Академический Документы

Профессиональный Документы

Культура Документы

Wto Contd

Загружено:

Nikita SangalОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Wto Contd

Загружено:

Nikita SangalАвторское право:

Доступные форматы

Preshipment inspection: a further check on importsback to top

Preshipment inspection is the practice of employing specialized private companies (or independent entities) to check shipment details essentially price, quantity and quality of goods ordered overseas. Used by governments of developing countries, the purpose is to safeguard national financial interests (preventing capital flight, commercial fraud, and customs duty evasion, for instance) and to compensate for inadequacies in administrative infrastructures. The Preshipment Inspection Agreement recognizes that GATT principles and obligations apply to the activities of preshipment inspection agencies mandated by governments. The obligations placed on governments which use preshipment inspections include non-discrimination, transparency, protection of confidential business information, avoiding unreasonable delay, the use of specific guidelines for conducting price verification and avoiding conflicts of interest by the inspection agencies. The obligations of exporting members towards countries using preshipment inspection include non-discrimination in the application of domestic laws and regulations, prompt publication of those laws and regulations and the provision of technical assistance where requested. The agreement establishes an independent review procedure. This is administered jointly by the International Federation of Inspection Agencies (IFIA), representing inspection agencies, and the International Chamber of Commerce (ICC), representing exporters. Its purpose is to resolve disputes between an exporter and an inspection agency. RULES OF ORIGIN Rules of origin are the criteria used to define where a product was made. They are an essential part of trade rules because a number of policies discriminate between exporting countries: quotas, preferential tariffs, anti-dumping actions, countervailing duty (charged to counter export subsidies), and more. Rules of origin are also used to compile trade statistics, and for mad e in ... labels that are attached to products. This is complicated by globalization and the way a product can be processed in several countries before it is ready for the market. The Rules of Origin Agreement requires WTO members to ensure that their rules of origin are transparent; that they do not have restricting, distorting or disruptive effects on international trade; that they are administered in a consistent, uniform, impartial and reasonable manner; and that they are based on a positive standard (in other words, they should state what does confer origin rather than what does not). For the longer term, the agreement aims for common (harmonized) rules of origin among all WTO members, except in some kinds of preferential trade for example, countries setting up a free trade area are allowed to use different rules of origin for products traded under their free trade agreement. The agreement establishes a harmonization work programme, based upon a set of principles, including making rules of origin objective, understandable and predictable. The work was due to end in July 1998, but several deadlines have been missed. It is being conducted by a Committee on Rules of Origin in the WTO and a Technical Committee under the auspices of the World Customs Organization in Brussels. The outcome will be a single set of rules of origin to be applied under non-preferential trading conditions by all WTO members in all circumstances. An annex to the agreement sets out a common declaration dealing with the operation of rules of origin on goods which qualif y for preferential treatment.

EXIM POLICY

Exim Policy, also known as the Foreign Trade Policy is announced every 5 years by Ministry of Commerce and Industry,

Government of India. It is updated every year on the 31st of March and all the amendments and improvements in the scheme are effective from the 1st of April. Exim policy deals in general provisions pertaining to exports and imports, promotional measures, duty exemption schemes, export promotion schemes, special economic zone programs and other details for different sectors. The Government announces a supplement to this policy each year. The Government of India also releases the Hand Book of Procedures detailing the procedures to be followed for each of the schemes mentioned in the Exim Policy.

Objectives Of The Exim Policy : Government control import of non-essential items through the EXIM Policy. At the same time, all-out efforts are made to promote exports. Thus, there are two aspects of Exim Policy; the import policy which is concerned with regulation and management of imports and the export policy which is concerned with exports not only promotion but also regulation. The main objective of the Government's EXIM Policy is to promote exports to the maximum extent. Exports should be promoted in such a manner that the economy of the country

is not affected by unregulated exportable items specially needed within the country. Export control is, therefore, exercised in respect of a limited number of items whose supply position demands that their exports should be regulated in the larger interests of the country. In other words, the main objective of the Exim Policy is:

To accelerate the economy from low level of economic activities to high level of economic activities by making it a globally oriented vibrant economy and to derive maximum benefits from expanding global market opportunities. To stimulate sustained economic growth by providing access to essential raw materials, intermediates, components,' consumables and capital goods required for augmenting production. To enhance the techno local strength and efficiency of Indian agriculture, industry and services, thereby, improving their competitiveness. To generate new employment. Opportunities and encourage the attainment of internationally accepted standards of quality. To provide quality consumer products at reasonable prices.

