Академический Документы

Профессиональный Документы

Культура Документы

Applying Kraljic's Matrix in Remote Environments

Загружено:

fatma630 оценок0% нашли этот документ полезным (0 голосов)

530 просмотров77 страницBusiness strategy

Оригинальное название

Application of Kraljic s Purchasing Portfolio Matrix in an Undeveloped Logistic Infrastructure. the Staatsolie Suriname Case by Dennis Mac Donald MBA2

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBusiness strategy

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

530 просмотров77 страницApplying Kraljic's Matrix in Remote Environments

Загружено:

fatma63Business strategy

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 77

MAASTRICHT SCHOOL OF MANAGEMENT

Application of Kraljics Purchasing Portfolio Matrix

in an Undeveloped Logistics Infrastructure

- The Staatsolie Suriname Case -

By

Dennis R. Mac Donald

(Suriname)

This paper was submitted in partial fulfillment of the requirements for the Masters of Business Administration (MBA)

degree at the Maastricht School of Management (MSM), Maastricht, the Netherlands, November 2006.

<This page intentionally left blank>

ACKNOWLEDGEMENTS

This research was done with the support of some individuals to whom I am very grateful.

First of all, I want to express my deepest gratitude to my thesis supervisor, dr. Cees J . Gelderman

who helped me through the study with his valuable remarks, encouragement and inspiration. Thank

you Cees it was an honor to have you as my supervisor and for always being available to listen to

me and to guide me to the right direction.

Secondly, special thanks go to all my MBA-intake-II fellow students, especially my thesis team

members Dynaida, J uliette, Meryl and Clifton for their stimulation, valuable remarks and

instructions during the several stages of my research.

Furthermore, I would like to express my gratitude to the research team members at Staatsolie for

their substantial support to this research project. In particular, I would like to thank Peter, Robbin

and Kenneth, also many thanks to my colleague, Duncan for his inspiration and useful instructions.

Thanks to Hans Lim A Po and Ollye Chin A Sen and their administrative supporting team at the

FHR Lim A Po Institute for making this all possible and manageable.

I would also like to thank Iwan Kortram, Finance Director of Staatsolie, for giving me the

opportunity to follow the program for my future career development.

Last but not least, I would like to thank my family, Hortence, Arusha, Xavaira and Silvio for their

inspiration and patience during this process.

Dennis R. Mac Donald

Paramaribo, November 2006

i

ABSTRACT

Portfolio models in purchasing have received large-scale recognition and have gained an increased

degree of adoption, especially in Western Europe (Gelderman, 2003). Kraljic (1983) introduced the

first comprehensive portfolio approach for purchasing and supply management. This approach

includes the construction of a portfolio matrix that classifies products on the basis of two

dimensions: profit impact and supply risk. Purchasing portfolio models, including Kraljics,

have been developed from a point of view of a well-developed industrialized logistics

infrastructure. The buyer-supplier relationships of companies situated in remote areas with an

undeveloped logistics infrastructure, however, are subject to, and often defined by, those (poor)

logistics infrastructures. A poor logistics infrastructure will have an impact on the supply risk, but

the Kraljic approach does not explicitly deal with issues of logistics and (a poor) infrastructure. This

led to the following problem statement, How may Kraljics purchasing portfolio model be used

under conditions of remote suppliers and an undeveloped logistics infrastructure?.

To deal with this problem statement the following four research questions were formulated:

1. Which characteristics of remoteness should be considered when adapting the Kraljic model for

use in remote areas?

2. Which adaptations to the dimensions of the Kraljic matrix are required, when using the Kraljic

approach under conditions of remote suppliers and an undeveloped logistics infrastructure?

3. Which adaptations to the categories of the Kraljic matrix are required when using the Kraljic

approach under conditions of remote suppliers and an undeveloped logistics infrastructure?

4. Which adaptations to the strategic recommendations of the Kraljic matrix are required when

using the Kraljic approach under conditions of remote suppliers and an undeveloped logistics

infrastructure?

The research method started with a literature review that included the research of many subject

areas that are related to purchasing, such as, ABC-analysis, commodity analysis, purchasing

portfolio models, and logistics as well as literature review on the characteristics of remote

environments. The information gained from the literature review formed a framework for the

adaptation of the Kraljic purchasing portfolio matrix for remote environments.

In this study remoteness or a remote environment is assumed to be geographically distant suppliers

where the buyer is located in an environment of poor or undeveloped logistics infrastructure, often

ii

developing countries (Caddick and Dale, 1987 and Fawcett, 2000). The characteristics to consider

for a remote environment are mainly linked to logistical problems and a lack of understanding of

the importance of logistics for the supply chain. The answer to the second research question reveals

that the dimension of profit impact is less dependent on the location of the business; therefore this

dimension does not need to be adapted for a remote environment, while for the supply risk several

factors have been identified that could have an impact on the supply risk dimension. With respect

to adaptations to the categories of the Kraljic matrix, no need was found to adapt these for remote

environments. Therefore, the original four categories, bottleneck, non-critical, leverage, and

strategic quadrants, can be used for remote environments. This study resulted in the addition of two

strategic recommendations to the Kraljic matrix: one strategy is the use of remote purchasing agents

and the other is the use of an advanced logistics management system between buyer and supplier.

Both these strategies are aimed at reducing the supply risk for remote environments.

In conjunction with the result from the literature study an action research method was used to apply

the adapted Kraljic matrix for the State Oil Company of Suriname, Staatsolie, a company that has to

do business within a remote environment.

In order to fill in the matrix and to arrive at the strategic recommendations, a five-step approach as

outlined by Gelderman (2003) was used. The use of this methodology upon a sample of 44

materials or classes of materials at Staatsolie resulted in a current purchasing portfolio matrix with

three main clusters in respectively the non-critical, the leverage and the strategic quadrant. The

portfolio matrix demonstrates that Staatsolie is facing an extreme supply risk with a substantial part

of its items that have a high profit impact, as a result of which it depends only on one or a limited

amount of suppliers for these materials.

Through application of differentiated purchasing strategies, the supply risk can be reduced, resulting

in a much better negotiating position for Staatsolie. The reduced supply risk will protect Staatsolie

against disastrous supply interruptions and unplanned shutdowns of its operations. Due to the

stronger negotiating position Staatsolie can make the most of their potential buying power.

