Академический Документы

Профессиональный Документы

Культура Документы

Mailbag: Q&A On Ukraine, US Equities, Emerging Markets, Puerto Rico, Bitcoin and Hedge Funds

Загружено:

cangeluИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mailbag: Q&A On Ukraine, US Equities, Emerging Markets, Puerto Rico, Bitcoin and Hedge Funds

Загружено:

cangeluАвторское право:

Доступные форматы

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

Mailbag: Q&A on Ukraine, US equities, emerging markets, Puerto Rico, Bitcoin and hedge funds This week, answers to 5 questions we have received on markets and investments. Before we begin, some information on the Ukraine and the Russian occupation of Crimea. Note below the high concentration of ethnic Russians on the Crimean peninsula (in part a by-product of the Red Army deporting Crimean Tatars after their collaboration with Germany during WWII; some have since returned, but only make up 12% of the Crimean population). In the 1950s, when Crimea was given to the Ukraine, it was probably seen as little more than a book-keeping entry by the Soviet Union given the control it exercised over its Republics. Crimea is also home to the Russian Black Sea fleet in Sevastopol, whose port is leased from the Ukraine through 2042.

Sources: Ukrainian 2001 Census, Wikimedia Commons

Crimea

Crimea

In this regard, Crimea (when considered separately from the Ukraine) looks different from other former Soviet Republics. While Russian language usage is high in many of these countries, the percentage of ethnic Russians tells a different story in terms of the size of the Russian diaspora.

Latvia Kazakh Estonia Ukraine Belarus Moldova Kyrgyz Azerbai Georgia Lithuania Uzbekis Turkmen % Russian ethnicity 27% 26% 24% 17% 11% 9% 9% 7% 6% 6% 6% 4% % actively using Russian language 58% 67% 39% 61% 78% 57% 29% 25% 37% 22% 20% 4% Sources: Country census reports, Temple University. 2008. Tajikis Armenia 1% 1% 17% 30%

It is difficult to know what happens from here; no one knows what Russias intentions are beyond Crimea. You will find comparisons to Germanys 1938 annexation of the Sudetenland in the press, 1 and there are risks of greater escalation . Our contacts that specialize on defense and military issues tell us that (as in 1938) the chances of European or US military support for the Ukraine are very low. The US is considering economic sanctions on the Russian government and its banks, and the State Department has drafted a list of Russian assets held abroad that could possibly be frozen, but that is all we have heard so far. For investors, this episode is likely to bring even more scrutiny on the pricing of emerging markets assets, the rising risks of a recession in Russia (growth is only running a little over 1% as things stand now), and the geopolitical risks facing countries like Turkey. As for Europe specifically, Russia controls the natural gas pipelines that cross the Ukraine and provide much of its energy, reducing EU leverage below whatever might have existed in the first place. One interesting thing to watch: the debate over US LNG exports. We wrote last year that we expect project approval to proceed very slowly, but there could be an acceleration of approvals if the US decided that it wanted to try and reduce the energy-related leverage that Russia has over its European natural gas customers.

1

We also do not know the degree of any Bay of Pigs issues in play, i.e., the extent to which Ukrainians acted out of the belief that Western powers would financially and militarily support them.

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

Are US equity markets too expensive to own? No, but theyre not cheap anymore, and small cap is getting more expensive. During the equity rally of 2009-2013, P/E multiples rose despite intermittent weakness in GDP and 2 corporate profits. With the exception of the late 1990s, US large cap P/Es are now edging toward the higher end of mid-cycle valuations. If so, future investor returns in equities may be more closely linked to earnings growth (which we expect to be in high single digits), and the success of active equity managers versus benchmarks. As one marker, consensus earnings growth expectations for 2014 have fallen from 11% last summer to around 9%. Small cap valuations look more expensive now, even when using 2014 consensus earnings estimates of 20%. From an historical perspective, 20% is not unreasonable; from 2003-2007, 3% GDP growth resulted in 20%-25% annual small cap earnings growth, and the same was true in the mid-1990s. But this is not a normal earnings environment: top-line revenue growth is weaker than usual, and earnings have been boosted by weakness in labor, interest and energy costs. Using a 10% earnings growth assumption instead, small cap valuations look more elevated. Given the worst winter/snowfall disruption in 35+ years, some US economic weakness appears weather-related, and I expect some catch-up in the spring. However, some of the weaker data (housings response to higher interest rates last fall) pre-dated cold weather, and the weather theory itself will take a couple of quarters to validate, leaving markets vulnerable to the kind of ups and downs we have seen so far this year. Theres a reason that we depicted markets as taking a pitstop on the cover of the 2014 Outlook; after a fantastic run, markets may need more proof of the good news thats currently priced in.

S&P 500 forward price to earnings ratio

Multiple

30x

3

Small cap valuations

Multiple, forward P/E of Russell 2000

24x 21x 18x

See footnote

Assuming 10% 2014 EPS 20% 2014 EPS

24x

18x

15x

12x

12x 9x 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 Source: BofA Merrill Lynch, Russell Investment Group. January 2014.

6x 1985

1989

1993

1997

2001

2005

2009

2013

Source: Datastream. February 2014.

