Академический Документы

Профессиональный Документы

Культура Документы

Chapter Questions and Problems: Chapter Seven Risks of Financial Institutions

Загружено:

Salim MattarИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter Questions and Problems: Chapter Seven Risks of Financial Institutions

Загружено:

Salim MattarАвторское право:

Доступные форматы

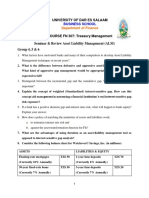

Chapter Seven Risks of Financial Institutions

Chapter Questions and Problems

1. How does a policy of matching the maturities of assets and liabilities work (a) to minimize interest rate risk and (b) against the asset-transformation function for FIs?

A policy of maturity matching will allow changes in market interest rates to have approximately the same effect on both interest income and interest expense. An increase in rates will tend to increase both income and expense, and a decrease in rates will tend to decrease both income and expense. The changes in income and expense may not be equal because of different cash flow characteristics of the assets and liabilities. The asset-transformation function of an FI involves investing short-term liabilities in long-term assets. Maturity matching clearly works against successful implementation of this process. 7. A bank invested $50 million in a two-year asset paying 10 percent interest per year and simultaneously issued a $50 million, one-year liability paying 8 percent interest per year. The liability will be rolled over after one year at the current market rate. What will be the banks net interest income if at the end of the first year all interest rates have increased by 1 percent (100 basis points)?

Net interest income is not affected in the first year, but NII will decrease in the second year. Year 1 $5,000,000 $4,000,000 $1,000,000 Year 2 $5,000,000 $4,500,000 $500,000

Interest income Interest expense Net interest income

The banks net interest income decreases in year 2 by $500,000 as the result of refinancing risk. 8. If the Swiss franc is expected to depreciate in the near future, would a U.S.-based FI in Bern City prefer to be net long or net short in its asset positions? Discuss.

The U.S. FI would prefer to be net short (liabilities greater than assets) in its asset position. The depreciation of the franc relative to the dollar means that the U.S. FI would pay back the net liability position with fewer dollars. In other words, the decrease in the foreign assets in dollar value after conversion will be less than the decrease in the value of the foreign liabilities in dollar value after conversion. 9. If an FI has the same amount of foreign assets and foreign liabilities in the same currency, has that FI necessarily reduced the risk involved in these international transactions to zero? Explain.

Matching the size of the foreign currency book will not eliminate the risk of the international transactions if the maturities of the assets and liabilities are mismatched. To the extent that the

asset and liabilities are mismatched in terms of maturities, or more importantly durations, the FI will be exposed to foreign interest rate risk. 30. Characterize the risk exposure(s) of the following FI transactions by choosing one or more of the risk types listed below: a. Interest rate risk b. Credit risk c. Off-balance-sheet risk (1) (2) (3) (4) (5) (6) (7) d. Technology risk e. Foreign exchange rate risk f. Country or sovereign risk

A bank finances a $10 million, six-year fixed-rate commercial loan by selling oneyear certificates of deposit. a, b An insurance company invests its policy premiums in a long-term municipal bond portfolio. a, b A French bank sells two-year fixed-rate notes to finance a two-year fixed-rate loan to a British entrepreneur. b, e, f A Japanese bank acquires an Austrian bank to facilitate clearing operations. a, b, c, d, e, f A mutual fund completely hedges its interest rate risk exposure using forward contingent contracts. b, c A bond dealer uses his own equity to buy Mexican debt on the less-developed country (LDC) bond market. a, b, e, f A securities firm sells a package of mortgage loans as mortgage-backed securities. a, b, c

Вам также может понравиться

- AccДокумент4 страницыAccrenoОценок пока нет

- 683sol01 PDFДокумент46 страниц683sol01 PDFUzma KhanОценок пока нет

- Risk MGT in Banking Midter Exam B&F7Документ3 страницыRisk MGT in Banking Midter Exam B&F7Abdelnasir HaiderОценок пока нет

- Solutions Chap007Документ13 страницSolutions Chap007Said Ur RahmanОценок пока нет

- MID-TERM Examination # 1 (30%) : Interest Paid 6 MillionДокумент7 страницMID-TERM Examination # 1 (30%) : Interest Paid 6 MillionTimbas TОценок пока нет