This study made clear that for remote environments adaptations have to be made to the Kraljic

matrix at the supply risk dimension and to the strategic recommendations. Further research is

recommended to gain a deeper understanding of the impact of remote aspects on the Kraljic matrix.

iii

ABBREVIATIONS

BCG Boston Consulting Group

E&P Exploration & Production

HRM Human Resources Management

HSE Health Safety and Environment

ISO International Organization for Standardization

LDC Less Developed Countries

MCC Maintenance Control Center

MMBLS Million Barrels

MW Mega Watt

PEP Production Expansion Program

PPP Purchasing Policy and Procedures

iv

CONTENT

ACKNOWLEDGEMENTS...........................................................................................................i

ABSTRACT.....................................................................................................................................ii

ABBREVIATIONS.......................................................................................................................iv

CHAPTER 1. INTRODUCTION..............................................................................................1

Section 1.1. General.....................................................................................................................1

Section 1.2. Problem Statement and research questions.............................................................2

Section 1.3. Research methods ....................................................................................................3

Section 1.4. Scope and Limitations..............................................................................................4

Section 1.5. Chapter Overview....................................................................................................4

Section 1.6. Summary...................................................................................................................4

CHAPTER 2. LITERATURE REVIEW.................................................................................5

Section 2.1. From Pareto to Kraljic ............................................................................................5

Section 2.2. The Kraljic Purchasing Portfolio Matrix.................................................................8

Section 2.3. Criticisms and Support of the Kraljic Matrix ........................................................16

Section 2.4. Remoteness.............................................................................................................19

Section 2.5. Summary.................................................................................................................21

CHAPTER 3. THE KRALJ IC MATRIX ADAPTED TO REMOTENESS................22

Section 3.1. Adaptations to the Dimensions ..............................................................................22

Section 3.2. Adaptations to the Categories................................................................................24

Section 3.3. Impact on the strategic recommendations .............................................................25

Section 3.4. Summary.................................................................................................................27

CHAPTER 4. PORTFOLIO ANALYSIS WITH THE KRALJ IC MATRIX..............28

Section 4.1. Methodology...........................................................................................................28

Section 4.2. Summary.................................................................................................................31

CHAPTER 5. BUSINESS CONTEXT ..................................................................................33

Section 5.1. Company description .............................................................................................33

Section 5.2. Purchasing Function within Staatsolie..................................................................34

Section 5.3. Inventory Management ..........................................................................................35

Section 5.4. Summary.................................................................................................................36

CHAPTER 6. RESEARCH RESULTS..................................................................................38

Section 6.1. Preparation............................................................................................................38

Section 6.2. Designing and filling in the matrix ........................................................................38

Section 6.3. Interpretation of the results....................................................................................41

Section 6.4. Defining strategic directions..................................................................................44

Section 6.5. Summary.................................................................................................................49

v

CHAPTER 7. CONCLUSIONS AND RECOMMENDATIONS...............................50

Section 7.1. Conclusions........................................................................................................50

Section 7.2. Recommendations ..............................................................................................52

APPENDIX 1: Stages of Purchasing Sophistication, Kraljic 1983..............................53

APPENDIX 2: The Purchasing Portfolio Matrix, Kraljic 1983.....................................54

APPENDIX 3: Organization Structure Staatsolie.............................................................55

APPENDIX 4: Organization Structure Procurement Division Staatsolie...................56

APPENDIX 5: Customer Classes for Materials................................................................57

APPENDIX 6: Commodity Groups (short list)....................................................................58

APPENDIX 7: Material Classes and Products for Supply Risk....................................59

APPENDIX 8: Staatsolies Purchasing Portfolio Matrix (Linear Scale)........................60

APPENDIX 9: Staatsolies Purchasing Portfolio Matrix (Logarithmic Scale)...............61

APPENDIX 10: Strategic Recommendation for Staatsolie Purchasing Portfolio.......62

APPENDIX 11: Staatsolies Improved Purchasing Portfolio Matrix.............................63

BIBLIOGRAPHY:........................................................................................................................64

vi

CHAPTER 1. INTRODUCTION

Section 1.1. General

Portfolio models have been used in strategic planning and marketing, but their application to the

field of purchasing has been limited. This, however, appears to be changing as procurement

management is viewed more and more as being of strategic importance (Nellore and Sderquist,

2000). According to Kraljic (1983), instead of simply monitoring current developments,

management must learn to use these developments to its own advantage. This calls for nothing less

than a total change of perspective: from purchasing which is an operational function, to supply

management which is strategic. The introduction of the Kraljic portfolio approach can be

considered a major breakthrough in the development of professional purchasing (Gelderman and

Van Weele, 2003). Kraljics approach has inspired many academics to undertake further research

into purchasing portfolio models (Canils and Gelderman, 2005).

Obviously, not all products and not all buyer-supplier relationships are to be managed in the same

manner. In general, purchasing portfolio models aim at developing differentiated purchasing and

supplier strategies. Kraljic (1983) introduced the first comprehensive portfolio approach for

purchasing and supply management. Shortly after the oil crisis in 1973, he posited that purchasing

must become supply management, advising companies to progress toward more effective supply

management. Kraljic accompanied this advice with a practical portfolio tool for shaping the supply

strategy.

Kraljics categories and strategies recommendations matrix was developed for BASF, a European

chemical multinational, in the early seventies, around 1973, 1974. Kraljic (1983) made a reasonable

case for the usefulness of his portfolio approach by describing the experiences of four large

industrial companies. More recent empirical studies have corroborated the usefulness of the matrix

in practice (e.g. Carter, 1997; Lilliecreutz and Ydreskog, 1999; Gelderman and Van Weele, 2003

and 2005; J ohnson and Wagner, 2004). However, all of these studies have been carried out in

companies that are located in developed countries under conditions of a well-developed

infrastructure.

1

In many developing and former state-regulated countries the logistic infrastructure is poor, customs

and regulations unclear and inefficient, the logistics supply market underdeveloped, and the risk for

crime high (Andersson and Norrman, 2002). These conditions result in relatively high supply risks,

as the number of trustworthy or capable partners is low and the few existing ones enjoy a better

negotiating position. Obviously, for companies located in these environments it is more difficult

and more costly to develop close, productive relationships with their geographically distant

suppliers. The challenge begins with identifying and qualifying capable suppliers in regions of the

world where buyers have little experience (Fawcett, 2000). However, it remains unclear whether the

Kraljic matrix could be applied under such remote conditions. The concept remote conditions

within this study refers to a situation where a company is operating in a country or region where the

logistics infrastructure for the procurement of materials is limited or not well developed.

Section 1.2. Problem Statement and research questions

Purchasing portfolio models, including Kraljics, have been developed from a point of view of well-

developed industrialized logistics infrastructures. The buyer-supplier relationships of companies

situated in remote areas with an undeveloped logistics infrastructure, however, are subject to, and

often defined by, those (poor) logistics infrastructures. Poor logistics infrastructures will influence

lead times and therefore will impact the supply risk. It is clear that an undeveloped logistics

infrastructure should play a significant part in the Kraljic approach. However, the Kraljic approach

does not explicitly deal with issues of logistics and (a poor) infrastructure. This gave rise to the

problem statement for this study:

How may Kraljics purchasing portfolio model be used under conditions of remote suppliers and an

undeveloped logistics infrastructure?

In order to deal with the problem statement, the following research questions were answered by this

study:

1. Which characteristics of remoteness should be considered when adapting the Kraljic model for

use in remote areas?

2. Which adaptations to the dimensions of the Kraljic matrix are required, when using the Kraljic

approach under conditions of remote suppliers and an undeveloped logistics infrastructure?

2

3. Which adaptations to the categories of the Kraljic matrix are required when using the Kraljic

approach under conditions of remote suppliers and an undeveloped logistics infrastructure?

4. Which adaptations to the strategic recommendations of the Kraljic matrix are required when

using the Kraljic approach under conditions of remote suppliers and an undeveloped logistics

infrastructure?

Section 1.3. Research methods

The main objective of this research paper was to identify and describe the application of the Kraljic

purchasing portfolio model to remote areas. To establish a theoretical framework a literature

research was conducted. Based on the literature study, a revised version of the Kraljic approach was

developed, including adjusted dimensions (factors), and strategic recommendations. This new

purchasing portfolio model was tested and refined by means of action research in which the new

model was used in practice. The model was tested and evaluated in a location where the logistics

infrastructure is relatively poor, namely at the State Oil Company of Suriname, Staatsolie. Figure

1.1 provides an overview of the research model.