P/Es look higher when stripping out the tech sector, which trades as a discount to its history. We wrote about this on June 24, 2013. The difference between the haves and have-nots in tech is more extreme than in other sectors (when measured by dispersion of revenue growth), and the disruption from cloud/mobile computing has negatively affected some companies. A model forecasting P/Es based on revenues, earnings, dividend yield, margins, RoE, RoA, etc. shows that tech P/Es are more rational than they might appear at first glance, with the results showing that investors pay for growth. We separately looked at size, and found that todays large tech companies are twice as big relative to the overall economy as they were during the 1990s. This may also explain lower overall P/Es on tech stocks than in the past.

3

The spikes in small cap P/Es indicate the two ways that P/Es can run ahead of market fundamentals. In the first episode in Q1 2000, small cap stocks sky-rocketed while earnings estimates were stable. In Q4 2001, small cap stocks staged a relief rally after 9/11 while earnings estimates were still falling sharply.

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

Are emerging market equities very cheap yet? Short answer: No. If you own little and plan to own some, slowly averaging into a position avoids the need to pick the bottom.

Big 4 EM debtor nation equities have fallen by ~15% in US$ terms since December 2012. However, we have only seen a modest decline in their P/Es since earnings expectations have fallen almost as fast as equity markets have. On a technical basis, the second chart looks at the number of EM sectors (there are 62 of them) trading below their 2-year moving averages. Distress on this kind of chart typically looks more like 80%-90% than the current 55%, so this is not a sign of capitulation.

EM debtor nations trade at higher multiples than surplus nations, P/E multiple,12-month forward

12.5x 12.0x 11.5x 11.0x 10.5x 10.0x 9.5x 9.0x 60% 40%

Sectors trading below their 2-year moving averages

Percent of 62 MSCI EM sectors

100%

Brazil, India, Indonesia and Turkey

80%

Rest of the Emerging Markets

20% 0% 1997 2001 2005 2009 Source: MSCI, BCA Research, JPMS LLC. February 2014.

8.5x Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Source: MSCI. JPMS LLC. January 2014. Sector neutral P/Es used. The rest of the emerging markets are the other countries in the MSCI EM Equity Index.

2013

As for return on equity, while the trend in the US has been improving, EM trends have been weaker. I am not sure that all of this is cyclical; our Chief Economist Michael Vaknin has done some interesting research suggesting that the US outsourcing cycle may have hit some kind of limit (see Appendix on % of US consumption goods based on imports). As for the latest news, debtor nation interest rates 4 are still rising and negatively impacting retail sales, employment and capital spending. While current accounts are improving in India (due in part to a collapse in gold imports), there is still more to go in the other EM debtor nations. It feels like we are at least a few months away from some kind of economic stabilization. Consider averaging in if your positions are well below targeted levels, since it will be difficult to pick the bottom.

Return on equity

ROEs for S&P 500 vs. MSCI Emerging Markets

18% 16% 14% 12% 10% 8% 6% 4% 2% 2002 2004 2006 2008 2010 2012 14%

EM debtors experience rising rates

Percent, average of Brazil, India, Indonesia, and Turkey

22% 10.5% 20% 10.0% 18% 16%

S&P 500

9.5% 9.0% 8.5% 8.0% 7.5% 7.0% 6.5%

5-year interest rates

MSCI EM

12% 10% 8% 2014

1-year interest rates

Source: MSCI, Bloomberg, JPMS LLC. January 2014.

6.0% 2011 2012 Source: Bloomberg. February 2014.

2013

2014

To me, the speed of increase in debt is more relevant than the level of debt. After China, countries like Turkey and Brazil lead the pack in terms of EM private sector debt growth since 2008. Petrobras (arguably the worlds most indebted and highly leveraged major oil company) presents a related challenge for Brazil: based on its current cash flow and expenditure plans, it would need to borrow $20 billion per year.

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

Will the Commonwealth of Puerto Rico default? If the CPR can execute a critically important ~$3 bn bond offering this month, it should get two years of breathing room, but the long run does not look good. My experience tells me that a country whose population and employment are falling will eventually hit the wall, since income growth may never catch up to rising debt service, even if the country slashes spending. Heres an outline of the situation in the Commonwealth of Puerto Rico (CPR): The CPR has been in recession for 7 years, in part a consequence of manufacturing incentives for the US pharmaceutical industry expiring in 2006 (some companies have since decamped to Singapore and Ireland). The government is the largest employer by a large margin, and ~45% of CPR citizens live below the poverty line; this compares to 22% in the worst US state (Mississippi). With its $70 billion in debt (85% of which are revenue bonds), the CPR debt to GDP ratio is ~70%, which is a high for a country whose cost of debt is much higher than its growth rate. Thats also recorded debt; its pensions are abysmally funded at the 5%-20% level. The ratio of active to retired workers in the Employee Retirement System is around 1.1x (e.g., very low). Some good news: CPR debt maturities are back-loaded, with only 9% maturing within the next 3 years. If the CPR issues $3 billion in March, it should obtain a couple of years of breathing room before the next round of maturities. It remains to be seen what terms are required to get buyers interested. Long maturity, uninsured CPR general obligation debt is trading at 65-70 cents on 5 the dollar with a 7.5% yield , so new issue buyers may have to be incented with higher yields and/or sub-par issue prices. The new CPR bond reportedly offers investors a New York jurisdiction of issuance; if markets ascribe value to it, what does that suggest about options the CPR has regarding its domestically issued debt? [Holding local law Greek debt made bondholders more susceptible to legal maneuvers that compelled their participation in a debt exchange that resulted in substantial debt forgiveness; UK-jurisdiction Greek debt was paid in full]. The CPR has been scrambling to get to a balanced budget from a 5% deficit: spending cuts, corporate tax hikes, airport privatization, a plan to reduce oil-fired electricity in favor of cheaper natural gas (the CPR gets 68% of electricity from oil), draconian cuts to pension benefits and a shift to defined contribution for future retirees. Some of these steps put downward pressure on GDP, so their medium-term impact on debt sustainability is unclear. Rating agencies expect that it will take 1-2 years to achieve a balanced budget, a year longer than the CPRs timeframe.

