Академический Документы

Профессиональный Документы

Культура Документы

Non-Current Assets in Financial Accounting

Загружено:

dmugalloyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Non-Current Assets in Financial Accounting

Загружено:

dmugalloyАвторское право:

Доступные форматы

Non-Current Assets in Financial Accounting

Noncurrent assets are long-term assets that are used in the conduct of the business. Whereas current assets are liquid and turn over in relatively short time periods, noncurrent assets usually turn over very slowly, on the order of once in several years. In other words, while the operating cycle for current assets is usually less than a year, the replacement cycle for noncurrent assets is longer than a year. In a high-tech organization, however, some noncurrent assets may be replaced more frequently. All noncurrent assets are recorded on the balance sheet at their historical acquisition costs. The disadvantage of this is that as time passes the historical costs of many noncurrent assets become out of date relative to their current market values. Consequently, they indicate little about the market value of the organization and about the future resources necessary to replace the assets. However, the historical costs listed on the balance sheet do represent the costs of these assets that will eventually be consumed by future operations. Recall from the previous chapter that current assets will be converted into cash or used in operations within a year or the firms operating cycle, whichever is longer. Noncurrent assets are not expected to be fully consumed within that period; thus, they are long-lived assets.

Identify three major types of noncurrent assets: 1. property, plant, and equipment 2. intangible assets 3. natural resources

Explain how to account for the acquisition of these assets. Describe the procedures for depreciation, amortization, and depletion. List the factors affecting managers selection of a depreciation method. Determine which post acquisition expenditures should be expensed and which should be capitalized.

Explain the accounting issues associated with asset write-downs and disposals. Interpret financial statement disclosures about noncurrent assets.

Noncurrent Assets Contents Property, Plant and Equipment (PPE)

Initial Valuation of Property, plant, and equipment (PPE) Depreciation of Property, plant, and equipment (PPE)

o o o o o o

Straight-Line Method (Depreciation Methods) Sum-of-the-Years-Digits Method (Depreciation Methods) Declining-Balance (DB) Methods (Depreciation Methods) Tax Depreciation Selection of Depreciation Method Misconceptions About Depreciation

Expenditures After Acquisition - Property, plant, and equipment (PPE) Disposals of Property, plant, and equipment (PPE) Write-Downs - Property, plant, and equipment (PPE) Financial Statement Presentation of Property, plant, and equipment (PPE) Utilization of Property, plant, and equipment (PPE) Percentage of PPE Depreciated (Age) Evaluation of the Accounting for Property, Plant, and Equipment (PPE)

Intangible Assets

Acquisition of Intangible Assets Amortization of Intangible Assets

Natural Resources

Depletion of Natural Resources

Вам также может понравиться

- CM Line Catalog ENUДокумент68 страницCM Line Catalog ENUdmugalloyОценок пока нет

- Specification For Tender For Primary GIS Up To 40.5kV Single Busbar (SBB)Документ28 страницSpecification For Tender For Primary GIS Up To 40.5kV Single Busbar (SBB)dmugalloyОценок пока нет

- SubmPowCables FINAL 10jun13 EnglДокумент20 страницSubmPowCables FINAL 10jun13 EnglManjul TakleОценок пока нет

- Technical Offer For 11kv Sm6 SwitchgearДокумент6 страницTechnical Offer For 11kv Sm6 SwitchgeardmugalloyОценок пока нет

- Bid 1000000297Документ6 страницBid 1000000297dmugalloyОценок пока нет

- CurrentRatings PDFДокумент0 страницCurrentRatings PDFVirajitha MaddumabandaraОценок пока нет

- Schneider Conext CL Contractual WarrantyДокумент5 страницSchneider Conext CL Contractual WarrantydmugalloyОценок пока нет

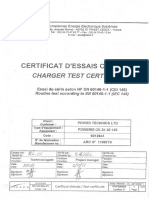

- Charger Test CertificateДокумент4 страницыCharger Test CertificatedmugalloyОценок пока нет

