Академический Документы

Профессиональный Документы

Культура Документы

Interest Rate Case

Загружено:

AshutoshИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Interest Rate Case

Загружено:

AshutoshАвторское право:

Доступные форматы

Read the following report on Indian economy and answer the questions at the end.

[This is only intended to be a specimen]

Indian bonds signal July interest rate rise is on the cards

July 13 (Reuters) - Investors in Indian federal bonds are pricing in a quarter percentage point increase in the short-term interest rate this month, concerned surging domestic demand and costlier oil may boost inflation, analysts said !he yield curve has steepened in the past t"o "ee#s, "ith the spread bet"een the one-year and 1$-year bond "idening to 1%% basis points from 11$, indicating long-term inflationary e&pectations are building in the economy !he '($$-billion economy, )sia*s third largest, is e&pected to maintain gro"th of ( percent in the current fiscal year that ends in +arch ,$$-, having averaged ( ( percent in the past t"o years ./iven the underlying momentum of demand in the economy is strong, it is probable that a rise in oil prices "ill be passed on in product and services prices to a significant e&tent,. said 0an1eet 0ingh, economist at I2I2I 0ecurities .In such an environment, policy ma#ers "ould be biased to"ard raising interest rates to contain inflationary e&pectations . 3vidence pointing to increased inflationary pressures seems to be stac#ing up International oil prices hit a fresh record above '-, a barrel last "ee# and India*s industrial output gro"th is running at its fastest pace in nine years 3arly concerns that the June-0eptember monsoon "ould be "ea# -- prompting analysts in June to say the central ban# "ould not raise rates at its July ,- revie" -- have been "iped a"ay on gro"ing signs the rainy season "ill, in fact, be normal ) normal monsoon "ould underpin rural incomes and cement economic gro"th e&pectations 4il prices have gained more than 1$ percent since the central ban# last raised the shortterm rate ,5 basis points to 5 $ percent in )pril -- a move that "as also aimed at containing oil-fired inflation !he rate, #no"n as the reverse repo rate, is used to price short-term loans !he ban# rate, used to price longer-term loans, has been at - $ percent since )pril ,$$3 )nalysts say policy ma#ers are li#ely to "ait to see ho" the monsoon "or#s out before considering a rise in that rate in 4ctober India*s 1-year treasury bill is yielding 5 6$ percent "hile the 1$-year bond has been returning around ( ,% percent this "ee#, the highest in , months INF !TI"N #R$$% 7uel comprises 1% , percent of the "holesale price inde& (89I), India*s most closely "atched inflation gauge, so this is li#ely to be a significant factor in central ban# deliberations !he central ban# estimates every dollar increase in crude, the country*s biggest import, pushes the 89I up 3$ basis points !he "holesale inflation rate is currently around % percent, do"n from 5 percent in )pril, but analysts say the fall "ill prove temporary .)s the base effects recede and domestic demand pressures intensify, inflation is li#ely to creep bac# up to nearer - percent to"ards the end of financial year ,$$5:$-,. 0tandard 2hartered ;an# said in a research report this "ee#

It e&pects inflation to average 5 percent to 5 5 percent in the financial year to the end of ne&t +arch .8e maintain our vie" that the tightening cycle in India is not over yet,. the ban# said &TR"N' (!T!) TI'*T$R I+,I(IT+ay*s industrial output rose a si<<ling 1$ 6 percent from a year earlier, pic#ing up sharply from )pril*s gro"th Industrial output accounts for a quarter of India*s gross domestic product and the data tallies "ith a surge in demand for ban# loans, "hich "ere about 3$ percent higher in June than a year earlier, as companies invest in capacity to meet demand !he pace of activity is li#ely to continue if the monsoon is normal this year =ealthy crops "ould boost rural incomes and demand, a #ey factor in economic gro"th since nearly t"o thirds of India*s one billion population live on the land )nalysts say the central ban# has also reined in high liquidity, possibly to manage inflation, by refraining from rupee intervention and allo"ing the currency to be nearly 1$ percent overvalued on a trade-"eighted basis, "hich is unusual but "hich helps curb oil-led inflation >eutsche ;an# said in a report this "ee# gro"th in the central ban#*s net foreign e&change assets, the foreign currencies it holds and built through intervention, has no" slo"ed to 6 3 percent year-on-year from 1- percent in early +ay, as the central ban# has stayed a"ay from intervening )nalysts say "hile a drop of nearly 3$$-billion rupees ('- ? billion) of e&cess funds in the ban#ing system since early +ay is a sign of tighter conditions, the central ban#*s ne&t step "ould be raising domestic rates to rein in inflation e&pectations

