Академический Документы

Профессиональный Документы

Культура Документы

Marginal Oportunity 1987

Загружено:

Jose Francisco Sotelo LeyvaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Marginal Oportunity 1987

Загружено:

Jose Francisco Sotelo LeyvaАвторское право:

Доступные форматы

MARGINAL OPPORTUNITYCOST AS A PLANNING CONCEPT IN NATURALRESOURCE MANAGEMENT David Pearce and Anil Markandyal Department of Economics University College

London Gower St., LondonWCIE 6BT United Kingdom Abstract Renewable resources are being used in non-sustainable ways in many countries in the world. The costs of non-sustainability need to be enumerated and valued in order to establish the desirability or otherwise of such development paths. The appropriate concept is marginal opportunity cost (MOC), a measure of the social costs of resource depletion. This concept is set in the context of models of the development process which stress the relationship between environment and development as a "coevolutionary" one rather than one of trading off material gain against environmental quality. Measures of MOC need to reflect the often intricate physical and ecological interlinkages within ecosystems, allowing for, e . g . , the relationship between deforestation, soil erosion, streamflow and sedimentation. In turn, MOC comprises direct costs of resource use, the externalities arising from ecological interlinkage, and a user cost component which arises because of non-sustainable resource use. Formulated in this way, MOC has implications for shadow pricing exercises, national accounting, and for the choice of sector and geographical area for project appraisal. I. Introduction There is now a widespread appreciation that the economic fortunes of many developing countries are inextricably bound up with the state of their natural environments. In particular, serious concern is being expressed at the d _ . e e facto treatment of the primary renewable resources--soil, water and forest biomass--as exhaustible resources, to be "mined" and depleted to the point of actual or potential nonrenewability. The features underlyingthis concern are: IThe views expressed in this paper are those of the authors, and should not be attributed to the World Bank, to its affiliated organizations, or to any individual acting on their behalf. The authors wish to acknowledge assistance from the World Bank and the U!~ ESRC for earlier work on which this paper is based. 18

MARGINAL OPPORTUNITY

COST

(a) exploitation giving rise to irreversibilityphenomena, notably desertifieation, such that the option to rebuild the stock to some policy-determined level is removed; (b) the complex interlinkages in the ecological systems which contain renewable resources, such that the costs of depletion of one resource are magnified through the interdependent systems; (c) the speed at which these effects occur; and (d) the immediate and future cost in terms of human misery, overwhelmingly among the rural poor, that arises because of resource degradation. Quantified descriptions now abound as do the pleas to take constructive action, viz., World Resources Institute [35], Repetto [25, 26], Bartelmus [3], Holdgate Ill], Warlord [3 l], and Pearee [20]. The costs of natural resource degradation (NRD) show up in two general ways. First, there is a direct dependence effect. Whereasdeveloped economies have "roundabout" technologies in which the relationship between final product and natural resources is often obscure and complex, developing countries tend to have household and agriculture sectors in which this roundaboutness is absent or small. Examples are the direct reliance on woodfuels (fuelwood and charcoal), rivers and lakes as sources of water for all uses, and even wildlife for food. As illustrations, only 24% of the rural sector in Africa had house connections to water supplies in 1983, although this was a marked increase on the 10.8% figure for 1970. Connections to urban households in Africa increased in number over the same period, but as a percentage of the urban population, the figure fell from 63.5% to 59.6% (World Health Organization [34]). Traditional fuels (woodfuels and other biomass) as a percentage of total primary energy supply is above 90% in Nepal, Malawi and Tanzania, and between 70 and 80% in GuineaBissau, Ethiopia, Sudan, Paraguay and Niger (authors' calculations from World Bank UNDP Energy Assessments). The very existence of subsistence agriculture underlines the direct dependence on soil fertility, rainfall, and natural or managed irrigation water. The depletion of these renewable resources is thus likely to have detrimental effects on the populations reliant upon them. Second, the development process itself will be affected perhaps more indirectly by NRD. Development is best indicated by a vector whose components include real incomes per head, health, education and other "basic needs." NRD affects a number of components of development via direct dependence, as with waterborne diseases. It also affects more traditional indicators of change such as per capita real incomes, especially if these are (properly) construed in sustainable terms. That is, resource depletion may well yield temporary short gains in real income in the same way as anyone can borrow from a capital fund, but continued depletion is likely to result in medium to long run income losses, depending, as we shall see, on the view taken about the dynamics of the development process. Examples of losses include depreciation in forest stocks due to non-sustainable logging practices [27]; hydroelectricity losses due to dam sedimentation arising, in part, from non-sustainable forest clearance for agriculture and woodfuels [29, 20]; crop losses due to diversion of natural fertilizers--livestock dung and crop residues--to use as fuels in the face of woodfuels shortages. In short, the renewable resource base of the economy ceases to be a "dispensable" input to the development process and must be viewed, instead, as both a condition of and an integral part of development. Complex issues arise about the optimal size of that renewable resource stock and we have addressed them elsewhere [24]. What is not in question, however, is that a number of countries have depleted critical renewable stocks to extremely high risk levels when measured in terms of development potential. This overall

