Академический Документы

Профессиональный Документы

Культура Документы

Value Research: JM Emerging Leaders

Загружено:

Sandeep BorseИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Value Research: JM Emerging Leaders

Загружено:

Sandeep BorseАвторское право:

Доступные форматы

Value Research

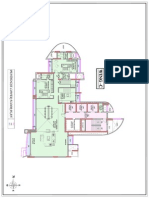

FUNDCARD

JM Emerging Leaders

Not Rated

Equity: Diversified

Investment Information

The scheme aims to generate long term capital

appreciation from investment in a portfolio of

stocks across all market capitalisation range. The

portfolio may include those companies operating

in emerging sectors of the economy or companies

which exhibit potential to become leaders of

tomorrow.

Launch

04-07-05

Growth, Dividend

Plans

NA

Div Freq.

3 Working Days

Redeem Time

1.25

Management Fee (%)

15 Hrs.

Dealing Time (Hrs.)

Min Investment (Rs.)

5000

Min SIP Investment (Rs.)

NA

Registrar

Karvy Computershare Pvt Ltd.

12.81(2007-08-09)

NAV

Sandip Sabharwal (Since Nov 06)

Advisor

Load:

2.25 % for investment upto Rs. 2.999 Cr.

Advisor : J M Financial Asset Management Private Ltd.

Address: 5th Floor, 'A' Wing, Laxmi Towers Bandra

Kurla Complex, Mumbai-400051

URL : www.JMFinancialmf.com

Return

Risk

FUND STYLE

Investment Style

Growth Blend Value

Fund Style Details

Total Stocks

P/E Ratio

P/B Ratio

Avg Mkt Cap(Cr.)

Market Cap

Giant

Large

Mid

Small

Tiny

Profile

High

Below Avg.

2007-07-31

Large Medium Small

Click here to view this fund on ValueReseachOnline.com

Portfolio Manager

Portfolio Analysis

Fund

Benchmark

26

200

26.61

43.84

3.31

1396

6.47

71,655

%

NA

2.08

40.44

Composition (%)

Equity

91.58

Debt

0.00

Cash

8.42

55.36

NA

Concentration

Top 5 Holdings

Top 10 Holdings

Top 3 Sectors

Fund Performance Vs

Category Average

! Quarterly Fund Return

+/- Category Average

Category Baseline

History

2007

2007

2006

2006

2005

2005

NA

NA

NA

Capitalisation

Stated Objective Growth

% Allocation

34.12

60.38

54.55

Company

Inst.

Sintex Industries

Diversified

23.18

P/E

%Asset

8.22

Bombay Rayon

Textiles

19.55

7.50

Apollo Tyres

Automobile 12.18

6.79

Hanung Toys and

Cons. ND

10.34

5.58

Bharati Shipyard

Services

18.41

5.39

Ansal Prop & Infra

Construction 21.76

5.37

Action Construction

Construction 26.03

5.37

NAV

12.53

10.58

10.36

NA

NA

NA

Total Return

18.48

0.76

NA

NA

NA

NA

Gitanjali Gems

Consumer D 19.19

4.98

NA

Orbit Corporation

Construction 162.99

4.82

Spicejet

Services

-18.48

4.51

Emco

Basic/Eng.

22.89

4.30

Nagarjuna Construction Construction 23.49

4.22

Sanghvi Movers

Construction 14.20

3.97

Century Textiles &

Diversified

13.56

3.54

Kalpataru Power

Metals

24.49

3.50

4.08

+/-S&P CNX Nifty

Category Rank

-38.82

42/163 144/145

172.7

Net Assets Rs. Cr

Risk Meter

54.9

LOW

NA

NA

NA

NA

NA

NA

NA

65.1

NA

NA

NA

MODERATE

HIGH

Based on Standard Deviation

Expenses & Turnover

Performance

2005

2006

2007

Qtr 1

Qtr 2

Qtr 3

NA

16.19

-8.98

NA

-13.69

22.26

NA

-0.66

NA

Qtr 4

2.84

1.15

NA

Total

NA

0.76

NA

Expense Ratio %

Management Fee

Turnover Ratio %

Net Assets Rs. Cr

03-07

03-06

03-05

03-04

2.42

2.13

NA

NA

1.21

132.91

1.07

228.07

NA

NA

NA

NA

63.2

40.9

NA

NA

Risk Analysis

Trailing Returns

Total

3 Months

6 Months

1 Years

2 Years

3 Years

5 Years

SinceLaunch

Sector

Weightings

22.96

17.87

25.00

13.19

NA

NA

12.53

2007-08-09

+/Category Growth of

Benchmark

Rank Rs 10,000

12.34

4/173

11.66

4/165

-13.93 151/161

-23.35 120/120

NA

NA

NA

NA

-25.52

--

12,296

11,787

12,500

12,812

0

0

12,811

Volatility Measurements

Mean

Beta

NA

NA

Standard Deviation

R-Squared

NA

NA

NA

NA

Sharpe Ratio

Alpha

Best/Worst Ret

Best(Period)

