Академический Документы

Профессиональный Документы

Культура Документы

CGRP39 - Seven Myths of CEO Succession

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CGRP39 - Seven Myths of CEO Succession

Авторское право:

Доступные форматы

STANFORD CLOSER LOOK SERIES

Topics, Issues, and Controversies in Corporate Governance and Leadership

Seven Myths of CEO Succession

By David F. Larcker, Stephen A. Miles, and Brian Tayan March 19, 2014

INTRODUCTiON

The chief executive officer of a company is responsible for a long list of decisions that impact corporate performance, including strategy, organizational design, and incentives. He or she also brings to bear a managerial and leadership style that has a considerable influence on workplace productivity and culture. As such, many believe that the selection of the CEO is the single most important decision that a board of directors can make. In recent years, several high profile transitions at major corporations such as Procter & Gamble, Microsoft and JC Penney have cast a spotlight on succession and called into question the reliability of the process that companies use to identify and develop future leaders. We examine seven common misconceptions relating to CEO succession.

MYTH #1: COmPANiES KNOW WHO THE NEXT CEO WiLL BE

would take 90 days on average to name a permanent successor.2 These results are surprising, given the importance that reliable succession planning has on corporate performance. For example, Behn, Dawley, Riley, and Yang (2006) find that corporate performance is inversely correlated with the length of the succession period (i.e., the longer it takes a company to name a successor, the worse it subsequently performs relative to peers).3

MYTH #2: THERE iS ONE BEST MODEL FOR SUCCESSiON

There are four general approaches to selecting a CEO: CEO-in-Waiting. The company promotes a leading candidate to the position of president or chief operating officer where he or she is groomed to eventually become the CEO. This approach allows the board to observe first-hand how an executive performs when given CEOlevel responsibility before having to commit to the appointment. Internal Development. The company identifies potential internal candidates and establishes a development plan for each. In time, the most promising (viable) candidate is promoted to CEO. This approach allows the company to groom and evaluate multiple executives before settling on a favorite.4 External Recruit. The company recruits an executive from outside the organization. This approach is preferable when the company lacks qualified internal talent, or the company is in a turnaround situation that requires significant strategic, operating, or financial change.

Every year, approximately 10 to 15 percent of companies change CEOs either because of retirement, recruitment to another firm, resignation following poor performance, or for health-related issues.1 For this reason, shareholders expect that companies have a chosen successor identified at all times to immediately assume the CEO position should the need arise. Unfortunately, research data indicates that this is often not the case. According to a 2010 study by Heidrick & Struggles and the Rock Center for Corporate Governance at Stanford University, only 54 percent of companies state that they are grooming a specific successor to the CEO position, and 39 percent claim to have no viable internal candidates to permanently replace the CEO if required to do so immediately. Companies estimate that it

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

Inside-Outside Approach. The company combines an internal development plan with an external search. This approach allows the company to compare leading internal candidates against the external market and select the most qualified individual. There are tradeoffs to each of these approaches. The correct model for a given company will depend on a variety of factors, including its current strategic and operating condition, the quality of the senior management team, the reliability of its internal talent development program, and the quality and availability of external talent. One reason that companies fall short at succession planning is that they often select the wrong model for their current situation. For example, a director with previous succession experience at Company A will advocate that Company B adopt the same model even when its situation calls for a different approach. Furthermore, the board and management often underestimate the difficulty, time, and cost of succession. Succession is a process not an event, and irrespective of the specific model that the board adopts, it is important that the process is managed well.

MYTH #3: THE CEO SHOULD PiCk A SUCCESSOR

the company as the board. The board is responsible for future performance and strategy, while the CEO has devised the current strategy and has a vested interest in its continuance. The board needs to determine whether future operating conditions will require a change in direction and a leader with a different perspective and skill set than the current CEO. Finally, the CEO is not always objective in the evaluation of talent, having biases and preferences that have built up over many years of working closely with certain individuals. He or she might advocate on behalf of a favored colleague or obstruct a disfavored colleague even though this is not in the best interest of the organization (see Exhibit 1). The CEO should advise on succession, but the final decision rests with the board.

