizing the function g around its steady state by a rst order Taylor

approximation:

k

t+1

k

+

g(k)

k

k=k

(k

t

k

) (2.20)

We can therefore study the local behavior of the nonlinear dierence equa-

tion (2.19) around the steady state by the rst order homogenous dierence

equation:

k

t+1

k

= (k

t

k

) (2.21)

26 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

0 0.05 0.1 0.15 0.2 0.25 0.3

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

capital intensity

c

a

p

i

t

a

l

i

n

t

e

n

s

i

t

y

steady state

k

*

k

*

45degree line

g(k)

linearized g(k) function

Figure 2.3: Capital Intensity in the Solow Model

where 0 < =

g(k)

k

k=k

< 1. Starting in period zero with an initial

capital intensity k

0

> 0, the solution to this initial value problem is: k

t

=

k

+

t

(k

0

k

). As 0 < < 1, the steady state k

is asymptotically stable.

That the original nonlinear dierence equation and the linearized version

deliver the same conclusion with respect to the stability of the equilibrium

point is not specic to the example just discussed. In particular, the following

theorem holds:

Theorem 3. Let X

be an equilibrium point of the nonlinear autonomous

dierence equation

X

t+1

= f (X

t

)

where f is continuously dierentiable at X

. Then

1. If [f

(X

)[ < 1, then X

is an asymptotically stable equilibrium point.

2. If [f

(X

)[ > 1, then X

is unstable.

Proof. The proof follows Elaydi (Elaydi, 1999, 2728). Suppose that [f

(X

)[

M < 1. Then, because of the continuity of the derivative, there exists an

interval J = (X

, X

+ ), > 0, such that [f

(X)[ M < 1 for all

X J. For X

0

J,

[X

1

X

[ = [f (X

0

) f (X

)[

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 27

The mean value theorem then implies that there exists , X

0

< < X

, such

that

[f (X

0

) f (X

)[ = [f

()[ [X

0

X

[ .

Hence we have

[X

1

X

[ M[X

0

X

[ .

This shows that X

1

is closer to X

and is thus also in J because M < 1. By

induction we therefore conclude that

[X

t

X

[ M

t

[X

0

X

[ .

For any > 0, let

= min, then [X

0

X

[ <

implies [X

t

X

[ <

for all t 0. X

is therefore a stable equilibrium point. In addition, X

is attractive because lim

t

[X

t

X

[ = 0. Thus, X

is asymptotically

stable.

The case [f

(X

)[ = 1 is not treated by this theorem. It involves a more

detailed analysis which can be found in (Elaydi, 1999, 2932).

A model of equity prices

Consider an economy where investors have two assets at their disposal. The

rst one is a riskless bank deposit which pays a constant interest rate r > 0

in each period. The second one is a common share which gives the owner the

right to a known dividend stream per share. The problem is to gure out

the share price p

t

as a function of the dividend stream (d

t+h

)

h=0,1,...

and the

interest rate r. As we abstract from uncertainty in this example, arbitrage

ensures that the return on both investments must be equal. Given that the

return on the investment in the share consists of the dividend payment d

t

and the expected price change p

e

t+1

p

t

, this arbitrage condition yields:

r =

d

t

+ p

e

t+1

p

t

p

t

p

e

t+1

= (1 + r)p

t

d

t

(2.22)

where p

e

t+1

denotes the price expected to prevail in the next period. Assuming

that expectations of the investors are rational which is equivalent to assum-

ing perfect foresight in the context of no uncertainty, the above arbitrage

equation turns into a simple rst order dierence equation:

p

t+1

= (1 + r)p

t

d

t

(2.23)

with = 1 + r and Z

t

= d

t1

. Because = 1 + r > 1, we can disregard

the backward solution as the innite sum will not converge for a constant

28 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

dividend stream. Turning to the forward solution, we note that X

(f)

t

is well

dened even for a constant dividend stream. In this case the particular

solution X

(f)

t

is nothing but the present discounted value of the dividend

stream. Thus, we envision the following general solution to the dierence

equation (2.23):

p

t

= (1 + r)

t

c

f

+ X

(f)

t

=

_

p

0

X

(f)

0

_

(1 + r)

t

+ X

(f)

t

(2.24)

where X

(f)

t

= (1 + r)

1

j=0

(1 + r)

j

d

t+j

. The term (1 + r)

t

c

f

is usually

called the bubble term because its behavior is unrelated to the dividend

stream; whereas the term X

(f)

t

is referred to as the fundamentals because it

is supposed to reect the intrinsic value of the share.