- Schneider LAPP Solar CablesДокумент2 страницыSchneider LAPP Solar CablesdmugalloyОценок пока нет

- Schneider Jinko Solar ModuleДокумент2 страницыSchneider Jinko Solar ModuledmugalloyОценок пока нет

- Ldp616 Gender Issues in Development Exam RevsДокумент56 страницLdp616 Gender Issues in Development Exam Revsdmugalloy100% (1)

- Citizens Guide To Public Procurement Procedures PDFДокумент50 страницCitizens Guide To Public Procurement Procedures PDFdmugalloyОценок пока нет

- Project EvaluationДокумент9 страницProject EvaluationProsper ShumbaОценок пока нет

- Result Based MonitoringДокумент11 страницResult Based MonitoringdmugalloyОценок пока нет

- Kenya GB 2015Документ19 страницKenya GB 2015dmugalloyОценок пока нет

- 1 s2.0 S2214157X13000117 Main PDFДокумент7 страниц1 s2.0 S2214157X13000117 Main PDFMickael SoaresОценок пока нет

- AmiranДокумент2 страницыAmirandmugalloy100% (1)

- Project Monitoring and Evaluation FormsДокумент23 страницыProject Monitoring and Evaluation FormsdmugalloyОценок пока нет

- MODERNIZING KENYAN AGRICULTURE THROUGH COLD STORAGEДокумент184 страницыMODERNIZING KENYAN AGRICULTURE THROUGH COLD STORAGEdmugalloy100% (1)

- LDP 607-Barriers To Impementation of TQM - February 2016Документ1 страницаLDP 607-Barriers To Impementation of TQM - February 2016dmugalloyОценок пока нет

- Chapter 2 Issues in Ex-Ante and Ex-Post Evaluations: Outline of This ChapterДокумент86 страницChapter 2 Issues in Ex-Ante and Ex-Post Evaluations: Outline of This ChapterdmugalloyОценок пока нет

- Principles of TQM - February 2016Документ3 страницыPrinciples of TQM - February 2016dmugalloyОценок пока нет

- Ldp604 Project Planning Design and Implementation Revision Exam QuestionsДокумент7 страницLdp604 Project Planning Design and Implementation Revision Exam QuestionsdmugalloyОценок пока нет

- Facilities Maintenance Training ReportДокумент2 страницыFacilities Maintenance Training ReportdmugalloyОценок пока нет

- Munyoroku - The Role of Organization Structure On Strategy Implementation Among Food Processing Companies in NairobiДокумент69 страницMunyoroku - The Role of Organization Structure On Strategy Implementation Among Food Processing Companies in NairobidmugalloyОценок пока нет

- Business Case and Summary 203357Документ53 страницыBusiness Case and Summary 203357dmugalloyОценок пока нет

- PRQ20150620 Tender Document For G-SectionДокумент184 страницыPRQ20150620 Tender Document For G-SectiondmugalloyОценок пока нет

- BMW Mission and Competitive StrategiesДокумент6 страницBMW Mission and Competitive StrategiesdmugalloyОценок пока нет

- Cat Part B Answer All The Questions.: TH THДокумент2 страницыCat Part B Answer All The Questions.: TH THdmugalloyОценок пока нет

- National TimerДокумент193 страницыNational TimerdmugalloyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Ramdump Memshare GPS 2019-04-01 09-39-17 PropsДокумент11 страницRamdump Memshare GPS 2019-04-01 09-39-17 PropsArdillaОценок пока нет

- Steps To Configure Linux For Oracle 9i Installation: 1. Change Kernel ParametersДокумент5 страницSteps To Configure Linux For Oracle 9i Installation: 1. Change Kernel ParametersruhelanikОценок пока нет

- Tygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingДокумент4 страницыTygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingAluizioОценок пока нет