MYTH #4: SUCCESSiON iS PRimARiLY A RiSk MANAGEmENT ISSUE

A fourth myth is that CEO succession planning is primarily a risk management issue. This perspective is summarized by the Securities and Exchange Commission: One of the boards key functions is to provide for succession planning so that the company is not adversely affected due to a vacancy in leadership. Recent events have underscored the importance of this board function to the governance of the corporation. We now recognize that CEO succession planning raises a significant policy issue regarding the governance of the corporation that transcends the day-to-day business matter of managing the workforce.6 While it is true that failure to plan for a change in leadership exposes an organization to considerable downside risk, succession planning affords companies the opportunity to build (and not just preserve) value. Successful companies map their succession plans to a forward-looking view of the organization. They identify critical positions, including members of the senior management team and below. Leadership and operating skills are determined for each position, and every executive is benchmarked against these skills. Development plans are crafted for each, and potential successors are identified. At its best, succession planning is as

STANFORD CLOSER LOOK SERIES 2

Succession planning involves two distinct activities. The first is the identification and development of candidates. The second is the selection of a successor. Many people associate succession planning with the selection event, but the majority of the work takes place identifying and grooming candidates before the selection event takes place. Because the CEO tends to be heavily involved in the development of these individuals, the board often defers to the CEO in the choice of his or her successor. This is particularly true when the outgoing CEO has had a successful career.5 There are several reasons, however, why the CEO should not be responsible for choosing a successor. First, the board has a fiduciary duty to make this decision. Even though the CEO has considerable direct knowledge of the candidates and their capabilities, it is the responsibility of the board, as representatives of the shareholders, to make this decision in an independent and objective manner. Second, the CEO does not have the same perspective on

SEVEN MYTHS OF CEO SUCCESSION

much success-oriented as it is risk-oriented. While risk management is an important element of succession planning, the primary focus should remain on building shareholder value (see Exhibit 2).

MYTH #5: BOARDS KNOW HOW TO EVALUATE CEO TALENT

Another myth of CEO succession is that boards know how to evaluate CEO talent. In practice, boards are not always adept at evaluating the current CEO or potential successors. For example, a 2013 survey by The Miles Group and the Rock Center for Corporate Governance finds that CEO performance evaluations place considerable weight on financial performance (such as accounting, operating, and stock price results) and not enough weight on the nonfinancial metrics (such as employee satisfaction, customer service, innovation, and talent development) that have proven correlation with the long-term success of organizations. Furthermore, a significant percentage of directors (21 percent) report having only moderate or little understanding of the strengths and weaknesses of the current CEO, while over a third of CEOs (35 percent) do not believe that the performance evaluation process is a meaningful exercise.7 The board of directors is also generally not very skilled at evaluating potential CEO candidates. With external candidates, boards tend to put considerable weight on financial track records and perceived leadership qualities, without enough consideration of how the operating conditions of the two companies might differ or how the executives leadership style might translate to a new environment. Similarly, internal candidates who are untested and unproven in a CEO role are even more difficult to evaluate (see below). As a result, boards often take a rearview mirror approach in choosing a successor: if the outgoing CEO was successful, they gravitate to a candidate (internal or external) with similar skills and characteristics; if the outgoing CEO was unsuccessful, they gravitate toward someone starkly different. Deep experience and a rigorous, thoughtful process help to mitigate these tendencies.

