Академический Документы

Профессиональный Документы

Культура Документы

Banking

Загружено:

Owolabi PetersАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Banking

Загружено:

Owolabi PetersАвторское право:

Доступные форматы

INTRODUCTION The evolution of banking in Nigeria pre-dates the nations independence.

It began with the activities of Elder Dempester and Company Limited of Liverpool, United Kingdom in 1892. Other notable organizations in the early times include the Nigerian Mercantile Bank Limited, Nigerian Farmers and Commercial Bank Limited, British and French Bank (which transformed to UBA) to the era of the Agbonmagbe Bank in 1945 which later transformed to WEMA Bank and African Continental Bank. However, most of the banks which had operated in Nigeria prior to independence were plagued by the challenges of poor capital base, INCOMPETENT management, stiff competition from foreign competitors and the recession of the 1930s. One important FACTOR which led to such massive bank failures was absence of regulatory framework, thus BETWEEN 1929 1952 HAS BEEN DESCRIBED as the era of free banking. HOWEVER, THE PERIOD FROM 1952 TO 1959 WAS THAT of legislation and regulation with the enactment of the Banking Ordinance of 1952 and the establishment of THE central bank in Nigeria. The 1958 Central Bank of Nigeria Act charged the Bank with responsibilities which include the issuance legal tender currency, the Maintenance of Nigerias external reserves to safeguard the external value of the domestic currency, the Promotion of monetary stability and a sound financial system as well as Acting as a banker and financial adviser to the Federal Government This laid the platform for the coordination and regulation of banking activities. More so, the prevailing situations at various points in time have necessitated the amendments to this Act. For instance, the 1969 Banking Act was enacted to correct the perceived weaknesses in the banking system and restore public confidence. The Nigerian Deposit Insurance Corporation was also established in 1988 to complement the CBNs role in the financial system. In 1991, the Banking and Other Financial institutions Act was proclaimed to replace both the Central Bank of Nigeria Act of 1958 and Banking Act of 1969 in order to strengthen the powers of the CBN. This was also followed by a recent amendment in 2007, which placed monetary and price stability on the front burner of the nations economic landscape. The banking industry segment of the Nigerian financial system which include the licenced Deposit Money Banks, Discount Houses, Finance Companies, Bureaux De Change, Primary Mortgage Institutions and Microfinance Banks have transformed over the years to assume the level of sophistication comparable to other emerging economies. Such areas of sophistication include new business models in terms of expansion and competition,

product development, technology leverage, regulation and supervision. Be that as it may, the primary role of any banking system is financial intermediation; whereby financial resources are pooled from areas of surplus and channeled to areas of needs with a view to ensuring steady and balanced economic growth.

However, in the case of Nigeria in the past 50 years, it is quite debatable if this significant role has discharged by the banks. To the average man on the street, banks were wont to declare huge profits on annual basis at the expense of the larger economy. There have been complaints of dearth of credits facilities in the system. Banks are being dubbed as parasites and risk averse by leveraging on thriving businesses or sectors only instead of assisting to nurture viable business ideas and enterprise to fruition. It is on record that citizens have at various times lost their live savings to bank failures. The issue of incessant bank failures, largely due to poor corporate governance, insider abuses, and ripping of customers has characterized the industry in past decades. The art, confidence and trust which are the hallmark of banking business have grossly eroded until recently when the management of the apex Bank has assured on the safety of deposits in the Nigerian banks. Without holding brief for the banks, it is pertinent to point out that those funds were being kept in trust for the depositors and there is the need to be cautious in managing such funds in the name of granting credit. The cheering news about the banking industry is that it has contributed immensely and even matched the fast pace of the nations development. And more than ever before, the regulatory authorities in recognition of the fact that genuine growth in the financial system is tied to the development of the real sector is taking the lead in ensuring that financial system contributes to the improvement of the real sector. It is heartwarming that efforts are been intensified to unlock the credit market for the real sector. In determining the way forward for the financial system, the onus is therefore, on the CBN and all other stake holders to evolve a safe and sound banking industry as it is too critical for the development of Nigerias economy. The journey to a prosperous financial system has just begun.

