Академический Документы

Профессиональный Документы

Культура Документы

Incomplete Record - Question

Загружено:

Chandran PachapanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Incomplete Record - Question

Загружено:

Chandran PachapanАвторское право:

Доступные форматы

[INTRODUCTION TO FINANCIAL ACCOUNTING] INCOMPLETE ACCOUNTS

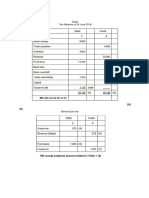

Question 1 Beckham owns a small store and does not keep a full set of accounts. The following information has been obtained in respect of the year ended 31 December 20x4. Summary of Bank Account: RM 4,820 Sundry expenses 94,608 Trade payables Insurance Rent Equipment Drawings Balance c/d 99,428 RM 1,560 76,040 2,640 5,200 4,000 7,200 2,788 99,428

Balance b/d Receipts from trade receivables

Beckham made cash sales totaling RM13,336 and used this to pay the following: RM Wages and salaries 12,427 Sundry expenses 106 Cash purchases 803 He took for his own use RM260 worth of goods purchases during the year. A discount of RM87 had been allowed to Beckham for prompt payment of a trade payables account. The following information is also available: 1 January 20x4 RM 8,400 400 7,362 5,928 420 8,428 31 December 20x4 RM 9,920 9,900 6,836 480 11,280

Equipment Rent accrued Trade receivables Trade payables Insurance prepaid Inventory

Beckham has indicated that RM120, included in the insurance payment during the year, for his personal insurance. Required: Prepare the Income Statement for Beckham for the year ended 31 December 20x4 and the Statement of Financial Position for the same date. (Total : 20 marks)

1|Page

[INTRODUCTION TO FINANCIAL ACCOUNTING] INCOMPLETE ACCOUNTS

Question 2 Alice is a sole trader. She did not maintain her accounting records properly. The following information was extracted from the bank account for the year ended 31/12/03.

Balance at 1/1/03 Cash sales Trade receivable

RM 5,600 20,500 71,400

Trade payable Rental Drawings Insurance Purchase of computer Salary Electricity

RM 51,200 8,800 13,000 5,000 8,000 3,750 6,000

The following information was obtained from the books of Alice:

Computer (NBV) Trade payable Trade receivable Inventory at cost Prepaid insurance Accrued salary Drawings-goods Drawings-cash sales received Required: (a)

31/12/02 RM 6,250 7,150 3,600 500 300 -

31/12/03 RM 7,000 5,800 9,700 3,800 800 550 1,250 3,000

Calculate Alices capital account at 1 Jan 2003. (2 marks)

(b)

Prepare Income Statement for the year ended 31 December 2003. (10 marks)

(c)

Prepare Statement of Financial Position as at 31 December 2003. (8 marks) (Total : 20 marks)

2|Page

[INTRODUCTION TO FINANCIAL ACCOUNTING] INCOMPLETE ACCOUNTS

Question 3 Manjit is a sole trader. She did not maintain her accounting records properly. The following information was extracted from the bank account for the year ended 31/12/06 RM Balance at 1/1/06 15,800 Cash banked 17,800 Trade receivable 150,000 RM Trade payable 90,000 Insurance 8,000 Drawings 12,000 Sundry expenses 12,500 Purchase of computer 7,000 Salary 30,000 Balance c/d 24,100

The following information was obtained from the books of Manjit: 1/1/06 RM 15,000 12,500 17,500 12,000 60 15,800 200 800 31/12/06 RM ? 66,484 18,200 17,000 70 24,100 1,000 600

Computer (NBV)cost 20,000 Trade payable Trade receivable Inventory at cost Cash in hand Bank Insurance prepaid Provision for bad debts

1. Discounts allowed to customers totaled RM8,500 and discounts received from suppliers were RM5,600. 2. Bad debts of RM2,000 were written off during the year. 3. Depreciation on the computer is charged at 20% on cost of assets held at the year end. 4. The following payments were made from cash which had been received from sales before paying into the bank: (i) (ii) (iii) (iv) Required: (a) (b) (c) Calculate Manjits capital account at 1 Jan 2006. Prepare Income Statement for the year ended 31 December 2006 Prepare Statement of Financial Position as at 31 December 2006 Drawings Purchases Salaries Sundry expenses RM5,000 RM15,000 RM350 RM120

