Академический Документы

Профессиональный Документы

Культура Документы

Aamir Internship Report

Загружено:

aamirmurad68Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Aamir Internship Report

Загружено:

aamirmurad68Авторское право:

Доступные форматы

University of Central Punjab

Internship Evaluation Form

Please sign the completed evaluation and return it to the student. The student will not receive credit for the internship until this form is

processed. Thank you for your assistance.

Student Name: ___________________________________ Date: ___________________

Evaluator Name: _________________________Evaluator Title: ____________________

Organization/host Name: ___________________________________________________

Address: ________________________________________________________________

Evaluation of personal qualities of the intern observed during the internship. Select one evaluation level for

each area.

excellent good average poor does not

apply

Ability to adapt to a

variety of tasks

Decision making;

judgment; setting

priorities

Persistence to

complete tasks

Ability to plan with &

work cooperatively

with others

Enthusiasm for the

experience

Attention to

accuracy and detail

Willingness to ask

for and use

guidance

Ability to cope in

stressful situations

Signature of Evaluator ____________________________________

Internship Report on

Meezan Bank

Submitted to

Dean

Prof. Muhammad Azhar Ikram Ahmed

Submitted by

Aamer Murad

2015

B-1

Faculty of Commerce

University of Central Punjab

History of Meezan Bank

During 1997, Al-Meezan Investment Bank is established as the first Islamic bank of Pakistan.

Mr. Syed Sarfaraz Ahmed appointed as first and founding Chief Executive Officer.

During 2002, the Shariah Supervisory Board is established at Al-Meezan Investment Bank led by

Justice (Retd.) Muhammad Taqi Usmani as chairman. State Bank sets criteria for establishment

of Islamic commercial banks in private sector and subsidiaries and stand-alone branches by

existing commercial banks to conduct Islamic banking in the country.

During 2003, A Musharaka-based Export Refinance Scheme has been designed by the State

Bank in coordination with Meezan Bank Limited, in order to provide export finance to eligible

exporters on the basis of Islamic modes of financing. Efforts are underway to develop Islamic

money market instruments like Ijarah Sukuk to facilitate the banks in respect of liquidity and

SLR management.

Pakistan’s first Shariah compliant Mortgage facility is launched by Meezan Bank. Approved by

the Shariah Supervisory Board, the product enables home purchase, home construction,

renovation, as well as replacement of any existing mortgage. Al Meezan Investment

Management Limited (AMIM), a group company of Meezan Bank, introduces Meezan Islamic

Fund (MIF). MIF is an open-end mutual fund that is Shariah compliant. Meezan Bank’s asset

management arm, Al Meezan Investment Management Limited (AMIM), launches the Meezan

Balance Fund (MBF). The offering was oversubscribed 1.25 times.

In March 2005, to further strengthen & ensure strict Shariah compliance in bank’s operation a

dedicated and full fledged Product Development & Shariah Compliance (PDSC) department

was formally setup. The role of this research department is centralization of Product

development activities, new product research, Islamic banking training and Shariah Compliance

functions. The department works under the guidance & supervision of bank’s Shariah Advisor –

Dr. Muhammad Imran Usmani and the Shariah Supervisory Board of the Bank.

PDSC now plays a very critical and vital role at the bank by actively supporting new product

development activities, refining existing products menu, preparing product policies &

standardize agreements, imparting Islamic banking knowledge at various levels to new &

existing staff members, corporate customers and general public, coordinating with bank’s

Shariah Board, conducting regular Shariah audits & reviews

During 2005, Meezan Bank launches the Meezan Islamic Institution Deposit Account (MIIDA),

a unique product tailored exclusively for Islamic Financial Institutions (IFIs). The facility is the

first of its kind in Pakistan, whereby Islamic Banks (including dedicated, as well as conventional

Islamic windows) now have the opportunity to manage excess liquidity by maintaining a

checking account with Meezan Bank specifically designed for this purpose.