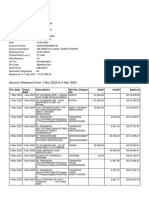

The latest ranking of Nigerian banks using the key indicators is shown below:

Earnings

One of the indices relied upon by industry watchers to evaluate the gains of the CBN intervention in 2009 is the banks earnings. In this regard, First Bank of Nigeria Plc led the pack in 2011 with gross earnings of N296.3 billion, followed by Zenith Bank Plc, Ecobank Nigeria Plc and Guaranty Trust Bank Plc with N244.07 billion, N227.1 billion and N1888.8 billion, which came second, third and fourth positions, respectively.

United Bank for Africa Plc, Access Bank Plc, Skye Bank Plc and Diamond Bank Plc followed in descending order, posting earnings of N184.83 billion, N138.9 billion, N104.832 billion and N83.4 billion, respectively to place fifth, sixth, seventh and eighth positions on the raking table.

Ninth position was occupied by First City Monument Bank Plc, with gross earnings of N80.4 billion, while Fidelity Bank Plc, StanbicIBTC , Sterling Bank Plc and Unity Bank which grossed N70.04 billion, N67.4 billion, N45.2 billion and N30.9 billion in earnings, respectively. Figures for other banks were not available.

Profits After Tax

The significant write downs of non-performing loans in 2011, just like 2010, impacted significantly on the profitability of many banks. Banks such as UBA, Diamond Bank, FCMB, GTB, Zentih Bank and FBN, among others, had to take haircuts in 2011 on the NPLs that were sold to AMCON. But those banks that transferred impaired assets that had adequate cover in the form of collateral, incurred less losses.

Accordingly, GTBank come out on top in terms of profitability, having posted a profit after tax of N52.65 billion, shoving First Bank to second position with N44.785 billion, while Zenith occupied third place with a PAT of N44billion. Access Bank came fourth with a PAT of N16.7

billion; it was followed by Sterling Bank with N6.7 billion and Fidelity - N5.182billion in that order. In seventh, eighth and ninth positions were Skye, StanbicIBTC and Unity Bank, which respectively reported PATs of 5.18 billion, 2.5 billion and 2.4 billion.

However, banks like FCMB, Diamond Bank and UBA, made losses after tax of N9.9 billion, N11.3 billion and N28.49billion, respectively, a clear indication that they made massive provisions for impaired loans on their books during the year under review.

Total Assets

In terms of assets, the configuration of the ranking table, post-resolution, has been slightly altered with the emergence of Access Bank and Ecobank Nigerian Plc entering the league of Tier I banks in the financial system. As at December 2011, in the graph reflecting the total asset of the banks, First Bank maintained the lead with N2.839 trillion in assets, while Zenith Bank ranked second with total assets of N2.309 trillion. UBA ranked third at N1.943 trillion while Access Banks business combination with erstwhile Intercontinental Bank has pushed it into fourth place, by shoving GTBank into fifth. Access Bank by December ending last year posted total assets of N1.635 trillion. GTBank, on the other hand, posted total assets of N1.612 trillion while Ecobank Plc, another bank that benefited from the acquisition of the defunct Oceanic Bank, amassed N1.321 trillion in total assets pushing it up to sixth position.

Ecobanks displacement of Union Bank, with total assets of N1.068 trillion, to seventh place on the ranking table means that Union Bank has been relegated to the league of Tier II banks, while Skye Bank occupied the eighth position with N927 billion in total assets. FCMBs acquisition of Finbank Plc could not help to catapult it into the league of Tier I banks but it moved it up some notches to ninth place with total assets of N844 billion, while Diamond Bank and Fidelity Bank occupied 10th and 11th positions with assets put at N804 billion and N741 billion respectively.