MYTH #6: BOARDS PREFER INTERNAL CANDiDATES

Most newly appointed CEOs are internal executives. According to Spencer Stuart, 74 percent of CEO transitions among S&P 500 companies during the ten year period 2004-2013 involved an internal replacement (see Exhibit 3). Research shows that companies that promote insiders to the CEO role tend to perform better, on average, than companies that recruit external replacements.8 As such, many shareholders and stakeholders believe that boards prefer internal candidates. However, this is often not the case. First, internal candidates have never actually been CEO. No amount of observation, coaching, and development will give the board 100 percent assurance that an untested executive can handle the complete responsibility until he or she assumes the role.9 Second, directors tend to view insiders as junior executives and therefore less qualified than external candidates that currently have CEO experience. They often forget that all CEOs had to work their way up through the ranks and at some point make the leap to the CEO level. Finally, directors do not have sufficient exposure to senior executives below the CEO, making it difficult to accurately assess their capacity for leadership and growth. According to one survey, only slightly more than half of directors understand the strengths and weaknesses of the senior executive team extremely or very well. Less than a quarter of directors (23 percent) formally participate in senior executive performance reviews, and only 7 percent act as a professional mentor to these individuals (see Exhibit 4).10 Without more regular exposure, it is difficult for the board to fully appreciate the leadership potential of internal candidates.

MYTH #7: BOARDS WANT A FEmALE OR MiNORiTY CEO

A final misconception about succession is that boards truly want to recruit a female or ethnic minority executive to the CEO position. Diversity ranks high on the list of attributes that board members formally look for in CEO candidates, and yet female and ethnic minorities continue to have low representation among actual CEOs. For example, only 5 percent of CEOs of Fortune 500 companies are women and 1 percent African-American.11

STANFORD CLOSER LOOK SERIES 3

SEVEN MYTHS OF CEO SUCCESSION

It is unclear why diversity candidates are not more regularly selected for the CEO role. Interviews with executive recruiters indicate that female executives and executives with ethnic backgrounds might exhibit leadership styles that are different from what directors are used to seeing. In making a final decision, it might be that boards are more comfortable selecting an executive whose behavioral attributes more closely match personal stereotypes of CEO leadership. There is some empirical support for this explanation. Rudman and Glick (1999) find that female executives are evaluated negatively for exhibiting traits that, in a man, are seen as positive (such as being action-oriented, decisive, and leader-like).12 Professor Deborah Gruenfeld of the Stanford Graduate School of Business explains that people prefer behavior that is consistent with perceived roles or stereotypes and are uncomfortable with behavior that is inconsistent with these. Women who are perceived as displaying masculine leadership traits are seen as violating expected norms of behavior, while at the same time, women who are perceived as displaying feminine traits are judged as less competent than male counterparts. This double-edged sword might work against successful female executives.13 Similar dynamics are potentially in play when it comes to evaluating executives who are ethnic minorities.

WHY THiS MATTERS

internal candidates. Why not? Wouldnt directors make better hiring decision if they were? Would the board be more likely to promote an internal candidate rather than look outside? Would they be more likely to promote female and minority candidates? 3. Board composition matters. Boards need to ensure that they have directors with succession experience who can work with management to establish best practices for succession planning and talent management. How many succession processes should a director participate in before he or she is considered qualified to lead one? Is there a difference between participating in a succession process as a CEO and as a director? How does the perspective change?