Worst(Period)

Month

14.07(06/07-07/07) -25.97(05/06-06/06)

Quarter

29.47(04/07-07/07) -24.36(04/06-07/06)

Year

33.34(07/06-07/07) -26.21(04/06-04/07)

% of

Stocks

Automobile

6.79

Basic/Eng.

4.30

Chemicals

NA

Construction 27.72

Consumer D 4.98

Cons. ND

5.67

Diversified

11.76

Energy

NA

Financial

NA

Health Care

NA

Metals

9.06

Others

NA

Services

13.80

Technology

NA

Textiles

7.50

Rel to

5-yyear

Benchmark High

Low

4.82

5.61

1.32

5.30

0.16

6.11

6.90

16.87

20.99

3.88

5.62

NA

3.08

19.15

0.19

6.79

4.30

NA

27.72

4.98

5.67

11.76

NA

NA

NA

9.06

NA

13.80

NA

7.50

6.79

4.30

NA

27.72

4.98

5.67

11.76

NA

NA

NA

9.06

NA

13.80

NA

7.50

www.valueresearchonline.com

2785-070814163937

Yes, I wish to subscribe to Mutual Fund Insight.

(Please tick below for a 1, 2 or 3 year subscription.)

Subscription

Normal

Cover Price

You Save

You Pay

Only

3 years

Rs 3600

1260 Best Offer

Rs 2340

2 years

Rs 2400

600

Rs 1800

1 year

Rs 1200

240

Rs 960

( PLEASE FILL IN BLOCK LETTERS )

Name (Mr/Ms/Mrs)...........................................................................................

Address ...........................................................................................................

.........................................................................................................................

.........................................................................................................................

Phone (with STD code) ..................................................................................

E-mail...............................................................................................................

Method of Payment

Cheque Number................................................Dated..................................................

Drawn on.............................................................Branch..............................................

(Specify Branch)

Favouring Mutual Fund Insight payable at New Delhi

Master Card

Visa

Please note, debit cards are not accepted for payment of subscription

Card Valid Until: Month..................................................Year.......................................

Cardholders Signature.................................................................................................

MAIL OR FAX THIS FORM NOW

ValueResearch India Pvt.Ltd.

5 Commercial Complex,

Chitra Vihar, Delhi 110 092

Phone: 011-22457916 /18, Fax: 22531830

MUMBAI

Phone: 022-228-38665, 022-228-38198

Fax: 022-665-41065

E-mail: mfi@valueresearchonline.com

www.valueresearchonline.com

Вам также может понравиться

- Landmark Capital - Fund BrochureДокумент37 страницLandmark Capital - Fund BrochureSandeep BorseОценок пока нет

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014От EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014Оценок пока нет

- Eclerx Services (Eclser) : Chugging Along..Документ6 страницEclerx Services (Eclser) : Chugging Along..shahavОценок пока нет

- Insurance ClaimДокумент16 страницInsurance Claimrajveer75% (4)

- 2013-5-22 First Resources CIMBДокумент27 страниц2013-5-22 First Resources CIMBphuawlОценок пока нет

- Dependency TheoryДокумент15 страницDependency TheoryJohn Paul Arcilla100% (1)

- Erman ExamplesДокумент19 страницErman Examplesukxgerard100% (2)

- Indiareit Apartment FundДокумент18 страницIndiareit Apartment FundSandeep BorseОценок пока нет

- 3P Lean Production Preparation PDFДокумент12 страниц3P Lean Production Preparation PDFshan4600100% (2)

- Laurence Connors - Bollinger Bands Trading Strategies That WorkДокумент32 страницыLaurence Connors - Bollinger Bands Trading Strategies That Work3dvg 10% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- Brunei OverviewДокумент29 страницBrunei OverviewTee MendozaОценок пока нет

- 2010 May - Morning Pack (DBS Group) For Asian StocksДокумент62 страницы2010 May - Morning Pack (DBS Group) For Asian StocksShipforОценок пока нет