SEZ

What is an SEZ? It is a geographical region that has economic laws that are more liberal than a countrys typical economic laws. An SEZ is a trade capacity development tool, with the goal to promote rapid economic growth by using tax and business incentives to attract foreign investment and technology. Today, there are approximately 3,000 SEZs operating in 120 countries, which account for over US$ 600 billion in exports and about 50 million jobs. By offering privileged terms, SEZs attract investment and foreign exchange, spur employment and boost the development of improved technologies and infrastructure. Moreover SEZs provide a medium wherein it not only attracts foreign companies looking for cheaper and efficient location to setup their offshore business, but it also allows the local industries to improve their export through a proper channel and with the help of the new foreign partners to the outside world at a very competitive price. SEZs offer relaxed tax and tarif f policies which is different from the other economic areas in the country. Duty free import of raw materials for production is one example. Moreover the Free trade zones attract big players who want to setup business without any license hassles and the long process involved in it. Most of the allotment is done through a single window system and which is highly transparent system. The bottom-line therefore is increased export and FDI (Foreign Direct Investments) enabling increased Public-private partnership and ultimately resulting in a development of world class infrastructure, boost economic growth, exports and employment. Where SEZs have really flourished? The concept of SEZs was largely pioneered by China, wherein the SEZs contribute to 20 percent of the total FDI. Then the SEZ model was also successfully implemented in Poland and Philippines. In the former the SEZs contribute to almost 35 percent of the FDI inflows. Shenzhen in China has been at the helm of rapid economic development, after growing by a staggering 28 percent for the last 25 years. Why SEZs are required? The SEZs are important in todays context for the third world countries which have been in the race for rapid economic growth. There are many positives which emerge out of establishing an SEZ. Let us have a look on these factors. For undertaking any kind of massive development program the government requires huge amount of funds. So it looks out for potential partners to help the government carry out the program. Now say for setting up an SEZ, the government may tie up with a private partner whose willing to invest in that area, thus a win-win situation for both. As in the government gets the capital needed to establish the required infrastructure and also the expertise. The private player on the other hand gets the right to market and use the SEZs with relaxed tax laws, thereby increasing its revenue generating capacity and also carrying out the economic growth of the company in a more efficient way with the better tax policies. Actually SEZs with relaxed import tariffs help the Import dependent and export driven industries to flourish by helping them develop manufactured goods at competitive prices. SEZs create immense employment opportunities. The setting up of SEZs creates lot of indirect employment in terms of labour required. Then after the completion it enables employment in the relevant industries operating in the SEZ. Then there are lots of indirect employments generated wherein people start investing around SEZ. For example SEZs are townships of their own; thereby there are shopping malls, restaurants, amusement parks setup around to attract people, thus resulting in more economic development in that area.

Moreover SEZs improve the countrys foreign export. Because of the increased FDI and Private Equity presence, the local manufacturers get to tie up with these big names and export their products which now carry a better brand value, therefore helping in creating a greater demand for the goods of local manufacturers. Moreover the massive capital required for expansion is brought in form of FDI resulting in increased economic activity. The increased exports from the country bring in more revenue for the country which improves the economic growth. SEZs help in creating a balanced economic growth in a country if they are properly located and implemented leading to tapping of local talent and contributing to increased economic activity in the area.

Drawbacks: The biggest challenges faced by SEZs in todays scenario are the taking away of agricultural land from the farmers. The farmers are being paid disproportionate money which is not in lieu of the current land prices. The best example could be seen in the case of farmers from Kalinganagar in Orissa where the money given was disproportionate to as high as 1:10 with respect to the market rates. Moreover SEZs are leading to decrease in crop production (arable Land Grabbing!) thus slowing down of agricultural activity in the country. (Though it may help boost it in other ways by increased export of local goods, both processed and non-processed). More and more farmers are moving towards the lucrative manufacturing side in search of greater economic security. Moreover the greatest problem that seems to be emerging out is that arable land is being used for non agricultural purpose which could lead to food crisis and loss of self sustenance in future. For example: Nadigram district of West Bengal. But FDI could also help in providing our farmers to gain access to technological better farming methods.

