Академический Документы

Профессиональный Документы

Культура Документы

AC 503 Midterms Reviewer Carolinian

Загружено:

Steffi Kay Diaz PantinoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AC 503 Midterms Reviewer Carolinian

Загружено:

Steffi Kay Diaz PantinoАвторское право:

Доступные форматы

Page 1 of 10

AC 503 Midterms Reviewer THEORY

1. The conceptual framework a. Sets out the concepts that underlie the preparation and presentation of financial statements for internal users. b. Is a Philippine Accounting Standard that defines standards for a particular measurement or disclosure issue. c. Is concerned with special purpose reports, for example, prospectuses and computations prepared for taxation purposes. d. Applies to the financial statements of all commercial, industrial and business reporting enterprises, whether in the public or private sector. . !hich statement is incorrect concerning the recognition principles" a. An asset is recogni#ed when it is probable that future economic benefits will flow to the enterprise and the asset has a cost or value that can be measured reliabl$. b. A liabilit$ is recogni#ed when it is possible that an outflow of resources embod$ing economic benefits will result from the settlement of a present obligation that can measured reliabl$. c. Income is recogni#ed when an increase in future economic benefits related to an increase in asset or a decrease in liabilit$ has arisen that can be measured reliabl$. d. %xpenses are recogni#ed when a decrease in future economic benefits related to an decrease in asset or an increase in liabilit$ has arisen that can be measured reliabl$. &. Information about economic resources controlled b$ the enterprise and its capacit$ to modif$ these resources is useful in predicting the a. Abilit$ of the enterprise to meet its financial commitments in the near term. b. Abilit$ of the enterprise to generate cash and cash e'uivalents in the future. c. Abilit$ of the enterprise to meet its financial commitments over a longer term. d. (uture borrowing needs and how future profits and cash flows will be distributed among interested users. ). %vents after the balance sheet date are the events, both favorable and unfavorable, that occur between the balance sheet date and the date a. !hen the audit report is authori#ed for issue. b. !hen financial statements are authori#ed for issue. c. !hen financial statements are issued. d. !hen the audit report is issued. *. The operating c$cle a. +easure the time elapsed between cash disbursement for inventor$ and cash collections of the sales price b. ,efers to the seasonal variations experienced b$ business enterprise c. Should be used to classif$ assets and liabilities as current if it is less than one $ear d. -annot exceed one $ear .. The following statements relate to cash. !hich statement is true" a. The term /cash e'uivalent0 refers to demand credit instruments such as mone$ order and bank drafts. b. The purpose of establishing a pett$ cash fund is to keep enough cash on hand to cover all normal operating expenses for a period of time. c. ,estricted cash balance should be presented as noncurrent asset. d. -ompensating balances re'uired b$ a bank ma$ be included in /cash and cash e'uivalent0. 1. 2apping is a. +aking the financial statements indicate a more favorable position b$ giving effect to transactions is a period other than that in which these actuall$ occurred. b. 3one to inflate the cash position or cover the theft of cash b$ depositing at the end of the accounting period a check drawing on one bank account in another bank account without making the necessar$ deduction in the balance of the first bank. c. An irregularit$ that conceals cash shortages b$ a dela$ in recording cash collections, retaining a customer4s pa$ment on credit sales and covering up the shortage with subse'uent cash receipts. d. A kind of fraud committed b$ making entr$ of fictitious pa$ments or failure to enter receipts.

Page 2 of 10

5. If the cash balance in a compan$6s bank statement is less than the correct cash balance and neither the compan$ nor the bank has made an$ errors, there must be a. 7utstanding checks b. 8ank charges not $et recorded b$ the compan$ c. 3eposits in transit d. 3eposits credited b$ the bank but not $et recorded b$ the compan$