- Success in Investment 10 03Документ36 страницSuccess in Investment 10 03JOHN MYKLUSCH100% (1)

- Toaz - Info Quiz On Foreign Transactions PRДокумент4 страницыToaz - Info Quiz On Foreign Transactions PRoizys131Оценок пока нет

- JM Emerging LeadersДокумент1 страницаJM Emerging LeadersSandeep BorseОценок пока нет

- Fidelity Equity FundДокумент2 страницыFidelity Equity FundSandeep Borse100% (1)

- Reliance Equity Opportunities FundДокумент1 страницаReliance Equity Opportunities FundSandeep BorseОценок пока нет

- Franklin India Flexicap FundДокумент1 страницаFranklin India Flexicap FundSandeep BorseОценок пока нет

- Fidelity Special Situations FundДокумент1 страницаFidelity Special Situations FundSandeep BorseОценок пока нет

- NiveshMantra MC TeamInvetopreneursДокумент10 страницNiveshMantra MC TeamInvetopreneursSourabh SinghОценок пока нет

- Value Research: FundcardДокумент4 страницыValue Research: FundcardYogi173Оценок пока нет

- Malaysia: Results ReviewДокумент10 страницMalaysia: Results ReviewFaizal FazilОценок пока нет

- Fundcard BNPParibasTaxAdvantagePlanДокумент4 страницыFundcard BNPParibasTaxAdvantagePlanYogi173Оценок пока нет

- Reliance Mutual Fund-FinalДокумент7 страницReliance Mutual Fund-FinalTamanna Mulchandani100% (1)

- Value Research: FundcardДокумент6 страницValue Research: FundcardAnonymous K3syqFОценок пока нет

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Документ4 страницыValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsОценок пока нет

- Study Of: Prof. Neeraj AmarnaniДокумент20 страницStudy Of: Prof. Neeraj Amarnanipankil_dalalОценок пока нет

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Документ4 страницыFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173Оценок пока нет

- Sip 06 May 201010Документ5 страницSip 06 May 201010Sneha SharmaОценок пока нет

- Performance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Документ1 страницаPerformance Data and Analytics Sep-13: Investment Philosophy Asset Allocation (%)Jazib SoofiОценок пока нет

- CRISIL Research Ier Report Somany 2013 Q2FY14fcДокумент10 страницCRISIL Research Ier Report Somany 2013 Q2FY14fcvikash tiggaОценок пока нет

- Sundaram Select MidcapДокумент2 страницыSundaram Select Midcapredchillies7Оценок пока нет

- Bumi Armada 4QFY11 20120228Документ3 страницыBumi Armada 4QFY11 20120228Bimb SecОценок пока нет

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesДокумент20 страницIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedОценок пока нет

- Earnings Update Q4FY15 (Company Update)Документ45 страницEarnings Update Q4FY15 (Company Update)Shyam SunderОценок пока нет

- Thermax Limited (THERMA) : Healthy ExecutionДокумент6 страницThermax Limited (THERMA) : Healthy Executionnikhilr05Оценок пока нет

- ValueResearchFundcard ICICIPrudentialTop100 2012feb02Документ6 страницValueResearchFundcard ICICIPrudentialTop100 2012feb02Ahmed Ahmed AliОценок пока нет

- Mutual Fund FundcardДокумент4 страницыMutual Fund FundcardYogi173Оценок пока нет

- Supreme Industries FundamentalДокумент8 страницSupreme Industries FundamentalSanjay JaiswalОценок пока нет

- Fundcard L&TCashДокумент4 страницыFundcard L&TCashYogi173Оценок пока нет

- Indian Hotels (INDHOT) : Disappoints AgainДокумент6 страницIndian Hotels (INDHOT) : Disappoints Againrakeshshah78Оценок пока нет

- DWSAlphaEquityFund 2014jul07Документ4 страницыDWSAlphaEquityFund 2014jul07Yogi173Оценок пока нет

- Presented By: Himanshu Gurani Roll No. 33Документ27 страницPresented By: Himanshu Gurani Roll No. 33AshishBhardwajОценок пока нет

- Sector Allocation: Reliance Vision Fund Vs BSE 100Документ2 страницыSector Allocation: Reliance Vision Fund Vs BSE 100Rijo PhilipsОценок пока нет

- ABG ShipyardДокумент9 страницABG ShipyardTejas MankarОценок пока нет

- PNB Analyst Presentation March16Документ29 страницPNB Analyst Presentation March16tamirisaarОценок пока нет