Purchasing

Portfolio

Theory

Logistics

Management

Theory

Adaptation to

Kraljic Model for

Remote Areas

Conclusions

and

Recommendations

Supply

Management

Remote Areas

Analysis Case Study

Expert Interviews

Figure 1.1. Research Model

3

Section 1.4. Scope and Limitations

The application of the adjusted Kraljic model for remote areas was validated for only one company.

Within the scope of this research paper no attempt was made to validate the framework through a

broader audience. The results of the study should not, therefore, be extrapolated to other companies

and other industries.

Section 1.5. Chapter Overview

This research paper is organized as follows:

Chapter one is an introduction of the research subject regarding purchasing portfolio models and the

characteristics of remote areas.

Chapter two provides an overview of the literature research pertaining to purchasing portfolio

models. In this chapter a detailed overview is given of the use of purchasing portfolio models to

define the different strategies in buyer supplier relations. In addition, the Kraljic purchasing

portfolio matrix is discussed in detail and some logistics constraints for remote areas are outlined.

Chapter three supplies an overview of the adaptations of the Kraljic matrix to remote environments

Chapter four supplies an overview of the research methodology used.

Chapter five describes the business context within which the study was carried out.

Chapter six expounds upon the findings and the analysis

Chapter seven provides the conclusion and recommendations.

Section 1.6. Summary

The present chapter demonstrated the need for adaptation of the Kraljic purchasing portfolio model

for use under conditions of remote suppliers and an undeveloped logistics infrastructure. The

process through which this paper attempted to arrive at such a model was laid down.

4

CHAPTER 2. LITERATURE REVIEW

Section 2.1. From Pareto to Kraljic

2.1.1. Pareto Analysis

For a long while the ABC-analysis or Pareto-analysis was the only tool available for differentiating

between important and less important purchases (Gelderman, 2005). In a Pareto curve items are

placed into one of three classes according to the cumulative number of purchasing orders and their

cumulative value. The A-category contains 20% of the number of orders, which typically accounts

for 80% of the total value. The B-category contains 30% of the items accounting for less than 20%

of the spending. The remaining 50% of the items accounts for less then 2% of the total spending of

the C-category. ABC-analysis is considered to be helpful in situations where the majority of

purchases spend is generated by a limited number of material categories.

ABC-analysis is usually applied to the financial value of the purchasing portfolio, essentially a

volume characteristic. Another volume characteristic is the number of parts, especially important in

discrete production. Instead of a volume dimension, it is also possible to use the cumulative number

of supplies. This classification differentiates suppliers with significant spend from the mass

suppliers with only small purchase volumes (Hartmann et al., 2002).

ABC-analysis concentrates on the financial value of items and ignores the cost of poor quality

(Burt, 1989), performance risk, social risk and other components (Hartmann et al., 2002). In

addition, the ABC-analysis fails to discriminate between the methods which should be used to

obtain different item categories (Steel and Court, 1996). ABC-analysis does not recommend spe-

cific strategies for each category, it merely provides information on the concentration of purchase

spend. It is a classification tool, not a portfolio model, since it does not provide (differentiated)

purchasing and supplier strategies.

2.1.2. Commodity Analysis

Commodity analysis is another example of a classification tool in purchasing (Gelderman, 2005).

This type of analysis divides the total purchasing volume in percentages for all combinations of

5

product groups and principal users. It reveals key users and the commodities that are most

important to them (Bauer, 1977). Commodity analysis identifies critical procurement areas, is

helpful for setting priorities, and provides recommendations with respect to the organization of

purchasing (assignment of responsibilities and centralized or decentralized purchasing). J ust as in

ABC-analysis, commodity analysis should be classified as a classification tool, since it too does not

provide (differentiated) purchasing and supplier strategies. They are both examples of a spend

analysis which is limited to the classification of the items and suppliers according to their financial

value.

2.1.3. Portfolio Analysis

A portfolio refers to a collection of related items. The portfolio concept stresses the importance of

the whole rather than the parts. It reflects the importance for balance in a collection on individual

elements. As a consequence it allows for differentiation and diversification, in our aim for balance

and an optimal use of limited resources. The portfolio concept has it roots in financial investments

in the 1950s. For business purposes, portfolio approaches haven been developed for applications in

investment theory, strategic management, marketing, and purchasing management. In general, the

portfolio concept focuses on the interdependencies among management decisions and emphasizes

an integrated approach (Turnbull, 1990).

According to Ellram and Olson (1997), portfolio models have primarily been used in strategic

decision-making to support resource allocation decisions among strategic business units. Perhaps

the most used, misused and discussed portfolio model is the Boston Consulting Groups (BCG)

growth/share matrix.

Portfolio models have been used in strategic planning and marketing, but their application to the

field of purchasing has been limited. This seems to be changing, however, as procurement

management has become more strategic (Nellore and Sderquist, 2000).

6

2.1.4. Kraljics Comprehensive Portfolio Approach

Kraljic (1983) introduced the first comprehensive portfolio approach for purchasing and supply

management. This approach includes the construction of a portfolio matrix that classifies products

on the basis of two dimensions: profit impact and supply risk with both a low and high end. The

result is a 2x2 matrix and a classification in four categories, figure 2.1 below.

With the help of this matrix, professional purchasers can differentiate between the various items and

supplier relations and choose strategies that are appropriate for each category, thereby effectively

managing suppliers (Nellore and Sderquist, 2000). Quite a number of scholars have introduced

variations on the original Kraljic matrix (e.g. Elliot-Shircore and Steele, 1985; Syson, 1992; Evans

and Hadeler, 1994; Ellram and Olsen, 1997; Gelderman, 2000; Van Weele, 2002). However, the

proposed matrices are very similar to the Kraljic matrix; the models employ practically the same

dimensions, the same categories and the same recommendations (Gelderman and Van Weele,

2005).

Non-Critical

Leverage Strategic

Bottleneck

Supply Risk

Profit Impact

Diversify

Balance

Exploit

Low High

L

o

w

H

i

g

h

Non-Critical

Leverage Strategic

Bottleneck

Supply Risk

Profit Impact

Diversify

Balance

Exploit

Low High

L

o

w

H

i

g

h

Figure 2.1. Kraljics categories and strategic recommendations matrix, source Kraljic (1983)

It is fair to conclude that the Kraljic matrix has become the standard in the field of purchasing

portfolio models (Gelderman, 2003).

7

In the course of time the Kraljic approach entered many textbooks on purchasing and supply

management. Purchasing portfolio models have gained ground in both research and practice

(Nellore and Sderquist, 2000).

The Kraljic portfolio approach can be considered an important breakthrough in the development of

theory in the field of purchasing and supply management. Syson (1992) characterized it as a

powerful tool to be used for diagnostic and prescriptive purposes and that goes far beyond the well-

known, rather simplistic ABC-analysis.

Commenting on purchasing management Ellram and Olson (1997), stated that portfolio models

could be used to improve the allocation of scarce resources by being one method of identifying

which groups of products, suppliers or relationships warrant greater attention than others.