3|Page

[INTRODUCTION TO FINANCIAL ACCOUNTING] INCOMPLETE ACCOUNTS

Question 4 The following summary for the year ended 31 March 20x9 has been prepared from the Cash Book of Beckham, a sports shop retailer. Receipts Cash Bank Balances b/fwd 172 3,246 Cash sales 640 8,777 Trade receivables 96 38,194 Cash from bank 693 Gift from a relative 9,000 Sale proceeds of motor vehicle 750 (NBV 500) Payments Trade payables 25,500 Wages 8,350 General expenses 82 7,498 Cash from bank 693 Drawings 800 11,600 Purchase of motor vehicle 8,999 Beckham did not keep a full set of accounting records, but the following additional information has been obtained: (1) Motor vehicle valued at Inventory valuation Trade receivables General expenses - prepaid - accrued Accrued wages Trade payables (2) 1 April 20x8 500 1,650 3,600 300 85 700 2,200 31 March 20x9 8,000 2,700 3,850 375 99 650 4,995

Beckham withdrew, from goods purchased during 20x9 and for his own personal use, items costing RM700. The Cash Book summary does not include bank charges of RM75 debited to Beckhams Account by the bank on 31 March 20X 9. Payments for rent, RM500, and private traveling costs, RM1,000, had been deducted from cash sales prior to banking.

(3)

(4)

Required: (a) (b) (c) Calculation of Beckhams Capital Account balance on 1 April 20x8. Income Statement for year ending 31 March 20x9. Statement of Financial Position of Beckham at 31 March 20x9.

4|Page

Вам также может понравиться

- Control Accounts Practice QuestionsДокумент5 страницControl Accounts Practice Questionsmairaj0897% (36)

- SAP FICO Steps T-Codes and PathsДокумент90 страницSAP FICO Steps T-Codes and Pathscharan rao100% (2)

- 35 Ipcc Accounting Practice ManualДокумент218 страниц35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Exercises - Trial Balance and Final Accounts - PracticeДокумент23 страницыExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Double Entry Pratice QuestionsДокумент3 страницыDouble Entry Pratice QuestionsVeronica Bailey100% (10)

- A Level Incomplete Records Practice QuestionsДокумент9 страницA Level Incomplete Records Practice QuestionsMUSTHARI KHANОценок пока нет

- Depreciation O Level NotesДокумент5 страницDepreciation O Level NotesBijoy SalahuddinОценок пока нет

- Accounting SolutionsДокумент30 страницAccounting SolutionsmerityesОценок пока нет

- M3 Business Engine Data Model IntroductionДокумент58 страницM3 Business Engine Data Model IntroductionVINEETH100% (2)

- MCQ Questions Set 2 Introduction To AccountingДокумент3 страницыMCQ Questions Set 2 Introduction To AccountingHsiu PingОценок пока нет

- Accounting Accruals and Prepayments ExerciseДокумент5 страницAccounting Accruals and Prepayments ExerciseAdelyneОценок пока нет

- Cash BookДокумент2 страницыCash BookfelixmuyoveОценок пока нет

- (Problems) - Audit of InventoriesДокумент22 страницы(Problems) - Audit of Inventoriesapatos40% (5)

- Books of Original EntryДокумент12 страницBooks of Original EntryAejaz Mohamed80% (5)

- Accounting Source Documents Quiz: QuestionsДокумент2 страницыAccounting Source Documents Quiz: QuestionsGilbert Cal100% (1)

- 4 Hour MACD Forex StrategyДокумент20 страниц4 Hour MACD Forex Strategyanzraina100% (8)

- Unit 1 Business Activity WorksheetДокумент3 страницыUnit 1 Business Activity WorksheetLeticia Corbellini100% (1)

- Single Entry and Incomplete RecordsДокумент5 страницSingle Entry and Incomplete RecordsCalifornia KnightОценок пока нет

- FA1 MOCK EXAM CHAPTER 1 To 5Документ6 страницFA1 MOCK EXAM CHAPTER 1 To 5Haris AhnedОценок пока нет