- ValueResearchFundcard ICICIPrudentialDiscovery 2012may20Документ6 страницValueResearchFundcard ICICIPrudentialDiscovery 2012may20Dinanath DabholkarОценок пока нет

- Eclerx Services LTD IER Quarterly Update First CutДокумент1 страницаEclerx Services LTD IER Quarterly Update First CutSakshi YadavОценок пока нет

- SharpДокумент6 страницSharppathanfor786Оценок пока нет

- Project Report On The Neogi Chemical CompanyДокумент7 страницProject Report On The Neogi Chemical Companyabhisheknagpal27Оценок пока нет

- Standalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaДокумент126 страницStandalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaGourav VermaОценок пока нет

- IRIS Corporation Berhad - Rimbunan Kaseh To Come in Next Quarter - 120827Документ2 страницыIRIS Corporation Berhad - Rimbunan Kaseh To Come in Next Quarter - 120827Amir AsrafОценок пока нет

- ValueResearchFundcard SBIMagnumIncome 2013jul17Документ6 страницValueResearchFundcard SBIMagnumIncome 2013jul17Chiman RaoОценок пока нет

- Wah Seong 4QFY11 20120223Документ3 страницыWah Seong 4QFY11 20120223Bimb SecОценок пока нет

- CMM Assignment - 2Документ36 страницCMM Assignment - 2Mithilesh SinghОценок пока нет

- td140219 2Документ7 страницtd140219 2Joyce SampoernaОценок пока нет

- Value Research: FundcardДокумент4 страницыValue Research: FundcardYogi173Оценок пока нет

- Ashoka BuildconДокумент6 страницAshoka BuildconSaurabh YadavОценок пока нет

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2012sep21Документ6 страницValueResearchFundcard CanaraRobecoEquityTaxSaver 2012sep21Gaurav KhullarОценок пока нет

- Assignments Semester IДокумент13 страницAssignments Semester Idriger43Оценок пока нет

- HDFC MF Sip PerformanceДокумент1 страницаHDFC MF Sip Performanceshivabtowin3301Оценок пока нет

- Accounts AssignmentДокумент7 страницAccounts AssignmentHari PrasaadhОценок пока нет

- Canara Robeco Infrastructure Infrastructure Fund: June 2008Документ3 страницыCanara Robeco Infrastructure Infrastructure Fund: June 2008Sushant SaxenaОценок пока нет

- Kotak BankДокумент28 страницKotak BankGyanendra SharmaОценок пока нет

- Reliance GrowthДокумент2 страницыReliance GrowthRoseRose RoseОценок пока нет

- Quippo Energy Private Limited-10152013 PDFДокумент3 страницыQuippo Energy Private Limited-10152013 PDFJagadeesh YathirajulaОценок пока нет

- Final TelecomДокумент23 страницыFinal TelecomHrishikesh DargeОценок пока нет

- FactSheet April14Документ15 страницFactSheet April14Prasad JadhavОценок пока нет

- A Mini Project Report On Fiancial ManagementДокумент15 страницA Mini Project Report On Fiancial ManagementAmit SharmaОценок пока нет

- Gilt Funds Trailing Returns From 2019Документ2 страницыGilt Funds Trailing Returns From 2019Sandeep BorseОценок пока нет

- Cover Page PicsДокумент3 страницыCover Page PicsSandeep BorseОценок пока нет

- Eastings and NorthingsДокумент1 страницаEastings and NorthingsSandeep BorseОценок пока нет

- Gilt Funds Traling Returns From 2015Документ2 страницыGilt Funds Traling Returns From 2015Sandeep BorseОценок пока нет

- Geography Worksheet IsceДокумент1 страницаGeography Worksheet IsceSandeep BorseОценок пока нет

- 7th ScienceДокумент22 страницы7th ScienceSandeep BorseОценок пока нет

- CCP - One PagerДокумент1 страницаCCP - One PagerSandeep BorseОценок пока нет

- IDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YДокумент1 страницаIDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseОценок пока нет

- Debt Fund Portfolio June 2017Документ10 страницDebt Fund Portfolio June 2017Sandeep BorseОценок пока нет

- ARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsДокумент5 страницARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsSandeep BorseОценок пока нет

- REC Capital Gain Bond-10200083Документ4 страницыREC Capital Gain Bond-10200083viralshukla4290Оценок пока нет

- Nhai54ecapr16 21705523Документ2 страницыNhai54ecapr16 21705523Sandeep BorseОценок пока нет

- Crisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Документ1 страницаCrisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Sandeep BorseОценок пока нет

- DSP Focus 25Документ1 страницаDSP Focus 25Sandeep BorseОценок пока нет

- BNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YДокумент1 страницаBNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseОценок пока нет

- Mahalaxmi Presentation InvestorsДокумент29 страницMahalaxmi Presentation InvestorsSandeep BorseОценок пока нет

- PolicySchedule PDFДокумент1 страницаPolicySchedule PDFSandeep Borse100% (1)

- Large Funds Performance Jan 2016Документ1 страницаLarge Funds Performance Jan 2016Sandeep BorseОценок пока нет

- Asset AllocationДокумент29 страницAsset AllocationSandeep BorseОценок пока нет

- There'S Life Beyond Bank FdsДокумент20 страницThere'S Life Beyond Bank FdsSandeep BorseОценок пока нет

- Transactions - Apartment FundДокумент5 страницTransactions - Apartment FundSandeep BorseОценок пока нет

- Sunita RuiaДокумент3 страницыSunita RuiaSandeep BorseОценок пока нет

- Project Sunrise Grande Floor PlanДокумент6 страницProject Sunrise Grande Floor PlanSandeep BorseОценок пока нет

- Atlantis C Wing Lower FLRДокумент1 страницаAtlantis C Wing Lower FLRSandeep BorseОценок пока нет

- Magicbricks OfferДокумент14 страницMagicbricks OfferSandeep BorseОценок пока нет

- Khar PropertyДокумент7 страницKhar PropertySandeep BorseОценок пока нет

- Melvin Jones FellowДокумент4 страницыMelvin Jones FellowSandeep BorseОценок пока нет

- New Nri FormДокумент2 страницыNew Nri FormSharath BhavanasiОценок пока нет

- Port PricingДокумент6 страницPort PricingMahin1977Оценок пока нет

- Eco402 Collection of Old PapersДокумент37 страницEco402 Collection of Old Paperscs619finalproject.com100% (2)

- Nama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZДокумент5 страницNama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZFikky Chandra SilabanОценок пока нет

- QuestionДокумент5 страницQuestionakhileshmoney143Оценок пока нет

- Fi 410 Chapter 3Документ50 страницFi 410 Chapter 3Austin Hazelrig100% (1)

- Introduction To Financial ManagementДокумент18 страницIntroduction To Financial Managementcopy smartОценок пока нет

- Human Resource AccountingДокумент14 страницHuman Resource AccountingsumitruОценок пока нет

- AS 37 (IAS Plus)Документ6 страницAS 37 (IAS Plus)SarmadОценок пока нет

- Apti 9Документ4 страницыApti 9Shikha AryaОценок пока нет

- Vertical Balance SheetДокумент3 страницыVertical Balance Sheetamit2201Оценок пока нет

- Financial Accounting: Accounting Basics: Branches of AccountingДокумент7 страницFinancial Accounting: Accounting Basics: Branches of AccountingLucky HartanОценок пока нет

- KsadsadsДокумент3 страницыKsadsadsKenneth Bryan Tegerero Tegio0% (1)

- The Statement of Cash Flows: Mcgraw-Hill/IrwinДокумент30 страницThe Statement of Cash Flows: Mcgraw-Hill/Irwinpawas_sharmaОценок пока нет

- 1Q21 Net Income Above Expectation: Semirara Mining CorporationДокумент8 страниц1Q21 Net Income Above Expectation: Semirara Mining CorporationJajahinaОценок пока нет

- The Wolf of Wall Street 2013Документ313 страницThe Wolf of Wall Street 2013AshokОценок пока нет

- Unit 6 WACCДокумент16 страницUnit 6 WACCAnuska JayswalОценок пока нет

- PGPACM ProspectusДокумент19 страницPGPACM Prospectusviratarun100% (1)

- Chris Burniske, Jack Tatar - CryptoassetsДокумент6 страницChris Burniske, Jack Tatar - CryptoassetsJasvinder TanejaОценок пока нет

- IBREL Annual Report2019Документ276 страницIBREL Annual Report2019Anonymous 0BpXe7RMОценок пока нет

- As 20Документ6 страницAs 20Rajiv JhaОценок пока нет

- Banking Laws Non Performing Assets A Study of Legal RegulationsДокумент26 страницBanking Laws Non Performing Assets A Study of Legal Regulationssandhya raniОценок пока нет

- The Investment Detective PDFДокумент2 страницыThe Investment Detective PDFAroosa KhawajaОценок пока нет