Академический Документы

Профессиональный Документы

Культура Документы

NAJAM SETHI EXPOSED #9 - FBR Notice 22nd May 2013

Загружено:

PTI OfficialАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

NAJAM SETHI EXPOSED #9 - FBR Notice 22nd May 2013

Загружено:

PTI OfficialАвторское право:

Доступные форматы

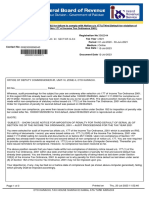

FBR Notice to Najam Sethi on May 22nd, 2013

DEPUTY COMMISSIONER INLAND REVENUE-AUDIT 01, ZONE II, REGIONAL TAX OFFICE, LAHORE. Tele No. 042-99214091 Dated:- May 22, 2013 To Mr. Najam Aziz Sethi C/O M/S Media Times Limited, 41-N GULBERG, LAHORE NTN. 0453890-7 Subject:- NOTICE U/S 182(2) OF THE INCOME TAX ORDINANCE, 2001 (THE ORDINANCE) TAX YEAR 2009 Please refer to the above subject. Consequent upon the order issued vide DCR No.07 dated 31 -05-2013 an amount of Rs. 49,471,666 was added in your income on account of investment in property through unexplained sources of income. You were not able to submit any document in support of your contention that the property does not belong to you. You are also liable to pay penalty equal to 100% of the tax sough to be evaded on account of concealed investment in the purchase of an apartment, situated at Manhattan, New York, in terms of sr. no.12 of Section 182(1) of the Ordinance, as follows: Total un-explained / concealed investment in purchase of an apartment as discussed above. Rs. 98,943,332 Addition of 1/2 of the un-explained / concealed investment in the purchase of an apartment Rs.49,471,666 Tax sought to be evaded @ 20% Rs.9,894,333 Penalty equal to 100% of the tax evaded Rs.9,894,333 You are requested to show cause that why not 100% penalty equal to the amount of tax short fall be imposed on you under sr.12 of the section 182(1) of the Ordinance. The due date and time of filing of reply and hearing is fixed as 07-062013 at 11:00 hours.

(USMAN ASGHAR) Deputy Commissioner Inland Revenue

Вам также может понравиться

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesОт EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesОценок пока нет

- BIR Rulings (2017 - 2018)Документ2 631 страницаBIR Rulings (2017 - 2018)Jerwin DaveОценок пока нет

- Akbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanДокумент1 страницаAkbar Manzil Near Khan Plywood Neelum Road Lower Plate Neelum Road Lower Plate Attique-Ur-RehmanSaad KhanОценок пока нет

- G.R. Nos. 134587Документ8 страницG.R. Nos. 134587Ann ChanОценок пока нет

- Proclamation Sale Auction Flat South Mumbai On 5 11 2019Документ3 страницыProclamation Sale Auction Flat South Mumbai On 5 11 2019Priyanka SharmaОценок пока нет

- Adjudicaton Order EpcgДокумент3 страницыAdjudicaton Order Epcgdsouzaraymond78Оценок пока нет

- Contex vs. CIR, GR No. 151135, 2 July 2004Документ8 страницContex vs. CIR, GR No. 151135, 2 July 2004Christopher ArellanoОценок пока нет

- Tax Collector Correspondence3630204090545Документ1 страницаTax Collector Correspondence3630204090545Muhammad Ayan MalikОценок пока нет

- Petitioner Vs Vs Respondent: Second DivisionДокумент11 страницPetitioner Vs Vs Respondent: Second DivisionPatricia BenildaОценок пока нет

- Accenture V Commissioner, GR 190102, July 11, 2012Документ20 страницAccenture V Commissioner, GR 190102, July 11, 2012Eumell Alexis PaleОценок пока нет

- 3.G.R. No. 103092Документ5 страниц3.G.R. No. 103092Lord AumarОценок пока нет

- Republic of The Philippines of Tax Appeals City: First DivisionДокумент11 страницRepublic of The Philippines of Tax Appeals City: First DivisionLady Paul SyОценок пока нет

- Tax Alert (December 2020)Документ10 страницTax Alert (December 2020)Rheneir MoraОценок пока нет

- CIR v. Benguet Corp.Документ1 страницаCIR v. Benguet Corp.Chou TakahiroОценок пока нет

- Republic vs. Heirs of JalandoniДокумент18 страницRepublic vs. Heirs of JalandoniJose Emmanuel DolorОценок пока нет