Section 2.2. The Kraljic Purchasing Portfolio Matrix

Section 2.2.1. General

Kraljic (1983) advised managers to guard their firms against damaging supply interruptions and to

deal with continuous technological change and economic growth. In his seminal paper he advised

companies to establish more effective supply management. He proclaimed, purchasing must

become supply management (Kraljic 1983, p. 109). He presented a figure as Exhibit I (see

Appendix 1) that classified the stages of purchasing sophistication within companies. This figure

identified four stages: (1) purchasing management, (2) materials management, (3) sourcing

management, and (4) supply management. Kraljic (1983, p. 111) further argued that supply

management is particularly relevant when the supply market is complex and the importance of

purchasing is high.

Specifically for the fourth stage of purchasing sophistication, supply management, Kraljic (1983)

proposed a four-phase framework for developing supply strategies for single products or product

groups. In the first phase, a company is to classify all its purchased products depending on the

associated profit impact and supply risk into one of four categories: Strategic, Bottleneck, Non-

Critical, and Leverage. Subsequently, the company should weigh the bargaining power of its

suppliers against its own power. At the third phase, the company should position the products that

8

were identified in the first phase as strategic (high profit impact and high supply risk), in a portfolio

matrix. Finally, depending on the companys own strength and the strength of the supply market,

the company is to develop purchasing strategies and action plans for products labeled strategic.

Three general purchasing strategies are recommended: exploitation, in the case of buyer dominance;

balance, in the case of a balanced relationship; and diversification, in the case of supplier

dominance.

In his 1983 article Kraljic introduced a nine-block Purchasing Portfolio Matrix to be used for

strategic items as Exhibit IV (see Appendix 2).

It should be noted that Kraljic focuses on strategic products; for the other item categories,

bottleneck, non-critical, and leverage, Kraljic merely formulated a number of main tasks. Other

scholars have filled this gap (e.g. Van Weele, 2002; Syson, 1992; Elliott-Shircore and Steele, 1985).

They refined the matrix and elaborated on the 'main tasks' for bottleneck, non-critical and leverage

items. In addition, they formulated strategic recommendations, resulting in an overall purchasing

strategy recommendation for each portfolio quadrant (see figure 2.2). This refined matrix is

commonly referred to as Kraljics Purchasing Portfolio Matrix (e.g. Ellram and Olsen, 1997;

Lilliecreutz and Ydreskog, 1999; Van Weele, 2002; Gelderman, 2003), not to be confused with his

original nine-block model.

With the help of the refined Kraljic Purchasing Portfolio Matrix, professional purchasers can

differentiate between the various supplier relations and choose strategies that are appropriate for

each category and thereby effectively manage suppliers (Nellore and Sderquist, 2000).

Supply Risk

Profit Impact

Assure supply

Form partnerships Exploit purchasing power

Ensure Efficient processing

Non-Critical

Leverage Strategic

Bottleneck

Low High

L

o

w

H

i

g

h

Supply Risk

Profit Impact

Assure supply

Form partnerships Exploit purchasing power

Ensure Efficient processing

Non-Critical

Leverage Strategic

Bottleneck

Low High

L

o

w

H

i

g

h

Figure 2.2: The Kraljic Purchasing Portfolio Matrix (modified from Kraljic, 1983, p. 111)

9

Gelderman (2003), has discussed and evaluated Kraljic approach on: dimensions; categories; and

strategic recommendations. This is described in the following sections.

2.2.1.1. Dimensions

a. Theoretical foundations of the Kraljic Purchasing Portfolio Matrix

A generally accepted view on the purchasing function is that it should prevent disruptions in

production of other activities. Some authors describe the general objectives of purchasing and

supply management in terms of the five rights which professional purchasing should achieve in

the acquisition of materials: the right quality, from the right supplier, in the right quantity, at the

right time, and at the right place (Dobler and Burt, 1996). The right supply, the right time and the

right place refer to logistics aspects of supply management. Products should be bought for the right

price, which refers to the commercial and financial aspects of purchasing. An attractive feature of

the portfolio approach is that it encompasses two key variables with respect to these crucial aspects:

profit impact is linked to the commercial requirements, supply risk is related to logistics issues,

amongst others. However, it is not clear why only these particular dimensions are selected for use in

Kraljics portfolio approach. Gelderman (2003) concluded that Kraljics article does not provide

any reference to a theoretical foundation or comprehensive perspective. In his article Kraljic offers

a basic tool for purchasing management, although it is without any reference to literature or

documented evidence. The tool is developed for practical use. The combination of the two

dimensions is to minimize supply vulnerability and make the most of potential buying power

(Kraljic, 1983: 112).

b. Measurement issues

In general, decisions based on portfolio models are proven to be sensitive to the choice of

dimensions, factors and weights. There is a demarcation problem with respect to the measurement

of key variables. What is the exact distinction between high and low supply risk. Ellram and

Olson (1997) emphasized that the weighting of each factor is the most important of the

implementation process, but at the same time very subjective. De Boer (1997) suggested a fully

customized approach: organizations should determine their own criteria as well as their own

specific threshold values. Nellore and Sderquist (2000) pointed out that there is a risk that the

variables used in portfolio analysis might not be accurate proxies for the dimensions they are

suppose to measure.

10

c. Confusion with the first matrix dimensions

According to Gelderman (2003) many authors refer to the Kraljic approach as being a single

portfolio matrix, based on the dimensions strategic importance (or just importance) and

complexity of the supply market, see for instance Kamann (2000), Ellram and Olson (1997), and

Lilliecreutz and Ydreskog (1999). Kraljic himself is partly responsible for this confusion over the

names of the dimensions Gelderman (2003). Before introducing the portfolio approach, Kraljic

(1983: 111) presented a figure in as Exhibit 1 (see Appendix 1) that uses importance of

purchasing and complexity of supply market as dimensions. However, this figure is not part of

the portfolio approach, it does not classify product categories, nor does it provide strategic recom-

mendations. The name of the picture clarifies the purpose of the matrix; the stages of purchasing

sophistication.

2.2.1.2. Categories

a. The focus on one category

Kraljic is concerned about disastrous supply disruptions of vital materials. From this perspective it

is logical that Kraljic should focus on strategic items with a high profit impact and a high supply

risk. The second matrix, presented by Kraljic as Exhibit IV (see Appendix 2), only applies to

strategic items. For the other categories a list is provided merely of main tasks, the required

information and the advised decision level. The conclusion is that these categories are disregarded.

An elaboration for strategies for bottleneck, leverage and non-critical items was offered by Van

Weele in 1992.

b. The role of power and dependence

The fundamental assumption of portfolio models seems to be that differences in power and

dependence between buyer and supplier exist (Canils and Gelderman, 2005). However, Kraljics

approach does not explicitly deal with issues of power and dependence. Some of the strategic

recommendations obviously refer to prevailing power structure (exploitation of power), others do

not. In Kraljics first matrix it is not clear in what way profit impact and supply risk are related

to the relative power position of the buying company. Presumably, the buyer is more powerful than

the supplier in the case of leverage items, while the opposite might be true for bottleneck items. In

the second matrix, for the strategic item categories, the role of power is more clearly defined; a

buyer-supplier relationship can be balanced, buyer-dominated or supplier-dominated. The Kraljic

11

approach deals in a rather implicit way with issues of power and dependence. The application

implies dealing with two matrices without being clear about the role of power and dependence.