9. !hich of the following is not true" a. The imprest pett$ cash s$stem in effect adheres to the rule of disbursement b$ check. b. %ntries are made to the Pett$ -ash account onl$ to increase or decrease the si#e of the fund or to ad:ust the balance if not replenished at $ear;end. c. The Pett$ -ash account is debited when the fund is replenished. d. All of these are not true. 1<. In the case of long;term installments receivable =real estate installment sales> where a ma:or portion of the receivables will be collected be$ond the normal operating c$cle a. The entire receivables are classified as noncurrent b. 7nl$ the portion currentl$ due is classified as current and the balance as noncurrent c. The entire receivables are classified as current with disclosure of the amount not currentl$ due d. The entire receivables are classified as current without disclosure of the amount not currentl$ due 11. A discount given to a customer for purchasing a large volume of merchandise is t$picall$ referred to as a a. 'uantit$ discount. b. cash discount. c. trade discount. d. si#e discount. 1 . !hen the allowance method of recogni#ing bad debt expense is used, the entr$ to record the write;off of a specific uncollectible account would decrease a. Allowance for doubtful accounts. c. ?et reali#able value of accounts receivable. b. ?et income. d. !orking capital. 1&. At the beginning of <1&, (inne$ -ompan$ received a three;$ear interest;bearing P1,<<<,<<< trade note. (inne$ reported this note as a P1,<<<,<<< trade note receivable on its <1& $ear; end statement of financial position and P1,<<<,<<< as sales revenue for <1&. !hat effect did this accounting for the note have on (inne$4s net earnings for <1&, <1), <1*, and its retained earnings at the end of <1*, respectivel$" a. 7verstate, overstate, understate, no effect b. 7verstate, understate, understate, no effect c. 7verstate, understate, understate, understate d. ?o effect, no effect, no effect, no effect 1). The carr$ing value of an impaired note before recogni#ing a loan impairment a. Includes accrued interest. b. %xcludes accrued interest c. Is the same as the carr$ing value after recogni#ing the impairment. d. Is less than the carr$ing value after recogni#ing the impairment. 1*. !hich of the following is true when accounts receivable are factored without recourse" a. The transaction ma$ be accounted for as either a secured borrowing or as a sale. b. The receivables are used as collateral for a promissor$ note issued to the factor b$ the owner of the receivables. c. The factor assumes the risk of collectibilit$ and absorbs an$ credit losses in collecting the receivables. d. The financing cost should be recogni#ed ratabl$ over the collection period of the receivables. 1.. !hich of the following items should be excluded from a compan$6s inventor$ at the balance sheet date" a. @oods in transit which were sold (78 destination. b. @oods delivered to another compan$ for sale on consignment.

Page 3 of 10

c. @oods sold to a customer which are being held for the customer to call for at the customer6s convenience. d. @oods in transit which were purchased (78 shipping point. 11. The original cost of an inventor$ item value. The net reali#able value less inventor$ item should be valued at a. ,eplacement cost b. ?et reali#able value is above both the replacement cost and net reali#able normal profit margin is below the original cost. The c. ?et reali#able value less normal profit margin d. 7riginal cost

15. ?et reali#able value is a. -urrent replacement cost b. %stimated selling price c. %stimated selling price less estimated cost to complete d. %stimated selling price less estimated cost to complete and estimated cost to sell 19. !hich of the following is correct" a. Selling costs are product costs. b. +anufacturing overhead costs are product costs. c. Interest costs for routine inventories are product costs. d. All of these. <. To produce an inventor$ valuation which approximates the lower of average cost or market using the conservative retail inventor$ method, the computation of the ratio of cost to retail should a. Include markups but not markdowns c. Include markups and markdowns b. Ignore both markups and markdowns d. Include markdowns but not markups 1. !hich statement is false concerning merchandising operations" a. -ash discounts are normall$ reflected in the financial records but trade discounts are not. b. A ma:or difference between the financial statements of service firms and merchandising firms is the inclusion of cost of goods sold in the income statement of a merchandising firm. c. The terms /freight prepaid0 and /freight collect0 designate the part$ who is to bear the transportation cost. d. A firm using a periodic inventor$ s$stem determines its inventor$ onl$ at the end of the period. . @enerall$ speaking, biological assets relating to agricultural activit$ should be measured using a. Aistorical cost c. A fair value approach b. Aistorical cost less depreciation B impairment d. ?et reali#able value &. A financial asset is held for trading if =choose the incorrect one> a. It is ac'uired principall$ for the purpose of selling or repurchasing it in the near term. b. In initial recognition, it is part of a portfolio of financial assets that are managed together and for which there is evidence of a recent actual pattern of short;term profit taking. c. It is a derivative that is not designated as an effective hedging instrument. d. It is a derivative that is designated as an effective hedging instrument. ). If the financial asset is held for trading or if the financial asset is measured at fair value through profit or loss, transaction costs directl$ attributable to the ac'uisition shall beC a. -apitali#ed as cost of the financial asset b. %xpensed immediatel$ when incurred c. 3eferred and amorti#ed over a reasonable period d. Included as component of other comprehensive income *. A financial instrument is an$ contract that gives rise to a. A financial asset of one entit$ and a financial liabilit$ or e'uit$ instrument of another entit$. b. A financial asset onl$. c. A financial liabilit$ onl$. d. A financial asset of one entit$ and a financial liabilit$ of another entit$ onl$.

