Академический Документы

Профессиональный Документы

Культура Документы

Business Environment Assignment

Загружено:

VishrutmadАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Environment Assignment

Загружено:

VishrutmadАвторское право:

Доступные форматы

policy rate Monetary policy is the process by which monetary authority of a country, generally a central bank controls the

supply of money in the economy by exercising its control over interest rates in order to maintain price stability and achieve high economic growth.[1] In India, the central monetary authority is the eserve !ank of India " !I#. is so designed as to maintain the price stability in the economy. monetary tool used for controlling innflation, determining day to day li$uidity operations, and for determining other market rates. deposit rate the interest rate that banking institutions pay to depositors or account holders. bank rate !ank rate, also referred to as the discount rate in %merican &nglish,[1] is the rate of interest which a central bank charges on the loans and advances to a commercial bank. 'henever a bank has a shortage of funds, they can typically borrow from the central bank based on the monetary policy of the country repo rate the repo rate is the rate at which the central bank lends short(term money to the banks against securities. % reduction in the repo rate will help banks to get money at a cheaper rate. 'hen the repo rate increases, borrowing from the central bank becomes more expensive. It is more applicable when there is a li$uidity crunch in the market. reserve repo rate )he reverse repo rate is the rate at which banks can park surplus funds with reserve bank, while the repo rate is the rate at which the banks borrow from the central bank. It is mostly done when there is surplus li$uidity in the market. reserve ratios )he reserve re$uirement "or cash reserve ratio# is a central bank regulation employed by most, but not all, of the world*s central banks, that sets the minimum fraction of customer deposits and notes that each commercial bank must hold as reserves "rather than lend out#. )hese re$uired reserves are normally in the form of cash stored physically in a bank vault "vault cash# or deposits made with a central bank. )he re$uired reserve ratio is sometimes used as a tool in monetary policy, influencing the country*s borrowing and interest rates by changing the amount of funds available for banks to make loans with.[1] 'estern central banks rarely alter the reserve re$uirements because it would cause immediate li$uidity problems for banks with low excess reserves+ they generally prefer to use open market operations "buying and selling government(issued bonds# to implement their monetary policy.

slr ,tatutory li$uidity ratio refers amount that the commercial banks re$uire to maintain in the form of gold or govt. approved securities before providing credit to the customers. -ere by approved securities we mean, bond and shares of different companies. ,tatutory .i$uidity atio is determined and maintained by the eserve !ank of India in order to control the expansion of bank credit. It is determined as percentage of total demand and time liabilities. )ime .iabilities refer to the liabilities, which the commercial banks are liable to pay to the customers after a certain period mutually agreed upon and demand liabilities are such deposits of the customers which are payable on demand. example of time liability is a fixed deposits for / months, which is not payable on demand but after six months. example of demand liability is deposit maintained in saving account or current account, which are payable on demand through a withdrawal form of a che$ue. ,. is used by bankers and indicates the minimum percentage of deposits that the bank has to maintain in form of gold,cash or other approved securities.)hus, we can say that it is ratio of cash and some other approved liabilities"deposits#. It regulates the credit growth in India crr ,tatutory li$uidity ratio refers amount that the commercial banks re$uire to maintain in the form of gold or govt. approved securities before providing credit to the customers. -ere by approved securities we mean, bond and shares of different companies. ,tatutory .i$uidity atio is determined and maintained by the eserve !ank of India in order to control the expansion of bank credit. It is determined as percentage of total demand and time liabilities. )ime .iabilities refer to the liabilities, which the commercial banks are liable to pay to the customers after a certain period mutually agreed upon and demand liabilities are such deposits of the customers which are payable on demand. example of time liability is a fixed deposits for / months, which is not payable on demand but after six months. example of demand liability is deposit maintained in saving account or current account, which are payable on demand through a withdrawal form of a che$ue. ,. is used by bankers and indicates the minimum percentage of deposits that the bank has to maintain in form of gold,cash or other approved securities.)hus, we can say that it is ratio of cash and some other approved liabilities"deposits#. It regulates the credit growth in India 'hat is everse epo rate0

everse epo rate is the rate at which the !I borrows money from commercial banks. !anks are always happy to lend money to the !I since their money are in safe hands with a good interest. %n increase in reverse repo rate can prompt banks to park more funds with the !I to earn higher returns on idle cash. It is also a tool which can be used by the !I to drain excess money out of the banking system. 'hat is a epo ate0

)he rate at which the !I lends money to commercial banks is called repo rate. It is an

instrument of monetary policy. 'henever banks have any shortage of funds they can borrow from the !I. % reduction in the repo rate helps banks get money at a cheaper rate and vice versa. )he repo rate in India is similar to the discount rate in the 1,. marginal standing facility rate Marginal ,tanding 2acility "M,2# is a new scheme announced by the eserve !ank of India " !I# in its Monetary 3olicy "4511(14# and refers to the penal rate at which banks can borrow money from the central bank over and above what is available to them through the .%2 window.