- Combine For Print Part TwoДокумент13 страницCombine For Print Part TwoEloiza Lajara RamosОценок пока нет

- Chapter 1 - Business Transactions and DocumentationДокумент40 страницChapter 1 - Business Transactions and Documentationshemida86% (7)

- Three Column Cash BookДокумент5 страницThree Column Cash Bookvinodksrini007100% (2)

- Accounting Notes PDFДокумент129 страницAccounting Notes PDFLeeroy Gift100% (1)

- What's So Special About Special GL Indicators PDFДокумент10 страницWhat's So Special About Special GL Indicators PDFspmotaОценок пока нет

- Accounting Problem Book 2011 PDFДокумент103 страницыAccounting Problem Book 2011 PDFViệt Đức Lê67% (3)

- Inventory Valuation-ProblemsДокумент3 страницыInventory Valuation-ProblemsKaran100% (1)

- Chapter17 Incomplete RecordsДокумент24 страницыChapter17 Incomplete Recordsmustafakarim100% (1)

- Audit Problem - QuizzerДокумент27 страницAudit Problem - QuizzerCharis Marie Urgel75% (8)

- Assignment Questions For Financial StatementsДокумент5 страницAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- Manufacturing Accounts Notes and QuestionsДокумент31 страницаManufacturing Accounts Notes and QuestionsRoshan RamkhalawonОценок пока нет

- Swyft Logistics - Oracle NetSuite - Keystone ConsultingДокумент38 страницSwyft Logistics - Oracle NetSuite - Keystone ConsultingMAVENS ConsultantsОценок пока нет

- CHAPTER 7 - Bad Debts and Doubtful DebtsДокумент24 страницыCHAPTER 7 - Bad Debts and Doubtful DebtsMuhammad Adib100% (2)

- A Level AccountingДокумент35 страницA Level AccountingMatloob Ilahi100% (3)

- FinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFДокумент10 страницFinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFSherona ReidОценок пока нет

- 13 Single Entry and Incomplete Records - Additional ExercisesДокумент5 страниц13 Single Entry and Incomplete Records - Additional ExercisesMei Mei Chan100% (2)

- Manufacturing Account LESSON NOTESДокумент11 страницManufacturing Account LESSON NOTESKourtnee Francis100% (2)

- Chapter (2) Eg Ex No 1 To 6 AnswersДокумент3 страницыChapter (2) Eg Ex No 1 To 6 AnswersJames Milzer100% (1)

- Incomplete RecordsДокумент27 страницIncomplete RecordsSteven Raintung0% (1)

- Level 1 Book Keeping With Logo PDFДокумент14 страницLevel 1 Book Keeping With Logo PDFShwe HtayОценок пока нет

- Revision Worksheet FundamentalsДокумент2 страницыRevision Worksheet Fundamentalssshyam3100% (1)

- Self Balancing Ledger Question BankДокумент4 страницыSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Class Exercise - Bank ReconciliationДокумент5 страницClass Exercise - Bank Reconciliationmoosanippp0% (2)

- Accounting Eq Class 11 Practice QuestionsДокумент3 страницыAccounting Eq Class 11 Practice QuestionsSwami NarangОценок пока нет

- Suspense FA1 Practise Exercise To Students PDFДокумент2 страницыSuspense FA1 Practise Exercise To Students PDFJannatul Ferdous Pontha100% (1)

- Chapter 17 - Control AccountsДокумент17 страницChapter 17 - Control Accountsshemida75% (4)

- Answer Key Accounting Paper 2 Term 3 Form 4Документ8 страницAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedОценок пока нет

- 02 Accounting Study NotesДокумент4 страницы02 Accounting Study NotesJonas Scheck100% (2)

- Financial Accounting R. Kit PDFДокумент342 страницыFinancial Accounting R. Kit PDFBenson100% (1)

- Accounting Revision Notes (0452)Документ38 страницAccounting Revision Notes (0452)MissAditi KОценок пока нет

- FA2 Accruals and PrepaymentsДокумент4 страницыFA2 Accruals and Prepaymentsamna zamanОценок пока нет

- Double Entry System WorksheetДокумент26 страницDouble Entry System WorksheetFarrukhsgОценок пока нет