SEZs in China were initially exempted from national Labor Laws (despite being a communist country!). This model sustained initially because the foreign investors were given the leverage to train the workers and even fire them if incompetent. This Hire or Fire policy initially helped in sustaining foreign investors confidence in the Chinese domestic labor competence, but in the long run such laws must be made more stringent once the confidence is reposed so as to hedge the workers from hostile company policies.

The SEZs if not properly located could lead to Supply Chain Management problems as well. Moreover improper planning could lead to unbalanced growth in the region giving an impression of pseudo-development. For example most of the SEZs in China are in proximity to the ports and also close to each other, while these have been at the helm of economic development most of the interior hinterland is vastly underdeveloped. SEZs could also lead to income disparities with divide between the rich and poor increasing if not properly planned.

SEZs mostly if setup for the manufacturing sector should be carefully planned to carry out proper pollution monitoring and control mechanism. Stringent measures may prove to be expensive but are also extremely important. Shenzhen in china has been the worst affected among SEZs in China where the sky is grey for most part of the day courtesy the polluting industries. The measures should be taken to make surroundings livable for multitude of people living in the SEZs. Moreover care should be taken to properly treat effluents from industries not to affect surrounding rivers. Also the SEZs should be carefully planned not to affect the natural habitat around (Gurgaon SEZ affecting the Bharatpur bird sanctuary)

India and SEZ: Overview: The SEZ policy was first introduced in India in April 2000, as a part of the Export-Import (EXIM) policy of India. Considering the need to enhance foreign investment and promote exports from the country and realizing the need that level playing field must be made available to the domestic enterprises and manufacturers to be competitive globally, the Government of India in April 2000 announced the introduction of Special Economic Zones policy in the country deemed to be foreign territory for the purposes of trade operations, duties and tariffs. To provide an internationally competitive and hassle free environment for exports, units were allowed be set up in SEZ for manufacture of goods and rendering of services. All the import/export operations of the SEZ units are on self-certification basis. The units in the Zone are required to be a net foreign exchange earner but they would not be subjected to any pre-determined value addition or minimum export performance requirements. Sales in the Domestic Tariff Area by SEZ units are subject to payment of full Custom Duty and as per import policy in force. Further Offshore banking units are being allowed to be set up in the SEZs. Are SEZs New to India? India is one of the first countries in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports. Asias first EPZ was set up in Kandla in 1965. With a view to create an environment for achieving rapid growth in exports, a Special Economic Zone policy was announced in the Export and Import (EXIM) Policy 2000. Under this policy, one of the main features is that the designated duty free enclave to be treated as foreign territory only for trade operations and duties and tariffs. No license required for import. The

manufacturing, trading or service activities are allowed. While EPZs are industrial estates, SEZs are virtually industrial townships that provide supportive infrastructure such as housing, roads, ports and telecommunication. The scope of activities that can be undertaken in the SEZs is much wider and their linkages with the domestic economy are stronger. Resultantly they have a diversified industrial base. Their role is not transient like the EPZs, as they are intended to be instruments of regional development as well as export promotion. As such, SEZs can have tremendous impact on exports, inflow of foreign investment and employment generation. SEZ Act 2005: To provide a stable economic environment for the promotion of Export-import of goods in a quick, efficient and hassle-free manner, Government of India enacted the SEZ Act, which received the assent of the President of India on June 23, 2005. The SEZ Act and the SEZ Rules, 2006 (SEZ Rules) were notified on February 10, 2006. The SEZ Act is expected to give a big thrust to exports and consequently to the foreign direct investment (FDI) inflows into India, and is considered to be one of the finest pieces of legislation that may well represent the future of the industrial development strategy in India. The new law is aimed at encouraging public-private partnership to develop world-class infrastructure and attract private investment (domestic and foreign), boosting economic growth, exports and employment. The SEZs Rules, inter-alia, provide for drastic simplification of procedures and for single window clearance on matters relating to central as well as state governments. Investment of the order of Rs.100,000 crores over the next 3 years with an employment potential of over 5 lakh is expected from the new SEZs apart from indirect employment during the construction period of the SEZs. Heavy investments are expected in sectors like IT, Pharma, Bio-technology, Textiles, Petro-chemicals, Auto-components, etc. The SEZ Rules provides the simplification of procedures for development, operation, and maintenance of the Special Economic Zones and for setting up and conducting business in SEZs. This includes simplified compliance procedures and documentation with an emphasis on self-certification; single window clearance for setting up of an SEZ, setting up a unit in SEZs and clearance on matters relating to Central as well as State Governments; no requirement for providing bank guarantees; contract manufacturing for foreign principals with option to obtain sub-contracting permission at the initial approval stage; and Import-Export of all items through personal baggage.