Remember that we want to gure out the price of a share. Take period

0 to be the current period and suppose that c

f

= p

0

X

(f)

0

> 0. This

means that the current stock price is higher than what can be justied by

the future dividend stream. According to the arbitrage equation (2.22) this

high price (compared to the dividend stream) can only be justied by an

appropriate capital gain, i.e. an appropriate expected price increase in the

next period. This makes price in the next period even more dierent from the

fundamentals which must be justied by an even greater capital gain in the

following period, and so on. In the end the bubble term takes over and the

share price becomes almost unrelated to the dividend stream. This situation

is, however, not sustainable in the long run.

7

Therefore the only reasonable

current share price p

0

is X

(f)

0

. This eectively eliminates the bubble term

and we are left with the solution:

p

t

= X

(f)

t

= (1 + r)

1

j=0

(1 + r)

j

d

t+j

(2.25)

Thus, the price of a share always equals the present discounted value of the

corresponding dividend stream. Such a solution is reasonable in a situation

with no uncertainty and no information problems. Note this solution implies

that the price immediately responds to any change in the expected dividend

stream. The eect of a change in d

t+h

, h = 0, 1, 2, . . . on p

t

is given by

p

t

d

t+h

= (1 + r)

h1

h = 0, 1, . . .

Thus, the eect diminishes the further the change takes place in the future.

Consider now a permanent change in dividends, i.e. a change where all

7

A similar argument applies to the case c

f

= p

0

X

(f)

0

< 0.

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 29

dividends increase by some constant amount d. The corresponding price

change p

t

equals:

p

t

= (1 + r)

1

j=0

(1 + r)

j

d =

d

r

Similarly a proportional increase of all dividends would lead to the same pro-

portional increase in the share price. These comparative exercises demon-

strate that the rational expectations solution which eliminates the bubble

term makes sense.

Cagans model of hyperination

In periods of hyperination the price level rises by more than 50 percent a

month. As these periods are usually rather short lived, they can serve as

a laboratory for the study of the relation between money supply and the

price level because other factors like changes in real output can be ignored.

Denoting by m

t

the logarithm of the money stock in period t and by p

t

the

logarithm of the price level in period t, the model rst proposed by Cagan

(1956) consists of the following three equations.

8

m

d

t

p

t

= (p

e

t+1

p

t

), < 0 (money demand)

m

s

t

= m

d

t

= m

t

(money supply)

p

e

t+1

p

t

= (p

t

p

t1

), > 0 (adaptive expectations)

The rst equation is a money demand equation in logarithmic form. It

relates the logged demand for the real money stock, m

d

t

p

t

, where the

superscript d stands for demand, to the rate of ination expected to prevail

in period t + 1, p

e

t+1

p

t

, where the superscript e stands for expectation.

This relation is negative because households and rms want to hold less

money if they expect the real value of money to deteriorate in the next

period due to high ination rates. Thus, < 0. In this model the central

bank perfectly controls the money stock and sets it independently of the

development of the price level. The model treats the logarithm of the supply

of the money stock, m

s

t

, where the the superscript s stands for supply, as

exogenous. The money stock injected in the economy is completely absorbed

by the economy so that in each point in time the supply of money equals

the demand of money. Combining the rst two equation, i.e. replacing m

d

t

by m

t

in the rst equation, leads to a portfolio equilibrium condition. As

we will see the behavior of the model depends crucially on the way in which

8

See also the analysis in Sargent (1987).

30 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

expectations are modelled. Following the original contribution by Cagan, we

postulated that expectations are formed adaptively, i.e. agents form their

expectations by extrapolating past ination. The third equation postulates

a very simple adaptive expectation formation scheme: ination expected

to prevail in the next period is just proportional to the current ination.

Thereby the proportionality factor is assumed to be positive, meaning that

expected ination increases if current ination increases. Combining all three

equation of the model and solving for p

t

, we arrive at the following linear

nonhomogeneous rst order dierence equation.

p

t

=

1 +

p

t1

+

1

1 +

m

t

= p

t1

+ Z

t

(2.26)

where =

1+

and where Z

t

=

1

1+

m

t

.

