Академический Документы

Профессиональный Документы

Культура Документы

Income Statement Template 2

Загружено:

Iqbal BaryarАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Income Statement Template 2

Загружено:

Iqbal BaryarАвторское право:

Доступные форматы

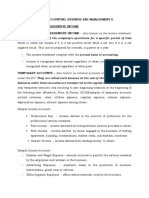

Note:

This section will provide you guidelines on how to prepare income statement of your business.

The statement templates provided, serve as a guide towards bare minimum line items that may be included in the financial statements. Please note that com set of financial statements includes: income statement, balance sheet and cash flows along with explanatory notes. Further, you may seek professional guida for preparation of formal financial statements, if deemed necessary. Entries in this template that are marked in black indicate use of formulae. Please avoid tempering with formulae based entries.

Income Statement (Amount in Rs.)

Year 1 Year 2 Year 3

Sales

This figure is obtained by multiplying number of units sold in a year with the net sales price of the product / service.

Cost of Goods Sold: This includes cost of raw material, labour, and factory overheads incurred during the production for the units sold. (This figure be obtained by multiplying cost per unit with the total number of units sold during the year). In case of service based businesses, cost of delivering services maybe included. Year 1 B C D E Raw material Wages Overheads Cost of Goods Sold The cost of raw material used in production of goods sold. The amount paid to direct labour employed by the business, e.g. production workers in case of a manufacturing concern. The production cost other than direct material and direct labour. (B+C+D) 0 0 0 Year 2 Year 3

Gross Profit

Profit earned from the difference between amount of sales and cost of goods sold. (A-E)

G H I J K L M N O P

Expenditures: Selling, Admin and General expenditure. Paid to workers other than direct labour e.g. managers, Salaries accountant, salesman, peon. Rent Utilities Insurance Advertising Depreciation Other Office Expenditure Others Interest on Loan Sub - Total Rent of the factory or office building (If Any). Amount paid for indirect electricity, telephone, Gas, water bills other than used for production and accounted for in "D". Amount paid as insurance of plant/machinery, office vehicles or any other business assets. Any expenditure incurred for advertising and promotion of your business. Amount of depreciation for the year, charged against fixed assets of the business. Office stationery, entertainment, janitorial services. Any other expenditures related to your business. Interest paid on Short Term (working Capital) and Long Term Loan. (G+H+I+J+K+L+M+N+O) 0 0 0

Operating Income

Gross profit minus Expenditure. (F-P)

Tax

Tax applicable according to the income of the business.

Net Income

Operating Income - Tax Amount. (Q-R)

are income statement of your business.

wards bare minimum line items that may be included in the financial statements. Please note that complete , balance sheet and cash flows along with explanatory notes. Further, you may seek professional guidance d necessary.

e use of formulae. Please avoid tempering with formulae based entries.

Year 4

aw material, labour, and factory overheads incurred during the production for the units sold. (This figure can the total number of units sold during the year). In case of service based businesses, cost of delivering the

Year 4

expenditure.

Вам также может понравиться

- DCF Model ExplanationДокумент10 страницDCF Model ExplanationMehak GuptaОценок пока нет

- Annual Profit BudgetДокумент4 страницыAnnual Profit BudgetPaul Julius de PioОценок пока нет

- Master Input Sheet: InputsДокумент37 страницMaster Input Sheet: Inputsminhthuc203Оценок пока нет

- SBV Financial StatementsДокумент17 страницSBV Financial Statementsbhundofcbm0% (1)

- RoarДокумент19 страницRoarFrank HernandezОценок пока нет

- Variable Costs and Fixed CostsДокумент2 страницыVariable Costs and Fixed CostsDon McArthney TugaoenОценок пока нет

- Profit and Loss Statement TemplateДокумент8 страницProfit and Loss Statement TemplateJerarudo BoknoyОценок пока нет

- SBV Financial StatementsДокумент18 страницSBV Financial StatementsAmsalu WalelignОценок пока нет

- Cost AccountingДокумент36 страницCost AccountingNikhil PatelОценок пока нет

- 12 Month Profit and Loss ProjectionДокумент3 страницы12 Month Profit and Loss ProjectionBadoiu LiviuОценок пока нет

- Final Accounts/ Financial StatementsДокумент53 страницыFinal Accounts/ Financial Statementsrachealll100% (1)

- Framework Manufacturing Costs 2021Документ13 страницFramework Manufacturing Costs 2021Boi NonoОценок пока нет

- Accounting For Manufacturing ConcernДокумент3 страницыAccounting For Manufacturing ConcernPervez Ahmed ShaikhОценок пока нет

- Financial Templates - W1Документ7 страницFinancial Templates - W1Abhijit BhattacharyaОценок пока нет