M,2, being a penal rate, is always fixed above the repo rate. )he M,2 would be the last resort for banks once they exhaust all borrowing options including the li$uidity ad6ustment facility by pledging through government securities, which has lower rate of interest in comparison with the M,2. )he M,2 would be a penal rate for banks and the banks can borrow funds by pledging government securities within the limits of the statutory li$uidity ratio. )he scheme has been introduced by !I with the main aim of reducing volatility in the overnight lending rates in the inter(bank market and to enable smooth monetary transmission in the financial system. reference rate % reference rate is a rate that determines pay(offs in a financial contract and that is outside the control of the parties to the contract. It is often some form of .I!7 rate, but it can take many forms, such as a consumer price index, a house price index or an unemployment rate. 3arties to the contract choose a reference rate that neither party has power to manipulate. exchange rate In finance, an exchange rate "also known as a foreign(exchange rate, forex rate, 28 rate or %gio# between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country9s currency in terms of another currency.[1] 2or example, an interbank exchange rate of :1 ;apanese yen ";3<, =# to the 1nited ,tates dollar "1,># means that =:1 will be exchanged for each 1,>1 or that 1,>1 will be exchanged for each =:1. &xchange rates are determined in the foreign exchange market,[4] which is open to a wide range of different types of buyers and sellers where currency trading is continuous? 4@ hours a day except weekends, i.e. trading from 45?1A BM) on ,unday until 44?55 BM) 2riday. )he spot exchange rate refers to the current exchange rate. )he forward exchange rate refers to an exchange rate that is $uoted and traded today but for delivery and payment on a specific future date. Cefinition of *Ceposit Interest ate*

)he interest rate paid by financial institutions to deposit account holders. Ceposit accounts include certificates of deposit, savings accounts and self(directed deposit retirement accounts.

Ceposit

ate Meaning?

In deposit terminology, a term Ceposit ate refers to the amount of money paid out in interest by a bank or financial institution on cash deposits. !anks pay deposit rates on savings and other investment accounts. base rate base rate generally refers to the "base# class probabilities unconditioned on featural evidence, fre$uently also known as prior probabilities. In plainer words, if it were the case that 1D of the public were Emedical professionalsE, and ::D of the public were not Emedical professionalsE, then the base rate of medical professionals is simply 1D. In science, particularly medicine, the base rate is critical for comparison. It may at first seem impressive that 1555 people beat their winter cold while using *)reatment 8*, until we look at the entire *)reatment 8* population and find that the base rate of success is actually only 1F155 "i.e. 155 555 people tried the treatment, but the other :: 555 people never really beat their winter cold#. )he treatment*s effectiveness is clearer when such base rate information "i.e. E1555 people... out of how many0E# is available. Gote that controls may likewise offer further information for comparison+ maybe the control groups, who were using no treatment at all, had their own base rate success of AF155. Hontrols thus indicate that *)reatment 8* actually makes things worse, despite that initial proud claim about 1555 people. )he normative method for integrating base rates "prior probabilities# and featural evidence "likelihoods# is given by !ayes rule.I

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PDFДокумент2 страницыPDFSunil RameshОценок пока нет

- FAR.3015 Cash and Cash EquivalentsДокумент3 страницыFAR.3015 Cash and Cash EquivalentsJoana Tatac100% (1)

- CPIO contact details for SBI Hyderabad regionДокумент252 страницыCPIO contact details for SBI Hyderabad regionVishal YadavОценок пока нет

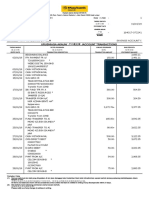

- 164017-073241 20190331 PDFДокумент5 страниц164017-073241 20190331 PDFjalaluddinОценок пока нет

- Factors Influencing Adoption of Internet Banking in KenyaДокумент102 страницыFactors Influencing Adoption of Internet Banking in KenyaLivingstone Alex M. Ong'wen100% (4)