Ken Favaro, Per-Ola Karlsson, and Gary Nielson, CEO Succession Report, Booz & Co. (2012). 2 Heidrick & Struggles and the Rock Center for Corporate Governance at Stanford University, 2010 CEO Succession Planning Survey, (2010). 3 Bruce K. Behn, David D. Dawley, Richard Riley, and Ya-wen Yang, Deaths of CEOs: Are Delays in Naming Successors and Insider/Outsider Succession Associated with Subsequent Firm Performance? Journal of Managerial Issues (Spring 2006). 4 There are two varieties of the internal development model. In the first, a formal competition (or horse race) is established between leading internal candidates. The classic example is General Electric, where three senior executives (Jeffrey Immelt, Robert Nardelli, and James McNerney) were identified as potential successors to outgoing CEO Jack Welch before Immelt was given the job. Because the formal horse race invites considerable outside scrutiny, fewer companies today designate a formal competition. Instead, companies identify promising executives and assign development plans to each without a formal designation that they are competing for the CEO job. This approach reduces scrutiny and increases the chance that a company can retain the executives who lose out in the race. For example, Intel and General Motors both employed this model in recent years, and each successfully retained several of the executives who were not given the CEO job. By contrast, Nardelli and McNerney both resigned from GE shortly after losing out to Immelt. 5 For example, a recent Wall Street Journal about succession at the Walt Disney Company says that, given the successful tenure of CEO Robert Iger, whomever Mr. Iger endorses as his favored successor will likely have a strong shot at earning the approval of Disneys board as well. See: Ben Fritz and Joann S. Lublin, Who Will Replace Iger? Disney CEO Battle Looms, The Wall Street Journal (March 15, 2014). 6 SEC Staff Legal Bulletin 14E (CF), Shareholder Proposals, (Oct. 27, 2009). Available at: http://www.sec.gov/interps/legal/cfslb14e.htm. 7 The Miles Group and the Rock Center for Corporate Governance at Stanford University, 2013 CEO Performance Evaluation Survey, (2013). 8 Note that research results might be confounded by the fact that companies that require external CEOs tend to be in worse financial condition. See: Ken Favaro, Per-Ola Karlsson, and Gary L. Neilson 2010, CEO Succession 2000-2009: A Decade of Convergence and

1

1. A viable succession plan is critical to the longterm success of any organization. To be effective, succession planning should be a continuous and ongoing activity rather than a one-time decision that is required when a CEO resigns or is fired. Succession is a process rather than an event. Why arent more companies prepared for a change at the top? What organizational and cultural impediments stand in the way? 2. The board of directors, and not the CEO, is responsible for driving the succession process at companies. While recent regulatory changes have helped to focus attention on the need for boards to develop a viable succession plan, more work can be done. For example, survey data suggests that boards are not very knowledgeable about the qualifications and leadership skills of

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

Compression, Booz & Company Inc., strategy+business (Summer 2010); and Mark R. Huson, Paul H. Malatesta, and Robert Parrino, Managerial Succession and Firm Performance, Journal of Financial Economics (2004). 9 Directors often mistakenly use the phrase ready now to describe an idea candidate, when, by definition, an internal candidate cannot be ready now. Instead, viability is a better litmus test for evaluating successors. 10 The Conference Board, The Institute of Executive Development, and the Rock Center for Corporate Governance at Stanford University, How Well Do Corporate Directors Know Senior Management? The Conference Board Governance Center, Director Notes (2014). 11 See: A Look at 23 Women CEOs Running Fortune 500 Firms, The Associated Press (December 10, 2013); and African American Chairman & CEO of Fortune 500 Companies, BlackEntrepreneurProfile.com (March 11, 2014). 12 Laurie A. Rudman and Peter Glick, Feminized Management and Backlash toward Agentic Women, Journal of Personality and Social Psychology (1999). 13 Deborah Gruenfeld, Having Power and Influence, (June 4, 2013), Available at: http://www.trendhunter.com/keynote/body-language-speech. David Larcker is Director of the Corporate Governance Research Initiative at the Stanford Graduate School of Business and senior faculty member at the Rock Center for Corporate Governance at Stanford University. Stephen Miles is founder and Chief Executive Ofcer of The Miles Group. Brian Tayan is a researcher with Stanfords Corporate Governance Research Initiative. Larcker and Tayan are coauthors of the books A Real Look at Real World Corporate Governance and Corporate Governance Matters. The authors would like to thank Michelle E. Gutman for research assistance in the preparation of these materials. The Stanford Closer Look Series is a collection of short case studies that explore topics, issues, and controversies in corporate governance and leadership. The Closer Look Series is published by the Corporate Governance Research Initiative at the Stanford Graduate School of Business and the Rock Center for Corporate Governance at Stanford University. For more information, visit: http://www.gsb.stanford.edu/cldr. Copyright 2014 by the Board of Trustees of the Leland Stanford Junior University. All rights reserved.