Keystone Bank Limited, StanbicIBTC, Mainstreet Bank and Sterling Bank Limited, occupied 12th, 13th, 14th and 15th positions with total assets put at N641 billion, N554 billion, N519 billion and N504 billion respectively, while at the bottom of the ladder were Standard Chartered Bank, Enterprise Bank and Wema Bank with assets of N230 billion, N188 billion and N159 billion, respectively.

Based on the research, the total assets of the banking sector stood at N19.501 trillion, of which the six banks in the Tier I segment, with assets of N11.659 trillion, accounted for almost 60 per cent (59.79 per cent) of total assets.

Total Deposits

According to research estimates by CHD, the position of Nigerian banks on the ranking table for deposits was not different from what obtained on the assets table. First Bank still led the pack at N1.900 trillion in deposits for the period under review and was followed by Zenith Bank with deposits of N1.654 trillion. Meanwhile, UBA Plc emerged third with total deposits of N1.445 trillion, while Access Bank again maintained its fourth position with a deposit base of N1.102 trillion, pushing GTBank, with deposits of N1.033 trillion, to fifth place. Like Access Bank, the growth in Ecobanks deposits, put at N971 billion, significantly showed the gains of its acquisition of Oceanic Bank. Ecobank was catapulted several places to sixth on the ladder from 17th position the previous year.

Under the second tier, there was a repositioning of banks, with Skye Bank occupying pole position at seventh place with deposits of N658 billion, Diamond Bank followed in eighth position with N602 billion, while FCMB, Fidelity, and Union Bank were ranked 9th, 10th and 11th positions, with deposits of N585 billion, N560 billion and N500 billion, respectively. It was apparent that Union Bank, in spite of the CBN intervention, suffered a significant loss in deposits between 2009 and 2011.

Sterling Bank came 12th with deposits of N407 billion, Keystone Bank was 13th on the table in terms of deposits, recording N388 billion, while Stanbic IBTC, Mainstreet Bank and Unity Bank came 14th, 15th and 16th places on the ladder with deposit of N292 billion, N281 billion, and N222 billion, respectively. Again, at the bottom of the ladder were Citibank, Standard Chartered, Enterprise Bank and Wema, which posted deposits of N206 billion, N163billion, N134 billion and N121 billion, respectively.

Total deposits of the banking industry was put at N13.224 trillion, of which the Tier banks, with deposits of N8.105 trillion, accounted for 61.29 per cent of total industry deposits.

Branch Networks Perhaps, the intervention of regulatory authorities could be said to have caused a more profound upset among Nigerian banks in the area of branch networks. This is because apart from UBA and First Bank, two of the oldest banks with presence in virtually all the nooks and crannies of the country, two banks, hitherto in the Tier II and III segment of the sector in terms of branch networks, have crept to the top of the ladder to displace several others. Union Bank, on the other hand, maintained its place in the Tier I segment of the market, based on the size of its branch network. Under branch networks, UBA came first with 706 branches with First Bank following closely at 630 branches. However, Ecobank has shot into third position with 606 branches after its takeover of Oceanic Bank, while Access Bank emerged the fourth largest bank in terms of branches at 515 after it inherited about 366 branches of the defunct Intercontinental Bank Plc. Union Bank occupied fifth place with 350 branches, FCMB, which was one of the banks at the bottom of the ladder in terms of branches, moved up 16 places to sixth with 323 branches, while Zenith, Skye, Mainstreet and Unity Banks occupied the next places at 315, 260, 250 and 234 branches, respectively.

Also in a descending order, Keystone, Diamond and Fidelity Banks boast 230, 220 and 211 branches, respectively, while GTBank, which has consistently relied on e-payment platforms to drive its business, had a branch footprint of 181 to occupy the 19th place. Other than Stanbic IBTC, which has grown its branches to 171 at 20th place, other foreign banks Standard Chartered, with 26 branches, and Citibank at 13 branches remained at the bottom of the league.

Total industry branch network by December 2011, stood at 5,734 branches, of which the banks with largest branch networks UBA, FBN, Ecobank, Access Bank, Union Bank and FCMB with 3,131 branches, accounted for 54.6 per cent of total branches.