19

DAVID PEARCE

AND ANIL MARKANDYA

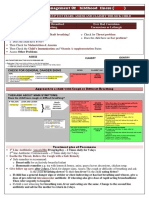

message is reeent but now familiar (see, for example, I~33,5]). In this paper we show how the tools of analysis that are already familiar to natural resource economists can be used to elicit certain features of the N R D process which both (a) assist in explaining that process, and (b) point towards policy measures designed to correct it. The eoncept we use to investigate these aspects of N R D is marginal opportunity cost. In calculating marginal opportunity cost, we seek a measure of the true cost of an action or poliey which depletes a unit of a renewable resource. The relevant context is one in which that resource is depleted in sueh a way that the natural regenerative process does not ensue, i.e., the resource is subject to non-sustainable management practice. Since the concept is no different to the more familiar one of social egst, but in the context of natural resources being consumed on an unsustainable basis, it may be argued that it is "nothing new." In terms of the familiarity of concepts, we accept that observation--at least as far as economists are concerned--but argue that it is suggestive and thought-organislng in several interesting ways. In particular, we shall argue that it tells us something about (i) the social pricing of natural resources in developing economies, (ii) the spatial dimensions of project investment appraisal, and (iii) the intertemporal dimensions of the N R D process. To set the scene further, we briefly consider the nature of the links between economies and their natural environments, and the emerging models of development which focus on the renewable resouree base. If. Economy-Ecology Linkages Since Kenneth Boulding's seminal "spaeeship earth" essay [4], there has been general but not universal awareness that the "linear economy" of economic textbooks is a misleading abstraction. Linear economies consist of production and consumption sectors, with the process of maximising the social utility of consumption being constrained only by the rate at which resources ean be transformed into produetion and consumption. Boulding observed that the laws of conservation of mass link the natural resource base, which "feeds" the produetion sector, to the emission of wastes into the receiving natural environments. Since the environments themselves have limited (though variable) waste assimilative capacities, constraints (beyond the limitations set by time and social organisation) exist on the rate of resource transformation (additional to those in conventional economic models), and on the time period over which sueh transformations can take place. The constraint set by the relationship between waste emissions and environmental assimilative capacity is the analogue of rules for the sustainable use of renewable resources, namely that "harvest" rates should not exceed natural or managed yields. The linear economy is replaced with one in which not just flows of flnanee are circular, but so also are the flows of materials and energy. Moreover, these two "layers" of the system interact: economie and ecological systems are not separate. Boulding further aeknowledged the economic importanee of ecological cycles familiar to any life scientist--e.g., earbon cycles, hydrologic eyeles and nutrient cycles. His focus was planet earth as a global ecosystem, but others have shown how the prineiples apply to regional and national economic systems (Kneese, Ayres and d'Arge [13], Hafkamp [10]. In the developing economy context Figure 1 provides a stylised summary of some of the main economy ecosystem linkages as they relate to renewable resources. A system shock, say in the form of agricultural colonisation of a hitherto afforested area, is seen to

20

M_A~GINAL O P P O _ ~ T U N I T Y C O S T S

FIGURE 1

AH via Nutritional Impact

A Q via Reduced Labor input

Diversion to Fuel Use of Dung & Crop Residues

~ Q via Reduced Livestock

Shock--"l--'----I~

/~ Q via . Reduced Land Productivity

~Q

alinity

I Sedimentation/Siltation of Rivers Irrigation Hydro

Ao,ql-

.~

Impact on J River,Estuary, J Reef Fisheries]

Reduced Electricity Output

/k Q via

Drinking Water Effects

/xa

~ H via Disease ~ H and A Q

21

DAVID PEARCE AND ANIL MAI~KANDYA

have various '~nock-on" effects. Loss of tree cover increases soil erosion, erosion adds to watercourse sedimentation, reducing electricity output, raising flood plains, and so on. The direction and scale of these effects depends on a second "layer" of the economy-ecosystem interaction, namely the level of social organisation. Thus the social response to deforestation could be its replacement with stable agricultural systems which prevent soil erosion. In figure l, ~ Q refers to effects which show up in measured or measurable development indicators. The essential point is that economic development is not independent of the renewable resource base. In Norgaard's terms, economy and ecosystem are "coevolutionary": development of one requires the harmonious evolution of the other [16, 17]. In the language of neoclassical economics, the system shock generates external effects. But analysis in terms of the theory of external effects needs to be broadened in light of the following: (i) the externalities may well be pervasive because of extensive ecosystem linkages accompanied by the direct dependence phenomenon; (ii) the externalities may well extend over wide geographic areas, although the watershed appears to set a reasonably bounded system before effects are dissipated; (iii) the externalities have a temporal aspect, in that resource degradation now precludes resource use benefits in the future; and (iv) development, in the sense of processes which are currently thought to contribute to sustainable growth in social indicators, is often itself the source of externality which, in turn, is compounded to feed back negatively on development. Marginal opportunity cost (MOC), as a social cost measure, seeks to identify and measure the true social costs of actions and policies such as deforestation. As such, it has to begin by identifying the relevant ecosystem linkages. MOC is already an organising concept. Ill. Alternative Models It is fashionable to speak of the social goal in developing economies as sustainable development. Unfortunately, the term has come to mean all things to all men, not least because "development" itself is value loaded as a concept. Four strands seem discernible: (i) traditional mode~s of 'steady state' growth such as can be found in the theory of economic growth;~ (ii) development paths which are resilient to external shocks such as drought, population change, and exogenous events such as world price changes in commodity and input markets [8]; (iii) development with an explicit bias to the rural poor and to immediate benefits [@; and (iv) development which honors certain 'rules of the game,' notably the physical requirements for the sustainable use of resources such as land, water, biomass and the assimilative capacity of the environment [19, 21, 18]. 2For a survey, see Jones [12] and Hache [9].