- SWOT Analysis of Solar Energy in India: Abdul Khader.J Mohamed Idris.PДокумент4 страницыSWOT Analysis of Solar Energy in India: Abdul Khader.J Mohamed Idris.PSuhas VaishnavОценок пока нет

- SYNOPSIS - Impact of GST On Small Traders!Документ21 страницаSYNOPSIS - Impact of GST On Small Traders!Laxmi PriyaОценок пока нет

- Optimization of The Spray-Drying Process For Developing Guava Powder Using Response Surface MethodologyДокумент7 страницOptimization of The Spray-Drying Process For Developing Guava Powder Using Response Surface MethodologyDr-Paras PorwalОценок пока нет

- Report Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIДокумент26 страницReport Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIHafizh ZuhdaОценок пока нет

- Term Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )Документ16 страницTerm Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )spachecofdz0% (1)

- A General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFДокумент37 страницA General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDiego JesusОценок пока нет

- Health Education and Health PromotionДокумент4 страницыHealth Education and Health PromotionRamela Mae SalvatierraОценок пока нет

- NOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationДокумент10 страницNOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationNur AfiqahОценок пока нет

- (Bio) Chemistry of Bacterial Leaching-Direct vs. Indirect BioleachingДокумент17 страниц(Bio) Chemistry of Bacterial Leaching-Direct vs. Indirect BioleachingKatherine Natalia Pino Arredondo100% (1)

- The Online Medical Booking Store Project ReportДокумент4 страницыThe Online Medical Booking Store Project Reportharshal chogle100% (2)

- Arduino Guide using MPU-6050 and nRF24L01Документ29 страницArduino Guide using MPU-6050 and nRF24L01usmanОценок пока нет

- AE-Electrical LMRC PDFДокумент26 страницAE-Electrical LMRC PDFDeepak GautamОценок пока нет

- Identifying The TopicДокумент2 страницыIdentifying The TopicrioОценок пока нет

- ĐỀ SỐ 3Документ5 страницĐỀ SỐ 3Thanhh TrúcОценок пока нет

- Basic Five Creative ArtsДокумент4 страницыBasic Five Creative Artsprincedonkor177Оценок пока нет

- APC Smart-UPS 1500VA LCD 230V: Part Number: SMT1500IДокумент3 страницыAPC Smart-UPS 1500VA LCD 230V: Part Number: SMT1500IDesigan SannasyОценок пока нет

- Timely characters and creatorsДокумент4 страницыTimely characters and creatorsnschober3Оценок пока нет

- Amul ReportДокумент48 страницAmul ReportUjwal JaiswalОценок пока нет

- BPO UNIT - 5 Types of Securities Mode of Creating Charge Bank Guarantees Basel NormsДокумент61 страницаBPO UNIT - 5 Types of Securities Mode of Creating Charge Bank Guarantees Basel NormsDishank JohriОценок пока нет

- Machine Learning: Bilal KhanДокумент26 страницMachine Learning: Bilal KhanBilal KhanОценок пока нет

- Empowerment Technology Reviewer: First SemesterДокумент5 страницEmpowerment Technology Reviewer: First SemesterNinayD.MatubisОценок пока нет

- Module - No. 3 CGP G12. - Subong - BalucaДокумент21 страницаModule - No. 3 CGP G12. - Subong - BalucaVoome Lurche100% (2)

- Biomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCДокумент125 страницBiomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCAlpesh Jadhav100% (1)

- GIS Arrester PDFДокумент0 страницGIS Arrester PDFMrC03Оценок пока нет

- Determination of Vitamin C in FoodsДокумент11 страницDetermination of Vitamin C in FoodsDalal Shab JakhodiyaОценок пока нет

- AVANTIZ 2021 LNR125 (B927) EngineДокумент16 страницAVANTIZ 2021 LNR125 (B927) EngineNg Chor TeckОценок пока нет

- Human Resouse Accounting Nature and Its ApplicationsДокумент12 страницHuman Resouse Accounting Nature and Its ApplicationsParas JainОценок пока нет