Improved NPL Ratios Following the intervention of AMCON and the purchase of banks toxic assets, there has been a significant increase in the non-performing loan (NPL) ratios of Nigerian banks. AMCON cleaned banks balance sheet by purchasing a total of N4.2 trillion non-performing loan at a cost of N1.7 trillion and at a proportion of about 44 kobo to a naira. It also moved to takeover the loans of those banks that had exceeded their single obligor limit or which posted a systemic risk to the banking sector. CBN also pegged the NPL ratio of banks at five per cent for the entire banking industry.

As at December last year, most banks recorded less than five percent NPL ratios. According to the research estimates, First Bank had the lowest non-performing ratio of about two per cent as against five per cent it recorded before the CBN/AMCON intervention. GTBank followed with about 2.5 per cent, in contrast to about 11 per cent before AMCON mopped up the NPLs on its books. FCMBs NPL ratio also dropped to three per cent as against 10 per cent before its acquisition of Finbank, while Enterprise Bank, which had an NPL ratio of 70 per cent before the intervention dropped to 3.5 per cent, post resolution. Mainstreet Bank, which had NPLs of 70 percent, pre-resolution, recorded four per cent as December 2011, while UBA dropped from eight per cent to four per cent.

Before the AMCONs intervention, Zenith Bank had an NPL ratio of 7 per cent but currently has about four per cent. As for Sterling Bank, its NPL ratio was put at about 4.5 per cent as at December 2011 as against 25 per cent before its acquisition of the defunct Equitorial Trust Bank Limited. Skye Banks NPL ratio dropped to about 4.5 per cent whereas it had an NPL ratio of 20 percent before the resolution.

Ecobank was obviously one of the major beneficiaries of the intervention as it slashed its NPL ratio to five per cent as against about 45 per cent. Union

Bank, on the other hand, recorded an NPL ratio of seven per cent, although the figure was about 60 per cent before AMCON moved in. StanbicIBTC posted an NPL ratio of 8 per cent as against 15 per cent, while Access Banks NPL ratio was put at 9 per cent, down from 20 per cent, pre resolution. Access Banks NPL ratio, which exceeded the CBN threshold, is believed to have been affected by its acquisition of the former Intercontinental Bank.

In spite of its massive loan write downs and sale of NPLs to AMCON, Diamond Bank still had an NPL ratio of 12 per cent well above the CBN threshold and 25 per cent higher than the eight per cent recorded before the banking system resolution. Unity Bank, which had an NPL ratio of about 30 per cent, recorded 12 percent in 2011, while Keystones NPL ratio fell from 70 per cent in 2009 to 12 per cent in the year under review. Fidelity Bank also dropped to 15 per cent from about 20 per cent, while Wema Bank recorded an NPL ratio of over 60 per cent as against 80 per cent in 2009, showing that a significant portion of its assets are still impaired.

Capital Adequacy

One significant aspect of the intervention was the injection of funds by AMCON to raise the capital adequacy ratio of nine of the troubled banks, which industry watchers have said has been responsible for the renewed interest by investors in the Nigeria banks. The capital adequacy is used to protect depositors and promote the stability and efficiency of financial systems globally.