22

MAI~GINALO P P O R T U N I T Y COSTS These alternative views are discussed in detail in Pearce [23]. The fourth variant, which has its heritage in the work of Boulding, is the most suggestive and has direct relevance to the processes giving rise to NRD in developing countries. Moreover, when translated to a dynamic context, it has affinities with the few attempts that have been made to develop an 'ecological' theory of economic change, notably the major neglected work of Wilkinson [32], recently revived and tested by Common [7]. On Wilkinson'stheory, development actually only occurs as a result of some disequilibrium relationship between the economy and its population, and the natural resource system supporting it. But the kinds of change that take place in response to the disequilibrium offer no guarantee that the economy will get on to a stable path--it might also collapse or enter a depression stage. In the modern context, the risk of failure may be quite high as the social forces responding to disequilibrium are accompanied, and often swamped, by policy responses from government and other authorities. If the two are not in harmony, the failure risk is high. Up to the level of the 'ecological bound' set by the endowment of natural resources-especially renewable ones-economic change may be steady. As the bound is encountered disequilibrium occurs. Pursuit of the traditional development path can easily lead to short run gains, notably as the renewable resource stock is depleted: borrowing from the natural capital base takes place. In the absence of major technological breakthroughs, the development path is short-lived (a few decades rather than many). A sustainable development path occurs only if the ecological bound itself is shifted. Mechanisms for doing this will be the application of relevant technology, management of renewable resources to secure higher natural yields, investment in assimilative capacity, recyclingf and a switch to borrowing from exhaustible resources such as oil and coal.~ Policies to shift the bounds themselves may be risky--technology may create as many problems as it solves, as, for example, with some of the experience of agricultural mechanisation unsuited to soil depth. In this sense, development is no more guaranteed than it is in any of the traditional models of economic growth. What the model does do is to suggest a central role for ecological factors in the development process, so that it becomes clear that the risks of the 'push' for development are greatly magnified if these factors are ignored. How does this, albeit very sketchy, outline of an ecological development process fit with the concept of marginal opportunity cost? By forcing attention to be paid to the components of MOC their role in the development process is highlighted. As we shall see, MOC is future oriented as well as spatially oriented. Ecological bounds enter the picture through a 'user cost' component which measures the benefit foregone in the future by depletion of the resource today. Arguably, even this user cost component has to be modified to ensure that the full costs of non-sustainable actions today are accounted for [22], but the general point is adequate for current purposes. Having invoked MOC several times, we now explain the concept in more detail.

3Such a path is very likely to have the features of Conway's concept [8] of sustainability, i.e., development will take place through diversification of inputs and outputs rather than monocultural activity.

23

DAVID PEA.~CE AND ANIL MAI-hKANDYA IV. The Concept of MarginalOpportunity Cost

When a small amount of a natural resource is used up, the true value of that resource is measured by the marginal opportunity cost. In this definition, the word "marginal" occurs because the calculation is done for a small change in the rate of usage. Economists frequently use marginal concepts in determining the rules for resource allocation and in measuring scarcity. The reason for this is that the appropriate level of use of a resource can often be calculated by equating the marginal cost of that resource with the marginal benefit derived from its use. If both marginal cost and benefit can be calculated, then we can cheek to see whether they are e q u a l If the cost exceeds the benefit at the margin, then this indicates that the resource is being overexploited and its use should be cut back a little. Equally,if the marginal benefit exceeds the cost, then increasing exploitation slightly should be beneficial. In addition to working out the appropriate level of use of a resource, calculations of marginal cost can also be of use in evaluating public investment projects and government regulations. Such activities often involve small changes in the composition and level of the natural resource base of the country. If the costs of such changes can be measured, they can be included in the overall calculus of costs and benefits, from which a decision on the suitability of the investment or regulation can be made. In this respect, the marginal opportunity cost, which we describe in detail below, is the same as the marginal social cost of any input used in, or affected by, the project or regulation. The difference is that it refers to the marginal cost of a natural resource and is calculated somewhat differently. Although we have argued that MOC is generally the right measure of searcity, there are situations where the appropriate concept is not a marginal one. In particular, this will be so when the policies being considered involve large changes to the stocks of natural resources. Then the value of a small change in the resource, suitably scaled up, will not be an accurate measure and what is required is a comparison between the value of the total stock before and after the change. Also, changes in the values of related resources and commodities should be compared ex ante and . ex post. Such'global' comparisons will be required typically in the context ol natural resource management when evaluating the consequencesof eeologieal disasters. In such eases, the notion of a 'marginal disaster' is something of a contradiction in terms. Thisqualification to the use of marginal measures is important and should always be borne in mind. However, it remains true that the most relevant and frequently used concept in the managementof scarce natural resources is MOC. The words "opportunity cost" in the term that we are consideringrefer to the best alternative use to which a particular set of resources could be put if they were not being used for the purpose which is being costed. These costs can be broken down into three components. First, there is the direct cost of the activity. Extracting natural resources requires labor, materials, etc. For example, cutting down a tree may require one man day of labor. Suppose that the same man day could, if devoted to another activity, produce goods and services to the value of SX. ~'henthe opportunity cost of that labor is said to be SX and that is the figure that should be entered into the direct cost calculation. The relationship between the opportunity cost as described above and what is actually paid in to the worker can be quite complex, and involves a number of considerations that are not relevant to this paper. What is relevant is to note that, in general, actual payments for inputs and commodities will need to be adjusted in the light of taxes and market imperfections in order to obtain their