- CASE DOCTRINES - 2020 Jurisprudence Updates (SC and CTA Cases)Документ12 страницCASE DOCTRINES - 2020 Jurisprudence Updates (SC and CTA Cases)Carlota VillaromanОценок пока нет

- H. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005Документ16 страницH. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005Christopher ArellanoОценок пока нет

- Direct Tax Case Email No 212 - 2018Документ4 страницыDirect Tax Case Email No 212 - 2018AbidRazaca0% (1)

- Asmt 10 1920Документ69 страницAsmt 10 1920Prashant ZawareОценок пока нет

- Accenture, Inc. vs. Commissioner of Internal RevenueДокумент14 страницAccenture, Inc. vs. Commissioner of Internal Revenuevince005Оценок пока нет

- Statement of FactsДокумент32 страницыStatement of FactsThe Ultra IndiaОценок пока нет

- Blank 8Документ11 страницBlank 8Stephen Celoso EscartinОценок пока нет

- G.R. NO. 190102 ACCENTURE, INC., Petitioner,: PrincipleДокумент3 страницыG.R. NO. 190102 ACCENTURE, INC., Petitioner,: PrincipleEmmanuel BurcerОценок пока нет

- Contex Corporation vs. CIR Persons LiableДокумент16 страницContex Corporation vs. CIR Persons LiableEvan NervezaОценок пока нет

- C.T.A. Eb Case No. 853. August 22, 2013Документ28 страницC.T.A. Eb Case No. 853. August 22, 2013Edu ParungaoОценок пока нет

- Dlonsod Case Digest Income TaxДокумент11 страницDlonsod Case Digest Income TaxRalph MondayОценок пока нет

- Appeal No. C/11799-11801/2017-DBДокумент7 страницAppeal No. C/11799-11801/2017-DBCESTAT, Ahmedabad Commissioner ARОценок пока нет

- Accenture v. CIR GRN 190102 2012 CabriaДокумент13 страницAccenture v. CIR GRN 190102 2012 CabriaDarrel ClariñoОценок пока нет

- Upreme QI:ourt: L/epublic of Tbe TlbilippineДокумент26 страницUpreme QI:ourt: L/epublic of Tbe Tlbilippinejemybanez81Оценок пока нет

- Part D - Focus CasesДокумент22 страницыPart D - Focus CasesShalom MangalindanОценок пока нет

- 105 IMPSA Construction Corporation vs. CIR (CTA EB Case No. 685, May 24, 2011)Документ10 страниц105 IMPSA Construction Corporation vs. CIR (CTA EB Case No. 685, May 24, 2011)Alfred GarciaОценок пока нет

- AT&T Communications Services Phils. Inc. v. CIRДокумент8 страницAT&T Communications Services Phils. Inc. v. CIRAnonymous 8liWSgmIОценок пока нет

- Republic of The Philippines Court of Appeals Quezon: TAX CityДокумент27 страницRepublic of The Philippines Court of Appeals Quezon: TAX CitydoookaОценок пока нет

- G.R. No. 152609 June 29, 2005 Commissioner of Internal Revenue, Petitioner, American Express International, Inc. (Philippine Branch), RespondentДокумент16 страницG.R. No. 152609 June 29, 2005 Commissioner of Internal Revenue, Petitioner, American Express International, Inc. (Philippine Branch), RespondentSamuel John CahimatОценок пока нет

- 2020 P T D 1908Документ2 страницы2020 P T D 1908haseeb AhsanОценок пока нет

- Legal Notice - Rackly Craft PVT - LTDДокумент4 страницыLegal Notice - Rackly Craft PVT - LTDUtkarsh KhandelwalОценок пока нет

- Bureau of Internal Revenue Quezon City March 2, 2011: Republic of The Philippines Department of FinanceДокумент3 страницыBureau of Internal Revenue Quezon City March 2, 2011: Republic of The Philippines Department of FinanceBret MonsantoОценок пока нет

- 2021 S C M R 437Документ3 страницы2021 S C M R 437Yahia MustafaОценок пока нет

- Cta Case No. 6862Документ17 страницCta Case No. 6862matinikkiОценок пока нет

- Tax2 Smi Ed Phil Tech Vs CirДокумент24 страницыTax2 Smi Ed Phil Tech Vs CirReysaОценок пока нет