- Interest Rate RiskДокумент35 страницInterest Rate RisksimraОценок пока нет

- AccountingДокумент10 страницAccountingrenoОценок пока нет

- Solution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionДокумент17 страницSolution Manual For Financial Institutions Managementa Risk Management Approach Saunders Cornett 8th EditionAmandaMartinxdwj100% (37)

- Chapter Seven Risks of Financial IntermediationДокумент15 страницChapter Seven Risks of Financial IntermediationOsan JewelОценок пока нет

- Refinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenДокумент6 страницRefinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenJeffОценок пока нет

- 1 What Is A Difference Between A Forward Contract and A Future ContractДокумент6 страниц1 What Is A Difference Between A Forward Contract and A Future ContractAlok SinghОценок пока нет

- Chap 7 Slides Risk ManagementДокумент43 страницыChap 7 Slides Risk ManagementSinpaoОценок пока нет

- 1 - Tutorial ExercisesДокумент2 страницы1 - Tutorial ExercisesahmedОценок пока нет

- Global Finance Exam - 2 Fall 2012Документ6 страницGlobal Finance Exam - 2 Fall 2012mauricio0327Оценок пока нет

- Chap007end of CHPTДокумент5 страницChap007end of CHPTAhmed ObaidОценок пока нет

- Merged Seminar SheetsДокумент19 страницMerged Seminar SheetsCharlieОценок пока нет

- 15 Bond Valuation Part AДокумент24 страницы15 Bond Valuation Part AprernaОценок пока нет

- Problems To Be Solved in ClassДокумент4 страницыProblems To Be Solved in ClassAlp SanОценок пока нет

- Risk Management Solution Chapters Seven-EightДокумент9 страницRisk Management Solution Chapters Seven-EightBombitaОценок пока нет

- Tutorial 8Документ2 страницыTutorial 8Sean AustinОценок пока нет

- Chapter 18Документ9 страницChapter 18Selena JungОценок пока нет

- MarketshomeworkДокумент2 страницыMarketshomeworkMae BawaganОценок пока нет

- Solutions Manual Chapter Nineteen: Answers To Chapter 19 QuestionsДокумент8 страницSolutions Manual Chapter Nineteen: Answers To Chapter 19 QuestionsBiloni KadakiaОценок пока нет

- C The Adjustments of Nominal Interest Rates As Borrowers and LendersДокумент11 страницC The Adjustments of Nominal Interest Rates As Borrowers and LendersMasood AhamedОценок пока нет

- Exercise: Exchange Rate DeterminationДокумент9 страницExercise: Exchange Rate DeterminationRitik gargОценок пока нет

- R31 Non-Current (Long-Term) Liabilities Q BankДокумент16 страницR31 Non-Current (Long-Term) Liabilities Q BankAhmedОценок пока нет

- Chapter 7 Global Bond Investing HW SolutionsДокумент36 страницChapter 7 Global Bond Investing HW SolutionsNicky Supakorn100% (1)

- Assignment - 4 Jul 31Документ5 страницAssignment - 4 Jul 31spectrum_48Оценок пока нет

- R06 The Time Value of Money Q BankДокумент19 страницR06 The Time Value of Money Q BankTeddy JainОценок пока нет

- Post-Workshop Topic12 (Ch18)Документ3 страницыPost-Workshop Topic12 (Ch18)DelishaОценок пока нет

- Problem & SolutionДокумент19 страницProblem & Solutionfanuel kijojiОценок пока нет

- FIN 4604 Sample Questions IIIДокумент18 страницFIN 4604 Sample Questions IIIMohan RajОценок пока нет

- Seminar Questions Set II-1Документ4 страницыSeminar Questions Set II-1fanuel kijojiОценок пока нет

- Tutorial 2 QuestionsДокумент4 страницыTutorial 2 QuestionswarishaaОценок пока нет

- Bond MarketДокумент4 страницыBond Marketeunice.mazigeОценок пока нет

- Ch-25 SwapsДокумент34 страницыCh-25 Swapsvanessagreco17Оценок пока нет

- Questions, Anwers Chapter 22Документ3 страницыQuestions, Anwers Chapter 22basit111Оценок пока нет