From our previous discussion we know that the general solution of this

dierence equation is given as the sum of the general solution to the ho-

mogenous equation and a particular solution, p

(p)

t

, to the nonhomogeneous

equation:

p

t

=

t

c + p

(p)

t

One particular solution can be found by recursively inserting into equation

(2.26):

p

1

= p

0

+ Z

1

p

2

= p

1

+ Z

2

=

2

p

0

+ Z

1

+ Z

2

. . .

p

t

=

t

p

0

+

t1

Z

1

+

t2

Z

2

+ + Z

t1

+ Z

t

=

t

p

0

+

t1

i=0

i

Z

ti

This is again an illustration of the superposition principle. The logged price

in period t, p

t

, is just the sum of two components. The rst one is a function

of p

0

whereas the second one is a weighted sum of past logged money stocks.

In economics there is no natural starting period so that one may iterate the

above equation further, thereby going back into innite remote past:

p

t

= lim

i

t

p

ti

+

i=0

i

Z

ti

From a mathematical point of view this expression only makes sense if the

limit and the innite sum converge. Thus, additional assumptions are re-

quired. Suppose that logged money remained constant, i.e. m

t

= m < for

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 31

all t, then the logic of the model suggests that the logged price level should

remain nite as well. In mathematical terms this means that

i

should

converge. This is, however, a geometric sum so that convergence is achieved

if and only if

[[ =

1 +

< 1 (2.27)

Assuming that this stability condition holds, the general solution of the dif-

ference equation (2.26) implied by the Cagan model is:

p

t

=

t

c +

i=0

i

Z

ti

(2.28)

where the constant c can be computed from some boundary condition.

The stability condition therefore has important consequences. First, irre-

spective of the value of c, the rst term of the solution (the general solution

to the homogenous equation),

t

c, becomes less and less important as time

unfolds. Thus, for a large enough t, the logged price level will be dominated

by the particular solution to the nonhomogeneous equation,

i=0

i

Z

ti

. In

this innite sum, the more recent values of the money stock are more impor-

tant for the determination of the price level. The importance of past money

stocks diminishes as one goes further back into the past. Third, suppose

that money stock is increased by a constant percentage point, m, in every

period, then the eect on the logged price level, p

t

is given by

p

t

=

i=0

i

_

1

1 +

m

_

=

1

1

1

1 +

m = m.

Thus, the price level moves up by the same percentage point. Such a once-

and-for-all change is termed a permanent change. In contrast a transitory

change is a change which occurs only once. The eect of a transitory change

of m

t

by m in period t on the logged price level in period t + h for some

h 0 is given by

p

t+h

=

h

1

1 +

m =

_

1 +

_

h

1

1 +

m

The values

p

t+h

m

seen as a function of h 0 are called the impulse response

function. It gives the reaction of the logged price level over time to a transi-

tory change of the logged money stock. As is clear from the above formula,

the stability condition implies that eect on the logged price level dies out

exponentially over time. Usually the impulse response function is plotted as

a function of h as in gure 2.4 below.

32 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

0 2 4 6 8 10 12 14 16 18 20

2

1.5

1

0.5

0

0.5

1

1.5

2

h

Figure 2.4: Impulse response function of the Cagan model with adaptive

expectations taking = 0.5 and = 0.9

The character of the model changes dramatically if rational expectations

are assumed instead of adaptive expectation. In the context of a deterministic

model this amounts to assuming perfect foresight. Thus, the third equation

of the model is replaced by

p

e

t+1

= p

t+1

(2.29)

With this change the new dierence equation becomes:

p

t+1

=

1

p

t

+

m

t

= p

t

+ Z

t

(2.30)

with Z

t

= m

t

/. As =

1

> 1, the stability condition is violated. One

can nevertheless nd a meaningful particular solution of the nonhomogeneous

equation by iterating the dierence equation forwards in time instead of

backwards:

p

t

=

1

p

t+1

1

Z

t

=

1

_

1

p

t+2

1

Z

t+1

_

1

Z

t

=

2

p

t+2

2

Z

t+1

1

Z

t

. . .