- Order 3362544Документ3 страницыOrder 3362544hamza awanОценок пока нет

- CONTEX V CIRДокумент11 страницCONTEX V CIRYoo Si JinОценок пока нет

- No 77 Deutsche Bank AG Manila Branch V CommisionerДокумент2 страницыNo 77 Deutsche Bank AG Manila Branch V CommisionerAJ QuimОценок пока нет

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Документ16 страницCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017j0d3Оценок пока нет

- Mindanao II Geothermal Partnership vs. CIRДокумент47 страницMindanao II Geothermal Partnership vs. CIRAsHervea AbanteОценок пока нет

- CIR vs. CA (Fortune Case) GR No.119322, 4 June 1996Документ50 страницCIR vs. CA (Fortune Case) GR No.119322, 4 June 1996Christopher ArellanoОценок пока нет

- TAXATION 1 Smith V CommissionerДокумент79 страницTAXATION 1 Smith V CommissionerJoan Margaret GasatanОценок пока нет

- Ultra Vires and Invalid.: Custom SearchДокумент13 страницUltra Vires and Invalid.: Custom SearchJerome CasasОценок пока нет

- Search Result: Case TitleДокумент28 страницSearch Result: Case Titleic corОценок пока нет

- CIR Vs GonzalesДокумент16 страницCIR Vs GonzalesnorieОценок пока нет

- Republic of The Philippines Court of Tax Appeals Quezon: PetitionerДокумент32 страницыRepublic of The Philippines Court of Tax Appeals Quezon: PetitionerAvelino Garchitorena Alfelor Jr.Оценок пока нет

- Republic of The Philippines Court of Tax Appea Quezon CityДокумент10 страницRepublic of The Philippines Court of Tax Appea Quezon CitySonnyОценок пока нет

- E-Auction Sale Notice - NoslarДокумент2 страницыE-Auction Sale Notice - Noslardeepa rahejaОценок пока нет

- Commissioner of Internal Revenue v. PLDT, G.R. No. 140230, December 15, 2005Документ9 страницCommissioner of Internal Revenue v. PLDT, G.R. No. 140230, December 15, 2005Christopher ArellanoОценок пока нет

- CIR V PALДокумент21 страницаCIR V PALChin T. OndongОценок пока нет

- 46 Gaw Jr. v. Commissioner of Internal Revenue (NOTICE)Документ9 страниц46 Gaw Jr. v. Commissioner of Internal Revenue (NOTICE)ervingabralagbonОценок пока нет

- CIR v. Aichi Forging Company of Asia, Inc., G.R. No. 183421, October 22, 2014Документ5 страницCIR v. Aichi Forging Company of Asia, Inc., G.R. No. 183421, October 22, 2014samaral bentesinkoОценок пока нет

- 2 - Cir Vs SC JohnsonДокумент11 страниц2 - Cir Vs SC JohnsonMark Paul CortejosОценок пока нет

- Marcos II Vs CAДокумент15 страницMarcos II Vs CAGeorge AlmedaОценок пока нет

- So Ordered.: Velasco, JR., Peralta, Mendoza and Sereno, JJ.Документ25 страницSo Ordered.: Velasco, JR., Peralta, Mendoza and Sereno, JJ.RomОценок пока нет

- Supreme Court Decision On Panama Case (Urdu)Документ275 страницSupreme Court Decision On Panama Case (Urdu)PTI Official95% (215)

- PTI Digital PolicyДокумент17 страницPTI Digital PolicyPTI Official100% (3)

- Election Notification For Canada, Greece, Spain, Italy, France, HK, Japan - FinalДокумент3 страницыElection Notification For Canada, Greece, Spain, Italy, France, HK, Japan - FinalPTI OfficialОценок пока нет

- Election Notification For Canada, Greece, Spain, Italy, France, HK, Japan - FinalДокумент3 страницыElection Notification For Canada, Greece, Spain, Italy, France, HK, Japan - FinalPTI OfficialОценок пока нет

- JIT Report SummaryДокумент275 страницJIT Report SummaryArif Alvi100% (23)

- Panel Nomination Notification For Canada, Greece, Spain, Japan, Italy, France and Hong KongДокумент4 страницыPanel Nomination Notification For Canada, Greece, Spain, Japan, Italy, France and Hong KongPTI OfficialОценок пока нет

- Billion Trees Tsunami Afforestation Project in Khyber Pakhtunkhwa - WWF Monitoring Report 2015Документ149 страницBillion Trees Tsunami Afforestation Project in Khyber Pakhtunkhwa - WWF Monitoring Report 2015PTI Official100% (3)