- Chapter04 TestbankДокумент42 страницыChapter04 TestbankDuy ThứcОценок пока нет

- Exercises On Bond Portfolio StrategiesДокумент7 страницExercises On Bond Portfolio Strategiesmuzi jiОценок пока нет

- Section 5 - ch7 AnswersДокумент4 страницыSection 5 - ch7 AnswersDina AlfawalОценок пока нет

- Corporate Finance Academic Year 2011-2012 TutorialsДокумент21 страницаCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- SC Eoc08Документ25 страницSC Eoc08vanessagreco17Оценок пока нет

- Old Midterms 340Документ24 страницыOld Midterms 340shushanadavtyanОценок пока нет

- Module 3 - FILMORE ENTERPRISES - QuestionsДокумент4 страницыModule 3 - FILMORE ENTERPRISES - Questionsseth litchfieldОценок пока нет

- Interest Rate and Currency SwapsДокумент33 страницыInterest Rate and Currency SwapsMatt ToothacreОценок пока нет

- Financial Institutions Management - Chapter 5 Solutions PDFДокумент6 страницFinancial Institutions Management - Chapter 5 Solutions PDFJarrod RodriguesОценок пока нет

- Appendix - 8A The Maturity ModelДокумент10 страницAppendix - 8A The Maturity ModelAndreea IoanaОценок пока нет

- Week 8 Capital Adequacy Sounders1871Документ36 страницWeek 8 Capital Adequacy Sounders1871Nguyen Hoang ThaoОценок пока нет

- 2009-08-12 Saxo Bank Research Note - FDIC DIFДокумент3 страницы2009-08-12 Saxo Bank Research Note - FDIC DIFSwamiОценок пока нет

- Finc 445 HW IiiДокумент3 страницыFinc 445 HW IiiBruce_scribedОценок пока нет

- International Financial ManagementДокумент6 страницInternational Financial ManagementRavi GuptaОценок пока нет

- Choice Multiple Questions - Docx.u1conflictДокумент4 страницыChoice Multiple Questions - Docx.u1conflictAbdulaziz S.mОценок пока нет

- F9 Past PapersДокумент32 страницыF9 Past PapersBurhan MaqsoodОценок пока нет

- Financial Institutions Management - Solutions - Chap008Документ19 страницFinancial Institutions Management - Solutions - Chap008duncan01234Оценок пока нет

- Sample Questions CH 10, FIN 6633Документ3 страницыSample Questions CH 10, FIN 6633dragonfire19890% (1)

- Tugas Bab 14 Ak IntermediateДокумент2 страницыTugas Bab 14 Ak IntermediateSiti MulyaniОценок пока нет

- Paper - 2: Strategic Financial Management Questions Security ValuationДокумент21 страницаPaper - 2: Strategic Financial Management Questions Security Valuationsam kapoorОценок пока нет

- Ch5Probset Bonds+Interest 13ed. - MasterДокумент8 страницCh5Probset Bonds+Interest 13ed. - Masterpratiksha1091Оценок пока нет

- Competitive Advantage in Investing: Building Winning Professional PortfoliosОт EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosОценок пока нет

- Essay CP 5Документ2 страницыEssay CP 5Salim MattarОценок пока нет

- Shell PresДокумент11 страницShell PresSalim MattarОценок пока нет

- Ch01Hull Fund7eTestBankДокумент2 страницыCh01Hull Fund7eTestBankRoopam SaxenaОценок пока нет

- Answers Quiz2Документ3 страницыAnswers Quiz2Salim MattarОценок пока нет

- Ch. 1Документ9 страницCh. 1Salim MattarОценок пока нет

- Ch. 5IIДокумент7 страницCh. 5IISalim MattarОценок пока нет

- Chapter 7Документ85 страницChapter 7Salim MattarОценок пока нет

- Chapter 6Документ132 страницыChapter 6Salim MattarОценок пока нет

- Contoh COPYRIGHT TugasДокумент1 страницаContoh COPYRIGHT TugasBenyNoerBackboneОценок пока нет

- CH01 (Compatibility Mode) PDFДокумент16 страницCH01 (Compatibility Mode) PDFSalim MattarОценок пока нет

- RealTemp ChangelogДокумент2 страницыRealTemp ChangelogMihai DimoiuОценок пока нет