Puerto Rico in recession since 2006

Y/Y % change, Puerto Rican fiscal year (July-June)

6% 4% 2% 0% -2%

CPR: population decline

Population, index, 2001 = 100

106 104 102 100 98

U.S. (real GDP)

U.S. Worst U.S. State (Michigan) Puerto Rico

Puerto Rico (real GNP)

96

94 -4% 1990 1993 1996 1999 2002 2005 2008 2011 2014 92 1990 1993 1996 1999 2002 2005 Source: Planning Board, Government Development Bank. Estimates based on high f requency government data. February 2014. Source: United Nations, U.S. Census Bureau. 2013.

2008

2011

J.P. Morgan Securities has published extensively on the important differences between various CPR issuers: different collateral (e.g., sales taxes, essential service utility revenues), guarantors (~25% are insured by third parties), and overlays (some are hedged with interest rate swaps that are out of the money). The February ratings downgrade to BB does allow some investors to accelerate debt and require additional collateral, so total debt is a moving target. Theres language in the CPR constitution that prioritizes bondholders ahead of other claimants, but this kind of thing was written before people really had to contemplate the consequences of not paying social services and pensions. Its not clear how enforceable such clauses are in any jurisdiction.

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

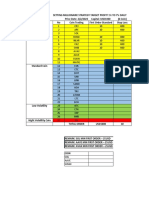

CPR: labor force decline

Employees on nonfarm payrolls, index, March 2006 = 100

105 100 95 90

CPR: debt term structure

Billions of USD

$25

U.S.

$20 $15 $10

85 80 75 1990

Puerto Rico

$5 $0 1993 1996 1999 2002 2005 2008 2011 2014 0-1 1-3 3-5 5-10 10-20 years years years years years Source: J.P. Morgan Securities LLC. May 2013. 20-30 years 30 years+

Source: Bureau of Labor Statistics. December 2013.

If the March debt offering goes well, there may be a further relief rally in the bonds, which are already trading ~10 points off of their lows. If thats the case, it might be a good time to make further reductions in uninsured general obligation exposure, and the in the weaker revenue bond issuers, given the weight of the economic and demographic evidence (and assuming no Federal bailout of bondholders). What do you make of Bitcoin? A lifeline for the financially oppressed, operational challenges, and the risk of it actually working The ingenuity behind the electronic currency Bitcoin is that it replicates the supply limitations of gold. Its architects might have thought that was the hardest part, but on any road to broader acceptance, it may turn out to have been the easiest. J.P. Morgans Investment Bank wrote a piece on Bitcoin and focused on whether it represents a store of value the way fiat currencies and precious metals 6 do . The authors concluded it does not: it is illiquid (daily turnover of the Mauritius Stock Exchange; massive ratio of value in circulation to daily float), volatile (20x more than the Yen; largest one-day drops to-date: 38%, 36%, 33%) and it offers no means of interim return to holders (e.g., cash yield). These are of course all static observations that could change if Bitcoin were much more broadly used. There is a constituency for whom Bitcoin may make sense even with this backdrop: the financially oppressed. Examples: businesses and individuals in countries with capital controls, dual exchange rates and persistently negative real deposit rates on savings (yes, there are countries even worse than the US; in Venezuela, real interest rates have been negative for 25 years). Whose citizens are in such a predicament? Theres an academic measure of capital controls on businesses and individuals that attempts to quantify this, and the worst two categories appear in the box below. Around half the people on the planet fall into this box, and they represent 28% of World GDP.

Countries with capital account restrictions

Most restrictive Venezuela Ukraine Angola Uzbekistan Myanmar Sudan Malaw i Guinea Bahamas Sierra Leone Next 10 China India Thailand South Africa Pakistan Malaysia Philippines Bangladesh Algeria Kazakhstan

20,000 10,000 0 06/2012 12/2012 06/2013 Source: Blockchain,Coindesk. March 2014. 12/2013 $200 $0

Bitcoin daily transaction volume and price in USD

Transactions per day (rolling 30-day average)

80,000 70,000 60,000 50,000 40,000 30,000

USD

$1,200

Low growth in transactions per day

$1,000 $800 $600

Price in USD

$400

GDP (bn $) Population (mm) GDP (bn $) Population (mm) 1,238 260 22,012 3,245 Source: Menzie and Ito, University of WisconsinMadison. IMF, 2011.