Page 4 of 10

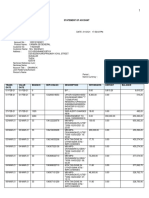

PROBLEMS 1. The following data pertain to %ncantadia -orporation on 3ecember &1, <1&C +etrobank current account no. 1 +etrobank current account no. Pa$roll account (oreign bank account D restricted =in e'uivalent pesos> Postage stamps %mplo$ee6s post dated check I7E from controller6s sister -redit memo from a vendor for a purchase return Traveler6s check ?ot;sufficient;funds check +one$ order Pett$ cash fund =P),<<< in currenc$ and expense receipts for P.,<<<> Treasur$ bills, due &F&1F1) =purchased 1 F<1F1&> Treasur$ bills, due 1F&1F1) =purchased 1F1F1&> P1,<<<,<<< =1<<,<<<> *<<,<<< 1,<<<,<<< 1,<<< ),<<< 1<,<<< <,<<< *<,<<< 1*,<<< &<,<<< 1<,<<< <<,<<< &<<,<<<

8ased on the above information, compute for the cash and cash e'uivalent that would be reported on the 3ecember &1, <1& balance sheet. a. P1,15),<<< c. P1,.5),<<< b. P1,)5),<<< d. P1,1<),<<< . Adam$a -orporation6s checkbook balance on 3ecember &1, <1& was P5,<<<,<<<. The same date Adam$a held the following items in its safeC A P1*<,<<< check pa$able to Adam$a, dated Ganuar$ ), 3ecember &1, checkbook balance. <1), that was included in the

A P <<,<<< check pa$able to Adam$a, deposited on 3ecember 1< and recorded on the same date, that was returned b$ the bank on 3ecember marked /?S(0. The check was redeposited 3ecember 1, <1&, and cleared 3ecember &<, <1&. ?o entr$ has been made b$ Adam$a for the receipt and the redeposit. A P*<<,<<< check pa$able to a supplier and drawn on Adam$a6s account, that was dated and recorded 3ecember &1, <1& but not mailed until Ganuar$ 1<, <1) In its 3ecember &1, <1& balance sheet, Adam$a should report cash at a. P5,1<<,<<< c. P5,&*<,<<< b. P5,**<,<<< d. P5,1*<,<<< &. Sapiro -ompan$ provided the following data for the purpose of reconciling the cash balance per book with the balance per bank statement on 3ecember &1, <1&C 8alance per bank statement 7utstanding checks =including certified checks of P1<<,<<<> 3eposit in transit 3ecember ?S( checks Proceeds of note collected b$ the bank for Sapiro, net of service charge of P <,<<< %rroneous bank debit to Sapiro6s account, representing ,<<<,<<< *<<,<<< <<,<<< 1*<,<<< 1*<,<<<

Page 5 of 10

a withdrawal of Siparo -ompan$ !hat was the cash balance per book on 3ecember &1, <1&" a. P 9<<,<<< c. P1,1*<,<<< b. P1,*<<,<<< d. P1, <<,<<< ). 7n 3ecember &1, <1 , Hiao Pai -ompan$ had the following cash balancesC -ash in bank Pett$ cash fund =all funds were reimbursed on 3ecember &1, <1 > Time deposit Saving deposit

&<<,<<<

P1*,<<<,<<< *<,<<< *,<<<,<<< ,<<<,<<<

-ash in bank includes P*<<,<<< of compensating balance against short term borrowing arrangement at 3ecember &1, <1 . The compensating balance is legall$ restricted as to withdrawal b$ Hiao Pai. A check of P&<<,<<< dated Ganuar$ 1*, <1& in pa$ment of accounts pa$able was recorded and mailed on 3ecember &1, <1 . In the current assets section of the 3ecember &1, <1 statement of financial position, what amount should be reported as /cash and cash e'uivalents0" a. P 1,5*<,<<< c. P 1,5<<,<<< b. P1.,5*<,<<< d. P1),5*<,<<< *. In preparing the bank reconciliation of 3$las -ompan$ for the month of Gul$, the following information is availableC 8alance per bank statement, 1F&1 3eposits in transit, 1F&1 7utstanding checks, 1F&1 3eposit erroneousl$ recorded b$ bank to -rews account, 1F15 8ank service charges for Gul$ !hat is the correct cash balance at Gul$ &1" a. P* ,51* b. P*),)*< c. P*),&1* d. P*),5 * P*),<1* 9,&1* 5,. * &1* 1*