- ACCT 100 Syllabus Fall 2012 NCДокумент4 страницыACCT 100 Syllabus Fall 2012 NCSalim MattarОценок пока нет

- ENT - 1-Nature & Importance of EntrepreneursДокумент25 страницENT - 1-Nature & Importance of EntrepreneursMajhar Ul Haque100% (4)

- AaaaaaaaaaaaaaaДокумент14 страницAaaaaaaaaaaaaaapreetianvay100% (1)

- P2int 2012 Dec QДокумент7 страницP2int 2012 Dec QMhamudul HasanОценок пока нет

- Instruction: at The End of Each Case, You Are Required To Answer Each RequirementДокумент3 страницыInstruction: at The End of Each Case, You Are Required To Answer Each RequirementWendelyn TutorОценок пока нет

- Accenture AHR Overview FinalДокумент6 страницAccenture AHR Overview FinalUdit SinghalОценок пока нет

- Business Plan For SalonДокумент34 страницыBusiness Plan For Salonvandanam1367% (6)

- Options Trading Strategies: Understanding Position DeltaДокумент4 страницыOptions Trading Strategies: Understanding Position Deltasubash1983Оценок пока нет

- Brampton Financial ReviewДокумент55 страницBrampton Financial ReviewToronto StarОценок пока нет

- Adani PowerДокумент10 страницAdani PowerMontu AdaniОценок пока нет

- Shirkah Partnership by Shoayb JoosubДокумент20 страницShirkah Partnership by Shoayb JoosubRidhwan-ulHaqueОценок пока нет

- Material Ledger Is Not Active in Valuation Area C002Документ6 страницMaterial Ledger Is Not Active in Valuation Area C002nabigcsОценок пока нет

- Created by L&DДокумент37 страницCreated by L&Dharshita khadayteОценок пока нет

- Trading Psychology ManualДокумент19 страницTrading Psychology ManualOgechinwankwo100% (1)

- A 1-12-2016 Petition DGVCL True-Up For FY 2015-16 V4Документ119 страницA 1-12-2016 Petition DGVCL True-Up For FY 2015-16 V4onlineОценок пока нет

- TOP 500 Non Individual - Arranged - AlphabeticallyДокумент12 страницTOP 500 Non Individual - Arranged - AlphabeticallyjcalaqОценок пока нет

- ForexДокумент94 страницыForexHarendra Singh BhadauriaОценок пока нет

- Usha Martin Limited: Unravelling The Vertical Integration StrategyДокумент14 страницUsha Martin Limited: Unravelling The Vertical Integration Strategykavyashreenitin100% (1)

- FCA NV 2018 Annual Report PDFДокумент323 страницыFCA NV 2018 Annual Report PDFKulbhushan ChaddhaОценок пока нет

- Ceres Gardening Company Graded QuestionsДокумент4 страницыCeres Gardening Company Graded QuestionsSai KumarОценок пока нет

- Presd Release Q1fy18Документ11 страницPresd Release Q1fy18priya.sunderОценок пока нет

- Ke1155 Xls EngДокумент167 страницKe1155 Xls EngKit KatОценок пока нет

- Civil Services Mentor May 2012 PDFДокумент121 страницаCivil Services Mentor May 2012 PDFBhavtosh ChaturvediОценок пока нет

- Ishares Core Growth Etf Portfolio: Key FactsДокумент2 страницыIshares Core Growth Etf Portfolio: Key FactsTushar PatelОценок пока нет

- Coca Cola Internship ReportДокумент74 страницыCoca Cola Internship ReportSaswat ChoudhuryОценок пока нет

- CSSEPДокумент136 страницCSSEPAbhinay KumarОценок пока нет

- Shuffled FinalДокумент54 страницыShuffled FinalAllen Robert SornitОценок пока нет

- Entrep Business Plan ChurrosДокумент17 страницEntrep Business Plan ChurrosBal Ri Mekoleu73% (11)

- Case Digest Gamboa Vs TevesДокумент4 страницыCase Digest Gamboa Vs TevesHazel Joy Galamay - Garduque100% (4)

- SS9 FMДокумент2 страницыSS9 FMNguyễn Hồng HạnhОценок пока нет