Академический Документы

Профессиональный Документы

Культура Документы

Philippine Deposit Insurance Corporation Case 2

Загружено:

Dave Lumasag CanumhayАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Philippine Deposit Insurance Corporation Case 2

Загружено:

Dave Lumasag CanumhayАвторское право:

Доступные форматы

PHILIPPINE DEPOSIT INSURANCE CORPORATION vs. CITIBANK, N.A. and BANK OF AMERICA, S.T. & N.A.

FACTS: PDIC conducted an examination of the books of account of Citibank and Bank of America, and discovered that, received from its head office and other foreign branches substantial amounts in dollars, covered by Certificates of Dollar Time Deposit that were interest-bearing with corresponding maturity dates which were not reported to PDIC as deposit liabilities that were subject to assessment for insurance. Citibank and BA each filed a petition for declaratory relief before the Court of First Instance (now the Regional Trial Court) seeking judgment stating that the money placements they received from their head office and other foreign branches were not deposits and did not give rise to insurable deposit liabilities under Sections 3 and 4 of R.A. No. 3591 (the PDIC Charter). The Regional Trial Court promulgated its decision in favor of Citibank and BA, ruling that the subject money placements were not deposits and did not give rise to insurable deposit liabilities, and that the deficiency assessments issued by PDIC were improper and erroneous. Therefore, Citibank and BA were not liable to pay the same. The RTC reasoned out that the money placements subject of the petitions were not assessable for insurance purposes under the PDIC Charter because said placements were deposits made outside of the Philippines and, under Section 3.05(b) of the PDIC Rules and Regulations, such deposits are excluded from the computation of deposit liabilities. The CA affirmed the decision of the RTC and found that the money placements were received as part of the banks internal dealings by Citibank and BA as agents of their respective head offices. This showed that the head office and the Philippine branch were considered as the same entity. Thus, no bank deposit could have arisen from the transactions between the Philippine branch and the head office because there did not exist two separate contracting parties to act as depositor and depositary. ISSUE: Whether or not the money placements subject matter of these petitions are assessable for insurance purposes under the PDIC Act. RULING: No, the funds in question are not deposits within the definition of the PDIC Charter and are, thus, excluded from assessment. Since the head office of a foreign bank and its branches are considered as one legal entity, the funds placed in the Philippine branch belong to one and the same bank. A bank cannot have a deposit with itself. As explained by the respondents, the transfer of funds, which resulted from the interbranch transactions, took place in the books of account of the respective branches in their head office located in the United States. Hence, because it is payable outside of the Philippines, it is not considered a deposit pursuant to Section 3(f) of the PDIC Charter:

Sec. 3(f) The term "deposit" means the unpaid balance of money or its equivalent received by a bank in the usual course of business and for which it has given or is obliged to give credit to a commercial, checking, savings, time or thrift account or which is evidenced by its certificate of deposit, and trust funds held by such bank whether retained or deposited in any department of said bank or deposit in another bank, together with such other obligations of a bank as the Board of Directors shall find and shall prescribe by regulations to be deposit liabilities of the Bank; Provided, that any obligation of a bank which is payable at the office of the bank located outside of the Philippines shall not be a deposit for any of the purposes of this Act or included as part of the total deposits or of the insured deposits ; Provided further, that any insured bank which is incorporated under the laws of the Philippines may elect to include for insurance its deposit obligation payable only at such branch.

Вам также может понравиться

- Madison Dismissal From City of MadisonДокумент5 страницMadison Dismissal From City of MadisonWAFF 48 NewsОценок пока нет

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkДокумент7 страницFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 Dockets100% (1)

- Fax Cover Sheet: E: SF-181 Race & Ethnicity FormДокумент2 страницыFax Cover Sheet: E: SF-181 Race & Ethnicity FormRick AlexanderОценок пока нет

- Articles of Incorporation and By-Laws - Microfinance NgoДокумент15 страницArticles of Incorporation and By-Laws - Microfinance NgoRen SamsonaОценок пока нет

- Barber Letter To Secretary of StateДокумент199 страницBarber Letter To Secretary of StateDylan SmithОценок пока нет

- CBV Collections Notice of Demand To Cease and Desist To All CreditorsДокумент3 страницыCBV Collections Notice of Demand To Cease and Desist To All CreditorskrystalmarienymannОценок пока нет