2.2.1.3. Strategic Recommendations

(a) The Suppliers side

The Kraljic approach does not explicitly take into account the possible strategies and reactions of

suppliers (Kamann, 2000). Nellore and Sderquist (2000) confirmed that it is imperative for any

portfolio used to indicate the characteristics of the supplier with regard to the specification

generation, the required relationship and required type of specification for a given component.

Unquestionably, the suppliers side should be included in any strategic thinking in the field of

purchasing and supply management. Different solutions have been proposed for this issue, although

it should be said that the Kraljic approach does not imply the neglect on the suppliers side. The

impression might be nourished by Kraljics focus on supply vulnerability, threats of material

scarcity and the situation on supply markets (Kraljic, 1983:109). Lilliecreutz and Ydreskog (1999)

proposed an additional evaluation of suppliers according to three dimensions: performance

assessment, relation characteristics and network position.

The most appropriate approach to adopt with each supplier can be determined by combining the

assessment of the suppliers view with the own purchasing Kraljic matrix. For example, a product

could be termed a strategic or bottleneck item from a purchasing perspective, but the account

categorized by the supplier as nuisance or exploitable; any aggressive or confrontational behaviour

could result in the supplier withdrawing from the situation, leaving the buying company with a

serious problem. Alternatively, should a product be strategic in the Kraljic matrix and also be core

for the supplier, there will be possibilities in forming close relationships and a partnership.

(b) Influencing the power balance: dynamics in the matrix

Lilliecreutz and Ydreskog (1999) stated: strategies that are based solely on Kraljics matrix lack

the dynamics of the power that the suppliers can obtain. They too stressed the importance of taking

the suppliers situation into account. Kempeners and van Weele (1997) pointed at the natural

conflict of interests in buyer-supplier relationships. Both are likely to prefer a dominant power

position due to the attached benefits. As a result, positions in the Kraljic matrix will always be

amendable to the dynamics of buyer-seller relationships. Parties are inclined to seek possibilities for

influencing their relatively powerful position.

12

(c) The nature of strategic recommendations

Gelderman (2003) argued that the strategic recommendations in the Kraljic matrix are quite reactive

in nature. They react and adapt to the prevailing structure of power in buyer-supplier relationships.

It is not clear if and how other positions in the matrix are to be pursued through the implementation

of the recommended main tasks. However, Kraljics Exhibit IV Purchasing Portfolio Matrix

for strategic items is especially designed to develop counter-strategies vis--vis key suppliers

(Kraljic, 1983). By plotting the buying strengths against the strengths of the supply market, three

basic power positions are identified and associated with three different suppliers strategies:

balance, exploit and diversify. It should be noted, however, that the strategies are rather generic by

nature, providing only rough indications for the most appropriate suppliers strategies. Discussing

Kraljic, most publications are limited to his figure with stages of purchasing sophistication shown in

his article as Exhibit I in Appendix 1 with the well-known categories: strategic, leverage, non-

critical and bottleneck. It might be assumed that all strategic products are to be managed by means

of (strategic) partnership. Looking at Kraljics Purchasing Portfolio Matrix for strategic items in

Appendix 2, we must conclude that this was certainly not Kraljics intention.

Section 2.2.2. The Kraljic Matrix with its Strategic Directions

A recent study by Gelderman and Van Weele (2003) paid attention to the experience of purchasing

professionals with the use of the portfolio matrix in practice. On the basis of three in-depth case

studies they found that practitioners distinguish between several separate purchasing strategies

within each portfolio quadrant. Some of these strategies focused on keeping the current position in

the quadrant, while other strategies were directed towards moving to another position. The case

studies revealed that, in addition to Kraljic's theory, experienced practitioners were very aware of

the different choices within each quadrant.

Based on the interviews and the overview of selected strategies, it was concluded that for each

category two different kinds of strategic directions could be distinguished:

1. actions to hold the same positions in the matrix, and

2. actions to pursue other positions in the matrix.

Holding on to a position implicitly means that current circumstances are taken for granted.

Gelderman and Van Weele (2003) observed that a position in the matrix could be accepted for

different reasons, sometimes positive, sometimes referring to a negative choice. A position might be

preferred because a firm is convinced that it is the best position for a certain item. In other cases a

13

position might be accepted, because there are no realistic possibilities for change. The first type of

strategy is of a more active, radical nature. When possible and desirable, other positions in the

matrix are identified and pursued. Figure 2.3 gives an overview of strategic directions for all

categories. If we take a look at the bottleneck and strategic quadrant at the right side of the matrix,

those movements that reduce the supply risk are pursued. In terms of the matrix, this means moving

to the left. Non-critical items are moved upwards; leverage items could be exchanged for strategic

positions.

1

2

3

4

5

6

8

7

9

Maintain strategic partnership

Accept the locked-in partnership

Terminate partnership, find new supplier

Develop a strategic partnership

Exploit buying power

(partner of convenience)

Individual ordering, pursue

Efficient processing

Pooling of requirements

Reduce dependence and risk,

Find other solutions

Accept the dependence, reduce

the negative consequences

Suppl y Ri sk

Low High

L

o

w

H

i

g

h

Pr of i t

Impact

St r at egi c

Bot t l eneck Non-cr i t i cal

Lever age

1

2

3

4

5

6

8

7

9

Maintain strategic partnership

Accept the locked-in partnership

Terminate partnership, find new supplier

Develop a strategic partnership

Exploit buying power

(partner of convenience)

Individual ordering, pursue

Efficient processing

Pooling of requirements

Reduce dependence and risk,

Find other solutions

Accept the dependence, reduce

the negative consequences

Suppl y Ri sk

Low High

L

o

w

H

i

g

h

Pr of i t

Impact

St r at egi c

Bot t l eneck Non-cr i t i cal

Lever age

Fig. 2.3. The Kraljic Purchasing Portfolio Matrix with Strategic Directions for all categories

he strategic positions and directions as illustrated in figure 1 can, according to Gelderman and van

Source: Gelderman and Van Weele (2003)

T

Weele (2003), be elaborated as follows:

14

Bottleneck items

(1) Moving to another position: decomplex the product, find a new supplier

Bottleneck items are by definition of low value and high risk. It should be interesting enough,

especially from an economic point of view, to search for other solutions. The solutions must lead to

a lower level of supply risk and a lower level of dependency on a supplier. This means shift towards

the non-critical quadrant.

(2) Holding the position: accept the dependency on a supplier, assurance of supply

If no other options are feasible, the position remains the same.

Non-critical items

(3) Moving to another position: pooling of requirements

Preferably, non-critical items are put together in large quantities, increasing the buying power of the

firm. If necessary, a process of standardization is pursued. The strategic direction is in all cases

towards the leverage quadrant, resulting in lower direct and indirect purchasing costs.

(4) Holding the position: individual ordering efficient processing

Whenever it is not possible to combine the purchasing requirements, the only remaining option is

some type of individual ordering. The purchasing strategy is aimed at reducing the administrative

costs which are connected to administrative activities.

Leverage items

(5) Holding position: exploit buying power, maintain a partnership of convenience

This generally preferred leverage position can be used for a rather aggressive supplier management.

Competitive bidding and short-term contracts are feasible options to exploit the leverage position.