- Spouses Moran sue Citytrust for check dishonor damagesДокумент2 страницыSpouses Moran sue Citytrust for check dishonor damagesHurjae Soriano LubagОценок пока нет

- FrontДокумент6 страницFrontVishrutmadОценок пока нет

- Prostitution in India and Its Role in The Spread of HIV InfectionДокумент7 страницProstitution in India and Its Role in The Spread of HIV InfectionVishrutmadОценок пока нет

- Learn About Computer RAM and Its ImportanceДокумент1 страницаLearn About Computer RAM and Its ImportanceVishrutmadОценок пока нет

- Thanking You Nehal DabasДокумент3 страницыThanking You Nehal DabasVishrutmadОценок пока нет

- Learn About Computer RAM and Its ImportanceДокумент1 страницаLearn About Computer RAM and Its ImportanceVishrutmadОценок пока нет

- Time Value of Money: Aman KhediaДокумент7 страницTime Value of Money: Aman KhediaSairam KhondОценок пока нет

- Engineering Economy (Board Exam Problems) : University of Science and Technology of Southern PhilippinesДокумент5 страницEngineering Economy (Board Exam Problems) : University of Science and Technology of Southern PhilippinesVea ValcorzaОценок пока нет

- Rosoft Office PowerPoint PresentationДокумент13 страницRosoft Office PowerPoint PresentationNancy VermaОценок пока нет

- IDBI ECS debit mandate formДокумент4 страницыIDBI ECS debit mandate formlotusnotesjct9497Оценок пока нет

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsДокумент3 страницыTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartОценок пока нет

- Share Market ScamДокумент14 страницShare Market ScamPramod DasadeОценок пока нет

- Banking Regulation ActДокумент18 страницBanking Regulation ActHomiga BalasubramanianОценок пока нет

- Casino Opening and Closing Procedures 2017Документ4 страницыCasino Opening and Closing Procedures 2017Angela BrownОценок пока нет

- Fees Structure International School 2011-12Документ5 страницFees Structure International School 2011-12Ashish PanchalОценок пока нет

- Credit ApprisalДокумент74 страницыCredit Apprisalpiupush100% (1)

- Fpayh Fpayhx FpaypДокумент448 страницFpayh Fpayhx FpaypSundarKrishnaОценок пока нет

- E Banking of Sonali BankДокумент37 страницE Banking of Sonali Bankmd shadab zaman RahatОценок пока нет

- HANDOUT01 - Cash and Cash EquivalentДокумент4 страницыHANDOUT01 - Cash and Cash EquivalentDymphna Ann CalumpianoОценок пока нет

- BPRD Circular No. 15 June 21, 1998: All Banks, Dear SirsДокумент40 страницBPRD Circular No. 15 June 21, 1998: All Banks, Dear SirsKyo 666Оценок пока нет

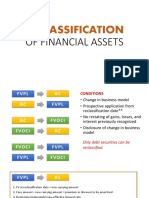

- Reclassification: of Financial AssetsДокумент15 страницReclassification: of Financial AssetsHazel Jane EsclamadaОценок пока нет

- Invoice 120289103981Документ1 страницаInvoice 120289103981Nuhu Ibrahim MaigariОценок пока нет

- A General Management Project On A Study On The Banking Sector With Special Reference To Basel Norms and Its Impact in IndiaДокумент34 страницыA General Management Project On A Study On The Banking Sector With Special Reference To Basel Norms and Its Impact in IndiaAnil kadamОценок пока нет

- Your Cable Network:: Tax InvoiceДокумент1 страницаYour Cable Network:: Tax InvoiceBabu JuluriОценок пока нет

- Research Project On ATM SystemДокумент8 страницResearch Project On ATM Systemgenuinespot100% (1)

- Punjab National Bank - Wikipedia, The Free EncyclopediaДокумент8 страницPunjab National Bank - Wikipedia, The Free EncyclopediaPurushotam SharmaОценок пока нет

- Repo and Reverse RepoДокумент17 страницRepo and Reverse RepoD>RОценок пока нет

- Derivative KitДокумент253 страницыDerivative KitSathish BettegowdaОценок пока нет

- XYZ Company Statement of Cash Flows AnalysisДокумент2 страницыXYZ Company Statement of Cash Flows AnalysisJasmine ActaОценок пока нет

- Cosmos Co-Operative BankДокумент17 страницCosmos Co-Operative Banknitinbn3Оценок пока нет