- Alliance For Jobs and The EconomyДокумент13 страницAlliance For Jobs and The EconomyJohn ArchibaldОценок пока нет

- Savpdp 0065Документ2 страницыSavpdp 0065LaLa BanksОценок пока нет

- William Jones ExampleДокумент19 страницWilliam Jones Exampleapi-320205434Оценок пока нет

- Personal WillДокумент4 страницыPersonal WillDavid NowakowskiОценок пока нет

- Common Sense Thomas Paine February 14, 1776Документ25 страницCommon Sense Thomas Paine February 14, 1776KregenerОценок пока нет

- 1957 Georgia Memorial To Congress Declared 14th Amendment Un-ConstitutionalДокумент3 страницы1957 Georgia Memorial To Congress Declared 14th Amendment Un-ConstitutionalTom Lacovara-Stewart RTR TruthMediaОценок пока нет

- Study Material For This LectureДокумент12 страницStudy Material For This Lectureosaie100% (1)

- Feebs Sec 1Документ18 страницFeebs Sec 1benismaelrepublicОценок пока нет

- Supreme Court Opinion, Case SummaryДокумент17 страницSupreme Court Opinion, Case Summarysavannahnow.comОценок пока нет

- Florida Notice of HomesteadДокумент2 страницыFlorida Notice of HomesteadWendy RulnickОценок пока нет

- Letter of Last Instruction ArticleДокумент9 страницLetter of Last Instruction ArticleKenneth Vercammen, Esq.Оценок пока нет

- Letter of Credit - Process: Step 1 - Issuance of LCДокумент8 страницLetter of Credit - Process: Step 1 - Issuance of LCRuchitha PrakashОценок пока нет

- Ma vs. Fernandez, G.R. No. 183133, July 26, 2010Документ18 страницMa vs. Fernandez, G.R. No. 183133, July 26, 2010AttyStickmanОценок пока нет

- Assignment Towards Fulfilment of Assessment in The Subject of Banking and FinanceДокумент4 страницыAssignment Towards Fulfilment of Assessment in The Subject of Banking and FinanceshalwОценок пока нет

- Requirements of A Legally Binding ContractДокумент10 страницRequirements of A Legally Binding ContractClitonTayОценок пока нет

- UN Conference On The Law of Treaties 1968-1969 - 2nd SessionДокумент379 страницUN Conference On The Law of Treaties 1968-1969 - 2nd SessionDaniel Silva QueirogaОценок пока нет

- Practising Certificate 2018Документ48 страницPractising Certificate 2018xidaОценок пока нет

- State Request For Statements of InterestДокумент3 страницыState Request For Statements of InterestThe Republican/MassLive.comОценок пока нет

- Affidavit of Successor: (One Box MUST Be Checked or The Form Will Be Rejected)Документ2 страницыAffidavit of Successor: (One Box MUST Be Checked or The Form Will Be Rejected)johnbbb111Оценок пока нет

- Form.31A - Amendment To Trust AgreementДокумент3 страницыForm.31A - Amendment To Trust AgreementBrian LitОценок пока нет

- PublicLaw97 280Документ1 страницаPublicLaw97 280Ambassador: Basadar: Qadar-Shar™, D.D. (h.c.) aka Kevin Carlton George™100% (1)

- Blakely Amended Motion For Bond Pending SentencingДокумент2 страницыBlakely Amended Motion For Bond Pending SentencingFOX54 News HuntsvilleОценок пока нет

- Thornton Master File RedactedДокумент39 страницThornton Master File Redactedthe kingfishОценок пока нет

- The Path To Freedom and End of Slavery in The United States 5Документ5 страницThe Path To Freedom and End of Slavery in The United States 5api-643967604Оценок пока нет

- Purchaser Eligibility Certification: Federal Deposit Insurance CorporationДокумент4 страницыPurchaser Eligibility Certification: Federal Deposit Insurance CorporationOneNationОценок пока нет

- 1874 OFFICE of The Governor May 6, 2020 PDFДокумент2 страницы1874 OFFICE of The Governor May 6, 2020 PDFempress_jawhara_hilal_elОценок пока нет

- Learn The Risk 2021 Statement of InformationДокумент2 страницыLearn The Risk 2021 Statement of InformationAndrew LiebichОценок пока нет

- BorrowerSignature PDFДокумент2 страницыBorrowerSignature PDFComeBackОценок пока нет