=

h

p

t+h

1

h1

i=0

i

Z

t+i

for h > 0

2.3. SOLUTIONS TO THE FIRST ORDER EQUATION 33

The logged price level in period t, p

t

, now depends on some expected logged

price level in the future, p

t+h

, and on the development of logged money

expected to be realized in the future. Because the economy is expected to

live forever, this forward iteration is carried on into the innite future to

yield:

p

t

= lim

h

h

p

t+h

i=0

i

Z

t+i

As 0 <

1

< 1, the limit and the innite sum are well dened, provided

that the logged money stock remains bounded. Under the assumption that

the logged money stock is expected to remain bounded, the economic logic

of the model suggests that the logged price level should remain bounded as

well. This suggests the following particular solution to the nonhomogeneous

equation:

p

(p)

t

=

1

i=0

i

Z

t+i

by the superposition principle the general solution of the nonhomogeneous

dierence equation (2.30) is:

p

t

=

t

c + p

(p)

t

=

t

c

1

i=0

i

Z

t+i

(2.31)

Due to the term

t

c, the logged price level growth exponentially without

bound although the logged money stock may be expected to remain bounded,

unless c = 0.

To summarize, the Cagan model suggests the following two solutions:

p

t

=

t

c

b

+ p

(b)

t

, whereby p

(b)

t

=

i=0

i

Z

ti

p

t

=

t

c

f

+ p

(f)

t

, whereby p

(f)

t

=

1

i=0

i

Z

t+i

Which of the two solutions is appropriate depends on the value of . If

[[ < 1 only the rst solution delivers sensible paths for p

t

, i.e. paths which

do not explode for bounded values of Z

t

. However, we have a whole families

of paths parametrized by the constant c

b

. Only when we chose a particular

initial value for p

t

0

for some t

0

, or equivalently a value for c

b

, will the price

path be uniquely determined. In this sense, we can say that the price level

is indeterminate. In the case [[ > 1 which is implied by the assumption

of rational expectations, only the second solution is meaningful because it

34 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

delivers a well-dened particular solution for bounded Z

t

s. However, the

general solution to the homogenous equation implies an exploding price level

except for c

f

= 0. Thus, there is only one non-exploding solution in this case:

p

t

= p

(f)

t

. The price level therefore equals in each period its steady state level.

The assumption of rational expectations together with the assumption that

a bounded forcing variable should lead to a bounded price path pinned down

a unique solution. Thus, the price level is determined without the need of

an initial condition.

2.4 Dierence Equations of Order p

We now turn to the general case represented by equation (2.1). As can

be easily veried if (X

(1)

t

) and (X

(2)

t

) are two particular solutions of the

nonhomogeneous equation, (X

(1)

t

) (X

(2)

t

) is a solution to the homogeneous

equation:

X

t

=

1

X

t1

+

2

X

t2

+ +

p

X

tp

,

p

,= 0. (2.32)

Thus, the superposition principle stated in Theorem 2 also holds in the gen-

eral case: the general solution to the nonhomogeneous equations can be

represented as the sum of the general solution to the homogeneous and a

particular solution to the nonhomogeneous equation. Thus, we begin the

analysis of the general case by an investigation of the homogeneous equa-

tion.

2.4.1 Homogeneous Dierence Equation of Order p

In order to nd the general solution of the homogeneous equation, we guess

that it will be of the same form as in the rst order case, i.e. of the form

c

t

, c ,= 0. Inserting this guess into the homogeneous equation (2.32), we get:

c

t

=

1

c

t1

+

2

c

t2

+ +

p

c

tp

which after cancelling out c, dividing by

t

and substituting z for

1

leads to:

1

1

z

2

z

2

p

z

p

= 0 (2.33)

This equation is called the characteristic equation of the homogeneous equa-

tion (2.32). Thus, in order for c

t

to be a solution to the homogeneous

equation z =

1

must be a root to the characteristic equation (2.33). These

roots are called the characteristic roots. Note that the assumption

p

,= 0

implies that none of the characteristic roots is equal to zero.

2.4. DIFFERENCE EQUATIONS OF ORDER P 35

From the Fundamental Theorem of Algebra we know that there are p,

possibly complex, roots to the characteristic equation. Denote these roots

by z

1

, . . . , z

p

and there corresponding

s by

1

, . . . ,

p

. To facilitate the

discussion consider rst the standard case where all p roots are distinct.

distinct roots

In this case we have the following theorem.