(6) Moving to another position: develop a strategic partnership

Exceptionally, the leverage position is abandoned in search for a more strategic partnership with a

supplier. A cooperative strategy is only pursued, if the supplier involved is willing and capable of

contributing to the competitive advantage of the firm. Such a role is only feasible for

technologically advanced suppliers.

15

Strategic items

(7) Holding the position: maintain a strategic partnership

Long-term relationships with key suppliers should always contribute to the competitive advantage

of the firm. Such relationships include mutual trust, mutual commitment, and an open exchange of

information. A successful partnership can be very valuable for both parties.

(8) Holding the position: accept a locked-in partnership

A position in the strategic quadrant may be due to not chosen, unfavorable conditions (e.g. patents,

monopoly, high switching costs). These circumstances produce an involuntary stay at the strategic

quadrant.

(9) Moving to another position: terminate a partnership, find a new supplier

A suppliers performance may become unacceptable and incorrigible. The firm will have to search,

develop and contract another supplier, while bringing the relationship with the non-performing

supplier to an end.

Section 2.3. Criticisms and Support of the Kraljic Matrix

In contrast to the growing acceptance and usage, purchasing portfolio models have become the

target of severe criticism (Gelderman and Van Weele 2005). Some argue that the complexity of

business decisions does not allow for just simple recommendations. Kraljic (1983) made a

reasonable case for the usefulness of the portfolio approach by describing the experiences of four

large industrial companies.

Section 2.3.1. Support of the Kraljic Matrix

Some case studies indicted that a purchasing portfolio model is a powerful tool for:

Coordinating the sourcing patterns of fairly autonomous strategic business units within

companies, resulting in leverage and synergy (Gelderman and Van Weele 2002).

Differentiating the overall purchasing strategy, with different strategies for different supplier

groups (Lilliecreutz and Ydreskog 1999)

16

Discussing, visualizing and illustrating the possibilities of the development of differentiated

purchasing strategies (Gelderman and Van Weele 2002)

Some other case studies indicated that:

Portfolio approaches can be used to improve the allocation of scarce resources (Olsen and

Ellram 1997)

A portfolio model provides a framework to understand and to focus a companys supply

strategy (Evans and Hadeler 1994)

A portfolio approach can make the difference between an unfocussed, ineffective purchasing

organization and a focused, effective one (Evans and Hadeler 1994), especially for those

companies that have never thought systematically about their procurement expenditure (Cox

1997)

The utilization of this purchasing methodology may lift the purchasing activity out of the

tactical, firefighting mode into a strategic role (Elliot-Shircore and Steele 1985)

It convinces top management of the effective role that purchasing can play in contributing to a

companys profit and success (Carter 1997)

Section 2.3.2. Criticism of the Kraljic Matrix

Purchasing portfolio models have been severely criticized too and there are doubts and questions

with respect to the following measurement issues:

The selection of variables: How could one know whether the most appropriate variables are

being used? (Nellore and Sderquist 2000)

The suppliers side: Why is the suppliers side disregarded in most portfolio models?

(Homburg 1995, Kamann 2000)

The operationalization of dimensions: What is exactly meant by profit impact and supply

risk? (Ramsay 1996)

The measurement of variables: How should the weighting of factors take place? (Olsen and

Ellram 1997)

The line of demarcation: What is the exact difference between high and low supply risk?

(Homburg 1995)

The simplicity of recommendations: How could one deduce strategies from an analysis that is

based on just two dimensions? (Dubois and Pedersen 2002)

17

Other criticisms relate to more fundamental issues and objections:

Portfolio models have a tendency to result in strategies that are independent of each other (Coat,

1983)

Portfolio models do not depict the interdependencies between two or more items in the matrix

(Olsen and Ellram 1997)

From a difference perspective, Cox (1997) condemned the portfolio methodology, because it

does not provide any proactive thinking about what can be done to change the existing reality in

the various supply chains in which companies are involved.

Gelderman and van Weele (2003) reported that experienced users have found a reply to the critique

of portfolio models, stressing that there is no simple, standardized blueprint for the application of

portfolio models. It requires critical thinking and sophistication of the purchasing function.

A more recent study by Gelderman and Van Weele (2005) attempted to provide new insights into

the relationship between purchasing sophistication (or maturity) and the usage of purchasing

portfolio models. Purchasing sophistication can be viewed as a key characteristic of the purchasing

function. The sophistication level of the function determines the extent to which the purchasing

function will be included in strategic management decision process (Pearson and Gritzmacher

1990). In the study of Gelderman and Van Weele (2005), purchasing sophistication is defined as the

level of professionalism of the purchasing function. Gelderman and Van Weele (2005) used the

following characteristics for the development of a purchasing sophistication construct:

Based on a survey of purchasing professionals by Gelderman and Van Weele (2005), the study

provides evidence that purchasing portfolio usage is associated with purchasing sophistication.

Users contrast in a positive way with nonusers of the portfolio, especially on their professionalism

(skills) and their position within their companies. The results of the study imply that top managers

discovering that portfolio management methods have not been endorsed by their purchasing

organizations should question the relative sophistication of the purchasing function. These

companies are probably lagging behind both in terms of professionalism and position of the

purchasing organization in the overall company hierarchy. The application of purchasing portfolio

management seems to have prerequisites both in terms of professionalism that needs to be present

and the exposure, i.e., locus that the purchasing domain has within the overall company

organization. The application of purchasing portfolio techniques requires skills extending beyond

18

traditional administrative competences. In addition, the purchasing function needs to have a clear

presence and position within the organizational hierarchy.

Section 2.4. Remoteness

In this study remoteness is limited to geographically distant suppliers where the buyer is located in

a developing country with an environment of poor or undeveloped logistics infrastructure (Caddick

and Dale, 1987 and Fawcett, 2000).

According to Fawcett (2000), it is simply more difficult and more costly to develop close,

productive relationships with geographically distant suppliers. Logistics problems have been

identified as the biggest obstacle in international sourcing. However, neither the purchasing nor the

logistics literature contains much information on logistics considerations in global sourcing.

As stated by Das and Handfield (1997), overseas transactions affect lead times and lead times

variability and carry increase risks of supply interruptions. Other common problems in international

sourcing include buyer-supplier time-zone lags, costs of obtaining post purchase supplier services

and rectifying errors in quality, part count, billing, etc. Add to that the basic difficulty in forming a

meaningful relationship with a supplier separated by oceans, customs, cultures and language.

The challenges many less developed countries (LDCs) currently face in developing their logistics

systems are legacies of the past (Razzaque, 1997). These are fundamental problems inherited not

only from their embryonic trappings but also from lack of understanding of logistics role and

importance. Furthermore, Razzaque stated that a rich and expanding literature on logistics systems

and management in advanced nations is available, in contrast to which the literature on those in

developing nations is only emerging. A survey of 532 publications on logistics management in

major Western journals for the period J anuary 1971 to J une 1995 revealed less than 20

contributions on developing nations.

According to Das and Handfield (1997), a number of studies have examined logistics in various

countries and regions. Studies examining distribution systems in industrialized nations are most

prevalent. Caddick and Dale (1987), Waters and Soman (1989) and Cook (1989) concentrate on

19

developing regions and remote areas. These studies provide useful information on a range of issues

pertaining to international logistics.