- Who Is MinorДокумент6 страницWho Is Minorabhijeet sinhaОценок пока нет

- 424 25 Excerpt Bumpus Exper Rept., Def, PMSJ, Sept. 30, 2019Документ7 страниц424 25 Excerpt Bumpus Exper Rept., Def, PMSJ, Sept. 30, 2019Jordyn Schneider100% (1)

- Affidavit of Mark MillerДокумент83 страницыAffidavit of Mark MillerCOASTОценок пока нет

- 13th AmendmentДокумент10 страниц13th AmendmentSumruhan GünerОценок пока нет

- Converted by PDF SuiteДокумент23 страницыConverted by PDF SuiteMartha100% (2)

- Eliot v. Freeman, 220 U.S. 178 (1910)Документ4 страницыEliot v. Freeman, 220 U.S. 178 (1910)Scribd Government DocsОценок пока нет

- Certificate Origin Template MerchandiseДокумент2 страницыCertificate Origin Template MerchandiseMaria MuñozОценок пока нет

- Statutory Declaration FormДокумент2 страницыStatutory Declaration FormRomil BadamiОценок пока нет

- Extinguish MentДокумент120 страницExtinguish MentConnieAllanaMacapagaoОценок пока нет

- Chapter 4 - Co-Ownership, Estates and TrustsДокумент8 страницChapter 4 - Co-Ownership, Estates and TrustsLiRose SmithОценок пока нет

- Portfolio Value Annual Fee: All Inclusive Fee ScheduleДокумент1 страницаPortfolio Value Annual Fee: All Inclusive Fee SchedulethenjhomebuyerОценок пока нет

- Insolvency Act 1936Документ96 страницInsolvency Act 1936Man WomanОценок пока нет

- Trustee's Complaint Against Denny Hecker's Girlfriend, Christi RowanДокумент10 страницTrustee's Complaint Against Denny Hecker's Girlfriend, Christi RowannathanmhansenОценок пока нет

- Banking LawsДокумент31 страницаBanking LawsJanMarkMontedeRamosWongОценок пока нет

- Revocation of Power of AttorneyДокумент1 страницаRevocation of Power of AttorneyDeness Caoili-MarceloОценок пока нет

- William T. Conklin v. United States, 36 F.3d 1105, 10th Cir. (1994)Документ3 страницыWilliam T. Conklin v. United States, 36 F.3d 1105, 10th Cir. (1994)Scribd Government DocsОценок пока нет

- USDC - DKT 25 - Errata - Filed by Calif Supreme CT in Support of Motion To DismissДокумент3 страницыUSDC - DKT 25 - Errata - Filed by Calif Supreme CT in Support of Motion To DismissHonor in JusticeОценок пока нет

- United States Court of Appeals, Fourth CircuitДокумент8 страницUnited States Court of Appeals, Fourth CircuitScribd Government DocsОценок пока нет

- Application For Employer Identification Number: All Caps Same As SSNДокумент2 страницыApplication For Employer Identification Number: All Caps Same As SSNMarcosLbivОценок пока нет

- Deed Declaration On Forest Land (FR, WR & OSR)Документ1 страницаDeed Declaration On Forest Land (FR, WR & OSR)Bernard YapОценок пока нет

- Mason Summary JudgmentДокумент24 страницыMason Summary JudgmentEriq Gardner100% (1)

- Last WillДокумент18 страницLast WillJohn Shannon Rodriguez100% (1)

- In the Matter of the Estate of Dorothy D. Buckley, Deceased. Appeal of Ethel Paiewonsky, a and the Roman Catholic Church, Prelature of the Virgin Islands, Inc., a Purported Beneficiary, 536 F.2d 580, 3rd Cir. (1976)Документ5 страницIn the Matter of the Estate of Dorothy D. Buckley, Deceased. Appeal of Ethel Paiewonsky, a and the Roman Catholic Church, Prelature of the Virgin Islands, Inc., a Purported Beneficiary, 536 F.2d 580, 3rd Cir. (1976)Scribd Government DocsОценок пока нет

- Motion Enlargement of Time To Respond To ComplaintДокумент2 страницыMotion Enlargement of Time To Respond To Complaintrodech01Оценок пока нет

- Letter of Rogatory 05-12-23Документ6 страницLetter of Rogatory 05-12-23BINGE TV EXCLUSIVEОценок пока нет