- Accacat Paper t3 Maintaining Financial ReДокумент32 страницыAccacat Paper t3 Maintaining Financial ReKian Yen0% (1)

- 7110 Specimen Paper 2010 P2msДокумент8 страниц7110 Specimen Paper 2010 P2msfgaushiya67% (3)

- Cambridge International AS and A Level Accounting Coursebook AnswerДокумент5 страницCambridge International AS and A Level Accounting Coursebook AnswerMopur NELLOREОценок пока нет

- Past Paper IIДокумент16 страницPast Paper IIWasim OmarshahОценок пока нет

- IGCSE Accounting Trial BalanceДокумент2 страницыIGCSE Accounting Trial BalanceHiОценок пока нет

- Cashbook Questions For PractiseДокумент21 страницаCashbook Questions For Practisedona100% (1)

- Double Entry Bookkeeping: Ledgers Journal Trial Balance Practice Questions Answer BankДокумент12 страницDouble Entry Bookkeeping: Ledgers Journal Trial Balance Practice Questions Answer BankUmar SageerОценок пока нет

- Financial Accounting Fundamentals May 2011Документ6 страницFinancial Accounting Fundamentals May 2011Kofi EwoenamОценок пока нет

- BCOMSC - Accounting 1 - 15-Jan-24 - S1Документ8 страницBCOMSC - Accounting 1 - 15-Jan-24 - S1blessingmudarikwa2Оценок пока нет

- Assignment Accounting FundamentalsДокумент2 страницыAssignment Accounting FundamentalsRajshree DewooОценок пока нет

- AssignmentДокумент5 страницAssignmentShar KhanОценок пока нет

- IPCC Accounts 31-10-10Документ1 страницаIPCC Accounts 31-10-10Esukapalli Siva ReddyОценок пока нет

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Документ3 страницы2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidОценок пока нет

- Single EntryДокумент0 страницSingle EntrylathadevaraajОценок пока нет

- Accountancy CLASS-XI-WPS OfficeДокумент7 страницAccountancy CLASS-XI-WPS Officemaruthesh.vОценок пока нет

- Cash Flow Statement - TutorialДокумент6 страницCash Flow Statement - TutorialChandran PachapanОценок пока нет

- MBA (E), Part-I, 1st Semester-2Документ27 страницMBA (E), Part-I, 1st Semester-2Rubab MirzaОценок пока нет

- AnswerДокумент1 страницаAnswerChandran PachapanОценок пока нет

- TaxationДокумент42 страницыTaxationNur SiaОценок пока нет

- Course PlanДокумент3 страницыCourse PlanChandran PachapanОценок пока нет

- BPP Learning Media Stockist Lists Asia Australasia 1112Документ2 страницыBPP Learning Media Stockist Lists Asia Australasia 1112Chandran PachapanОценок пока нет

- Cash Flow Statement - TutorialДокумент6 страницCash Flow Statement - TutorialChandran PachapanОценок пока нет

- Production OverheadДокумент1 страницаProduction OverheadChandran PachapanОценок пока нет

- Dec 2008Документ8 страницDec 2008Jehan PereraОценок пока нет

- ABC TutotialДокумент6 страницABC TutotialChandran PachapanОценок пока нет

- Basic Cost Accounting TermsДокумент3 страницыBasic Cost Accounting TermsChandran PachapanОценок пока нет

- Test 1 - QuestionДокумент4 страницыTest 1 - QuestionChandran PachapanОценок пока нет

- Ratio QuestionДокумент4 страницыRatio QuestionChandran PachapanОценок пока нет

- Assign Data MiningДокумент8 страницAssign Data MiningChandran PachapanОценок пока нет

- 4 Setting Advertising ObjectivesДокумент15 страниц4 Setting Advertising ObjectivesChandran PachapanОценок пока нет

- Quiz 1 - Basic EpsДокумент1 страницаQuiz 1 - Basic EpsChandran PachapanОценок пока нет

- Revision Tutorial Written QuestionsДокумент1 страницаRevision Tutorial Written QuestionsChandran PachapanОценок пока нет

- Deferred Tax ACCA ArticleДокумент9 страницDeferred Tax ACCA ArticleJavid HumbatovОценок пока нет