a)

What are the monetary policy instruments that are referred to in this report? Explain how they may be used to tackle the economic problem faced by the country as evident in the report. What has been the policy of RBI re ardin exchan e rates durin the period under review? What is the apparent reason for that course of action? Examine the link between inflation! interest rates! bond prices and yield with reference to the context iven in the report. Explain what is expected happen to the rate of rowth of dp and why.

b)

c) d)

Вам также может понравиться

- Case Study of SG Cowen New RecruitsДокумент4 страницыCase Study of SG Cowen New RecruitsAshutosh100% (12)

- Sonoco Case Study Question and AnswersДокумент5 страницSonoco Case Study Question and AnswersAshutosh80% (5)

- CV Newest Updated PDFДокумент2 страницыCV Newest Updated PDFAshutoshОценок пока нет

- CRISIL Research Cust Bulletin May13Документ24 страницыCRISIL Research Cust Bulletin May13Prashant KarpeОценок пока нет

- SIP VIP PPT 14-15 SalesДокумент19 страницSIP VIP PPT 14-15 SalesAshutoshОценок пока нет

- Internet Retailing in IndiaДокумент9 страницInternet Retailing in IndiaAshutoshОценок пока нет

- Building World-Class Automotive Supply Chains in IndiaДокумент22 страницыBuilding World-Class Automotive Supply Chains in IndiaSrinivasa KirankumarОценок пока нет

- Predictive Buying of AmazonДокумент4 страницыPredictive Buying of AmazonAshutoshОценок пока нет

- Theories of Interest RateДокумент10 страницTheories of Interest RateAshutoshОценок пока нет

- Strategic Management Lessons From Indian MythologyДокумент4 страницыStrategic Management Lessons From Indian MythologyAshutoshОценок пока нет

- Ram Mohan T T (ET) (03!03!2011) Pranab Deserves 9 On 10Документ2 страницыRam Mohan T T (ET) (03!03!2011) Pranab Deserves 9 On 10AshutoshОценок пока нет

- Database - Data Warehouse - Data Mining Competing On AnalyticsДокумент33 страницыDatabase - Data Warehouse - Data Mining Competing On AnalyticsrehanroxОценок пока нет

- Predictive AnalyticsДокумент14 страницPredictive AnalyticsAshutoshОценок пока нет

- Markov Analysis DetailsДокумент6 страницMarkov Analysis DetailsAshutoshОценок пока нет

- SDM by Vikas BaggaДокумент17 страницSDM by Vikas BaggaAshutoshОценок пока нет

- HR QuestionnairesДокумент4 страницыHR QuestionnairesAshutoshОценок пока нет

- Markov Analysis DiagramsДокумент7 страницMarkov Analysis DiagramsAshutoshОценок пока нет

- HR PlanningДокумент30 страницHR PlanningAshutoshОценок пока нет

- Using Targeted Analytics To Improve Talent Decisions.Документ11 страницUsing Targeted Analytics To Improve Talent Decisions.AshutoshОценок пока нет

- Creating A Business-Focused HR Function With Analytics and Integrated Talent ManagementДокумент7 страницCreating A Business-Focused HR Function With Analytics and Integrated Talent ManagementAshutoshОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Current Five Year PlanДокумент13 страницCurrent Five Year PlanDherandr SuneelОценок пока нет