Meezan Bank becomes the first customer of Islamic Insurance (Takaful) by signing the first

Memorandum of Understanding MoU with Pak Kuwait Takaful Company Limited (PKTCL).

The signing of this MoU has ushered Pakistan into a new era of Islamic Insurance (Takaful).

Vision

Establish Islamic banking as banking of first choice to facilitate the implementation of an

equitable economic system, providing a strong foundation for establishing a fair and just society

for mankind.

Mission

To be a premier Islamic bank, offering a one-stop shop for innovative value added products and

services to our customers within the bounds of Shariah, while optimizing the stakeholders value

through an organizational culture based on learning, fairness, respect for individual enterprise

and performance.

Our Service mission

To develop a commited service culture which

ensure the consistent delivery of our products and

services within the highest quality service parameters,

prmoting Islamic values and ensuring recognition and

a quality banking experiences to our customers.

“I wish Meezan Bank success in initiating the cause of

Riba-free banking”

General pervaiz musharraf president of Pakistan

Meezan bank Inauguration

September 2002

Board of Directors

The Board of Directors of Meezan Bank are:

H. E. Sheikh Ebrahim Bin Khalifa Al-Khalifa (Chairman)

(Minister of Housing, Ministry of Housing, Kingdom of Bahrain)

Naser Abdul Mohsen Al-Marri (Vice Chairman)

Jassar Dakheel Al-Jassar

Rana Ahmed Humayun

Mohammed Azzaroog Rajab

Ahmed Abdul Rahim Mohamed

Nawal Ahmed

Alaa A. Al-Sarawi

Wamiq Rizvi

Irfan Siddiqui (President & Chief Executive Officer)

Share Holders Rs. in million %

Noor Financial Investment

Ariful Islam Company, Kuwait

3,027 45.52

(Chief

Pakistan Kuwait Investment

Operating Company (Pvt.) Limited

1,995 30.00

Office

Islamic Development Bank, Jeddah 620 9.32

Others 1,008 15.16

Paid up Capital 6,650 100 %

Southern Central Northern

Region Region Region

Abbottabad

Hub (Lasbela) Bahawalpur

Dera Ismail

Hyderabad Daska

Khan

Shareholding Structure

Dera Ghazi

Karachi Gujar Khan

Khan

Nawabshah Faisalabad Haripur

Quetta

Gojra Islamabad

Sakrand Gujranwala Kohat

Sukkur Jhang Mansehra

Meezan's Branch Network Tando Adam Kasur Mardan

Alhamdolillah, Meezan Bank has established 166 Tando-Allah-

Lahore

branches in 40 cities across Pakistan. This is a Yar Muzaffarabad

milestone that is not only the success story of

Meezan Bank but also the continuing success story Mandi

Peshawar

Bahauddin

of Islamic Banking in Pakistan. With this extensive

network, our existing and potential customers are Rawalpindi

Mian Channu

now closer than ever in attaining Islamic Banking at

their doorstep. All branches provide real time online Multan Swat

banking facilities to customers.

Okara

As the first and largest dedicated Islamic Bank in

Pakistan, Meezan Bank team continues to build on Rahim Yar

Khan

its Vision of establishing "Islamic Banking the

Banking of First Choice". One of the key objectives Sadiqabad

of the Bank is to have its footprint strategically

placed throughout the country enabling the public Sahiwal

to avail the benefits of Shariah Compliant Banking in

their neighborhood. Sargodha

The Bank is currently segmented into three Regions Sheikhupura

of Pakistan. The cities in which the Bank presently

Sialkot

operates are as follows:

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- How To Create Make Print Payroll Pay Check Payslip Stub w-2 w/2 w2 1099 Forms Self Employed CreditДокумент7 страницHow To Create Make Print Payroll Pay Check Payslip Stub w-2 w/2 w2 1099 Forms Self Employed Creditrealstubs50% (4)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- TestamentaryTrusts Assante Nov 2006Документ10 страницTestamentaryTrusts Assante Nov 2006edlycos100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- How To Face Bank InterviewДокумент74 страницыHow To Face Bank InterviewTushar PatilОценок пока нет