The audacity of Bitcoin, John Normand, J.P. Morgan Global Rates & FX Research, February 11, 2014

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

Other (legal) uses could include cross-border trade, individual remittances to developing countries, small-denomination transactions for which processing fees are usually high, and a variety of small business transactions. So far, however, Bitcoin is the Esperanto of currencies: an elegant idea to transcend national borders that attracts a community of intensely avid followers, but which hasnt yet achieved broad acceptance. Ignore its price for a moment; actual purchase transaction growth has been low compared to the rise in trading activity. This could be a function of Bitcoins challenges, which can be described as follows: No free lunch. While the number of merchants accepting Bitcoin has risen to ~35,000, a steady flow of buyers, sellers and currency remitters, particularly those seeking to reduce frictional costs of the fiat currency system, might only participate when they can instantaneously convert Bitcoin receipts to cash. In the US, this can be done using merchant services like Bitpay and Coinbase, which currently charge ~1.0%. Are these sustainable fee levels given the Bitcoin price risk they are effectively taking, and are they properly capitalized? Im not sure. Regulation. In December, China announced that financial institutions and payment institutions cannot use Bitcoin, exchange it for RMB, or act as an intermediary for Bitcoin payments. Other countries may follow with similar restrictions, or regulate Bitcoin as a payment system which requires that intermediaries build anti-money laundering and know-your-client procedures. Safety. Bitcoins image took a hit with the collapse of the Mt Gox exchange and reported theft of 6% of all Bitcoins outstanding. How did this happen? Unclear, but our understanding is that Bitcoin transactions can take up to an hour to clear due to the complexity of the algorithms, which is a large enough window for fraudulent interference to divert Bitcoin flows. A related question: why did people hold Bitcoins at an exchange in the first place? Apparently, since Bitcoin wallets on your computer can be hacked, so much so that some are maintained on a cold basis (on computers that are not plugged into the internet). My head is spinning.

There are also issues around irreversible transfers, forgotten passwords leading to stranded Bitcoins and the lack of consumer protections. We hear from our contacts in Silicon Valley that a lot of time and money is being spent on addressing these issues with the goal of creating a more robust Bitcoin food chain. This all sounds completely feasible, but my guess is that it meaningfully raises the cost of execution vs. the fiat currency system that Bitcoin attempts to arbitrage. After digesting all the hyperbole and the pessimism, my biggest concern is not that Bitcoin will fail, but that it or one of its many virtual currency competitors will one day succeed. In the extreme, Bitcoin may lead to economic activity moving from the regulated economy to the underground shadow economy (after all, one Large shadow economies coincide with less wealth of its primary selling points lay in its inability to 70% be traced), even if some Bitcoin recipients Eachdotrepresentsa Shadow economy % of GDP faithfully declare it as income. If this were to 60% differentcountry happen, the tax burden would fall 50% disproportionately on the regulated economy that remains, creating a lot of unwelcome 40% distortions. Perhaps this is why there is a clear 30% inverse relationship between the size of a countrys shadow economy and its wealth per 20% capita. In other words, no one likes paying 10% taxes, but when no one actually does pay them, Per Capita GDP, real constant dollars, thousands everyone suffers. Libertarianism has its limits. 0%

$0 $10 $20 $30 Source: Conference Board, "Shadow Economies and Corruption", Buehn and Schneider. Economics E-Journal. October 2009. $40

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

My hedge fund portfolio returned 8% annually over the last 3 years. Was that any good? And are hedge funds generally less leveraged than before the financial crisis? 8% is below a simple stock-bond proxy, and above one that does a better job capturing the risk of diversified hedge fund ownership. Yes, HFs are now less leveraged, but leverage is rising. Whats the best way to assess performance of a diversified HF portfolio? Absolute thresholds (8%, or Libor + 3%) are unrealistically high in some markets and too low in others. A shorthand way is to compare it to returns on a stock-bond portfolio with a similar risk profile; and where risk profile is the volatility of monthly returns over the long run. What stock-bond portfolio mix makes sense? As shown below, while a 60 Equity / 40 Bond portfolio mix is popular, it has consistently generated a lot more volatility than the HFRI Composite. A benchmark of 45 Equity / 55 Bond is much closer, albeit with a +/- 2% margin of error. From 2011 to 2013, this mix delivered a 9.1% annual return, so 8% on hedge funds looks a little light. This is unsurprising given the magnitude of the recent equity rally.

In search of the best risk match for the HFRI Composite

Percent, rolling 3-year volatility difference

6% 5% 4% 3% 2% 1% 0% -1% -2%

Distribution of return volatilities of randomly generated portfolios of 20 hedge funds based on stated criteria, 2004-2013

90 80 70 60 50 40 30 20 Volatility of HFRI Composite Index, 2004-2013

60 S&P 500 / 40 Barclays Agg. less HFRI

6-factor model less HFRI

1997 1999 2001 2003

-3% 1995

45 S&P 500 / 55 Barclays Agg. less HFRI

2005 2007 2009 2011 2013

10 0 3.70% 4.20% 4.70% 5.20% 5.70% 6.20% 6.70% 7.20% 7.70% Volatility of individual portfolios Source: Pertrac, Bloomberg. January 2014.

Source: Bloomberg. January 2014.