- Constitution of the State of Minnesota — 1876 VersionОт EverandConstitution of the State of Minnesota — 1876 VersionОценок пока нет

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Документ2 страницыBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayОценок пока нет

- 2013 Bar Q&A in Political LawДокумент9 страниц2013 Bar Q&A in Political LawDave Lumasag CanumhayОценок пока нет

- Simex CaseДокумент1 страницаSimex CaseDave Lumasag CanumhayОценок пока нет

- Westmont Bank CaseДокумент2 страницыWestmont Bank CaseDave Lumasag CanumhayОценок пока нет

- The Consolidated Bank CaseДокумент1 страницаThe Consolidated Bank CaseDave Lumasag CanumhayОценок пока нет

- Karen Salvacion CaseДокумент2 страницыKaren Salvacion CaseDave Lumasag CanumhayОценок пока нет

- Bank of The Philippines Island and Grace Romero CaseДокумент1 страницаBank of The Philippines Island and Grace Romero CaseDave Lumasag CanumhayОценок пока нет

- Philippine Deposit Insurance Corporation Case - 8Документ1 страницаPhilippine Deposit Insurance Corporation Case - 8Dave Lumasag CanumhayОценок пока нет

- Philippine Deposit Insurance Corporation CaseДокумент1 страницаPhilippine Deposit Insurance Corporation CaseDave Lumasag CanumhayОценок пока нет

- Carmen LL Intengan CaseДокумент1 страницаCarmen LL Intengan CaseDave Lumasag CanumhayОценок пока нет

- Government Service Insurance System CaseДокумент2 страницыGovernment Service Insurance System CaseDave Lumasag CanumhayОценок пока нет

- Regional Trial Court: Petitioner, ForДокумент5 страницRegional Trial Court: Petitioner, ForDave Lumasag CanumhayОценок пока нет

- Bpi Employees Union CaseДокумент2 страницыBpi Employees Union CaseDave Lumasag CanumhayОценок пока нет

- Teofisto Guingona CaseДокумент2 страницыTeofisto Guingona CaseDave Lumasag CanumhayОценок пока нет

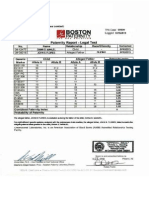

- Sample DNA Paternity Report (Exclusive)Документ1 страницаSample DNA Paternity Report (Exclusive)Dave Lumasag CanumhayОценок пока нет

- Bank of The Philippine Islands - Casa CaseДокумент1 страницаBank of The Philippine Islands - Casa CaseDave Lumasag CanumhayОценок пока нет

- Joseph Ejercito CaseДокумент2 страницыJoseph Ejercito CaseDave Lumasag CanumhayОценок пока нет

- Affidavit of LossДокумент2 страницыAffidavit of LossDave Lumasag CanumhayОценок пока нет

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Документ2 страницыBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayОценок пока нет

- Bpi Employees Union CaseДокумент2 страницыBpi Employees Union CaseDave Lumasag CanumhayОценок пока нет

- Sample Departure-AdmittanceДокумент1 страницаSample Departure-AdmittanceDave Lumasag CanumhayОценок пока нет

- Sample Boarding PassesДокумент1 страницаSample Boarding PassesDave Lumasag CanumhayОценок пока нет

- Answer With CounterclaimДокумент5 страницAnswer With CounterclaimDave Lumasag CanumhayОценок пока нет

- Luis G. Peralta CaseДокумент1 страницаLuis G. Peralta CaseDave Lumasag CanumhayОценок пока нет

- Regional Trial Court: Petitioner, ForДокумент5 страницRegional Trial Court: Petitioner, ForDave Lumasag CanumhayОценок пока нет

- Regional Trial Court: Petitioner, ForДокумент5 страницRegional Trial Court: Petitioner, ForDave Lumasag CanumhayОценок пока нет

- Pre Trial Brief - RespondentДокумент4 страницыPre Trial Brief - RespondentDave Lumasag CanumhayОценок пока нет

- Answer With CounterclaimДокумент5 страницAnswer With CounterclaimDave Lumasag CanumhayОценок пока нет

- Resignation LetterДокумент1 страницаResignation LetterDave Lumasag CanumhayОценок пока нет