Theorem 4. If all the roots of the characteristic equation are distinct, the

set

t

1

, . . . ,

t

p

forms a fundamental set of solutions.

Proof. It suces to show that det ((t) ,= 0 where ((t) is the Casarotian

matrix of

t

1

, . . . ,

t

p

.

det ((t) = det

_

_

_

_

_

t

1

t

2

. . .

t

p

t+1

1

t+1

2

. . .

t+1

p

.

.

.

.

.

.

.

.

.

.

.

.

t+p1

1

t+p1

2

. . .

t+p1

p

_

_

_

_

_

=

t

1

t

2

. . .

t

p

det

_

_

_

_

_

1 1 . . . 1

1

2

. . .

p

.

.

.

.

.

.

.

.

.

.

.

.

p1

1

p1

2

. . .

p1

p

_

_

_

_

_

This second matrix is called the Vandermonde matrix whose determinant

equals

1i<jp

(

j

i

) which is dierent from zero because the roots are

distinct. Thus, det ((t) ,= 0, because the roots are also dierent from zero.

The above Theorem thus implies that the general solution to the homo-

geneous equation X

(g)

t

is given by

X

(g)

t

= c

1

t

1

+ c

2

t

2

+ + c

p

t

p

(2.34)

multiple roots

When the roots of the characteristic equation are not distinct, the situa-

tion becomes more complicated. Denote the r distinct roots by z

1

, , z

r

,

r < p, and their corresponding multiplicities by m

1

, , m

r

. Writing the

homogeneous dierence equation in terms of the lag operator leads to

(1

1

L

p

L

p

) X

t

= (1

1

L)

m

1

(1

2

L)

m

2

(1

r

L)

m

r

X

t

= 0

(2.35)

36 CHAPTER 2. LINEAR DIFFERENCE EQUATIONS

where

i

, 1 i r equals

1

z

i

. In order to nd the general solution we will

proceed in several steps. First note if

t

is a solution to

(1

i

L)

m

i

t

= 0 (2.36)

it is also a solution to (2.35). Second, (

i

=

t

i

, t

t

i

, t

2

t

i

, , t

m

i

1

t

i

is

a fundamental set of solutions for equation (2.36). Before we prove this

statement in Lemma 2, we need the following lemma.

Lemma 1. For all k 1

(1 L)

k

t

s

= 0, 0 s < k

Proof. The application of the operator 1 L on t

s

leads to a polynomial of

degree s 1, because the term t

s

cancels in (1 L)t

s

= t

s

(t 1)

s

and only

terms of degree smaller than s remain. Applying 1 L again reduces the

degree of the polynomial again by one. Finally, (1L)

s

t

s

leads to a constant.

Thus, (1 L)

s+1

t

s

= 0. This proves the lemma because further applications

of 1 L will again result in zero.

Lemma 2. The set (

i

=

t

i

, t

t

i

, t

2

t

i

, , t

m

i

1

t

i

represents a fundamental

set of solutions to the equation (2.36).

Proof. Take s, 1 s m

i

1, then

(1

i

L)

m

i

(t

s

t

i

) =

t

i

(1 L)

m

i

t

s

= 0

because (1L)

m

i

t

s

= 0 according to Lemma 1.

9

Therefore t

s

t

i

is a solution to

(2.36). The set (

i

is linearly independent because the set 1, t, t

2

, , t

m

i

1

is linearly independent.

It is then easily seen that ( =

r

i=1

(

i

is a fundamental set of solutions

to the equation (2.35). Thus, the general solution can be written as

X

t

=

r

i=1

_

c

i0

+ c

i1

t + c

i2

t

2

+ + c

i,m

i

1

t

m

i

1

_

t

i

(2.37)

9

Here we made use of the relation p(L)(

t

i

g(t)) =

t

p(

i

L)g(t) where p(L) is a lag

polynomial and g is any discrete function.

2.4. DIFFERENCE EQUATIONS OF ORDER P 37

2.4.2 Nonhomogeneous Equation of Order p

As in the case of homogeneous dierence equations of order one, the set of

all solutions forms a linear space. The dimension of this space is given by the

order of the dierence equation, i.e. by p. Consider now two solutions, (X

(1)

)

and (X

(2)

) of the nonhomogeneous equation. It is easy to verify that (X

(1)

)

(X

(2)