- Economic Value AddedДокумент9 страницEconomic Value AddedLimisha ViswanathanОценок пока нет

- Real Estate Acronyms Commonly Used in The PhilippinesДокумент2 страницыReal Estate Acronyms Commonly Used in The PhilippineschachiОценок пока нет

- Estate & Donors Tax Case DigestsДокумент25 страницEstate & Donors Tax Case DigestsRonnaОценок пока нет

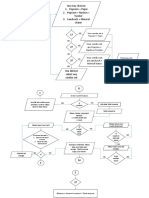

- FlowchartДокумент3 страницыFlowchartSarah SazaliОценок пока нет

- P-II - 2 - Advanced Accounting (Revised)Документ2 страницыP-II - 2 - Advanced Accounting (Revised)Syeda AiniОценок пока нет

- Handouts For Credit TransactionsДокумент15 страницHandouts For Credit TransactionsIrene Sheeran100% (1)

- Three Models of Financial RegulationДокумент16 страницThree Models of Financial RegulationRamjunum RandhirsinghОценок пока нет

- A1 - LittlefieldДокумент5 страницA1 - LittlefieldSwati Agrahari100% (1)

- Maybank vs. TarrosaДокумент9 страницMaybank vs. TarrosaJoel G. AyonОценок пока нет

- BIR Form No. 1601E - Guidelines and InstructionsДокумент3 страницыBIR Form No. 1601E - Guidelines and InstructionsGuia CatolicoОценок пока нет

- IBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Документ19 страницIBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Zehra RizviОценок пока нет

- Application Cum Declaration (To Be Completed by The Applicant) ApplicationДокумент2 страницыApplication Cum Declaration (To Be Completed by The Applicant) Applicationchhaperwal_pankajОценок пока нет

- Sale of Goods, PatnershipДокумент105 страницSale of Goods, PatnershipMelissa CoutinhoОценок пока нет

- Test Bank Fin Man 3Документ2 страницыTest Bank Fin Man 3Phillip RamosОценок пока нет

- 50 Slides For The Gold Bulls Incrementum Chartbook.01Документ50 страниц50 Slides For The Gold Bulls Incrementum Chartbook.01Zerohedge100% (1)

- Transpo ReviewerДокумент22 страницыTranspo ReviewerPéddiéGréiéОценок пока нет

- Khula Sizwe ProspectusДокумент154 страницыKhula Sizwe ProspectusPasha ZahariОценок пока нет

- Meenachi RKДокумент7 страницMeenachi RKmeenachiОценок пока нет

- Another BA OutlineДокумент97 страницAnother BA Outlineomidbo1100% (1)

- MATHINVS - Simple Annuities 3.3Документ10 страницMATHINVS - Simple Annuities 3.3Kathryn SantosОценок пока нет

- The Subprime Mortgage CrisisДокумент38 страницThe Subprime Mortgage Crisiseric3215Оценок пока нет

- Chapter 13: Commercial Bank Operations 3edДокумент26 страницChapter 13: Commercial Bank Operations 3edMarwa HassanОценок пока нет

- East Asian Miracle PDFДокумент11 страницEast Asian Miracle PDFDinesh KumarОценок пока нет

- Chap 010Документ23 страницыChap 010Qasih IzyanОценок пока нет

- Bangiya Gramin Vikash Bank Exam ChallanДокумент2 страницыBangiya Gramin Vikash Bank Exam Challananaga1982Оценок пока нет

- Suspense Accounts: Errors Affecting Trial Balance Agreement I. Single EntryДокумент7 страницSuspense Accounts: Errors Affecting Trial Balance Agreement I. Single EntryTawanda Tatenda HerbertОценок пока нет

- Premier Discover BrochureДокумент8 страницPremier Discover BrochuredfОценок пока нет