.. The 2I,%7 -orporation started its business on Ganuar$ 1, <1&. After considering the collections experience of other companies in the industr$, 2I,%7 -orporation established an allowance for bad debts estimated to be *I of credit sales. 7utstanding receivables recorded in the books of accounts on 3ecember &1, <1& totaled P*1*,<<<, while the allowance for bad debts account had a credit balance of P. ,*<< after recording estimated doubtful account expense for 3ecember and after writing off P1 ,*<< of uncollectible accounts. (urther anal$sis of the compan$6s accounts showed that merchandise purchased in <1& amounted to P , *<,<<< and ending merchandise inventor$ was P&1*,<<<. @oods were sold at )<I above cost. 5<I of total sales were on account. Total collections from customers, on the other hand, excluding proceeds from cash sales, amounted to P1,*<<,<<<. The net reali#able value of accounts receivable as of 3ecember &1, <1& is a. P)9*,<<< c. P*1 ,*<< b. P99&,1*< d. P51*,<<< 1. Aathoria -ompan$ began operations on Ganuar$ 1, <1 . 7n 3ecember &1, <1 , Aathoria provided for uncollectible accounts based on *I of annual credit sales. 7n Ganuar$ 1, <1&, Aathoria changed its method of determining its allowance for uncollectible accounts b$ appl$ing certain percentages to the accounts aging as followsC 3a$s past invoice date < D &< &1 D 9< 91 ;15< Percent deemed to be uncollectible *I 1<I <I

Page 6 of 10

7ver 15<

*<I

In addition, Aathoria wrote off all accounts receivable that were over 1 $ear old. The following additional information relates to the $ears ended 3ecember &1, <1& and <1 C -redit sales -ollections =excluding collections on recover$> Accounts written off ,ecover$ of accounts previousl$ written off 3a$s past invoice date at 3ecember &1 < to &< &1 to 9< 91 to 15< 7ver 15< <1& 1<,<<<,<<< 5,*<<,<<< &<<,<<< 5<,<<< 1,5<<,<<< .<<,<<< )<<,<<< <<,<<< <1 5,<<<,<<< .,<<<,<<< <<,<<< *<,<<< 5<<,<<< *<<,<<< )<<,<<< 1<<,<<<

!hat is the provision for uncollectible accounts for the $ear ended 3ecember &1, <1&" a. P *<,<<< c. P&&<,<<< b. P&<<,<<< d. P&5<,<<< 5. 7n 3ecember 1, <1& Pirena -ompan$ assigned on a nonnotification basis accounts receivable of P1<,<<<,<<< to a bank in consideration for a loan of 9<I of the receivables less a *I service fee on the accounts assigned. Pirena signed a note for the bank loan. 7n 3ecember &1, <1&, Pirena collected assigned accounts of P.,<<<,<<< less discount of P)<<,<<<. Pirena remitted the collections to the bank in partial pa$ment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1I per month on the loan balance. In its 3ecember &1, <1& balance sheet, Pirena should report note pa$able as a current liabilit$ at a. P),*<<,<<< c. P&,<9<,<<< b. P&,)<<,<<< d. P&,)9<,<<< 9. The following pertains to the notes receivable of Amihan -orporation for the calendar $ear <1&C Notes Receivab e 3ate Particulars 3ebit -redit Sept. 1 +ichelle, 1I, due in & months P& <,<<< 1 3iscounted +ichelle note P& <,<<< 7ct. 1 +abelle -o., )I, due in months 1, <<,<<< ?ov. 1 %leanor, )I, due in 1& months ,)<<,<<< &< ,igb$ -o., no interest, due in one $ear ,<<<,<<< &< 3iscounted ,igb$ -o. note ,<<<,<<< 3ec. 1 Sgt. Pepper, 15I, due in * months &,.<<,<<< 1 +s. Anna, President, 1 I, due in & months =(or cash loan given to +s. Anna> ),5<<,<<< All notes are trade notes receivable unless otherwise specified. The +ichelle note was paid on 3ecember 1 as per notification received from the bank. The +abelle -o. note was dishonored on the due date but the legal department has assured management of its full collectibilit$. At what amount on the current assets section of the balance sheet as of 3ecember &1, <1& will ?otes ,eceivable;trade be carried" a. P&,.<<,<<< c. P1, <<,<<< b. P.,<<<,<<< d. P5,<<<,<<< 1<. -limax -orp. factored P1*<,<<< of accounts receivable to Jillain -ompan$ on 3ecember &, <1 . -ontrol was surrendered b$ -limax. Jillain accepted the receivables sub:ect to recourse for nonpa$ment. Jillain assessed a fee of I and retains a holdback e'ual to )I of the accounts receivable. In addition, Thomas charged 1 I interest computed on a weighted average time to maturit$ of the receivables fift$;one da$s. The fair value of the recourse obligation is P1*,<<<. Assuming all receivables are collected -limax6s cost of factoring the receivables would be A. P1 ,*1* c. P 1,*1* 8. P1*,<<< d. P) ,*1*