24

MARGINAL

OPPORTUNITY

COSTS

opportunity cost. Such a process is sometimes referred to as "shadow pricing." The second component of MOC is referred to as the external cost. These costs arise, as was explained earlier, because changes in any one component of the natural resource base have impacts on the other components of that base and on the efficiency with which other economic activities can be conducted. For example, deforestation may result in s0il erosion and river and reservoir siltation. This could affect agricultural output, electricity output, and the level and quality of drinking water now and in the future. Such impacts are measured in terms of the value of the activity or commodity in its alternative use. So, referring to the above example, reduced agricultural and electricity output and drinking water have a cost equal to the sum of the willingnessesto pay for these commodities by the consumers. The fact that some costs occur in the future means that we discount them using a discount factor to make them comparable to present day costs. If, for example, the social discount rate is 5% per annum then a cost of $1.05 in one year's time is equivalent to a cost of one dollar today. In order to obtain these external costs, one has to look at the data on the actual prices paid for the commodities concerned, the nature and structure of taxes that apply to them, and to obtain more general information on the determinants of the demand for them. The latter will be relevant in finding out whether at the present time there is excess supply or demand for the items concerned, and in ascertaining what the likely future demand for them is likely to be. Although information on these issues is difficult to obtain, and imprecise when obtained, we believe that a useful approximation to the value of the marginal external cost can be calculated in many cases. As was stated at the beginningof this paper, the external costs of particular relevance are those that arise when the resource is being exploited on a non-sustainable basis. Such spiilover effects as do arise in a sustainable use situation are likely to be small and also, in some cases, to be internallsed. This means that, with repeated use, people will eventually realise the impact that the exploitation of natural resources has, and its costs will appear as a direct cost. The final component of MOC arises from intertemporal considerations. Initially, let us suppose that the resource we are dealing with is not renewable but fixed in supply, so that any positive rate of exploitation will imply eventual exhaustion. In that ease, using one unit of the resource now implies that it wiU be unavailable in the future. This places a scarcity premium on the resource, the amount of which will depend on how large the stock is relative to the rate of exploitation, how strong future demand is relative to present demand, what substitutes are likely to be available in the future and at what cost, and what the discount factor is. For details of the calculation of this premium, which is defined as the user cost, the reader is referred to Munasinghe and Sehramm [15]. Assume, for example, that, on current expectations, a resource which has a (direct plus external) cost of one dollar per unit will be exhausted in ten year's time. At that stage, it will be replaced by a substitute which has a price of $2. Then, at the moment of exhaustion of the first resource, we would expect it also to have a price of $2. Otherwise, either the substitute would be cheaper, in which case no one would buy the fixed resource, or the substitute would be more expensive, in which ease no one would want to buy that. The p r e s e n t value of $2 in ten years' time will depend on the r a t e of discount. I f the rate is 5% per annum, then this value is $1.23 (i.e., 2/(1.05)10). This means that one unit not used today but used in ten years' time has a value of $1.23. Consequently the opportunity cost of consuming the unit today can be said to be $1.23. Since we have calculated the marginal direct and external

25

DAVID R. PEARCE AND ANIL MARKANDYA costs as one dollar, there remains a premium of 23 cents to be added in order to obtain the overall marginal opportunity cost. This last component, which is the user cost, clearly depends on a large number of factors. The discount rate is obviously a key variable, but so are the future price of the substitute and the time at which it comes into use. Hence, uncertainty about future developments and prices will play a significant part in determining user cost. The above discussion has taken place in the context of an exhaustible resource. If the resource is renewable, and if its present and future use is likely to take place on a sustainable basis, then any of the resource that is exploited today will be exactly replaced through natural or managed regeneration. In that case, there will be no scarcity premium to be added to the present direct and external costs. However, the present situation in many countries is not one of sustainable use. In some of these, complete exhaustion of the resource is the most likely possibility. In that case, we can treat the resource as exhaustible and calculate the user cost as outlined above. In other cases, it might be possible to arrest the rate of exploitation so that at least a minimum stock (e.g., one that prevents major ecological disasters) is preserved. Doing so will take some time but once that minimum stock is attained, it would seem logical for the authorities to maintain it. Under this scenario, a scarcity premium can be attached to current usage of the resource because future use is going to be restricted and hence future prices are going to be higher (other things being equal). ~ To sum up, MOC is made up as follows: MOC = MDC + MEC + MUC where MDC is the marginal direct cost, MEC the marginal external cost and MUC the marginal user cost. A considerable amount of information is required for each of the components and particularly for the last two. MEC requires details of the engineering and scientific relationship between natural resources and economic activities. It occurs mainly when the resource is being exploited on a non-sustainable basis. MUC requires expectations to be formed about future patterns of exploitation; and about future developmentsin the demand f o r natural resources and the supply of substitutes for these resources. For renewable resources MUC only arises when the resource is being used on a nonsustainable basis. V. The Uses of MarginalOpportunity Cost We have defined MOC and have also attempted to show how it relates to the wider theory of the relationship between an economyand its ecosystems, all in the context of the development process. We now illustrate the uses to which the concept can be put. (i) MOC as an OrganizingConcept

Because MOC is a logical extension of the economist's traditional preoccupation with marginal cost pricing to achieve allocative efficiency both 4Details of the calculation of user cost for this and related situations can be found in Pearce and Markandya [24].