What if the HFRI Composite (which an investor cannot buy) understates the risk of owning actual hedge funds? To examine this question, we created 1,000 random portfolios of 20 hedge funds based on certain criteria (at least 7 years of performance, at least $750 mm of AUM, and equal weighted among long-short, macro, event-driven and relative value). The volatilities of these random portfolios were usually less than the HFRI Composite (see chart, right), so we proceed under the assumption that the HFRI does not understate diversified hedge fund portfolio return volatility. Next step: we can improve the accuracy of the stock-bond proxy, since there are better ways of capturing the risk of hedge fund ownership. As shown in the chart (green dotted line), we can replicate the volatility of the HFRI Composite more closely using a 6-factor model of US large cap, US small cap, emerging market equities, high yield, commodities and cash. Since 2001, the models combined equity weights are ~30% rather than 45%-50%, implying a much lower equity risk component of the HFRI. Using this factor model, the benchmark delivered 4% annually over the last three years, in which case 8% on a hedge fund portfolio looks better. If 4% seems bizarrely low as a benchmark, you might be over-estimating the volatility that diversified hedge fund portfolios have been generating. An equity vs. hedge fund comparison may have some appeal in terms of simplicity, but does not appear to have a foundation in the realized experience of diversified hedge fund investing, particularly over the last decade. Another way to say it: if you sell equities and buy a diversified HF portfolio on a 1:1 basis, you are probably making a very large risk reduction in your portfolio. For even more diversified HF portfolios (e.g., 40-50 funds, or those comprised of hedge fund of funds), volatilities are often lower, around 3%-4%. In this case, we would benchmark the HF portfolio against the Barclays Aggregate on its own. By extension, this is why some investors have added low-vol hedge fund exposure and reduced fixed income, in anticipation of rising rates.

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

Has hedge fund equity leverage declined since the crisis? Some press articles refer to the elevated level of debit balances (margin debt) on the New York Stock Exchange as a sign of elevated hedge fund leverage. Margin debt is a very imperfect proxy for hedge fund leverage, but can be directionally accurate. However, after normalizing these balances for the assets that hedge funds manage, implied leverage is considerably lower than 2002-2007 levels. This conclusion dovetails with data from J.P. Morgans Prime Brokerage department (which tracks the cash equities gross leverage of the hedge funds it does business with), as well as other prime brokerage desks. Both measures tell the same story: equity leverage is now rising after the depths of 2008, but is lower than it was precrisis. Note that this does not include measures of leverage related to certain credit strategies.

Hedge fund equity leverage

NYSE debit balance / HF AUM

0.22

Gross leverage

2.6 2.4

0.18

J.P.Morgan Prime Brokerage gross leverage NYSE debit balance / HF AUM

2.2 2.0 1.8 1.6

0.14

0.10 2002

1.4 2004 2006 2008 2010 2012

Source: Bloomberg, NYSE, J.P.Morgan Securities LLC. February 2014.

Michael Cembalest J.P. Morgan Asset Management

Appendix chart: have we reached the limit of US outsourcing?

Half of U.S. goods are outsourced, some already at the limit

Percent of U.S. consumption that is imported

100% 75% 50% 25%

Textiles

All items

0% 1950 1960 1970 1980 1990 2000 2010 Source: BEA, Census, JPMAM estimates. Prior to 1997, textile data are only available in 5-year increments (1987 and 1992). Prior to 1987 the textile share is estimated. Data as of 2012.

Sources Rocky start to new year for small caps, DeSanctis, Giannini, and Wang. BofA Merrill Lynch. February 11, 2014 US Fixed Income Markets Weekly," Puerto Rico Research Compilation, J.P. Morgan Securities, Oct 25, 2013 with subsequent updates through February 2014. What Matters for Financial Development? Capital Controls, Institutions, and Interactions," Chinn, Menzie D. and Hiro Ito. Journal of Development Economics, Volume 81, Issue 1, Pages 163-192, October. The Chinn-Ito financial openness index incorporates four metrics of restrictions on capital account transactions: (1) whether a country has multiple exchange rates; and whether restrictions are placed on (2) the current account, (3) the capital account, and/or (4) the use of export proceeds. Why Bitcoin Matters, Marc Andreessen, January 22, 2014

EYE ON THE MARKET

J.P. MORGAN

March 3, 2014

AMBAC: American Municipal Bond Assurance Corporation; AUM; Assets under management; BEA: Bureau of Economic Analysis; CPR: Commonwealth of Puerto Rico; HFRI: Hedge Fund Research Inc.; IMF: International Monetary Fund; NYSE: New York Stock Exchange; P/E: Price-to-earnings multiples; EPS: Earnings per share; RoA: Return on Assets; RoE: Return on Equity.

IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties. Each recipient of this material, and each agent thereof, may disclose to any person, without limitation, the US income and franchise tax treatment and tax structure of the transactions described herein and may disclose all materials of any kind (including opinions or other tax analyses) provided to each recipient insofar as the materials relate to a US income or franchise tax strategy provided to such recipient by JPMorgan Chase & Co. and its subsidiaries. The material contained herein is intended as a general market commentary. Opinions expressed herein are those of Michael Cembalest and may differ from those of other J.P. Morgan employees and affiliates. This information in no way constitutes J.P. Morgan research and should not be treated as such. Further, the views expressed herein may differ from that contained in J.P. Morgan research reports. The prices/quotes/statistics referenced herein have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness, any yield referenced is indicative and subject to change. References to the performance or characteristics of our portfolios generally refer to the discretionary Balanced Model Portfolios constructed by J.P. Morgan. It is a proxy for client performance and may not represent actual transactions or investments in client accounts. The views and strategies described herein may not be suitable for all investors. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. To the extent referenced herein, real estate, hedge funds, and other private investments may present significant risks, may be sold or redeemed at more or less than the original amount invested; there are no assurances that the stated investment objectives of any investment product will be met. JPMorgan Chase & Co. and its subsidiaries do not render accounting, legal or tax advice and is not a licensed insurance provider. You should consult with your independent advisors concerning such matters.Bank products and services offered by JP Morgan Chase Bank, N.A, and its affiliates. Securities are offered through J.P. Morgan Securities LLC, member NYSE, FINRA and SIPC, and its affiliates globally as local legislation permits. In the United Kingdom, this material is approved by J.P. Morgan International Bank Limited (JPMIB) with the registered office located at 25 Bank Street, Canary Wharf, London E14 5JP, registered in England No. 03838766 and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. In addition, this material may be distributed by: JPMorgan Chase Bank, N.A. Paris branch, which is regulated by the French banking authorities Autorit de Contrle Prudentiel and Autorit des Marchs Financiers; JPMorgan Chase Bank, N.A. Bahrain branch, licensed as a conventional wholesale bank by the Central Bank of Bahrain (for professional clients only); JPMorgan Chase Bank, N.A. Dubai branch, regulated by the Dubai Financial Services Authority. In Hong Kong, this material is distributed by JPMorgan Chase Bank, N.A. (JPMCB) Hong Kong branch except to recipients having an account at JPMCB Singapore branch and where this material relates to a Collective Investment Scheme in which case it is distributed by J.P. Morgan Securities (Asia Pacific) Limited (JPMSAPL). Both JPMCB Hong Kong branch and JPMSAPL are regulated by the Hong Kong Monetary Authority. In Singapore, this material is distributed by JPMCB Singapore branch except to recipients having an account at JPMCB Singapore branch and where this material relates to a Collective Investment Scheme (other than private funds such as a private equity and hedge funds) in which case it is distributed by J.P. Morgan (S.E.A.) Limited (JPMSEAL). Both JPMCB Singapore branch and JPMSEAL are regulated by the Monetary Authority of Singapore. With respect to countries in Latin America, the distribution of this material may be restricted in certain jurisdictions. Receipt of this material does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such funds securities in compliance with the laws of the corresponding jurisdiction. If you no longer wish to receive these communications please contact your J.P. Morgan representative. As a reminder, hedge funds (or funds of hedge funds), private equity funds, real estate funds and the like: Often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; Can be highly illiquid; Are not required to provide periodic pricing or valuation information to investors; May involve complex tax structures and delays in distributing important tax information; Are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any such fund. For complete information, please refer to the applicable offering memorandum. Past performance is not a guarantee of future results. Investment products: Not FDIC insured No bank guarantee May lose value 2014 JPMorgan Chase & Co. All rights reserved.

Вам также может понравиться

- 02 - Price Action StrategiesДокумент82 страницы02 - Price Action Strategiesvvpvarun94% (63)

- Nantuckets Nectar 2 & 3Документ3 страницыNantuckets Nectar 2 & 3Mayor100% (3)

- Actual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6 0Документ12 страницActual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6 0aliОценок пока нет

- DD - Phase II Process Letter - 5 Dec 2017Документ5 страницDD - Phase II Process Letter - 5 Dec 2017Vigneshwaran P VijeyakumarОценок пока нет

- Year1 Year3 Year3Документ3 страницыYear1 Year3 Year3Kyla de SilvaОценок пока нет

- M&a AssignmentДокумент63 страницыM&a AssignmentJason Baird50% (4)

- R55 Understanding Fixed-Income Risk and Return Q BankДокумент20 страницR55 Understanding Fixed-Income Risk and Return Q BankAhmedОценок пока нет

- Kohler Case Leo Final DraftДокумент16 страницKohler Case Leo Final DraftLeo Ng Shee Zher67% (3)

- Chart 1: Leading Economic Indicators: Page 1 of 11 445 Park Avenue, 5 Floor - New York, NY 10022 - 212.201.5800Документ11 страницChart 1: Leading Economic Indicators: Page 1 of 11 445 Park Avenue, 5 Floor - New York, NY 10022 - 212.201.5800sugumar_rОценок пока нет

- Spring 2014 HCA Letter FinalДокумент4 страницыSpring 2014 HCA Letter FinalDivGrowthОценок пока нет

- Bar Cap 3Документ11 страницBar Cap 3Aquila99999Оценок пока нет

- In Pursuit of Value: January, 2011Документ4 страницыIn Pursuit of Value: January, 2011Henry HoffmanОценок пока нет

- Lane Asset Management 2012 Stock Market Commentary and 2013 Fearless ForecastДокумент18 страницLane Asset Management 2012 Stock Market Commentary and 2013 Fearless ForecastEdward C LaneОценок пока нет

- Q3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyДокумент5 страницQ3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyJohn MathiasОценок пока нет

- Lane Asset Management Stock Market Commentary October 2011Документ9 страницLane Asset Management Stock Market Commentary October 2011Edward C LaneОценок пока нет