- PTI Canada Members List 2016Документ11 страницPTI Canada Members List 2016PTI OfficialОценок пока нет

- Self Declaration Form UK 2017Документ3 страницыSelf Declaration Form UK 2017PTI OfficialОценок пока нет

- Annex-A PTI Alberta-EB-Roles and ResponsibilitiesДокумент3 страницыAnnex-A PTI Alberta-EB-Roles and ResponsibilitiesPTI OfficialОценок пока нет

- OIC Self Declaration Form CANADA (2016)Документ3 страницыOIC Self Declaration Form CANADA (2016)PTI OfficialОценок пока нет

- PTI EC Rules and Regulations For Conducting IPE 2015Документ16 страницPTI EC Rules and Regulations For Conducting IPE 2015Engr Sahibzada Mamoor ShahОценок пока нет

- Report of Prevention of Conflict of Interest BillДокумент8 страницReport of Prevention of Conflict of Interest BillPTI OfficialОценок пока нет

- Code of Conduct ALBERTA 2016Документ2 страницыCode of Conduct ALBERTA 2016PTI OfficialОценок пока нет

- LB Candidate For South KarachiДокумент4 страницыLB Candidate For South KarachiPTI OfficialОценок пока нет

- Defamation Complaint by MR Sahibzada Jahangir To Channel 24Документ5 страницDefamation Complaint by MR Sahibzada Jahangir To Channel 24PTI OfficialОценок пока нет

- PTI Kuwait Members ListДокумент19 страницPTI Kuwait Members ListPTI OfficialОценок пока нет

- LB Candidate For West KarachiДокумент6 страницLB Candidate For West KarachiPTI OfficialОценок пока нет

- LB Candidate For Central KarachiДокумент6 страницLB Candidate For Central KarachiPTI OfficialОценок пока нет

- Governance & Policy Vol-1 Issue-1Документ24 страницыGovernance & Policy Vol-1 Issue-1PTI Official100% (1)

- LB Candidate For KorangiДокумент4 страницыLB Candidate For KorangiPTI OfficialОценок пока нет

- LB Candidate For MalirДокумент2 страницыLB Candidate For MalirPTI OfficialОценок пока нет

- NA-122: Polling Stations / Union Councils / Block Codes ListДокумент15 страницNA-122: Polling Stations / Union Councils / Block Codes ListPTI OfficialОценок пока нет

- Defamation Complaint by MR Amjad Khan To Channel 24Документ5 страницDefamation Complaint by MR Amjad Khan To Channel 24PTI OfficialОценок пока нет

- LB Candidate For East KarachiДокумент3 страницыLB Candidate For East KarachiPTI OfficialОценок пока нет

- PTI UAE Votes: Nazaryati Panel MembersДокумент19 страницPTI UAE Votes: Nazaryati Panel MembersPTI OfficialОценок пока нет

- PTI UAE Votes: Unknown MembershipДокумент6 страницPTI UAE Votes: Unknown MembershipPTI OfficialОценок пока нет

- PTI UAE Votes: EXPIRED MembershipДокумент3 страницыPTI UAE Votes: EXPIRED MembershipPTI OfficialОценок пока нет

- PTI UAE Votes: Haqiqi Panel MembersДокумент2 страницыPTI UAE Votes: Haqiqi Panel MembersPTI OfficialОценок пока нет

- Pti Uae Votes: Tiger Panel MembersДокумент4 страницыPti Uae Votes: Tiger Panel MembersPTI OfficialОценок пока нет

- The Hidden Wealth of Nations: The Scourge of Tax HavensОт EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensРейтинг: 4 из 5 звезд4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderОт EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsРейтинг: 3.5 из 5 звезд3.5/5 (9)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)От EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Рейтинг: 4.5 из 5 звезд4.5/5 (43)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderОт EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderРейтинг: 5 из 5 звезд5/5 (4)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingОт EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingРейтинг: 5 из 5 звезд5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОт EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОценок пока нет

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreОт EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreРейтинг: 4.5 из 5 звезд4.5/5 (13)

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadОт EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadОценок пока нет

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationОт EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationОценок пока нет

- Tax Savvy for Small Business: A Complete Tax Strategy GuideОт EverandTax Savvy for Small Business: A Complete Tax Strategy GuideРейтинг: 5 из 5 звезд5/5 (1)