26

MARGINAL

OPPORTUNITY

COSTS

intra- and inter-temporally, it serves as a mechanism for 'listing' the kinds of costs and benefits that need to be considered when evaluating investments to counteract NRD. Similarly, NRD is frequently a side effect of investment policy. In the investment context, MOC amounts to a marginal version of costbenefit analysis in general. For example, consider an investment to counteract desertification. A package of measures is introduced that includes shelterbelt forestry, soil management techniques, and tree growing for livestock fodder and fuel The benefits will show up as (a) savings in time spent collecting scarce fuelwood, (b) increases in farm productivity arising from improved livestock and improved soils, and (c) avoided damage due to desertificat~on. These benefits are the mirror images of the component cost items in MOC.~ Similarly, the true costs of allowing NRD to continue are indicated by MOC, just as we saw they were at the macroeconomic level when considering the costs of NRD in terms of conventional development objectives. (ii) MOC and Shadow Pricing MOC also has implications for shadow pricing--i.e., the prices that reflect the true state of scarcity of the natural resources in question. In the context of developing countries, shadow pricing practice for cost-benefit analysis tends to be based on the methodologies developed by Little and Mirrlees [14] and Squire and van der Tak [30]. In broad terms, this requires that input and outputs be valued according to their opportunity cost. For goods that either are or could be internationally traded, the relevant shadow price is the border price, the price that could be obtained by exporting it, or the price that has to be paid if importing it. If a tonne of oil is consumed domestically, for example, what is foregone is the foreign exchange that could have been earned if it were exported. For goods that are not (internationally) traded, the marginal cost of supply is the relevant shadow price since this reflects the cost of the resources used up in that supply. MOC now replaces the usual marginal cost concept, and thus becomes the shadow price for non-traded goods and inputs. For tradeables the border price remains the correct shadow price. Figure 2 shows the relationship between MOC and border prices. If the border price exceeds MOC the tradeable goods sector should be expanded since the marginal benefit of that expansion (the border price) exceeds the true marginal cost of the expansion (the MOC). A frequently heard complaint in developing economies is that the world market does not adequately compensate for the true costs of supply; the exporting nation bears all the costs of NRD and these outweigh the foreign exchange revenue. But in terms of Figure 2 this implies that the nation is operating to the right of Q*, the point where marginal benefits equal marginal costs of supply. If so, the tradables sector is too large and should be contracted. MOC as a pricing principle again forces attention on to the externalities associated with NRD. Moreover, it guides actual pricing policy in terms of the provision of incentives for alloeative efficiency. It is widely argued that pricing policy should first be concerned with the elimination or reduction of subsidies which encourage excessive resource use. As an allocative principle this is correct, i.e., 'proper' marginal cost pricing will tend to have incidental 5For a detailed example of an evaluation which shows high rates of return to investments in reducing MOC from desertification, see Anderson Ill.

27

DAVID t{. PEAI~CE AND ANIL MA.RKANDYA

Price. Coat MOC

,&~/J

Border Price

Q ~

0 Quantity of Traded Good

environmental benefits if it reduces improper and wasteful uses of resources. Failure to set irrigation water charges on the basis of user benefits, for example, is a notorious cause of inefficiency in the irrigated agricultural sector [28]. But it may well be that the divergence between marginal (private) cost and MOC is still very large even when marginal cost pricing is approximated. (iii) MOC and the "Unit of Account" The externality component of MOC reflects the ecological linkages between sectors. Observation of Figure I, however, shows that the effects can show up in locations quite distant from the initial "act" of NRD. Project evaluation thus needs to consider effects arising within a spatial "unit of account," and the natural unit is the watershed. The watershed as a management unit is, of course, well established in both developed and developing economies. Less practised is the analysis of entire watershed effects from the introduction of specific investments. An example of neglected feedback effects from the construction of hydroreservoirs is the "magnet" effect of the reservoir on human settlement in the immediate vicinity. In turn, the settlement may give rise to land clearance for agriculture and soil erosion which then contributes to siltation rates in the reservoir. In itself, MOC does not detect these effects, but allied to an understanding of watershed ecosystem functioning it will.