- Petty Cash BookДокумент13 страницPetty Cash BookChandran PachapanОценок пока нет

- Format - Individual Tax Computation - StudentsДокумент2 страницыFormat - Individual Tax Computation - StudentsChandran Pachapan0% (1)

- Ais JournalДокумент12 страницAis JournalChandran PachapanОценок пока нет

- Functional Budgets Prontor Limited Provides The Following Data For The Year Ending 31 December YearДокумент5 страницFunctional Budgets Prontor Limited Provides The Following Data For The Year Ending 31 December YearChandran PachapanОценок пока нет

- Quiz 1 - Basic EpsДокумент1 страницаQuiz 1 - Basic EpsChandran PachapanОценок пока нет

- Supporting References in Oracle Ebs r12Документ65 страницSupporting References in Oracle Ebs r12AbbasОценок пока нет

- Model Exam 1Документ25 страницModel Exam 1rahelsewunet0r37203510Оценок пока нет

- Cover Letter Examples For Accounts Payable SpecialistДокумент4 страницыCover Letter Examples For Accounts Payable Specialistfasofumidel3Оценок пока нет

- CV - Fiorela KostareДокумент3 страницыCV - Fiorela KostareEmianОценок пока нет

- hm6 Module3Документ27 страницhm6 Module3Irene Asiong NagramaОценок пока нет

- Accounts Payable Management Proposal Philippine Seven CorporationДокумент5 страницAccounts Payable Management Proposal Philippine Seven CorporationMarlon A. RodriguezОценок пока нет

- Uniform Certified Public Accountant Examinations May 1957 To Nov PDFДокумент191 страницаUniform Certified Public Accountant Examinations May 1957 To Nov PDFSweet EmmeОценок пока нет

- Part 2Документ8 страницPart 2Samuel FerolinoОценок пока нет

- Cash Conversion Cycle - What It Is and Why It's ImportantДокумент11 страницCash Conversion Cycle - What It Is and Why It's ImportantNdo De NinoОценок пока нет

- Using Adaptive Intelligence For FinancialsДокумент22 страницыUsing Adaptive Intelligence For FinancialsDanalakoti SuryaОценок пока нет

- LAD Add-On Localizations: Applies ToДокумент6 страницLAD Add-On Localizations: Applies ToRicardoОценок пока нет

- Luyen Tap Chuong 2 - and SOLUTION - Daily TransactionДокумент8 страницLuyen Tap Chuong 2 - and SOLUTION - Daily TransactionPham Huu KhiemОценок пока нет

- C9 - Jessica, S Dilemma Competing LoyaltiesДокумент6 страницC9 - Jessica, S Dilemma Competing LoyaltiesNutanОценок пока нет

- Thai Localized Manual 46CДокумент132 страницыThai Localized Manual 46Cic2810Оценок пока нет

- Susan Hairston ResumeДокумент2 страницыSusan Hairston ResumeGabriel HallОценок пока нет

- Nir Full Project NewДокумент71 страницаNir Full Project NewMK gamingОценок пока нет

- Audit LiabilitiesДокумент16 страницAudit LiabilitiesAnthony Koko CarlobosОценок пока нет

- 1 - Introduction To Accountign - Icap - Questions and Answers PDFДокумент202 страницы1 - Introduction To Accountign - Icap - Questions and Answers PDFM.Abdullah MBITОценок пока нет

- Prelim Answer Key: Redemption of Certificates Lapse of CertificatesДокумент8 страницPrelim Answer Key: Redemption of Certificates Lapse of CertificatesNikky Bless LeonarОценок пока нет

- AC1205 Module 3 - Audit of Liabilities (Discussion Guide) (Student) CorrectedДокумент2 страницыAC1205 Module 3 - Audit of Liabilities (Discussion Guide) (Student) Correctedssslll2Оценок пока нет

- Purchase and Payment Cycle: Learning ObjectivesДокумент21 страницаPurchase and Payment Cycle: Learning ObjectivesJoseph PamaongОценок пока нет

- Project ReportДокумент11 страницProject Reportbhumika ADLAKОценок пока нет

- EHP4 RN Financials EN PDFДокумент156 страницEHP4 RN Financials EN PDFOnur OnukОценок пока нет