In many countries, e.g. developing or formerly state-regulated ones, the logistics infrastructure is

bad, customs and regulations unclear and inefficient, the logistics supply market underdeveloped

and the crime risks are high (Andersson and Norrman, 2002). All this makes the supply risk high, as

the number of trustworthy or capable partners is low and the few existing ones enjoy a better

negotiating position.

Goonatilake (1990) provides useful insights into inventory management practices in developing

countries and contrasts them with those in developed countries. In developing countries inventory

control is lax and bureaucratic with little pressure to meet delivery dates and inventory costs;

infrastructure is poor; many of supply sources are overseas; and there is a shortage of trained

personnel. Thus inventories are used to buffer poor infrastructure and greater uncertainty.

If a country does not have a good base network of dependable transportation, warehousing,

communication and other related facilities, desired configuration of the network by the firm will be

difficult. Literature reveals that many LDCs lack an environment conducive to the development of a

good logistics system Das and Handfield (1997).

According to Razzaque (1997), it is clear that problems of logistics systems and barriers to logistics

development are unique to each country. The provision of links between productivity facilities and

consuming units, which is the fundamental role of logistics, is affected by differences in various

country specific factors such as geographical features, socio-economic and politico-legal systems,

cultural realities, industrial development and resources endowments.

As stated by Svensson (2000), disturbance in the supply chain may be mainly categorized as either

quantitative or qualitative. The causes of quantitative disturbances are events that create a lack of

components and materials for downstream activities in the supply chain, for example: breakdowns

or delays in transportation (i.e. by road or sea) caused by unexpected conditions, bad weather.

Causes of qualitative disturbance are events that lead to deficiencies in components and materials in

the supply chain, for example measurement errors in components, non-functioning articles. Due to

emerging situations suddenly affecting the supply chain, short-term disturbances appear often in the

context of quantitative and qualitative disturbances.

20

To conclude, this section has given the characteristics of remote environments in the supply chain.

These characteristics will be used in the next chapter in connection with the Kraljic matrix. The first

research question Which characteristics of remoteness should be considered when adapting the

Kraljic model for use in remote areas? has therefore been answered.

Section 2.5. Summary

In this chapter the most common purchasing portfolio models are identified and one of the most

commonly used models, the Kraljic Matrix, is discussed in detail. The strategic directions as set by

Kraljic (1983), as well as other strategies recently published by Gelderman and van Weele (2003)

are also outlined. Some criticism and support on the Kraljic matrix are discussed. Studies by

Gelderman et al (2005) provide evidence that purchasing portfolio usage is associated with

purchasing sophistication. Further detailed analysis is given on the characteristics of remoteness and

especially the logistics problems associated with the remote areas as well as the impact remote areas

have on the supply risk. Remote conditions, as defined in section 2.4, have an impact on the supply

risk. Lead times are affected and due to the logistics constraints there is an increase risk of supply

interruptions. Because of the impact on the supply risk some of the purchasing strategies shall have

to be focused on reducing the risk or look for alternative sources of supply. The information

gathered from the literature, especially the information for remote areas, offers a framework for the

adaptation of the Kraljic matrix to these areas. The next chapter proposes specific adaptations to the

Kraljic matrix to remoteness.

21

CHAPTER 3. THE KRALJIC MATRIX ADAPTED TO REMOTENESS

In this study the characteristics to consider when studying the purchasing function in remote

locations are limited to geographically distant suppliers where the buyer is located in a developing

country with an environment of poor or undeveloped logistics infrastructure.

Purchasing portfolio models, including Kraljics, have been developed from a point of view of a

well-developed industrialized logistics infrastructure. However, for companies situated in remote

areas, as formulated in section 2.4, the supply risk is particularly influenced by the logistics

infrastructure. Kraljic also considers the logistics aspects in his matrix, which is included in the

supply risk dimension, but the impact of logistics in the supply risk was considered minor, a logical

consequence of the fact that his research was done in areas with an industrialized logistics

infrastructure. In the following sections the impact of remoteness on the dimensions and factors, the

categories as well as the impact on strategic recommendations will be discussed.

Section 3.1. Adaptations to the Dimensions

According to Nellore and Sderquist (2000), the rationale behind dimensions is experience-based.

The dimensions as used in the Kraljic 1983 matrix are the profit impact and the supply risk. Poor

logistics infrastructure will negatively influence lead times and therefore will increase the supply

risk. It is clear, therefore, that an undeveloped logistics infrastructure should play a significant part

in the Kraljic approach. However, the Kraljic approach does not explicitly deal with issues of

logistics and infrastructure. The logistics covered by Kraljic does not deal with an undeveloped

logistics infrastructure; it deals with normal practices with respect to the logistics infrastructure.

However, in an undeveloped logistics infrastructure the supply risk is particularly influenced by

remoteness factors. To have a clear view on the influence of the respective factors to the dimensions

of the Kraljic matrix, two tables were generated with respectively factors used by Kraljic and

factors that, according to the findings of the author, are specifically focused on remote

environments.

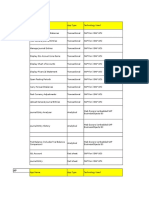

In table 3.1 the factors assigned by Kraljic to the two dimensions are listed. These factors are the

same used in Kraljics (1983) article.

22

Dimensions Factors

Profit Impact

Linked to commercial requirements

The profit impact of a specific items can be defined

by the following factors:

- Volume purchased and expected growth in demand

- Percentage of total purchase cost

- Impact on product quality

- Business growth

Supply Risk

Linked to logistics issues

The supply risk of a specific items can be defined

by the following factors:

- Market Conditions (Availability/scarcity)

- Number of suppliers

- Competitive demand

- Make-or-buy opportunities

- Storage risks

- Substitution possibilities

Table: 3.1. Factors determining the dimensions of the Purchasing Portfolio Matrix, according to Kraljic (1983)

Based on the literature research and findings in section 2.4, the author thought it might make sense

to make a match between the factors originally assigned by Kraljic (1983) and those applicable for

remote environments.

Dimensions Factors Source

Profit Impact

Linked to commercial requirements

The profit impact of a specific items can be defined

by the following factors:

- Volume purchased and expected growth in demand

- Percentage of total purchase cost

- Impact on product quality

- Business growth

Supply Risk

Linked to logistics issues

The supply risk of a specific items can be defined

by the following factors:

Kraljic

- Market Conditions (Availability/scarcity)

- Number of suppliers

- Competitive demand

- Make-or-buy opportunities

- Storage risks

- Substitution possibilities

- On Time delivery (lead times)

Das and Handfield, 1997

- Cultural differences

Das and Handfield, 1997

- Lack of Logistical knowledge

Razzaque, 1997

Factors influencing the - Supply interruptions (strikes, hurricanes, etc)

Svensson, 2000

Supply Risk in Remote - Duty and Custom Regulations

Andersson and Norm, 2002

Environments - Shortage of qualified personnel

Goonatilake, 1990

- Complicated import procedures

Andersson and Norm, 2002

- Payment conditions

Svensson, 2000

- Logistical related facilities (harbor, roads,

warehouses, communications, etc)

Das and Handfield, 1997

Table 3.2. Factors determining the dimensions of the Purchasing Portfolio Matrix, for Remote Environments

Adapted by the author from Kraljic (1983)

23

In table 3.2 above the combined list with factors assigned originally by Kraljic and those applicable

for remote environments is found. Although this combined list is not a comprehensive one, it might

be noticed that there are quite a number of factors under remote conditions that influence the

supply risk. These factors will definitely increase this supply risk for remote areas. Profit impact

in this respect is practically the same in remote areas and areas with well-developed logistics,

because the factors defining this dimension depend only on the business and economies of scale in

which the company operates. With respect to this dimension, no others factors are found for

specifically remote areas.