(iv) Discount R a t e s

Many of the external effects from NRD will show up in the future, perhaps being borne by those involved in the process, perhaps being borne by

28

MARGINAL

OPPORTUNITY

COSTS

future generations. The user cost component will tend to be borne by future generations. We noted previously that MOC has urged on the policy maker the fact that the non-sustainable harvesting of renewable resources will have future costs, both in terms of externalities (MEC) and in terms of foregone resource benefits (MUC). In both cases, the relevant cost is expressed in present value terms, i.e., the cost of future losses is expressed in terms of how they are viewed now. The size of these components will, therefore, be partially determined by the discount rates, that are often argued to reflect high rates of return that exist in underdevelopedagricultural sectors, or which reflect high interest rates in credit markets. Yet in both cases, it is the process of NRD which actually contributes to the high discount rates. NRD will make risk permia very high in actual credit markets, and if it is severe, it will generate high time preference rates as the search for immediate gains to prevent starvation becomes all the more urgent. Moreover, if high discount rates are adopted, there is a pardox, for they will reduce the MEC and MUC components of MOC, making it seem that NRD is less serious. The optimal level of investment in NRD avoidance thus appears less. NRD both creates high discount rates and is made worse by those discount rates. The fallacy lies in using market rates or inferred rates of time preference to guide the choice of social discount rate. High discount rates are, in many respects, a restatement of the NRD problem. (V) MOC and the National Accounts The national accounts of a country attempt to measure the value of the goods and services produced in that country and to show the division of that value between various categories of households. It is well known, of course, that this exercise is extremely difficult to do accurately, especially in developing countries, and that there are items that are both included and omitted incorrectly from the final calculation of national income. As far as natural resources are concerned, we need to consider those that are marketed and those that are used outside the cash economy separately. The former will be priced typically in terms of their direct cost alone (MDC), and the value included in the national accounts will reflect the equality between MDC and the willingnessto pay by the consumer for the resource that is used. However, the true value is less than that. This is because consumers of the resource impose costs on other agents in the form of restricted output and/or higher prices now and in the future. We measure these costs as MEC and MUC. Hence, in order to obtain the true value to society of the present consumption of the natural resource, we should subtract from the value of the marketed output, MEC plus MUC times the number of units consumed. MUC acts here as an analogue to the depreciation factor on capital, and so should be subtracted not from the calculations of gross income but from the net income figures. MEC is a mixture of present day and future costs, and its treatment with respect to gross and net income is unclear, without lookingat each case in detail. In some cases, government expenditure might be undertaken to mitigate some of the external effects of NRD. Such expenditures are frequently included as final government consumption, and appear in the national accounts as such. This, of course, is incorrect, because they are a cost of consumptionof natural resources and should be properly treated as an intermediate input and netted out of the national accounts. Indentifying these expenditures is made clearer once we start to measure MEC, to which they are relevant. When the natural resources used up do not go through the cash economy,

29

D A V I D PEARCE A N D ANIL I ~ K A N D Y A

they are either excluded from the national accounts or included on an estimated basis. The most likely situation here is that users of the resource bear the marginal direct cost and equate that to their marginal willingnessto pay for it. Hence, that is the "direct" value of the use of the resource. However, the same use imposes costs on others equal to MEC+MUC. Therefore, these should be subtracted from MDC to obtain the net value of consumption. What adjustment is then made to the accounts depends on what value had been originally included in them. One further point to note here is that while we have assumed that MDC is equal to the marginal willingnessto pay for the resource, this may not be the case if the resource is subject to private ownership and if the owners take a long-term view of the profitability of the resource. In that case, some or all of the MUC may be included in the price and the above propositions have to be altered appropriately.

(vi) MOC and Optimal Resourc e Stocks

The requirement of sustainable use for a resource does not imply a particular stock level for that resource. The choice of the optimal level of stock is arrived at by comparing MOC and the marginal benefits at different stock levels, assuming that the rate of extraction is equal to the rate of regeneration-i.e., that the resource is being used on a sustainable basis. Since we are dealing with sustainable use only, MOC will be calculated as the sum of MDC and MEC alone. It will, however, need to be calculated at different stock levels. Equating MOC and the marginal benefits then defines the optimal stock level, which we call S*. It is q~ite possible that this optimal stock is different from the current stock level, SU. For example, a resource rich country may take the view that it should reduce its stock level permanently, and use the proceeds to build up~its productive capital The path that the economy should take in going from Su to S* is determined by a dynamic optimisation exercise, in which the rates of capital accumulation and resource utilisation are the key variables. How fast or how slowly one proceeds will depend, among other things, on the marginal benefits of different levels of extraction, the marginal costs of those levels (MDC plus MEC), and the marginal productivity of capital. The scarcity premium associated with the use of the renewable resource is now endogenousto the whole analysis and does not have to be fed in as a separate piece of information. However, from the optimisation, this value of MUC for the path from SOto S* will be a potential output. Hence, we see that in determining both the equilibrium stock level and the path by which we get to that stock level, MDC and MEC are required pieces of information.

(vii) The Social Incidence of MOC

The present and future costs of resource exploitation fall on manyparties, some of whom are themselves significant users of the resource and others who are not. From a policy point of view, the incidence of these costs by income group is clearly important. T h e r e are a number of indications that, in distributional terms, it is often the poorest sections of the community that suffer the external costs of NRD. Although MOC does not provide the required information directly, the process of collecting the relevant data is facilitated when the framework for the estimation of MEC and MUC has been laid out.