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

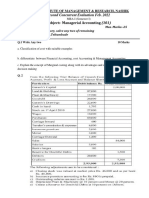

EXHibiT 1 SiX COmmON CEO bEHAViORS DURiNG SUCCESSiON

The cooperation of the outgoing CEO can have an important impact on succession. Below are six observed behavior groupings that CEOs tend to exhibit during the succession process.

THe ActiVe ADVisoR

The sitting CEO accepts that it is time to step down and is ready to do so. The CEO provides thoughtful insight into the selection process but does not overstep his or her role. The CEO limits opinions to when they are solicited and does not impose his or her will on the board. Disciplined, self-aware, and satised with the role as advisor, the CEO has full acceptance that the board will make the nal decision.

THe AggRessoR

The sitting CEO is relatively overt in his or her attempt to inuence the selection decision. This type of CEO will play nice for most of the process only to attempt to steer the selection toward a handpicked candidate at a key decision point, undermining other candidates in the process. The CEO will take a strong position with the board and try to force the outcome he or she favors.

THe PassiVe AggRessoR

The sitting CEO tries to inuence the selection process in a covert manner. The CEO subtly undermines certain candidates by the way he or she positions them to the board. He or she will come across not as manipulative but instead as an advisor. If this behavior is undetected until late in the process, the board might have to start from the beginning and exclude the CEO.

THe CapitUlatoR

When the board is close to making the nal decision on a successor, the CEO changes his or her mind about retirement and requests to stay longer. This behavior essentially forces the board to choose between the present and future leadership of the company. A nonexecutive director will need to meet with the CEO and rmly inform him or her that the board is moving forward with a successor.

THe HopeFUl SaVioR

The sitting CEO largely identies with the role of CEO and does not really want to retire. The CEO might actively promote successors in his or her own likeness. Alternatively, he or she might promote someone less capable in the hope that the successor will fail so that he or she can be swept back in to save the company.

THe PoWeR BlocKeR

The sitting CEO does not want to leave. He or she will throw up obstacles to slow or derail the process. The Power Blocker is different from the Hopeful Savior in the aggressiveness of approach. Whereas the Hopeful Savior is subtle, the Power Blocker is overt. He or she calls in favors with the board, makes direct personal appeals, or demands to stay.

Source: David F. Larcker and Stephen A. Miles (2011), cited in: David F. Larcker and Brian Tayan, Corporate Governance Matters: A Closer Look at Organizational Choices and Their Consequences (New York: FT Press, 2011).

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

EXHibiT 2 SENiOR EXECUTiVE DEVELOPmENT AND SUCCESSiON PLANNiNG SiX KeY ElemeNts oF SUccessFUl SUccessioN PlaNNiNg 1. StRategic PlaNNiNg. Determine what capabilities, roles, and talent are needed to execute the

business strategy today and in the future.

2. TaleNt AssessmeNt. Gauge the executive teams bench strength. Do we have who we need (now and in the future) and if not, how do we get there? 3. RecRUitiNg. Develop a talent pipeline for key roles/jobs. 4. PeRFoRmaNce AssessmeNt. Let people know they are valued contributors and provide them op-

portunities for development, exposures to executives, networking across divisions, etc. Get them on the corporate radar screen.

5. DeVelopmeNt. Create development plans for individuals (e.g., leadership workshops, classes, on-

the-job learning, assignments, special projects, 360s, external classes, etc.)

6. ReteNtioN aND ENgagemeNt. Reward and recognition, work environment, opportunities for de-

velopment, job autonomy and scope of responsibilities, etc.

Sample QUestioNs to CoNsiDeR BeFoRe aND DURiNg MeetiNgs

1. Current Organization Structure Is the current structure working? The right direct reports? Too many? Too few? Any job that isnt but should be reporting to top executive? Any missing capabilities that we need to recruit for? Critical jobs? Any other structural concerns? 2. Current Leadership Team 3. Identied Successors / Replacement Plans Succession plan, restructuring, eliminate job, etc. Who are internal successors 4. Additional Talent Pipeline Who are our high potentials? Focus on women and minorities What are their performance capabilities, potential? What should we do to develop them?