- Statement of Comprehensive IncomeДокумент4 страницыStatement of Comprehensive IncomeBlessylyn AguilarОценок пока нет

- Exhibit 6.3 Margin Money For Working CapitalДокумент12 страницExhibit 6.3 Margin Money For Working Capitalanon_285857320Оценок пока нет

- Final Accounts of A Sole Proprietorship BusinessДокумент20 страницFinal Accounts of A Sole Proprietorship BusinessShruti Kapoor100% (3)

- Income StatementДокумент1 страницаIncome StatementHabib Ul HaqОценок пока нет

- Manufacturing AccountДокумент36 страницManufacturing AccountSaksham RainaОценок пока нет

- How To Write A Traditional Business Plan: Step 1Документ5 страницHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanОценок пока нет

- Master Input Sheet: InputsДокумент34 страницыMaster Input Sheet: Inputsminhthuc203Оценок пока нет

- Here We Detail About The Classification of Expenditure IДокумент10 страницHere We Detail About The Classification of Expenditure INeelОценок пока нет

- Hotel Financial Model 2013 Blank V6Документ30 страницHotel Financial Model 2013 Blank V6Praveen Kumar SriragghavanОценок пока нет

- Profit and Loss AccountДокумент15 страницProfit and Loss AccountLogesh Waran100% (1)

- Manufacturing Accounts NotesДокумент9 страницManufacturing Accounts NotesFarrukhsg100% (5)

- Cost SheetДокумент9 страницCost Sheetsdiv92Оценок пока нет

- Manufacturing Accounts Departmental 1Документ12 страницManufacturing Accounts Departmental 1nandarsoe105Оценок пока нет

- Income Statement: Multi-Step FormatДокумент1 страницаIncome Statement: Multi-Step FormatJahja AjaОценок пока нет

- TEMPLATE Financial Projections WorkbookДокумент22 страницыTEMPLATE Financial Projections WorkbookFrancois ChampenoisОценок пока нет

- Example Income Statement:: Gross SalesДокумент2 страницыExample Income Statement:: Gross Salesabdirahman YonisОценок пока нет

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dДокумент32 страницыFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyОценок пока нет

- Cost of Goods Sold StatementДокумент5 страницCost of Goods Sold Statementaisharafiq1987100% (10)

- Statement of Comprehensive IncomeДокумент25 страницStatement of Comprehensive IncomeAngel Nichole ValenciaОценок пока нет

- CostingДокумент17 страницCostingZafarayeleОценок пока нет

- Joulling Mariana Mateus Forero Financial Math PDFДокумент5 страницJoulling Mariana Mateus Forero Financial Math PDFMariana NaglesОценок пока нет

- Weak Leaner ActivityДокумент5 страницWeak Leaner ActivityAshwini shenolkarОценок пока нет

- CH 04 Income StatementДокумент6 страницCH 04 Income Statementnreid2701Оценок пока нет

- Master Input Sheet: InputsДокумент34 страницыMaster Input Sheet: Inputsminhthuc203Оценок пока нет

- Manufacturing AccountsДокумент3 страницыManufacturing AccountsChelsea BenjaminОценок пока нет

- Inc StatmentДокумент3 страницыInc StatmentDilawarОценок пока нет

- Tally HistoryДокумент26 страницTally HistoryvimalnandiОценок пока нет

- Factory OverheadsДокумент22 страницыFactory OverheadskromatographicОценок пока нет

- Final AccountДокумент47 страницFinal Accountsakshi tomarОценок пока нет

- Chart of AccountsДокумент5 страницChart of AccountsMonroe P ZosaОценок пока нет

- Q2las4 1Документ9 страницQ2las4 1Justine BuenaventuraОценок пока нет

- Trading and Profit and Loss AccountДокумент5 страницTrading and Profit and Loss AccountDanish Azmi100% (1)

- Business Income Expense WorksheetДокумент1 страницаBusiness Income Expense Worksheethoanganh4meОценок пока нет

- Example of Direct and Indirect ExpensesДокумент14 страницExample of Direct and Indirect ExpensesEnamul HaqueОценок пока нет

- Developing Financial ProjectionsДокумент14 страницDeveloping Financial ProjectionsIngrid AtaydeОценок пока нет

- Profit and Loss Projection, 1yrДокумент1 страницаProfit and Loss Projection, 1yrKatu2010Оценок пока нет

- A. Detailed Organizational Structure of Finance DepartmentДокумент22 страницыA. Detailed Organizational Structure of Finance Departmentk_harlalkaОценок пока нет

- Manufacturing AccountsДокумент6 страницManufacturing Accountsdhanyasugukumar100% (2)