30

MARGINALOPPORTUNITYCOSTS VI. Conclusion The concept of marginal opportunity cost is not new. We suggest that in the context of nonsustainable use of renewable resources, MOC functions as an organizing concept. Its component parts serve to focus attention on the relationship between acts of resource depletion now and their effects elsewhere in the economy and in the future. Moreover, it is linked to a view of the development process which emphasises the role of renewable natural resources, and which argues that development and environmental preservation are inseparable parts of the process of social improvement. The informational requirements for the calculation of MOC are considerable and, to some extent, subjective. This is because expectations have to be formed about the likely pattern of future exploitation and the likely future demands and supplies of the resource and its substitutes. However, such experience as we have, indicates that the exercise can be undertaken and that the results, although necessarily approximate, are a useful tool in the planning and management of natural resources. REFERENCES I. 2. 3. 4. 5. 6. 7. 8. 9. 10. II. 12. 13. 14. 15. Anderson, D. (1987). The Economics of Rural Afforestation in Ecologically Threatened Areas, Johns Hopkins University Press, Baltimore. Ayres,R. U. and Kneese, A.V. (1969). "Production, Consumption and Externalities." American Economic Review. Vol. 59. Bartelmus,P. (1986). Environment and Development. Allen and Unwin, London. Boulding,K. (1966). "The Economics of Coming Spaceship Earth" in H. Jarrett, ed. Environmental Quality in Growing Economy. Johns Hopkins University Press, Baltimore. Brown,L. (198l). Building a Sustainable Society. Norton, New York. Chambers, R. (1983). Rural Development: Putting the Last First. Longman, London. Common,M. (1987). "Poverty and Progress Revisited," in D. Collard, D. W. Pearee, and D. Ulph (eds.), Economics, Growth and Sustainable Environments. Macmillan, London. Conway,G. (1983). "Agroecosystem analysis." ICCET Seris E. No. I, Centre for Environmental Technology,Imperial College, London. Hacehe,G. (1979). The Theory of Economic Growth. Macmillan, London. Hafkamp,W. (1984). Economic-Environmental Modeling in a NationalRegional System. North Holland, Amsterdam. Holdgate,1 % { . (1982). The World Environment, 1972-82. Tycooly,Dublin. Jones, H. (1975). An Introduction to Modern Theories of Economic Growth. Nelson, London. Kneese,A. V., Ayres, R. U. and d'Arge, R. (1970). Economics and the Environment: A Materials Balance Approach. Resources for the Future, Washington, D.C. Little, I. and Mirrlees, J. (1974). Project Appraisal and Planning for Development Countries. Heinemann, London. Munasinghe, M. and Schramm, G. (1983). Energy Economics, Demand Management and Conservation Policy. Van Nostrand, New York. 31

D A V I D P E A R C E A N D ANIL M A I ~ K A N D Y A

16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35.

Norgaard, R. (1984). "Coevolutionary Development Potential," Land Economics, Vol. 60. Norgaard, R. (1987). "The Epistemological Basis for Agroeeology,"in A. M. Altleri. The Scient!fic Basis of Agroeeology. Boulder, Colorado. Page, T. (1977). Conservati_on and Economic Efficiency. Johns Hopkins University Press, Baltimore. Pearce, D. W. (1976) "The Limits of Cost Benefit Analysis as a Guide to Environmental Policy," Kvklos. Fase. 1. Pearce, D. W. (1987). "The Economics of Natural Resource Degradation in Developing Countries," in R. K. Turner (ed.), Sustainable Environmental Management: princip!r and Practice, Frances Pinter, London. Pearce, D. W. (1987a). "The Foundations of an Ecological Economics," Ecological Modelling. (Forthcoming) Pearce, D. W. (1987b). "Optimal Prices for Sustainable Development,"in D. Collard, D. W. Pearce and D. Ulph (eds.), Economics, Growth and Sustainable Enyironments. Macmillan, London. Pearce, D. W. (1987c) "Sustainable Development: Ecologyand Economic Progress," University College London (mimeo). Pearce, D. W. and Markandya, A. (1987). "The Costs of Natural Resource Depletion in Low Income Developing Countries." University College, London. (Mimeo) Repetto, R. (ed.). (1986a) The Global Possible. Yale University Press, New Haven. Repetto, R. (1986b). Worl.dEnough and Time. Yale University Press, New Haven. Repetto, R. (1986c). Natural Resource Accounting in a Resource Based Economy: an Indonesian Case Study. World Resources Institute, Washington, D. C. Repetto, R. (1986d). Economic Policy Reform for Natural Resource Conservation. WorldResources Institute, Washington, D.C. Sfeir-Younis, A. (1986). Soil Conservation in Developing Countries. World Bank, Washington, D.C. (Mimeo) Squire, L. and Van der Tak, H. (1975). Economic Analysis of Projects. Johns Hopkins UniversityPress, Baltimore. Warford, J. (1987). Environmental Growth and Development, Projects Development Committee, World Bank, Washington, D.C. (Mimeo) Wilkinson, R. G. (1973). Povertyand Progress. Methuen, London. International Union for Conservation of Nature and Natural Resources (IUCN). (1980). World ConservationStrategy. Gland,Switzerland. World Health Organization. (1986). World Health Statistics: Safe Water Supply and Sanitation: Prere~]uisites for Health for All. Geneva. World Resources Institute. (1986). W()rld Resources Report. World Resources Institute, Washington, D.C.