- RMC No. 23-2007-Government Payments WithholdingДокумент7 страницRMC No. 23-2007-Government Payments WithholdingWizardche_13Оценок пока нет

- Floating PonttonДокумент9 страницFloating PonttonToniОценок пока нет

- WILDLIFEДокумент35 страницWILDLIFEnayab gulОценок пока нет

- Ag Advace Check 8-30Документ1 страницаAg Advace Check 8-30AceОценок пока нет

- Pr1 m4 Identifying The Inquiry and Stating The ProblemДокумент61 страницаPr1 m4 Identifying The Inquiry and Stating The ProblemaachecheutautautaОценок пока нет

- The Confederation or Fraternity of Initiates (1941)Документ82 страницыThe Confederation or Fraternity of Initiates (1941)Clymer777100% (1)

- Team 12 Moot CourtДокумент19 страницTeam 12 Moot CourtShailesh PandeyОценок пока нет

- PMP Chapter-12 P. Procurement ManagementДокумент30 страницPMP Chapter-12 P. Procurement Managementashkar299Оценок пока нет

- Why Should I Hire You - Interview QuestionsДокумент12 страницWhy Should I Hire You - Interview QuestionsMadhu Mahesh Raj100% (1)

- Coaching Manual RTC 8Документ1 страницаCoaching Manual RTC 8You fitОценок пока нет

- Lozada Vs MendozaДокумент4 страницыLozada Vs MendozaHarold EstacioОценок пока нет

- Tiananmen1989(六四事件)Документ55 страницTiananmen1989(六四事件)qianzhonghua100% (3)

- DIN EN 12516-2: January 2015Документ103 страницыDIN EN 12516-2: January 2015ReytingОценок пока нет

- The Behaviour and Ecology of The Zebrafish, Danio RerioДокумент22 страницыThe Behaviour and Ecology of The Zebrafish, Danio RerioNayara Santina VieiraОценок пока нет

- British Council IELTS Online Application SummaryДокумент3 страницыBritish Council IELTS Online Application Summarys_asadeОценок пока нет

- 3RD Last RPHДокумент5 страниц3RD Last RPHAdil Mohamad KadriОценок пока нет

- NURS 366 Exam 1 Study Guide and RubricДокумент7 страницNURS 366 Exam 1 Study Guide and RubriccmpОценок пока нет

- Discuss The Following Questions With Your Family Members Casually and Write The AnswersДокумент2 страницыDiscuss The Following Questions With Your Family Members Casually and Write The AnswersVincent Stephen AmalrajОценок пока нет

- Manual de Utilizare ProSpray 3.20 Airless SpraypackДокумент88 страницManual de Utilizare ProSpray 3.20 Airless Spraypackjohnny angeles ñiquenОценок пока нет

- ISCOM5508-GP (A) Configuration Guide (Rel - 02)Документ323 страницыISCOM5508-GP (A) Configuration Guide (Rel - 02)J SofariОценок пока нет

- Manuel Vs AlfecheДокумент2 страницыManuel Vs AlfecheGrace0% (1)

- Assignment 1: Microeconomics - Group 10Документ13 страницAssignment 1: Microeconomics - Group 10Hải LêОценок пока нет

- A Win-Win Water Management Approach in The PhilippinesДокумент29 страницA Win-Win Water Management Approach in The PhilippinesgbalizaОценок пока нет

- Reflexive PronounsДокумент2 страницыReflexive Pronounsquely8343% (7)

- Money Habits - Saddleback ChurchДокумент80 страницMoney Habits - Saddleback ChurchAndriamihaja MichelОценок пока нет

- AN6001-G16 Optical Line Terminal Equipment Product Overview Version AДокумент74 страницыAN6001-G16 Optical Line Terminal Equipment Product Overview Version AAdriano CostaОценок пока нет

- ACA 122-My Academic Plan (MAP) Assignment: InstructionsДокумент5 страницACA 122-My Academic Plan (MAP) Assignment: Instructionsapi-557842510Оценок пока нет

- Characteristics of Pop CultureДокумент3 страницыCharacteristics of Pop Culturekhimamad02Оценок пока нет

- Justice at Salem Reexamining The Witch Trials!!!!Документ140 страницJustice at Salem Reexamining The Witch Trials!!!!miarym1980Оценок пока нет

- How To Format Your Business ProposalДокумент2 страницыHow To Format Your Business Proposalwilly sergeОценок пока нет