- Cushman Wakefield Investment Atlas Summary 2013 FINALДокумент30 страницCushman Wakefield Investment Atlas Summary 2013 FINALparthacfaОценок пока нет

- The End of Buy and Hold ... and Hope Brian ReznyДокумент16 страницThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaОценок пока нет

- 10/14/14 Global-Macro Trading SimulationДокумент22 страницы10/14/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- 9/12/14 Global-Macro Trading SimulationДокумент9 страниц9/12/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- Hide and Seek: U.S. Economy UncertainДокумент12 страницHide and Seek: U.S. Economy UncertainCanadianValueОценок пока нет

- The Monarch Report 04-23-12Документ3 страницыThe Monarch Report 04-23-12monarchadvisorygroupОценок пока нет

- Lane Asset Management Stock Market Commentary September 2011Документ10 страницLane Asset Management Stock Market Commentary September 2011eclaneОценок пока нет

- Al Frank - 2012 TimeForValueДокумент20 страницAl Frank - 2012 TimeForValuecasefortrilsОценок пока нет

- InternationalTreasurer1997Apr28 Dollar StrengthДокумент2 страницыInternationalTreasurer1997Apr28 Dollar StrengthitreasurerОценок пока нет

- 9/15/14 Global-Macro Trading SimulationДокумент9 страниц9/15/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- AWN OctoberPortfolioUpdateДокумент10 страницAWN OctoberPortfolioUpdateCraig CannonОценок пока нет

- September 8, 2010 PostsДокумент431 страницаSeptember 8, 2010 PostsAlbert L. PeiaОценок пока нет

- The Advisory FinalДокумент4 страницыThe Advisory FinalAnonymous Feglbx5Оценок пока нет

- The Advisory FinalДокумент8 страницThe Advisory FinalAnonymous Feglbx5Оценок пока нет

- Global Economic Prospect AnalysisДокумент17 страницGlobal Economic Prospect AnalysisRezzoОценок пока нет

- Weekly CommentaryДокумент4 страницыWeekly Commentaryapi-150779697Оценок пока нет

- Lane Asset Management Stock Market Commentary November 2011Документ8 страницLane Asset Management Stock Market Commentary November 2011Edward C LaneОценок пока нет

- Investment Compass - Summer 2011 - Europe, Earnings, and ExpectationsДокумент4 страницыInvestment Compass - Summer 2011 - Europe, Earnings, and ExpectationsPacifica Partners Capital ManagementОценок пока нет

- 10/21/14 Global-Macro Trading SimulationДокумент20 страниц10/21/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- The Global Economy Is Slowing: in This Month's Issue..Документ52 страницыThe Global Economy Is Slowing: in This Month's Issue..Nicolae ChisoceanuОценок пока нет

- Weekly Market Commentary 3-17-2014Документ4 страницыWeekly Market Commentary 3-17-2014monarchadvisorygroupОценок пока нет

- Insights: Fallout From The US Debt DowngradeДокумент4 страницыInsights: Fallout From The US Debt Downgradericky3833Оценок пока нет

- Edition 5 - Chartered 12th May 2010Документ7 страницEdition 5 - Chartered 12th May 2010Joel HewishОценок пока нет

- BlackRock 2014 OutlookДокумент8 страницBlackRock 2014 OutlookMartinec TomášОценок пока нет

- Magnifier - October 2010Документ60 страницMagnifier - October 2010BCapital5Оценок пока нет

- 10/29/14 Global-Macro Trading SimulationДокумент21 страница10/29/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- Byron Wein - Blackstone - Time For A PauseДокумент4 страницыByron Wein - Blackstone - Time For A PausewaterhousebОценок пока нет

- Lane Asset Management Stock Market Commentary September 2015Документ10 страницLane Asset Management Stock Market Commentary September 2015Edward C LaneОценок пока нет

- The Monarch Report 4/1/2013Документ3 страницыThe Monarch Report 4/1/2013monarchadvisorygroupОценок пока нет

- Patient Capital Management IncДокумент6 страницPatient Capital Management Incricher jpОценок пока нет

- Following The Money in em Currency Markets: EconomicДокумент5 страницFollowing The Money in em Currency Markets: EconomicdpbasicОценок пока нет

- Lane Asset Management Stock Market Commentary April 2012Документ7 страницLane Asset Management Stock Market Commentary April 2012Edward C LaneОценок пока нет

- Lane Asset Management Stock Market Commentary December 2011Документ8 страницLane Asset Management Stock Market Commentary December 2011Edward C LaneОценок пока нет

- 01-31-11 Breakfast With DaveДокумент8 страниц01-31-11 Breakfast With DavetngarrettОценок пока нет

- Market Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearДокумент4 страницыMarket Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearCLORIS4Оценок пока нет

- US Fixed Income Markets WeeklyДокумент96 страницUS Fixed Income Markets Weeklyckman10014100% (1)

- Weekly Market Commentary 3-512-2012Документ4 страницыWeekly Market Commentary 3-512-2012monarchadvisorygroupОценок пока нет

- Weekly Market Commentary 3/25/2013Документ5 страницWeekly Market Commentary 3/25/2013monarchadvisorygroupОценок пока нет

- May 252010 PostsДокумент14 страницMay 252010 PostsAlbert L. PeiaОценок пока нет