In Nigeria, the banking industrys stipulated minimum CAR is 10 per cent. However, the CBN recently said that with successful recapitalisation of the rescued banks had raised the average CAR of all banks operating in Nigeria to 17.12 per cent. Accordingly, Enterprise Bank which had a negative CAR of 120 per cent in 2009 saw its CAR improve to 40 per cent CAR after AMCONs injection of N121.4 billion. Another nationalised bank, Mainstreet posted a CAR of 30 per cent in 2011, whereas it had a negative ratio of 118 per cent in 2009. Fidelity Banks CAR declined from 40 per cent to 30 per cent while FCMBs CAR was put at 28 per cent. Zenith Bank remained marginally unchanged, recording a slight difference in its CAR ratio, pre and post-resolution, moving from 29 per cent in 2009 to 28 per cent in 2011. Stanbic IBTC had a CAR of 35 per cent in 2009, but if dropped to 25 per cent in 2011. First Bank also showed its capital remained unimpaired as its CAR remained unchanged at 22 per cent since 2009. Access Bank had a CAR of 22 per cent in December 2011, down from 30 per cent in 2009, signifying that its acquisition of Intercontinental Bank with a negative CAR of 50 percent had an impact on its capital. Union Bank, on the other hand, which had a negative CAR of 30 per cent, pre-intervention, rose to 20 percent in 2011. Skye Bank is another bank that has been able to raise its CAR. The bank, according to its managing director, Mr. Kehinde Durosinmi-Etti, was able to raise $100 million dollars through a private placement.

He said in Lagos last week that the apex bank was currently vetting the deal. Consequently, it raised its CAR from 18 per cent, pre-intervention, to 20 percent in 2011. GTBank, in 2009, had a CAR of 22 per cent but the ratio declined marginally to 20 percent in 2011. Ecobank had a CAR

of 20 per cent, post-resolution, down from 25 percent, which was also an indication that its business combination with Oceanic Bank, which had a negative CAR of 30 percent, had depressed Ecobanks capital

UBA Plc had a CAR of 20 per cent, in December 2011, as against 18 percent recorded in 2009, while Sterling Banks CAR in 2011 was put at 20 per cent. Prior to the intervention, the legacy Sterling Bank recorded a CAR of 18 per cent CAR. Wema Bank with a negative CAR of about 50 per cent, in 2009, improved its CAR to 18 per cent, post-resolution. As for Diamond Bank, it CAR, in December 2011, was put at 18 percent, down from 22 per cent in 2009, while Keystone Bank moved from its negative position of 68 per cent to 18 per cent in 2011.

Liquidity Ratios At the last meeting of the CBNs monetary Policy Committee in Abuja, the banking industrys liquidity ratio was put at 30 per cent. However, the research showed that as at the December 20011, the liquidity ratios of most of the banks, especially the intervened ones, were well above the threshold of 30 per cent stipulated by the central bank. Curiously, some banks recorded a drop in their liquidity ratios. For instance, Keystone Banks liquidity ratio which stood at 100 per cent in 2009, dropped to 30 per cent in 2011. Union Bank, which boasted of a 98 percent liquidity ratio prior to the intervention, had a liquidity ratio of 48 per cent in 2011, while Wema had 27 per cent liquidity ratio in 2011, as against 95 per cent in 2009. Still revelling in its business combination with the defunct Intercontinental Bank, Access Banks liquidity ratio rose from 30 per cent in 2009 to 70 per cent, post-resolution, while Stanbic IBTCs liquidity ratio rose to 72 per cent from 50 per cent in 2009. Mainstreet Bank also recorded a rise in its liquidity ratio from 25 per cent to 70 per cent in 2011, while First Banks liquidity position remained solid at 65 per cent from about 70 per cent, prior to the banking industry intervention.

Sterling Bank recorded a liquidity ratio of 68 per cent in 2011, whereas the banks liquidity was put at 50 per cent in 2009. UBAs liquidity also significantly improved to about 60 per cent as against 50 per cent before the intervention, while GTBank grew its liquidity ratio to 60 per cent in 2011 up from 50 per cent. However, Fidelity Banks liquidity ratio dropped to 55 per cent from 70 per cent in 2009, in contrast to Unity and Diamond Banks, which improved their liquidity from 30 per cent and 40 per cent to about 50 percent apiece.

Zenith Bank which recorded a liquidity ratio of 70 per cent, post-resolution, dropped significantly to 40 per cent, while FCMB posted a ration of 40 per cent in 2011, against 55 per cent in 2009. Ecobanks liquidity ratio in 2011 was 38 per cent while the figure for 2009 was about 50 percent.