With a view to augmenting infrastructure facilities for export production it has been decided to permit the setting up of Special Economic Zones (SEZs) in the public, private, joint sector or by the State Governments. The minimum size of the Special Economic Zone shall not be less than 1000 hectares. Minimum area requirement shall, however, not be applicable to product specific and port/airport based SEZ. This measure is expected to promote self-contained areas supported by world-class infrastructure oriented towards export production. Any private/public/joint sector or State Government or its agencies can set up Special Economic Zone (SEZ).

Вам также может понравиться

- NegotiationДокумент12 страницNegotiationNikita SangalОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Amity School of Business BBA, 4th Semester ASB: Module 5: Verbal Ability & Reading ComprehensionsДокумент23 страницыAmity School of Business BBA, 4th Semester ASB: Module 5: Verbal Ability & Reading ComprehensionsNikita SangalОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Amity School of Business: BBA, Semester IV Analytical Skills BuildingДокумент28 страницAmity School of Business: BBA, Semester IV Analytical Skills BuildingNikita SangalОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Small Talk, Presentation Skills and Business MeetingsДокумент20 страницSmall Talk, Presentation Skills and Business MeetingsNikita SangalОценок пока нет

- Ratio and ProprtionДокумент17 страницRatio and ProprtionNikita SangalОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Case StudyДокумент8 страницCase StudyNikita SangalОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Behavioral Science: Sap ProjectДокумент13 страницBehavioral Science: Sap ProjectNikita SangalОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Strategy and Tactics of Distributive BargainingДокумент18 страницStrategy and Tactics of Distributive BargainingNikita SangalОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Organizational ChangeДокумент14 страницOrganizational ChangeNikita SangalОценок пока нет

- Organizational ChangeДокумент19 страницOrganizational ChangeNikita SangalОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Mod 6Документ13 страницMod 6Nikita SangalОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Salient Features of The Participation of Workers in Management BillДокумент1 страницаThe Salient Features of The Participation of Workers in Management BillNikita SangalОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Essentials of Payment of Gratuity ActДокумент4 страницыEssentials of Payment of Gratuity ActNikita SangalОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Negotiation Strategy and PlanningДокумент22 страницыNegotiation Strategy and PlanningNikita SangalОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Social Context of NegotiationДокумент16 страницThe Social Context of NegotiationNikita Sangal100% (1)

- Cross Cultural Communication-1Документ10 страницCross Cultural Communication-1Nikita SangalОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- EthnocentrismДокумент10 страницEthnocentrismNikita SangalОценок пока нет

- Communication Competence NotesДокумент7 страницCommunication Competence NotesNikita SangalОценок пока нет

- Technical Barriers To Trade TBT SlidesДокумент12 страницTechnical Barriers To Trade TBT SlidesNikita SangalОценок пока нет

- Importance of Culture in CommДокумент30 страницImportance of Culture in CommNikita SangalОценок пока нет

- Subsidies and Countervailing Measures SLIDESДокумент14 страницSubsidies and Countervailing Measures SLIDESNikita SangalОценок пока нет

- Tariffs - Oldest Form of Trade PolicyДокумент29 страницTariffs - Oldest Form of Trade PolicyNikita SangalОценок пока нет

- Data Analytics For Accounting, 2nd Edition Vernon Richardson PDFДокумент1 026 страницData Analytics For Accounting, 2nd Edition Vernon Richardson PDFjie100% (1)

- Transfer Deed Government of PakistanДокумент3 страницыTransfer Deed Government of Pakistanapi-3803246Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

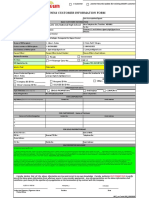

- Business Customer Information FormДокумент3 страницыBusiness Customer Information Formpretty mangayОценок пока нет

- Tax InvoiceДокумент1 страницаTax Invoicesmarty sdОценок пока нет

- Practical Accounting of Cash Flow From Operating ActivitiesДокумент13 страницPractical Accounting of Cash Flow From Operating ActivitiesDJ Nicart63% (8)