Who are your key players?

How are they doing? What are their performance, career potential, & interests/ aspirations? Strengths, weaknesses, development needs? What are we doing to help develop them? Any retention risks? Any missing talent?

Who are external successors? Are they ready to step up? If not, what are we doing to help develop them? Retention risks (if no bigger job opens up or passed over)? Development thoughts/ plans?

Source: The Institute of Executive Development and The Rock Center for Corporate Governance at Stanford University, 2014 Report on Senior Executive Succession Planning and Talent Development, (2014).

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

EXHibiT 3 CEO TRANSiTiONS: INTERNAL V. EXTERNAL SUCCESSORS S&P 500 CEO TRaNsitioNs (2004-2013)

Source: Spencer Stuart, 2013 CEO Transitions.

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

EXHibiT 4 DiRECTOR KNOWLEDGE OF SENiOR EXECUTiVES Does YoUR compaNY HaVe a FoRmal taleNt DeVelopmeNt pRogRam FoR seNioR eXecUtiVes beloW tHe CEO?

Does YoUR compaNY assigN a boaRD meNtoR to seNioR eXecUtiVes beloW tHe CEO?

Do NoN-emploYee DiRectoRs ReceiVe UpDates oR pRogRess RepoRts oN tHe DeVelopmeNt oF seNioR eXecUtiVes beloW tHe CEO?

STANFORD CLOSER LOOK SERIES

SEVEN MYTHS OF CEO SUCCESSION

EXHibiT 4 CONTiNUED HoW Well Do NoN-emploYee DiRectoRs UNDeRstaND tHe stReNgtHs aND WeaKNesses oF seNioR eXecUtiVes beloW tHe CEO?

Do NoN-emploYee DiRectoRs FoRmallY paRticipate iN tHe peRFoRmaNce eValUatioN oF tHe seNioR eXecUtiVes beloW tHe CEO?NioR eXecUtiVes beloW tHe CEO?

Source: The Conference Board, The Institute of Executive Development, and the Rock Center for Corporate Governance at Stanford University, How Well Do Corporate Directors Know the Senior Management Team? (2014).

STANFORD CLOSER LOOK SERIES

10

Вам также может понравиться

- Board Composition, Quality, & TurnoverДокумент24 страницыBoard Composition, Quality, & TurnoverStanford GSB Corporate Governance Research InitiativeОценок пока нет

- 2019 U.S. Tax SurveyДокумент34 страницы2019 U.S. Tax SurveyStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Spread of COVID-19 DisclosureДокумент15 страницThe Spread of COVID-19 DisclosureStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Diversity in The C-Suite: Fortune 100 C-Suite Organizational ChartsДокумент115 страницDiversity in The C-Suite: Fortune 100 C-Suite Organizational ChartsStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Principles of Corporate Governance: A Guide To Understanding Concepts of Corporate GovernanceДокумент5 страницThe Principles of Corporate Governance: A Guide To Understanding Concepts of Corporate GovernanceStanford GSB Corporate Governance Research Initiative100% (1)

- Stakeholders and Shareholders: Are Executives Really "Penny Wise and Pound Foolish" About ESG?Документ8 страницStakeholders and Shareholders: Are Executives Really "Penny Wise and Pound Foolish" About ESG?Stanford GSB Corporate Governance Research InitiativeОценок пока нет