Page 7 of 10

11. The Alena -orporation sold a piece of e'uipment to Kbarro, Inc. on April 1, <1&, in exchange for an P5<<,<<< non;interest bearing note due on April 1, <1). The note had no read$ market, and there was no established exchange price for the e'uipment. The prevailing interest rate for a note of this t$pe at April 1, <1&, was 1 I. The carr$ing value of the note receivable on 3ecember &1, <1& is a. P5<<,<<< c. P.9),95) b. P. <,5.) d. P11),11 1 . +entor 8ank granted a loan to a borrower on Ganuar$ 1, <1 . The interest on the loan is 5I pa$able annuall$ starting 3ecember &1, <1 . The loan matures in three $ears on 3ecember &1, <1). 3ata related to the loan areC Principal amount 7rigination fee charged against the borrower 3irect origination cost incurred &,<<<,<<< 1<<,<<< .<,&<<

After considering the origination fee charged to the borrower and the direct origination cost incurred, the effective rate on the loan is .I !hat is the carr$ing amount of the loan receivable on 3ecember &1, <1 " a. P&,<<<,<<< c. P&,1<9,5<< b. P&,1.<,<<< d. P&, 1<,.5 1&. 7n 7ctober 1*, <1&, 3ana$a -ompan$ purchased goods costing P),*<<,<<<. The freight term is (78 3estination. Some of the costs incurred with the sale and deliver$ of the goods wereC Packaging for shipment Shipping Special handling charges <<,<<< <<,<<< 1<<,<<<

These goods were received on 7ctober 11, <1&. !hat amount of cost for these goods should be included in 3ana$a6s inventor$" a. P),*<<,<<< c. P),1<<,<<< b. P),9<<,<<< d. P*,<<<,<<< 1). The following 'uarterl$ cost data have been accumulated for Gestabock$ +fg. Inc. ,aw materials D beginning inventor$ =Gan. 1, <1 > Purchases 5,*<< units LP1.<< 11,<<< units LP1.*< Transferred 1,*<< units of raw materials to work in processC !ork in process D beginning inventor$ =Gan. 1, <1 > 3irect labor +anufacturing overhead !ork in process D ending inventor$ =+ar. &1, <1 > *,.<< units LP1&.*< P *<,<<< P& *,<<< ), << units LP1&.1* 1<,<<< units LP..<<

If Gestabock$ uses the (I(7 method for valuing raw materials inventories, compute for the cost of goods manufactured for the 'uarter ended +arch &1 <1 . a. P.99,1*< c. P1&),5*< b. P111,<<< d. P1).,5*< 1*. The ph$sical count conducted in the warehouse of Imaw -ompan$ on 3ecember &1, <1& revealed merchandise with a total cost of P&,.<<,<<< was on hand on that date. Aowever the following items were excluded from the countC @oods sold to a customer, which are being held for the customer to call for at the customer6s convenience with a cost of P <<,<<<. A packing case containing a product costing P5<,<<< was standing in the shipping room when the ph$sical inventor$ was taken. It was not included in the inventor$ because it was marked /hold for shipping instructions0. Kour investigation revealed that the customer6s

Page 8 of 10

order was dated 3ecember <, <1&, but that the case was shipped and the customer billed on Ganuar$ 1<, <1&. +erchandise held b$ (inishing -ompan$ costing P&<<,<<< for further processing and packaging.