- Market Commentary 11-26-12Документ3 страницыMarket Commentary 11-26-12CLORIS4Оценок пока нет

- Bill Miller 2010 01 CommentaryДокумент3 страницыBill Miller 2010 01 CommentarytekesburОценок пока нет

- March 152010 PostsДокумент11 страницMarch 152010 PostsAlbert L. PeiaОценок пока нет

- Eta Investment Report: A Year For The History BooksДокумент31 страницаEta Investment Report: A Year For The History BooksTerence MollОценок пока нет

- BarCap July8 The Emerging Markets Weekly Sunshine Behind The CloudsДокумент36 страницBarCap July8 The Emerging Markets Weekly Sunshine Behind The Cloudsr3vansОценок пока нет

- 10/8/14 Global-Macro Trading SimulationДокумент19 страниц10/8/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- C CC CCCДокумент7 страницC CC CCCKelvingrove Partners, LLCОценок пока нет

- How Long Is The Subprime TunnelДокумент6 страницHow Long Is The Subprime TunnelAlampilli BaburajОценок пока нет

- Eekly Conomic Pdate: 227,000 New Jobs, But Jobless Rate Still at 8.3%Документ2 страницыEekly Conomic Pdate: 227,000 New Jobs, But Jobless Rate Still at 8.3%api-118535366Оценок пока нет

- 06-06-11 - EOTM - Occam's RazorДокумент5 страниц06-06-11 - EOTM - Occam's Razorlee_ankitОценок пока нет

- 0320 US Fixed Income Markets WeeklyДокумент96 страниц0320 US Fixed Income Markets WeeklycwuuuuОценок пока нет

- 10/17/14 Global-Macro Trading SimulationДокумент20 страниц10/17/14 Global-Macro Trading SimulationPaul KimОценок пока нет

- Technical Analysis For Mega ProfitДокумент385 страницTechnical Analysis For Mega ProfitpartogibutarbutarОценок пока нет

- Mid-Course Internship Report: Foreign Trade University Ho Chi Minh City CampusДокумент37 страницMid-Course Internship Report: Foreign Trade University Ho Chi Minh City CampusHoàng PhongОценок пока нет

- Capital Asset Pricing Model (CAPM)Документ2 страницыCapital Asset Pricing Model (CAPM)RОценок пока нет

- Principles and Practices of Insurance Business (PDBI-1001)Документ16 страницPrinciples and Practices of Insurance Business (PDBI-1001)shakhawat hossainОценок пока нет

- Valuation: Spring 2020: Aswath DamodaranДокумент18 страницValuation: Spring 2020: Aswath DamodaranElliОценок пока нет

- Chapter 10: Common Stock ValuationДокумент7 страницChapter 10: Common Stock ValuationJhela HemarОценок пока нет

- AIK Pertanyaan CH 1-6 Kelompok 6Документ15 страницAIK Pertanyaan CH 1-6 Kelompok 6DindaОценок пока нет

- Wiley CPAexcel - FAR - 13 Disclosure RequirementsДокумент2 страницыWiley CPAexcel - FAR - 13 Disclosure RequirementsAimeeОценок пока нет

- Sustainability Analysis On NVDAДокумент24 страницыSustainability Analysis On NVDABalaji PadmanabanОценок пока нет

- Working Capital Management Project Tata MotorsДокумент24 страницыWorking Capital Management Project Tata MotorsThë FähãdОценок пока нет

- Unit 5 Ratio AnalysisДокумент43 страницыUnit 5 Ratio Analysisjatin4verma-2100% (1)

- Business Valuation ThesisДокумент106 страницBusiness Valuation ThesisElena LópezОценок пока нет

- Mod 1 Valuation and ConceptswДокумент2 страницыMod 1 Valuation and Conceptswvenice cambryОценок пока нет

- Retio Analysis Profitability Ratios: Gross MarginДокумент7 страницRetio Analysis Profitability Ratios: Gross MarginAmjath JamalОценок пока нет

- Full Test 5 CO Management AccountingДокумент59 страницFull Test 5 CO Management AccountingDiana Dobrescu50% (2)

- Pricing of Port ServicesДокумент130 страницPricing of Port ServicesvenkateswarantОценок пока нет

- Thaler - The End of Behavioral FinanceДокумент7 страницThaler - The End of Behavioral FinanceFelipe Alejandro Torres CastroОценок пока нет

- Syllabus MBA (General) Two Years Full Time Programme: M.J.P. Rohilkhand UniversityДокумент31 страницаSyllabus MBA (General) Two Years Full Time Programme: M.J.P. Rohilkhand UniversityMalay PatelОценок пока нет

- Mishkin - Chapter 7 - MarkupДокумент39 страницMishkin - Chapter 7 - MarkupJeet JainОценок пока нет

- Net Present Value: $0.00 Solution: NPV of Project IsДокумент4 страницыNet Present Value: $0.00 Solution: NPV of Project IspmanerkarОценок пока нет

- National Municipal Asset Valuation ManualДокумент86 страницNational Municipal Asset Valuation Manualkhan_sadi0% (1)

- Formula Cointech2u Setting Trading 1k To 200k Update 12 04 2023Документ45 страницFormula Cointech2u Setting Trading 1k To 200k Update 12 04 2023AndhikaОценок пока нет