- Pay For Performance But Not Too Much Pay: The American Public's View of CEO PayДокумент19 страницPay For Performance But Not Too Much Pay: The American Public's View of CEO PayStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Stakeholders Take Center Stage: Director Views On Priorities and SocietyДокумент32 страницыStakeholders Take Center Stage: Director Views On Priorities and SocietyStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Diversity in The C-Suite: The Dismal State of Diversity Among Fortune 100 Senior ExecutivesДокумент23 страницыDiversity in The C-Suite: The Dismal State of Diversity Among Fortune 100 Senior ExecutivesStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Core Concepts: Shareholders and ActivismДокумент5 страницCore Concepts: Shareholders and ActivismStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Governance of Corporate Insider Equity TradesДокумент9 страницGovernance of Corporate Insider Equity TradesStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Loosey-Goosey Governance: Four Misunderstood Terms in Corporate GovernanceДокумент17 страницLoosey-Goosey Governance: Four Misunderstood Terms in Corporate GovernanceStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Evolution of Corporate Governance: 2018 Study of Inception To IPOДокумент23 страницыThe Evolution of Corporate Governance: 2018 Study of Inception To IPOStanford GSB Corporate Governance Research Initiative100% (1)

- Core Concepts: Shareholders and ActivismДокумент5 страницCore Concepts: Shareholders and ActivismStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Business Case For ESGДокумент8 страницThe Business Case For ESGStanford GSB Corporate Governance Research Initiative100% (2)

- The Wells Fargo Cross-Selling Scandal The Wells Fargo Cross-Selling ScandalДокумент16 страницThe Wells Fargo Cross-Selling Scandal The Wells Fargo Cross-Selling ScandalStanford GSB Corporate Governance Research Initiative100% (1)

- 2019 Survey On Shareholder Versus Stakeholder InterestsДокумент17 страниц2019 Survey On Shareholder Versus Stakeholder InterestsStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Where Does Human Resources Sit at The Strategy Table?Документ11 страницWhere Does Human Resources Sit at The Strategy Table?Stanford GSB Corporate Governance Research InitiativeОценок пока нет

- Environmental, Social and Governance (ESG) Activities - Research SpotlightДокумент18 страницEnvironmental, Social and Governance (ESG) Activities - Research SpotlightStanford GSB Corporate Governance Research Initiative78% (9)

- Dual-Class Shares - Research SpotlightДокумент12 страницDual-Class Shares - Research SpotlightStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Scaling Up: The Implementation of Corporate Governance in Pre-IPO CompaniesДокумент12 страницScaling Up: The Implementation of Corporate Governance in Pre-IPO CompaniesStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Double-Edged Sword of CEO ActivismДокумент12 страницThe Double-Edged Sword of CEO ActivismStanford GSB Corporate Governance Research Initiative100% (1)

- Board Structure: DataДокумент18 страницBoard Structure: DataStanford GSB Corporate Governance Research InitiativeОценок пока нет

- CEO Succession - Data SpotlightДокумент16 страницCEO Succession - Data SpotlightStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Stanford 2018 CEO Activism Survey ResultsДокумент17 страницStanford 2018 CEO Activism Survey ResultsStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Cashing It In: Private-Company Exchanges and Employee Stock Sales Prior To IPOДокумент15 страницCashing It In: Private-Company Exchanges and Employee Stock Sales Prior To IPOStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Big Thumb On The Scale: An Overview of The Proxy Advisory IndustryДокумент11 страницThe Big Thumb On The Scale: An Overview of The Proxy Advisory IndustryStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Corporate Governance Data Spotlight: Failure, Fraud, and ScandalДокумент23 страницыCorporate Governance Data Spotlight: Failure, Fraud, and ScandalStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Netflix Approach To Governance: Genuine Transparency With The BoardДокумент7 страницNetflix Approach To Governance: Genuine Transparency With The BoardStanford GSB Corporate Governance Research InitiativeОценок пока нет

- Shareholders & Corporate Control: DataДокумент18 страницShareholders & Corporate Control: DataStanford GSB Corporate Governance Research InitiativeОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- BFC Employment Application Form Bahrain - Docx2 15 2Документ4 страницыBFC Employment Application Form Bahrain - Docx2 15 2Abbas Ali100% (1)

- Anand Mahindra's Leadership Journey and AchievementsДокумент36 страницAnand Mahindra's Leadership Journey and AchievementsAravind KumarОценок пока нет

- NPCC Recruitment for Site and Junior EngineersДокумент6 страницNPCC Recruitment for Site and Junior EngineersMirang ShahОценок пока нет