The correct amount of inventor$ that should be reported in Imaw -ompan$6s balance sheet at 3ecember &1, <1& is a. P),15<,<<< c. P&,55<,<<< b. P&,95<,<<< d. P),1<<,<<< 1.. The records of Awoo6s !holesale and ,etail Store report the following data for the month of Ganuar$ <1&C 8eginning inventor$ at cost Purchases at cost (reight on purchases Purchase returns at cost 8eginning inventor$ at sales price Purchase returns at sales price Initial mark up on purchases 5.<,<<< .,**<,<<< 1*<,<<< &.<,<<< 1, <<,<<< * *,<<< ),&*<,<<< ?et Additional mark up ?et +ark down Sales Sales discounts %mplo$ee discounts Theft and breakage ) *,<<< 1*<,<<< 9,)*<,<<< )<<,<<< &<<,<<< 1*<,<<<

Esing the average retail inventor$ method, Awoo6s cost of sales is a. P.,&9<,<<< c. P.,<5<,<<< b. P.,1*<,<<< d. P.,&&.,<<< 11. Pegaslick -ompan$ uses the first;in, first;out retail method of inventor$ valuation. The following information is availableC 8eginning inventor$ Purchases ?et markups ?et markdowns Sales -ost P ,*<<,<<< 1&,*<<,<<< ,etail P ),<<<,<<< 1.,<<<,<<< &,<<<,<<< 1,<<<,<<< 1*,<<<,<<<

!hat would be the estimated cost of the ending inventor$" a. P1,<<<,<<< c. P*,11<,<<< b. P*, *<,<<< d. P),1*<,<<< 15. A ph$sical inventor$ taken on 3ecember &1, <1& resulted in an ending inventor$ of P1,))<,<<<. 8anak -ompan$ suspects some inventor$ ma$ have been taken b$ emplo$ees. To estimate the cost of missing inventor$, the following were gatheredC Inventor$, 3ec. &1, <1 Purchases during <1& -ash sales during <1& Shipment received on 3ecember ., <1&, included in ph$sical inventor$, but not recorded as purchases 3eposits made with suppliers, entered as purchases. @oods not received in <1& -ollections on accounts receivable, <1& Accounts receivable, Ganuar$ 1, <1& Accounts receivable, 3ecember &1, <1& @ross profit percentage on sales P1, 5<,<<< *,.)<,<<< 1,)<<,<<< )<,<<< were 5<,<<< 1, <<,<<< 1,<<<,<<< 1, <<,<<< )<I

At 3ecember &1, <1& what is the estimated cost of missing inventor$" a. P <<,<<< c. P1,<<<,<<< b. P1.<,<<< d. P < 19. ?akba -ompan$ installs replacement siding, windows, and louvered glass doors for famil$ homes. At 3ecember &1, <1&, the balance of raw materials inventor$ account was P*< ,<<<, and the allowance for inventor$ writedown was P&&,<<<. The inventor$ cost and market data at 3ecember &1, <1&, are as followsC Cost Re! aceme"t Sa es Net Norma

Page 9 of 10

Cost Aluminum siding +ahogan$ siding 2ouvered glass door @lass windows Total 59,<<< 9),<<< 1 *,<<< 19),<<< *< ,<<< 5.,<<< 9 ,<<< 1&*,<<< 11),<<< ) 1,<<<

Price 91,*<< 9&,<<< 1 9,<<< <*,<<< *15,*<< c. P11,<<< d. P <

Rea i#ab e va $e 51,<<< 5*,<<< 111,<<< 191,<<< )5<,<<<

Pro%it *,<<< 1,<<< 1<,<<< <,<<< & ,<<<

The loss on inventor$ write down is a. P 5,<<< b. P *,<<<

<. Staggerceps (orester -ompan$, on adoption of PAS )1, has reclassified certain assets as biological assets. The total value of the forest assets is P.,<<<,<<<, which comprisesC (reestanding trees 2and under trees ,oads in forests *,1<<,<<< .<<,<<< &<<,<<< .,<<<,<<<