Вам также может понравиться

- Long Before Digital Effects Appeared, Animatronics Were Making CinematicДокумент16 страницLong Before Digital Effects Appeared, Animatronics Were Making CinematicOwolabi PetersОценок пока нет

- ProposalДокумент7 страницProposalOwolabi PetersОценок пока нет

- Effect of Motivation On Employee Performance in Public Middle Level TechnicalДокумент11 страницEffect of Motivation On Employee Performance in Public Middle Level TechnicalOwolabi PetersОценок пока нет

- Project ProposalДокумент9 страницProject ProposalOwolabi PetersОценок пока нет

- Awosanya Victoria Afolake: Address - 26, Rev Oluwatimiro Avenue, Elepe, Ikorodu, Lagos 08031991825,08118424762Документ2 страницыAwosanya Victoria Afolake: Address - 26, Rev Oluwatimiro Avenue, Elepe, Ikorodu, Lagos 08031991825,08118424762Owolabi PetersОценок пока нет

- Igbowukwu ArtДокумент6 страницIgbowukwu ArtOwolabi PetersОценок пока нет

- New CV Owolabi Peters CCNA, MCITPДокумент3 страницыNew CV Owolabi Peters CCNA, MCITPOwolabi PetersОценок пока нет

- Chapter Two Review of LiteratureДокумент28 страницChapter Two Review of LiteratureOwolabi PetersОценок пока нет

- Name: Ukoha Chidiuto Elizabeth Matric: 1409072032 DEPT.: Mass Communication HND Ii Course: Intro To Science Writing Applied ScienceДокумент6 страницName: Ukoha Chidiuto Elizabeth Matric: 1409072032 DEPT.: Mass Communication HND Ii Course: Intro To Science Writing Applied ScienceOwolabi PetersОценок пока нет

- Project Proposal ON Maintaining Food Hygiene Standards To Combat Food Poisoning in The Hotel Industry in Hotel BY Azeez Sekinat Motunrayo 1505012040Документ7 страницProject Proposal ON Maintaining Food Hygiene Standards To Combat Food Poisoning in The Hotel Industry in Hotel BY Azeez Sekinat Motunrayo 1505012040Owolabi Peters50% (2)

- Chapter Three 3.0 Materials and Methods 3.1 Experimental UnitsДокумент2 страницыChapter Three 3.0 Materials and Methods 3.1 Experimental UnitsOwolabi PetersОценок пока нет

- Dare's Project Proposal NewДокумент5 страницDare's Project Proposal NewOwolabi PetersОценок пока нет

- Human Behavior and Interpersonal CommДокумент11 страницHuman Behavior and Interpersonal CommOwolabi PetersОценок пока нет

- Project Proposal On The Impact of Use of Models On Patronage of A Product (Case Study of Mary Kay) by Olatoyegun Maria Folashade 1409072122Документ5 страницProject Proposal On The Impact of Use of Models On Patronage of A Product (Case Study of Mary Kay) by Olatoyegun Maria Folashade 1409072122Owolabi PetersОценок пока нет

- The Role of Nigerian Stock Exchange in Industrial DevelopmentДокумент61 страницаThe Role of Nigerian Stock Exchange in Industrial DevelopmentOwolabi PetersОценок пока нет

- Chapter One 1.1 Background To The StudyДокумент7 страницChapter One 1.1 Background To The StudyOwolabi PetersОценок пока нет

- The Origin of ReligionДокумент1 страницаThe Origin of ReligionOwolabi PetersОценок пока нет

- Cable 31Документ6 страницCable 31Owolabi PetersОценок пока нет

- Chapter Two LatestДокумент13 страницChapter Two LatestOwolabi PetersОценок пока нет

- Name: Akin-Lawrence Fisayo Esther Matric: 134072015 Course: International Communication and World PressДокумент6 страницName: Akin-Lawrence Fisayo Esther Matric: 134072015 Course: International Communication and World PressOwolabi PetersОценок пока нет