- International Monetary System PDFДокумент27 страницInternational Monetary System PDFSuntheng KhieuОценок пока нет

- 17 Engineering EconomicsДокумент7 страниц17 Engineering EconomicsM Hadianto WaruwuОценок пока нет

- VAT PayableSetupДокумент15 страницVAT PayableSetupHyder Abbas100% (1)

- F 843Документ1 страницаF 843Manjula.bsОценок пока нет

- Market Equilibrium and The Determination of PricesДокумент35 страницMarket Equilibrium and The Determination of PricesNiña Alyanna Babasa Marte100% (1)

- BLADES Chuong 4Документ2 страницыBLADES Chuong 4Mỹ Trâm Trương ThịОценок пока нет

- ActionAid Factsheet - Special Drawing Rights The Global Reserve SystemДокумент7 страницActionAid Factsheet - Special Drawing Rights The Global Reserve SystemShani MughalОценок пока нет

- Key Question AnswersДокумент32 страницыKey Question AnswersChikalanga BakaaОценок пока нет

- Resume of Srpeak4Документ2 страницыResume of Srpeak4api-25647173Оценок пока нет

- 12 Pol Science Ncert CH 9Документ5 страниц12 Pol Science Ncert CH 9Mohit AntilОценок пока нет

- Lgu Budgeting ProcessДокумент3 страницыLgu Budgeting ProcessArthur MericoОценок пока нет

- Agamata Answer KeyДокумент5 страницAgamata Answer KeyBromanineОценок пока нет

- Pros and Cons of Different Exchange Rate SystemsДокумент4 страницыPros and Cons of Different Exchange Rate Systemsdanishia09Оценок пока нет

- Moghbel Final ReportДокумент3 страницыMoghbel Final ReportSulagna22Оценок пока нет

- Practice Multiple Choice QuestionsДокумент5 страницPractice Multiple Choice QuestionsAshford ThomОценок пока нет

- Account Symphony TheatreДокумент1 821 страницаAccount Symphony Theatresuryagc0% (1)

- CAGE China vs. IndiaДокумент2 страницыCAGE China vs. IndiaVinny TuschkaОценок пока нет

- 2006 RMO 18-2006 LOA CriteriaДокумент3 страницы2006 RMO 18-2006 LOA Criteriaedong the greatОценок пока нет

- Fi FL FX SystemsДокумент7 страницFi FL FX SystemsAnonymous btU0rk0pNОценок пока нет

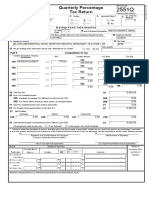

- Quarterly Percentage Tax Return: 12 - DecemberДокумент1 страницаQuarterly Percentage Tax Return: 12 - DecemberralphalonzoОценок пока нет

- Together LA Industrial Tax Exemption Study 6 2016Документ79 страницTogether LA Industrial Tax Exemption Study 6 2016Katherine SayreОценок пока нет

- History of GattДокумент38 страницHistory of GattAdil100% (3)

- Aggregate Supply PowerPoint PresentationДокумент24 страницыAggregate Supply PowerPoint PresentationRatna VadraОценок пока нет

- Regionalism in Canada: The Forgotten DiversityДокумент37 страницRegionalism in Canada: The Forgotten DiversityHồ Tấn100% (1)

- New 5Документ5 страницNew 5nikosОценок пока нет

- Day To Day EconomicsДокумент12 страницDay To Day EconomicsPrateek SinglaОценок пока нет

- Contemporary WorldДокумент2 страницыContemporary Worldeys shopОценок пока нет

- RR 15-2010 Additional Notes To Financial StatementsДокумент9 страницRR 15-2010 Additional Notes To Financial StatementsMary Grace Caguioa AgasОценок пока нет

- June 2010 6EC02 QPДокумент32 страницыJune 2010 6EC02 QPMiri RoseОценок пока нет