In Staggerceps6 statement of financial position, how much of the forest assets shall be classified as biological assets" a. P*,1<<,<<< c. P*,)<<,<<< b. P*,1<<,<<< d. P.,<<<,<<< 1. PeepstaAoo -ompan$ purchased marketable e'uit$ securities during <1& to be held as /trading0. An anal$sis of the current investments on 3ecember &1, <1& showed the followingC A -ompan$ ordinar$ shares 8 -ompan$ ordinar$ shares - -ompan$ preference shares 3 -ompan$ preference shares -ost 1,<<<,<<< 1,*<<,<<< ,<<<,<<< ,*<<,<<< +arket 5<<,<<< 1,5<<,<<< 1,1<<,<<< ,.<<,<<<

!hat is the measurement of the financial assets held for trading on 3ecember &1, <1&" a. P.,9<<,<<< c. P1,<<<,<<< b. P.,5<<,<<< d. P.,*<<,<<< . Molephant -ompan$ ac'uired an e'uit$ instrument for P),<<<,<<< on +arch &1, <1 to be measured at fair value through other comprehensive income. The direct ac'uisition costs incurred amounted to P1<<,<<<. 7n 3ecember &1, <1 , the fair value of the instrument was P*,*<<,<<< and the transaction costs that would be incurred on the sale of the investment were estimated at P.<<,<<<. !hat amount of unreali#ed gain should be recogni#ed in the income statement for the $ear ended 3ecember &1, <1 " a. P <<,<<< c. P5<<,<<< b. P9<<,<<< d. P < &. 7n Ganuar$ 1, <1&, Iceguin Ace -ompan$ purchased marketable e'uit$ securities to be held as /trading0 for P*,<<<,<<<. The entit$ also paid commission, taxes and other transaction costs amounting to P <<,<<<. The securities had a market value of P*,*<<,<<< on 3ecember &1, <1&. ?o securities were sold during <1&. The transaction costs that would be incurred on the disposal of the investment are estimated at P1<<,<<<. !hat amount of unreali#ed gain or loss on these securities should be reported in the <1& income statement" a. P*<<,<<< unreali#ed loss c. P)<<,<<< unreali#ed loss b. P*<<,<<< unreali#ed gain d. P)<<,<<< unreali#ed gain

Page 10 of 10

). The following items were among those that were reported on 8ANAN7? -ompan$6s income statement for the $ear ended 3ecember &1, <1&C 2egal and audit fees ,ent for office space Interest on acceptances pa$able 2oss on abandoned data processing e'uipment Insurance P ,<<<,<<< .,<<<,<<< 1,<<<,<<< *<<,<<< <<,<<<

The office space is used e'uall$ b$ the sales and accounting departments. !hat amount should be classified as general and administrative expenses" a. P5, <<,<<< c. P., <<,<<< b. P*, <<,<<< d. P*,<<<,<<< *. The following information was taken from AAKAAAK -ompan$6s accounting records for the $ear ended 3ecember &1, <1&C 3ecrease in raw materials inventor$ Increase in goods in process inventor$ Increase in finished goods inventor$ ,aw materials purchased 3irect labor pa$roll (actor$ overhead (reight out (reight in The cost of goods sold is a. P*9,<<<,<<< b. P*1,<<<,<<< P 1,<<<,<<< &,<<<,<<< ,<<<,<<< )<,<<<,<<< 1<,<<<,<<< .,<<<,<<< ),<<<,<<< *,<<<,<<<

c. P.1,<<<,<<< d. P.&,<<<,<<<

M&L '(0)3*

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Case Nike Cost of Capital - FinalДокумент7 страницCase Nike Cost of Capital - FinalNick ChongsanguanОценок пока нет

- Modigliani & Miller Capital Structure TheoryДокумент2 страницыModigliani & Miller Capital Structure TheoryJoao Mariares de VasconcelosОценок пока нет

- TalumpatiДокумент3 страницыTalumpatiSteffi Kay Diaz Pantino50% (2)

- Statement of AccountДокумент5 страницStatement of Accountmutaia pandian100% (1)

- Swaps - Interest Rate and Currency PDFДокумент64 страницыSwaps - Interest Rate and Currency PDFKarishma MittalОценок пока нет

- Gold MarketДокумент25 страницGold MarketVirendra Jha100% (1)

- Hall 5e TB Ch01Документ14 страницHall 5e TB Ch01J.C. S. Maala100% (2)

- Theological Reflection kUSINA NI MARTHAДокумент1 страницаTheological Reflection kUSINA NI MARTHASteffi Kay Diaz PantinoОценок пока нет

- Credit Crisis Kind of IndieДокумент2 страницыCredit Crisis Kind of IndieSteffi Kay Diaz PantinoОценок пока нет