- Policy For Rehabilitation and Resettlement of Land OwnersДокумент5 страницPolicy For Rehabilitation and Resettlement of Land OwnersrarkОценок пока нет

- MBA I Sem I Assignments PDFДокумент10 страницMBA I Sem I Assignments PDFharish chaudhariОценок пока нет

- Developing A Business PlanДокумент15 страницDeveloping A Business PlanMd ShohanОценок пока нет

- Nascon Placement & ConsultantДокумент15 страницNascon Placement & ConsultantDeepanshuОценок пока нет

- Account Statement: Customer Cash PositionДокумент5 страницAccount Statement: Customer Cash PositionrizkyОценок пока нет

- Bece 15 em PDFДокумент10 страницBece 15 em PDFSiva SankarОценок пока нет

- Session - 046Документ8 страницSession - 046Abcdef GhОценок пока нет

- Practice Perf CompДокумент28 страницPractice Perf CompsooguyОценок пока нет

- CPA Licensure Education Requirements Self-AssessmentДокумент6 страницCPA Licensure Education Requirements Self-Assessmentj loОценок пока нет

- Proceedings of The 11th Tourism Outlook Conference, 2 - 5 Octobre, 2018Документ663 страницыProceedings of The 11th Tourism Outlook Conference, 2 - 5 Octobre, 2018M. Tekin KOÇKARОценок пока нет

- Victoria Care Indonesia Billingual 30 Jun 2021 Q2Документ111 страницVictoria Care Indonesia Billingual 30 Jun 2021 Q2Sugiarto ChasОценок пока нет

- Entreprenuership Final Exam 2022Документ5 страницEntreprenuership Final Exam 2022Hanwell Keith SantosОценок пока нет

- GilletteДокумент9 страницGilletteManas MaheshwariОценок пока нет

- VERITAS Storage Foundation 5.0 For Linux - FundamentalsДокумент400 страницVERITAS Storage Foundation 5.0 For Linux - FundamentalsMaria Ghazalia CameroonОценок пока нет

- List of Investment Banks-UKДокумент5 страницList of Investment Banks-UKnnaemekenОценок пока нет

- MIS Course Reflections on Skills DevelopmentДокумент6 страницMIS Course Reflections on Skills DevelopmentNikhil Reddy GОценок пока нет

- Chapter 10Документ47 страницChapter 10Ferdinand MacolОценок пока нет

- Tanishq vs GoldPlus: Understanding the Difference in Jewelry Brand CampaignsДокумент5 страницTanishq vs GoldPlus: Understanding the Difference in Jewelry Brand CampaignsAnkita BhardwajОценок пока нет

- NTU Cat Management Network Annual General Report For Academic Year 2016/2017Документ42 страницыNTU Cat Management Network Annual General Report For Academic Year 2016/2017Cat Management NetworkОценок пока нет

- Vault-Finance Practice GuideДокумент126 страницVault-Finance Practice GuideMohit Sharma100% (1)

- FYP 2-Kashf Foundation FINALДокумент44 страницыFYP 2-Kashf Foundation FINALHassaan AhmadОценок пока нет

- Resume Arshad MOДокумент5 страницResume Arshad MOArshad KhanОценок пока нет

- Implementasi - Konsep - Penta - Helix - Dalam - Pengembangan Potensi Desa PDFДокумент10 страницImplementasi - Konsep - Penta - Helix - Dalam - Pengembangan Potensi Desa PDFHaydar BlackListОценок пока нет

- Titan IndustriesДокумент2 страницыTitan IndustriesAbhishikta DasОценок пока нет

- Tybms ProjectДокумент5 страницTybms Projectpanzu50% (2)

- RealEstateFinancialModelingCourse EXPERIMENTДокумент12 страницRealEstateFinancialModelingCourse EXPERIMENTVijay Singh100% (1)

- Open Vs Traditional EdiДокумент5 страницOpen Vs Traditional EdiSaurabh2510Оценок пока нет