- 5.7 Income Statement TemplateДокумент2 страницы5.7 Income Statement TemplateTRan TrinhОценок пока нет

- Corporate Income TaxДокумент14 страницCorporate Income Tax36. Lê Minh Phương 12A3Оценок пока нет

- Cost Accounting - Aunja MamДокумент51 страницаCost Accounting - Aunja MamRavi Kumar PariharОценок пока нет

- Accounting and Finance Formulas: A Simple IntroductionОт EverandAccounting and Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- ASNT NDT Basic Part 10Документ9 страницASNT NDT Basic Part 10Anonymous gFcnQ4goОценок пока нет

- Wis5 DefectДокумент46 страницWis5 DefectAnonymous gFcnQ4goОценок пока нет

- ASNT NDT Basic Part 12Документ10 страницASNT NDT Basic Part 12Anonymous gFcnQ4go0% (1)

- ASNT NDT Basic Part 13Документ4 страницыASNT NDT Basic Part 13Anonymous gFcnQ4go100% (1)

- ASNT Basic Book Part 11Документ12 страницASNT Basic Book Part 11Anonymous gFcnQ4goОценок пока нет

- Inspection HandbookДокумент126 страницInspection Handbooksteffy18295% (21)

- Material & Processes For NDT Part 5Документ14 страницMaterial & Processes For NDT Part 5Anonymous gFcnQ4goОценок пока нет

- ASNT Basic Book Part 7Документ9 страницASNT Basic Book Part 7Anonymous gFcnQ4go100% (1)

- ASNT NDT Basic Book Part 009Документ11 страницASNT NDT Basic Book Part 009Anonymous gFcnQ4goОценок пока нет

- RT Level IIIДокумент100 страницRT Level IIIhadi100% (2)

- Elecromagnetic Test Method Level-1 2 3 ASNT-Question-Answer Book - 2nd EditionДокумент82 страницыElecromagnetic Test Method Level-1 2 3 ASNT-Question-Answer Book - 2nd EditionAnonymous gFcnQ4go78% (9)

- Ndtel Sop Mtbs77eydДокумент8 страницNdtel Sop Mtbs77eydAnonymous gFcnQ4goОценок пока нет

- ASNT Basic Part 8Документ11 страницASNT Basic Part 8Anonymous gFcnQ4goОценок пока нет

- Asnt Basic l3 Part 6Документ9 страницAsnt Basic l3 Part 6Anonymous gFcnQ4go100% (1)

- MT Procedure For MAG50Документ17 страницMT Procedure For MAG50Anonymous gFcnQ4go100% (1)

- Material & Processes For NDT Part 3Документ5 страницMaterial & Processes For NDT Part 3Anonymous gFcnQ4goОценок пока нет

- Material & Processes For NDT Part 4Документ15 страницMaterial & Processes For NDT Part 4Anonymous gFcnQ4goОценок пока нет

- Thermography GuideДокумент14 страницThermography GuidemounikanaikiniОценок пока нет

- Thermography GuideДокумент14 страницThermography GuidemounikanaikiniОценок пока нет

- Material & Processes For NDT Part 1Документ4 страницыMaterial & Processes For NDT Part 1Anonymous gFcnQ4goОценок пока нет

- Electro Magnetic Field MCQ PDFДокумент64 страницыElectro Magnetic Field MCQ PDFAnonymous gFcnQ4go100% (3)

- Method A - Water Wash Fluorescent InspectionДокумент1 страницаMethod A - Water Wash Fluorescent InspectionizmitlimonОценок пока нет

- Ut Lavender QuestionДокумент27 страницUt Lavender QuestionbirthinonceОценок пока нет

- Material & Processes For NDT Part 2Документ11 страницMaterial & Processes For NDT Part 2Anonymous gFcnQ4goОценок пока нет

- Introduction To Indoor ElectricalДокумент16 страницIntroduction To Indoor ElectricalAnonymous gFcnQ4goОценок пока нет

- Maintence CheckДокумент2 страницыMaintence CheckAnonymous gFcnQ4goОценок пока нет

- Using Magnetic Flux Density To Identify Anomalies in Pipe Wall ThicknessДокумент21 страницаUsing Magnetic Flux Density To Identify Anomalies in Pipe Wall ThicknessAnonymous gFcnQ4goОценок пока нет

- ASNT VT-2 Book FinalДокумент107 страницASNT VT-2 Book FinalMirza Safeer Ahmad100% (6)

- 71-12 Checklist Against ISO 17025Документ14 страниц71-12 Checklist Against ISO 17025Dario MandicОценок пока нет

- Questions and Answers For PTДокумент8 страницQuestions and Answers For PTAnonymous gFcnQ4go60% (5)