32

Вам также может понравиться

- The Politics of Vulnerability and Resilience: Georg Frerks Jeroen Warner Bart WeijsДокумент18 страницThe Politics of Vulnerability and Resilience: Georg Frerks Jeroen Warner Bart WeijsJose Francisco Sotelo LeyvaОценок пока нет

- Ahmad Et Al 2019 DisastersДокумент36 страницAhmad Et Al 2019 DisastersJose Francisco Sotelo LeyvaОценок пока нет

- Berkes 2007Документ13 страницBerkes 2007Jose Francisco Sotelo LeyvaОценок пока нет

- Environmental Science and Policy: Contents Lists Available atДокумент10 страницEnvironmental Science and Policy: Contents Lists Available atJose Francisco Sotelo LeyvaОценок пока нет

- Post-Normal Science - RavetzДокумент10 страницPost-Normal Science - RavetzJose Francisco Sotelo LeyvaОценок пока нет

- Risk, Rationality, and ResilienceДокумент7 страницRisk, Rationality, and ResilienceJose Francisco Sotelo LeyvaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- South Valley University Faculty of Science Geology Department Dr. Mohamed Youssef AliДокумент29 страницSouth Valley University Faculty of Science Geology Department Dr. Mohamed Youssef AliHari Dante Cry100% (1)

- Water Reuse RoundtableДокумент10 страницWater Reuse RoundtableajiiithОценок пока нет

- Buckthorpe Etal 23 Optimising Early Stage ACL Rehab ProcessДокумент24 страницыBuckthorpe Etal 23 Optimising Early Stage ACL Rehab ProcessCole VincentОценок пока нет

- 1943 Dentures Consent FormДокумент2 страницы1943 Dentures Consent FormJitender ReddyОценок пока нет

- Motor Starting: Why Do The Calculation?Документ13 страницMotor Starting: Why Do The Calculation?carlos_eqnОценок пока нет

- IMCI UpdatedДокумент5 страницIMCI UpdatedMalak RagehОценок пока нет

- Battery Installation ProcedureДокумент5 страницBattery Installation ProceduresantoshkumarОценок пока нет

- Defect Origin (J) Phase Requirement Analysis Design Coding Unit TestingДокумент87 страницDefect Origin (J) Phase Requirement Analysis Design Coding Unit Testingashish_jain_csОценок пока нет

- HPE 3PAR StoreServ 20000 Storage Service and Upgrade Guide Service EditionДокумент282 страницыHPE 3PAR StoreServ 20000 Storage Service and Upgrade Guide Service Editionben boltОценок пока нет

- Worksheet - Labeling Waves: NameДокумент2 страницыWorksheet - Labeling Waves: NameNubar MammadovaОценок пока нет

- FP Lecture Midterm Exam Sec - Sem.2020Документ4 страницыFP Lecture Midterm Exam Sec - Sem.2020SAEEDA ALMUQAHWIОценок пока нет

- Osce05ans 110918053819 Phpapp01Документ20 страницOsce05ans 110918053819 Phpapp01masood alamОценок пока нет

- JMO 2023 (7, 8) Question PaperДокумент2 страницыJMO 2023 (7, 8) Question PaperSuryanshu BhardwajОценок пока нет

- OLFACTIVE TRAINING 101 by SozioДокумент36 страницOLFACTIVE TRAINING 101 by SoziojaviercdeaeОценок пока нет

- Sop ExcelДокумент104 страницыSop ExcelRizky C. AriestaОценок пока нет

- Foundation Design LectureДокумент59 страницFoundation Design LectureJamaica MarambaОценок пока нет

- Water Vapor Permeability of Polypropylene: Fusion Science and TechnologyДокумент5 страницWater Vapor Permeability of Polypropylene: Fusion Science and TechnologyBobОценок пока нет

- Rumah Cerdas Bahasa Inggris Belajar Bahasa Inggris Dari Nol 4 Minggu Langsung BisaДокумент3 страницыRumah Cerdas Bahasa Inggris Belajar Bahasa Inggris Dari Nol 4 Minggu Langsung BisaArditya CitraОценок пока нет

- XYZprint User Manual en V1 1003Документ25 страницXYZprint User Manual en V1 1003reza rizaldiОценок пока нет

- E Numbers Are Number Codes ForДокумент3 страницыE Numbers Are Number Codes ForaradhyaОценок пока нет

- American Pile Driving Equipment Equipment CatalogДокумент25 страницAmerican Pile Driving Equipment Equipment CatalogW Morales100% (1)

- WD 02Документ1 страницаWD 02Elezer BatchoОценок пока нет

- Magical ExercisesДокумент5 страницMagical ExercisesAnonymous ytxGqZОценок пока нет

- Nurtured Womb e BookДокумент22 страницыNurtured Womb e BookSteph's Desserts100% (1)

- BiPAP ST Clinical ManualДокумент37 страницBiPAP ST Clinical ManualEng. Edelson Martins100% (2)

- Pitman SolutionДокумент190 страницPitman SolutionBon Siranart50% (2)

- SFT PresentationДокумент16 страницSFT Presentationapna indiaОценок пока нет

- Notice - Appeal Process List of Appeal Panel (Final 12.1.24)Документ13 страницNotice - Appeal Process List of Appeal Panel (Final 12.1.24)FyBerri InkОценок пока нет

- Part 3-Chap 2 - Classification of Buildings Based On OccupanciesДокумент60 страницPart 3-Chap 2 - Classification of Buildings Based On Occupanciesfaruque65Оценок пока нет

- Module 02 Connect Hardware Peripherals EndaleДокумент49 страницModule 02 Connect Hardware Peripherals EndaleSoli Mondo100% (1)