- L. E. Thompson, and Ruby Thompson v. Commissioner of Internal Revenue, 489 F.2d 288, 4th Cir. (1974)Документ8 страницL. E. Thompson, and Ruby Thompson v. Commissioner of Internal Revenue, 489 F.2d 288, 4th Cir. (1974)Scribd Government DocsОценок пока нет

- Exclusions From Gross IncomeДокумент29 страницExclusions From Gross IncomeJC89% (9)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Rubio Vs CIRДокумент3 страницыRubio Vs CIRJoovs JoovhoОценок пока нет

- Rotated - END RINGДокумент21 страницаRotated - END RINGHEWITT ROBINSОценок пока нет

- RR No. 6-2015 PDFДокумент5 страницRR No. 6-2015 PDFErlene CompraОценок пока нет

- Khurram HR AssignmentДокумент5 страницKhurram HR AssignmentMuhamamd RehanОценок пока нет

- Annual Internal Audit Plan ReportДокумент23 страницыAnnual Internal Audit Plan ReportEva JulioОценок пока нет

- 218880-2018-Revenue Office Tax Exemption Manual TESLite20221008-12-1h3k0fuДокумент71 страница218880-2018-Revenue Office Tax Exemption Manual TESLite20221008-12-1h3k0fuLoren SanapoОценок пока нет

- CIR vs. Pilipinas Shell Petroleum Corp., GR Nos. 197945 & 204119-20, 9 Jul 2018Документ25 страницCIR vs. Pilipinas Shell Petroleum Corp., GR Nos. 197945 & 204119-20, 9 Jul 2018raph basilioОценок пока нет

- CAPITALGAINS 3rdsep PDFДокумент202 страницыCAPITALGAINS 3rdsep PDFPhani Kumar SomarajupalliОценок пока нет

- Robert Dahl: The Concept of PowerДокумент15 страницRobert Dahl: The Concept of PowerIvica BocevskiОценок пока нет

- Final ProjectДокумент5 страницFinal ProjectAkshayОценок пока нет

- Application Form Validated: Registration DataДокумент12 страницApplication Form Validated: Registration DataClaudiaIonitaОценок пока нет

- Fundamentals of Accounting 1Документ15 страницFundamentals of Accounting 1Estacio B. Iraida Juna100% (1)

- Royal Malaysian Customs Department: Jabatan Kastam Diraja MalaysiaДокумент5 страницRoyal Malaysian Customs Department: Jabatan Kastam Diraja MalaysiaSyed IsaОценок пока нет

- 2008jun PDFДокумент1 страница2008jun PDFphone2hireОценок пока нет

- Accize Si Taxe de Consumatie 2007-2015Документ12 страницAccize Si Taxe de Consumatie 2007-2015Adelina GînduОценок пока нет

- Lecturer 1 Sole ProprietorshipДокумент11 страницLecturer 1 Sole ProprietorshipGoitse LithekoОценок пока нет

- BIR Form 2307Документ1 страницаBIR Form 2307Aizhel Villegas ArcipeОценок пока нет

- Acc 423 Advanced TaxationДокумент50 страницAcc 423 Advanced Taxationkajojo joyОценок пока нет

- Brake Valve, Relay Valve 27.12.19 PDFДокумент1 страницаBrake Valve, Relay Valve 27.12.19 PDFnithinОценок пока нет

- CUSTOMS LAW MANUAL - NotesДокумент10 страницCUSTOMS LAW MANUAL - NotesChetanya KapoorОценок пока нет

- Gap Between Irrigation Service Price PDFДокумент370 страницGap Between Irrigation Service Price PDFNguyen Van KienОценок пока нет

- Chapter 19 & 20Документ23 страницыChapter 19 & 20Kershey Salac100% (6)

- Salient Features of GSTДокумент9 страницSalient Features of GSTKunal MalhotraОценок пока нет

- The War after the War: A New History of ReconstructionОт EverandThe War after the War: A New History of ReconstructionРейтинг: 5 из 5 звезд5/5 (2)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldОт EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldРейтинг: 4.5 из 5 звезд4.5/5 (1146)

- The Age of Magical Overthinking: Notes on Modern IrrationalityОт EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityРейтинг: 4 из 5 звезд4/5 (32)