The answer to the second research question, Which adaptations to the dimensions of the Kraljic

matrix are required, when using the Kraljic approach under conditions of remote suppliers and an

undeveloped logistics infrastructure? can be summarized as follows: profit impact is less depen-

dent on the location of the business and, therefore, does not have to be adapted for remote locations,

while for supply risk there are more defining factors than Kraljics considers, as illustrated in table

3.2. These additional factors do have an impact on the supply risk dimension as will be demon-

strated in chapter 6.

Section 3.2. Adaptations to the Categories

The four item categories used by Kraljic are strategic, leverage, bottleneck and non-critical. Other

authors such as Van Weele (1992), and Ellram and Olson (1997) who introduced similar models,

use the same categories. As stated previously, Kraljic (1983) focused in his second matrix, see

Appendix 2, on the strategic items, which are characterized by a high profit impact and a high

supply risk. For the other categories a list was provided merely of main tasks, the required

information and the advised decision level. Non-critical and leverage items, at the left side of the

matrix, are the ones most influenced by the increased supply risk due to the remote conditions and,

therefore, some of the leverage and some of the non-critical items will automatically shift to the

right half of the Kraljic matrix and become respectively strategic and bottleneck items for buyers

that have to deal with poor logistics.

To answer the third research question, Which adaptations to the categories of the Kraljic matrix

are required when using the Kraljic approach under conditions of remote suppliers and an

undeveloped logistics infrastructure?, it must be concluded that no new categories to be

24

formulated for remote conditions, but merely a shift will need take place for some items from the

non-critical and leverage categories to respectively the bottleneck and strategic categories.

Section 3.3. Impact on the strategic recommendations

Kraljics (1983) strategy recommendations were primarily meant for strategic items. A recent study

by Gelderman and van Weele (2003), however, based on three in-depth case studies found that

practitioners distinguish between several separate purchasing strategies for each portfolio quadrant.

Some of these strategies focused on keeping the current position in the quadrant, while other

strategies were directed towards moving to another position. The case studies revealed that,

additionally to Kraljic's theory, experienced practitioners were very aware of the different choices

within each quadrant. The strategies as outlined in section 2.2.2 are also applicable for remote areas,

but as the supply risk in a remote environment is mainly influenced by the logistics, the company

must therefore put more efforts in strategies that improve the logistics framework of the supplies.

These strategies are to decrease the supply risk and will be useful for bottleneck and strategic items.

As a result of the literature study it might be concluded that for remote areas primarily the logistics

environment between buyer and supplier influences the strategies for buyer-supplier relationships.

Due to the increased supply risk for remote areas, which is especially associated to the logistics

problems, this paper recommends the following two additional strategies for specifically bottleneck

and strategic items for inclusion in Gelderman and van Weeles adaptation to Kraljics Purchasing

Portfolio Matrix, see fig 3.1 (illustrated as strategy 10 & 11):

- Use of remote purchasing agents; Depending on the purchasing volume a strategy to consider is

the use of a purchasing agent as intermediate between the remote supplier and buyer. As the

purchasing agent will be responsible to supply a major part of buyers materials and supplies he

will be forced to manage the flow of material from suppliers warehouses up to the suppliers

export harbor or even up to buyers import harbor. As a purchasing agent he will also be

responsible to monitor the processing time of the orders and will be able to secure payments to

the supplier, packers, forwarders and third party logistics

1

, which will lead to a fast release of

materials and therefore decrease the supply risk.

1

According to Knemeyer et al (2004), Third Party Logistics is the relationship between a shipper and a third party.

25

- Integrated logistics management system between buyer and supplier; A sophisticated integrated

logistic management system at buyer and supplier or purchasing agent facility will give real-

time information on material flow. Buyer can therefore take pro-active actions whenever any

deviation on processing time might occur.

It is clear that besides these two strategies, the strategies as elaborated by Gelderman and Van

Weele (2003) can also be used for such a remote environment. Likewise the strategies for a remote

environment can also be used in an environment with a well-developed logistics infrastructure.

However, the improvement of the supply risk will be much smaller than in a remote environment.

1

2

3

4

5

6

8

7

9

Maintain strategic partnership

Accept the locked-in partnership

T erminate partnership, find new supplier

Develop a strategic partnership

E xploit buying power

(partner of convenience)

Individual ordering, pursue

E fficient processing

P ooling of requirements

R educe dependence and risk,

F ind other solutions

Accept the dependence, reduce

the negative consequences

Su p p l y Ri s k

Low

High

L

o

w

H

i

g

h

Pr o f i t

Im p ac t

St r at eg i c

B o t t l en ec k No n -c r i t i c al

L ev er ag e

10 & 11

Use remote purchasing agent

Use logistics management system

1

2

3

4

5

6

8

7

9

Maintain strategic partnership

Accept the locked-in partnership

T erminate partnership, find new supplier

Develop a strategic partnership

E xploit buying power

(partner of convenience)

Individual ordering, pursue

E fficient processing

P ooling of requirements

R educe dependence and risk,

F ind other solutions

Accept the dependence, reduce

the negative consequences

Su p p l y Ri s k

Low

High

L

o

w

H

i

g

h

Pr o f i t

Im p ac t

St r at eg i c

B o t t l en ec k No n -c r i t i c al

L ev er ag e

10 & 11

Use remote purchasing agent

Use logistics management system

Fig 3.1. The Kraljic Purchasing Portfolio Matrix with Strategic Directions for all Categories, adapted for Remoteness

Adapted from: Gelderman and Van Weele (2003)

It is suggested to call this matrix the Kraljic Remote Environment Matrix.

The identification of two additional strategies, namely the Use of remote purchasing agents, and

implementing an Integrated logistics management system between buyer and supplier, give the

26

answer to the forth research question: Which adaptations to the strategic recommendations of the

Kraljic matrix are required when using the Kraljic approach under conditions of remote suppliers

and an undeveloped logistics infrastructure?

Section 3.4. Summary

In the present chapter the influence of remote conditions on the Kraljic purchasing portfolio matrix

is outlined. Profit impact depends mainly on the scale on which the company operates, and

therefore a remote area has no major impact on this dimension. Because of the complicated logistics

involved for remote areas, supply risk for these areas is defined by more factors than Kraljic

considered, compared to environments with well-developed logistics infrastructures, and therefore

these remote areas are facing an increased supply risk. Remoteness has no impact on the existing

four categories of the matrix, but with respect to the strategy recommendations for the category of

strategic items, two strategies, focusing on improved logistics, have been added to the matrix. In the

next chapter the methodology to fill in the matrix and define the strategic recommendations is

discussed.

27

CHAPTER 4. PORTFOLIO ANALYSIS WITH THE KRALJIC MATRIX

Section 4.1. Methodology

In order to systematically fill in the matrix and to identify the strategic recommendations for a

particular firm or industry, a five-step approach as outlined by Gelderman (2003) will be used. This