- Patients Medicine and ComputerДокумент22 страницыPatients Medicine and ComputerSteffi Kay Diaz PantinoОценок пока нет

- Steffi QuotesДокумент7 страницSteffi QuotesSteffi Kay Diaz PantinoОценок пока нет

- Executive SummaryДокумент2 страницыExecutive SummarySteffi Kay Diaz PantinoОценок пока нет

- Executive SummaryДокумент2 страницыExecutive SummarySteffi Kay Diaz PantinoОценок пока нет

- 1st Year Blockings For PostingДокумент10 страниц1st Year Blockings For PostingSteffi Kay Diaz PantinoОценок пока нет

- Sample SM Cases CF Ross 13Документ4 страницыSample SM Cases CF Ross 13Daniel Alonso Ochoa GordónОценок пока нет

- @csupdates Chapter 21 CIRP, Liquidation Wining Up SBECДокумент29 страниц@csupdates Chapter 21 CIRP, Liquidation Wining Up SBECthevinayakshuklaaОценок пока нет

- Unit 5 Woking CapitalДокумент10 страницUnit 5 Woking CapitalRich ManОценок пока нет

- Set 5 ENGLISH Questions & Answers 180309: Answer AДокумент9 страницSet 5 ENGLISH Questions & Answers 180309: Answer AAzri LunduОценок пока нет

- How To Buy CryptocurrenciesДокумент2 страницыHow To Buy CryptocurrenciesObinna ObiefuleОценок пока нет

- Assurance VieДокумент4 страницыAssurance Vievincent.reynaud.74Оценок пока нет

- Kroll Lowers Its Recommended US Equity Risk PremiumДокумент3 страницыKroll Lowers Its Recommended US Equity Risk PremiumAz RaОценок пока нет

- Any Need For Naira Re Denomination NowДокумент10 страницAny Need For Naira Re Denomination NowUtri DianniarОценок пока нет

- Enron and AndersonДокумент30 страницEnron and AndersonAzizki Wanie100% (2)

- Bofa MarzoДокумент12 страницBofa MarzoDavid SanchezОценок пока нет

- Lobj18 0005498Документ48 страницLobj18 0005498Nadil NinduwaraОценок пока нет

- Global Rates Trader - A Taper Trade PreviewДокумент19 страницGlobal Rates Trader - A Taper Trade PreviewRafael Lizana ZúñigaОценок пока нет

- Icungamutungo N'ibaruramari Mumakoperative HarmonizedДокумент26 страницIcungamutungo N'ibaruramari Mumakoperative HarmonizedSamuel UWIDUTIJEОценок пока нет

- Reviewer Cfas MidtermsДокумент3 страницыReviewer Cfas MidtermsPixie CanaveralОценок пока нет

- Screenshot 2023-11-26 at 12.01.23 AMДокумент73 страницыScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8Оценок пока нет

- CTP BooksДокумент3 страницыCTP BooksuzernaamОценок пока нет

- SBI Contra Fund FactsheetДокумент1 страницаSBI Contra Fund FactsheetAman VermaОценок пока нет

- Challan Form CSS PDFДокумент2 страницыChallan Form CSS PDFMuhammd Shahroz YousafОценок пока нет

- Macroeconomics: Case Fair OsterДокумент26 страницMacroeconomics: Case Fair OsterMikhel BeltranОценок пока нет

- Green Nature Triangles Project General ProposalДокумент3 страницыGreen Nature Triangles Project General Proposalapi-540658681Оценок пока нет

- Fulvian Zahid Kuis MenkeuДокумент3 страницыFulvian Zahid Kuis MenkeuCarihunian DepokОценок пока нет

- Solution Manual For Financial Economics Frank J Fabozzi Edwin H Neave Guofu Zhou Full DownloadДокумент4 страницыSolution Manual For Financial Economics Frank J Fabozzi Edwin H Neave Guofu Zhou Full Downloadbrandonfowler12031998mgj100% (37)

- Brookfield Asset Management 1Q19 Investor PresentationДокумент92 страницыBrookfield Asset Management 1Q19 Investor PresentationTunan ChenОценок пока нет

- Mfu Can & PayezzДокумент2 страницыMfu Can & PayezzAsif IqbalОценок пока нет

- App Form Personal Account Application Form 103 v4Документ11 страницApp Form Personal Account Application Form 103 v4Shaliena LeeОценок пока нет