- Name: Akintayo Kehinde Monsurat Matric: 134072081 Course: International Communication and World PressДокумент4 страницыName: Akintayo Kehinde Monsurat Matric: 134072081 Course: International Communication and World PressOwolabi PetersОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Two Brain MetricsДокумент27 страницTwo Brain MetricsJay MikeОценок пока нет

- Government of Kerala: Rs. Rs. RsДокумент25 страницGovernment of Kerala: Rs. Rs. RsmuhammedОценок пока нет

- 9 Bank of The Phil. Islands vs. Intermediate Appellate Court PDFДокумент7 страниц9 Bank of The Phil. Islands vs. Intermediate Appellate Court PDFKristabelleCapaОценок пока нет

- UntitledДокумент8 страницUntitledRae SlaughterОценок пока нет

- Chapter 8: Cash and Bank Management Daily Procedures: ObjectivesДокумент26 страницChapter 8: Cash and Bank Management Daily Procedures: ObjectivesArturo GonzalezОценок пока нет

- Training Report On Anand RathiДокумент92 страницыTraining Report On Anand Rathirahulsogani123Оценок пока нет

- FINA1904 - ALL Weitzel - Spring 2019Документ11 страницFINA1904 - ALL Weitzel - Spring 2019JamesОценок пока нет

- Act1104midterm Exam Wit AnsДокумент9 страницAct1104midterm Exam Wit AnsDyen100% (1)

- EconomicsДокумент10 страницEconomicsCalvinОценок пока нет

- Income Tax Law & Practice Unit 4Документ8 страницIncome Tax Law & Practice Unit 4MuskanОценок пока нет

- AE 111 Final Summative Assessment 2Документ3 страницыAE 111 Final Summative Assessment 2Djunah ArellanoОценок пока нет

- GU215RG Post To Home Address: SurreyДокумент1 страницаGU215RG Post To Home Address: SurreyhelikacarvalhoОценок пока нет

- 04 2013-2014 Financial AgreementДокумент2 страницы04 2013-2014 Financial Agreementapi-234678525Оценок пока нет

- External Debt Development and Management: Presentations On IndiaДокумент22 страницыExternal Debt Development and Management: Presentations On IndiaYasser KhanОценок пока нет

- What Is EMD in Contract Work - Google SearchДокумент3 страницыWhat Is EMD in Contract Work - Google SearchRanjanОценок пока нет

- Merchant BankingДокумент49 страницMerchant BankingChandrika DasОценок пока нет

- Account Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент2 страницыAccount Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesameer bawejaОценок пока нет

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureДокумент6 страницThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureSachinОценок пока нет

- Valuation Part 2Документ82 страницыValuation Part 2Dương Thu TràОценок пока нет

- DIY Discharge Debt GuideДокумент4 страницыDIY Discharge Debt GuideAnthony VinsonОценок пока нет

- Finanacial Performance Analysis of HDFC BankДокумент54 страницыFinanacial Performance Analysis of HDFC BankSharuk KhanОценок пока нет

- BP Amoco (B)Документ32 страницыBP Amoco (B)Arnab RoyОценок пока нет

- AssignmentДокумент7 страницAssignmentMona VimlaОценок пока нет

- Basic Guidance To AccountingДокумент5 страницBasic Guidance To AccountingAishwarya ShelarОценок пока нет

- 4 AdjustmentДокумент19 страниц4 AdjustmentMina AmirОценок пока нет

- Investment Undertakings PDFДокумент64 страницыInvestment Undertakings PDFDianneОценок пока нет

- Unit 1Документ92 страницыUnit 1Amrit KaurОценок пока нет

- Commercial Law Review Cases Batch Recto LawДокумент12 страницCommercial Law Review Cases Batch Recto LawKarmaranthОценок пока нет

- Yes BankДокумент9 страницYes Bankरायटर लेखनवालाОценок пока нет

- The Nigerian Financial System at A Glance - Monetary Policy DepartmentДокумент356 страницThe Nigerian Financial System at A Glance - Monetary Policy DepartmentAgbons EbohonОценок пока нет